TSX VENTURE COMPANIES:

AGRIMARINE HOLDINGS INC. ("FSH")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the third tranche of a Non-Brokered Private Placement announced July 9,

2009 and amended August 18, 2009:

Number of Shares: 400,000 shares

Purchase Price: $0.25 per share

Warrants: 400,000 share purchase warrants to purchase

400,000 shares

Warrant Exercise Price: $0.35 for a two year period

Number of Placees: 2 placees

Insider / Pro Group

Participation: N/A

Finder's Fee: $8,000 in cash and 32,000 Finder's Warrants

payable to NBCN Inc. where each Finder's

Warrant has the same terms as those in the

above private placement.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

ANTHONY CLARK INTERNATIONAL INSURANCE BROKERS LTD. ("ACL")

BULLETIN TYPE: Halt

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

Effective at 6:55 a.m. PST, August 27, 2009, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

---------------------------------------------------------------------------

BROADBAND LEARNING CORPORATION ("BLC")

BULLETIN TYPE: Halt

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

Effective at 11:34 p.m. PST, August 27, 2009, trading in the shares of the

Company was halted pending contact with the Company; this regulatory halt

is imposed by Investment Industry Regulatory Organization of Canada, the

Market Regulator of the Exchange pursuant to the provisions of Section

10.9(1) of the Universal Market Integrity Rules.

TSX-X

---------------------------------------------------------------------------

CANADIAN IMPERIAL VENTURE CORP. ("CQV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the second tranche a Non-Brokered Private Placement announced June 3,

2009:

Number of Shares: 16,750,000 shares (of which 5,250,000 are

flow-through)

Purchase Price: $0.02 per share

Warrants: 5,750,000share purchase warrants to purchase

5,750,000 shares

Warrant Exercise Price: $0.05 for a one year period

$0.10 in the second year

Number of Placees: 8 placees (2 - f/t; 6 nf/t)

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Kirby Mercer Y 1,750,000 nf/t

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

CMC METALS LTD. ("CMB")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange bulletin dated August 24, 2009, with

respect to a Non-Brokered Private Placement announced August 13, 2009, the

finders' fees section has been amended as follows:

Finders' Fees: $3,500 cash payable to Wolverton Securities

Ltd.

$2,756.25 cash payable to Jennings Capital

Inc.

$2,803.50 cash payable to Canaccord Capital

Corp.

TSX-X

---------------------------------------------------------------------------

CONWAY RESOURCES INC. ("CWY")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 2,742,640 shares, at a deemed price of $0.05 per share and 2,742,640

warrants to purchase 2,742,640 shares at an exercise price of $0.10 during

a one-year period, to settle an outstanding debt of $137,132.00, as

announced by way of a news release dated August 26, 2009.

Number of Creditors: 4 creditors

RESSOURCES CONWAY INC. ("CWY")

TYPE DE BULLETIN : Emission d'actions en reglement d'une dette

DATE DU BULLETIN : Le 27 aout 2009

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation de la

societe en vertu de l'emission proposee de 2 742 640 actions, au prix de

0,05 $ l'action et 2 742 640 bons de souscription permettant de souscrire

2 742 640 actions au prix d'exercice de 0,10 $ pendant une periode d'un

an, en reglement d'une dette de 137 132,00 $, tel qu'annonce par voie de

communique de presse le 26 aout 2009.

Nombre de creanciers : 4 creanciers

TSX-X

---------------------------------------------------------------------------

DOBHAI VENTURES INC. ("DOB.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated August 26, 2009, effective

at 12:54 p.m., PST, August 27, 2009 trading in the shares of the Company

will remain halted pending receipt and review of acceptable documentation

regarding the Qualifying Transaction pursuant to Listings Policy 2.4.

TSX-X

---------------------------------------------------------------------------

ETNA RESOURCES INC. ("ETN")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

Effective at 6:01 a.m., PST, August 27, 2009, shares of the Company

resumed trading, an announcement having been made over Market News

Publishing.

TSX-X

---------------------------------------------------------------------------

EXCEL GOLD MINING INC. ("EGM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with

respect to a Non-Brokered Private Placement announced on August 6, 7 and

12, 2009:

Number of Shares: 10,000,000 flow-through common shares

Purchase Price: $0.08 per common share

Warrants: 10,000,000 warrants to purchase 10,000,000

common shares

Warrant Exercise Price: $0.135 for an 18-month period

Finder's Fee: The amounts of $60,000 and $20,000 cash, along

with 500,000 Agents' Options, were each paid

to Limited Market Dealer and Industrial

Alliance Securities, respectively. Each option

entitles the Holder to purchase one common

share and one common share purchase warrant

at a price of $0.08 over a period of 18 months

following the closing of the Private

Placement. Each warrant carries the same terms

as those described above.

The Company has confirmed the closing of the above-mentioned Private

Placement by way of a press release dated August 25, 2009.

LES MINES D'OR EXCEL INC. ("EGM")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN : Le 27 aout 2009

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce les 6,

7 et 12 aout 2009 :

Nombre d'actions : 10 000 000 d'actions ordinaires accreditives

Prix : 0,08 $ par action ordinaire

Bons de souscription : 10 000 000 de bons de souscription permettant

de souscrire a 10 000 000 d'actions ordinaires

Prix d'exercice des bons : 0,135 $ pour une periode de 18 mois

Honoraires

d'intermediation : Les sommes de 60 000 $ et 20 000 $ en especes,

ainsi que 500 000 options ont respectivement

ete payes a Limited Market Dealer et Valeurs

mobiliers Industrial Alliance. Chaque option

permet au titulaire d'acquerir une action

ordinaire et un bon de souscription au prix de

$0.08 pendant une periode de 18 mois suivant

la cloture du placement prive. Chaque bon de

souscription porte les memes termes que ceux

decrits ci-dessus.

La societe a confirme la cloture du placement prive precite par voie d'un

communique de presse date du 25 aout 2009.

TSX-X

---------------------------------------------------------------------------

GLAMIS RESOURCES LTD. ("GLM.RT")

BULLETIN TYPE: Rights Expiry-Delist

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

Effective at the opening Tuesday, September 1, 2009, the Rights of the

Company will trade for cash. The Rights expire September 4, 2009 and will

therefore be delisted at the close of business September 4, 2009.

TRADE DATES

September 1, 2009 - TO SETTLE - September 2, 2009

September 2, 2009 - TO SETTLE - September 3, 2009

September 3, 2009 - TO SETTLE - September 4, 2009

September 4, 2009 - TO SETTLE - September 4, 2009

The above is in compliance with Trading Rule C.2.18 - Expiry Date:

Trading in the rights shall be for cash for the three trading days

preceding the expiry date and also on expiry date. On the expiry date,

trading shall cease at 12 o'clock noon E.T. and no transactions shall take

place thereafter except with permission of the Exchange.

TSX-X

---------------------------------------------------------------------------

GOLDEN DORY RESOURCES CORP. ("GDR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced July 21, 2009:

Number of Shares: 1,875,000 shares

Purchase Price: $0.08 per share

Warrants: 1,875,000 share purchase warrants to purchase

1,875,000 shares

Warrant Exercise Price: $0.15 for a two year period

Number of Placees: 1 placee

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. (Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.)

TSX-X

---------------------------------------------------------------------------

MINDORO RESOURCES LTD. ("MIO")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: August 27, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced August 19, 2009:

Number of Shares: 6,233,000 shares

Purchase Price: $0.10 per unit

Warrants: 6,233,000 share purchase warrants to purchase

6,233,000 shares

Warrant Exercise Price: $0.20 per share in the first year and $0.30

per share to the end of year two

Number of Placees: 27 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Units

James Climie Y 150,000

Debrenlar Holdings Ltd.

(Doug Frondall) Y 100,000

John R. Garden &

Company Holdings Ltd.

(A Robsn Garden) Y 100,000

Penny Gould Y 50,000

John Tosney Y 100,000

Peter Vander Velde P 50,000

Finder's Fee: $7,530 cash and 7,530 Agent's Options payable

to Northern Securities.

- Each Agent's Option is exercisable at a price

of $0.12 for a period of two years.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. (

TSX-X

---------------------------------------------------------------------------

NORTHERN STAR MINING CORP. ("NSM")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: August 27, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced July 7, 2009 and amended on July

20, 2009:

Number of Shares: 37,993,000 non flow-through shares

7,528,497 flow-through shares

Purchase Price: $0.50 per non flow-through share

$0.56 per flow-through share

Warrants: 18,996,500 share purchase warrants to purchase

18,996,500 shares

Warrant Exercise Price: $0.70 for a three year period

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Nicholas Shinder P 16,000

Thierry Tremblay P 16,000

Alain Pacquet P 14,000

Agents' Fees: $1,093,069.98 and 2,131,022 Agent Warrants

payable to Casimir Capital LLP

$233,347.61 and 456,648 Agent Warrants payable

to Canaccord Capital Corp.

$217,849.61 and 456,648 Agent Warrants payable

to Wellington West Capital Markets Inc.

$79,625 and 142,188 Agent Warrants payable to

Limited Market Dealer Inc.

$980 payable to First Canada Capital Partners

Inc.

- Each Agent Warrant is exercisable at $0.70 for

a three year period

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. (Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.)

TSX-X

---------------------------------------------------------------------------

NORWOOD RESOURCES LTD. ("NRS")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debenture/s

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced July 15, 2009:

Secured Convertible Note: $6,121,783.05 with 87,454,015 detachable

warrants.

Conversion Price: Convertible into shares at $0.07 of principal

outstanding.

Maturity date: Two years from closing.

Warrants Each warrant will have a term of two years

from the date of issuance of the notes and

entitle the holder to purchase one common

share. The warrants are exercisable at the

price of $0.10 for two years. However, if the

Company's shares close above $0.50 per share

for ten consecutive trading days, the Company

may, upon notice to the warrant holders,

shorten the exercise period of the warrants

to 30 days.

Interest rate: 10%

Number of Placees: 135 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P Principal Amount

Raymond Cahill Y 3,571,428

David Klepacki Y 571,428

Edward Mercaldo Y 12,499,999

Graeme Phipps Y 3,571,428

Carlos Garin Y 271,428

Greg Chornoboy P 300,000

James A. Richardson P 1,071,428

Peter Taylor P 285,714

Cormark Securities

Investment Trust P 3,571,428

Tonya L. Fleming P 142,857

David Beddis P 571,428

Brent Watson P 714,285

Todd Kepler P 1,428,571

Ed Flood P 142,857

Peter Ross P 357,142

Thomas Seltzer P 250,000

Robert J. Sheppard P 100,000

Jock Ross P 650,000

Reg Smith P 150,000

Michael O'Brien P 150,000

Andrew Johns P 100,000

David Lyall P 1,000,000

David Joel Appleton P 142,857

Brian Mercer P 1,000,000

Ula Hartner P 714,285

Millenium Management

Corporation (Jay Sujir) Y 1,071,428

Finders' Fees: $19,660 cash payable to Haywood Securities

Inc.

$7,525 cash payable to Dundee Securities Corp.

$875 cash payable to Woodstone Capital Inc.

$12,775 cash payable to Raymond James Ltd.

$23,300 cash payable to Jennings Capital Inc.

$39,070 cash payable to Archie Adams.

$22,500 cash payable to Cormark Securities

Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

OLYMPIA FINANCIAL GROUP INC. ("OLY")

BULLETIN TYPE: Normal Course Issuer Bid

BULLETIN DATE: August 27, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has been advised by the Company that pursuant to a

Notice of Intention to make a Normal Course Issuer Bid dated August 26,

2009, it may repurchase for cancellation, up to 123,677 shares in its own

capital stock. The purchases are to be made through the facilities of TSX

Venture Exchange during the period September 1, 2009 to August 31, 2010.

Purchases pursuant to the bid will be made by Canaccord Capital

Corporation on behalf of the Company.

TSX-X

---------------------------------------------------------------------------

PIONEERING TECHNOLOGY CORP. ("PTE")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 889,642 shares to settle outstanding debt for $100,000.

Number of Creditors: 1 Creditor

Insider / Pro Group Participation:

Insider equals Y / Amount Deemed Price

McAllister Holdings Ltd. Y $100,000 $0.112404712

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

---------------------------------------------------------------------------

PRIMARY PETROLEUM CORPORATION ("PIE")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to the

Purchase and Sale Agreement (the "Agreement") between Primary Petroleum

Corporation (the "Company") and Commercial Energy of Montana Inc. (the

"Purchaser") for the disposition of the Company's land, oil and gas

leases, wells and all other physical assets contained therein ("Prairie

Dell Field"). Pursuant to the terms of the Agreement, the sale price will

be equal to the Company's cost in the Prairie Dell Field on the date of

closing in the gross amount of USD$1,502,639.50. The purchase price will

be satisfied using cash.

This transaction was announced in the Company's press release dated June 1

and July 14, 2009.

TSX-X

---------------------------------------------------------------------------

REEF RESOURCES LTD. ("REE")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 2,187,500 flow-through shares and 3,251,265 non flow-through shares

to settle outstanding debt for $359,276.

Number of Creditors: 18 Creditors

Insider / Pro Group Participation:

Insider equals Y / Amount Deemed Price

Creditor Progroup equals P Owing per Share # of Shares

2024280 Ontario Inc.

(Tariq Malik) Y $15,000 $0.05 300,000 FT

713431 Alberta Ltd.

(Arnie Hansen) Y $70,000 $0.05 1,400,000 FT

Larry Olson

and Associates

(Larry Olson) Y $24,375 $0.05 487,500 FT

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

---------------------------------------------------------------------------

RIVERSTONE RESOURCES INC. ("RVS")

BULLETIN TYPE: Private Placement-Brokered, Amendment

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

Further to the bulletins dated June 17, 2009 and June 29, 2009, TSX

Venture Exchange has accepted a second amendment to a Non-Brokered Private

Placement announced June 2, 2009 and June 9, 2009. The amendment relates

to the payment of finder's fees as follows:

Finders' fees: Haywood Securities Inc. receives $11,484 and

76,560 finder's warrants.

Canaccord Capital Corporation receives $24,600

and 164,000 finder's warrants.

Fraser Mackenzie Limited receives $47,208 and

314,720 finder's warrants.

Sandfire Securities Inc. receives $10,844.40

and 72,296 finder's warrants.

Northern Securities Inc. receives $26,400 and

176,000 finder's warrants.

Bolder Investment Partners receives $3,600 and

24,000 finder's warrants.

Tracey S. Denis receives $1,200 and 8,000

finder's warrants.

Ben Lee receives $1,560 and 10,400 finder's

warrants.

- Each finder's warrant is exercisable to

acquire one additional share at a price of

$0.20 per share for a 24 month period.

TSX-X

---------------------------------------------------------------------------

ROMARCO MINERALS INC. ("R")

BULLETIN TYPE: Prospectus-Share Offering

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

Effective August 6, 2009, the Company's Prospectus dated August 6, 2009

was filed with and accepted by TSX Venture Exchange, and filed with and

receipted by the Securities Commissions in each of British Columbia,

Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia and

Newfoundland and Labrador, pursuant to the provisions of the respective

Securities Acts.

Underwriters: Paradigm Capital Inc., GMP Securities L.P.,

Macquarie Capital Markets Canada Ltd., and

Wellington West Capital Markets Inc.

Offering: 45,500,000 shares

Share Price: $0.88 per share

Underwriters' Fees: $2,762,760, plus 3,139,500 compensation

options. Each compensation option entitles the

Underwriters to purchase one common share at a

price of $0.88 for a period of 2 years from

closing.

Over-Allotment Option: The Underwriters have over-allotted shares in

connection with this offering and the Company

has granted to the Underwriters 6,825,000

additional shares, equal to 15% of the

offering, for gross proceeds of $6,006,000.

TSX-X

---------------------------------------------------------------------------

SANU RESOURCES LTD. ("SNU")

BULLETIN TYPE: Halt

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

Effective at the opening, August 27, 2009, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

---------------------------------------------------------------------------

SANU RESOURCES LTD. ("SNU")

BULLETIN TYPE: Delist-Offer to Purchase

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

Effective at the close of business August 27, 2009, the common shares of

Sanu Resources Ltd. (the "Company") will be delisted from TSX Venture

Exchange. The delisting of the Company's shares results from Canadian Gold

Hunter purchasing 100% of the Company's shares pursuant to an Arrangement

Agreement dated June 30, 2009. Sanu Resources Ltd. shareholders will

receive 0.5725 shares of Canadian Gold Hunter Corp. for every Sanu

Resources Ltd. common share held. For further information please refer to

the Company's information circular dated July 20, 2009 and the Company's

news release dated August 20, 2009.

TSX-X

---------------------------------------------------------------------------

SNS SILVER CORP. ("SNS")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation with

respect to a Non-Brokered Private Placement announced August 7, 2009:

Number of Shares: 4,040,000 shares

Purchase Price: $0.10 per share

Warrants: 4,040,000 share purchase warrants to purchase

4,040,000 shares

Warrant Exercise Price: $0.20 for a two year period

Number of Placees: 11 placees

Finders' Fees: $23,100 and 231,000 warrants payable to

Redplug Capital

$3,980 payable to Joel Warawa

$1,050 payable to Roland Schemel

$1,050 and 10,500 warrants payable to Union

Securities Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

STRATEGIC OIL & GAS LTD. ("SOG")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing final documentation in

respect of the Company's arm's length acquisition (the Acquisition) of

ZinMac Inc. (ZinMac), carried out through the issuance by the Company of

5,000,000 common shares at a deemed price of $0.25 per share, and the

exchange of 100,000 common share purchase warrants of ZinMac for 370,370

common share purchase warrants of the Company, exercisable at $0.27 per

share until May 8, 2011, which Acquisition was effected pursuant to an

exempt take over bid made by the Company to the nine shareholders of

ZinMac, in accordance with applicable securities laws.

For further details, please refer to the Company's news releases dated

July 30, 2008 and March 12, 2009.

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P # of Shares

Sean Hayes Y 555,556

Anthony Wain Y 555,556

Gupreet Sawhney Y 555,556

TSX-X

---------------------------------------------------------------------------

TRAFINA ENERGY LTD. ("TFA.A")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to a

Sale and Purchase Agreement (the "Agreement") between the Company and an

arm's length third party (the "Vendor") dated August 11, 2009. Under the

terms of the Agreement the Company will purchase a 50% interest in certain

producing assets in Alberta and Saskatchewan from the Vendor for $10 plus

a sliding scale royalty and the assumption of related operating,

abandonment and reclamation liabilities. The sliding scale royalty ranges

from 0% to 7.5% for all existing wells. The sliding scale royalty is

capped such that, when combined with other royalties, aggregate royalties

on the wells will not exceed 15%.

TSX-X

---------------------------------------------------------------------------

VIOR INC. (SOCIETE D'EXPLORATION MINIERE) ("VIO")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debenture

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced on August 14, 2009:

Convertible Debenture: $150,000

Conversion Price: Principal is convertible at the option of the

holder into common shares at a conversion

price of $0.10 per share until August 12,

2012.

Maturity Date: August 12, 2012

Interest Rate: 12% per annum

Warrants: 1,500,000 warrants to purchase 1,500,000

common shares

Warrants Exercise Price: $0.12 per common share during the first 12

months following the closing of the Private

Placement and $0.13 during the 12 months

subsequent.

Number of Placees: 1 placee

The Company has confirmed the closing of the above-mentioned Private

Placement.

SOCIETE D'EXPLORATION MINIERE VIOR INC. ("VIO")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier,

debenture convertible

DATE DU BULLETIN : Le 27 aout 2009

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 14

aout 2009 :

Debenture convertible : 150 000 $

Prix de conversion : Le capital est convertible en actions

ordinaires au gre du detenteur au prix de

conversion de 0,10 $ par action jusqu'au 12

aout 2012.

Date d'echeance : le 12 aout 2012

Taux d'interet : 12 % par annee

Bons de souscription : 1 500 000 bons permettant d'acquerir 1 500 000

actions ordinaires

Prix d'exercice des bons : 0,12 $ pendant les premiers 12 mois suivant

la cloture du placement prive et 0,13 $

pendant les 12 mois subsequents.

Nombre de souscripteurs : 1 souscripteur

La societe a confirme la cloture du placement prive mentionne ci-dessus.

TSX-X

---------------------------------------------------------------------------

VIRIDIS ENERGY INC. ("VRD")

BULLETIN TYPE: Shares for Debt, Remain Halted

BULLETIN DATE: August 27, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 719,125 shares to settle outstanding debt for $53,934.43.

Number of Creditors: 1 Creditor

Insider / Pro Group

Participation: N/A

The Company shall issue a news release when the shares are issued and the

debt extinguished.

Trading in the shares of the Company will remain halted.

TSX-X

---------------------------------------------------------------------------

NEX COMPANY:

YONGE STREET CAPITAL CORP. ("YSC.H")

BULLETIN TYPE: Halt

BULLETIN DATE: August 27, 2009

NEX Company

Effective at 9:12 a.m. PST, August 27, 2009, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

---------------------------------------------------------------------------

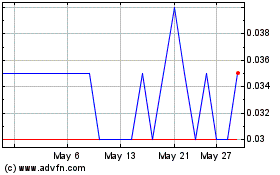

CMC Metals (TSXV:CMB)

Historical Stock Chart

From May 2024 to Jun 2024

CMC Metals (TSXV:CMB)

Historical Stock Chart

From Jun 2023 to Jun 2024