Gildan Activewear Inc. (TSX: GIL)(NYSE: GIL) -

- Adjusted EPS of U.S. $0.24 vs. U.S. $0.04 in Q1 2009

- Growth in Sales Revenues of 20% Compared to Q1 2009

- Market Share of 61.3% in U.S. Wholesale Distributor

Channel

- Consolidated Gross Margins of 29.8%

- Free Cash Flow of U.S. $43 million in Quarter

- Continuing Positive Development of Retail Business

- Full Year Outlook Reconfirmed

Gildan Activewear Inc. (TSX: GIL)(NYSE: GIL) today announced its

financial results for the first quarter of its 2010 fiscal year and

also reconfirmed its sales and gross margin assumptions which it

had previously provided in its outlook for the full fiscal

year.

First Quarter Sales and Earnings

Gildan reported net earnings of U.S. $28.0 million and diluted

EPS of U.S. $0.23 for its first fiscal quarter ended January 3,

2010, after reflecting a restructuring charge of U.S. $0.01 per

share related to the consolidation of its U.S. distribution

activities announced on December 10, 2009. Net earnings were U.S.

$4.4 million or U.S. $0.04 per share in the first quarter of fiscal

2009. Before reflecting restructuring charges in both fiscal years,

adjusted net earnings amounted to U.S. $29.2 million or U.S. $0.24

per share in the first quarter of fiscal 2010, compared to U.S.

$5.3 million or U.S. $0.04 per share in the first quarter of fiscal

2009. The significant increase in net earnings and EPS in the first

quarter compared to last year was due to strong growth in

activewear unit sales volumes, more favourable manufacturing,

cotton and energy costs, and more favourable activewear

product-mix, partially offset by lower activewear selling prices.

EPS for the first quarter was slightly higher than the Company's

internal forecast as the impact of lower than anticipated

promotional activity in the U.S. wholesale distributor channel and

more favourable product-mix more than offset the impact of the

timing of replenishment of the U.S. wholesale distributor channel,

which is benefitting activewear shipments early in the second

quarter of the fiscal year.

Net sales in the first quarter of fiscal 2010 amounted to U.S.

$220.4 million, up 19.8% from U.S. $184.0 million in the first

quarter of last year. Sales of activewear and underwear were U.S.

$152.9 million, up 32.0% from U.S. $115.8 million last year, and

sales of socks were U.S. $67.5 million, compared to U.S. $68.2

million last year. The first quarter is seasonally the lowest

quarter in the fiscal year for Gildan's activewear sales.

The strong recovery in sales of activewear and underwear

compared to fiscal 2009 primarily reflected a 31.5% increase in

activewear unit sales volumes, due to higher market share in the

U.S. wholesale distributor channel, lower seasonal inventory

destocking by distributors than in the first quarter of fiscal

2009, and increased penetration of international and other

screenprint markets. These positive factors, together with more

favourable activewear product-mix, were partially offset by an 8.9%

decline in overall industry unit shipments from U.S. distributors

to U.S. screenprinters, and an approximate 3.5% reduction in net

selling prices for activewear, compared to the first quarter of

fiscal 2009.

The table below summarizes the data from the S.T.A.R.S. report

produced by ACNielsen Market Decisions, which tracks unit volume

shipments of activewear from U.S. wholesale distributors to U.S.

screenprinters, for the calendar quarter ended December 31,

2009.

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Three months ended Three months ended

December 31, December 31,

2009 vs. 2008 2009 2008

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Unit Growth Market Share

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Gildan Industry Gildan

--------------------------------------------------------------------------

--------------------------------------------------------------------------

All products 5.0% (8.9)% 61.3% 53.3%

T-shirts 5.5% (8.9)% 62.7% 54.2%

Fleece 1.7% (7.2)% 56.8% 51.9%

Sport shirts (0.1)% (12.5)% 40.3% 35.4%

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Overall inventories in the U.S. distributor channel at December

31, 2009 were down by 15.5% compared with a year ago. Gildan's

share of distributor inventories was 49.8%, compared with its

market share of 61.3% in the first quarter as shown above.

Preliminary S.T.A.R.S. data for the month of January 2010 indicates

that overall industry shipments declined by 1.5% compared to

January 2009, and that Gildan's market share for all product

categories combined was 64.3%, compared with 61.3% for the December

quarter.

Sales of socks in the first quarter were essentially flat

compared to a year ago in spite of the negative sales impact of the

discontinuance of unprofitable sock programs and the elimination of

baby apparel and layette programs under licensed brands, which had

been included in the Kentucky Derby Hosiery acquisition and did not

fit with Gildan's business model. The impact of eliminating these

programs was essentially offset by the performance of continuing

sock programs, including new mass retailer private label sock

brands introduced during fiscal 2009.

Consolidated gross margins in the first quarter were 29.8%,

compared to 21.1% in the first quarter of fiscal 2009. The increase

in gross margins compared to last year was due to significant gains

in manufacturing efficiencies, lower cotton and energy costs and

more favourable activewear product-mix, partially offset by lower

net selling prices for activewear, as well as the impact of

additional inventory provisions.

Selling, general and administrative expenses in the first

quarter were U.S. $34.0 million, compared to U.S. $33.5 million in

the first quarter of fiscal 2009. The slight increase in SG&A

expenses from last year was due to the impact of the higher-valued

Canadian dollar on corporate administrative expenses and higher

performance-driven variable compensation expenses, partially offset

by the non-recurrence of provisions for doubtful receivable

accounts recorded in the first quarter of fiscal 2009 as well as

lower legal and professional fees. As a percentage of sales,

SG&A expenses declined to 15.4%, compared with 18.2% a year

ago.

Cash Flows and Financial Position

The Company generated free cash flow of U.S. $42.5 million in

the first quarter. Accounts receivable were reduced by U.S. $81.9

million compared with October 4, 2009 and the Company continues to

be comfortable with its accounts receivable collections and credit

exposures. Inventory levels were increased by U.S. $43.1 million

during the quarter, in order to build finished goods inventories of

activewear to capitalize on demand during the peak summer selling

season for T-shirts. The Company invested U.S. $34.0 million in

capital expenditures, primarily for its new retail distribution

centre and office building in Charleston, S.C. and for the ramp-up

of the Rio Nance IV sock factory in Honduras. The Company also paid

approximately U.S. $13 million for the provincial component of its

income tax settlement with the Canada Revenue Agency. This payment

had been fully provided for in the fourth quarter of fiscal 2008.

At the end of the first quarter, the Company had cash and cash

equivalents of U.S. $141.1 million, and its U.S. $400 million bank

credit facility was unutilized.

Development of Retail Programs

The Company has begun to ship a new underwear program for

Walmart, under the Starter brand, as well as further new Starter

programs for socks. In addition, the Company is beginning shipment

of the other new underwear and sock programs for national retailers

which it announced in December. The Company has significant

opportunities to build on these programs, and is in active

discussions with mass-retailers for further retail programs, in

line with its strategy to be a major full-line supplier of socks,

underwear and activewear for mass-retailers.

Outlook

The Company reconfirmed the outlook and sales and margin

assumptions for the full fiscal year, which it had provided on

December 10, 2009. The Company continues to project full year sales

revenues in excess of U.S. $1.2 billion, up approximately 17%

compared with fiscal 2009, and gross margins for the full year of

approximately 26%. Gross margins in the second half of the fiscal

year are assumed to be negatively impacted by higher cotton costs,

which have not been assumed to be passed through into higher

selling prices. The Company has continued to base its outlook on

the assumption of continuing weak economic conditions, resulting in

no growth in overall industry demand being projected for the

balance of the fiscal year. Based on preliminary S.T.A.R.S. data

for the month of January 2010, overall industry demand in the U.S.

wholesale distributor channel appears to be stabilizing.

The Company has increased its capital expenditure forecast for

fiscal 2010 to approximately U.S. $145 million, compared to U.S.

$130 million projected in December. The increase in projected

capital expenditures is due to the acceleration of planned sewing

capacity expansion projects required to support the Company's

projected sales growth, further capacity expansion and additional

knitting machines at the new Rio Nance IV sock facility, and

additional investment in the biomass project in Honduras, which is

expected to result in further incremental cost savings.

Disclosure of Outstanding Share Data

As of January 31, 2010, there were 121,039,631 common shares

issued and outstanding along with 1,462,901 stock options and

903,714 dilutive restricted share units ("Treasury RSUs")

outstanding. Each stock option entitles the holder to purchase one

common share at the end of the vesting period at a pre-determined

option price. Each Treasury RSU entitles the holder to receive one

common share from treasury at the end of the vesting period,

without any monetary consideration being paid to the Company.

However, at least 50% of Treasury RSU grants are subject to the

attainment of performance objectives set by the Board of

Directors.

Financial Highlights

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(in US$ millions, except per share

amounts or otherwise indicated) Q1 2010 Q1 2009

--------------------------------------------------------------------------

(unaudited) (unaudited)

Net sales 220.4 184.0

Gross profit 65.7 38.9

Selling, general and administrative expenses (SG&A) 34.0 33.5

Operating income 30.2 4.5

EBITDA (1) 44.4 17.6

Net earnings 28.0 4.4

Adjusted net earnings (2) 29.2 5.3

--------------------------------------------------------------------------

Diluted EPS 0.23 0.04

Adjusted diluted EPS (2) 0.24 0.04

--------------------------------------------------------------------------

Gross margin 29.8% 21.1%

SG&A as a percentage of sales 15.4% 18.2%

Operating margin 13.7% 2.4%

--------------------------------------------------------------------------

Cash flows from operating activities 73.9 15.9

Free cash flow (3) 42.5 2.9

--------------------------------------------------------------------------

January 3, October 4, January 4,

As at 2010 2009 2009

--------------------------------------------------------------------------

(unaudited) (unaudited) (unaudited)

Inventories 345.0 301.9 386.4

Trade accounts receivable 77.7 159.6 84.2

Cash in excess of total indebtedness

(Net indebtedness)(4) 137.9 95.3 (36.8)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(1), (2), (3), (4): Please refer to Non-GAAP Financial Measures of this

press release.

Certain minor rounding variances exist between the financial statements and

this summary.

Information for Shareholders

This release should be read in conjunction with Gildan's 2010

First Quarter Management's Discussion and Analysis ("MD&A")

dated February 9, 2010 and its interim consolidated financial

statements for the three months ended January 3, 2010 (available at

http://gildan.com/corporate/IR/quarterlyReports.cfm) which is

incorporated by reference in this release, and which will be filed

by Gildan with the Canadian securities regulatory authorities and

with the U.S. Securities and Exchange Commission.

Gildan Activewear Inc. will hold a conference call to discuss

these results today at 5:00 PM EST. The conference call can be

accessed by dialing 800-261-3417 (Canada & U.S.) or

617-614-3673 (international) and entering passcode 68365130, or by

live sound webcast on Gildan's Internet site ("Investor Relations"

section) at the following address:

http://gildan.com/corporate/IR/webcastPresentations.cfm. If you are

unable to participate in the conference call, a replay will be

available starting that same day at 8:00 PM EST by dialing

888-286-8010 (Canada & U.S.) or 617-801-6888 (international)

and entering passcode 36782235, until Tuesday, February 16, 2010 at

midnight, or by sound web cast on Gildan's Internet site for 30

days.

Profile

Gildan is a vertically-integrated marketer and manufacturer of

quality branded basic apparel. The Company is the leading supplier

of activewear for the screenprint market in the U.S. and Canada. It

is also a leading supplier to this market in Europe, and is

establishing a growing presence in Mexico and the Asia-Pacific

region. The Company sells T-shirts, sport shirts and fleece in

large quantities to wholesale distributors as undecorated "blanks",

which are subsequently decorated by screenprinters with designs and

logos. Consumers ultimately purchase the Company's products, with

the Gildan label, in venues such as sports, entertainment and

corporate events, and travel and tourism destinations. The

Company's products are also utilized for work uniforms and other

end-uses to convey individual, group and team identity. The Company

is also a leading supplier of private label and Gildan branded

socks primarily sold to mass-market retailers. In addition, Gildan

has an objective to become a significant supplier of men's and

boys' underwear and undecorated activewear products to mass-market

retailers in North America.

Forward-Looking Statements

Certain statements included in this press release constitute

"forward-looking statements" within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 and Canadian securities

legislation and regulations, and are subject to important risks,

uncertainties and assumptions. This forward-looking information

includes, amongst others, information with respect to our

objectives and the strategies to achieve these objectives, as well

as information with respect to our beliefs, plans, expectations,

anticipations, estimates and intentions. Forward-looking statements

generally can be identified by the use of conditional or

forward-looking terminology such as "may", "will", "expect",

"intend", "estimate", "project", "assume", "anticipate", "plan",

"foresee", "believe" or "continue" or the negatives of these terms

or variations of them or similar terminology. We refer you to the

Company's filings with the Canadian securities regulatory

authorities and the U.S. Securities and Exchange Commission, as

well as the "Risks and Uncertainties" section and the risks

described under the section "Financial Risk Management" of the 2009

Annual MD&A, as subsequently updated in our first quarter 2010

interim MD&A, for a discussion of the various factors that may

affect the Company's future results. Material factors and

assumptions that were applied in drawing a conclusion or making a

forecast or projection are also set out throughout this

document.

Forward-looking information is inherently uncertain and the

results or events predicted in such forward-looking information may

differ materially from actual results or events. Material factors,

which could cause actual results or events to differ materially

from a conclusion, forecast or projection in such forward-looking

information, include, but are not limited to:

- our ability to implement our growth strategies and plans,

including achieving market share gains, implementing cost reduction

initiatives and completing and successfully integrating

acquisitions;

- the intensity of competitive activity and our ability to

compete effectively;

- adverse changes in general economic and financial conditions

globally or in one or more of the markets we serve;

- our reliance on a small number of significant customers;

- the fact that our customers do not commit contractually to

minimum quantity purchases;

- our ability to anticipate changes in consumer preferences and

trends;

- our ability to manage inventory levels effectively in relation

to changes in customer demand;

- fluctuations and volatility in the price of raw materials used

to manufacture our products, such as cotton and polyester

fibres;

- our dependence on key suppliers and our ability to maintain an

uninterrupted supply of raw materials;

- the impact of climate, political, social and economic risks in

the countries in which we operate;

- disruption to manufacturing and distribution activities due to

labour disruptions, political instability, bad weather, natural

disasters and other unforeseen adverse events;

- changes to international trade legislation that the Company is

currently relying on in conducting its manufacturing operations or

the application of safeguards thereunder;

- factors or circumstances that could increase our effective

income tax rate, including the outcome of any tax audits or changes

to applicable tax laws or treaties;

- compliance with applicable environmental, tax, trade,

employment, health and safety, and other laws and regulations in

the jurisdictions in which we operate;

- our significant reliance on computerized information systems

for our business operations;

- changes in our relationship with our employees or changes to

domestic and foreign employment laws and regulations;

- negative publicity as a result of violation of labour laws or

unethical labour or other business practices by the Company or one

of its third-party contractors;

- our dependence on key management and our ability to attract

and retain key personnel;

- changes to and failure to comply with consumer product safety

laws and regulations;

- changes in accounting policies and estimates; and

- exposure to risks arising from financial instruments,

including credit risk, liquidity risk, foreign currency risk and

interest rate risk.

These factors may cause the Company's actual performance and

financial results in future periods to differ materially from any

estimates or projections of future performance or results expressed

or implied by such forward-looking statements. Forward-looking

statements do not take into account the effect that transactions or

non-recurring or other special items announced or occurring after

the statements are made, may have on the Company's business. For

example, they do not include the effect of business dispositions,

acquisitions, other business transactions, asset write-downs or

other charges announced or occurring after forward-looking

statements are made. The financial impact of such transactions and

non-recurring and other special items can be complex and

necessarily depends on the facts particular to each of them.

We believe that the expectations represented by our

forward-looking statements are reasonable, yet there can be no

assurance that such expectations will prove to be correct. The

purpose of the forward-looking statements is to provide the reader

with a description of management's expectations regarding the

Company's fiscal 2010 financial performance and may not be

appropriate for other purposes. Furthermore, unless otherwise

stated, the forward-looking statements contained in this press

release are made as of the date of this press release, and we do

not undertake any obligation to update publicly or to revise any of

the included forward-looking statements, whether as a result of new

information, future events or otherwise unless required by

applicable legislation or regulation. The forward-looking

statements contained in this press release are expressly qualified

by this cautionary statement.

Non-GAAP Financial Measures

This release includes reference to certain non-GAAP financial

measures such as EBITDA, adjusted net earnings, adjusted diluted

EPS, free cash flow, total indebtedness, and cash in excess of

total indebtedness/net indebtedness. These non-GAAP measures do not

have any standardized meanings prescribed by Canadian GAAP and are

therefore unlikely to be comparable to similar measures presented

by other companies. Accordingly, they should not be considered in

isolation. The terms and definitions of the non-GAAP measures used

in this press release and a reconciliation of each non-GAAP measure

to the most directly comparable GAAP measure are provided

below.

(1) EBITDA

EBITDA is calculated as earnings before interest, taxes and

depreciation and amortization and excludes the impact of

restructuring and other charges, as well as the non-controlling

interest in the consolidated joint venture. The Company uses

EBITDA, among other measures, to assess the operating performance

of our business. We also believe this measure is commonly used by

investors and analysts to measure a company's ability to service

debt and to meet other payment obligations, or as a common

valuation measurement. We exclude depreciation and amortization

expenses, which are non-cash in nature and can vary significantly

depending upon accounting methods or non-operating factors such as

historical cost. Excluding these items does not imply they are

necessarily non-recurring.

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(in U.S.$ millions) Q1 2010 Q1 2009

--------------------------------------------------------------------------

Net earnings 28.0 4.4

Restructuring and other charges 1.6 0.9

Depreciation and amortization 16.0 15.9

Variation of depreciation included in inventories (2.6) (4.4)

Interest, net - 0.9

Income taxes 1.2 0.3

Non-controlling interest in consolidated joint venture 0.2 (0.4)

--------------------------------------------------------------------------

EBITDA 44.4 17.6

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Certain minor rounding variances exist between the financial statements and

this summary.

(2) Adjusted net earnings and adjusted diluted EPS

Adjusted net earnings and adjusted diluted earnings per share

are calculated as net earnings and diluted earnings per share

excluding restructuring and other charges net of income tax

recovery, as discussed in Note 7 to the unaudited interim

consolidated financial statements. The Company uses and presents

these non-GAAP measures to assess its operating performance from

one period to the next without the variation caused by

restructuring and other charges that could potentially distort the

analysis of trends in our business performance. Excluding these

items does not imply they are necessarily non-recurring.

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(in U.S.$ millions, except per share amounts) Q1 2010 Q1 2009

--------------------------------------------------------------------------

Net earnings 28.0 4.4

Adjustments for:

Restructuring and other charges 1.6 0.9

Income tax recovery on restructuring and other charges (0.4) -

--------------------------------------------------------------------------

Adjusted net earnings 29.2 5.3

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Basic EPS 0.23 0.04

Diluted EPS 0.23 0.04

Adjusted diluted EPS 0.24 0.04

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Certain minor rounding variances exist between the financial statements and

this summary.

(3) Free cash flow

Free cash flow is defined as cash from operating activities

including net changes in non-cash working capital balances, less

cash flow used in investing activities excluding business

acquisitions. We consider free cash flow to be an important

indicator of the financial strength and performance of our

business, because it shows how much cash is available after capital

expenditures to repay debt and to reinvest in our business. We

believe this measure is commonly used by investors and analysts

when valuing a business and its underlying assets.

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(in U.S.$ millions) Q1 2010 Q1 2009

--------------------------------------------------------------------------

Cash flows from operating activities 73.9 15.9

Cash flows used in investing activities (31.4) (12.1)

Adjustments for:

Restricted cash reimbursed related to business acquisition - (0.9)

--------------------------------------------------------------------------

Free cash flow 42.5 2.9

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Certain minor rounding variances exist between the financial statements and

this summary.

(4) Total indebtedness and Cash in excess of total

indebtedness/Net indebtedness

We consider total indebtedness and cash in excess of total

indebtedness / (net indebtedness) to be important indicators of the

financial leverage of the Company.

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(in U.S.$ millions) Q1 2010 Q4 2009 Q1 2009

--------------------------------------------------------------------------

Current portion of long-term debt (2.0) (2.8) (3.0)

Long-term debt (1.2) (1.6) (48.2)

--------------------------------------------------------------------------

Total indebtedness (3.2) (4.4) (51.2)

Cash and cash equivalents 141.1 99.7 14.4

--------------------------------------------------------------------------

Cash in excess of total indebtedness

(Net indebtedness) 137.9 95.3 (36.8)

--------------------------------------------------------------------------

Certain minor rounding variances exist between the financial statements

and this summary.

Contacts: Investor Relations: Laurence G. Sellyn Executive

Vice-President, Chief Financial and Administrative Officer

514-343-8805 lsellyn@gildan.com Sophie Argiriou Director, Investor

Communications 514-343-8815 sargiriou@gildan.com Media Relations:

Genevieve Gosselin Director, Corporate Communications 514-343-8814

ggosselin@gildan.com

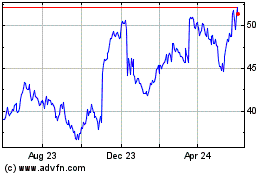

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Jul 2024 to Jul 2024

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Jul 2023 to Jul 2024