H&R Announces $100 Million Offering of Convertible Debentures

July 12 2010 - 4:17PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES. ANY FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A

VIOLATION OF U.S. SECURITIES LAW.

H&R Real Estate Investment Trust ("H&R") (TSX:HR.UN) has announced that it has

entered into an agreement to sell, to a syndicate of underwriters co-led by

CIBC, RBC Capital Markets and TD Securities Inc., on a bought deal basis, $100

million principal amount 5.90% convertible unsecured subordinated debentures

(the "Debentures"). Closing is expected to occur on or about July 27, 2010,

subject to regulatory approval.

The net proceeds of the offering will be used to repay debt, for potential

acquisitions, and for general trust purposes.

The Debentures will bear interest at a rate of 5.90% per annum payable

semi-annually in arrears on June 30 and December 31 in each year commencing on

December 31, 2010, and will mature on June 30, 2020 (the "Maturity Date"). The

Debentures will be convertible at the holder's option into stapled units of H&R

(the "Stapled Units") at any time prior to the earlier of the Maturity Date and

the date fixed for redemption at a conversion price of $23.50 per Stapled Unit

(the "Conversion Price"). The Debentures will not be redeemable on or before

June 30, 2014. After June 30, 2014 and prior to June 30, 2016, the Debentures

may be redeemed in whole or in part from time to time at H&R's option provided

that the volume weighted average trading price for the Stapled Units is not less

than 125% of the Conversion Price. On and after June 30, 2016 and prior to the

Maturity Date, the Debentures may be redeemed in whole or in part from time to

time at H&R's option at a price equal to their principal amount plus accrued and

unpaid interest. Subject to regulatory approval, H&R may satisfy its obligation

to repay the principal amount of the Debentures on redemption or at maturity, in

whole or in part, by delivering that number of Stapled Units equal to the amount

due divided by 95% of the market price for the units at that time, plus accrued

interest in cash.

The offering is being made under H&R's existing amended and restated short from

base shelf prospectus dated January 18, 2010. The terms of the offering will be

described in a prospectus supplement to be filed with Canadian securities

regulators.

About H&R REIT and H&R Finance Trust

H&R REIT is an open-ended real estate investment trust, which owns a North

American portfolio of 33 office, 118 industrial and 121 retail properties

comprising nearly 39 million square feet, with a net book value of $4.1 billion.

The foundation of H&R REIT's success since inception in 1996 has been a

disciplined strategy that leads to consistent and profitable growth. H&R REIT

leases its properties long term to creditworthy tenants and strives to match

those leases with primarily long-term, fixed-rate financing. As a result, leases

representing only 6.8% of total rentable area will expire from Q2 2010 to Q4

2012, while only 12.5% of H&R REIT's total mortgage payable will mature. H&R

Finance Trust is an unincorporated investment trust, which primarily invests in

notes issued by an H&R REIT subsidiary. In 2008, H&R REIT completed an internal

reorganization which resulted in each issued and outstanding H&R REIT unit

trading together with a unit of H&R Finance Trust as a "stapled unit" on the

Toronto Stock Exchange. Additional information regarding H&R REIT and H&R

Finance Trust is available at www.hr-reit.com and on www.sedar.com.

Forward-looking Statements

Certain information in this news release contains forward-looking information

within the meaning of applicable securities laws (also known as forward-looking

statements) including, among others, statements relating to the objectives of

H&R REIT and H&R Finance Trust (together, "H&R"), strategies to achieve those

objectives, H&R's beliefs, plans, estimates, and intentions, and similar

statements concerning anticipated future events, results, circumstances,

performance or expectations that are not historical facts including, in

particular, H&R REIT's expectation regarding future developments in connection

with The Bow, and the amount of actual distributions to unitholders

notwithstanding the trustees adoption of a distribution policy (which takes into

account the REIT's covenant to its lenders to not distribute cash in excess of

70% of FFO). Forward-looking statements generally can be identified by words

such as "outlook", "objective", "may", "will", "expect", "intend", "estimate",

"anticipate", "believe", "should", "plans", "project", "budget" or "continue" or

similar expressions suggesting future outcomes or events. Such forward-looking

statements reflect H&R's current beliefs and are based on information currently

available to management. These statements are not guarantees of future

performance and are based on H&R's estimates and assumptions that are subject to

risk and uncertainties, including those discussed in H&R's materials filed with

the Canadian securities regulatory authorities from time to time, which could

cause the actual results and performance of H&R to differ materially from the

forward-looking statements contained in this news release. Those risks and

uncertainties include, among other things, risks related to:

prices and market value of securities of H&R; availability of cash for

distributions; development and financing relating to The Bow development;

restrictions pursuant to the terms of indebtedness; liquidity; credit risk and

tenant concentration; interest rate and other debt related risk; tax risk;

ability to access capital markets; dilution; lease rollover risk; construction

risks; currency risk; unitholder liability; co-ownership interest in properties;

competition for real property investments; environmental matters; reliance on

one corporation for management of substantially all H&R REIT's properties;

changes in legislation and indebtedness of H&R. Material factors or assumptions

that were applied in drawing a conclusion or making an estimate set out in the

forward-looking statements include that the general economy is stable; local

real estate conditions are stable; interest rates are relatively stable; and

equity and debt markets continue to provide access to capital. H&R cautions that

this list of factors is not exhaustive. Although the forward-looking statements

contained in this news release are based upon what H&R believes is reasonable

assumptions, there can be no assurance that actual results will be consistent

with these forward-looking statements. All forward-looking statements in this

news release are qualified by these cautionary statements. These forwardlooking

statements are made as of today, and H&R, except as required by applicable law,

assumes no obligation to update or revise them to reflect new information or the

occurrence of future events or circumstances.

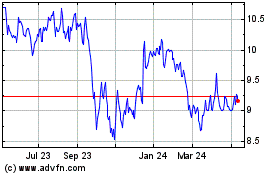

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Jun 2024 to Jul 2024

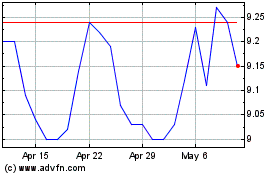

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Jul 2023 to Jul 2024