H&R REIT TO ACQUIRE ATRIUM ON BAY IN DOWNTOWN TORONTO; PROVIDES IFRS UPDATE ON VALUATION OF INVESTMENT PROPERTIES

January 04 2011 - 5:00PM

PR Newswire (Canada)

TORONTO, Jan. 4 /CNW/ -- TORONTO, Jan. 4 /CNW/ - H&R Real

Estate Investment Trust (TSX: HR.UN) ("H&R REIT") is pleased to

announce that it has entered into an agreement to purchase 595 Bay

Street, 20 & 40 Dundas Street West and 306 Yonge Street in

Toronto, which are collectively known as the "Atrium on Bay"

property for a total purchase price of $344.8 million. The year 1

capitalization rate is expected to be approximately 6.5% and it is

anticipated that the acquisition will close by April 2011. The

property comprises 915,378 sq.ft. of 'Class A' office space and

135,929 sq.ft. of prime retail premises. CIBC, Legal Aid Ontario,

Public Guardian & Trustee, Land Registry Office, Hydro One

Networks, Hunter Keity Muntz & Beatty, University Health

Network and other government tenants comprise approximately 75% of

the total rental area. The property is 98% occupied and has an

average lease term to expiry of 5 years. The property has one of

the largest floor plates in downtown Toronto, which can accommodate

office tenants requiring premises from 1,500 sq.ft. to 88,000

sq.ft. on a single floor. In addition to having direct underground

access to the subway and the PATH, the property is in close

proximity to City Hall, Queen's Park, the provincial court

buildings, the major downtown hospitals and Ryerson University. The

purchase price will be satisfied by the assumption of a

non-recourse, $190-million mortgage having a remaining term to

maturity of approximately 7 years, with the balance of the purchase

price currently expected to be paid in cash drawn from H&R

REIT's operating facility. H&R REIT President and CEO Tom

Hofstedter said, "Below market rents, excess density for expansion

of the office space, investment grade institutional tenants, and

increasing demand for efficient, well priced and strategically

located office and retail space are some of the primary reasons why

we feel confident that the Atrium on Bay will provide our

unitholders with reliable and increasing returns on their

investment and will be a prestigious addition to our portfolio of

high quality properties." IFRS Update ----------- International

Financial Reporting Standards ("IFRS") became effective on January

1, 2011. As a result, H&R REIT's 2011 financial statements will

include 2010 comparative figures under IFRS. H&R REIT's first

reporting period under IFRS will commence with the interim

financial statements for the three months ending March 31, 2011.

For the purpose of its transition to IFRS, H&R REIT will

disclose the fair value of its investment properties at January 1,

2010 and September 30, 2010 in the notes to its financial

statements as follows:

-------------------------------------------------------------------------

January 1, 2010 September 30, 2010 (billions) (billions)

-------------------------------------------------------------------------

Net Book Value of income-producing properties as reported under

Canadian GAAP(1) $4.1 $4.1

-------------------------------------------------------------------------

IFRS note disclosure to be reported $5.1 $5.3

-------------------------------------------------------------------------

Increase in value of income-producing properties $1.0 $1.2

-------------------------------------------------------------------------

(1) These amounts include tenant inducements, deferred leasing

costs and intangible liabilities. The majority of H&R REIT's

portfolio (i.e. 268 properties) was appraised by a leading

independent national real estate appraisal firm as at January 1,

2010. The fair value of these properties was appraised at $4.9

billion. The 13 remaining properties were valued internally by

H&R REIT as at January 1, 2010. The September 30, 2010 fair

values were all internally valued. Based on the foregoing, the

total weighted average overall capitalization rate ("OCR") was

determined to be 7.71% on January 1, 2010 and 7.45% on September

30, 2010. More specifically, weighted average OCRs by geographic

segments were as follows: ---------------------------------------

January 1, 2010 September 30, 2010

-------------------------------------------------------------------------

Canadian - aggregated capitalization rate 7.48% 7.28%

-------------------------------------------------------------------------

United States - aggregated capitalization rate 8.60% 8.15%

-------------------------------------------------------------------------

H&R REIT will elect to use the cost model to value its

investment properties when preparing financial statements as part

of the first-time adoption of IFRS. However, as provided under

IFRS, H&R REIT will elect to use fair value as the deemed cost

for 13 of its properties. This election will result in a net

increase to investment properties on the balance sheet as at

January 1, 2010 of approximately $531 million, net of impairments.

About H&R REIT and H&R Finance Trust H&R REIT is an

open-ended real estate investment trust, which owns a North

American portfolio of 35 office, 118 industrial and 130 retail

properties comprising over 39 million square feet, with a net book

value of $4.1 billion. The foundation of H&R REIT's success

since inception in 1996 has been a disciplined strategy that leads

to consistent and profitable growth. H&R REIT strives to lease

its properties long term to creditworthy tenants and to match those

leases with primarily long-term, fixed-rate financing. H&R

Finance Trust is an unincorporated investment trust, which

primarily invests in notes issued by an H&R REIT subsidiary. In

2008, H&R REIT completed an internal reorganization which

resulted in each issued and outstanding H&R REIT unit trading

together with a unit of H&R Finance Trust as a "stapled unit"

on the Toronto Stock Exchange. Additional information regarding

H&R REIT and H&R Finance Trust is available at

www.hr-reit.com and on www.sedar.com. Forward-looking Statements

Certain information in this news release contains forward-looking

information within the meaning of applicable securities laws (also

known as forward-looking statements) including, among others,

statements relating to the objectives of H&R REIT and H&R

Finance Trust (together,"H&R"), strategies to achieve those

objectives, H&R's beliefs, plans, estimates, and intentions,

and similar statements concerning anticipated future events,

results, circumstances, performance or expectations that are not

historical facts including, in particular, H&R REIT's

expectation regarding its acquisition of the "Atrium on Bay"

property and H&R's expectation concerning disclosure under and

transition to IFRS. Forward-looking statements generally can be

identified by words such as "outlook", "objective", "may", "will",

"expect", "intend", "estimate", "anticipate", "believe", "should",

"plans", "project", "budget" or "continue" or similar expressions

suggesting future outcomes or events. Such forward-looking

statements reflect H&R's current beliefs and are based on

information currently available to management. These statements are

not guarantees of future performance and are based on H&R's

estimates and assumptions that are subject to risk and

uncertainties, including those discussed in H&R's materials

filed with the Canadian securities regulatory authorities from time

to time, which could cause the actual results and performance of

H&R to differ materially from the forward-looking statements

contained in this news release. Those risks and uncertainties

include, among other things, risks related to: prices and market

value of securities of H&R; availability of cash for

distributions; development and financing relating to The Bow

development; restrictions pursuant to the terms of indebtedness;

liquidity; credit risk and tenant concentration; interest rate and

other debt related risk; tax risk; ability to access capital

markets; dilution; lease rollover risk; construction risks;

currency risk; unitholder liability; co-ownership interest in

properties; competition for real property investments;

environmental matters; reliance on one corporation for management

of substantially all H&R REIT's properties; changes in

legislation and indebtedness of H&R. Material factors or

assumptions that were applied in drawing a conclusion or making an

estimate set out in the forward-looking statements include that the

general economy is stable; local real estate conditions are stable;

interest rates are relatively stable; and equity and debt markets

continue to provide access to capital. H&R cautions that this

list of factors is not exhaustive. Although the forward-looking

statements contained in this news release are based upon what

H&R believes is reasonable assumptions, there can be no

assurance that actual results will be consistent with these

forward-looking statements. All forward-looking statements in this

news release are qualified by these cautionary statements. These

forward-looking statements are made as of today and H&R, except

as required by applicable law, assumes no obligation to update or

revise them to reflect new information or the occurrence of future

events or circumstances. Larry Froom, Chief Financial Officer,

H&R REIT, 416-635-7520, or e-mail info@hr-reit.com

Copyright

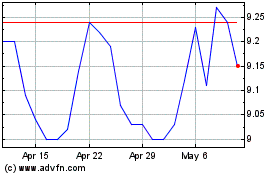

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Jun 2024 to Jul 2024

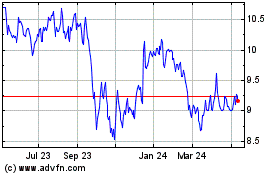

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Jul 2023 to Jul 2024