Coro Amends Terms of San Jorge Agreement

February 29 2012 - 11:02AM

Marketwired Canada

Coro Mining Corp. ("Coro" or the "Company") (TSX:COP) is pleased to announce

that Franco-Nevada Corporation ("Franco Nevada") and the Company have agreed to

amend the terms of the Purchase Agreement by which Coro may acquire its 100%

interest in Minera San Jorge ("MSJ"). Franco Nevada acquired Lumina Royalty

Corp, the previous owner of MSJ in December 2011.

The amended terms for Coro to acquire 100% of MSJ are as follows;

-- Option payments by Coro of US$1.25 million per year, for 10 years,

payable quarterly, commencing March 31, 2012

-- Coro may at any time, prepay the outstanding amount with a one-time

payment equal to the net present value of the future payments, using a

5% discount rate

-- A 7.5% Net Smelter Return ("NSR") payable by Coro on all gold produced

from the property

-- The option payments are not payable when exceeded by the gold NSR

payment for the period

-- No other consideration, obligations, payments, or royalties are due to

Franco Nevada, and Coro may withdraw from the Agreement at any time by

not making the payments due.

Table 1 compares the amended terms with the previous acquisition terms. The

companies have signed a non-binding letter of intent and are in the process of

finalizing the amended agreement.

Alan Stephens, President and CEO of Coro commented, "We are very pleased that

Franco Nevada has shown its willingness to modify the terms of the Purchase

Agreement. The previous agreement contemplated US$9.25 million in payments over

the next 15 months; the new option payment schedule allows Coro to stage its

investment in the project until it has greater certainty on the ability to

permit the project in Mendoza province. The Company will provide its

shareholders with an update of the status of San Jorge shortly."

As of December 31, 2011 the Company had approximately CA$12 million in cash, and

is well funded to advance its projects.

Table:1 - Comparative Table of Significant Acquisition terms

---------------------------------------------------------------------------

Previous Outstanding Payments Amended Terms

---------------------------------------------------------------------------

Remaining Cash US$9.25m- Due US$5m in May US$1.25m annually,

Payments 2012 and US$4.25m in May 2013 payable quarterly,

commencing March 31, for

ten years

---------------------------------------------------------------------------

Commercial Sulphide Payment: None

Production Payment US$0.02 per lb on the copper

contained in the mineable

proven and probable sulphide

reserves

Oxide Payment:

US$0.025 per lb on the copper

contained in the mineable

proven and probable oxide

reserves

NB: The total cash payments of

US$16m were deductible from

the first of the above

payments

---------------------------------------------------------------------------

Copper Royalty A copper royalty was also due None

on any production in excess of

the aforementioned reserves

payments of US$0.015 per lb of

production from the sulphides

and US$0.02 per lb of

production from the oxides.

---------------------------------------------------------------------------

Non-Copper NSR 1.5% NSR on all non-copper 7.5% NSR on all gold

production produced

---------------------------------------------------------------------------

CORO MINING CORP.

Alan Stephens, President and CEO

About Coro Mining Corp.:

The Company was founded with the goal of building a mining company focused on

medium-sized base and precious metals deposits in Latin America. The Company

intends to achieve this through the exploration for, and acquisition of,

projects that can be developed and placed into production. Coro's porphyry

copper properties include the Berta, El Desesperado, Chacay, Llancahue, and

Celeste exploration projects located in Chile and the advanced San Jorge

porphyry copper-gold project, in Argentina.

This news release includes certain "forward-looking statements" under applicable

Canadian securities legislation. Such forward-looking statements or information,

including but not limited to those with respect to the prices of copper,

estimated future production, estimated costs of future production, permitting

time lines, involve known and unknown risks, uncertainties, and other factors

which may cause the actual results, performance or achievements of the Company

to be materially different from any future results, performance or achievements

expressed or implied by such forward-looking statements or information. Such

factors include, among others, the actual prices of copper, the factual results

of current exploration, development and mining activities, changes in project

parameters as plans continue to be evaluated, as well as those factors disclosed

in the Company's documents filed from time to time with the securities

regulators in the Provinces of British Columbia, Alberta, Saskatchewan,

Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and

Newfoundland and Labrador.

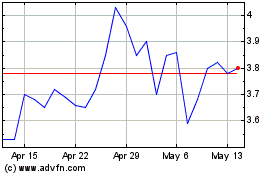

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jun 2024 to Jul 2024

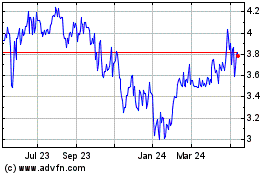

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jul 2023 to Jul 2024