Coro Mining Corporation ("Coro", or the "Company") (TSX:COP) is

pleased to announce a new development alternative for San Jorge and

the highlights from the Copper Leach Project ("the Project") based

on a Preliminary Feasibility Study ("PFS") (the "Propipe PFS") by

Process and Pipeline Projects SA. ("Propipe"), based in Santiago,

Chile, which will be filed on SEDAR within 45 days. The Project is

located in the Provinces of Mendoza and San Juan, Argentina. This

announcement describes the highlights from the Propipe PFS for

development of the Project using heap leaching only, involving the

construction of an SXEW heap leach plant outside of the province of

Mendoza in the neighbouring pro-mining province of San Juan. Ore

transport would be by means of a 22km long railway line to be

constructed for the Project. Current legislation in the Province of

Mendoza prohibits the use sulphuric acid required in heap leaching

of copper ore. The Company and Propipe have received a legal

opinion that there should be no legal impediment to the transport

of ore between Mendoza and San Juan.

This PFS takes into account the outcomes of an engineering study

completed in 2008 by Ausenco Canada Inc. ("Ausenco"), as announced

in the Company's news release dated April 3, 2008, and revised and

updated by Propipe in late 2011. The Propipe PFS includes the

resources, reserves, open pit mine plan, operating and capital

costs and financial analysis for a leach Project which describes

the production of up to 25,000 tonnes (55 million lbs) per year of

copper cathode for a period of 10 years. It is a comprehensive

study of the viability of the Project that has advanced to a stage

where the mining method has been established and an effective

method of mineral processing has been determined, and includes a

financial analysis based on reasonable assumptions of technical,

engineering, legal, operating, economic, social, and environmental

factors and the evaluation of other relevant factors which are

sufficient to determine if all or part of the mineral resource may

be classified as a mineral reserve.

The Propipe PFS was prepared in conjunction with a NI 43-101

resource estimate completed by NCL Ingenieria y Construccion S.A.

("NCL"), Santiago, Chile, as announced in the Company's news

release on January 16, 2008. No additional drilling has been

completed on the Project since the date of that estimate, and the

resource has not been updated since then. The mine plan is

unchanged from the Ausenco report, and no additional metallurgical

testwork has been completed since the date of the Ausenco report.

Full particulars of all exploration data, the key assumptions,

parameters and methods used to estimate mineral resources, quality

control and data verification methods are as disclosed in the

Ausenceo report, filed by the Company on SEDAR on May 23, 2008.

All references to $ in this News Release are references to

US$.

Highlights:

-- Measured and Indicated Resources of oxide and enriched material of 58

million tonnes at 0.59% CuT containing 342,600 tonnes (750 million lbs)

of copper

-- Proven and Probable Mineral Reserves of oxide and enriched ores of 48

million tonnes at 0.61% CuT containing 294,600 tonnes (650 million lbs)

of copper

-- Mine life: 10 years

-- Total copper production: 223,400 tonnes (492 million lbs)

-- Copper price: $2.80/lb, flat

-- Average cash operating costs in years 1 to 5: $1.26/lb Cu

-- Stand-alone acid plant generating Project acid requirements and

contributing to power requirements

-- Initial capital costs: $184.5 million (with an accuracy of +/- 25%,

including $5 million in project contingency, $15 million in other

provisions and $8.2 million in working capital)

-- Pre-tax NPV(10%): $259.5 million, IRR: 41%

-- After tax NPV(10%): $132.7 million, IRR: 29%

-- Copper recovery sensitivity (+/-10%): NPV(10%): +/- $48.6 million, IRR:

+/- 6.8%

-- Operating cost sensitivity (+/-10%): NPV(10%): +/- $23.4 million, IRR:

+/- 3.4%

-- Capital cost sensitivity ( +/-10%): NPV(10%): +/- $12.6 million, IRR:

+/- 3.5%

-- Sulphur price sensitivity (+/-10%): NPV(10%): +/- $2.6 million, IRR: +/-

0.4%

-- Copper price sensitivity:

----------------------------------------------------------------------------

Copper Price, $/lb $1.96 $2.24 $2.52 $2.80 $3.08 $3.36 $3.64

----------------------------------------------------------------------------

NPV(10%) After Tax $

mill -$19.2 $33.0 $83.3 $132.7 $181.6 $230.3 $279.0

----------------------------------------------------------------------------

IRR, % 7.0 15.0 22.4 29.3 35.8 42.0 48.2

----------------------------------------------------------------------------

Alan Stephens, President and CEO of Coro commented, "Coro is

pleased with the outcome of this latest study which once again

confirms the robust nature of San Jorge. The Company is confident

that this revised San Jorge development plan can be executed in an

environmentally responsible manner to the lasting economic and

social benefit of the Provinces of Mendoza and San Juan. In

addition, the Project has the potential to more than satisfy

Argentina's current consumption of copper, and thus could be

developed in accordance with the country's stated policy of

reducing imports. We further believe that the combination of what

would essentially be a rock quarrying operation, similar to many

others currently operating in Mendoza, together with a processing

plant located in San Juan, which has a vibrant and well developed

metalliferous mining industry, should satisfy essentially all of

the objections that were raised to the previous flotation project

which was denied legislative ratification in Mendoza last year.

A copy of this news release together with an accompanying letter

will be sent to all of the members of the recently formed Federal

Organisation of Mining Provinces ("OFEMI"), which includes Mendoza,

in order that they may consider the importance of this Project to

Argentina. Upon the successful development of this leach project

the Company will consider the alternatives for a flotation

project."

I. Mineral Resources:

San Jorge is a mid-sized porphyry copper gold deposit,

containing oxide, enriched, and primary mineralization. Resources

are contained within Oxide material, which can only be processed by

heap leach methods; Enriched material, which could be processed by

heap leach or flotation; and Primary material which can only be

processed by flotation methods. The table below summarizes mineral

resources on the San Jorge property. Mineral reserves disclosed on

the following page are included in the mineral resource numbers

below. The mineral resource calculations described below are

effective as at January 16, 2008 and have remained unchanged since

this date.

Table 1: Mineral Resources

Measure & Indicated (at 0.30% CuT cut-off)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

million

tonnes CuT Au CuT Metal Au

Domain Category (Mt) (%) (g/t) (Mlb) (Mozs)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Oxide Measured 19 0.59 0.23 250 0.15

----------------------------------------------------------------------------

Oxide Indicated 13 0.46 0.20 130 0.80

----------------------------------------------------------------------------

Oxide Measured + Indicated 32 0.53 0.22 380 0.23

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Enriched Measured 24 0.67 0.21 360 0.17

----------------------------------------------------------------------------

Enriched Indicated 1.6 0.47 0.20 17 0.01

----------------------------------------------------------------------------

Enriched Measured + Indicated 26 0.65 0.21 370 0.18

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Primary Measured 36 0.49 0.23 390 0.27

----------------------------------------------------------------------------

Primary Indicated 100 0.41 0.18 910 0.58

----------------------------------------------------------------------------

Primary Measured + Indicated 136 0.43 0.19 1,300 0.85

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Totals Measured + Indicated 190 0.48 0.21 2,000 1.30

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The gold and the Primary resources would not be recoverable in

the Leach Only Project, and therefore only the leachable oxide and

enriched copper resources within an economic envelope of $1.50/lb

copper are shown in Table 2 below:

To view, "Table 2: Leach Only Project Mineral Resources Within

Economic Envelope, based on a $1.50/lb Cu price", please visit the

following link:

http://media3.marketwire.com/docs/coro-0305-table-2.pdf.

II. Mineral Reserves, Mining, Processing and Production

Plan:

The Project contemplates an open pit mine to extract oxide and

enriched material and their processing by heap leach methods,

(including bacterial leaching for the enriched material) and

recovery of cathode copper via solvent extraction-electro winning

(SXEW) together with an on-site sulphur burning acid plant. Overall

ore contained in the mine plan developed by NCL is 48.4 million

tonnes, with an average grade of 0.61% CuT. The Mineral Reserves

are categorized as 83% Proven and 17% Probable of which 55% is

oxide and 45% is enriched as is set out in Table 3. The Inferred

resources are currently considered as waste. The mineral reserve

calculations described below are effective as at May 23, 2008 and

subsequently validated by NCL.

Table 3: San Jorge - Mineral Reserves by Categories and Ore

Type

----------------------------------------------------------------------------

Proven Probable Total

----------------------------------------------------------------------------

ORE COG% kt CuT% CuS% kt CuT% CuS% kt CuT% CuS% %

----------------------------------------------------------------------------

OXIDE 0.3 18,433 0.60 0.47 7,985 0.50 0.39 26,418 0.57 0.44 55

----------------------------------------------------------------------------

ENRICHED 0.2 21,583 0.66 0.13 389 0.47 0.09 21,972 0.66 0.13 45

----------------------------------------------------------------------------

TOTAL 40,016 0.63 0.28 8,374 0.50 0.37 48,390 0.61 0.30 100

----------------------------------------------------------------------------

% 83 17 100

----------------------------------------------------------------------------

The mine plan was driven by two factors; firstly to process up

to a maximum of 6.3 million tonnes per year in the crushing plant;

and secondly to minimize the overall strip ratio, especially in the

early years. This plan to place a total of 48.4 million tonnes of

oxide and enriched material on to heap leach pads was then used by

Propipe to prepare a processing plan for the production of up to

25,000 tonnes per year of copper cathodes during the Life of Mine

("LOM") as is set out in Table 4:

Table 4: Mine, Plant Processing and Production Plan

----------------------------------------------------------------------------

2015 2016 2017 2018 2019

Leach Only Year 1 2 3 4 5

----------------------------------------------------------------------------

Mine Oxide kt 6,000 5,000 5,002 2,891 2,048

Extraction Enriches kt 1,593 1,586 2,073 2,014 2,104

Total Ore kt 7,593 6,586 7,075 4,905 4,152

Waste kt 6,772 4,927 4,511 6,420 6,848

Strip Ratio 0.89 0.75 0.64 1.31 1.65

----------------------------------------------------------------------------

Plant Feed Oxide kt 5,868 5,132 4,466 2,891 2,584

CuT % 0.50 0.55 0.66 0.76 0.46

Enriched kt 0 0 0 2,068 3,716

CuT % 0.00 0.00 0.00 0.44 0.47

Total Ore kt 5,868 5,132 4,466 4,958 6,300

----------------------------------------------------------------------------

Production Avg Recovery % 85.00 85.00 85.00 79.48 73.84

Acid Cons Kg/t 21.1 22.7 31.4 26.2 17.9

Copper Cathodes t 24,999 24,129 24,997 24,661 21,532

Cash Cost (US$c/Lb 125 122 113 122 147

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2020 2021 2022 2023 2024 Total

Leach Only Year 6 7 8 9 10

----------------------------------------------------------------------------

Mine Oxide kt 2,758 2,182 537 COG 0.3 CuT 26,418

Extraction Enriches kt 3,858 6,342 2,401 COG 0.2 CuT 21,971

Total Ore kt 6,616 8,524 2,938 48,389

Waste kt 4,384 2,475 738 37,075

Strip Ratio 0.66 0.29 0.25 0.77

----------------------------------------------------------------------------

Plant Feed Oxide kt 2,758 2,182 537 0 0 26,418

CuT % 0.44 0.54 0.98 0.00 0.00

Enriched kt 3,542 3,050 1,834 5,680 2,082 21,972

CuT % 0.52 0.70 1.60 0.63 0.63

Total Ore kt 6,300 5,232 2,371 5,680 2,082 48,390

----------------------------------------------------------------------------

Production Avg Recovery % 73.70 73.00 69.15 66.30 66.30

Acid Cons Kg/t 18.5 22.4 40.6 17.6 17.6 22.5

Copper Cathodes t 22,547 24,215 23,916 23,684 8,683 223,363

Cash Cost (US$c/Lb 138 121 91 144 179 126

----------------------------------------------------------------------------

The overall LOM strip ratio is relatively low at 0.77:1, peaking

at 1.65:1 in the fifth year with a minimum strip ratio of 0.25:1 in

year eight.

Since the Ausenco engineering study was published in May 2008,

the economic parameters concerning capital and operating costs and

copper price have changed significantly. Costs have increased due

to escalation of labour cost, diesel, power, consumables and

materials, plus the additional transport cost resulting from the

proposed location of the process plant 22 km from the mine. At the

same time, the copper prices have also increased significantly,

compensating for the upward trend in costs. The technical

parameters of the project remained unchanged from the Ausenco

study, except for the location of the heap leach operation. In

order to assess changes in the economic parameters since 2008, NCL

carried out an analysis of the validity of the open pit design,

reserves and mine plan evaluated in the Ausenco study, and

concluded that all those elements are valid under the conditions of

the current study. The main conclusion of the analysis is that

increases in the operating costs are mostly offset by increases in

copper price, to the extent that the selected pit from a Whittle

exercise run using the current parameters is virtually identical to

the pit selected in the 2008 Study. The validity of the Ausenco

mine plan was therefore confirmed; it preferentially extracts oxide

ore early in the mine life, delaying the mining and processing of

the enriched ore which had slower leach kinetics, as well as

deferring project capital. The production plan contains 223,400

tonnes (492 million lbs) of recoverable copper as cathode.

A total of seventeen 4 & 6 m column tests were completed at

SGS Laboratories, Santiago, Chile in 2008. The metallurgical

parameters were validated by Propipe from a diffusion controlled

leaching model developed by Ausenco in 2008. That model used a

scale-up factor of 1.5 and derivation of the projected leach cycle

of 115 days for oxide and 150 days for enriched, average acid

consumptions of 26.1 kg/t for oxide and 18.3 kg/t for enriched, and

recoveries of 85% of total copper for oxide and 66.3% of total

copper for enriched.

Capital and operating cost estimates were updated by Propipe and

reflect the market environment in Argentina (Q4 2011) for owner

mining, crushing, agglomeration, transport and stacking of ore,

acid production from a sulfur burning acid plant, cathode

production by solvent extraction and electro-winning, and cathode

transportation. After a series of trade off studies of the various

power and acid supply alternatives, it was concluded that current

and projected sulfuric acid shortages were best addressed by the

inclusion of a 140,000 ton per year on-site sulfur burning acid

plant. The acid and co-gen power plant was estimated to have a

capital cost of $23.6 million, and was sized to provide the

projected sulfuric acid requirements for the operation, and

approximately half of the 10 MW required project power. The rest of

the power will be supplied from the Argentinean grid in Calingasta

located 93 km to the north of the leaching plant, in San Juan

province, at a cost of $11.5 million.

Trade off studies were also performed to determine the most cost

efficient way of hauling ore from the mine site to the leach

process plant in San Juan. Trucking, conveyor and rail were

studied, with the lowest operational cost and optimal technical

alternative being a 22 km railway with 3,000 HP locomotive and 42

wagons of 56 tonnes capacity, for a total cost of $23.5 million.

Water will be supplied by a 20 km pipeline from the El Tigre stream

located in the Yalguaraz ranch, owned by Minera San Jorge.

III. Operating Costs:

All operating costs associated with ore transport to San Juan

and acid plant were included in the plant operating costs, as shown

in Table 5:

Table 5: Average Annual Operating Costs

----------------------------------------------------------------------------

2015 2016 2017 2018 2019

Cash Cost Summary 1 2 3 4 5

----------------------------------------------------------------------------

MINE $k 23,425 22,037 21,792 22,519 22,876

$/t ore 3.99 4.29 4.88 4.54 3.63

$/kg Cu 0.94 0.91 0.87 0.91 1.06

c/lb 42.50 41.43 39.54 41.42 48.19

$/ton mov 1.63 1.89 1.88 1.98 1.74

----------------------------------------------------------------------------

PLANT $k 35,938 33,085 31,023 34,389 37,236

$/t ore 6.12 6.45 6.95 6.94 5.91

$/kg Cu 1.44 1.37 1.24 1.39 1.73

c/lb 65.21 62.20 56.29 63.25 78.44

----------------------------------------------------------------------------

G&A $k 9,570 9,570 9,570 9,570 9,570

$/t ore 1.63 1.86 2.14 1.93 1.52

$/kg Cu 0.38 0.40 0.38 0.39 0.44

c/lb 17.36 17.99 17.36 17.60 20.16

----------------------------------------------------------------------------

TOTAL $k 68,933 64,692 62,385 66,478 69,681

c/lb 125 122 113 122 147

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2020 2021 2022 2023 2024 TOTAL LOM

Cash Cost Summary 6 7 8 9 10 COST

----------------------------------------------------------------------------

MINE $k 21,931 20,410 12,494 9,153 4,165 180,802

$/t ore 3.48 3.90 5.27 1.61 2.00 3.74

$/kg Cu 0.97 0.84 0.52 0.39 0.48 0.81

c/lb 44.12 38.23 23.70 17.53 21.76 36.72

$/ton mov 1.99 1.86 3.40 1.61 2.00 1.89

----------------------------------------------------------------------------

PLANT $k 37,233 34,638 25,778 56,343 20,590 346,253

$/t ore 5.91 6.62 10.87 9.92 9.89 7.16

$/kg Cu 1.65 1.43 1.08 2.38 2.37 1.55

c/lb 74.90 64.89 48.89 107.91 107.56 70.32

----------------------------------------------------------------------------

G&A $k 9,570 9,570 9,570 9,570 9,570 95,697

$/t ore 1.52 1.83 4.04 1.68 4.60 1.98

$/kg Cu 0.42 0.40 0.40 0.40 1.10 0.43

c/lb 19.25 17.93 18.15 18.33 49.99 19.43

----------------------------------------------------------------------------

TOTAL $k 68,733 64,619 47,841 75,065 34,325 622,752

c/lb 138 121 91 144 179 126

----------------------------------------------------------------------------

IV. Capital Costs:

Initial capital costs, including mining fleet, ore transport,

plant, infrastructure, other provisions, owner costs, working

capital, and contingencies, were estimated by Propipe at $184.5

million, as set out in Table 6:

Table 6: Capital Cost Estimate

----------------------------------------------------------------------------

Initial Capital Expenditure $000's

----------------------------------------------------------------------------

10: Mining 22,050

----------------------------------------------------------------------------

20: Process 49,997

----------------------------------------------------------------------------

40: Utilities & Reagents 2,089

----------------------------------------------------------------------------

50: Onsite Infrastructure 6,549

----------------------------------------------------------------------------

60: Offsite Infrastructure 64,094

Includes: Acid and Co-generation Plant 23,598

Includes: Ore Railway transport to San Juan 23,510

----------------------------------------------------------------------------

70: Indirects 12,479

----------------------------------------------------------------------------

80: Owners Costs 6,763

----------------------------------------------------------------------------

90: Other 20,478

Includes: Working Capital 8,182

Includes: Contingency 5,000

----------------------------------------------------------------------------

Total 184,499

----------------------------------------------------------------------------

An additional $17 million in capital is expended over the life

of the Project as deferred, sustaining and closure costs. The

capital cost estimate excludes losses or gains that may arise from

foreign exchange rate variations, cost escalation, and other

factors, as detailed in the PFS.

V. Financial Analysis:

The Project has been evaluated on both a pre-tax and after-tax

basis, including export levy and provincial royalty. The base case

operating cash flow peaks at $76 million in the 2nd year with a

minimum cash flow of $23 million in the tenth year, which is the

last operating period, as shown in Table 7 below:

Table 7: Operating Cash Flows

----------------------------------------------------------------------------

2014 2015 2016 2017 2018 2019

Cash Flows - $million 0 1 2 3 4 5

----------------------------------------------------------------------------

Revenues 0 154 149 154 152 133

Operating Cost 0 69 65 62 66 70

----------------------------------------------------------------------------

Operating Cash Flows 0 85 84 92 86 63

----------------------------------------------------------------------------

Initial Capital Investment 176 0 0 0 0 0

Deferred Capital Investment 0 2 1 1 1 1

Working Capital 8 -1 -0 0 0 -0

VAT Effect 0 11 -1 -0 1 1

Export Tax 0 5 5 5 5 5

Provintial Tax 0 3 3 3 3 2

Taxes 0 0 0 15 26 19

----------------------------------------------------------------------------

Cash Flow After Tax -184 65 76 67 49 36

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2020 2021 2022 2023 2024

Cash Flows - $million 6 7 8 9 10 TOTAL

----------------------------------------------------------------------------

Revenues 139 149 148 146 54 1,379

Operating Cost 69 65 48 75 34 623

----------------------------------------------------------------------------

Operating Cash Flows 70 85 100 71 19 756

----------------------------------------------------------------------------

Initial Capital Investment 0 0 0 0 0 176

Deferred Capital Investment 1 1 1 1 5 17

Working Capital -0 -2 3 -5 -4 0

VAT Effect -0 -1 -3 6 -13 0

Export Tax 5 5 5 5 2 47

Provintial Tax 3 3 3 2 1 27

Taxes 21 26 32 22 5 167

----------------------------------------------------------------------------

Cash Flow After Tax 41 52 59 40 23 322

----------------------------------------------------------------------------

A summary of the economic evaluation at the base case copper

price of $2.80/lb is shown in Table 8:

Table 8: Economic Evaluation at $2.80/lb

----------------------------------------------------------------------------

Economic Evaluation Summary - $m Base Case LT $ 2.80 /lb

----------------------------------------------------------------------------

Discount Rate 8% 10% 12%

----------------------------------------------------------------------------

Pre Tax Project NPV 302 259 222

------------------------------

IRR 41%

----------------------------------------------------------------------------

After Tax Project NPV 160 133 109

------------------------------

IRR 29%

----------------------------------------------------------------------------

Payback (years) 4

----------------------------------------------------------------------------

VI. NI 43-101 PFS:

Propipe managed the preparation of the PFS which will be

completed and filed on SEDAR and Coro's web site within 45 days of

this release.

All principal technical personnel and Qualified Persons ("QP")

participating in the development and review of this PFS have

extensive relevant experience. The various parties responsible for

supplying data and other information for the report are as

follows:

Sergio Alvarado, BSc (Hons.) Geology, Member of Canadian

Institute of Mining, Metallurgy and Petroleum (CIM), The Chilean

Mining Commission (CMC) and The Chilean Mining Engineers Institute

(IIMCh), who served as an associated consultant for Propipe, was

responsible for the overall preparation of the PFS as defined in

National Instrument 43-101, Standards of Disclosure for Mineral

Projects and in compliance with Form 43-101F1. He has no

relationship with the Company other than in the preparation of this

report.

Rodrigo de Brito Mello, FAusIMM (Consulting Geologist, RBM Ltda)

served as the Qualified Person for those parts of the PFS relating

to geology and resource estimation. Mr. Mello completed a site

visit from October 22nd to 26th 2007, when he was employed by NCL

as a geologist and served as QP for both reports mentioned above.

Mr Alvarado has no relationship with the Company other than in the

preparation of this report. He has no relationship with the Company

other than in the preparation of this report.

Eduardo Rosselot, Mining Engineer, Chartered Engineer (CEng)

Engineering Council UK, Professional Member of Institute of

Materials, Minerals and Mining (IMMM) UK, Professional Member of

Colegio de Ingenieros de Chile, who served as an associated

consultant for NCL, was responsible for the section relating to

mining. Mr. Rosselot visited the property in January 2012. He has

no relationship with the Company other than in the preparation of

this report.

Enrique Quiroga, Mining Engineer, member of Engineering School

(Chile) and The Chilean Mining Commission, who served as an

associated consultant for Propipe, was responsible for those

sections relating to mining and process design, engineering and

cost estimation. Mr Quiroga visited the property in September 2011.

He has no relationship with the Company other than in the

preparation of this report.

Jaime Simpson, employed by Propipe as Technical &

Development and Research Manager, was responsible for metallurgical

process, engineering input, capital and operational cost estimate

for plant. Mr Simpson visited the property in January 2011. He has

no relationship with the Company other than in the preparation of

this report.

Victor Araya, employed by Propipe as Project Director, was

responsible for infrastructure capital estimate and undertaking

cash flow analysis. He has no relationship with the Company other

than in the preparation of this report.

Heriban Soto, MSc, PhD, QP, Technical Director SGS, was

responsible for supervising the metallurgical test work and

reporting. He has no relationship with the Company other than in

the preparation of this report.

The financial analysis was completed by Coro management.

Collectively, Sergio Alvarado, Rodrigo de Brito Mello, Eduardo

Rosellot, Enrique Quiroga and Heriban Soto are the Qualified

Persons for purposes of National Instrument 43-101, and have

approved the San Jorge Information contained in this press

release.

Alan Stephens FIMMM, President and CEO of Coro, a geologist with

more than 36 years of industry experience is the Qualified Person

for Coro who has reviewed and approved the contents of this press

release.

All mineral resources have been estimated in accordance with the

definition standards on mineral resources and mineral reserves of

the Canadian Institute of Mining, Metallurgy and Petroleum referred

to in National Instrument 43-101, commonly referred to as NI

43-101. U.S. reporting requirements for disclosure of mineral

properties are governed by the United States Securities and

Exchange Commission (SEC) Industry Guide 7. Canadian and Guide 7

standards are substantially different. This press release uses the

terms "measured," "indicated" and "inferred" resources. Mineral

resources which are not mineral reserves do not have demonstrated

economic viability. We advise investors that while those terms are

recognized and required by Canadian regulations, the SEC does not

recognize them. Inferred mineral resources are considered too

speculative geologically to have economic considerations applied to

them that enable them to be categorized as mineral reserves.

CORO MINING CORP.

Alan Stephens, President and CEO

About Coro Mining Corp.:

The Company was founded with the goal of building a mining

company focused on medium-sized base and precious metals deposits

in Latin America. The Company intends to achieve this through the

exploration for, and acquisition of, projects that can be developed

and placed into production. Coro's properties include the advanced

San Jorge copper-gold project, in Argentina, and the Berta, El

Desesperado, Chacay, Llancahue, and Celeste copper exploration

properties located in Chile.

About ProPipe S.A.:

ProPipe is a Chilean supplier of consultancy, engineering and

project management services to its customers in the mining process,

infrastructure and environment markets. ProPipe have relevant

experience in conceptual and basic design, preliminary feasibility

and feasibilities studies, and detailed engineering for mining

companies in Chile; some of the main clients are BHP Billiton's

Minera Escondida, Antofagasta Minerals's Minera Los Pelambres,

Minera El Tesoro, Minera Esperanza, Minera Las Cenizas and Algorta

Norte. The latest Propipe's projects are Camarones 12,000 ton per

year Copper Cathodes plants, Algorta Norte 78 km Sea Water Pipeline

and Minera Escondida Coloso Filter Plant Expansion Project.

ProPipe main office is located in Santiago of Chile, and have

more than 100 professionals dedicated to the design and management

of engineering projects, allowing covering efficiently the stages

of evaluation, design and implementation of projects.

This news release includes certain "forward-looking statements"

under applicable Canadian securities legislation. Such

forward-looking statements or information, including but not

limited to those with respect to the Company's business strategy,

the prices of copper, construction schedules, operating and capital

budgets, anticipated mineral recoveries, estimated future

production, estimated costs of future production, permitting time

lines, involve known and unknown risks, uncertainties, and other

factors which may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements or information. Such factors

include, among others, global economic conditions, changes in

prices or demand for commodities including, in particular, copper,

changes in exchange rates, changes in national or local

governments, changes in legislation or regulation or the

implementation or interpretation of laws or regulations, changes in

tax rates, timeliness of government approvals, political or

environmental activism, the factual results of current exploration,

development and mining activities, accuracy of resource and reserve

estimates, changes in project parameters as plans continue to be

evaluated, access to skilled personnel, labour relations, costs of

labour, costs and availability of materials and equipment, changes

in refining or transportation costs, as well as those other factors

disclosed in the Company's documents filed from time to time with

the securities regulators in the Provinces of British Columbia,

Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova

Scotia, Prince Edward Island and Newfoundland and Labrador. The

Company does not intend, and does not assume any obligation, to

update these forward-looking statements, except as required by

applicable laws. Actual results may differ materially from those

expressed or implied by such forward-looking statements.

Contacts: Coro Mining Corp. Michael Philpot Executive

Vice-President (604) 682 5546investor.info@coromining.com

www.coromining.com

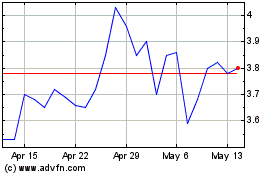

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jun 2024 to Jul 2024

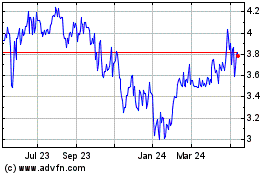

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jul 2023 to Jul 2024