Pinetree Capital Ltd. Announces Unaudited Financial Results for the Three Months Ended March 31, 2013

May 14 2013 - 4:00PM

Marketwired

Pinetree Capital Ltd. ("Pinetree") (TSX:PNP) today announces its

unaudited interim consolidated financial results for the three

months ended March 31, 2013.

For the three months ended March 31, 2013, Pinetree had a net

loss of $47 million, as compared to $5 million for the same quarter

last year. Net loss for the three months ended March 31, 2013 was

primarily the result of net investment losses of $42 million,

comprised of $45 million in unrealized losses on investments offset

by realized gains on dispositions of investments of $3 million.

Loss per share was $0.33 for the three months ended March 31, 2013,

as compared to $0.04 for the three months ended March 31, 2012.

The composition of Pinetree's investment portfolio by sector as

at March 31, 2013 as compared to the end of last year is outlined

in the following table:

============================================================================

March 31, 2013 December 31, 2012

------------------------------------------

Sector ($'000) % of Total ($'000) % of Total

----------------------------------------------------------------------------

Resources:

Precious metals 95,851 43.8 145,169 53.7

Potash, lithium and rare earths 26,497 12.1 27,739 10.3

Uranium 26,229 12.0 18,875 7.0

Base metals 25,702 11.8 31,075 11.5

Oil and gas 23,187 10.6 30,433 11.2

Coal 1,897 0.9 2,140 0.8

------------------------------------------

Total resources 199,363 91.2 255,431 94.5

------------------------------------------

Technology and other 19,152 8.8 14,749 5.5

------------------------------------------

Total investments 218,515 100.0 270,180 100.0

============================================================================

As at March 31, 2013, total investments at fair value was $219

million, as compared to $270 million as at December 31, 2012, a

decrease of 19%.

Net asset value per share decreased 23% to $1.20 as at March 31,

2013, from $1.55 as at December 31, 2012.

About Pinetree

Pinetree Capital Ltd. ("Pinetree") was incorporated under the

laws of the Province of Ontario and its shares are publicly-traded

on the Toronto Stock Exchange ("TSX") under the symbol "PNP".

Pinetree is a diversified investment and merchant banking firm

focused on the small cap market. Pinetree's investments are

primarily in the resources sector: Precious Metals, Base Metals,

Oil and Gas, Potash, Lithium and Rare Earths, Uranium and Coal.

Pinetree's investment approach is to develop a macro view of a

sector, build a position consistent with the view by identifying

micro-cap opportunities within that sector, and devise an exit

strategy designed to maximize our relative return in light of

changing fundamentals and opportunities. Pinetree is recognized as

a value added partner in the resource industry.

Pinetree discloses an unaudited monthly net asset value per

share within 15 days after each month-end. For the latest month-end

net asset value per share and for more details about Pinetree and

its investments, please visit our website at

www.pinetreecapital.com.

Use of Non-GAAP Measures

NAV (net asset value per share) is a non-GAAP (international

financial reporting standards) measure calculated as the value of

total assets less the value of total liabilities divided by the

total number of common shares outstanding as at a specific date.

The term NAV does not have any standardized meaning according to

GAAP and therefore may not be comparable to similar measures

presented by other companies. There is no comparable GAAP measure

presented in Pinetree's consolidated financial statements and thus

no applicable quantitative reconciliation for such non-GAAP

financial measure. The Company has calculated NAV consistently for

many years and believes that NAV can provide information useful to

its shareholders in understanding its performance, and may assist

in the evaluation of its business relative to that of its

peers.

Contacts: Pinetree Capital Ltd. Sheldon Inwentash, CPA, CA.

Chairman & CEO 416-941-9600 Pinetree Capital Ltd. Gerry

Feldman, CPA, CA. CFO & Vice President, Corporate Development

416-643-3884feldman@pinetreecapital.com Pinetree Capital Ltd. 130

King Street West, Suite 250 Toronto, Ontario, Canada, M5X 2A2

www.pinetreecapital.com Investor Relations: Pinetree Capital Ltd.

Richard Patricio, LL.B. Vice President, Legal and Corporate Affairs

416-941-9600ir@pinetreecapital.com

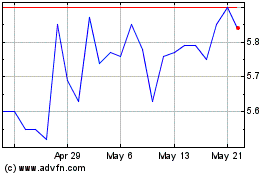

Pinetree Capital (TSX:PNP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Pinetree Capital (TSX:PNP)

Historical Stock Chart

From Jul 2023 to Jul 2024