Full Metal Announces $4,000,000 Equity Financing

May 13 2010 - 4:56PM

Marketwired Canada

NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRES

Full Metal Minerals Ltd. (TSX VENTURE:FMM) ("Full Metal" or the "Company") is

pleased to announce that it has entered into an agreement with Canaccord Genuity

Corp. ("Canaccord Genuity", or, the "Agent") to sell up to 20,000,000 units (the

"Units"), on a private placement basis, at a price of $0.20 per unit for gross

proceeds of up to $4,000,000 (the "Offering"). A Unit will consist of one common

share and one-half of one common share purchase warrant (a "Warrant"). Each

whole warrant will entitle the holder to subscribe for one additional common

share at a price of $0.28 for a period of 24 months from the date of closing.

Completion of the private placement will be subject to usual conditions,

including satisfactory due diligence and regulatory approval, including

acceptance of the TSX Venture Exchange.

As consideration for acting as Agent, Canaccord Genuity will be paid a

commission of 7% of the total proceeds raised upon closing and issued agents'

warrants ("Agents' Warrants") equal to 8% of the Units issued pursuant to this

Offering. Each Agents' Warrant will be exercisable to acquire one common share

at $0.25 expiring 24 months after the closing date.

The Company has also granted the Agent an over-allotment option to increase the

Offering by up to $1,000,000, exercisable 48 hours prior to closing.

The Company intends to use the net proceeds from the offering to advance the

Company's exploration properties and for general working capital purposes.

ON BEHALF OF THE BOARD OF DIRECTORS

Michael Williams, President and Director

Full Metal Minerals (TSXV:FMM)

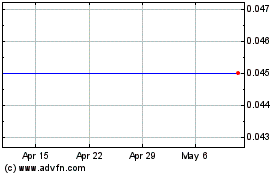

Historical Stock Chart

From Jun 2024 to Jul 2024

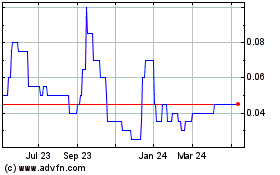

Full Metal Minerals (TSXV:FMM)

Historical Stock Chart

From Jul 2023 to Jul 2024