AndeanGold Announces Closing of $1.5 Million Private Placement

October 27 2010 - 9:00AM

Marketwired Canada

AndeanGold Ltd. ("the Company" or "AndeanGold") (TSX VENTURE:AAU) is pleased to

announce that the Company has closed the final tranche of its previously

announced non-brokered private placement ("Placement") (news releases of

September 23, 2010 and October 8, 2010). Under the Placement, the Company issued

a total of 12,500,000 units ("Units") at a price of $0.12 per Unit to raise

aggregate gross proceeds of $1,500,000. Each Unit is comprised of one common

share and one-half of one common share purchase warrant. Each whole warrant will

entitle the holder to purchase one additional common share for one year from the

respective closing date of each tranche at a price of $0.20.

Pursuant to the second tranche of the Placement, the Company issued an aggregate

of 8,750,000 Units to raise aggregate gross proceeds of $1,050,000. The first

tranche of the Placement closed on October 8, 2010 and involved the issuance of

an aggregate of 3,751,000 Units to raise aggregate gross proceeds of $450,000.

In accordance with applicable securities laws and the policies of the TSX

Venture Exchange, the Company paid finders' fees with respect to portions of the

Placement, amounting to $71,645 in cash commissions and the issuance of 597,041

warrants, each warrant entitling the holder to purchase one additional common

share for one year from the respective closing date of each tranche at a price

of $0.20.

The Company also paid a corporate finance fee with respect to the Placement in

the form of an option to purchase up to 10% of the number of Units sold at a

price of $0.12 per Unit for a period of 30 days following the closing. This

option has been exercised, resulting in the issuance of an additional 1,000,000

Units, for gross proceeds of $120,000. Thus, in connection with the overall

Placement, the Company issued an aggregate of 13,500,000 Units to raise

aggregate gross proceeds of $1,620,000.

All securities issued in the Placement will be subject to a four-month hold

period from the Closing of the Placement.

The Placement remains subject to the receipt of final acceptance from the TSX

Venture Exchange.

The proceeds of the Placement will be used principally to fund a Phase I drill

program on the Company's Urumalqui Project in Peru and for general working

capital purposes.

About AndeanGold Ltd.:

AndeanGold Ltd. is engaged in the acquisition, exploration and potential

development of primarily precious metals properties, principally in Peru and

Ecuador. The focus of the Company's exploration activities is presently in

advancing its Urumalqui Project, as well as pursuing mineral property

acquisitions, in Peru. In Ecuador, the Company's activities have been limited to

administrative and legal matters due to the Mining Mandate issued by the Ecuador

Constituent Assembly on April 18, 2008. In November 2009, President Correa

signed the Mining Regulations into law pursuant to the requirements of the new

Mines Law, which was passed in January 2009. This was the final legal precursor

to the re-initiation of exploration and mining development in Ecuador. The

Company has been issued new mining titles under the new Mines law to its three

key Ecuadorian projects and has filed the requisite documents with the Ministry

of Non-Renewable Natural Resources and Ministry of Environment in support of the

Company's request to renew exploration programs on its key projects in Ecuador.

The Company is actively working with government officials to achieve this end.

Please refer to AndeanGold's website at www.andeangoldltd.com for further

information on the Company's projects and activities.

On Behalf of the Board of Directors of ANDEANGOLD LTD.

Anthony F. Ciali, President, CEO and Director

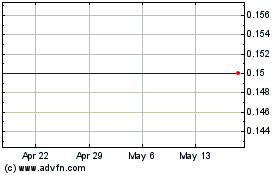

Angold Resources (TSXV:AAU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Angold Resources (TSXV:AAU)

Historical Stock Chart

From Jul 2023 to Jul 2024