Coro Acquires New Copper-Gold Porphyry Project in Chile

August 14 2012 - 8:59AM

Marketwired Canada

Coro Mining Corp. ("Coro" or the "Company") (TSX:COP) is pleased to announce

that it has entered into an option agreement to acquire the El Inca Property

from a local Chilean company. The 1,706 hectare Property is located

approximately 4km northeast of the village of Inca de Oro, in the III Region of

Chile, at an elevation of 1,700m (Figure 1). The Property is also located

approximately 20km east of the Company's Berta project, where a resource

definition drill program and sampling for metallurgical test work, is currently

in progress. The Inca de Oro porphyry copper-gold project, owned by a

PanAust/Codelco joint venture, borders the Property immediately to southwest.

In July 2012, PanAust announced the results of a feasibility study at Inca de

Oro for a 12mt per year flotation operation which concluded, among other things,

that the project would not provide a sufficient return for the joint venture

partners, but that project economics would be materially enhanced by the

delineation of additional mineral resources. Details of this feasibility study

can be found on the PanAust website.

Alan Stephens, President and CEO of Coro commented, "The El Inca Property is

subdivided into 3 claim groups, two of which are subject to rights of first

refusal ("ROFR"). The largest claim group named Porvenir, which is not subject

to a ROFR, includes a large gravel covered area approximately 2km to the

northeast of the PanAust/Codelco deposit which we believe may host a major

porphyry copper-gold deposit similar to Inca de Oro, which was discovered in

2005 by Codelco and is covered by 50-80m of gravel. We intend to initiate a

reverse circulation (RC) drill program to test this target immediately after the

completion of our Berta project infill drill program. We also see potential for

smaller tonnage, oxide copper mineralization in a cluster of hydrothermal

breccia pipes which outcrop in the eastern section of the Property. Two of these

breccia pipes, Delirio and Tucumana, are located within the remaining two claim

groups, named Calaverita and Delirio, each of which are subject to ROFRs, while

a third pipe, Manto Cuba, is located within the Porvenir claim group. We intend

to evaluate these breccias in order to assess their potential to provide oxide

feed to our Berta project."

El Inca Option Terms

Coro may acquire 100% of the El Inca property for a total of up to

CAD$10,000,000, depending on the exercise of the ROFRs, by making the following

staged option payments:

Porvenir Claim Group Total; $4,000,000

----------------------------------------------------------------------------

On signing: CAD$200,000

6 months from signing: CAD$100,000

12 months from signing: CAD$200,000

24 months from signing: CAD$200,000

36 months from signing: CAD$300,000

48 months from signing: CAD$1,250,000

60 months from signing: CAD$1,750,000

Calaverita Claim Group Total; $3,000,000 (subject to ROFR)

----------------------------------------------------------------------------

6 months from signing: CAD$100,000

12 months from signing: CAD$100,000

24 months from signing: CAD$150,000

36 months from signing: CAD$150,000

48 months from signing: CAD$250,000

60 months from signing: CAD$2,250,000

Delirio Claim GroupTotal; $3,000,000 (subject to ROFR)

----------------------------------------------------------------------------

6 months from signing: CAD$100,000

12 months from signing: CAD$100,000

24 months from signing: CAD$150,000

36 months from signing: CAD$150,000

48 months from signing: CAD$250,000

60 months from signing: CAD$2,250,000

About El Inca

The outcropping area of the El Inca property has been subject to artisanal

scale, open pit mining of high grade oxide mineralization, hosted by several

hydrothermal breccia bodies. The wider area of the breccias, including claims

not forming part of the Inca Property, was explored by Samex Mining Corp. during

the period 2006-9. According to published information, this included diamond

drilling, underground and surface sampling, and an Induced Polarization survey,

but Coro does not have access to the details of this work. Apart from 2 old

Codelco RC holes located in the extreme southwest corner of the property, no

drilling has been completed in the covered area of the Porvenir claim group

which constitutes the Company's primary target. Figure 2 shows the 3 claim

groups and the location of the Property relative to the Inca de Oro project, and

to the paved highway.

Sergio Rivera, Vice President of Exploration, Coro Mining Corp., a geologist

with more than 30 years of experience and a member of the Colegio de Geologos de

Chile and of the Instituto de Ingenieros de Minas de Chile, was responsible for

the design and execution of the exploration program and is the Qualified Person

for the purposes of NI 43-101. Alan Stephens, FIMMM, President and CEO, of Coro

Mining Corp., a geologist with more than 36 years of experience, and a Qualified

Person for the purposes of NI 43-101, is responsible for the contents of this

news release.

CORO MINING CORP.

Alan Stephens, President and CEO

About Coro Mining Corp.:

The Company was founded with the goal of building a mining company focused on

medium-sized base and precious metals deposits in Latin America. The Company

intends to achieve this through the exploration for, and acquisition of,

projects that can be developed and placed into production. Coro's properties

include the advanced San Jorge copper-gold project, in Argentina, and the Berta,

Chacay, Llancahue, and Celeste copper exploration properties located in Chile.

This news release includes certain "forward-looking statements" under applicable

Canadian securities legislation. Such forward-looking statements or information,

including but not limited to those with respect to the prices of copper,

estimated future production, estimated costs of future production, permitting

time lines, involve known and unknown risks, uncertainties, and other factors

which may cause the actual results, performance or achievements of the Company

to be materially different from any future results, performance or achievements

expressed or implied by such forward-looking statements or information. Such

factors include, among others, the actual prices of copper, the factual results

of current exploration, development and mining activities, changes in project

parameters as plans continue to be evaluated, as well as those factors disclosed

in the Company's documents filed from time to time with the securities

regulators in the Provinces of British Columbia, Alberta, Saskatchewan,

Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and

Newfoundland and Labrador.

To view Figures 1 and 2, click on the following link:

http://media3.marketwire.com/docs/c813m.pdf

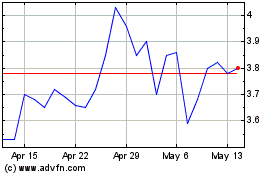

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jun 2024 to Jul 2024

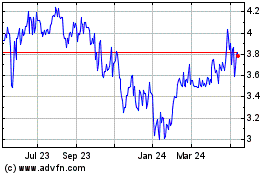

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jul 2023 to Jul 2024