TORONTO, May 14, 2012 /CNW/ - For the three months ended March 31,

2012, total Leon's sales were $200,651,000 including $43,220,000 of

franchise sales ($191,592,000 including $40,809,000 of franchise

sales in 2011), an increase of 4.7%. Same store sales were down

0.7% from the prior year first quarter. Net income was $8,599,000,

$0.12 per common share ($10,293,000, $0.15 per common share in

2011). The profit decrease in the quarter compared to the prior

quarter was mainly due to higher marketing expenses and opening

costs related to four new stores that were opened in the latter

part of 2011. Major renovations are well underway in our Sudbury

and Sault Ste. Marie, Ontario corporate stores. Our Kentville

franchise has recently opened a new and larger replacement store in

Coldbrook, Nova Scotia. Construction has also started for a brand

new franchise store to replace our existing St. John, New Brunswick

store. Finally, the Company has secured sites for four new

corporate stores in: Orangeville and Brantford, Ontario;

Sherbrooke, Quebec; and Rocky View County, Alberta, which is just

north of Calgary. Our current plan is to open these locations

during the latter part of 2012 and in 2013. As previously

announced, we paid a quarterly 10¢ dividend on April 5, 2012. Today

we are happy to announce that the Directors have declared a

quarterly dividend of 10¢ per common share payable on the 6(th) day

of July 2012 to shareholders of record at the close of business on

the 6(th) day of June 2012. As of 2007, dividends paid by Leon's

Furniture Limited are "eligible dividends" pursuant to the changes

to the Income Tax Act under Bill C-28, Canada. EARNINGS PER SHARE

FOR EACH QUARTER MARCH JUNE SEPT. DEC. YEAR

31 30 30 31 TOTAL 2012 - Basic 12¢ $0.12 - Fully 12¢ $0.12 Diluted

2011 - Basic 15¢ 16¢ 22¢ 28¢ $0.81 - Fully 14¢ 15¢ 21¢ 27¢ $0.78

Diluted 2010 - Basic 17¢ 17¢ 26¢ 30¢ $0.90 - Fully 16¢ 16¢ 25¢ 29¢

$0.87 Diluted LEON'S FURNITURE LIMITED / MEUBLES LEON LTÉE Mark J.

Leon Chairman of the Board MANAGEMENT'S DISCUSSION AND ANALYSIS For

the three months ended March 31, 2012 and 2011 Dated: May 14, 2012

The Management's Discussion and Analysis ("MD&A") for Leon's

Furniture Limited/Meubles Leon Ltée (the "Company") should be read

in conjunction with i) the Company's 2011 audited consolidated

financial statements and the related notes and MD&A and ii) the

Company's unaudited interim condensed consolidated financial

statements for the three months ended March 31, 2012 and the

related notes. Cautionary Statement Regarding Forward-Looking

Statements This MD&A is intended to provide readers with the

information that management believes is required to gain an

understanding of Leon's Furniture Limited's current results and to

assess the Company's future prospects. This MD&A, and in

particular the section under heading "Outlook", includes

forward-looking statements, which are based on certain assumptions

and reflect Leon's Furniture Limited's current plans and

expectations. These forward-looking statements are subject to a

number of risks and uncertainties that could cause actual results

and future prospects to differ materially from current

expectations. Some of the factors that can cause actual results to

differ materially from current expectations are: a continuing

slowdown in the Canadian economy; a further drop in consumer

confidence; and dependency on product from third party suppliers.

Given these risks and uncertainties, investors should not place

undue reliance on forward-looking statements as a prediction of

actual results. Readers of this report are cautioned that actual

events and results may vary. Financial Statements Governance

Practice Leon's Furniture Limited's unaudited interim condensed

consolidated financial statements have been prepared in accordance

with International Financial Reporting Standards ("IFRS") and

incorporate the requirements of IAS 34, Interim Financial Reporting

as issued by the International Accounting Standards Board ("IASB").

The amounts expressed are in Canadian dollars. Per share amounts

are calculated using the weighted average number of shares

outstanding for the applicable period. The Audit Committee of the

Board of Directors of Leon's Furniture Limited reviewed the

MD&A and the unaudited interim condensed consolidated financial

statements, and recommended that the Board of Directors approve

them. Following review by the full Board, the unaudited interim

condensed consolidated financial statements and MD&A were

approved on May 14, 2012. Introduction Leon's Furniture Limited has

been in the furniture retail business for over 100 years. The

Company's 43 corporate and 32 franchise stores can be found in

every province across Canada except British Columbia. Main product

lines sold at retail include furniture, appliances and electronics.

Revenues and Expenses For the three months ended March 31, 2012,

total Leon's sales were $200,651,000 including $43,220,000 of

franchise sales ($191,592,000 including $40,809,000 of franchise

sales in 2011), an increase of 4.7%. Leon's corporate sales of

$157,431,000 in the first quarter of 2012, increased by $6,648,000,

or 4.4%, compared to the first quarter of 2011. The increase

in sales in the first quarter compared to the prior year was the

result of opening four new stores in the latter part of the prior

year. Same store sales decreased by 0.7% compared to the prior

year. Leon's franchise sales of $43,220,000 in the first quarter of

2012, increased by $2,411,000 or 5.9%, compared to the first

quarter of 2011. The increase in sales in the first quarter

compared to the same period in the prior year was mainly the result

of opening two new stores in the latter part of 2011. Same store

franchise sales increased by 1.6%. Our gross margin for the first

quarter 2012 of 40.8% was down approximately 0.8% from the first

quarter of 2011. The decrease in gross margin was mainly

attributable to the decline in electronics margins. Net operating

expenses of $53,306,000 were up $4,016,000 or 8.1% for the first

quarter 2012 compared to the first quarter of 2011. The increase in

operating expenses compared to the prior year were mainly due to

two factors; higher costs including marketing, payroll and

occupancy as a result of opening four new corporate stores in late

2011, being Guelph, Ontario; Mississauga, Ontario; Rosemère,

Quebec; and Regina, Saskatchewan; higher sales commissions expenses

as a result of higher sales for the quarter compared to the prior

year quarter. Our accounting policy is to expense all new store

opening costs as incurred. As a result of the above, net income for

the first quarter of 2012 was $8,599,000, $0.12 per common share

($10,293,000, $0.15 per common share in 2011), a decrease of $0.03

per common share. Annual Financial Information ($ in thousands,

except 2011 2010 2009 earnings per share and dividends) Net

corporate sales 682,836 710,435 703,180 Leon's franchise sales

196,725 197,062 194,290 Total Leon's system-wide 879,561 907,497

897,470 sales Net income 56,666 63,284 56,864 Earnings per share

Basic $0.81 $0.90 $0.80 Diluted $0.78 $0.87 $0.78 Total assets

595,339 566,674 529,156 Common share dividends $0.37 $0.32 $0.28

declared Special common share $0.15 - $0.20 dividends declared

Convertible, non-voting $0.20 $0.18 $0.14 shares dividends declared

Liquidity and Financial Resources ($ in thousands, Mar 31/12 Dec

31/11 Mar 31/11 except dividends per share) Cash, cash 195,931

221,823 202,770 equivalents, available-for-sale financial assets

Trade and other 17,315 28,937 17,262 accounts receivable Inventory

91,694 87,830 78,444 Total assets 563,793 595,339 544,053 Working

capital 208,154 204,649 202,832 CurrentQuarter Prior Prior Mar 31,

2012 Quarter Quarter For the 3 months Dec 31, Mar 31, ended 2011

2011 Cash flow provided (7,581) 26,230 (687) by (used in)

operations Purchase of 3,586 6,336 2,876 property, plant and

equipment Repurchase of 232 219 715 capital stock Dividends paid

17,457 6,292 6,310 Dividends paid per $0.25 $0.09 $0.09 share Cash,

cash equivalents and available-for-sale financial assets decreased

by $25,892,000 in the quarter mainly as a result of dividends paid.

Major renovations are well underway in our Sudbury and Sault Ste.

Marie, Ontario corporate stores. Our Kentville franchise has

recently opened a new and larger replacement store in Coldbrook,

Nova Scotia. Construction has also started for a brand new

franchise store to replace our existing St. John, New Brunswick

store. Finally, the Company has secured sites for four new

corporate stores in: Orangeville and Brantford, Ontario;

Sherbrooke, Quebec; and Rocky View County, Alberta, which is just

north of Calgary. Our current plan is to open these locations

during the latter part of 2012 and 2013. All funding for new store

projects and renovations are planned to come from our existing cash

resources. Quarterly Results (2012, 2011, 2010) Quarterly Income

Statement ($000) - except per share data

___________________________________________________________________________________________

| | Quarter Ended | Quarter Ended | Quarter Ended | Quarter Ended |

| | March 31 | December 31 | September 30 | June 30 |

|___________|___________________|___________________|___________________|___________________|

| | 2012 | 2011 | 2011 | 2010 | 2011 | 2010 | 2011 | 2010 |

|___________|_________|_________|_________|_________|_________|_________|_________|_________|

|Leon's | 157,431| 150,783| 193,823| 197,888| 174,373| 182,125|

163,857| 168,952| |corporate | | | | | | | | | |sales | | | | | | |

| |

|___________|_________|_________|_________|_________|_________|_________|_________|_________|

|Leon's | 43,220| 40,809| 61,166| 59,820| 49,273| 49,421| 45,477|

45,493| |franchise | | | | | | | | | |sales | | | | | | | | |

|___________|_________|_________|_________|_________|_________|_________|_________|_________|

|Total | 200,651| 191,592| 254,989| 257,708| 223,646| 231,546|

209,334| 214,445| |Leon's | | | | | | | | | |system-wide| | | | | |

| | | |sales | | | | | | | | |

|___________|_________|_________|_________|_________|_________|_________|_________|_________|

|Net income | $0.12| $0.15| $0.28| $0.30| $0.22| $0.26| $0.16|

$0.17| |per share | | | | | | | | |

|___________|_________|_________|_________|_________|_________|_________|_________|_________|

|Fully | $0.12| $0.14| $0.27| $0.29| $0.21| $0.25| $0.15| $0.16|

|diluted per| | | | | | | | | |share | | | | | | | | |

|___________|_________|_________|_________|_________|_________|_________|_________|_________|

Common Shares At March 31, 2012, there were 69,919,120 common

shares issued and outstanding. During the first quarter 2012,

19,104 shares were repurchased at an average cost of $12.16 and

then cancelled by the Company through its Normal Course Issuer Bid.

In addition, during the quarter ended March 31, 2012, 89,668

convertible, non-voting series 2002 shares and 32,822 convertible,

non-voting series 2005 shares were converted into common shares.

There were 12,237 convertible, non-voting series 2009 shares

cancelled. For details on the Company's commitments related to its

redeemable shares, please refer to note 13 of the unaudited interim

condensed consolidated financial statements. Commitments ($ in

thousands) PaymentsDueby Period Contractual Lessthan 2-3 After5

Obligations Total 1 year years 4-5years years Operating Leases 1

59,065 6,859 12,512 12,647 27,047 Purchase Obligations 4,551 4,551

- - - Total Contractual Obligations 63,616 11,410 12,512 12,647

27,047 (1)The Company is obligated under operating leases to future

minimum rental payments for various land and building sites across

Canada. Critical Accounting Estimates and Assumptions Please refer

to Note 4 of the 2011 annual consolidated financial statements for

the Company's critical accounting estimates and assumptions.

Pending Changes to Accounting Policies Several new and amended

standards are not yet effective for the Company's interim condensed

consolidated financial statements for the three month period ended

March 31, 2012. These pending changes to accounting standards

and amendments are the same as those discussed in Note 3 of Leon's

2011 annual consolidated financial statements. Please refer

to the section heading "Accounting standards and amendments issued

but not yet adopted" for further details, presented within Note 3

of Leon's 2011 annual consolidated financial statements. Risks and

Uncertainties For a complete discussion of the risks and

uncertainties which apply to the Company's business and operating

results please refer to the Company's Annual Information Form dated

March 30, 2012 available on www.sedar.com. Disclosure Controls

& Procedures Management is responsible for establishing and

maintaining a system of disclosure controls and procedures to

provide reasonable assurance that all material information relating

to the Company is gathered and reported on a timely basis to senior

management, including the Chief Executive Officer and Chief

Financial Officer so that appropriate decisions can be made by them

regarding public disclosure. Internal Controls over Financial

Reporting Management is also responsible for establishing and

maintaining adequate internal control over financial reporting to

provide reasonable assurance regarding the reliability of financial

reporting and the preparation of consolidated financial statements

for external purposes in accordance with IFRS. All internal

control systems, no matter how well designed, have inherent

limitations. Therefore, even those systems determined to be

effective can provide only reasonable assurance with respect to

consolidated financial statement preparation and presentation.

Additionally, management is required to use judgment in evaluating

controls and procedures. Changes in Internal Control over Financial

Reporting Management has also evaluated whether there were changes

in the Company's internal control over financial reporting that

occurred during the period beginning on January 1, 2012 and ended

on March 31, 2012 that have materially affected, or are reasonably

likely to materially affect, the Company's internal control over

financial reporting. The Company has determined that no material

changes in internal controls have occurred during this period.

Outlook The slowdown in the economy which began in 2009 continues

to affect our results and we do not see signs of any immediate

improvement. As such, we anticipate that consumer discretionary

spending will remain soft throughout 2012. To help counter this, we

plan an even more robust marketing and merchandising campaign for

the balance of 2012. The recent opening of four new stores in the

latter part of 2011 should also aid our sales in 2012. Even with

these measures in place, growing profits in 2012 will be

challenging, but our strong financial position coupled with our

experience in adjusting to changing market conditions, provide us

with the confidence to adapt to the prevailing economic conditions.

Non-IFRS Financial Measures In order to provide additional insight

into the business, the Company has provided the measure of same

store sales, in the revenue and expenses section above. This

measure does not have a standardized meaning prescribed by IFRS but

it is a key indicator used by the Company to measure performance

against prior period results. Comparable store sales are defined as

sales generated by stores that have been open or closed for more

than 12 months on a yearly basis. The reconciliation between total

corporate sales (an IFRS measure) and comparable store sales is

provided below: ($ in thousands and Mar31,2012 Mar 31, 2011 for the

3 months ended) Net corporate sales 157,431 150,783 Adjustments for

7,675 - stores not in both fiscal periods Comparable store 149,756

150,783 sales NOTICE OF NO AUDITOR REVIEW OF INTERIM FINANCIAL

STATEMENTS Under National Instrument 51-102, Part 4, subsection

4.3(3)(a), if an auditor has not performed a review of the interim

financial statements, they must be accompanied by a notice

indicating that the financial statements have not been reviewed by

an auditor. The accompanying unaudited interim financial statements

of the company have been prepared by and are the responsibility of

the company's management. No auditor has performed a review of

these financial statements. Terrence T. Leon Dominic Scarangella

President & Chief Executive Vice President & Chief

Financial Officer Officer Dated as of the 14(th) day of May, 2012.

Interim Condensed Consolidated Financial Statements Leon's

Furniture Limited INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION (UNAUDITED) As at March 31 As at December 31 ($ in

thousands) 2012 2011 ASSETS Current assets Cash and cash

equivalents [notes 4 and 6] 50,640 72,505 Available-for-sale

financial assets [notes 4 and 19e] 145,291 149,318 Trade

receivables [note 4] 17,315 28,937 Income taxes receivable 7,427

5,182 Inventories 91,694 87,830 Total current assets 312,367

343,772 Other assets 1,442 1,431 Property, plant and equipment

[note 8] 214,416 214,158 Investment properties [note 9] 8,353 8,366

Intangible assets [note 10] 3,751 3,958 Goodwill 11,282 11,282

Deferred income tax assets 12,182 12,372 Total assets 563,793

595,339 LIABILITIES ANDSHAREHOLDERS' EQUITY Current liabilities

Trade and other payables [notes 4 and 11] 53,324 75,126 Provisions

[note 12] 9,356 11,231 Customers' deposits 18,736 19,157 Dividends

payable [note 14] 6,993 17,457 Deferred warranty plan revenue

15,804 16,152 Total current liabilities 104,213 139,123 Deferred

warranty plan revenue 18,721 19,445 Redeemable share liability

[notes 4 and 13] 604 382 Deferred income tax liabilities 11,007

10,928 Total liabilities 134,545 169,878 Shareholders'equity

attributable to the shareholders of theCompany Common shares [note

14] 21,870 20,918 Retained earnings 406,023 404,647 Accumulated

other comprehensive income 1,355 (104) Total shareholders' equity

429,248 425,461 Total liabilities and shareholder's equity 563,793

595,339 Commitments and contingencies [note 19] The accompanying

notes are an integral part of these unaudited interim condensed

consolidated financialstatements Interim Condensed Consolidated

Financial Statements Leon's Furniture Limited INTERIM CONSOLIDATED

INCOME STATEMENTS (UNAUDITED) Three months ended March 31 ($ in

thousands) 2012 2011 Revenue[note 15] 157,431 150,783 Cost of sales

[note 7] 93,218 88,065 Gross profit 64,213 62,718 Operating

expenses[note 16] General and administrative expenses 22,854 22,395

Sales and marketing expenses 20,512 18,512 Occupancy expenses 8,629

7,440 Other operating expenses 1,311 943 53,306 49,290 Operating

profit 10,907 13,428 Finance income 749 821 Profit before income

tax 11,656 14,249 Income tax expense [note 17] 3,057 3,956 Profit

for the period attributable to theshareholders of the Company 8,599

10,293 Earnings per share [note 18] Basic $0.12 $0.15 Diluted $0.12

$0.14 The accompanying notes are an integralpart of these unaudited

interim condensedconsolidatedfinancial statements. Interim

Condensed Consolidated Financial Statements Leon's Furniture

Limited INTERIM CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED) Three months ended March 31 Net of tax ($ in thousands)

2012 Tax effect 2012 Profit for the period 8,599 - 8,599 Other

comprehensive income, net of tax Unrealized gains on

available-for-sale financial assets arising during the period 1,735

227 1,508 Reclassification adjustment for net gains and (losses)

included in profit for the period (57) (8) (49) Change in

unrealized gains on available-for-sale financial assets arising

during the period 1,678 219 1,459 Comprehensive income for the

period attributable to the shareholders of the Company 10,277 219

10,058 Net of tax 2011 Tax effect 2011 Profit for the period 10,293

- 10,293 Other comprehensive income, net of tax Unrealized gains on

available-for-sale financial assets arising during the period 450

128 322 Reclassification adjustment for net gains and (losses)

included in profit for the period (3) - (3) Change in unrealized

gains on available-for-sale financial assets arising during the

period 447 128 319 Comprehensive income forthe period attributable

to the shareholders of theCompany 10,740 128 10,612 The

accompanying notes are an integral part of these unaudited interim

condensedconsolidatedfinancial statements. Interim Condensed

Consolidated Financial Statements Leon's Furniture Limited INTERIM

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (UNAUDITED)

Accumulated other comprehensive Retained ($ in thousands)

Commonshares income earnings Total As at December 31, 2010 19,177

480 390,629 410,286 Comprehensive income Profit for the period — —

10,293 10,293 Change in unrealized gains on available-for-sale —

319 — 319 financial assets arising during the period Total

comprehensive income — 319 10,293 10,612 Transactions with

shareholders Dividends declared — — (6,317) (6,317) Management

share purchase plan [note 13] 946 — — 946 Repurchase of common

shares [note 14] (6) — (709) (715) Total transactions with

shareholders 940 — (7,026) (6,086) As at March 31, 2011 20,117 799

393,896 414,812 As at December 31, 2011 20,918 (104) 404,647

425,461 Comprehensive income Profit for the period — — 8,599 8,599

Change in unrealized gains on available-for-sale — 1,459 — 1,459

financial assets arising during the period Total comprehensive

income — 1,459 8,599 10,058 Transactions with shareholders

Dividends declared — — (6,993) (6,993) Management share purchase

plan 954 — — 954 [note 13] Repurchase of common shares (2) — (230)

(232) [note 14] Total transactions 952 — (7,223) (6,271) with

shareholders As at March 31, 2012 21,870 1,355 406,023 429,248 The

accompanying notes arean integral part of these unaudited interim

condensedconsolidatedfinancial statements. Interim Condensed

Consolidated Financial Statements Leon's Furniture Limited INTERIM

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) Three months

ended March 31 ($ in thousands) 2012 2011 OPERATING ACTIVITIES

Profit for the period 8,599 10,293 Add (deduct) items not involving

an outlay of cash Depreciation of property, plant and equipment and

investment properties 3,375 2,977 Amortization of intangible assets

216 221 Amortization of deferred warranty plan revenue (4,167)

(4,297) Gain on sale of property, plant and equipment (2) -

Deferred income taxes 50 86 Gain (loss) on sale of

available-for-sale financial assets (115) 43 Cash received on

warranty plan sales 3,095 3,505 11,051 12,828 Net change in

non-cash working capital balances related to operations [note

20(a)] (18,632) (13,515) Cash used in operating activities (7,581)

(687) INVESTING ACTIVITIES Purchase of property, plant &

equipment (3,586) (2,876) Purchase of intangible assets (9) -

Proceeds on sale of property, plant & equipment 3 - Purchase of

available-for-sale financial assets (129,990) (94,024) Proceeds on

sale of available-for-sale financial assets 135,810 104,566

Decrease in employee share purchase loans [note 13] 1,177 1,156

Cash provided by investing activities 3,405 8,822 FINANCING

ACTIVITIES Dividends paid [note 14] (17,457) (6,310) Repurchase of

common shares [note (232) (715) 14] Cash used in financing

activities (17,689) (7,025) Net (decrease) increase in cash and

cash equivalents during the period (21,865) 1,110 Cash and cash

equivalents, 72,505 71,589 beginning of period Cash and cash

equivalents, end of 50,640 72,699 period The accompanying notes

arean integral part of these unaudited

interimcondensedconsolidatedfinancial statements. Notes to the

Interim Condensed Consolidated Financial Statements (Unaudited)

Leon's Furniture Limited Tabular amounts in thousands of Canadian

dollars except shares outstanding and earnings per share For the

three month periods ended March 31, 2012 and 2011 1. GENERAL

INFORMATION Leon's Furniture Limited was incorporated by Articles

of Incorporation under the Business Corporations Act on February

28, 1969. Leon's Furniture Limited and its subsidiaries ("Leon's"

or the "Company") is a public company with its common shares listed

on the Toronto Stock Exchange and is incorporated and domiciled in

Canada. The address of the Company's head and registered office is

45 Gordon Mackay Road, Toronto, Ontario, M9N 3X3. Leon's is a

retailer of home furnishings, electronics and appliances across

Canada from Alberta to Newfoundland and Labrador. The Company owns

a chain of forty-one retail stores operating as Leon's Home

Furnishings Super Stores, two retail stores operating under the

brand of Appliance Canada and operates an ecommerce internet site

www.leons.ca. In addition, the Company has twenty-seven franchisees

operating thirty-two Leon's Furniture franchise stores. 2. BASIS OF

PRESENTATION The interim condensed consolidated financial

statements of the Company are prepared in accordance with IAS 34,

Interim Financial Reporting, as issued by the International

Accounting Standards Board ("IASB"). These interim condensed

consolidated financial statements have been prepared using the same

accounting policies and methods of computation as the annual

consolidated financial statements of Leon's for the year ended

December 31, 2011. The disclosure contained in these interim

condensed consolidated financial statements does not include all

requirements in IAS 1, Presentation of Financial Statements.

Accordingly, the interim condensed consolidated financial

statements should be read in conjunction with the annual

consolidated financial statements for the year ended December 31,

2011. The preparation of interim financial statements in accordance

with IAS 34 requires the use of certain critical accounting

estimates. It also requires management to exercise judgment

in applying the Company's accounting policies. The areas

involving a higher degree of judgment or complexity, or areas where

assumptions and estimates are significant to the financial

statements are consistent with those disclosed in the notes to the

annual consolidated financial statements for the year ended

December 31, 2011. Accordingly, certain information and note

disclosure normally included in the annual financial statements

prepared in accordance with International Financial Reporting

Standards ("IFRS"), as issued by the IASB, have been omitted or

condensed. The financial statements of the Company include

the financial results of Leon's Furniture Limited and its wholly

owned subsidiaries, Murlee Holdings Limited, Leon Holdings (1967)

Limited and Ablan Insurance Corporation. The interim condensed

consolidated financial statements have been prepared using the

historical cost convention, as modified by certain financial assets

measured at fair value through profit or loss. These interim

condensed consolidated financial statements were approved and

authorized for issuance by the Board of Directors on May 14, 2012.

3. STANDARDS ISSUED BUT NOT EFFECTIVE Several new and amended

standards are not yet effective for the Company's interim condensed

consolidated financial statements for the three month period ended

March 31, 2012. These pending changes to accounting standards

and amendments are the same as those discussed in Note 3 of Leon's

2011 annual consolidated financial statements. Please refer

to the section heading "Accounting standards and amendments issued

but not yet adopted" for further details, presented within Note 3

of Leon's 2011 annual consolidated financial statements. 4.

FINANCIAL RISK MANAGEMENT Classification of financial instruments

and fair value The classification of the Company's financial

instruments, as well as, their carrying amounts and fair values are

disclosed in the table below.

_________________________________________________________________________

|Financial |Designation |Measurement | March| December| |Instrument

| | |31, 2012| 31, 2011|

|__________________|__________________|______________|________|___________|

|Cash and cash |Available-for-sale|Fair value | 50,640| 72,505|

|equivalents | | | | |

|__________________|__________________|______________|________|___________|

|Available-for-sale|Available-for-sale|Fair Value | 145,291|

149,318| |financial assets | | | | |

|__________________|__________________|______________|________|___________|

|Trade receivables |Loans and |Amortized cost| 17,315| 28,937| |

|receivables | | | |

|__________________|__________________|______________|________|___________|

|Trade and other |Other financial |Amortized cost| 53,324| 75,126|

|payables |liabilities | | | |

|__________________|__________________|______________|________|___________|

|Redeemable share |Other financial |Amortized cost| 604| 382|

|liability |liabilities | | | |

|__________________|__________________|______________|________|___________|

Fair value hierarchy The following table classifies financial

assets and liabilities that are recognized on the consolidated

statements of financial position at fair value in a hierarchy that

is based on significance of the inputs used in making the

measurements. The levels in the hierarchy are: Level 1: Quoted

prices (unadjusted) in active markets for identical assets or

liabilities Level 2: Inputs other than quoted prices included

within level 1 that are observable for the asset or liability,

either directly (that is, as prices) or indirectly (that is,

derived from prices) Level 3: Inputs for the asset or liability

that are not based on observable market data (that is, unobservable

inputs).

__________________________________________________________________

|Financial | Hierarchy level | March 31,2012| December31,|

|Instruments at | | | 2011| |Fair Value | | | |

|__________________|_________________|_______________|_____________|

|Cash and cash | 1 | 50,640| 72,505| |equivalents | | | |

|__________________|_________________|_______________|_____________|

|Available-for-sale| 1 | 33,718| 31,147| |financial assets -| | | |

|Equities | | | |

|__________________|_________________|_______________|_____________|

|Available-for-sale| 2 | 111,573| 118,171| |financial assets -| | |

| |Bonds | | | |

|__________________|_________________|_______________|_____________|

Financial risks factors The Company's activities expose it to a

variety of financial risks: market risk (including foreign currency

risk, interest rate risk, and other price risk), credit risk and

liquidity risk. Risk management is carried out by the Company

by identifying and evaluating the financial risks inherent within

its operations. The Company's overall risk management

activities seek to minimize potential adverse effects on the

Company's financial performance. (a) Market risk

(i) Foreign exchange risk - The Company is exposed to foreign

currency risk. Certain merchandise is paid for in U.S. dollars.

This foreign exchange cost is included in the inventory cost. The

Company does not believe it has significant foreign currency risk

with respect to its trade payables in U.S. dollars. The Company is

also exposed to foreign currency risk on its foreign currency

denominated portfolio of available-for-sale financial assets,

primarily related to actively traded international equities. As at

March 31, 2012, the Company's investment portfolio included 12% of

foreign currency denominated assets [as at December 31, 2011 -

10%]. This risk is monitored by the Company's investment managers

in an effort to reduce the Company's exposure to foreign currency

exchange rate risk. (ii) Interest rate risk - The Company is

exposed to interest rate risk through its portfolio of

available-for-sale financial assets by holding cash, cash

equivalents and actively traded Canadian and international Bonds.

At March 31, 2012, 83% of the Company's investment portfolio was

made up of cash, cash equivalents and Canadian and international

Bonds [as at December 31, 2011 - 86%]. This risk is monitored by

the Company's investment managers in an effort to reduce the

Company's exposure to interest rate risk. The exposure to this risk

is minimal due to the short-term maturities of the bonds held. The

Company is not subject to any other interest rate risk. (iii) Price

risk - The Company is exposed to fluctuations in the market prices

of its portfolio of available-for-sale financial assets. Changes in

the fair value of the available-for-sale financial assets are

recorded, net of income taxes, in accumulated other comprehensive

income as it relates to unrecognized gains and losses. The risk is

managed by the Company and its investment managers by ensuring a

conservative asset allocation of bonds and equities.

(b) Credit risk Credit risk arises from cash and

cash equivalents, available-for-sale financial assets and trade

receivables. The Company places its cash and cash equivalents and

available-for-sale financial assets with institutions of high

credit worthiness. Maximum credit risk exposure represents the loss

that would be incurred if all of the Company's counterparties were

to default at the same time. The Company has some credit risk

associated with its trade receivables as it relates to the

Appliance Canada division that is partially mitigated by the

Company's credit management practices. The Company's trade

receivables total $17,315,000 as at March 31, 2012 [as at December

31, 2011 - $28,937,000]. The amount of trade receivables that the

Company has determined to be past due [which is defined as a

balance that is more than 90 days past due] is $85,000 as at March

31, 2012 [as at December 31, 2011 - $191,000] which relates

entirely to the Appliance Canada division. The Company's provision

for impairment of trade receivables, established through on-going

monitoring of individual customer accounts, was $500,000 as at

March 31, 2012 [as at December 31, 2011 - $500,000]. The majority

of the Company's sales are paid through cash, credit card or

non-recourse third-party finance. The Company relies on one

third-party credit supplier to supply financing to its customers.

(c) Liquidity risk The Company has no outstanding

borrowings and does not rely upon available credit facilities to

finance operations or to finance committed capital

expenditures. The portfolio of available-for-sale financial

assets consists primarily of actively traded Canadian and

international bonds. There is no immediate need for cash by

the Company from its investment portfolio. The Company expects to

settle its trade and other payables within 30 days of the period

end date. The redeemable share liability does not have any fixed

terms of repayment. 5. CAPITAL RISK MANAGEMENT The Company defines

capital as shareholders' equity. The Company's objectives

when managing capital are to: -- ensure sufficient liquidity to

support its financial obligations and execute its operating and

strategic plans; and -- utilize working capital to negotiate

favourable supplier agreements both in respect of early payment

discounts and overall payment terms. The Company is not subject to

any externally imposed capital requirements. 6. CASH AND CASH

EQUIVALENTS

__________________________________________________________________

| | As at March 31, 2012| As at December 31,| | | | 2011|

|______________________|______________________|____________________|

|Cash at bank and on | 5,070| 2,181| |hand | 45,570| 70,324|

|Short-term investments| | |

|______________________|______________________|____________________|

|Totals | 50,640| 72,505|

|______________________|______________________|____________________|

7. INVENTORIES The amount of inventory recognized as an expense for

the three month period ended March 31, 2012 was $91,301,000 (period

ended March 31, 2011 - $85,873,000) which is presented within cost

of sales on the interim consolidated income statements. During the

three month period ended March 31, 2012, there was $125,000 in

inventory write-downs (three month period ended March 31, 2011 -

$149,000). At March 31, 2012, the inventory markdown provision

totaled $4,971,000 (As at December 31, 2011 - $4,846,000). There

were no reversals of any write-down for the period ended March 31,

2012 (period ended March 31, 2011 - $nil). None of the Company's

inventory has been pledged as security for any liabilities of the

Company. 8. PROPERTY, PLANT AND EQUIPMENT

_____________________________________________________________________________________________

| | | | | | Computer| Building| | | | Land| Buildings| Equipment|

Vehicles| hardware| improvements| Total|

|____________|________|___________|___________|__________|__________|______________|__________|

|As at | | | | | | | | |December 31,| 55,331| 82,604| 11,061|

3,348| 1,117| 48,031| 201,492| |2011: | 100| 9,165| 4,403| 2,253|

164| 9,253| 25,338| |Opening net | —| —| —| 18| —| —| 18| |book

value | —| 3,563| 2,029| 1,271| 538| 5,253| 12,654| |Additions | |

| | | | | | |Disposals | | | | | | | | |Depreciation| | | | | | | |

|____________|________|___________|___________|__________|__________|______________|__________|

|Closing net | 55,431| 88,206| 13,435| 4,312| 743| 52,031| 214,158|

|book value | | | | | | | |

|____________|________|___________|___________|__________|__________|______________|__________|

|As at | | | | | | | | |December 31,| 55,431| 184,530| 40,456|

23,051| 9,115| 87,526| 400,109| |2011: | —| 96,324| 27,021| 18,739|

8,372| 35,495| 185,951| |Cost | | | | | | | | |Accumulated | | | |

| | | | |depreciation| | | | | | | |

|____________|________|___________|___________|__________|__________|______________|__________|

|Net book | 55,431| 88,206| 13,435| 4,312| 743| 52,031| 214,158|

|value | | | | | | | |

|____________|________|___________|___________|__________|__________|______________|__________|

|As at March | | | | | | | | |31, 2012: | 55,431| 88,206| 13,435|

4,312| 743| 52,031| 214,158| |Opening net | (50)| 7| 365| 209| —|

3,090| 3,621| |book value | —| —| —| 1| —| —| 1| |Additions | —|

972| 535| 339| 114| 1,402| 3,362| |Disposals | | | | | | | |

|Depreciation| | | | | | | |

|____________|________|___________|___________|__________|__________|______________|__________|

|Closing net | 55,381| 87,241| 13,265| 4,181| 629| 53,719| 214,416|

|book value | | | | | | | |

|____________|________|___________|___________|__________|__________|______________|__________|

|As at March | | | | | | | | |31, 2012: | 55,381| 184,537| 40,821|

23,185| 9,115| 90,616| 403,655| |Cost | —| 97,296| 27,556| 19,004|

8,486| 36,897| 189,239| |Accumulated | | | | | | | | |depreciation|

| | | | | | |

|____________|________|___________|___________|__________|__________|______________|__________|

|Net book | 55,381| 87,241| 13,265| 4,181| 629| 53,719| 214,416|

|value | | | | | | | |

|____________|________|___________|___________|__________|__________|______________|__________|

Included in the above balances at March 31, 2012 are assets not

being amortized with a net book value of approximately $2,946,000

[as at December 31, 2011 - $2,638,000] being

construction-in-progress. 9. INVESTMENT PROPERTIES

_____________________________________________________________________

| | | | Building| | | | Land| Buildings| improvements| Total|

|_____________________|_________|___________|______________|__________|

|As at December | | | | | |31,2011: | 8,286| —| 131| 8,417|

|Opening net book | —| —| —| —| |value | —| —| —| —| |Additions |

—| —| 51| 51| |Disposals | | | | | |Depreciation | | | | |

|_____________________|_________|___________|______________|__________|

|Closing net book | 8,286| —| 80| 8,366| |value | | | | |

|_____________________|_________|___________|______________|__________|

|As at December 31, | | | | | |2011: | 8,286| 8,039| 1,457| 17,782|

|Cost | -| 8,039| 1,377| 9,416| |Accumulated | | | | |

|depreciation | | | | |

|_____________________|_________|___________|______________|__________|

|Net book value | 8,286| —| 80| 8,366|

|_____________________|_________|___________|______________|__________|

|As at March 31, 2012:| | | | | |Opening net book | 8,286| —| 80|

8,366| |value | —| —| —| —| |Additions | —| —| —| —| |Disposals |

—| —| 13| 13| |Depreciation | | | | |

|_____________________|_________|___________|______________|__________|

|Closing net book | 8,286| —| 67| 8,353| |value | | | | |

|_____________________|_________|___________|______________|__________|

|As at March 31, 2012:| | | | | |Cost | 8,286| 8,039| 1,457|

17,782| |Accumulated | —| 8,039| 1,390| 9,429| |depreciation | | |

| |

|_____________________|_________|___________|______________|__________|

|Net book value | 8,286| —| 67| 8,353|

|_____________________|_________|___________|______________|__________|

The fair value of the investment property portfolio as at March 31,

2012 was approximately $29,750,000 [as at December 31, 2011 -

$29,750,000]. The fair value was compiled internally by management

based on available market evidence. 10. INTANGIBLE ASSETS

______________________________________________________________________

| | Customer| Brand| Non-compete| Computer| | | | relationships|

name| Agreement| software| Total|

|____________|______________|_______|____________|__________|__________|

| | | | | | | |As at | | | | | | |December 31,| 1,250| 1,750| 625|

1,277| 4,902| |2011: | —|—| —| (64)| (64)| |Opening net | —|—| —|

—| —| |book value | 250| 250| 125| 255| 880| |Additions | | | | | |

|Disposals | | | | | | |Amortization| | | | | | |for the year| | |

| | |

|____________|______________|_______|____________|__________|__________|

|Net book | 1,000| 1,500| 500| 958| 3,958| |value | | | | | |

|____________|______________|_______|____________|__________|__________|

| | | | | | | |As at | | | | | | |December 31,| | | | | | |2011: |

2,000| 2,500| 1,000| 4,202| 9,702| |Cost | 1,000| 1,000| 500|

3,244| 5,744| |Accumulated | | | | | | |amortization| | | | | |

|____________|______________|_______|____________|__________|__________|

|Net book | 1,000| 1,500| 500| 958| 3,958| |value | | | | | |

|____________|______________|_______|____________|__________|__________|

| | | | | | | |As at March | | | | | | |31, 2012: | | | | | |

|Opening net | 1,000| 1,500| 500| 958| 3,958| |book value | —|—| —|

9| 9| |Additions | —|—| —| —| —| |Disposals | 63| 62| 31| 60| 216|

|Amortization| | | | | | |for the year| | | | | |

|____________|______________|_______|____________|__________|__________|

|Closing net | 937| 1,438| 469| 907| 3,751| |book value | | | | | |

|____________|______________|_______|____________|__________|__________|

| | | | | | | |As at March | | | | | | |31, 2012: | | | | | | |Cost

| 2,000| 2,500| 1,000| 4,211| 9,711| |Accumulated | 1,063| 1,062|

531| 3,304| 5,960| |amortization| | | | | |

|____________|______________|_______|____________|__________|__________|

|Net book | 937| 1,438| 469| 907| 3,751| |value | | | | | |

|____________|______________|_______|____________|__________|__________|

11. TRADE AND OTHER PAYABLES

_________________________________________________________________ |

| As at March 31, 2012| Asat December 31, 2011|

|_________________|______________________|________________________|

|Trade payables | 45,494| 62,485| |Other payables | 7,830| 12,641|

|_________________|______________________|________________________|

| | 53,324| 75,126|

|_________________|______________________|________________________|

12. PROVISIONS

____________________________________________________________________

| | Profit sharing and| | | | | bonuses| Vacation pay| Totals|

|_____________________|___________________|______________|___________|

|As at December 31, | 10,860| 371| 11,231| |2011 | | | |

|_____________________|___________________|______________|___________|

| Additional | 2,900| 1,328| 4,228| |provisions | (1,865)| — |

(1,865)| | Unused amounts | (3,865)| (373)| (4,238)| |reversed | |

| | | Utilized during the| | | | |quarter | | | |

|_____________________|___________________|______________|___________|

|As at March 31, 2012 | 8,030| 1,326| 9,356|

|_____________________|___________________|______________|___________|

(a) The provision for profit sharing

and bonuses is payable within the first half of the following

fiscal year. (b) The provision for

vacation pay represents employee entitlements to untaken vacation

at each reporting date. 13. REDEEMABLE SHARE LIABILITY

____________________________________________________________________

| | As at| As at| | | March 31,| December 31,| | | 2012| 2011|

|_______________________________________|____________|_______________|

| | | | |Authorized | | | |2,284,000 convertible, non-voting, | | |

|series 2002 shares | | | |806,000 convertible, non-voting, series|

| | |2005 | | | |1,224,000 convertible, non-voting, | | | |series

2009 shares | 4,155| 4,799| | | | | |Issued and fully paid | 4,800|

5,111| |578,080 series 2002 shares | | | |[December 31, 2011 -

667,748] | 9,761| 9,869| |508,426 series 2005 shares | | |

|[December 31, 2011 - 541,248] | (18,112)| (19,397)| |1,102,870

series 2009 shares | | | |[December 31, 2011 - 1,115,107] | | |

|Less employee share purchase loans | | |

|_______________________________________|____________|_______________|

| | 604| 382|

|_______________________________________|____________|_______________|

Under the terms of the Plan, the Company advanced non-interest

bearing loans to certain of its employees in 2002, 2005 and 2009 to

allow them to acquire convertible, non-voting, series 2002 shares,

series 2005 shares and series 2009 shares, respectively, of the

Company. These loans are repayable through the application

against the loans of any dividends on the shares, with any

remaining balance repayable on the date the shares are converted to

common shares. Each issued and fully paid for series 2002,

2005 and 2009 share may be converted into one common share at any

time after the fifth anniversary date of the issue of these shares

and prior to the tenth anniversary of such issue.

Series 2002 shares may also be redeemed at the option of the holder

or by the Company at any time after the fifth anniversary date of

the issue of these shares and must be redeemed prior to the tenth

anniversary of such issue. The series 2005 and series 2009

shares are redeemable at the option of the holder for a period of

one business day following the date of issue of such shares.

The Company has the option to redeem the series 2005 and series

2009 shares at any time after the fifth anniversary date of the

issue of these shares and must redeem them prior to the tenth

anniversary of such issue. The redemption price is equal to

the original issue price of the shares adjusted for subsequent

subdivisions of shares plus accrued and unpaid dividends. The

purchase prices of the shares are $7.19 per series 2002 share,

$9.44 per series 2005 share and $8.85 per series 2009 share.

Dividends paid to holders of series 2002, 2005 and 2009 shares of

approximately $465,000 [2011 - $470,000] have been used to

reduce the respective shareholder loans. The preferred dividends

are paid once a year during the first quarter. During the three

month period ended March 31, 2012, 89,668 series 2002 shares [three

month period ended March 31, 2011 - 71,198] and 32,822

series 2005 shares [three month period ended March 31, 2011 -

45,986] were converted into common shares with a stated value of

approximately $644,000 [three month period ended March 31,

2011 - $512,000] and $310,000 [three month period ended March

31, 2011 - $434,000], respectively. During the three month

period ended March 31, 2012, the Company cancelled 12,237 series

2009 shares [three month period ended March 31, 2011 - nil] in the

amount of $108,000 [three month period ended March 31, 2011 -

$nil]. 14. COMMON SHARES

_____________________________________________________________________

| | As at March 31,| As at December 31,| | | 2012| 2011|

|____________________________|__________________|_____________________|

| | | | |Authorized -Unlimited common| | | |shares | | |

|____________________________|__________________|_____________________|

| | | | |Issued | | | |69,919,120 common shares | 21,870| 20,918|

|[December 31, 2011 - | | | |69,815,734] | | |

|____________________________|__________________|_____________________|

During the three month period ended March 31, 2012, 89,668 series

2002 shares [three month period ended March 31, 2011 - 71,198]

and 32,822 series 2005 shares [three month period ended March 31,

2011 - 45,986] were converted into common shares with a stated

value of approximately $644,000 [three month period ended March 31,

2011 - $512,000] and $310,000 [three month period ended March

31, 2011 - $434,000], respectively. During the three month

period ended March 31, 2012, the Company repurchased 19,104 [three

month period ended March 31, 2011 - 51,274] of its common

shares on the open market pursuant to the terms and conditions of

Normal Course Issuer Bid at a net cost of approximately $232,000

[three month period ended March 31, 2011 - $715,000].

All shares repurchased by the Company pursuant to its Normal Course

Issuer Bid have been cancelled. The repurchase of common

shares resulted in a reduction of share capital in the amount of

approximately $2,000 [three month period ended March 31,

2011 - $6,000]. The excess net cost over the average

carrying value of the shares of approximately $230,000 [three month

period ended March 31, 2011 - $709,000] has been recorded as a

reduction in retained earnings. The dividends paid for the three

month periods ended March 31, 2012 and March 31, 2011 were

$17,457,000 [$0.25 per share] and $6,310,000 [$0.09 per share]

respectively. 15. REVENUE

_________________________________________________________________ |

|Three month period| Three month period| | | ended March 31,| ended

March 31, 2011| | | 2012| |

|______________________|__________________|_______________________|

|Sale of goods by | 152,585| 146,054| |corporate stores | 2,760|

2,531| |Royalty income from | 1,898| 2,014| |franchisees | 188|

184| |Extended warranty | | | |revenue | | | |Rental income from |

| | |investment property | | |

|______________________|__________________|_______________________|

| | 157,431| 150,783|

|______________________|__________________|_______________________|

16. OPERATING EXPENSES BY NATURE

_____________________________________________________________________

| | Three month period| Three month period| | | ended March 31,

2012| ended March 31, 2011|

|_____________________|_______________________|_______________________|

|Depreciation of | | | |property, plant and | 3,375| 2,977|

|equipment and | | | |investment properties| | |

|_____________________|_______________________|_______________________|

|Amortization of | 216| 221| |intangible assets | | |

|_____________________|_______________________|_______________________|

|Operating lease | 1,280| 791| |payments | | |

|_____________________|_______________________|_______________________|

17. INCOME TAX EXPENSE

_____________________________________________________________________

| | Three month period| Threemonth period| | | ended March 31,

2012| ended March 31, 2011|

|_____________________|_______________________|_______________________|

|Current income tax | 3,118| 3,885| |expense | (61)| 71| |Deferred

income tax | | | |(recovery) expense | | |

|_____________________|_______________________|_______________________|

| | 3,057| 3,956|

|_____________________|_______________________|_______________________|

Income tax expense is recognized based on management's best

estimate of the weighted average annual income tax rate expected

for the full financial year. The estimated average annual rates

used for the three month periods ended March 31, 2012 and

March 31, 2011 were 26.75% and 28.5%, respectively. 18. EARNINGS

PER SHARE Earnings per share are calculated using the weighted

average number of shares outstanding. The weighted average number

of shares used in the basic earnings per share calculations

amounted to 69,870,782 for the three month period ended March 31,

2012 [three month period ended March 31, 2011 - 70,148,298] The

following table reconciles the profit for the period and the number

of shares for the basic and diluted earnings per share

calculations:

_____________________________________________________________________

| | | Profit for the| Weighted| Per share| | | | period| average|

amount| | | | attributed to| number of| | | | | common| shares| | |

| | shareholders| | |

|______________|____________|_______________|__________|______________|

| |Basic | 8,599|69,870,782| 0.12| |

|____________|_______________|__________|______________| |

|Dilutive | —| 2,256,893| —| |Three month |effect (note| | | |

|period ended |13) | | | | |March 31,

|____________|_______________|__________|______________| |2012

|Diluted | 8,599|72,127,675| 0.12|

|______________|____________|_______________|__________|______________|

| |Basic | 10,293|70,148,298| 0.15| |

|____________|_______________|__________|______________| |

|Dilutive | —| 2,529,283| —| | |effect (note| | | | |Three month

|13) | | | | |period ended

|____________|_______________|__________|______________| |March 31,

2011|Diluted | 10,293|72,677,581| 0.14|

|______________|____________|_______________|__________|______________|

19. COMMITMENTS AND CONTINGENCIES [a] The cost to complete all

construction-in-progress as at March 31, 2012 totals $1,817,000 at

three locations [December 31, 2011 - to complete at two locations

at an approximate cost of $4,407,000]. [b] The Company is obligated

under operating leases for future minimum annual rental payments

for certain land and buildings as follows:

____________________________________________________________ |No

later than 1 year | 6,859| |Later than 1 year and no later than 5

years | 25,159| |Later than 5 years | 27,047|

|________________________________________________|___________| | |

59,065|

|________________________________________________|___________| [c]

The future minimum lease payments receivable under non-cancellable

operating leases for certain land and buildings classified as

investment property are as follows:

___________________________________________________________ |No

later than 1 year | 791| |Later than 1 year and no later than 5

years | 2,435| |Later than 5 years | 1,291|

|________________________________________________|__________| | |

4,517|

|________________________________________________|__________| [d]

The Company has issued approximately $255,000 in letters of credit

primarily with respect to buildings under construction or being

completed. [e] Pursuant to a reinsurance agreement relating to the

extended warranty sales, the Company has pledged available-for-sale

financial assets amounting to $20,523,000 [as at December 31, 2011

- $20,257,000] and provided a letter of credit of $1,500,000 [as at

December 31, 2011 - $1,500,000] for the benefit of the insurance

company. 20. INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS [a] The

net change in non-cash working capital balances related to

operations consists of the following:

____________________________________________________________________

| | Three month period| Three month period| | | ended March31,

2012| ended March 31, 2011|

|_____________________|______________________|_______________________|

|Trade receivables | 11,622| 11,307| |Inventories | (3,864)| 6,979|

|Other assets | (11)| 13| |Trade, other payables| (23,713)|

(28,834)| |and provisions | (2,245)| (3,044)| |Income taxes payable

| (421)| 64| |Customers' deposits | | |

|_____________________|______________________|_______________________|

| | (18,632)| (13,515)|

|_____________________|______________________|_______________________|

[b] Supplemental cash flow information:

_________________________________________________________________ |

| Three monthperiod| Three month period| | | ended March 31,| ended

March 31, 2011| | | 2012| |

|______________________|__________________|_______________________|

|Income taxes paid | 5,257| 7,118|

|______________________|__________________|_______________________|

[c] During the three month period, property, plant and equipment

were acquired at an aggregate cost of $3,621,000 [period ended

March 31, 2011 - $5,524,000], of which $909,000 [2011 - $874,000]

is included in trade and other payables as at December 31, 2011.

Leon's Furniture Limited

CONTACT: Dominic Scarangella, Tel: 416.243.4073

Copyright

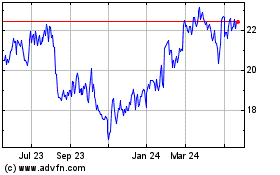

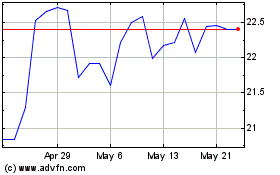

Leons Furniture (TSX:LNF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Leons Furniture (TSX:LNF)

Historical Stock Chart

From Jul 2023 to Jul 2024