Coro Announces Letter of Intent for Berta Project and Provides Update on Its Other Projects

May 08 2013 - 10:37AM

Marketwired Canada

Coro Mining Corp. ("Coro" or the "Company") (TSX:COP) is pleased to announce

that it has signed a Letter of Intent ("LOI") with ProPipe SA, ("ProPipe") an

engineering firm based in Santiago, Chile which gives ProPipe the right to earn

up to a 50% interest in the Berta property, located approximately 20km west of

the village of Inca de Oro, in the III Region of Chile. Coro also announces that

it has renegotiated the terms of its underlying option agreement to acquire

Berta, by reducing the payment due on 10th June 2013 from US$1,500,000 to

US$500,000 and the final payment due on 10th June 2014 from US$3,500,000 to

US$2,500,000. A 1.5% NSR will now apply to all production from the property.

Alan Stephens, President and CEO of Coro commented, "We are delighted that

ProPipe have agreed to become our partner on the Berta project, and are

confident that their extensive Chilean engineering experience will result in the

expeditious development of an operation capable of producing approximately 5,000

tpy copper cathode, on a highly cost effective basis. ProPipe carried out the

Company's recent NI43-101 resource estimate technical report and as a result are

fully familiar with the project. We hope that Berta will form the basis of a new

business partnership which will combine Coro's demonstrated ability to identify

new projects, and ProPipe's capacity to develop them efficiently and will be the

first step in building a sustainable cash flow generating business for the

Company."

Victor Araya, Director of ProPipe commented, "We are very pleased to have the

opportunity to participate in the development of Berta, and wish to advance it

to a production decision as soon as possible. ProPipe look forward to

establishing a relationship with Coro, and hope that it will lead to new

opportunities to build a high technology, performance mining business in Chile

in the future."

The principal terms of the LOI are;

Within 10 days of signing the LOI, Coro will form a new company, NewSCM and

transfer its rights to the Berta property.

ProPipe may earn up to 50% of the shares in NewSCM by completing a series of

payments, work commitments and project financing, thereby earning percentages of

that company as follows;

-- Making the US$500,000 option payment due on 10th June 2013: 10% earned

-- Completing and filing an Environmental Impact Declaration by 30th July

2013: 3% earned

-- Completing a NI43-101 compliant PEA by September 30th 2013: 5% earned

-- Obtaining and structuring project financing on non-recourse basis, at

market conditions, with funds available within 6 months of completion of

the PEA, for a minimum of 70% of the project cost, including a cost

overrun facility, as determined in the PEA. In the event that this

financing is for 100% of the project cost, ProPipe will earn 32% of New

SCM, for a total shareholding of 50%. If the financing is between 70%

and 100% of the required funding, ProPipe will earn a pro-rata

shareholding in NewSCM. At the minimum 70% level, they would earn 22.4%

of NewSCM, for a total shareholding of 40.4%. In the event that less

than 100% funding is received, ProPipe have the right to earn the

corresponding shareholding for the percentage difference in funding, or

to assign their right to do so to a third party on the same terms. In

the event that they do neither, they must complete such additional work

and reports as required by Coro by March 31st 2014, for Coro to obtain

the financing required and thus earn the corresponding shareholding.

-- In the event that ProPipe do not arrange a minimum of 70% project

financing, they must complete a NI43-101 compliant DFS for the project

by 31st March 2014, and by so doing, will earn an additional 7%

shareholding, for a total shareholding of 25% in NewSCM. Coro and

ProPipe will then seek project financing on a pro-rata basis

-- In the event that the financing does not include the US$2,500,000 option

payment due on June 10th 2014, ProPipe and Coro will fund this pro-rata.

-- ProPipe will be Operator during the development and construction of the

project, thereafter the Operatorship will alternate every 2 years.

-- There will be a 30 day due diligence period to confirm title to the

property, followed by the expeditious drawing up and signature of a

definitive shareholders agreement.

About ProPipe SA

ProPipe is a Chilean supplier of consultancy, engineering and project management

services to its customers in the mining process, infrastructure and environment

markets. ProPipe have relevant experience in conceptual and basic design,

preliminary feasibility and feasibilities studies, and detailed engineering for

mining companies in Chile. Some of its principal clients are BHP Billiton

(Minera Escondida), Antofagasta Minerals (Minera Los Pelambres, Minera El

Tesoro, and Minera Esperanza), Minera Las Cenizas and Algorta Norte. ProPipe's

recent projects include the Camarones 7,000 tonne per year copper cathode plant,

the Algorta Norte 78 km sea water pipeline, and Minera Escondida's Coloso filter

plant expansion project.

About Berta

Berta is a modest sized, near surface, copper oxide deposit, with

mineralization, as defined by drilling, mapping and geochemistry, occurring in

three principal areas; Berta Sur, Central and Norte. It is associated with

sub-vertical, elongate, potassically altered porphyry intrusive bodies and

related hydrothermal and intrusive breccias, emplaced into a tonalite stock. At

Berta Sur, this mineralization is present within a roughly horseshoe shape area

with oxidation extending from surface to depths of 50m to 100m. Berta Central

comprises several smaller bodies, located immediately north of Berta Sur, which

were the focus for previous small scale copper oxide production. Berta Norte

comprises several, discreet, NW oriented zones of mineralization, individually

25-85m in width, 100-250m in strike length and partially gravel covered.

Coro announced a NI43-101 compliant resource estimate for the Berta Sur area, in

its news release NR12-19, dated December 6th 2012 and the results of preliminary

metallurgical test work in its news release NR12-17, dated November 5th 2012. We

see potential for additional resources on the property in the Berta Central

deposits, and believe there may be potential in the surrounding district to

augment these.

Other Projects

Chacay

All final agreements have been signed with Teck for the sale of the Chacay

property and we are in the final stages of registering the claims transfer with

the authorities. Payment of US$2,000,000, as described in our news release

NR13-03, dated April 2nd 2013, will be received upon delivery of proof of

transfer to Teck, which we expect to be completed very shortly.

Payen, El Desesperado and Llancahue

In light of the current difficult market conditions, Coro has elected to seek

partners for its three active Chilean exploration projects. Confidentiality

agreements have been signed with a number of companies, and data and field

reviews completed by several of them.

San Jorge

The approval process for the update to the Company's approved Environmental

Impact Study ("EIS") submitted to the government of Mendoza, Argentina in July

2012, in relation to the San Jorge Bi-provincial Leach Project ("SJBP")

continues to progress within the applicable time frames established by the

provincial regulations. The SJBP Leach Project comprises a rock quarrying

operation in Mendoza province together with a processing plant located in San

Juan province, for the production of up to 25,000 tonnes per year of copper in

cathode. The approval sought is confined to the proposed railway line to

transport ore from the San Jorge quarry to a planned solvent

extraction/electro-winning plant located in San Juan. Once granted, no further

environmental approvals would be required from the Mendoza government, as the

quarry itself and associated crushing facilities have already been approved in

the existing EIS.

The SJBP Leach Project could be operated in full compliance with all existing

laws and regulations in both provinces and applicable royalties would be paid to

the province of Mendoza. Additionally, as no mineral processing would take place

in Mendoza, no substances banned by the 7722 law would be employed there. We

continue to look forward to the approval of this simple update by the Mendoza

authorities later this year, so that a further EIS for the proposed plant

facilities in San Juan province can be prepared and submitted.

Alan Stephens, FIMMM, President and CEO of Coro, a geologist with more than 37

years of experience, is the Qualified Person for Coro who has reviewed and

approved the contents of this news release.

CORO MINING CORP.

Alan Stephens, President and CEO

About Coro Mining Corp.:

The Company was founded with the goal of building a mining company focused on

medium-sized base and precious metals deposits in Latin America. The Company

intends to achieve this through the exploration for, and acquisition of,

projects that can be developed and placed into production. Coro's properties

include the Berta copper development project and the Payen, El Desesperado,

Llancahue exploration properties all located in Chile; and the advanced San

Jorge copper-gold project, in Argentina.

This news release includes certain "forward-looking statements" under applicable

Canadian securities legislation. Such forward-looking statements or information,

including but not limited to those with respect to the prices of copper,

estimated future production, estimated costs of future production, permitting

time lines, involve known and unknown risks, uncertainties, and other factors

which may cause the actual results, performance or achievements of the Company

to be materially different from any future results, performance or achievements

expressed or implied by such forward-looking statements or information. Such

factors include, among others, the actual prices of copper, the factual results

of current exploration, development and mining activities, changes in project

parameters as plans continue to be evaluated, as well as those factors disclosed

in the Company's documents filed from time to time with the securities

regulators in the Provinces of British Columbia, Alberta, Saskatchewan,

Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and

Newfoundland and Labrador.

FOR FURTHER INFORMATION PLEASE CONTACT:

Coro Mining Corp.

Michael Philpot

Executive Vice-President

(604) 682 5546

investor.info@coromining.com

www.coromining.com

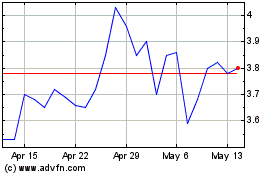

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jun 2024 to Jul 2024

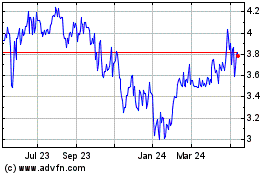

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jul 2023 to Jul 2024