Coro Announces Acquisition of New Chilean Copper Project

February 21 2012 - 11:35AM

Marketwired Canada

Coro Mining Corp. ("Coro" or the "Company") (TSX:COP) is pleased to announce

that it has entered into an option agreement to acquire the El Desesperado

Property from a local Chilean company. The 698 hectare property hosts porphyry

copper style mineralization and is located approximately 7km northwest of the

city of Calama, and 16km southwest of the world famous Chuquicamata copper mine,

in the II Region of Chile, at an elevation of 2,500m (Figure 1:

http://file.marketwire.com/release/COPFig1.pdf). The Toki Cluster porphyry

copper deposits currently being evaluated by Codelco, are located immediately to

the east of the property. They comprise the major Toki, Quetena, Genoveva and

Opache centers of porphyry copper mineralization, each containing several

hundred million tonnes of copper oxide resources, grading 0.4-0.5%Cu, and

entirely covered by gravels.

In December 2011, Codelco initiated the permitting process for production of

cathode copper from the combined Quetena and Genoveva deposits. According to the

publicly available Environmental Impact Study, this will involve an open pit at

each of the deposits, the trucking of 30,000tpd of higher grade ore to the

existing SXEW facilities at Chuquicamata, and 60,000tpd of Run of Mine dump

leaching at the project site, followed by pumping of solution to Chuquicamata.

Planned production is 528,000 tonnes of cathode copper over the 10 year life of

the project, with an average production of 62,000 tpy Cu in the first five

years. Capital investment is estimated to be US$244,000,000.

The Genoveva planned open pit rim is located approximately 1km to the east of

the El Desesperado property, while the Opache deposit is located approximately

2km to the east-southeast (Figure 2:

http://media3.marketwire.com/docs/COPFig2.pdf).

Alan Stephens, President and CEO of Coro, commented, "We are very pleased to

have acquired the El Desesperado property. We believe that it has significant

potential for the discovery of a new member of the Toki Cluster deposits, and we

intend to complete surface exploration and a drilling program to confirm this.

El Desesperado is the latest project in our Chilean porphyry copper exploration

portfolio, which consists of the Berta project, where we expect to initiate a

second drilling campaign shortly; the Chacay project, where we have a identified

a significant chalcocite enrichment blanket; and Llancahue, where we plan

additional drilling later this year. Together with San Jorge in Argentina, Coro

is now evaluating five porphyry copper deposits, and we expect to add to this

total in 2012."

El Desesperado Option Terms

Coro may acquire 100% of the El Desesperado property for a total of

US$13,000,000 by making the following staged option payments;

On signing: US$200,000 (paid)

12 months from signing: US$500,000

24 months from signing: US$1,300,000

36 months from signing: US$3,000,000

48 months from signing: US$8,000,000

In addition, a 1.9% sales royalty is payable on any production from the

property, over which Coro has a first right of refusal.

About El Desesperado

Based on outcropping alteration, lithologies and copper oxides, Coro believes

there is good potential in the untested northern part of the El Desesperado

property to host significant mineralization of similar style to the adjacent

Genoveva and Quetena deposits. These are associated with swarms of NNE oriented

Eocene porphyry dykes and stocks, intruded into both Paleozoic volcanics and

precursor Tertiary plutons. Zones of low grade copper mineralization associated

with potassic alteration are related to the porphyries and higher copper grades

occur where this has been overprinted by sericite alteration, or where later

veining is present. The Toki Cluster deposits have been oxidized to depths in

excess of 100m beneath the gravel cover and host major copper oxide resources,

as well as significant underlying primary sulphide mineralization.

Small scale open pit mining and vat leaching of copper oxide bearing breccias,

took place at the Quetena Mine on the property during the 1960-70's, and it was

subsequently explored by two major mining companies, firstly in 1997-98 prior to

the discovery of the Toki Cluster; and secondly in 2004. The first company

completed wide spaced reverse circulation and diamond drilling (11 holes,

2,582m), mostly aimed at testing geophysical targets, while the second company

completed vertical reverse circulation drilling (2 holes, 700m) which tested two

conceptual targets. In neither case, was significant mineralization intersected;

however, none of the previous drilling was completed in the highly prospective

northern part of the property.

As of December 31, 2011 the Company had approximately CA$12 million in cash, and

is well funded to advance its projects.

CORO MINING CORP.

Alan Stephens, President and CEO

About Coro Mining Corp.:

The Company was founded with the goal of building a mining company focused on

medium-sized base and precious metals deposits in Latin America. The Company

intends to achieve this through the exploration for, and acquisition of,

projects that can be developed and placed into production. Coro's porphyry

copper properties include the Berta, Chacay, Llancahue, and Celeste exploration

projects located in Chile and the advanced San Jorge porphyry copper-gold

project, in Argentina.

This news release includes certain "forward-looking statements" under applicable

Canadian securities legislation. Such forward-looking statements or information,

including but not limited to those with respect to the prices of copper,

estimated future production, estimated costs of future production, permitting

time lines, involve known and unknown risks, uncertainties, and other factors

which may cause the actual results, performance or achievements of the Company

to be materially different from any future results, performance or achievements

expressed or implied by such forward-looking statements or information. Such

factors include, among others, the actual prices of copper, the factual results

of current exploration, development and mining activities, changes in project

parameters as plans continue to be evaluated, as well as those factors disclosed

in the Company's documents filed from time to time with the securities

regulators in the Provinces of British Columbia, Alberta, Saskatchewan,

Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and

Newfoundland and Labrador.

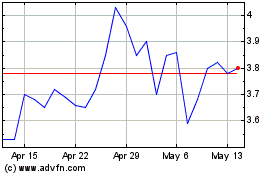

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jun 2024 to Jul 2024

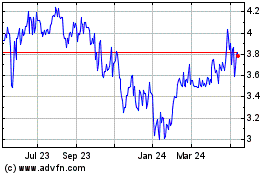

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jul 2023 to Jul 2024