Excelsior Updates Hangingstone Reserve and Resource Estimates

March 27 2008 - 1:22PM

Marketwired Canada

Excelsior Energy Limited (TSX VENTURE:ELE) ("Excelsior" or the "Company") is

pleased to announce the completion of an updated independent evaluation of

bitumen reserves and resources on Excelsior's Hangingstone property, near Fort

McMurray, Alberta. The effective date of the evaluation is December 31, 2007

("the effective date"). The report was prepared in respect of Excelsior's year

end reporting obligations under NI 51-101. The effective date of the evaluation

provided for the inclusion of two wells from this winters' core drilling

program. An additional 24 wells were drilled, cored and logged after the

effective date of the report. A complete resource analysis of the Hangingstone

asset including all 26 core wells is expected to be available in the second

quarter, 2008.

The reserve and resource estimates were prepared by DeGolyer and MacNaughton in

a report ("the DeGolyer report") with an effective date of December 31, 2007.

The DeGolyer report was prepared using assumptions and methodology guidelines

outlined in the Canadian Oil and Gas Evaluation Handbook ("COGE Handbook") and

in accordance with National Instrument 51-101.

Bitumen Reserves

Well control and the presence of a prior cyclic steam stimulation project on the

lands provided for an assignment of 43.9 million barrels of probable reserves to

Excelsior's working interest share on 2.5 sections of Hangingstone lands.

Probable and possible bitumen reserves were estimated at 53.7 million barrels to

Excelsior's working interest share as of the effective date.

The DeGolyer report estimated that Excelsior's probable reserves would generate

$ 1,875 million of future net revenue with a net present value of $ 123.7

million discounted at 10%, after deduction of $ 415.7 million in future capital

requirements and abandonment costs of $ 0.5 million.

Probable plus possible bitumen reserves were forecast to generate $ 2,373.5

million of future net revenue with a 10 percent present value of $ 147.9

million, after deduction of future capital requirements of $ 526.6 million.

Contingent Resources

The DeGolyer report was also able to assign additional contingent resources to

Hangingstone lands. Best estimate contingent resources were estimated at 253.3

million barrels (Excelsior's working interest share); low estimate contingent

resources were estimated at 94.7 million barrels (Excelsior's working interest

share) and high estimate contingent resources were estimated at 571.6 million

barrels (Excelsior's working interest share). Contingent resources are further

categorized as marginal (Marginal Contingent Resources - Those quantities

associated with technically feasible projects that are either currently economic

or projected to be economic under reasonably forecasted improvements in

commercial conditions but are not committed for development because of one or

more contingencies).

The resource volumes have not been classified as reserves at this time pending

delineation drilling, development planning and regulatory applications. Resource

values should be considered as indicative in nature only.

Estimations of reserves and future net revenue discussed in this press release

constitute forward looking statements. See "Forward Looking Statements" below.

All references to future net revenue in this press release are estimated before

tax.

Robert Bailey, COO and Vice President of Excelsior commented; "DeGolyer and

MacNaughton integrated Excelsior's seismic data and 2007 drilling results in the

current analysis. The enhanced data set provided for significant increases in

probable reserves and best estimate contingent resources on the Hangingstone

asset. The balance of the winter drilling program, including 24 additional core

wells, is expected to allow for additional resource bookings."

Summary Tables

----------------------------------------------------------------------------

Excelsior Energy Limited

Hangingstone 75% Working Interest

Bitumen Reserves (MMbbl)

----------------------------------------------------------------------------

30/04/2007 31/12/2007

Probable (2P) (1) 19.2 43.9

Probable plus Possible (2) 40.2 53.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Excelsior Energy Limited

Hangingstone 75% Working Interest

Bitumen Reserves (MMbbl)

----------------------------------------------------------------------------

31/05/2007 31/12/2007

Low Estimate Contingent (3) (4) (5) 82.9 94.7

Best Estimate Contingent (6) 130.2 253.3

High Estimate Contingent (7) 193.1 576.6

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Excelsior Energy Limited

10 % Value of Future Net Revenue (8)

Forecast Prices and Costs

Bitumen Reserves and Resources (MM $)

----------------------------------------------------------------------------

30/04/2007 31/12/2007

Probable (2P) 57.8 123.7

Probable plus Possible 99.3 147.9

Low Estimate Contingent - -

Best Estimate Contingent - -

High Estimate Contingent - -

----------------------------------------------------------------------------

Notes:

1) Probable reserves are those additional reserves that are less certain to

be recovered than proven reserves. It is equally likely that the actual

remaining quantities recovered will be greater or less than the sum of

the proven plus probable reserves.

2) Possible reserves are those additional reserves that are less certain to

be recovered than probable reserves. There is only a 10 % probability

that the quantities actually recovered will equal or exceed the sum of

the proven plus probable plus possible reserves.

3) Contingent resources are those quantities of oil and gas, estimated on a

given date, to be potentially recoverable from known accumulations but

are not currently economic. The DeGolyer report has categorized these

resources as contingent as additional delineation drilling, development

planning, project design and further regulatory applications are

required.

4) Contingent resources are further categorized as sub-marginal.

Sub-marginal contingent resources are those quantities associated with

technically feasible projects that are either economic or are expected

to be economic under reasonable forecasted improvements in commercial

conditions but are not committed for development because of one or more

contingencies.

5) Low Estimate is considered to be a conservative estimate of the quantity

that will actually be recovered from the accumulation. If probabilistic

methods are used, this term reflects P90 confidence level.

6) Best Estimate is considered to be the best estimate of the quantity that

will actually be recovered from the accumulation. If probabilistic

methods are used this term is a measure of central tendency of the

uncertainty distribution (P50).

7) High Estimate is considered to be an optimistic estimate of the quantity

that will actually be recovered from the accumulation. If probabilistic

methods are used the term reflects a P10 confidence level.

8) All references to future net revenue in this table are estimated before

tax.

About Excelsior Energy:

Excelsior is active in oil sands exploration and appraisal in the Hangingstone

and West Surmont areas near Fort McMurray, Alberta. Excelsior holds a 75%

working interest in 39 contiguous sections at Hangingstone and will own a 75 %

working interest in an additional 19 contiguous sections at West Surmont upon

completion of its farm-in obligations. The Company also holds a 100% working

interest in Blocks 16/1a and 16/6c in the UK North Sea and minor interests in

gas production in Alberta.

The Company strategy is to capture oil and gas appraisal and development

opportunities where we can leverage Management's diverse international

experience and field development expertise. This includes heavy oil reservoir

engineering and development of complex fields. The scale of the oil sands

resource opportunity in Alberta complements Excelsior's international portfolio

and strategy.

Forward-Looking Statements: This news release contains statements about future

events that are forward looking in nature and, as a result, are subject to

certain risks and uncertainties such as changes in plans or the occurrence of

unexpected events. Actual results may differ from the estimates provided by

management. Readers are cautioned not to place undue reliance on these

statements.

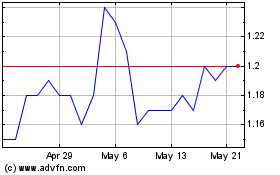

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jun 2024 to Jul 2024

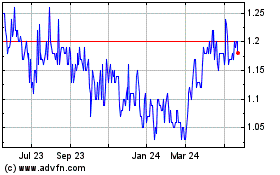

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jul 2023 to Jul 2024