Firm Capital Apartment Trust Reports 2020 Results and Increased NAV to $9.84 Per Unit

March 10 2021 - 7:41PM

Firm Capital Apartment Real Estate Investment Trust (the

“

Trust”), (TSXV: FCA.U), (TSXV: FCA.UN) is pleased

to report its financial results for the year ended December 31,

2020:

ATTRACTIVE VALUATION RELATIVE TO

PEERS

Based on the current trading price of $6.15 per

Trust Unit, the Trust trades at a 38% discount to its NAV of $9.84

per Trust Unit and has one of the highest distribution yields of

3.8% in the Multi-Residential REIT sector, while maintaining a

conservative 74% AFFO Payout Ratio.

EARNINGS

- For the three months ended December 31, 2020, Net Income was

approximately $2.5 million, in comparison to the $3.5 million

reported for the three months ended December 31, 2019. For the year

ended December 31, 2020, Net Income was $5.6 million in comparison

to the $7.1 million reported for the year ended December 31, 2019.

For the year ended December 31, 2020, excluding Fair Value

Adjustments, Net Income was $2.0 million, in comparison to the $1.2

million reported for the year ended December 31, 2019;

- For the three months ended December 31, 2020, AFFO was

approximately $0.6 million, an increase compared to the $0.2

million reported for the three months ended December 31, 2019. For

the year ended December 31, 2020, AFFO was $2.0 million, a 16%

increase compared to the $1.7 million reported for the year ended

December 31, 2019;

- Results for the three months and year ended December 31, 2020

are as follows:

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

Dec 31,2020 |

|

Dec 31,2019 |

|

|

Dec 31,2020 |

|

Dec 31,2019 |

|

|

Net Income |

$ |

2,471,888 |

|

$ |

3,514,541 |

|

|

$ |

5,604,354 |

|

$ |

7,055,862 |

|

|

FFO |

$ |

468,125 |

|

$ |

8,611 |

|

|

$ |

4,739,715 |

|

$ |

1,394,335 |

|

|

AFFO |

$ |

616,601 |

|

$ |

202,342 |

|

|

$ |

2,013,423 |

|

$ |

1,731,910 |

|

|

Distributions |

$ |

455,170 |

|

$ |

409,183 |

|

|

$ |

1,911,984 |

|

$ |

1,636,731 |

|

| FFO

Per Unit |

$ |

0.06 |

|

$ |

0.00 |

|

|

$ |

0.60 |

|

$ |

0.20 |

|

| AFFO

Per Unit |

$ |

0.08 |

|

$ |

0.03 |

|

|

$ |

0.26 |

|

$ |

0.25 |

|

|

Distributions Per Unit |

$ |

0.06 |

|

$ |

0.06 |

|

|

$ |

0.24 |

|

$ |

0.24 |

|

| AFFO

Payout Ratio |

|

74 |

% |

|

202 |

% |

|

|

95 |

% |

|

95 |

% |

- 93% RENT COLLECTIONS:Since the beginning of

Q4/2020, the Trust has received approximately 93% of its expected

rent and is actively either collecting the remaining rent or

working with tenants who require assistance;

- 100% RETURN OF CAPITAL ON 2020

DISTRIBUTIONS:The Trust’s distributions for 2020 were tax

efficient to unitholders as it delivered a 100% return of capital.

The 100% return of capital is in excess of the 85% projected when

the Trust converted from a Corporation at the beginning of

2020;

- INCREASED NAV BY 13% CAGR TO $9.84 PER TRUST

UNIT:Since Q3/2017, the Trust has increased NAV from $7.85

per Trust Unit to $9.84 per Trust Unit for a +13% Compounded Annual

Growth Rate (“CAGR”);

- $21.6 MILLION BRONX, NY MORTGAGE

REFINANCING:On February 25, 2021, the first mortgage on

the Bronx, NY joint venture was refinanced for gross proceeds of

$21.6 million. With the $3.6 million net proceeds received from the

refinance and the $1.6 million of capital contributed by Common

Shareholders, the Preferred Equity was repaid in full. The mortgage

is a 3.51%, $21.6 million first mortgage with a 12-year term

amortizing over 30 years;

- ACCRETIVE $38 MILLION ACQUISITION:On September

22, 2020, the Trust closed an equity accounted and preferred

investment to acquire a 235 unit multi-family residential portfolio

located in Hyattsvile, MD (the “North Pointe

Acquistion”). The purchase price for 100% of the North

Point Acquistion was $40.5 million (including transaction costs).

The North Pointe Acquistion was financed, in part with a $29.7

million, 3.0% first mortgage due on September 21, 2024. The Trust

contributed $4.0 million of preferred equity yielding 8% and $3.4

million of common equity representing a 50% ownership interest in

the investment;

- SALE OF BRIDGEPORT, CT JOINT VENTURE:On

December 23, 2020, the Trust completed a sale of its interest in

fourteen multi-family buildings located in Bridgeport, Connecticut

to its joint venture partner (the “Bridgeport

Sale”). The Trust received net proceeds of approximately

$4.5 million from the Bridgeport Sale consisting of a repayment of

its preferred equity (inclusive of accrued interest) of $2.8

million and $1.7 million of common equity, respectively;

- ACCRETIVE TRUST UNIT REDEMPTION AND NCIB

ACTIVITY:On July 27, 2020, the Trust redeemed 686,200

Trust Units (representing approximately 8% of the issued and

outstanding Trust Units) at a price of CAD $5.35 per Trust Unit

($4.00 per Trust Unit) per Trust Unit representing total gross cost

of CAD $3.7 million ($2.8 million);

- The Trust has also purchased to date for cancellation 128,100

Trust Units for total gross cost of approximately $0.7 million

through its NCIB. In addition, the Trust purchased for cancellation

Convertible Unsecured Debentures under its NCIB having a face

amount of CAD$61,000 at a weighted average price of $78.00 per

Debenture, or CAD $47,710 ($35,768); and

- DISTRIBUTIONS:On March 10, 2021, the Trust

declared and approved quarterly distributions of $0.059 per unit

for unitholders on record on March 31, 2021 payable on or about

April 15, 2021.

For the complete financial statements including

Management’s Discussion & Analysis, please visit www.sedar.com

or the Trust’s website at www.firmcapital.com

ABOUT FIRM CAPITAL APARTMENT REAL ESTATE

INVESTMENT TRUST

- Firm Capital Apartment Real Estate Investment Trust is a U.S.

focused real estate investment trust that pursues multi-residential

income producing real estate and related debt investments on both a

wholly owned and joint venture basis. The Trust has ownership

interests in a total of 1,846 apartment units diversely located in

Florida, Connecticut, Texas, New York, New Jersey, Georgia and

Maryland.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

Certain information in this news release

constitutes forward-looking statements under applicable securities

law. Any statements that are contained in this news release that

are not statements of historical fact may be deemed to be

forward-looking statements. Forward-looking statements are often

identified by terms such as "may", "should", "anticipate",

"expect", "intend" and similar expressions.

Forward-looking statements necessarily involve

known and unknown risks, including, without limitation, risks

associated with general economic conditions; adverse factors

affecting the U.S. real estate market generally or those specific

markets in which the Trust holds properties; volatility of real

estate prices; inability to access sufficient capital from internal

and external sources, and/or inability to access sufficient capital

on favourable terms; industry and government regulation; changes in

legislation, income tax and regulatory matters; the ability of the

Trust to implement its business strategies; competition; currency

and interest rate fluctuations and other risks. Additional risk

factors that may impact the Trust or cause actual results and

performance to differ from the forward looking statements contained

herein are set forth in the Trust's Annual Information form under

the heading Risk Factors (a copy of which can be obtained under the

Trust's profile on www.sedar.com).

Readers are cautioned that the foregoing list is

not exhaustive. Readers are further cautioned not to place undue

reliance on forward-looking statements as there can be no assurance

that the plans, intentions or expectations upon which they are

placed will occur. Such information, although considered reasonable

by management at the time of preparation, may prove to be incorrect

and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are

expressly qualified by this cautionary statement. Except as

required by applicable law, the Trust undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events or otherwise.

Certain financial information presented in this

press release reflect certain non-International Financial Reporting

Standards (“IFRS”) financial measures, which

include, but not limited to NOI, FFO and AFFO. These measures are

commonly used by real estate investment companies as useful metrics

for measuring performance, however, they do not have standardized

meaning prescribed by IFRS and are not necessarily comparable to

similar measures presented by other real estate investment

companies. These terms are defined in the Trust’s Management

Discussion and Analysis for the year ended December 31, 2020 filed

on www.sedar.com.

Neither the Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

| For further information, please contact: |

| Sandy Poklar |

Mark Goldreich |

| President & Chief Executive Officer |

Chief Financial Officer |

| (416) 635-0221 |

(416) 635-0221 |

| |

|

| For Investor Relations information, please

contact: |

| Victoria Moayedi |

|

| Director, Investor Relations |

|

| (416) 635-0221 |

|

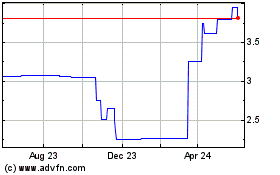

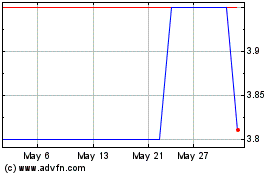

Firm Capital Apartment R... (TSXV:FCA.U)

Historical Stock Chart

From Jun 2024 to Jul 2024

Firm Capital Apartment R... (TSXV:FCA.U)

Historical Stock Chart

From Jul 2023 to Jul 2024