Gildan Activewear Inc. (TSX:GIL)(NYSE:GIL)

- Fourth Quarter in Line with Prior Guidance -

- Full Year EPS Up 20.4% Compared to Fiscal 2010 -

-Loss Projected for Q1 2012 Due to High-Cost Cotton, Distributor

Inventory Destocking, Promotional Discounting and Special

Distributor Inventory Devaluation Discount -

- Balance of Fiscal 2012 Projected to Show Gradual Recovery Due

to Lower Cotton and Manufacturing Costs -

- Declaration of Quarterly Dividend of U.S. $0.075 per share

-

Gildan Activewear Inc. (TSX:GIL)(NYSE:GIL) today announced its

results for the fourth quarter of fiscal 2011 as well as for the

full fiscal year, which were in line with its prior earnings

guidance. The Company also initiated its sales and earnings

guidance for fiscal 2012. The Company is projecting a loss in the

first quarter of fiscal 2012, followed by an anticipated gradual

strengthening in results in the balance of the fiscal year, as the

Company finishes consuming inventories produced with high-cost

cotton and achieves projected manufacturing efficiencies. Due to

the loss in the first quarter, full year adjusted EPS in fiscal

2012 is currently projected to be approximately U.S. $1.30,

compared to adjusted EPS of U.S. $2.01 in fiscal 2011.

Fourth Quarter Sales and Earnings

Net earnings for the fourth fiscal quarter ended October 2, 2011

were U.S. $48.5 million or U.S. $0.40 per share on a diluted basis,

down respectively 14.6% and 14.9% from U.S. $56.8 million or U.S.

$0.47 per share in the fourth quarter of fiscal 2010. Results for

the fourth quarter include restructuring charges totalling U.S.

$2.3 million after-tax or U.S. $0.02 per share, to write down the

carrying value of facilities held for sale and to recognize

additional pension costs for the former Gold Toe Moretz pension

plan, which the Company intends to terminate in 2012. Before the

restructuring charges in both years, adjusted net earnings were

U.S. $50.8 million or U.S. $0.42 per share, down respectively 12.9%

and 12.5% from U.S. $58.3 million or U.S. $0.48 per share.

The decline in adjusted net earnings and EPS in the fourth

quarter compared to last year was due to the significant increase

in the cost of cotton, which was not fully recovered in higher net

selling prices, lower unit sales volumes for activewear and the

non-recurrence of insurance proceeds and a cotton subsidy received

in the fourth quarter of last year. These negative factors were

partially offset by the positive impact of income tax recoveries in

the fourth quarter of fiscal 2011, more favourable activewear

product-mix, lower SG&A expenses and the earnings accretion

from the acquisition of Gold Toe Moretz.

Adjusted EPS slightly exceeded the Company's guidance for the

quarter of approximately U.S. $0.40 provided on August 4, 2011.

Compared to its August guidance, the unfavourable impact of weaker

demand and increased promotional discounting in the wholesale

distributor channel, lower inventory replenishment by mass-market

retailers and lower than forecast sock manufacturing efficiencies

was more than offset by the later than anticipated timing of

destocking of inventories by wholesale distributors, which is now

occurring in the first quarter of fiscal 2012, and the benefit of

income tax recoveries.

Net sales in the fourth quarter amounted to U.S. $481.8 million,

up 30.6% from U.S. $368.9 million in the fourth quarter of fiscal

2010. The Company had forecast in August that sales in the fourth

quarter would be slightly below U.S. $500 million. Sales of

activewear and underwear amounted to U.S. $368.9 million, up 20.0%

from fiscal 2010, and sales of socks were U.S. $112.9 million, up

83.6% from U.S. $61.5 million a year ago.

The growth in sales of activewear and underwear compared to the

fourth quarter of fiscal 2010 was due to an approximate 23%

increase in average net selling prices, partially offset by a 7.6%

reduction in unit volume shipments which declined due to a 6.3%

reduction in industry shipments from U.S. distributors to U.S.

screenprinters and seasonal destocking in the U.S. screenprint

market which was less than anticipated. Gildan's market share in

the U.S. distributor channel in the fourth quarter was 62.3%,

according to the CREST report, and was essentially unchanged from

62.1% in the fourth quarter of last year. Consequently, the Company

has recaptured the slight loss of market share incurred earlier in

the fiscal year, when it was unable to fully service demand for its

products due to capacity constraints and sub-optimal inventory

levels.

The increase in sales revenues for socks was due to the

acquisition of Gold Toe Moretz. Shipments of socks in the fourth

quarter of fiscal 2011 were negatively impacted by weak market

conditions and inventory destocking by mass-market retailers. Also,

sales of socks in the fourth quarter of fiscal 2010 were positively

impacted by the later timing of shipments of back-to-school

programs.

Gross margins in the fourth quarter were 20.4% compared with the

Company's guidance in August of approximately 22%, and 27.3% in the

fourth quarter of last year. Gross margins were lower than forecast

due to higher than forecast selling price promotions in the U.S.

wholesale distributor channel in the month of September and lower

than projected sock manufacturing efficiencies. The decrease in

gross margins compared to last year was due to the significant

increase in the cost of cotton, which was not fully recovered in

higher selling prices, and the non-recurrence of the proceeds from

the insurance claim for the Haiti earthquake and a cotton subsidy

received in Gildan's U.S. yarn-spinning joint venture, which

together positively impacted gross margins by over 400 basis points

in the fourth quarter of last year. These negative factors were

partially offset by more favourable activewear product-mix and the

impact of the acquisition of Gold Toe Moretz.

SG&A expenses in the fourth quarter increased to U.S. $53.3

million from U.S. $42.0 million in the fourth quarter of last year.

The increase in SG&A expenses was due to the impact of

including Gold Toe Moretz, which resulted in approximately U.S. $15

million of additional SG&A expenses, partially offset by the

non-recurrence of a U.S. $1.5 million provision for doubtful

accounts receivable in the fourth quarter of last year and lower

distribution expenses.

Adjusted EPS in the fourth quarter included income tax

recoveries totalling approximately U.S. $7.6 million arising from

losses in the Company's U.S. legal entities.

Full Year Sales and Earnings

Net sales for fiscal 2011 amounted to U.S. $1,726.0 million, up

31.6% from U.S. $1,311.5 million in fiscal 2010. The growth in

sales revenues was due to higher net selling prices and increased

unit sales volumes for activewear and underwear, as well as the

impact of the acquisition of Gold Toe Moretz, partially offset by

lower organic sock sales. Unit sales growth in activewear and

underwear of 7.7% reflected the recovery in market conditions in

the U.S. wholesale distributor channel in the first half of the

fiscal year, the Company's penetration in other screenprint markets

and increased shipments of activewear and underwear to mass-market

retailers, partially offset by an approximate 8% decline in overall

market demand in shipments from U.S. distributors to U.S.

screenprinters in the second half of the fiscal year.

Net earnings for fiscal 2011 amounted to U.S. $239.9 million or

U.S. $1.96 per share, up 21.0% and 20.2% respectively from U.S.

$198.2 million or U.S. $1.63 per share in fiscal 2010. Adjusted net

earnings before restructuring charges were U.S. $245.5 million or

U.S. $2.01 per share, up 20.6% and 20.4% respectively from U.S.

$203.6 million or U.S. $1.67 per share last year. The growth in

earnings and EPS was due to increased sales revenues for

activewear, which, together with the earnings and EPS accretion

attributable to the Gold Toe Moretz acquisition and income tax

recoveries, more than offset the impact of higher cotton and other

input costs, lower organic sales of socks and increased selling,

general and administrative expenses.

Cash Flow and Financial Position

The Company ended the fourth quarter and the financial year with

cash and cash equivalents of U.S. $88.8 million and U.S. $209.0

million of bank indebtedness. In the fourth quarter the Company

generated EBITDA of U.S. $65.6 million and free cash flow of U.S.

$61.8 million. Inventories, which had been at sub-optimal levels to

adequately service customer demand throughout the first three

quarters of the fiscal year, increased by approximately U.S. $55.0

million during the fourth quarter. Capital expenditures in the

fourth quarter amounted to U.S. $50.8 million. During the fourth

quarter, the Company utilized its normal course issuer bid program

to repurchase 400,000 of its common shares outstanding.

EBITDA for the full fiscal year amounted to U.S. $312.5 million

and the Company generated free cash flow of U.S. $7.3 million in

fiscal 2011.

Segmented Reporting

Beginning in the first quarter of fiscal 2012, Gildan will begin

reporting its retail business as a separate operating business

segment, in line with the new operating and internal financial

reporting structure of the Company. Gildan is now structured as two

operating businesses, each of which has accountability for its

financial performance and return on capital. The screenprint

business will continue to be headquartered in Barbados and the new

retail business operations are headquartered in Charleston, South

Carolina.

The Company has made significant investments in its

manufacturing and distribution facilities to support the

development of its retail business, and has also undertaken the

recent strategic acquisition of Gold Toe Moretz. The Company

believes that its investments in manufacturing technology and the

consistently high quality of its products will enable it over time

to successfully develop the Gildan® brand for retail, and maximize

the further growth potential of its Gold Toe®, PowerSox®,

SilverToe®, Auro®, All Pro®, and GT® brands as well as its

exclusive U.S. sock license for the Under Armour® and New Balance®

brands. The Company will also evaluate other possible consumer

brand acquisitions to complement its organic retail growth.

A major objective for the Company in fiscal 2012 will be to

achieve more acceptable profit margins and returns on capital for

its retail business, which has been unprofitable in fiscal 2011 due

to a combination of factors, including the high cost of cotton, the

transition of sock manufacturing from the U.S. to Honduras, the

ramp-up of its new distribution centre, and the development of a

significant overhead infrastructure to implement the Company's

retail strategy and drive the future growth of the business.

In addition, the Company has been shifting its retail

product-mix to de-emphasize and forego private label programs which

do not meet its profit criteria and to focus on the development of

its owned and licensed brands, together with selective private

label programs which fit with its efficient large-scale vertical

manufacturing and which provide acceptable profitability and

returns.

Gildan is projecting that its retail business will begin to

report operating profits during the course of fiscal 2012, due to

lower-cost cotton and manufacturing efficiencies. Subsequent future

growth in retail operating margins will be driven by unit volume

growth, which will result in increased manufacturing efficiencies

and increased SG&A leverage, as well as by projected additional

synergies from the Gold Toe Moretz acquisition.

Outlook

The Company is providing sales and earnings guidance, based on

the assumption of continuing weak overall economic conditions and

weak industry demand. Also, the industry is managing through a

unique transition from rapid inflation in cotton costs to rapid

deflation.

The Company is projecting a loss of approximately $0.40 per

share in its first fiscal quarter on projected sales of

approximately U.S. $300 million, compared with EPS of U.S. $0.30 in

the first quarter of fiscal 2011 on sales of U.S. $331.3

million.

Short-term promotional discounting began to increase at the end

of the fourth quarter, and has continued to increase in the first

quarter of fiscal 2012. Also, in the first quarter, in anticipation

of selling price reductions, distributors have been supplying

screenprinter demand without replenishing inventory levels,

resulting in excess producer inventories and further increases in

promotional discounting as producers seek to maintain capacity

utilization in their manufacturing facilities. As the market

leader, in order to enable distributors to plan their business and

stimulate screenprinter demand for Gildan products, Gildan

announced yesterday that it is reducing gross selling prices in the

U.S. wholesale distributor channel effective December 5, 2011, and

applying the benefit of this price reduction to existing

distributor inventories. The impact of the special distributor

inventory devaluation discount on first quarter results is

projected to be approximately U.S. $0.16 per share.

Although Gildan is no longer constrained by lack of capacity and

is maintaining a high market share, the combination of weak end-use

demand and distributor destocking is projected to result in an

approximate 40% decline in Gildan's unit sales volumes in the

screenprint market in the first quarter, compared to the first

quarter of fiscal 2011. In addition, the first quarter is

seasonally the lowest-volume quarter of the fiscal year.

The projected results for the first fiscal quarter are due to a

combination of factors including the significant destocking of

inventories by distributors, increased promotional pricing at the

same time that the Company is consuming inventories produced with

high cotton costs, the impact of the special distributor inventory

devaluation discount, and extension of the normal holiday

production downtime in December, in order to manage inventory

levels.

In the second half of the fiscal year, the Company expects to

benefit from significantly lower cotton costs compared with both

the first half of fiscal 2012 and the second half of fiscal 2011.

Also, the Company is projecting increased efficiencies in its sock

manufacturing operations. Adjusted EPS for fiscal 2012 is projected

to be approximately U.S. $1.30, down 35% from U.S. $2.01 per share

in fiscal 2011. Net sales revenues in fiscal 2012 are projected to

be approximately U.S. $1.9 billion, compared with U.S. $1,726

million in fiscal 2011. Sales revenues for the screenprint business

are projected to be approximately U.S. $1.3 billion, and retail

sales revenues are projected to be approximately U.S. $0.6

billion.

The projected reduction in full year EPS in fiscal 2012 compared

to 2011 is primarily due to higher cotton costs in the first half

of the year, lower selling prices for activewear, the special

distributor devaluation discount and the non-recurrence of income

tax recoveries during fiscal 2011. These negative factors are

assumed to be partially offset by assumed lower cotton costs in the

second half of the year, projected higher net selling prices for

socks and underwear, projected higher activewear sales volumes,

more favourable manufacturing efficiencies, after taking account of

shutdown costs assumed in fiscal 2012, and the EPS accretion from a

full year of earnings from the acquisition of Gold Toe Moretz.

It is emphasized that the current environment for the Company's

business is highly uncertain and volatile, and the financial

projections provided for fiscal 2012 could be significantly

impacted by any improvement or further deterioration in conditions

and in the underlying assumptions for the business.

The main assumptions underlying the Company's sales and earnings

guidance for fiscal 2012 are set out below. Projected results are

highly sensitive to changes in assumptions for unit volumes and

unit selling prices, as well as for future cotton prices and the

Company's ability to achieve projected manufacturing cost

reductions.

- Overall industry shipments from U.S. distributors to U.S.

screenprinters are assumed to be down by approximately 2.5% in

fiscal 2012 compared to fiscal 2011. Industry shipments in the

second quarter of fiscal 2012 are assumed to be down by 5% compared

to the second quarter of fiscal 2011, the same decline as projected

in the first quarter. Industry shipments in the second half of

fiscal 2012 are assumed to be essentially unchanged from a low base

in the second half of fiscal 2011. The Company is assuming an

average market share of approximately 65% in the U.S. wholesale

distributor channel in fiscal 2012. The Company is projecting

growth in sales volumes in international and other markets in

fiscal 2012. The Company estimates that every one million dozen

change in demand for activewear impacts annual EPS by over U.S.

$0.05. The Company has scheduled additional manufacturing downtime

in addition to the shutdown in the first quarter due to the assumed

weak market demand.

- It has been assumed that net selling prices in the screenprint

market will decline slightly during the balance of fiscal 2012 and

that selling prices will be lower than in fiscal 2011. However,

there is no assurance that selling price competition will not be

more severe than projected, as manufacturers seek to maintain mill

capacity utilization. The Company estimates that every 1% change in

screenprint net selling prices impacts projected EPS for fiscal

2012 by approximately U.S. $0.10.

- Selling price increases which were recently implemented in the

retail market did not reflect the full pass-through of high-cost

cotton. Therefore, while gross margins for retail products are

continuing to be adversely affected in the first half of fiscal

2012 by the high cost of cotton, it is not currently expected that

Gildan's selling prices to retailers will decline when the Company

benefits from lower cotton costs in the second half of the fiscal

year.

- Cotton costs in the first half of the fiscal year will be

significantly higher than the first half of fiscal 2011. The weak

demand environment is projected to result in slower consumption of

inventories manufactured with high-cost cotton. The consumption of

such inventories is now assumed to continue until early in the

third quarter of fiscal 2012. However, based on current futures,

cotton costs in the second half of the fiscal year are expected to

be significantly lower than the second half of fiscal 2011.

- SG&A in fiscal 2012 is assumed to increase by

approximately U.S. $25 million compared to fiscal 2011, due to the

inclusion of Gold Toe Moretz for the full fiscal year. The income

tax rate in fiscal 2012 is currently assumed to be approximately

1%.

The Company expects to generate free cash flow of approximately

U.S. $75 million - U.S. $100 million in fiscal 2012. The Company

expects to use cash in the first half of the fiscal year, due to

the loss in the first quarter and working capital requirements for

the peak summer selling season in the T-shirt industry. Capital

expenditures are projected to amount to approximately U.S. $100

million, including the ramp-up of the Rio Nance V facility.

Although the Company is continuing to accelerate its ramp-up of the

new facility, it plans to carefully manage production in line with

market demand. The Company is currently planning to manage capacity

and inventory levels by temporarily reducing capacity at the Rio

Nance I facility.

Declaration of Quarterly Dividend and Renewal of Normal Course

Issuer Bid

The Board of Directors has declared a cash dividend of U.S.

$0.075 per share, payable on January 6, 2012 to shareholders of

record on December 15, 2011. This dividend is an "eligible

dividend" for the purposes of the Income Tax Act (Canada) and any

other applicable provincial legislation pertaining to eligible

dividends.

In addition, the Company announced that it is renewing its

normal course issuer bid to repurchase outstanding shares of the

Company in the open market. Under its renewed bid, the Company

intends to purchase up to 1 million common shares, representing

approximately 0.8% of the Company's issued and outstanding common

shares, in accordance with the requirements of the TSX. As of

November 30, 2011 the Company had 121,410,406 shares issued and

outstanding.

Gildan is authorized to make purchases under the bid during the

period from December 6, 2011 to December 5, 2012, or until such

time as the bid is completed or terminated at Gildan's option.

Purchases will be made on the open market on both the TSX and the

NYSE. Under the bid, Gildan may purchase up to a maximum of 107,619

shares daily, which represents 25% of the average daily trading

volume on the TSX for the most recently completed six calendar

months. The price to be paid will be the market price of the shares

on the stock exchange on which such shares are purchased at the

time of acquisition. Shares purchased under the bid will be

cancelled.

At the date hereof, directors, senior officers and other

insiders of the Company have indicated that they may sell up to

approximately 55,000 shares of the Company during the course of the

bid primarily to cover tax liabilities from the vesting of

restricted share unit grants and from the exercise of certain stock

option awards that are expiring, having reached their maximum

ten-year term. The benefits to any insider whose shares are

purchased would be the same as the benefits available to all other

shareholders whose shares are purchased.

The purchase of common shares under the normal course issuer bid

may, in the Company's opinion, represent an appropriate use of

funds in the event that the shares trade at a price which does not

adequately reflect their value in relation to Gildan's assets,

business and future business prospects. The purchase of shares will

also offset the dilutive effect of the issuance of shares pursuant

to Gildan's compensation plans.

During the period from December 6, 2010 to December 5, 2011

inclusively, the Company purchased under its current normal course

issuer bid a total of 400,000 of its issued and outstanding common

shares.

International Financial Reporting Standards (IFRS)

As disclosed in our previous regulatory filings, IFRS is

replacing Canadian GAAP for publicly accountable enterprises for

fiscal years beginning on or after January 1, 2011. As a result,

the Company will begin reporting under IFRS for its fiscal 2012

interim and annual financial statements beginning October 3, 2011,

with comparative information presented for fiscal 2011. Our 2011

Annual Management's Discussion and Analysis will include an update

on the status of our IFRS transition plan as well as an updated

summary of the impact of the significant differences identified

between Canadian GAAP and IFRS on our opening fiscal 2011 balance

sheet and our consolidated statement of earnings and comprehensive

income for the year ended October 2, 2011. The Company's adjusted

net earnings outlook for fiscal 2012 reflects the adoption of IFRS

in fiscal 2012, and the Company does not expect the adoption of

IFRS to have a material impact on its net earnings or adjusted net

earnings for fiscal 2012.

Disclosure of Outstanding Share Data

As of November 30, 2011, there were 121,410,406 common shares

issued and outstanding along with 1,150,000 stock options and

914,390 dilutive restricted share units ("Treasury RSUs")

outstanding. Each stock option entitles the holder to purchase one

common share at the end of the vesting period at a pre determined

option price. Each Treasury RSU entitles the holder to receive one

common share from treasury at the end of the vesting period,

without any monetary consideration being paid to the Company.

However, the vesting of at least 50% of each Treasury RSU grant is

contingent on the achievement of performance conditions that are

primarily based on the Company's average return on assets

performance for the period as compared to the S&P/TSX Capped

Consumer Discretionary Index, excluding income trusts, or as

determined by the Board of Directors.

Information for Shareholders

Gildan Activewear Inc. will hold a conference call to discuss

these results today at 8:30 AM ET. The conference call can be

accessed by dialing 866-321-6651 (Canada & U.S.) or

416-642-5212 (international) and entering passcode 4653929, or by

live sound webcast on Gildan's Internet site ("Investor Relations"

section) at the following address:

http://gildan.com/corporate/IR/webcastPresentations.cfm. If you are

unable to participate in the conference call, a replay will be

available starting that same day at 11:30 AM ET by dialing

888-203-1112 (Canada & U.S.) or 647-436-0148 (international)

and entering passcode 4653929, until December 8, 2011 at midnight,

or by sound web cast on Gildan's Internet site for 30 days.

The Company expects to file its 2011 Management's Discussion and

Analysis and its 2011 audited Consolidated Financial Statements

with the Canadian securities regulatory authorities and with the

U.S. Securities and Exchange Commission during the week of December

5, 2011.

About Gildan

Gildan is a marketer and globally low-cost vertically-integrated

manufacturer of quality branded basic apparel. Gildan® is the

leading activewear brand in the screenprint market in the U.S. and

Canada. The brand is continuing to grow in Europe, Mexico and the

Asia-Pacific region. The Company sells T-shirts, sport shirts and

fleece as undecorated "blanks", which are subsequently decorated by

screenprinters with designs and logos. The Company is also one of

the world's largest suppliers of branded and private label

athletic, casual and dress socks sold to a broad spectrum of

retailers in the U.S. Gildan markets its sock products under a

diversified portfolio of company-owned brands, including Gold Toe®,

PowerSox®, SilverToe®, Auro®, All Pro®, GT®, and the Gildan® brand.

The Company is also the exclusive U.S. sock licensee for the Under

Armour® and New Balance® brands. In addition to socks, the Company

is increasingly becoming a significant supplier of underwear and

undecorated activewear products in the retail channel. With

approximately 29,500 employees worldwide, Gildan owns and operates

highly efficient, large-scale, environmentally and socially

responsible facilities in Central America and the Caribbean Basin

and has begun the development of a manufacturing hub in Bangladesh

to support its planned growth in Asia and Europe. More information

on the Company can be found on Gildan's website at

www.gildan.com.

Forward-Looking Statements

Certain statements included in this press release constitute

"forward-looking statements" within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 and Canadian securities

legislation and regulations, and are subject to important risks,

uncertainties and assumptions. This forward-looking information

includes, amongst others, information with respect to our

objectives and the strategies to achieve these objectives, as well

as information with respect to our beliefs, plans, expectations,

anticipations, estimates and intentions, including, without

limitation, our expectation with regards to industry demand and

unit volume growth, sales revenue, gross margins, selling, general

and administrative expenses, earnings per share, capital

expenditures, market share, selling prices, cotton costs, income

tax rate, and free cash flow. Forward-looking statements generally

can be identified by the use of conditional or forward-looking

terminology such as "may", "will", "expect", "intend", "estimate",

"project", "assume", "anticipate", "plan", "foresee", "believe" or

"continue" or the negatives of these terms or variations of them or

similar terminology. We refer you to the Company's filings with the

Canadian securities regulatory authorities and the U.S. Securities

and Exchange Commission, as well as the "Risks and Uncertainties"

section and the risks described under the "Critical Accounting

Estimates" and "Financial Risk Management" sections in our most

recent Management's Discussion and Analysis for a discussion of the

various factors that may affect the Company's future results.

Material factors and assumptions that were applied in drawing a

conclusion or making a forecast or projection are also set out

throughout this document.

Forward-looking information is inherently uncertain and the

results or events predicted in such forward-looking information may

differ materially from actual results or events. Material factors,

which could cause actual results or events to differ materially

from a conclusion, forecast or projection in such forward-looking

information, include, but are not limited to:

-- our ability to implement our growth strategies and plans, including

achieving market share gains, implementing cost reduction initiatives

and completing and successfully integrating acquisitions;

-- the intensity of competitive activity and our ability to compete

effectively;

-- adverse changes in general economic and financial conditions globally or

in one or more of the markets we serve;

-- our reliance on a small number of significant customers;

-- the fact that our customers do not commit contractually to minimum

quantity purchases;

-- our ability to anticipate changes in consumer preferences and trends;

-- our ability to manage production and inventory levels effectively in

relation to changes in customer demand;

-- fluctuations and volatility in the price of raw materials used to

manufacture our products, such as cotton and polyester fibres;

-- our dependence on key suppliers and our ability to maintain an

uninterrupted supply of raw materials and finished goods;

-- the impact of climate, political, social and economic risks in the

countries in which we operate or from which we source;

-- disruption to manufacturing and distribution activities due to labour

disruptions, political instability, bad weather, natural disasters,

pandemics and other unforeseen adverse events;

-- changes to international trade legislation that the Company is currently

relying on in conducting its manufacturing operations or the application

of safeguards thereunder;

-- factors or circumstances that could increase our effective income tax

rate, including the outcome of any tax audits or changes to applicable

tax laws or treaties;

-- compliance with applicable environmental, tax, trade, employment, health

and safety, and other laws and regulations in the jurisdictions in which

we operate;

-- our significant reliance on computerized information systems for our

business operations;

-- changes in our relationship with our employees or changes to domestic

and foreign employment laws and regulations;

-- negative publicity as a result of violation of local labour laws or

international labour standards, or unethical labour or other business

practices by the Company or one of its third-party contractors;

-- our dependence on key management and our ability to attract and/or

retain key personnel;

-- changes to and failure to comply with consumer product safety laws and

regulations;

-- adverse changes in third party licensing arrangements and licensed

brands;

-- our ability to protect our intellectual property rights;

-- changes in accounting policies and estimates; and

-- exposure to risks arising from financial instruments, including credit

risk, liquidity risk, foreign currency risk and interest rate risk, as

well as risks arising from commodity prices.

These factors may cause the Company's actual performance and

financial results in future periods to differ materially from any

estimates or projections of future performance or results expressed

or implied by such forward-looking statements. Forward-looking

statements do not take into account the effect that transactions or

non-recurring or other special items announced or occurring after

the statements are made, may have on the Company's business. For

example, they do not include the effect of business dispositions,

acquisitions, other business transactions, asset write-downs, asset

impairment losses or other charges announced or occurring after

forward-looking statements are made. The financial impact of such

transactions and non-recurring and other special items can be

complex and necessarily depends on the facts particular to each of

them.

There can be no assurance that the expectations represented by

our forward-looking statements will prove to be correct. The

purpose of the forward-looking statements is to provide the reader

with a description of management's expectations regarding the

Company's fiscal 2012 financial performance and may not be

appropriate for other purposes. Furthermore, unless otherwise

stated, the forward-looking statements contained in this press

release are made as of the date of this press release, and we do

not undertake any obligation to update publicly or to revise any of

the included forward-looking statements, whether as a result of new

information, future events or otherwise unless required by

applicable legislation or regulation. The forward-looking

statements contained in this press release are expressly qualified

by this cautionary statement.

Non-GAAP Financial Measures

This press release includes references to certain non-GAAP

financial measures such as EBITDA, adjusted net earnings, adjusted

diluted EPS, free cash flow, total indebtedness, and net

indebtedness (cash in excess of total indebtedness). These non-GAAP

measures do not have any standardized meanings prescribed by

Canadian GAAP and are therefore unlikely to be comparable to

similar measures presented by other companies. Accordingly, they

should not be considered in isolation. The terms and definitions of

the non-GAAP measures used in this press release and a

reconciliation of each non-GAAP measure to the most directly

comparable GAAP measure are provided below.

EBITDA

EBITDA is calculated as earnings before interest, taxes and

depreciation and amortization and excludes the impact of

restructuring and acquisition-related costs, as well as the

non-controlling interest in consolidated joint venture. The Company

uses EBITDA, among other measures, to assess the operating

performance of its business. The Company also believes this measure

is commonly used by investors and analysts to measure a company's

ability to service debt and to meet other payment obligations, or

as a common valuation measurement. The Company excludes

depreciation and amortization expenses, which are non-cash in

nature and can vary significantly depending upon accounting methods

or non-operating factors such as historical cost. Excluding these

items does not imply they are necessarily non-recurring.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(in U.S.$ millions) Q4 2011 Q4 2010 YTD 2011 YTD 2010

----------------------------------------------------------------------------

Net earnings 48.5 56.8 239.9 198.2

Restructuring and acquisition-

related costs 3.6 2.8 8.5 8.7

Depreciation and amortization 21.9 17.6 79.8 66.5

Variation of depreciation

included in inventories (1.4) 0.1 (3.4) 2.7

Interest expense, net 1.7 0.1 2.9 0.4

Income taxes (8.9) (2.5) (15.7) (1.9)

Non-controlling interest of

consolidated joint venture 0.2 2.7 0.5 3.8

----------------------------------------------------------------------------

EBITDA 65.6 77.6 312.5 278.4

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Certain minor rounding variances exist between the financial statements and

this summary.

Adjusted net earnings and adjusted diluted EPS

Adjusted net earnings and adjusted diluted earnings per share

are calculated as net earnings and earnings per share excluding

restructuring and acquisition-related costs. The Company uses and

presents these non-GAAP measures to assess its operating

performance from one period to the next without the variation

caused by restructuring and acquisition-related costs that could

potentially distort the analysis of trends in its business

performance. Excluding these items does not imply they are

necessarily non-recurring.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(in U.S.$ millions, except per

share amounts) Q4 2011 Q4 2010 YTD 2011 YTD 2010

----------------------------------------------------------------------------

Net earnings 48.5 56.8 239.9 198.2

Adjustments for:

Restructuring and acquisition-

related costs 3.6 2.8 8.5 8.7

Income tax recovery on

restructuring and

acquisition-related costs (1.3) (1.3) (2.9) (3.3)

----------------------------------------------------------------------------

Adjusted net earnings 50.8 58.3 245.5 203.6

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic EPS(i) 0.40 0.47 1.97 1.64

Diluted EPS(i) 0.40 0.47 1.96 1.63

Adjusted diluted EPS(i) 0.42 0.48 2.01 1.67

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(i) Quarterly EPS may not add to year-to-date EPS due to rounding

Certain minor rounding variances exist between the financial statements and

this summary.

Free cash flow

Free cash flow is defined as cash from operating activities

including net changes in non-cash working capital balances, less

cash flow used in investing activities excluding business

acquisitions. The Company considers free cash flow to be an

important indicator of the financial strength and performance of

its business, because it shows how much cash is available after

capital expenditures to repay debt and to reinvest in its business.

The Company believes this measure is commonly used by investors and

analysts when valuing a business and its underlying assets.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(in U.S.$ millions) Q4 2011 Q4 2010 YTD 2011 YTD 2010

----------------------------------------------------------------------------

Cash flows from operating

activities 110.7 90.0 181.6 301.6

Cash flows used in investing

activities (46.0) (33.1) (523.9) (141.2)

Adjustments for:

Business acquisitions (2.9) 0.5 349.6 15.8

Restricted cash reimbursed

related to a business

acquisition - - - (0.3)

----------------------------------------------------------------------------

Free cash flow 61.8 57.4 7.3 175.9

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Certain minor rounding variances exist between the financial statements and

this summary.

Total indebtedness and Net indebtedness (Cash in excess of total

indebtedness)

The Company considers total indebtedness and net indebtedness

(cash in excess of total indebtedness) to be important indicators

of the financial leverage of the Company.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(in U.S.$ millions) Q4 2011 Q4 2010

----------------------------------------------------------------------------

Long-term debt and Total indebtedness 209.0 -

Cash and cash equivalents (88.8) (258.4)

----------------------------------------------------------------------------

Net indebtedness (Cash in excess of total

indebtedness) 120.2 (258.4)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Certain minor rounding variances exist between the financial statements and

this summary.

Gildan Activewear Inc.

Consolidated Balance Sheets

(in thousands of U.S. dollars)

October 2, 2011 October 3, 2010

----------------------------------

(unaudited) (audited)

Current assets:

Cash and cash equivalents $ 88,802 $ 258,442

Trade accounts receivable 191,594 145,684

Income taxes receivable 515 -

Inventories 575,594 332,542

Prepaid expenses and deposits 10,966 9,584

Future income taxes 11,666 6,340

Other current assets 9,307 9,079

----------------------------------

888,444 761,671

Property, plant and equipment 565,398 479,292

Assets held for sale 13,142 3,246

Intangible assets 256,467 61,321

Goodwill 153,219 10,197

Other assets 13,051 11,805

----------------------------------

Total assets $ 1,889,721 $ 1,327,532

----------------------------------

----------------------------------

Current liabilities:

Accounts payable and accrued liabilities $ 315,269 $ 186,205

Income taxes payable - 5,024

----------------------------------

315,269 191,229

Long-term debt 209,000 -

Future income taxes 26,575 10,816

Non-controlling interest in consolidated

joint venture 11,562 11,058

Shareholders' equity:

Share capital 100,436 97,036

Contributed surplus 16,526 10,091

Retained earnings 1,184,781 982,764

Accumulated other comprehensive income 25,572 24,538

----------------------------------

1,210,353 1,007,302

----------------------------------

1,327,315 1,114,429

----------------------------------

Total liabilities and shareholders' equity $ 1,889,721 $ 1,327,532

----------------------------------

----------------------------------

See accompanying condensed notes to consolidated financial statements.

Gildan Activewear Inc.

Consolidated Statements of Earnings and Comprehensive Income

(in thousands of U.S. dollars, except per share data)

Three months ended Twelve months ended

----------------------------------------------------

October 2, October 3, October 2, October 3,

2011 2010 2011 2010

----------------------------------------------------

(unaudited) (unaudited) (unaudited) (audited)

Net sales $ 481,755 $ 368,935 $ 1,726,041 $ 1,311,463

Cost of sales 383,304 268,268 1,288,293 947,206

----------------------------------------------------

Gross profit 98,451 100,667 437,748 364,257

Selling, general and

administrative expenses 53,291 42,045 199,132 154,674

Restructuring and

acquisition-related

costs (note 1) 3,554 2,783 8,465 8,705

----------------------------------------------------

Operating income 41,606 55,839 230,151 200,878

Financial expense

(income), net (note 2) 1,825 (1,132) 5,485 751

Non-controlling interest

in consolidated joint

venture 198 2,691 504 3,786

----------------------------------------------------

Earnings before income

taxes 39,583 54,280 224,162 196,341

Income taxes (8,951) (2,536) (15,742) (1,904)

----------------------------------------------------

Net earnings 48,534 56,816 239,904 198,245

Other comprehensive

(loss) income, net of

related income taxes (330) (3,425) 1,034 (1,710)

----------------------------------------------------

Comprehensive income $ 48,204 $ 53,391 $ 240,938 $ 196,535

----------------------------------------------------

----------------------------------------------------

Earnings per share:

Basic EPS $ 0.40 $ 0.47 $ 1.97 $ 1.64

Diluted EPS $ 0.40 $ 0.47 $ 1.96 $ 1.63

Weighted average number

of shares outstanding

(in thousands):

Basic 121,548 121,334 121,526 121,159

Diluted 122,143 122,141 122,283 121,980

See accompanying condensed notes to consolidated financial statements.

Gildan Activewear Inc.

Consolidated Statements of Cash Flows

(in thousands of U.S. dollars)

Three months ended Twelve months ended

----------------------------------------------------

October 2, October 3, October 2, October 3,

2011 2010 2011 2010

----------------------------------------------------

(unaudited) (unaudited) (unaudited) (audited)

Cash flows from (used

in) operating

activities:

Net earnings $ 48,534 $ 56,816 $ 239,904 $ 198,245

Adjustments for non-

cash items (note 3) 16,449 13,244 70,851 72,360

----------------------------------------------------

64,983 70,060 310,755 270,605

Changes in non-cash

working capital

balances:

Trade accounts

receivable 81,230 23,673 (18,861) 16,018

Inventories (54,495) (7,989) (182,080) (32,280)

Prepaid expenses and

deposits 1,525 1,012 698 2,020

Other current assets 1,885 921 1,883 (168)

Accounts payable and

accrued liabilities 21,544 (3,310) 74,496 52,127

Income taxes payable (5,992) 5,586 (5,341) (6,771)

----------------------------------------------------

110,680 89,953 181,550 301,551

Cash flows from (used

in) financing

activities:

(Decrease) increase in

amounts drawn under

revolving long-term

credit facility (43,000) - 209,000 -

Dividends paid (9,154) - (27,496) -

Increase in other

long-term debt - - - 43

Repayment of other

long-term debt - (58) - (4,430)

Proceeds from the

issuance of shares 326 203 4,017 1,869

Repurchase and

cancellation of

shares (10,537) - (10,537) -

Repurchase of shares (2,152) - (2,152) -

Recovery related to

repricing of stock

options previously

exercised - - - 1,159

----------------------------------------------------

(64,517) 145 172,832 (1,359)

Cash flows from (used

in) investing

activities:

Purchase of property,

plant and equipment (49,042) (33,242) (159,946) (126,855)

Purchase of intangible

assets (1,776) (109) (4,776) (1,026)

Business acquisitions 2,856 (524) (349,639) (15,850)

Payment of contingent

consideration - - (5,815) -

Restricted cash

related to a business

acquisition - - - 254

Purchase of corporate

asset, net of

proceeds - - (3,693) -

Proceeds on disposal

of assets held for

sale 657 320 1,125 4,708

Net decrease

(increase) in other

assets 1,324 423 (1,193) (2,477)

----------------------------------------------------

(45,981) (33,132) (523,937) (141,246)

Effect of exchange rate

changes on cash and

cash equivalents

denominated in foreign

currencies (373) 267 (85) (236)

----------------------------------------------------

Net (decrease) increase

in cash and cash

equivalents during the

period (191) 57,233 (169,640) 158,710

Cash and cash

equivalents, beginning

of period 88,993 201,209 258,442 99,732

----------------------------------------------------

Cash and cash

equivalents, end of

period $ 88,802 $ 258,442 $ 88,802 $ 258,442

----------------------------------------------------

----------------------------------------------------

See accompanying condensed notes to consolidated financial statements.

Gildan Activewear Inc. - Condensed notes to the consolidated financial

statements (unaudited)

(Tabular amounts in thousands of U.S. dollars, unless otherwise noted)

For complete notes to the consolidated financial statements,

please refer to the filings with the various securities regulatory

authorities which are expected to be available during the week of

December 5, 2011.

1. Restructuring and acquisition-related costs

Three months ended Twelve months ended

--------------------------------------------------

October 2, October 3, October 2, October 3,

2011 2010 2011 2010

--------------------------------------------------

Loss on disposal of assets

held for sale $ 475 $ 470 $ 634 $ 37

Accelerated depreciation - 218 - 2,488

Asset impairment loss and

write-down of assets held

for sale 1,422 784 1,722 1,826

Employee termination costs

and other benefits 122 71 2,887 744

Other exit costs 1,535 1,335 3,222 3,705

Adjustment for employment

contract - (95) - (95)

--------------------------------------------------

$ 3,554 $ 2,783 $ 8,465 $ 8,705

--------------------------------------------------

--------------------------------------------------

2. Financial expense (income), net:

Three months ended Twelve months ended

----------------------------------------------------

October 2, October 3, October 2, October 3,

2011 2010 2011 2010

----------------------------------------------------

Interest expense $ 1,701 $ 137 $ 2,856 $ 436

Bank and other financial

charges 810 462 2,216 1,504

Foreign exchange gain (686) (1,738) (1,098) (1,084)

Derivative loss (gain)

on financial

instruments not

designated for hedge

accounting - 7 1,511 (105)

----------------------------------------------------

$ 1,825 $ (1,132)$ 5,485 $ 751

----------------------------------------------------

----------------------------------------------------

3. Adjustments for non-cash items:

Three months ended Twelve months ended

----------------------------------------------------

October 2, October 3, October 2, October 3,

2011 2010 2011 2010

----------------------------------------------------

Depreciation and

amortization (note 4) $ 21,933 $ 17,617 $ 79,808 $ 66,472

Variation of

depreciation included

in inventories (note 4) (1,383) 58 (3,423) 2,725

Restructuring charges

related to assets held

for sale and property,

plant and equipment 1,897 1,472 2,356 4,351

(Gain) loss on disposal

of long-lived assets (26) (165) 1,877 842

Loss on disposal of

corporate asset - - 3,693 -

Stock-based compensation

costs 1,477 935 4,899 4,081

Future income taxes (6,038) (8,366) (19,118) (11,427)

Non-controlling interest

in consolidated joint

venture 198 2,691 504 3,786

Unrealized net (gain)

loss on foreign

exchange and financial

derivatives not

designated as cash flow

hedges (1,353) (973) 255 846

Adjustments to financial

derivatives included in

other comprehensive

income, net of amounts

reclassified to net

earnings (256) (25) - 684

----------------------------------------------------

$ 16,449 $ 13,244 $ 70,851 $ 72,360

----------------------------------------------------

----------------------------------------------------

4. Depreciation and amortization:

Three months ended Twelve months ended

--------------------------------------------------

October 2, October 3, October 2, October 3,

2011 2010 2011 2010

--------------------------------------------------

Depreciation and

amortization of property,

plant and equipment and

intangible assets $ 21,933 $ 17,617 $ 79,808 $ 66,472

Adjustment for the

variation of depreciation

of property, plant and

equipment and intangible

assets included in

inventories at the

beginning and end of the

period (1,383) 58 (3,423) 2,725

--------------------------------------------------

Depreciation and

amortization included in

the consolidated

statements of earnings

and comprehensive income $ 20,550 $ 17,675 $ 76,385 $ 69,197

--------------------------------------------------

Comprised of:

Depreciation of

property, plant and

equipment $ 16,074 $ 15,462 $ 63,283 $ 60,378

Amortization of

intangible assets 4,468 2,210 13,087 8,797

Amortization of

financing costs and

other 8 3 15 22

--------------------------------------------------

Depreciation and

amortization included

in the consolidated

statements of earnings

and comprehensive

income $ 20,550 $ 17,675 $ 76,385 $ 69,197

--------------------------------------------------

--------------------------------------------------

5. Segmented Sales:

Three months ended Twelve months ended

----------------------------------------------------

October 2, October 3, October 2, October 3,

2011 2010 2011 2010

----------------------------------------------------

The company has two

customers accounting

for at least 10% of

total net sales:

Customer A 17.4% 17.6% 19.4% 21.0%

Customer B 10.4% 16.9% 12.1% 14.3%

----------------------------------------------------

----------------------------------------------------

Net sales were derived

from customers located

in the following

geographic areas:

United States $ 428,674 $ 328,050 $ 1,536,670 $ 1,154,776

Canada 18,622 16,128 63,422 54,160

Europe and other 34,459 24,757 125,949 102,527

----------------------------------------------------

$ 481,755 $ 368,935 $ 1,726,041 $ 1,311,463

----------------------------------------------------

----------------------------------------------------

Net sales by major

product group:

Activewear and

underwear $ 368,897 $ 307,476 $ 1,406,036 $ 1,084,953

Socks 112,858 61,459 320,005 226,510

----------------------------------------------------

$ 481,755 $ 368,935 $ 1,726,041 $ 1,311,463

----------------------------------------------------

----------------------------------------------------

Contacts: Investor Relations Laurence G. Sellyn Executive

Vice-President Chief Financial and Administrative Officer (514)

343-8805lsellyn@gildan.com Sophie Argiriou Director Investor

Communications (514) 343-8815sargiriou@gildan.com Media Relations

Genevieve Gosselin Director Corporate Communications (514)

343-8814ggosselin@gildan.com

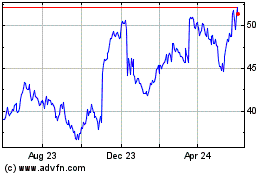

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Jul 2024 to Jul 2024

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Jul 2023 to Jul 2024