Coro Signs Term Sheet With Minera Aurex for the Payen Copper-Gold Porphyry Project

August 08 2013 - 8:00AM

Marketwired Canada

Coro Mining Corp. ("Coro" or the "Company") (TSX:COP) is pleased to announce

that its subsidiary, Minera Coro Chile Ltda. ("MCC") has signed a Term Sheet

with Minera Aurex (Chile) Limitada ("Aurex"), an indirect subsidiary of

Freeport-McMoRan Copper & Gold Inc., for Aurex to acquire an interest in MCC's

Payen Property. The 1,225 hectare Property is located approximately 90km NNE of

La Serena, 4km W of the Panamerican Highway and approximately 47km from the

coast, in the III Region of Chile, at an elevation of 1,100m (Figure 1). Aurex

and MCC intend to execute a final agreement on or before September 15th 2013,

subject to Aurex's satisfactory completion of due diligence by September 10th

2013. MCC has granted Aurex an exclusive right to acquire its interest in the

property.

Coro is also pleased to announce that it has renegotiated the acquisition terms

for its El Desesperado porphyry copper project, located 7km NW of Calama in the

II Region of Chile.

Alan Stephens, President and CEO of Coro commented, "We believe that Payen has

the potential to host a major copper-gold porphyry deposit, and we look forward

to seeing the results of Aurex's exploration program as it develops. This

represents further progress in Coro's strategy of bringing in partners for its

projects in these difficult markets, and follows our recent announcements

regarding advancing our Berta project to production with an experienced Chilean

engineering company as our partner. We are also pleased to have renegotiated the

terms of our El Desesperado option, which will facilitate its ongoing

exploration."

Acquisition Terms

As shown on Table 1 below, Aurex may acquire a 70% interest in Payen by

completing all of the following;

-- Paying US$16,500,000 in option payments to the underlying Property owner

-- Expending US$13,000,000 in work commitments on the Property

-- Paying US$1,000,000 to MCC

-- Paying an additional US$21,500,000 to MCC upon formation of an operating

company owned 70% by Aurex and 30% by MCC to advance the project,

immediately after Aurex's acquisition of its interest.

Table 1: Payen Acquisition Terms (in U.S. dollars)

----------------------------------------------------------------------------

Underlying

Option Work Payment

Date Payment Commitment to MCC

----------------------------------------------------------------------------

On October 10 2013 $500,000 (firm) - -

By October 10 2014 $1,000,000 $1,500,000 -

By October 10 2015 $2,000,000 $3,500,000 $500,000

By October 10 2016 $13,000,000 $8,000,000 $500,000

On formation of operating

company $21,500,000

----------------------------------------------------------------------------

Total $16,500,000 $13,000,000 $22,500,000

----------------------------------------------------------------------------

The operating company may complete a Feasibility Study to NI43-101 standards on

a best efforts basis by October 10, 2019 at Aurex's expense, at which point MCC

will have the option of refunding 20% of the costs of the Feasibility Study to

Aurex and thereby own 20% of the operating company, or will immediately dilute

to a 2% Net Smelter Return ("NSR"). If MCC elects to refund its 20% share of the

Feasibility Study, the operating company shareholders will be responsible for

all future costs on a pro-rata basis, or be subject to dilution.

About Payen

The large NE-SW oriented Pajonales alteration zone is located in the same 90-110

million year old belt of porphyry copper-gold deposits as Teck's Andacollo mine,

Cemin's Dos Amigos mine, PanAust's Inca de Oro & Carmen projects and Hot Chili's

Frontera project, which is located some 2.5km SE of the Payen property boundary.

The Payen property covers the northeastern third of the Pajonales alteration

zone, where it is at its widest, and where the alteration appears most intense.

The northern end of the property is transected by a NW fault which has uplifted

to the north and exposed a potassically altered and quartz stockworked diorite

porphyry with associated copper-gold mineralization. This has been subjected to

reverse circulation drilling carried out by the Property owner in 2009, and

diamond drilling completed by a private Chilean company in 2011-2012. Results of

this drilling were summarized in the Company's news release of October 17th

2012.

This mineralization is associated with a magnetic high anomaly, and Coro's

exploration has shown that several other similar mag highs are present on the

property, coinciding with outcropping mineralized diorite porphyry stocks. Much

of the remainder of the property hosts extensive phyllic alteration with

outcropping leached cap, quartz stockworking, remnant copper oxides, and

associated magnetic low and copper geochemical anomalies. High sulphidation

alteration, including phreatomagmatic breccias and silicified ledges with

anomalous gold, indicative of a remnant lithocap are exposed at the highest

elevations. Previous geochemical sampling has indicated the presence of strongly

anomalous copper associated with certain areas of the phyllic alteration, which

Coro believes have good potential to host chalcocite enrichment.

The Property is subject to a 2.5%NSR, of which half (1.25%NSR) may be purchased

for US$10,000,000 at any time up to Commencement of Commercial Production.

El Desesperado Project; Renegotiated Terms

Coro and the property owners have agreed to reschedule the option payments for

the El Desesperado property as shown in Table 2 below.

Table 2: Amended El Desesperado Property Option

Payments (in U.S. dollars)

On or Before Original Renegotiated

----------------------------------------------------

17th February 2012 $200,000

-------------------------------------

17th February 2013 $500,000

----------------------------------------------------

17th February 2014 $1,300,000 $650,000

----------------------------------------------------

17th February 2015 $3,000,000 $1,750,000

----------------------------------------------------

17th February 2016 $8,000,000 $9,900,000

----------------------------------------------------

Total $13,000,000 $13,000,000

----------------------------------------------------

The El Desesperado property continues to be subject to a 1.95% sales royalty.

Alan Stephens, FIMMM, President and CEO, of Coro Mining Corp, a geologist with

more than 37 years of experience, and a Qualified Person for the purposes of NI

43-101, is responsible for the contents of this news release.

CORO MINING CORP.

Alan Stephens, President and CEO

About Coro Mining Corp.:

The Company was founded with the goal of building a mining company focused on

medium-sized base and precious metals deposits in Latin America. The Company

intends to achieve this through the exploration for, and acquisition of,

projects that can be developed and placed into production. Coro's properties

include the Berta, Payen, El Desesperado, Llancahue, and Celeste copper

exploration properties located in Chile, and the advanced San Jorge copper-gold

project, in Argentina. Earlier this year, Coro sold its Chacay property to a

subsidiary of Teck for US$2,500,000 in cash plus a 1.5%NSR.

This news release includes certain "forward-looking statements" under applicable

Canadian securities legislation. Such forward-looking statements or information,

including but not limited to those with respect to the prices of copper,

estimated future production, estimated costs of future production, permitting

time lines, involve known and unknown risks, uncertainties, and other factors

which may cause the actual results, performance or achievements of the Company

to be materially different from any future results, performance or achievements

expressed or implied by such forward-looking statements or information. Such

factors include, among others, the actual prices of copper, the factual results

of current exploration, development and mining activities, changes in project

parameters as plans continue to be evaluated, as well as those factors disclosed

in the Company's documents filed from time to time with the securities

regulators in the Provinces of British Columbia, Alberta, Saskatchewan,

Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and

Newfoundland and Labrador.

To view Figure 1, click on the following link:

http://media3.marketwire.com/docs/cop87m.pdf

FOR FURTHER INFORMATION PLEASE CONTACT:

Coro Mining Corp.

Michael Philpot

Executive Vice-President

(604) 682 5546

investor.info@coromining.com

www.coromining.com

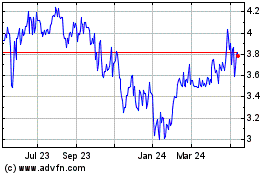

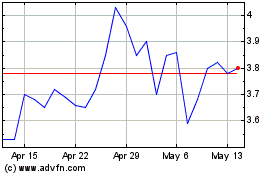

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jul 2023 to Jul 2024