Transcontinental Inc. (TSX:TCL.A)(TSX:TCL.B)(TSX:TCL.PR.D)

----------------------------------------------------------------------------

(in millions of

dollars, except per

share data) Q4-13 Q4-12 % 2013 2012 %

----------------------------------------------------------------------------

Revenues 566.3 585.1 (3.2) 2,110.1 2,112.1 (0.1)

----------------------------------------------------------------------------

Adjusted operating

income before

amortization

(1)(Adjusted EBITDA) 112.6 123.8 (9.0) 349.1 357.6 (2.4)

----------------------------------------------------------------------------

Adjusted operating

income (1)(Adjusted

EBIT) 86.1 96.4 (10.7) 243.8 245.2 (0.6)

----------------------------------------------------------------------------

Adjusted net income

applicable to

participating shares

(1) 58.2 61.9 (6.0) 157.2 149.4 5.2

----------------------------------------------------------------------------

Per share 0.75 0.77 (2.6) 2.02 1.85 9.2

----------------------------------------------------------------------------

Net income (loss)

applicable to

participating shares (92.2) (51.9) - (14.5) (183.3) -

----------------------------------------------------------------------------

Per share (1.19) (0.65) - (0.19) (2.27) -

----------------------------------------------------------------------------

Note 1: Please refer to the table "Reconciliation of Non-IFRS financial

measures" in this press release.

Highlights of Fiscal 2013

-- Adjusted net income applicable to participating shares grew 5.2%, from

$149.4 million to $157.2 million; on a per share basis, it rose from

$1.85 to $2.02.

-- Excellent Printing Sector performance, including $30 million in realized

synergies from the acquisition of Quad/Graphics Canada, Inc. in 2013 and

$40 million since the acquisition in March 2012.

-- Recorded an asset impairment charge (including goodwill) of $170 million

mainly due to difficult market conditions in the Media Sector.

-- Successfully launched in-store marketing printing services for Canadian

retailers, which generated annualized revenues of $25 million in 2013.

-- Received an amount of US$200 million from the renegotiation of an

agreement with Hearst Corporation.

-- Declared a special dividend of $1.00 per participating share, or

approximately $78 million, in addition to the regular dividend.

-- Maintained a solid financial position with a net indebtedness ratio of

0.91x.

-- Entered into a definitive agreement pursuant to which the Corporation

will acquire all Quebec community newspapers and associated web

properties from Sun Media Corporation, a subsidiary of Quebecor Media,

for a total purchase price of $75 million, as well as an agreement with

Quebecor Media for the printing of some of its magazines and direct

marketing material.

Transcontinental Inc.'s (TSX:TCL.A)(TSX:TCL.B)(TSX:TCL.PR.D) revenues for fiscal

2013 remained stable at $2.1 billion. This performance is mainly related to the

contribution from acquisitions, in particular the acquisition of Quad/Graphics

Canada, Inc., which was however offset by the end of the contract to print and

distribute Zellers flyers, a decrease in volume in our book and magazine

printing operations, a difficult advertising environment and the incentives

granted for the renewal of certain contracts in 2012.

Adjusted operating income declined slightly, or 0.6%, from $245.2 million to

$243.8 million. This slight decrease is primarily due to the share-price

variance in fiscal 2013, compared to fiscal 2012 (a 62% rise in share price),

which increased the stock-based compensation expense, as well as the reasons

mentioned above. This decrease in adjusted operating income was partially

offset, however, by synergies derived from the acquisition of Quad/Graphics

Canada, Inc. and the optimization of our company-wide cost structure. Net income

applicable to participating shares improved from a loss of $183.3 million, or

$2.27 per share, to a loss of $14.5 million, or $0.19 per share. This

improvement is mainly due to unusual income tax adjustments of $115.2 million

recorded in 2012, including financial expenses, and to a lower asset impairment

charge in 2013. Adjusted net income applicable to participating shares grew

5.2%, from $149.4 million, or $1.85 per share, to $157.2 million, or $2.02 per

share.

"In fiscal 2013, considering the profound transformation that is ongoing in our

industry, we have delivered strong results that reflect the excellence of our

manufacturing know-how and our new product and service development efforts,"

said Francois Olivier, President and Chief Executive Officer. "I am especially

proud of the solid performance delivered by our Printing Sector which increased

its adjusted operating income by 12%, or $23 million, making 2013 a record year

for this operating segment. These results are due in large part to the

successful integration of Quad/Graphics Canada, Inc.'s operations into our print

network, which generated significant synergies and enabled greater optimization

of our platform. In addition, despite the ongoing challenge of a soft

advertising market, I would highlight that the launch of new digital media

products in 2013, as well as investments in non-advertising related businesses,

such as educational publishing, contributed to maintaining our revenues.

As a result of our excellent financial position and our ability to generate

significant cash flows, we were able to both significantly reduce our debt and

pay a special dividend to our participating shareholders in addition to paying

the regular dividend. Our strong balance sheet gives us the financial

flexibility we need to strategically pursue our transformation in conjunction

with our employees, our communities, our shareholders and our customers."

Other Highlights for Fiscal 2013

Printing Sector

In fiscal year 2013, our Printing Sector recorded a significant increase in

adjusted operating income of 12%, or $23 million, to reach $223 million. The

integration of Quad/Graphics Canada, Inc.'s operations generated $30 million in

synergies in 2013 and $40 million since the acquisition in March 2012. During

fiscal 2013, we concluded several multi-year agreements valued at over $40

million per year, including an agreement with Safeway U.S. to print flyers at

our plant in Fremont, California; a five-year agreement to print the Calgary

Herald and the Vancouver Sun, both owned by Postmedia Network Inc.; and an

agreement with Shoppers Drug Mart/Pharmaprix for in-store marketing, a promising

new niche.

Media Sector

Ted Markle was appointed President of the Media Sector. Following his

appointment, he revised the sector's organizational structure with the aim of

reducing costs and increasing return on investment. We formed a strategic

alliance with Zone3, further to which the latter will handle television

production for TC Media's brands and which also provides for the merger of all

our television production operations with those of Zone3. We successfully

launched Vero, an inspiring women magazine, and four TC Media flagship brands on

iPad: Coup de pouce, Canadian Living, ELLE Quebec and Elle Canada. We

successfully re-launched high-potential titles: Coup de pouce, Canadian Living

and Western Living. In order to diversify our operations by capturing non

advertising-related revenue streams, we acquired Groupe Modulo, a publisher of

French-language educational materials. We launched the TC Media Incubator, a

laboratory for the creation, development and incubation of new digital products.

In addition, we introduced AutoGo.com and JobGO.ca, two new and innovative media

platforms. In light of ongoing analysis in the Media Sector, we made the

difficult decision to close More and Vita, which were no longer achieving

expected results.

Financial Highlights

Fiscal 2013 was characterized by debt reduction, due to our significant cash

flows and the amount of US$200 million received from the renegotiation of an

agreement with Hearst Corporation. Our adjusted net indebtedness ratio improved

from 1.32x as at October 31, 2012 to 0.91x as at October 31, 2013. During fiscal

2013, TC Transcontinental continued a multi-pronged approach to capital

allocation. The Corporation focused on future growth by investing $74 million in

property, plant and equipment and intangible assets as well as $25 million in

strategic acquisitions. It also distributed cash to its shareholders through the

payment of quarterly dividends of $52 million to holders of participating and

preferred shares, the payment of a special dividend of $78 million to holders of

participating shares and the repurchase of participating shares for a total

amount of $12 million.

Asset Impairment

In the fiscal year ended October 31, 2013, the Corporation recorded an asset

impairment charge of $170 million, of which $160 million is related to goodwill,

mainly as a result of the difficult market conditions in the Media Sector that

continue to adversely affect the advertising revenues of certain business

groups.

Fourth Quarter

TC Transcontinental's revenues for the fourth quarter declined from $585.1

million in 2012 to $566.3 million in 2013, mainly as a result of the difficult

market conditions that affected our magazine and book printing operations. This

decrease is also attributable to the soft advertising market that continued to

impact our Media Sector, mostly in local markets, and to the end of the contract

to print and distribute Zellers flyers after its store closures. The decrease

was partially offset by new contracts in the Printing Sector.

In the fourth quarter, adjusted operating income decreased by 10.7%, from $96.4

million to $86.1 million. The main reason for this decline is the share-price

variance in the fourth quarter of 2013, which increased the stock-based

compensation expense, as well as the favourable non-recurring items recorded in

the fourth quarter of 2012. The combined results of the two operating sectors

were relatively stable. The Printing Sector delivered an increase of 12%, or $7

million, in adjusted operating income as a result of synergies generated from

the integration of Quad/Graphics Canada, Inc.'s operations as well as a decrease

in our costs arising from the optimization of our platform. Adjusted operating

income in our Media Sector declined by 28%, or $9 million, during the fourth

quarter mostly due to the soft local advertising market.

Net income applicable to participating shares decreased from a loss of $51.9

million, or $0.65 per share, to a loss of $92.2 million, or $1.19 per share,

mainly due to an increase in the asset impairment charge, partially offset by

the favourable effect of the write-down of tax assets recorded in the fourth

quarter of 2012. Adjusted net income applicable to participating shares was down

6.0%, from $61.9 million to $58.2 million, mostly as a result of the decrease in

our results explained above, partially offset by a decrease in income taxes and

financial expenses. On a per share basis, it declined from $0.77 to $0.75.

For more detailed financial information, please see Management's Discussion and

Analysis for the fiscal year ended October 31, 2013 as well as the financial

statements in the "Investors" section of our website at www.tc.tc

Subsequent Event

Announcement of a definitive agreement to acquire all Quebec community

newspapers from Sun Media Corporation

On December 5th, 2013, the Corporation announced that it has entered into a

definitive agreement pursuant to which it will acquire all Quebec community

newspapers and associated web properties from Sun Media Corporation, a

subsidiary of Quebecor Media, for a total purchase price of $75 million. This

agreement has been approved by the Boards of Directors of both Transcontinental

Inc. and Quebecor Media Inc., and the transaction is subject to obtaining

regulatory clearances under the Canadian Competition Act.

Outlook

The Printing Sector generated synergies reaching approximately $40 million, as

expected at the time of the acquisition of Quad/Graphics Canada, Inc., and

should generate a few million dollars in additional synergies during fiscal

2014. In addition, since the start of fiscal 2013, we have signed new agreements

to print newspapers, flyers, and marketing products whose contribution should be

noted more significantly in fiscal 2014. We will continue to develop our

offering to retailers, more specifically with respect to in-store marketing, and

pursue our efforts to integrate other Canadian newspaper publishers into our

efficient printing network. However, these items should be offset by an

anticipated decrease in volume within our existing magazine and book printing

operations.

In the Media Sector, the difficult market conditions with respect to advertising

spending in our local and national markets are likely to persist. As a result,

we will continue to optimize our cost structure to limit the potential impact on

profit margins. Furthermore, we will keep on investing in the development of new

products and services, mostly digital and interactive.

The new agreements announced with Quebecor Media Inc. for the printing of some

of its magazines and direct marketing materials should begin to progressively

have a positive impact as of February 2014. We also entered into a definitive

agreement with Sun Media Corporation, a subsidiary of Quebecor Media, subject to

regulatory approval, to acquire all of its Quebec community newspapers.

Following the closure of this transaction, we expect these items to have an

annualized impact of around $20 million on operating income before amortization.

We will continue to generate significant cash flows in the short-term, and our

excellent financial position should permit us to continue applying our

three-pronged capital management approach, which allows us to reduce our debt,

pay dividends and invest in our transformation focusing on our core

competencies, such as manufacturing. We will also keep on developing internal

projects and evaluating strategic acquisitions to maintain our position as

Canadian leader in marketing activation, while developing new niches to ensure

the long-term growth and profitability of the business.

Reconciliation of Non-IFRS Financial Measures

Financial data have been prepared in conformity with IFRS. However, certain

measures used in this press release do not have any standardized meaning under

IFRS and could be calculated differently by other companies. We believe that

many readers analyze our results based on certain non-IFRS financial measures

because such measures are normalized for evaluating the Corporation's operating

performance. Management uses such non-IFRS financial information to evaluate the

performance of its operations and managers. These measures should be considered

in addition to, not as a substitute for or superior to, measures of financial

performance prepared in accordance with IFRS.

The following table reconciles IFRS financial measures to non-IFRS financial

measures.

Reconciliation of Non-IFRS financial measures

(unaudited)

----------------------------------------------------------------------------

Three months ended Years ended October

October 31 31

(in millions of dollars, except

per share amounts) 2013 2012 2013 2012

----------------------------------------------------------------------------

Net income (loss) applicable to

participating shares $ (92.2) $ (51.9) $ (14.5) $ (183.3)

Dividends on preferred shares 1.7 1.7 6.8 6.8

Net loss (income) related to

discontinued operations (after

tax) - 0.3 - 7.4

Non-controlling interests 0.3 0.6 0.4 0.6

Unusual adjustments to income

taxes - 57.2 - 99.2

Income tax expenses 2.0 6.6 27.6 13.1

Financial expenses related to

unusual adjustments to income

taxes - - - 16.0

Financial expenses 5.7 7.8 25.5 30.5

Gain on business acquisition - (0.4) - (32.1)

Impairment of assets 165.3 51.2 170.0 232.0

Restructuring and other costs 3.3 23.3 28.0 55.0

----------------------------------------------------------------------------

Adjusted operating income $ 86.1 $ 96.4 $ 243.8 $ 245.2

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Amortization 26.5 27.4 105.3 112.4

----------------------------------------------------------------------------

Adjusted operating income

before amortization $ 112.6 $ 123.8 $ 349.1 $ 357.6

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income (loss) applicable to

participating shares $ (92.2) $ (51.9) $ (14.5) $ (183.3)

Net loss (income) from

discontinued operations (after

tax) - 0.3 - 7.4

Unusual adjustments to income

taxes - 57.2 - 99.2

Net financial expenses related

to unusual adjustments to

income taxes (after tax) - - - 16.0

Gain on business acquisition

(after tax) - (0.4) - (32.1)

Impairment of assets (after

tax) 147.9 39.9 151.3 202.6

Restructuring and other costs

(after tax) 2.5 16.8 20.4 39.6

----------------------------------------------------------------------------

Adjusted net income applicable

to participating shares $ 58.2 $ 61.9 $ 157.2 $ 149.4

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Average number of participating

shares outstanding 77.9 80.0 78.0 80.7

----------------------------------------------------------------------------

Adjusted net income applicable

to participating shares per

share $ 0.75 $ 0.77 $ 2.02 $ 1.85

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

As at As at

October October

31, 31,

2013 2012

----------------------------------------------------------------------------

Long-term debt $ 128.9 $ 204.1

Current portion of long-term debt 218.3 283.5

Cash (30.3) (16.8)

----------------------------------------------------------------------------

Net indebtedness $ 316.9 $ 470.8

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Adjusted operating income before amortization (last 12

months) $ 349.1 $ 357.6

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net indebtedness ratio 0.91x 1.32x

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Dividends

Dividend on Participating Shares

The Corporation's Board of Directors declared a quarterly dividend of $0.145 per

share on Class A Subordinate Voting Shares and Class B Shares. This dividend is

payable on January 20, 2014 to shareholders of record at the close of business

on January 3, 2014.

Dividend on Preferred Shares

The Board declared a quarterly dividend of $0.4253 per share on cumulative

5-year rate reset first preferred shares, series D. This dividend is payable on

January 15, 2014. On an annual basis, this represents a dividend of $1.6875 per

preferred share.

Additional Information

Conference Call

Upon releasing its fiscal 2013 results, the Corporation will hold a conference

call for the financial community today at 4:15 p.m. The dial-in numbers are 514

940-2795 or 1 416 644-3418 or 1 800-814-4861 and the access code is 4651012.

Media may hear the call in listen-only mode or tune in to the simultaneous audio

broadcast on the Corporation's Web site, which will then be archived for 30

days. For media requests for information or interviews, please contact Nathalie

St-Jean, Senior Advisor, Corporate Communications of TC Transcontinental, at 514

954-3581.

Profile

Largest printer and leading provider of media and marketing activation solutions

in Canada, TC Transcontinental creates products and services that allow

businesses to attract, reach and retain their target customers. The Corporation

specializes in print and digital media, the production of magazines, newspapers,

books and custom content, mass and personalized marketing, interactive and

mobile applications, and door-to-door distribution.

Transcontinental Inc. (TSX:TCL.A)(TSX:TCL.B)(TSX:TCL.PR.D), including TC

Transcontinental, TC Media and TC Transcontinental Printing, has over 9,000

employees in Canada and the United States, and revenues of C$2.1 billion in

2013. Website www.tc.tc.

Forward-looking Statements

Our public communications often contain oral or written forward-looking

statements which are based on the expectations of management and inherently

subject to a certain number of risks and uncertainties, known and unknown. By

their very nature, forward-looking statements are derived from both general and

specific assumptions. The Corporation cautions against undue reliance on such

statements since actual results or events may differ materially from the

expectations expressed or implied in them. Forward-looking statements may

include observations concerning the Corporation's objectives, strategy,

anticipated financial results and business outlook. The Corporation's future

performance may also be affected by a number of factors, many of which are

beyond the Corporation's will or control. These factors include, but are not

limited to, the economic situation in the world and particularly in Canada and

the United States, structural changes in the industries in which the Corporation

operates, the exchange rate, availability of capital, energy costs, competition,

as well as the Corporation's capacity to engage in strategic transactions and

integrate acquisitions into its activities. The main risks, uncertainties and

factors that could influence actual results are described in Management's

Discussion and Analysis (MD&A) for the fiscal year ended on October 31st, 2013

and in the latest Annual Information Form.

Unless otherwise indicated by the Corporation, forward-looking statements do not

take into account the potential impact of non-recurring or other unusual items,

nor of divestitures, business combinations, mergers or acquisitions which may be

announced after the date of December 5, 2013.

The forward-looking statements in this press release are made pursuant to the

"safe harbour" provisions of applicable Canadian securities legislation.

The forward-looking statements in this release are based on current expectations

and information available as at December 5, 2013. Such forward-looking

information may also be found in other documents filed with Canadian securities

regulators or in other communications. The Corporation's management disclaims

any intention or obligation to update or revise these statements unless

otherwise required by the securities authorities.

CONSOLIDATED STATEMENTS OF INCOME (LOSS)

Years ended October 31, 2013 and 2012

(in millions of Canadian dollars, except per share data)

----------------------------------------------------------------------------

2013 2012

----------------------------------------------------------------------------

Revenues $ 2,110.1 $ 2,112.1

Operating expenses 1,761.0 1,754.5

Restructuring and other costs 28.0 55.0

Impairment of assets 170.0 232.0

Gain on business acquisition - (32.1)

----------------------------------------------------------------------------

Operating income before amortization 151.1 102.7

Amortization 105.3 112.4

----------------------------------------------------------------------------

Operating income (loss) 45.8 (9.7)

Net financial expenses 25.5 46.5

----------------------------------------------------------------------------

Income (loss) before income taxes 20.3 (56.2)

Income taxes 27.6 112.3

----------------------------------------------------------------------------

Net loss from continuing operations (7.3) (168.5)

Net loss from discontinued operations - (7.4)

----------------------------------------------------------------------------

Net loss (7.3) (175.9)

Non-controlling interests 0.4 0.6

----------------------------------------------------------------------------

Net loss attributable to shareholders of the

Corporation (7.7) (176.5)

Dividends on preferred shares, net of related taxes 6.8 6.8

----------------------------------------------------------------------------

Net loss attributable to participating shares $ (14.5) $ (183.3)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net loss per participating share - basic and

diluted

Continuing operations $ (0.19) $ (2.18)

Discontinued operations - (0.09)

----------------------------------------------------------------------------

$ (0.19) $ (2.27)

----------------------------------------------------------------------------

Weighted average number of participating shares -

basic and diluted (in millions) 78.0 80.7

----------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

Years ended October 31, 2013 and 2012

(in millions of Canadian dollars)

----------------------------------------------------------------------------

2013 2012

----------------------------------------------------------------------------

Net loss $ (7.3) $ (175.9)

Other comprehensive income (loss)

Items that will be reclassified to net income

(loss):

Net change related to cash flow hedges

Net change in the fair value of derivatives

designated as cash flow hedges 2.8 (0.6)

Reclassification of the net change in the fair

value of derivatives designated as cash flow

hedges in prior periods, recognized in net

income (loss) during the period (2.8) 3.9

Related income taxes (0.2) 0.9

----------------------------------------------------------------------------

0.2 2.4

----------------------------------------------------------------------------

Cumulative translation differences

Unrealized exchange net gains on the

translation of the financial statements of

foreign operations 1.0 0.7

Unrealized exchange losses on the translation

of a debt designated as a hedge of a net

investment in foreign operations (1.6) -

Related income taxes (0.2) -

----------------------------------------------------------------------------

(0.4) 0.7

----------------------------------------------------------------------------

Items that will not be reclassified to net income

(loss):

Changes in actuarial gains and losses in respect

of defined benefit plans

Actuarial gains (losses) in respect of defined

benefit plans 85.2 (81.9)

Related income taxes 22.7 (22.5)

----------------------------------------------------------------------------

62.5 (59.4)

----------------------------------------------------------------------------

Other comprehensive income (loss) 62.3 (56.3)

----------------------------------------------------------------------------

Comprehensive income (loss) $ 55.0 $ (232.2)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Attributable to:

Shareholders of the Corporation $ 54.6 $ (232.8)

Non-controlling interests 0.4 0.6

----------------------------------------------------------------------------

$ 55.0 $ (232.2)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Years ended October 31, 2013 and 2012

(in millions of Canadian dollars)

----------------------------------------------------------------------------

Attributable to shareholders of the Corporation

-----------------------------------------------------------

Accumulated

other

Share Contributed Retained comprehensive

capital surplus earnings loss Total

----------------------------------------------------------------------------

Balance as at

November 1,

2012 $ 467.7 $ 2.5 $ 514.2 $ (84.4)$ 900.0

Net income

(loss) - - (7.7) - (7.7)

Other

comprehensive

income - - - 62.3 62.3

Shareholders'

contributions

and

distributions

to

shareholders

Participating

share

redemptions (6.4) - (5.2) - (11.6)

Exercice of

stock options 1.5 (0.3) - - 1.2

Dividends - - (129.9) - (129.9)

Stock-option

based

compensation - 0.7 - - 0.7

----------------------------------------------------------------------------

Balance as at

October 31,

2013 $ 462.8 $ 2.9 $ 371.4 $ (22.1)$ 815.0

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Balance as at

November 1,

2011 $ 478.1 $ 1.8 $ 750.3 $ (28.1)$ 1,202.1

Net income

(loss) - - (176.5) - (176.5)

Other

comprehensive

loss - - - (56.3) (56.3)

Shareholders'

contributions

and

distributions

to

shareholders

Participating

share

redemptions (11.0) - (6.8) - (17.8)

Exercise of

stock options 0.6 (0.1) - - 0.5

Dividends - - (52.8) - (52.8)

Stock-option

based

compensation - 0.8 - - 0.8

----------------------------------------------------------------------------

Balance as at

October 31,

2012 $ 467.7 $ 2.5 $ 514.2 $ (84.4)$ 900.0

----------------------------------------------------------------------------

----------------------------------------------------------------------------

------------------------------------------------------------

Non-controlling

interests Total equity

------------------------------------------------------------

Balance as at

November 1,

2012 $ 1.4 $ 901.4

Net income

(loss) 0.4 (7.3)

Other

comprehensive

income - 62.3

Shareholders'

contributions

and

distributions

to

shareholders

Participating

share

redemptions - (11.6)

Exercice of

stock options - 1.2

Dividends (1.4) (131.3)

Stock-option

based

compensation - 0.7

------------------------------------------------------------

Balance as at

October 31,

2013 $ 0.4 $ 815.4

------------------------------------------------------------

------------------------------------------------------------

Balance as at

November 1,

2011 $ 0.8 $ 1,202.9

Net income

(loss) 0.6 (175.9)

Other

comprehensive

loss - (56.3)

Shareholders'

contributions

and

distributions

to

shareholders

Participating

share

redemptions - (17.8)

Exercise of

stock options - 0.5

Dividends - (52.8)

Stock-option

based

compensation - 0.8

------------------------------------------------------------

Balance as at

October 31,

2012 $ 1.4 $ 901.4

------------------------------------------------------------

------------------------------------------------------------

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

Years ended October 31, 2013 and 2012

(in millions of Canadian dollars)

----------------------------------------------------------------------------

As at As at

October 31, October 31,

2013 2012

----------------------------------------------------------------------------

Current assets

Cash $ 30.3 $ 16.8

Accounts receivable 421.2 449.8

Income taxes receivable 12.5 38.9

Inventories 82.0 82.5

Prepaid expenses and other current assets 14.1 14.7

----------------------------------------------------------------------------

560.1 602.7

Property, plant and equipment 596.6 651.2

Intangible assets 194.2 171.5

Goodwill 325.7 487.0

Deferred income taxes 148.0 192.6

Other assets 34.7 31.2

----------------------------------------------------------------------------

$ 1,859.3 $ 2,136.2

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Current liabilities

Accounts payable and accrued liabilities $ 275.8 $ 336.8

Provisions 10.3 15.5

Income taxes payable 6.4 50.3

Deferred revenues and deposits 61.1 39.3

Current portion of long-term debt 218.3 283.5

----------------------------------------------------------------------------

571.9 725.4

Long-term debt 128.9 204.1

Deferred income taxes 67.1 68.4

Provisions 40.2 45.3

Other liabilities 235.8 191.6

----------------------------------------------------------------------------

1,043.9 1,234.8

----------------------------------------------------------------------------

Equity

Share capital 462.8 467.7

Contributed surplus 2.9 2.5

Retained earnings 371.4 514.2

Accumulated other comprehensive loss (22.1) (84.4)

----------------------------------------------------------------------------

Attributable to shareholders of the

Corporation 815.0 900.0

----------------------------------------------------------------------------

Non-controlling interests 0.4 1.4

----------------------------------------------------------------------------

815.4 901.4

----------------------------------------------------------------------------

$ 1,859.3 $ 2,136.2

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years ended October 31, 2013 and 2012

(in millions of Canadian dollars)

----------------------------------------------------------------------------

2013 2012

----------------------------------------------------------------------------

Operating activities

Net loss $ (7.3) $ (175.9)

Less: Net loss from discontinued operations - (7.4)

----------------------------------------------------------------------------

Net loss from continuing operations (7.3) (168.5)

Adjustments to reconcile net loss from continuing

operations and cash flows from operating activities:

Amortization 131.2 132.9

Impairment of assets 170.0 232.0

Gain on business acquisition - (32.1)

Financial expenses on long-term debt 20.1 27.0

Interest on tax reassessment - 16.0

Net loss (gain) on disposal of assets 0.2 (1.2)

Income taxes 27.6 112.3

Stock-option based compensation 0.7 0.8

Other (1.9) 1.6

----------------------------------------------------------------------------

Cash flows generated by operating activities before

changes in non-cash operating items and income tax

paid 340.6 320.8

Changes in non-cash operating items 88.2 (43.8)

Income tax paid (12.6) (48.0)

----------------------------------------------------------------------------

Cash flows from continuing operations 416.2 229.0

----------------------------------------------------------------------------

Cash flows from discontinued operations - 0.9

----------------------------------------------------------------------------

416.2 229.9

----------------------------------------------------------------------------

Investing activities

Business combinations (24.5) (60.4)

Acquisitions of property, plant and equipment (47.4) (37.3)

Disposals of property, plant and equipment 5.1 3.6

Increase in intangible assets (26.8) (22.0)

----------------------------------------------------------------------------

Cash flows from investments in continuing

operations (93.6) (116.1)

----------------------------------------------------------------------------

Cash flows from investments in discontinued

operations - 10.0

----------------------------------------------------------------------------

(93.6) (106.1)

----------------------------------------------------------------------------

Financing activities

Reimbursement of long-term debt (88.8) (89.8)

Net increase (decrease) in revolving term credit

facility (57.6) 11.4

Financial expenses on long-term debt (20.5) (26.1)

Interest on tax reassessment - (8.1)

Dividends on participating shares (123.1) (46.0)

Dividends on preferred shares (6.8) (6.8)

Dividends on non-controlling interests (1.4) -

Issuance of participating shares 1.2 0.5

Participating share redemptions (12.1) (17.3)

----------------------------------------------------------------------------

Cash flows from the financing of continuing

operations (309.1) (182.2)

----------------------------------------------------------------------------

Effect of exchange rate changes on cash denominated

in foreign currencies - 0.2

----------------------------------------------------------------------------

Net change in cash 13.5 (58.2)

Cash at beginning of year 16.8 75.0

----------------------------------------------------------------------------

Cash at end of year $ 30.3 $ 16.8

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Non-cash investing and financing activities

Net change in capital asset acquisitions financed

by accounts payable $ (3.8) $ 2.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Media: Nathalie St-Jean

Senior Advisor, Corporate Communications

TC Transcontinental

Telephone : 514 954-3581

nathalie.st-jean@tc.tc

www.tc.tc

Financial Community: Jennifer F. McCaughey

Senior Director, Investor Relations

and External Corporate Communications

TC Transcontinental

Telephone : 514 954-2821

jennifer.mccaughey@tc.tc / www.tc.tc

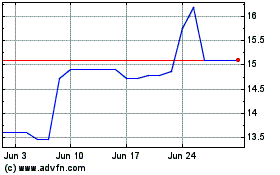

Transcontinental (TSX:TCL.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

Transcontinental (TSX:TCL.B)

Historical Stock Chart

From Jul 2023 to Jul 2024