TORONTO, Aug. 13 /CNW/ -- TORONTO, Aug. 13 /CNW/ - For the three

months ended June 30, 2010, total Leon's sales were $212,277,000

including $45,493,000 of franchise sales ($209,931,000 including

$44,693,000 of franchise sales in 2009), an increase of 1.1%. Net

income was $11,873,000, 17 cents per common share ($8,620,000, 12

cents per common share in 2009), an increase of 41.7% per common

share. For the six months ended June 30, 2010, total Leon's sales

were $413,396,000 including $87,821,000 of franchise sales

($405,131,000 including $87,368,000 of franchise sales in 2009), an

increase of 2.0% and net income was $23,843,000, 34 cents per

common share ($17,191,000, 24 cents per common share in 2009), an

increase of 41.7% per common share. For the second quarter of 2010,

we are pleased to report higher sales and a significant improvement

in profits when compared to the second quarter of 2009. Higher

sales reflect a general improvement in the economy. The profit

improvement was mainly the result of three key factors: higher

sales compared to the prior year's quarter; an improvement in our

gross margin which was aided by the strengthening of the Canadian

dollar along with a more favourable product mix; and the

continuation of improved productivity and expense controls that

were initiated in the prior year. Although we are satisfied with

the results year to date, we believe that we must remain vigilant

for the balance of 2010 in order to continue to improve the

performance of our Company. Pursuant to our robust expansion plans

announced last quarter, construction is well on its way on a new

73,000 sq. ft. facility in Thunder Bay, Ontario which we plan to

open before the end of this year. We will soon begin construction

on a new 84,000 sq. ft. building in Regina, Saskatchewan that we

plan to open by the spring of 2011. In addition, we have signed

leases for a 76,000 sq. ft. store in Guelph, Ontario and a 46,700

sq. ft. store in Rosemère, Quebec. We anticipate the opening of

these showrooms, which will be completely renovated, by the summer

of 2011. We also plan major renovations and additions to be

complete by the end of the year at our Sault St. Marie and Sudbury

stores. Finally, we have just recently signed two new franchises;

Collingwood and Fort Frances, Ontario with anticipated grand

openings this fall. In light of our strong financial performance

year to date and excellent liquidity, the Directors are pleased to

declare an increase in the quarterly dividend from 7 cents per

common share to 9 cents per common share payable on the 8th day of

October 2010 to shareholders of record at the close of business on

the 8th day of September 2010. As of 2007, dividends paid by Leon's

Furniture Limited are "eligible dividends" pursuant to the changes

to the Income Tax Act under Bill C-28, Canada. The Directors have

also approved, subject to obtaining regulatory approvals, the

continuation of the Company's ongoing Normal Course Issuer Bid,

which expires on September 9, 2010. Pursuant to the continued bid,

the Company intends, in the twelve months commencing September 10,

2010, to purchase up to the lesser of 4.99% of its Common Shares

outstanding on August 30, 2010, and the amount equal to 4.99% of

its Common Shares outstanding on the date the Toronto Stock

Exchange accepts the notice of intention to make a normal course

issuer bid. Since September 10, 2009, the date on which Leon's

current issuer bid commenced, the Company has purchased 413,317

Common Shares at an average price of $10.38 per share. The

Company's Board of Directors believes that the purchase of its

common shares is an appropriate use of its corporate funds, given

its very strong liquidity position. EARNINGS PER SHARE FOR EACH

QUARTER ----------------------------------- MARCH 31 JUNE 30 SEPT.

30 DEC. 31 YEAR -------- ------- -------- ------- ---- TOTAL -----

2010 - Basic 17 cents 17 cents $0.34 - Fully Diluted 16 cents 16

cents $0.32 2009 - Basic 12 cents 12 cents 22 cents 34 cents $0.80

- Fully Diluted 12 cents 12 cents 21 cents 33 cents $0.78 2008 -

Basic 16 cents 16 cents 25 cents 33 cents $0.90 - Fully Diluted 15

cents 16 cents 24 cents 32 cents $0.87 LEON'S FURNITURE LIMITED -

MEUBLES LEON LTEE Mark J. Leon Chairman of the Board MANAGEMENT'S

DISCUSSION AND ANALYSIS August 13, 2010 Management's Discussion and

Analysis ("MD&A") should be read in conjunction with the

unaudited consolidated interim financial statements of the Company

for the six months ended June 30, 2010, the MD&A for the year

ended December 31, 2009, the audited consolidated financial

statements for the year ended December 31, 2009 and the Company's

Annual Information Form dated March 24, 2010. Financial Statements

Governance Practice Leon's Furniture Limited's financial statements

have been prepared in accordance with Canadian Generally Accepted

Accounting Principles and the amounts expressed are in Canadian

dollars. This MD&A is intended to provide readers with the

information that management believes is required to gain an

understanding of Leon's Furniture Limited's current results and to

assess the Company's future prospects. Accordingly, sections of

this report contain forward-looking statements that are based on

current plans and expectations. These forward-looking statements

are effected by risks and uncertainties that could have a material

impact on future prospects. Readers are cautioned that actual

events and results will vary. The Audit Committee of the Board of

Directors of Leon's Furniture Limited reviewed the MD&A and the

financial statements, and recommended that the Board of Directors

approve them. Following review by the full Board of Directors, the

financial statements and the MD&A were approved. Introduction

Leon's Furniture Limited has been in the furniture retail business

for over 100 years. The company's 38 corporate and 28 franchise

stores can be found in every province except British Columbia. Main

product lines sold at retail include furniture, appliances and

electronics. Revenues and Expenses For the three months ended June

30, 2010, total Leon's sales were $212,277,000 including

$45,493,000 of franchise sales ($209,931,000 including $44,693,000

of franchise sales in 2009), an increase of 1.1%. Leon's corporate

sales of $166,784,000 in the second quarter of 2010, increased by

$1,546,000 or 0.9%, compared to the second quarter of 2009. The

increase in sales in the second quarter compared to the prior year

was the result of the growth of new stores. Same store corporate

sales were up marginally compared to the prior year. Leon's

franchise sales of $45,493,000 in the second quarter of 2010

increased by $800,000, or 1.8% compared to the second quarter of

2009. Our gross margin for the second quarter of 2010 of 39.93% has

increased 1.8% from the second quarter 2009. Similar to the first

quarter 2010, we saw our product margin on imported goods increase

in the quarter due to the appreciation of the Canadian dollar

versus the US dollar which resulted in lower product costs. Higher

margins were also experienced as a result of a more favorable

product mix and a reduction in our sales finance expenses compared

to the prior year second quarter. Net operating expenses of

$49,380,000 were down $884,000 or 1.8% for the second quarter of

2010 compared to the second quarter of 2009. Payroll and commission

costs were up 0.9% in the quarter compared to the prior year. This

slight increase was mainly the result of the yearly increase in

salary and wage costs at the beginning of April 2010 and the

increase in sales commissions. The significant decrease in net

operating expenses for the second quarter of 2010 mainly relates to

the decrease in advertising costs. Advertising expenses decreased

$2,161,000 or 23.9% for the second quarter compared to the prior

year. In 2009, the Company enhanced its marketing campaign to

celebrate the Company's 100th Anniversary. For the most part, all

other operating costs as a percentage of sales were basically flat

as a percentage of sales compared to the prior year second quarter.

As a result of the above, net income for the second quarter of 2010

was $11,873,000, 17 cents per common share ($8,620,000, 12 cents

per common share in 2009), an increase of 41.7% per common share.

For the six months ended June 30, 2010, total Leon's sales were

$413,396,000 including $87,821,000 of franchise sales ($405,131,000

including $87,368,000 of franchise sales in 2009), an increase of

2.0% and net income was $23,843,000, 34 cents per common share

($17,191,000, 24 cents per common share in 2009), an increase of

41.7% per common share. Annual Financial Information ($ in

thousands, except earnings per share and dividends) 2009 2008 2007

Net corporate sales 703,180 740,376 637,456 Leon franchise sales

194,290 209,848 195,925 Total Leon sales 897,470 950,224 833,381

Net income 56,864 63,390 58,494 Earnings per share Basic $0.80

$0.90 $0.83 Diluted $0.78 $0.87 $0.80 Total Assets 529,156 513,408

475,226 Common Share Dividends Declared $0.48 $0.38 $0.2725

Convertible, Non-Voting Shares Dividends Declared $0.14 $0.14 $0.14

Liquidity and Financial Resources ($ in thousands, except dividends

per share) Balances as at: June 30/10 Dec. 31/09 June 30/09

---------- ---------- ---------- Cash, cash equivalents and

marketable securities (including restricted marketable securities)

175,703 170,726 130,172 Accounts receivable 20,013 31,501 16,933

Inventory 92,925 83,957 96,473 Total assets 532,421 529,156 502,517

Working capital 178,527 164,759 142,889 Current Prior Prior Quarter

Quarter Quarter For the 3 months ended June 30/10 Dec. 31/09 June

30/09 ---------- ---------- ---------- Cash flow from operations

18,626 48,444 13,961 Purchase of capital assets 4,568 1,480 5,180

Repurchase of capital stock 814 3,023 384 Dividends paid 4,937

19,111 4,953 Dividends paid per share $0.07 $0.27 $0.07 Cash and

marketable securities (including restricted marketable securities)

increased by $7,445,000 in the quarter mainly as the result of the

net income generated from operations. Marketable securities consist

primarily of bonds with maturities not exceeding 5 years with an

interest rate range of 0.341% to 6.65% and are stated at market

value. As part of the warranty reinsurance agreement with a

subsidiary, the Company has pledged assets, which are part of the

investment portfolio. The pledged assets are for the benefit of the

primary insurance company. The assets are in the form of a trust

with a financial institution amounting to $19,319,000. Inventory

increased by $7,303,000 from the first quarter of 2010. The

increase is the result of timing differences in receiving furniture

from Asia. When compared to the prior year, June 30, 2009,

inventory is down despite higher sales year to date. This year,

construction is well on its way on a new 73,000 sq. ft. facility in

Thunder Bay, Ontario which we plan to open before the end of this

year. We will soon begin construction on a new 84,000 sq. ft.

building in Regina, Saskatchewan that we plan to open by the spring

of 2011. We have also signed leases for a 76,000 sq. ft. store in

Guelph, Ontario and a 46,700 sq. ft. store in Rosemère, Quebec. We

anticipate the opening of these showrooms, which will be completely

renovated, by the summer of 2011. We also plan major renovations

and additions to be complete by the end of the year at our Sault

St. Marie and Sudbury stores. In addition, we have just recently

signed two new franchises; Collingwood and Fort Frances, Ontario

with anticipated grand openings this fall. At the present time, all

funding for new store projects and renovations are scheduled to

come from our existing cash resources. Common Shares At June 30,

2010, there were 70,486,975 common shares issued and outstanding.

During the second quarter of 2010, 18,840 (2009 - 39,316)

convertible, non-voting series 2002 shares were converted to common

shares. The Company repurchased 67,059 (2009 - 39,468) of its

common shares on the open market at an average cost of $12.15

pursuant to the terms and conditions of our current Normal Course

Issuer Bid. All shares repurchased by the Company have been

cancelled. For the six month period ending June 30, 2010, the

Company repurchased 67,059 common shares at an average price of

$12.15 (2009 - 123,168 at an average price of $8.82) and 76,423

(2009 - 70,787) convertible, non-voting series 2002 shares were

converted to common shares. Commitments

-------------------------------------------------------------------------

($ in thousands) Payments Due by Period

----------------------------------------------- Less than 2-3 4-5

After Contractual Obligations Total 1 year years years 5 years

-------------------------------------------------------------------------

Operating leases(1) 33,391 1,733 7,932 6,610 17,116

-------------------------------------------------------------------------

Purchase obligations(2) 4,190 4,190 - - -

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Total contractual obligations 37,581 5,923 7,932 6,610 17,116

-------------------------------------------------------------------------

(1) The Company is obligated under operating leases to future

minimum annual rental payments for various land and building sites

across Canada. (2) The estimated cost to complete construction in

progress at one location in Canada. In addition, the Company has

commitments related to redeemable shares as follows: As at As at

June 30, December 31, ($ in thousands) 2010 2009 Authorized

2,284,000 convertible, non-voting, series 2002 shares 806,000

convertible, non-voting, series 2005 shares 1,222,000 convertible,

non-voting, series 2009 shares Issued 892,610 series 2002 shares

(2009 - 969,033) $ 6,416 $ 6,965 689,513 series 2005 shares (2009 -

689,513) 6,511 6,511 1,207,000 series 2009 shares (2009 -

1,207,000) 10,683 10,683 Less employees share purchase loans

(23,363) (23,776)

-------------------------------------------------------------------------

Redeemable share liability 247 285

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Under the terms of its Management Share Purchase Plan, the Company

advanced non-interest bearing loans to certain of its employees in

2002, 2005 and 2009 to allow them to acquire convertible,

non-voting, series 2002 shares, series 2005 shares and series 2009

shares, respectively, of the Company. These loans are repayable

through the application against the loans of any dividends on the

shares, with any remaining balance repayable on the date the shares

are converted to common shares. Each issued and fully paid for

series 2002, 2005 and 2009 share may be converted into one common

share at any time after the fifth anniversary date of the issue of

these shares and prior to the tenth anniversary of such issue. The

series 2002 shares may also be redeemed at the option of the holder

or by the Company at any time after the fifth anniversary date of

the issue of these shares and must be redeemed prior to the tenth

anniversary of such issue. The series 2005 and 2009 shares are

redeemable at the option of the holder for a period of one business

day following the date of issue of such shares. The Company has the

option to redeem the series 2005 and 2009 shares at any time after

the fifth anniversary date of the issue of these shares and must

redeem prior to the tenth anniversary of such issue. The redemption

price is equal to the original issue price of the shares adjusted

for subsequent subdivisions of shares plus accrued and unpaid

dividends. The purchase prices of the shares are $7.19 per series

2002 share, $9.44 per series 2005 share and $8.85 per series 2009

share. Dividends paid to holders of series 2002, 2005 and 2009

shares of approximately $401,000 (2009 - $261,000) have been used

to reduce the respective shareholder loans. During the second

quarter 2010, 18,840 convertible, non-voting series 2002 shares

were converted into common shares with a stated value of $135,000

(2009 - 39,316 for a stated value of $283,000). For the six month

period, 76,423 convertible non-voting series 2002 shares were

converted into common shares with a stated value of $549,000 (2009

- 70,787 for a stated value of $509,000). During the second quarter

2009, the Company issued 1,207,000 series 2009 shares for proceeds

of $10,683,000. In addition, the Company advanced non-interest

bearing loans in the amount of $10,683,000 to certain of its

employees to acquire these shares. Quarterly Results (2010, 2009,

2008) Quarterly Income Statement ($ in thousands, except earnings

per share)

-------------------------------------------------------------------------

Quarter Ended Quarter Ended June 30 March 31

-------------------------------------------------------------------------

2010 2009 2010 2009

-------------------------------------------------------------------------

Leon corporate sales 166,784 165,238 158,791 152,525

-------------------------------------------------------------------------

Leon franchise sales 45,493 44,693 42,328 42,675

-------------------------------------------------------------------------

Total Leon sales 212,277 209,931 201,119 195,200

-------------------------------------------------------------------------

Net income per share $0.17 $0.12 $0.17 $0.12

-------------------------------------------------------------------------

Fully diluted per share $0.16 $0.12 $0.16 $0.12

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Quarter Ended Quarter Ended December 31 September 30

-------------------------------------------------------------------------

2009 2008 2009 2008

-------------------------------------------------------------------------

Leon corporate sales 197,986 206,088 187,431 202,985

-------------------------------------------------------------------------

Leon franchise sales 57,679 63,803 49,243 56,219

-------------------------------------------------------------------------

Total Leon sales 255,665 269,891 236,674 259,204

-------------------------------------------------------------------------

Net income per share $0.34 $0.33 $0.22 $0.25

-------------------------------------------------------------------------

Fully diluted per share $0.33 $0.32 $0.21 $0.24

-------------------------------------------------------------------------

Critical Accounting Policies and Estimates Our significant

accounting policies are contained in Note 1 to the consolidated

financial statements for the year ended December 31, 2009. Certain

of these policies involve critical accounting estimates because

they require us to make particularly subjective or complex

judgments about matters that are inherently uncertain and because

of the likelihood that materially different amounts could be

reported under different conditions or using different assumptions.

Revenue Recognition Sales are recognized as revenue for accounting

purposes upon the customer either picking up the merchandise or

when merchandise is delivered to the customers' home. The Company

offers customers the option to finance purchases through various

third party financing companies. In situations where a customer

elects to take advantage of delayed payment terms, the costs of

financing these sales are deducted from sales. Finance costs

deducted from sales year to date for 2010 have decreased when

compared to the same period for 2009. The cost decrease is a result

of the fewer extended promotional terms offered in 2010. During

2009, extended promotional terms were offered to coincide with the

Company's 100th Anniversary. Inventories The Company measures

inventories at the lower of cost, determined on a first-in,

first-out basis, and net realizable value. The Company estimates

the net realizable value as the amount at which inventories are

expected to be sold by taking into account fluctuations of retail

prices due to prevailing market conditions. If required,

inventories are written down to net realizable value when the cost

of inventories is estimated to not be recoverable due to

obsolescence, damage or declining selling prices. Reserves for slow

moving and damaged inventory are deducted in our evaluation of

inventories. The reserve for slow moving inventory is based on many

years of historic retail experience. The reserve is calculated by

analyzing all inventory on hand older than one year. Damaged

inventory is coded as such and placed in specific locations. The

amount of damaged reserve is determined by specific product

categories. The Company's inventory amount encompasses one category

which is goods purchased and held for resale in the ordinary course

of business. The amount of inventory recognized as an expense for

the three and six month periods ended June 30, 2010 was $97,904,000

and $189,037,000 (2009 - $100,009,000 and $190,160,000) and is

presented within cost of sales on the consolidated statements of

income. There were inventory write-downs of $332,000 (2009 -

$216,000) recognized as an expense during the period ended June 30,

2010. As at June 30, 2010, the inventory markdown provision

totalled $4,000,000 (2009 - $3,419,000). There were no reversals of

any write-down for the period ended June 30, 2010. Furthermore none

of the Company's inventory has been pledged as security for any

liabilities of the Company. Warranty Revenue Warranty revenues are

deferred and taken into income on a straight-line basis over the

life of the warranty period. Warranty revenues included in sales

year to date for 2010 are $8,238,000 compared to $8,008,000 in

2009. Warranty expenses deducted through costs of goods sold year

to date for 2010 are $2,846,000 compared to $2,870,000 in 2009.

Warranty repairs for particular electronic products have started to

decrease due to the replacement of these products with newer

technologically advanced products. Franchise Royalties Leon's

franchisees operate as independent owners. The Company charges the

franchisee a royalty fee based primarily on a percentage of the

franchisees' gross sales. This royalty income is recorded by the

Company on an accrual basis under the heading "other income" and is

up 0.3% year to date for 2010 compared to 2009 which is in line

with the increase in franchise sales for the six month period ended

June 30, 2010. Volume Rebates The Company receives vendor rebates

on certain products based on the volume of purchases made during

specified periods. The rebates are deducted from the inventory

value of goods received and are recognized as a reduction of cost

of goods sold as sales occur. Pending Changes to Accounting

Policies International Financial Reporting Standards ("IFRS") In

March 2009, the Accounting Standards Board ("AcSB") issued its

exposure draft "Adopting IFRS in Canada, II" which reconfirmed that

publicly accountable enterprises are required to adopt

International Financial Reporting Standards, as issued by the

International Accounting Standards Board ("IASB"), for fiscal years

beginning on or after January 1, 2011. Accordingly, the Company

will be required to adopt IFRS on January 1, 2011, including

interim periods in fiscal 2011. Comparative interim and annual

information will be required for the year ending December 31, 2010.

The Company has commenced the process to transition from current

Canadian GAAP to IFRS. As previously stated, we have established an

internal project leader that is led by executive management and

includes key participants from various areas of the Company as

necessary to plan and achieve a smooth transition to IFRS. Periodic

progress reporting to the audit committee on the status of the IFRS

implementation has been ongoing since fiscal year 2009. The Company

has mostly completed the detailed impact analysis phase of its

conversion project for the standards that affect the transition to

IFRS. The Company is currently focusing its efforts on the

solutions development phase. To date, the project is progressing

according to plan. The following table summarizes the key

activities of the Company's IFRS conversion project:

-------------------------------------------------------------------------

Key Activities Target Milestones Current Status

-------------------------------------------------------------------------

Identify differences Complete assessment of Completed. between IFRS

and differences between IFRS Canadian GAAP. and GAAP.

-------------------------------------------------------------------------

Select accounting Review and approval of Under management review.

policy choices. policy decisions by Q3 2010.

-------------------------------------------------------------------------

Evaluate and select Confirm selection of Completed (see section

which IFRS 1 exemptions by Q2 2010. below). exemptions will be

taken on transition to IFRS.

-------------------------------------------------------------------------

Prepare financial Management approval and In progress. statements

and audit committee review note disclosures of preliminary pro

forma in compliance with financial statements IFRS. and note

disclosures during the second half of fiscal 2010.

-------------------------------------------------------------------------

Quantify the effect Quantification of the In progress. of

converting to effect of the conversion IFRS. by beginning of Q4

2010.

-------------------------------------------------------------------------

Prepare first time Reconciliation completed Differences currently

adoption and approved by being quantified. reconciliation

changeover date. Reconciliation to be required under developed

during Q4 of IFRS 1. 2010.

-------------------------------------------------------------------------

Identify required Complete a review of Identification of changes to

the systems and process to changes required to the financial system

address additional financial systems was based on the systems

required to preliminarily determined implementation implement IFRS.

to be minimal. of IFRS.

-------------------------------------------------------------------------

The table below provides a brief summary of select IFRS that may

impact Leon's, their differences from Canadian Generally Accepted

Accounting Principles ("GAAP") and their potential impact to the

Company. The table is not comprehensive and does not include all of

the differences from GAAP for the standards noted. Also, the table

does not include all the standards that may require changes for the

transition to IFRS. Although nothing has been identified to date,

ongoing work relating to other standards not presented in the table

may possibly have a significant impact on the Company's

consolidated financial statements.

-------------------------------------------------------------------------

Standards Difference from GAAP Potential Impact

-------------------------------------------------------------------------

Presentation and IFRS requires This will be the most disclosure

significantly more significant impact to disclosure than GAAP for

the Company. The other certain standards. In differences and

impacts some cases, IFRS also noted throughout this requires

different table will cause presentation on the measurement

differences, balance sheet and income but based on historical

statement. In addition, analysis and current a new statement

entitled future projections their "Consolidated Statement impact on

the operating of Changes in Equity" profit is not expected will be

included upon to be significant. The the conversion to IFRS.

increased disclosure requirements will necessitate adjustments to

some current processes and the implementation of new financial

reporting processes to ensure the appropriate data is collected for

disclosure purposes.

-------------------------------------------------------------------------

Property, plant and Significant asset The annual amortization

equipment (PP&E) components must be expense may change to

depreciated separately. reflect further This accounting treatment

componentization of the is commonly referred to Company's PP&E.

as componentization of PP&E.

-------------------------------------------------------------------------

First-time adoption IFRS contains explicit The Company has selected

guidance on first-time the available elections adoption of IFRS.

There the Company wishes to are several elections make and will

apply them available to ease the in preparing the opening

transition to IFRS and balance sheet under some mandatory

exemptions IFRS. The following from retrospective elections will be

made application of IFRS. under IFRS 1: - The Company has elected

to use the exemption to carry forward our Canadian GAAP accounting

of the Appliance Canada business acquisition. - The Company does

not elect to record property, plant and equipment at fair value on

transition. The Company is accounting for these items at their

historical cost.

-------------------------------------------------------------------------

The Company will continue to report throughout 2010 on its

conclusions and accounting policy choices on the standards noted

above. The Company's external auditors will commence their detailed

review of the Company's accounting policy position papers during

the third quarter of 2010. In addition to disclosing qualitative

analysis on the impacts of the transition to IFRS, the Company

still expects to be in a position to disclose quantitative

information in the third quarter of 2010. While the Company

believes it has performed an appropriate level of analysis in

selecting its IFRS accounting policies, actual quantitative results

may reveal additional impacts to the Company that were not

anticipated. The IASB has several projects slated for completion in

2010 and 2011 that may impact the transition to IFRS and the

financial statements of the Company. The Company continues to

monitor the IASB's progress on these projects and their impact on

the Company's transition to IFRS. Impact on information systems and

technology The most significant information system challenge for

the IFRS conversion is to ensure the Company has the ability to

track its IFRS adjustments in the year of transition and that any

new IFRS compliance reports can be produced to facilitate the

preparation of IFRS financial statements. The Company is confident

in its ability to track IFRS adjustments throughout 2010 to

facilitate the preparation of the increased note disclosure

required under IFRS. As of now, the transition is not expected to

have a significant impact on the Company's other information

systems. Impact on internal controls over financial reporting and

disclosure controls and procedures As described further below, in

accordance with its conversion plan the Company is continually

reviewing its internal controls over financial reporting and its

disclosure controls and procedures and will update these as

required to ensure they are appropriate for reporting under IFRS.

As noted, the transition to IFRS for the Company mainly affects the

presentation and disclosure of its financial statements. This may

lead to process changes in order to facilitate the reporting of

more detailed information in the notes to the financial statements,

but it is not currently expected to lead to many measurement or

fundamental differences in the accounting processes used by the

Company. Also, the Company has implemented controls over its IFRS

adjustment process, which primarily includes review by qualified

members of Leon's head office finance and accounting department.

The conversion to IFRS exposes the Company to control risks when

there are new or modified processes. To address these risks the

Company has been designing controls for areas where increased

judgment is required. Financial reporting expertise Over the past

couple of years, the Company's key financial reporting managers

have attended several IFRS training courses. The Company's IFRS

project leader has also reviewed detailed technical accounting

training internally on the differences between GAAP and IFRS as

they apply to the Company. Business Activities The transition to

IFRS is currently having a minimal impact on Leon's operational

activities. Disclosure Controls and Internal Control Over Financial

Reporting Based on the evaluation of disclosure controls and

procedures, the CEO and the CFO have concluded that the Company's

disclosure controls and procedures were effective as at June 30,

2010. There have been no changes in the Company's internal control

over financial reporting during the period ended on June 30, 2010

that have materially affected, or are reasonably likely to

materially affect, its internal control over financial reporting.

Outlook Similar to the first quarter of 2010, we saw a slight

improvement in same store sales from the prior year quarter which

was aided by the general improvement in consumer confidence.

However, current trends are indicating that there may be a slight

slowdown in the Canadian economy going forward. In addition, the

new HST measures that went into place July 1, 2010 in Ontario,

along with increasing interest rates, may slow down consumer

spending going forward. To counter this, we plan a very robust

marketing and merchandising campaign for the balance of the year.

Even with these measures in place, growing sales and profits for

the balance of this year will be very challenging. Despite this,

our strong financial position coupled with our experience in

adjusting to changing market conditions, allow us to look to the

future with cautious optimism. Financial Statements Governance

Practice Leon's Furniture Limited's financial statements have been

prepared in accordance with Canadian generally accepted accounting

principles. The Audit Committee of the Board of Directors of Leon's

Furniture Limited reviewed Management's Discussion and Analysis and

the financial statements, and recommended the Board of Directors

approve them. Following review by the full Board of Directors, the

financial statements and the MD&A were approved.

Forward-Looking Statements This MD&A, in particular the section

under the heading "Outlook", includes forward-looking statements,

which are based on certain assumptions and reflect Leon's Furniture

Limited's current expectations. These forward-looking statements

are subject to a number of risks and uncertainties that could cause

actual results to differ materially from current expectations. Some

of the factors that can cause actual results to differ materially

from current expectations are: a further slowdown in the Canadian

economy; drop in consumer confidence and dependency on product from

third party suppliers. Given these risks and uncertainties,

investors should not place undue reliance on forward-looking

statements as a prediction of actual results. Leon's Furniture

Limited P.O. Box 1100, Stn. "B" Weston, ON M9L 2R8 Phone: (416)

243-4073 Fax: (416) 243-7890 NOTICE OF NO AUDITOR REVIEW OF INTERIM

FINANCIAL STATEMENTS Under National Instrument 51-102, Part 4,

subsection 4.3(3)(a), if an auditor has not performed a review of

the interim financial statements, they must be accompanied by a

notice indicating that the financial statements have not been

reviewed by an auditor. The accompanying unaudited interim

financial statements of the company have been prepared by and are

the responsibility of the company's management. No auditor has

performed a review of these financial statements.

--------------------------- --------------------------------

Terrence T. Leon Dominic Scarangella President & Chief

Executive Vice President & Chief Financial Officer Officer

Dated as of the 13th day of August, 2010 Leon's Furniture

Limited-Meubles Leon Ltee Incorporated under the laws of Ontario

CONSOLIDATED BALANCE SHEETS (UNAUDITED) As at As at June 30

December 31 ($ in thousands) 2010 2009

-------------------------------------------------------------------------

ASSETS Current Cash and cash equivalents 65,497 58,301 Marketable

securities 90,887 94,337 Restricted marketable securities 19,319

18,088 Accounts receivable 20,013 31,501 Income taxes recoverable

3,139 - Inventory 92,925 83,957 Future tax assets 824 1,133

-------------------------------------------------------------------------

Total current assets 292,604 287,317 Prepaid expenses 1,438 1,560

Goodwill 11,282 11,282 Intangibles 5,215 5,334 Future tax assets

11,777 11,465 Property, plant & equipment net 210,105 212,198

-------------------------------------------------------------------------

532,421 529,156

-------------------------------------------------------------------------

-------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY Current Accounts payable and

accrued liabilities 73,817 83,880 Income taxes payable - 1,958

Customers' deposits 18,270 15,632 Dividends payable 4,936 4,938

Deferred warranty plan revenue 17,054 16,150

-------------------------------------------------------------------------

Total current liabilities 114,077 122,558 Deferred warranty plan

revenue 20,958 22,248 Redeemable share liability 247 383 Future tax

liabilities 9,316 8,829

-------------------------------------------------------------------------

Total liabilities 144,598 154,018

-------------------------------------------------------------------------

Shareholders' equity Common shares 18,222 17,704 Retained earnings

370,763 357,576 Accumulated other comprehensive income (1,162)

(142)

-------------------------------------------------------------------------

Total shareholders' equity 387,823 375,138

-------------------------------------------------------------------------

532,421 529,156

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Leon's Furniture Limited-Meubles Leon Ltee CONSOLIDATED STATEMENTS

OF INCOME AND RETAINED EARNINGS (UNAUDITED) Period ended June 30th

3 months 6 months ($ in thousands) ended ended 2010 2009 2010 2009

Sales 166,784 165,238 325,575 317,763 Cost of sales 100,187 102,343

193,685 194,785

-------------------------------------------------------------------------

Gross profit 66,597 62,895 131,890 122,978

-------------------------------------------------------------------------

Operating expenses (income) Salaries and commissions 26,305 26,070

51,028 50,314 Advertising 6,886 9,047 14,476 18,200 Rent and

property taxes 3,547 2,757 7,035 5,601 Amortization 3,975 4,169

7,943 8,115 Employee profit-sharing plan 1,212 1,030 2,374 1,867

Other operating expenses 10,487 10,208 20,810 20,532 Interest

income (663) (766) (1,354) (1,618) Other income (2,369) (2,251)

(5,249) (5,234)

-------------------------------------------------------------------------

49,380 50,264 97,063 97,777

-------------------------------------------------------------------------

Income before income taxes 17,217 12,631 34,827 25,201 Provision

for income taxes 5,344 4,011 10,984 8,010

-------------------------------------------------------------------------

Net income for the period 11,873 8,620 23,843 17,191 Retained

earnings, beginning of the period 364,609 341,910 357,576 338,960

Dividends declared (4,936) (4,949) (9,873) (9,902) Excess of cost

of share repurchase over carrying value of related shares (783)

(365) (783) (1,033)

-------------------------------------------------------------------------

Retained earnings, end of period 370,763 345,216 370,763 345,216

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Weighted average number of common shares outstanding ('000's) Basic

70,525 70,696 70,520 70,725 Diluted 73,323 71,831 73,299 71,739

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Earnings per share Basic $0.17 $0.12 $0.34 $0.24 Diluted $0.16

$0.12 $0.32 $0.24

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Dividends declared per share Common $0.07 $0.07 $0.14 $0.14

Convertible, non-voting - - - -

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Leon's Furniture Limited-Meubles Leon Ltee CONSOLIDATED STATEMENTS

OF CASH FLOWS (UNAUDITED) Period ended June 30th 3 months 6 months

($ in thousands) ended ended 2010 2009 2010 2009

-------------------------------------------------------------------------

OPERATING ACTIVITIES Net income for the period 11,873 8,620 23,843

17,191 Add (deduct) items not involving a current cash payment

Amortization of property, plant & equipment 3,786 3,981 7,565

7,803 Amortization of intangible assets 189 188 378 312

Amortization of deferred warranty revenue (4,133) (4,030) (8,238)

(8,008) Loss (gain) on sale of marketable securities (43) 100 (164)

134 Future tax expense 225 2 659 300 Gain on sale of property,

plant & equipment (2) (16) (6) (17) Cash received on warranty

sales 3,928 3,880 7,852 7,916

-------------------------------------------------------------------------

15,823 12,725 31,889 25,631 Net change in non-cash working capital

balances related to operations 2,803 1,236 (10,392) (14,836)

-------------------------------------------------------------------------

Cash provided by operating activities 18,626 13,961 21,497 10,795

-------------------------------------------------------------------------

INVESTING ACTIVITIES Purchase of property, plant & equipment

(4,568) (5,180) (4,966) (7,083) Purchase of intangibles - - (259) -

Proceeds on sale of property, plant & equipment 3 20 11 22

Purchase of marketable securities (125,853) (68,538) (198,588)

(118,838) Proceeds on sale of marketable securities 143,263 64,840

199,777 119,992 Issuance of series 2009 redeemable share liability

- 10,683 - 10,683 Decrease (increase) in employee share purchase

loans 142 (10,400) 413 (10,076) Purchase of Appliance Canada Ltd. -

(842) - (2,382)

-------------------------------------------------------------------------

Cash provided by (used in) investing activities 12,987 (9,417)

(3,612) (7,682)

-------------------------------------------------------------------------

FINANCING ACTIVITIES Dividends paid (4,937) (4,953) (9,875) (9,905)

Repurchase of common shares (814) (384) (814) (1,091)

-------------------------------------------------------------------------

Cash used in financing activities (5,751) (5,337) (10,689) (10,996)

-------------------------------------------------------------------------

Net increase (decrease) in cash and cash equivalents during the

period 25,862 (793) 7,196 (7,883) Cash and cash equivalents,

beginning of period 39,635 32,393 58,301 39,483

-------------------------------------------------------------------------

Cash and cash equivalents, end of period 65,497 31,600 65,497

31,600

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Leon's Furniture Limited-Meubles Leon Ltee CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME (UNAUDITED) Three month period ended June

30th ($ in thousands) Net Tax of tax 2010 effect 2010 Net income

for the period 11,873 - 11,873 Other comprehensive income, net of

tax Unrealized losses on available-for-sale financial assets

arising during the period (981) (147) (834) Reclassification

adjustment for net gains and (losses) included in net income (69)

(11) (58) --------------------------------- Change in unrealized

losses on available-for-sale financial assets arising during the

period (1,050) (158) (892) ---------------------------------

Comprehensive income for the period 10,823 (158) 10,981

--------------------------------- ---------------------------------

Net Tax of tax 2009 effect 2009 Net income for the period 8,620 -

8,620 Other comprehensive income, net of tax Unrealized gains on

available-for-sale financial assets arising during the period 1,145

199 946 Reclassification adjustment for net gains and (losses)

included in net income 84 14 70 ---------------------------------

Change in unrealized gains on available-for-sale financial assets

arising during the period 1,229 213 1,016

--------------------------------- Comprehensive income for the

period 9,849 213 9,636 ---------------------------------

--------------------------------- Six month period ended June 30th

($ in thousands) Net Tax of tax 2010 effect 2010 Net income for the

period 23,843 23,843 Other comprehensive income, net of tax

Unrealized losses on available-for-sale financial assets arising

during the period (1,266) (184) (1,082) Reclassification adjustment

for net gains and (losses) included in net income 72 10 62

--------------------------------- Change in unrealized losses on

available-for-sale financial assets arising during the period

(1,194) (174) (1,020) ---------------------------------

Comprehensive income for the period 22,649 (174) 22,823

--------------------------------- ---------------------------------

Net Tax of tax 2009 effect 2009 Net income for the period 17,191 -

17,191 Other comprehensive income, net of tax Unrealized gains on

available-for-sale financial assets arising during the period 15 8

7 Reclassification adjustment for net gains and (losses) included

in net income 53 8 45 --------------------------------- Change in

unrealized gains on available-for-sale financial assets arising

during the period 68 16 52 ---------------------------------

Comprehensive income for the period 17,259 16 17,243

--------------------------------- ---------------------------------

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS UNAUDITED 1.

BASIS OF PREPARATION These unaudited interim consolidated financial

statements have been prepared by management in accordance with

Canadian generally accepted accounting principles ("GAAP") for

interim financial statements. They do not include all of the

disclosures required by Canadian generally accepted accounting

principles for annual financial statements and accordingly, the

interim financial information should be read in conjunction with

the Company's annual consolidated financial statements. The interim

financial information has been prepared using the same accounting

policies as set out in note 1 to the consolidated financial

statements for the year ended December 31, 2009. 2. PENDING CHANGES

IN ACCOUNTING POLICIES INTERNATIONAL FINANCIAL REPORTING STANDARDS

("IFRS") In March 2009, the Accounting Standards Board ("AcSB")

issued its exposure draft "Adopting IFRS in Canada, II" which

reconfirmed that publicly accountable enterprises are required to

adopt International Financial Reporting Standards (IFRS) for fiscal

years beginning on or after January 1, 2011. Accordingly, the

Company will be required to adopt IFRS on January 1, 2011,

including interim periods in fiscal 2011. Comparative interim and

annual information will be required for the year ending December

31, 2010. As part of its transition to IFRS, the Company has

developed an implementation plan which includes an extensive

analysis of accounting differences between Canadian GAAP and IFRS

and the assessment of the expected impact of the accounting

differences on its consolidated financial statements. The Company

is in the process of transitioning its financial statement

reporting, presentation and disclosure to IFRS in time to meet the

January 1, 2011 deadline. The process will be ongoing as new

standards and recommendations are issued by the International

Accounting Standards Board and AcSB. Further details regarding the

Company's transition to IFRS are included in the Company's June 30,

2010 Management's Discussion and Analysis filed on The System for

Electronic Document Analysis and Retrieval ("SEDAR"). 3.

ACCUMULATED OTHER COMPREHENSIVE INCOME As at June 30, 2010

accumulated other comprehensive income was comprised of the

unrealized losses on marketable securities of $1,378,000

($1,162,000 net of tax). 2010 2009 Balance, beginning of period $

(142) $ (2,095) Changes in unrealized (losses) gains on

available-for-sale financial assets arising during the period

(1,020) 52 ---------- ---------- Balance, end of period $ (1,162) $

(2,043) ---------- ---------- ---------- ---------- 4. INCOME TAXES

The Company's total cash payments for income taxes paid in the

three month period ending June 30, 2010 were $6,912,000 (2009 -

$8,064,000) and for the six month period were $15,783,000 (2009 -

$16,684,000). 5. SHARE CAPITAL During the quarter, 67,059 common

shares were repurchased (2009 - 39,468) on the open market pursuant

to the terms and conditions of the current Normal Course Issuer Bid

at a net cost of approximately $814,000 (2009 - net cost of

approximately $384,000). For the six month period, the Company

repurchased 67,059 (2009 - 123,168) common shares at a net cost of

approximately $814,000 (2009 - $1,091,000). All shares repurchased

by the Company pursuant to its Normal Course Issuer Bids have been

cancelled. The repurchase of common shares resulted in a reduction

of share capital in the amount of approximately $31,000 (2009 -

$58,000). The excess net cost over the carrying value of the shares

of approximately $783,000 (2009 - $1,033,000) has been recorded as

a reduction in retained earnings. During the quarter ended June 30,

2010, 18,840 convertible non-voting series 2002 shares (2009 -

39,316) were converted into common shares with a stated value of

approximately $135,000 (2009 - $283,000). For the six month period,

76,423 convertible non-voting series 2002 shares (2009 - 70,787)

were converted to common shares with a stated value of

approximately $549,000 (2009 - $509,000). During the second quarter

of 2009, the Company issued $1,207,000 series 2009 shares for

proceeds of $10,683,000. In addition, the Company advanced

non-interest bearing loans in the amount of $10,683,000 to certain

of its employees to acquire these shares. 6. CLASSIFICATION AND

FAIR VALUE OF FINANCIAL INSTRUMENTS As at June 30, 2010, the

classification of the Company's financial instruments is as

follows: June 30, 2010 Other Loans Finan- and cial Avail- Receiv-

Liabil- Held for able ables ities Trading for Sale (amort- (amort-

Total Financial (fair (fair ized ized Carrying Fair Assets value)

value) cost) cost) Amount Value Cash and cash equivalents 65,497 -

- - 65,497 65,497 Accounts receivable - - 20,013 - 20,013 20,013

Marketable securities - 90,887 - - 90,887 90,887 Restricted

marketable securities - 19,319 - - 19,319 19,319 Income taxes

recoverable - - 3,139 - 3,139 3,139 Financial Liabilities Accounts

payable and accrued liabilities - - - 73,817 73,817 73,817

Redeemable share liability - - - 247 247 247 December 31, 2009

Other Loans Finan- and cial Avail- Receiv- Liabil- Held for able

ables ities Trading for Sale (amort- (amort- Total Financial (fair

(fair ized ized Carrying Fair Assets value) value) cost) cost)

Amount Value Cash and cash equivalents 58,301 - - - 58,301 58,301

Accounts receivable - - 31,501 - 31,501 31,501 Marketable

securities - 94,337 - - 94,337 94,337 Restricted marketable

securities - 18,088 - - 18,088 18,088 Financial Liabilities

Accounts payable and accrued liabilities - - - 83,880 83,880 83,880

Income taxes payable - - - 1,958 1,958 1,958 Redeemable share

liability - - - 383 383 383 The Company's fair value measurements

of financial instruments within the fair value hierarchy, as at

June 30, 2010 and December 31, 2009 consists primarily of

investments valued using Level 1 inputs. RISK MANAGEMENT The

Company is exposed to various risks associated with its financial

instruments. These risks are summarized as credit risk, liquidity

risk and market risk. The significant risks for the Company's

financial instruments are: i) Credit risk The Company believes at

this point in time, it has some credit risk associated to its

accounts receivable as it relates to the Appliance Canada division

that is partly mitigated by the Company's credit management

practices. The majority of the Company's sales are paid through

cash, credit card or third party finance. The Company relies on two

third party credit suppliers to supply financing alternatives to

our customers. ii) Liquidity risk The Company has no outstanding

debt and does not rely upon available credit facilities to finance

operations or to finance committed capital expenditures. The

portfolio of marketable securities consists primarily of Canadian

and International bonds. There is no immediate need for cash from

our investment portfolio. iii) Foreign currency risk The Company is

exposed to foreign currency exchange rate risk. Some merchandise is

paid for in U.S. dollars. The foreign currency cost is included in

the inventory cost. The Company does not believe it has significant

foreign currency risk with respect to its accounts payable in U.S.

dollars. iv) Market price risk The Company is exposed to

fluctuations in the market prices of its marketable securities that

are classified as available for sale. Changes in the fair value of

marketable securities are recorded, net of income taxes, in

accumulated other comprehensive income (note 3). The risk is

managed by ensuring a relatively conservative asset allocation of

bonds and equities. 7. CAPITAL MANAGEMENT The Company defines

capital as shareholders' equity. The Company's objectives when

managing capital are to: - ensure sufficient liquidity to support

its financial obligations and execute its operating and strategic

plans; and - utilize working capital to negotiate favourable

supplier agreements both in respect of early payment discounts and

overall payment terms. Dominic Scarangella, Tel: 416.243.4073

Copyright

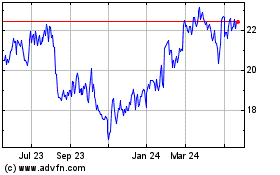

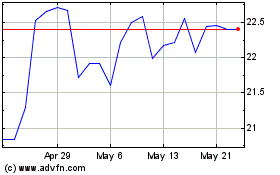

Leons Furniture (TSX:LNF)

Historical Stock Chart

From Jul 2024 to Aug 2024

Leons Furniture (TSX:LNF)

Historical Stock Chart

From Aug 2023 to Aug 2024