Transcontinental Inc. Announces the Renewal of its Normal Course Issuer Bid

April 10 2014 - 2:42PM

Marketwired Canada

Transcontinental Inc. (TSX:TCL.A)(TSX:TCL.B)(TSX:TCL.PR.D) has been authorized

to purchase for cancellation on the open market, between April 15, 2014 and

April 14, 2015, up to 4,742,369 of its Class A Subordinate Voting Shares,

representing 10% of the 47,423,698 public float Class A Subordinate Voting

Shares as of April 2, 2014 (63,188,951 issued and outstantding Class A

Subordinate Voting Shares as of April 2, 2014), and up to 741,640 of its Class B

Shares, representing 5% of the 14,832,816 issued and outstanding Class B Shares

as of April 2, 2014. The average daily trading volume on the Toronto Stock

Exchange of Class A Subordinate Voting Shares for the past six months was

214,267 and the average daily trading volume on the Toronto Stock Exchange of

Class B Shares for the past six months was 548. In accordance with the Toronto

Stock Exchange requirements, a maximum daily purchase of the greater of 25% of

these averages or 1,000 shares may be made, which represent a total of 53,566

Class A subordinate Voting Shares and a total of 1,000 Class B Shares. The

purchases will be made in the normal course of business at market prices through

the facilities of the Toronto Stock Exchange and/or alternative Canadian trading

platforms in accordance with the requirements of the exchange and/or, subject to

the approval of any securities authority by private agreements. If necessary,

purchases through private agreements will be executed at a price that is less

than the prevailing market price on the Toronto Stock Exchange at the time of

the purchase.

The Corporation believes that the purchase of the Class A subordinate Voting

Shares and Class B Shares would constitute an economically worthwhile use by the

Corporation of its funds and is in the best interest of the Corporation and its

shareholders. During the period from April 15, 2013 to April 10, 2014,

Transcontinental Inc. did not purchase Class A Subordinate Voting Shares or

Class B Shares.

In connection with the program, the Corporation established an automatic

securities purchase plan to provide standard instructions regarding how the

Corporation's shares are to be repurchased under the program. Accordingly, the

Corporation may repurchase its shares under the automatic plan on any trading

day during the program including during self-imposed trading blackout periods.

The automatic plan will commence and should terminate together with the program.

It constitutes an "automatic plan" for purposes of applicable Canadian

securities legislation and has been reviewed by the Toronto Stock Exchange.

About TC Transcontinental

Largest printer and leading provider of media and marketing activation solutions

in Canada, TC Transcontinental creates products and services that allow

businesses to attract, reach and retain their target customers. The Corporation

specializes in print and digital media, the production of magazines, newspapers,

books and custom content, mass and personalized marketing, interactive and

mobile applications, and door-to-door distribution.

Transcontinental Inc. (TSX:TCL.A)(TSX:TCL.B)(TSX:TCL.PR.D), including TC

Transcontinental, TC Media and TC Transcontinental Printing, has over 9,000

employees in Canada and the United States, and revenues of C$2.1 billion in

2013. Website www.tc.tc.

FOR FURTHER INFORMATION PLEASE CONTACT:

Media: Nathalie St-Jean

Senior Advisor, Corporate

Communications

TC Transcontinental

Telephone : 514 954-3581

nathalie.st-jean@tc.tc / www.tc.tc

Financial Community: Jennifer F. McCaughey

Senior Director, Investor Relations

and External Corporate Communications

TC Transcontinental

Telephone : 514 954-2821

jennifer.mccaughey@tc.tc / www.tc.tc

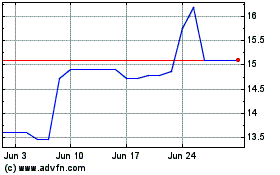

Transcontinental (TSX:TCL.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

Transcontinental (TSX:TCL.B)

Historical Stock Chart

From Jul 2023 to Jul 2024