Pinetree Capital Ltd. Announces Fiscal 2010 Financial Results; An 86% Increase in Net Asset Value

March 10 2011 - 4:00PM

Marketwired

Pinetree Capital Ltd. ("Pinetree") (TSX: PNP) today announces its

audited consolidated financial results for the year ended December

31, 2010.

Net asset value per share increased to $4.71 as at December 31,

2010 from $2.53 as at December 31, 2009, an 86% increase.

For the year ended December 31, 2010, Pinetree had net income of

$296 million, as compared to $157 million last year. The net income

was primarily from net investment gains of $383 million in the

year, comprised of $341 million in unrealized gains on investments

and realized gains on dispositions of investments of $43 million.

Earnings per share were $2.18, as compared to $1.19 per share in

the year ended December 31, 2009.

The composition of Pinetree's investment portfolio (accounted

for at fair value) by sector as at December 31, 2010, as compared

to the prior year, is outlined in the following table:

============================================================================

December 31, 2010 December 31, 2009

--------------------------------------------

Sector ($'000) % of Total ($'000) % of Total

----------------------------------------------------------------------------

Resources:

Precious Metals 316,667 39.9 158,027 43.1

Base Metals 148,063 18.6 71,711 19.5

Uranium and Coal 171,112 21.6 49,066 13.4

Oil & Gas 72,263 9.1 34,404 9.4

Potash, Lithium and Rare

Earths 66,524 8.4 27,103 7.4

--------------------------------------------

Total Resources 774,629 97.6 340,311 92.8

--------------------------------------------

Technology/Other 19,235 2.4 26.413 7.2

============================================================================

As at December 31, 2010, total investments at fair value was

$794 million, as compared to $367 million as at December 31, 2009,

while the total number of investments decreased to 428 from 429 as

at December 31, 2009. Three hundred and ninety of the investments

or 91.1% (December 31, 2009 - 383 or 89.3%) were in the resource

sector, consistent with Pinetree's primary investment strategy.

During the three months ended December 31, 2010, Pinetree had

unaudited net income of $229 million, as compared to $20 million

for the same period last year. The net income was primarily from

net investment gains of $292 million in the quarter, comprised of

$265 million in unrealized gains on investments and realized gains

on dispositions of investments of $27 million. Earnings per share

were $1.68, as compared to $0.15 per share in the three months

ended December 31, 2009.

Sheldon Inwentash, Pinetree's Chairman and CEO, stated, "2010

was a very strong year for Pinetree and the markets in which we

invest, as the value of our investment portfolio more than doubled.

We also expanded the portfolio in areas where we see opportunities

for continued growth going forward. Our outlook for the resource

sector remains positive."

About Pinetree

Pinetree Capital Ltd. ("Pinetree") was incorporated under the

laws of the Province of Ontario and its shares are publicly-traded

on the Toronto Stock Exchange ("TSX") under the symbol "PNP".

Pinetree is a diversified investment and venture capital firm

focused on the small cap market. Pinetree's investments are

primarily in the resources sector: Precious Metals, Uranium and

Coal, Base Metals, Oil and Gas, and Potash, Lithium and Rare

Earths. Pinetree's investment approach is to develop a macro view

of a sector, build a position consistent with the view by

identifying micro-cap opportunities within that sector, and devise

an exit strategy designed to maximize our relative return in light

of changing fundamentals and opportunities and is recognized as a

value added partner in the resource industry.

Pinetree discloses an unaudited monthly net asset value per

share within 15 days after a month-end. For the latest month-end

net asset value per share and for more details about Pinetree and

its investments, please visit our website at

www.pinetreecapital.com.

Use of Non-GAAP Measures

"Net asset value per share" is a non-GAAP measure defined as

total assets less total liabilities divided by the total number of

common shares of Pinetree outstanding. The term net asset value per

share does not have any standardized meaning according to GAAP and

therefore may not be comparable to similar measures presented by

other companies. We believe that the measure provides information

useful to our shareholders in understanding our performance,

facilitates the comparison of the quarterly and year-end results of

our ongoing operations and provides a meaningful measure to

evaluate our business relative to that of our peers.

Contacts: Pinetree Capital Ltd. Sheldon Inwentash Chairman &

CEO 416-941-9600 Investor Relations: Pinetree Capital Ltd. Richard

Patricio Vice President, Legal and Corporate Affairs 416-941-9600

ir@pinetreecapital.com www.pinetreecapital.com

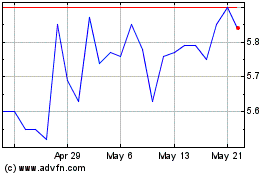

Pinetree Capital (TSX:PNP)

Historical Stock Chart

From Jul 2024 to Aug 2024

Pinetree Capital (TSX:PNP)

Historical Stock Chart

From Aug 2023 to Aug 2024