Lions Gate Metals Inc. and Copper Fox Metals Inc. Announce Business Combination

February 27 2009 - 9:00AM

Marketwired

Lions Gate Metals Inc. ("Lions Gate") (TSX VENTURE: LGM) and Copper

Fox Metals ("Copper Fox") (TSX VENTURE: CUU) are pleased to

announce that they have entered into a binding letter of intent

("LOI") containing the principal terms by which, subject to

satisfaction of certain conditions, Lions Gate will acquire all of

the issued and outstanding common shares of Copper Fox through a

plan of arrangement or other form of business combination (the

"Business Combination").

The LOI contemplates that each Copper Fox shareholder will

receive 0.094 common shares of Lions Gate for every one common

share of Copper Fox. For every one common share issued by Lions

Gate to Copper Fox shareholders, they will also receive 0.5

warrants of Lions Gate. Each full warrant and payment of $2.00 will

entitle the holder to purchase an additional share of Lions Gate

for a period of five years. In addition, all outstanding

convertible securities of Copper Fox will be exchanged for

comparable convertible securities of Lions Gate in an amount and at

exercise prices adjusted in accordance with the same exchange

ratio.

The LOI contemplates that Lions Gate may complete a private

placement of up to 2,500,000 units of Copper Fox at $0.08 per unit

for proceeds to Copper Fox of up to $200,000. Each unit will be

comprised of one common share of Copper Fox and one share purchase

warrant, each such warrant entitling Lions Gate to purchase one

additional common share of Copper Fox at $0.08 per share for a

period of two years. The private placement is to be advanced in

tranches of $25,000 at the discretion of Lions Gate. The units will

be cancelled on closing of the Business Combination.

There are currently 112,501,585 Copper Fox common shares issued

and outstanding, 8,898,000 outstanding options to purchase Copper

Fox common shares and 15,921,404 Copper Fox common shares issuable

pursuant to outstanding share purchase warrants.

Copper Fox will be seeking agreements supporting the Business

Combination from the directors and officers of Copper Fox to vote

their shares in favour of the Business Combination.

The Business Combination will require the approval of Copper Fox

security holders and the TSX Venture Exchange, and will be subject

to other customary conditions, including the execution of a

definitive agreement and completion of due diligence. The Business

Combination is also subject to the successful negotiation of debt

settlement agreements with Copper Fox's creditors.

The LOI provides that Copper Fox shall not, directly or

indirectly, solicit, initiate or encourage letter of intent offers

from, or negotiations with, any third party with respect to any

other potential merger or acquisition of all or a material portion

of Copper Fox's business, assets or outstanding securities except

where required to satisfy fiduciary obligations of directors. Both

parties have agreed to pay non-completion fees under certain

circumstances. The transaction is expected to close by June 30,

2009.

Mark E. Hewett, President and Director of Lions Gate, stated, "I

am very pleased that Lions Gate has been able to execute this

binding LOI with Copper Fox. The successful completion of the

Business Combination will position the combined companies with two

very strong copper properties within B.C. This includes a very

prospective exploration stage copper property close to Houston B.C.

as well as a significant copper and gold project in northwestern

B.C. In addition, we are excited to include in our new management

team some very strong technical and financial personnel. This

Business Combination further strengthens our exploration and

development position in the copper industry, and allows us to

continue to build through further acquisitions while maintaining an

attractive capital structure."

Guillermo Salazar, President and CEO of Copper Fox, stated, "I

am delighted that Copper Fox has been able to enter into this

binding LOI with Lions Gate. This transaction will allow us to

advance and unlock the inherent value of our core assets including

the Schaft Creek deposit, solidify Copper Fox's financial position,

and leverage the combined asset base with a view to adding to the

shareholders' value. The synergies in focus of business and

management are apparent and we believe that they will strengthen

the combined entity's position in the copper sector."

Information on Lions Gate and Copper Fox may be viewed on the

internet at their respective websites noted below, or at the

Canadian securities regulator's website at www.sedar.com.

Cautionary Statements Regarding the Business Combination:

Completion of the transaction is subject to a number of conditions,

including regulatory approval, shareholder approvals, completion of

satisfactory due diligence, a definitive agreement and approval of

the British Columbia Supreme Court. There can be no assurance that

the transaction will be completed as proposed or at all. Investors

are cautioned that, except as disclosed in the Management

Information Circular to be prepared in connection with the

transaction, any information released or received with respect to

the business combination may not be accurate or complete and should

not be relied upon. Trading in the securities of exploration and

development stage resource companies should be considered highly

speculative.

Forward-Looking Statements: Statements in this release that are

forward-looking statements are subject to various risks and

uncertainties concerning the specific factors disclosed under the

heading "Risk Factors" and elsewhere in the corporations' periodic

filings with Canadian Securities Regulators. Such information

contained herein represents management's best judgment as of the

date hereof based on information currently available. Statements in

this press release other than purely historical information,

including statements relating to the companies' future plans and

objectives or expected results, constitute forward-looking

statements. Forward looking statements are based on numerous

assumptions and are subject to all of the risks and uncertainties

inherent in the companies' business, including risks inherent in

mineral exploration and development. The companies do not assume

the obligation to update any forward-looking statement. In

particular, no representation is made in this release as to the

timing of the business combination, whether the business

combination will complete on the terms described herein or at all,

the success or value of the combined companies after the business

combination. In addition, there are numerous risks and other

factors that will influence a development decision, including

concluding resource evaluations on mineral properties, mine design

limitations, permitting risks and economic factors, all of which

may be beyond our control.

U.S. Cautionary Statements: We advise US investors that while

the terms "measured resources", "indicated resources" and "inferred

resources" are recognized and required by Canadian regulations, the

US Securities and Exchange Commission does not recognize these

terms. US investors are cautioned not to assume that any part or

all of the material in these categories will ever be converted into

reserves.

For further information on Lions Gate Metals and its projects

please visit our web site at www.Lionsgatemetals.com.

TSX Venture Exchange: The TSX Venture Exchange has not reviewed,

and does not accept, responsibility for the adequacy or accuracy of

this release.

Contacts: Lions Gate Metals Inc. Mark Hewett President &

Director (604) 683-7588 Lions Gate Metals Inc. Blair McIntyre

Business Development and Investor Relations (604) 683-7588 (604)

683-7589 (FAX) Email: info@LionsGateMetals.com Website:

www.lionsgatemetals.com Copper Fox Metals Inc. Guillermo Salazar

President & CEO (403) 264-2820 Website:

www.copperfoxmetals.com

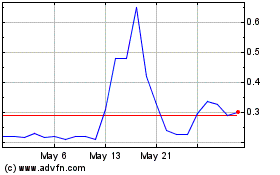

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From Jun 2024 to Jul 2024

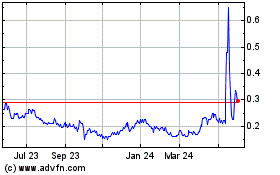

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From Jul 2023 to Jul 2024