H&R REIT Completes the Acquisition of the Hess Tower in Houston

December 22 2011 - 2:40PM

PR Newswire (Canada)

TORONTO, Dec. 22, 2011 /CNW/ - H&R Real Estate Investment Trust

(the "REIT") is pleased to announce that it has completed the

previously announced acquisition of the Hess Tower. This recently

completed State-of-the-Art office tower in Houston, Texas was

purchased for U.S. $442.5 million. As one of downtown Houston's

most energy efficient office buildings, Hess Tower has achieved the

prestigious LEED Platinum certification for Core and Shell, the

U.S. Green Building Council's highest rating. The property is

comprised of an impeccably designed 29-storey office tower offering

844,763 rentable square feet of superior office space connected by

a climate-controlled skybridge to its adjacent 10-level, 1,430

space parking garage. Hess Tower is part of Houston's

Pedestrian Tunnel System that interconnects 77 of Houston's major

downtown office buildings to an abundance of upscale restaurants

and retail, first class hotels, and world class sports and

entertainment destinations. Completed in June 2011, Hess Tower is

fully leased to Hess Corporation, a global integrated energy

company listed on the New York Stock Exchange. The purchase price

was funded from the REIT's operating facilities and cash on hand

(including proceeds from the REIT's offering of stapled units

completed earlier today). The REIT has secured a commitment for a

U.S. $250 million first mortgage financing at 4.5% per annum for 8

years. Closing of the mortgage is expected to occur in January

2012. Tom Hofstedter, President and CEO of the REIT stated: "This

acquisition presents a truly rare opportunity to acquire a

best-in-class, LEED Platinum office tower in an irreplaceable

downtown Houston location, overlooking the recently completed

Discovery Green Park, with a long-term triple net lease secured by

a Fortune 100 investment grade tenant at a 6.6% capitalization

rate. Hess Tower, along with the recently acquired Gotham Center in

New York City and the Bow in downtown Calgary, will together become

the hallmark of our portfolio of high quality properties that will

provide stable and growing cash flow to our unitholders for decades

to come". About H&R REIT H&R REIT is an open-ended real

estate investment trust, which owns a North American portfolio of

39 office, 117 industrial and 133 retail properties comprising over

43 million square feet, with a net book value of approximately $5.9

billion. The foundation of H&R REIT's success since inception

in 1996 has been a disciplined strategy that leads to consistent

and profitable growth. H&R REIT leases its properties long term

to creditworthy tenants and strives to match those leases with

primarily long-term, fixed-rate financing. Forward-looking

Statements Certain statements in this news release contains

forward-looking information within the meaning of applicable

securities laws (also known as forward-looking statements),

including in particular, H&R's expectation regarding the

expected completion of the Hess Tower mortgage. Such

forward-looking statements reflect H&R's current beliefs and

are based on information currently available to management. These

statements are not guarantees of future performance and are based

on H&R's estimates and assumptions that are subject to risks

and uncertainties, including those discussed in H&R's materials

filed with the Canadian securities regulatory authorities from time

to time, which could cause the actual results and performance of

H&R to differ materially from the forward-looking statements

contained in this news release. Those risks and uncertainties

include, among other things, risks related to: prices and market

value of securities of H&R; availability of cash for

distributions; development and financing relating to the Bow

development; restrictions pursuant to the terms of indebtedness;

liquidity; credit risk and tenant concentration; interest rate and

other debt related risk; tax risk; ability to access capital

markets; dilution; lease rollover risk; construction risks;

currency risk; unitholder liability; co-ownership interest in

properties; competition for real property investments;

environmental matters; reliance on one corporation for management

of substantially all of the REIT's properties and changes in

legislation and indebtedness of H&R. Material factors or

assumptions that were applied in drawing a conclusion or making an

estimate set out in the forward-looking statements include that the

general economy is stable; local real estate conditions are stable;

interest rates are relatively stable; and equity and debt markets

continue to provide access to capital. H&R cautions that this

list of factors is not exhaustive. Although the forward-looking

statements contained in this news release are based upon what

H&R believes are reasonable assumptions, there can be no

assurance that actual results will be consistent with these

forward-looking statements. All forward-looking statements in this

news release are qualified by these cautionary statements. These

forward-looking statements are made as of today and H&R, except

as required by applicable law, assumes no obligation to update or

revise them to reflect new information or the occurrence of future

events or circumstances. SOURCE H&R Real Estate Investment

Trust Image with caption: " Hess Tower, Houston, TX (CNW

Group/H&R Real Estate Investment Trust)". Image available at:

http://photos.newswire.ca/images/download/20111222_C8940_PHOTO_EN_8481.jpg

H&R Real Estate Investment Trust CONTACT: Larry Froom,Chief

Financial Officer, H&R REIT(416) 635-7520, or e-mail

info@hr-reit.com

Copyright

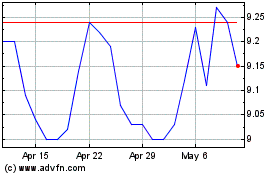

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Jun 2024 to Jul 2024

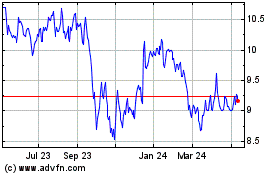

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Jul 2023 to Jul 2024