Gildan Activewear Inc. (TSX: GIL) (NYSE: GIL) today announced its

financial results for the first quarter of its 2009 fiscal year,

and suspended its EPS guidance for the full fiscal year, which it

had initiated on December 11, 2008, due to increasing uncertainty

about macro-economic conditions and the potential impact of the

economic and financial crisis on Gildan's served markets and

customer base. The Company also updated its capital expenditure

plans for fiscal 2009.

First Quarter Sales and Earnings

Gildan reported net earnings of U.S. $4.3 million and diluted

EPS of U.S. $0.04 for its first fiscal quarter ended January 4,

2009, compared with net earnings of U.S. $27.9 million and diluted

EPS of U.S. $0.23 in the first quarter of fiscal 2008. The Company

had provided EPS guidance of US $0.00 - $0.05 for the first quarter

of fiscal 2009.

The reduction in net earnings and EPS in the first quarter

compared to last year was primarily due to significantly lower unit

sales volumes, combined with higher cotton and energy costs

reflected in inventories consumed in cost of sales during the

quarter, more unfavourable activewear product-mix, and increased

provisions for accounts receivable. Cotton costs are projected to

be at their highest point during the year in the first quarter of

fiscal 2009, and were at their lowest point during fiscal 2008 in

the first quarter. These negative factors were partially offset by

favourable manufacturing efficiencies and higher net selling prices

for activewear, compared to the first quarter of fiscal 2008.

Compared to the Company's EPS guidance for the quarter, the impact

of lower than projected selling price discounts was offset by lower

than projected unit sales volumes, due to continuing inventory

destocking by U.S. wholesale distributors, and increased provisions

for accounts receivable.

Sales in the first quarter of fiscal 2009, which is seasonally

the lowest quarter of the fiscal year for Gildan's activewear

sales, amounted to U.S. $184.0 million, down 26.5% from U.S. $250.5

million in the first quarter of last year. Increased market share

penetration in the U.S. screenprint channel was more than offset by

an 11.6% decline in overall industry unit shipments in the channel

and the significant impact of inventory reductions during the

quarter by U.S. wholesale distributors. Sales were also negatively

impacted by more unfavourable activewear product-mix. Sales of

socks included an extra two weeks of sales from the Prewett

acquisition, which was effective from October 15, 2007. However,

unit sales of socks decreased due to the elimination of

unprofitable sock product-lines during fiscal 2008, and a reduction

in inventories carried by retailer. Unit sales of Gildan socks from

the Company's major retail customers to consumers were essentially

unchanged compared with the previous year, in spite of weak overall

retail market conditions.

The table below summarizes data from the S.T.A.R.S. report

produced by ACNielsen Market Decisions, which tracks unit volume

shipments from wholesale distributors to U.S. screenprinters, for

the calendar quarter ended December 31, 2008:

Gildan Gildan Gildan Industry

Market Market Unit Growth Unit Growth

Share Share Q1 2009 vs. Q1 2009 vs.

Q1 2009 Q1 2008 Q1 2008 Q1 2008

----------------------------------------------------------------------

53.3% 49.3% All activewear products (4.7%) (11.6%)

54.2% 50.0% T-shirts (3.8%) (10.9%)

51.9% 49.1% Fleece (7.1%) (12.0%)

35.4% 35.4% Sport shirts (25.7%) (25.8%)

Gross margins in the first quarter were 21.1%, compared to 26.2%

after recasting prior year comparatives to reflect the

reclassification of manufacturing depreciation and certain items

from selling, general and administrative expenses to cost of sales.

Recast prior year comparative figures have been provided in the

Investor Relations section of the Company's website. Compared to

the recast gross margins for the first quarter of fiscal 2008, the

decline in gross margins was due to significantly higher cotton and

energy costs, more unfavourable activewear product-mix due to a

lower proportion of high-valued fleece and long-sleeve T-shirts,

higher depreciation expenses absorbed in cost of sales, a higher

proportion of sales of socks compared to activewear, the temporary

impact of additional packaging costs related to a transition in

sock private label brands for Gildan's largest retail customer,

which is being implemented in the second half of fiscal 2009, and

higher labour costs, partially offset by increased manufacturing

efficiencies, the non-recurrence of sock inventory write-downs in

the first quarter of fiscal 2008, and higher net selling prices

compared to the first quarter of last year.

Selling, general and administrative expenses, after reflecting

the reclassification of certain items in both years as disclosed in

the Company's website, were U.S. $33.5 million, compared with U.S.

$31.7 million in the first quarter of fiscal 2008. The approximate

U.S. $2 million impact of an increase in accounts receivable

provisions, together with higher professional and legal fees, were

partially offset by lower volume-related distribution expenses and

the impact of the reduction in the value of the Canadian dollar on

Gildan's corporate administrative expenses.

EPS Outlook and Guidance for Fiscal 2009

Although the Company initiated EPS guidance for fiscal 2009 in

mid-December, and has so far met its EPS expectations in spite of

difficult market conditions, the Company believes that it is

prudent to suspend its earnings guidance due to increasing

uncertainty regarding the severity and duration of the current

economic and financial crisis. In addition, continuing weak end-use

demand and tighter credit markets may affect the financial

condition and liquidity of wholesale customers, resulting in

increased credit risk and a need for the Company to prudently

balance short-term market share considerations with such increased

customer credit risk.

Gildan's operations are performing well, and the Company

believes that its strong competitive positioning, combined with its

strong balance-sheet and free cash flow generation, will allow it

to take advantage of potential opportunities resulting from any

industry rationalization or restructuring that may occur as a

result of a prolonged industry downturn and crisis in

liquidity.

Cash Flows and Capital Expenditures

The Company generated free cash flow of approximately U.S. $3

million in the first quarter of fiscal 2009, after capital

expenditures and the payment of prior year income taxes pursuant to

the Company's settlement of its transfer pricing audit with the

Canada Revenue Agency. Cash flows from operating activities before

depreciation expenses and other non-cash items, together with

approximately U.S. $120 million of cash inflows from the collection

of accounts receivables in the quarter, were used to finance an

approximate U.S. $66 million increase in inventories to meet

anticipated sales demand and approximately U.S. $14 million of

capital expenditures, as well as to pay approximately U.S. $24

million of income taxes, and U.S. $31 million of accounts payable

and accrued liabilities.

The Company ended the first quarter of fiscal 2009 with net

indebtedness of approximately U.S. $37 million, and continues to

have significant financing capacity and flexibility under its

revolving bank credit facility, which matures in 2013. A major

objective for the Company in fiscal 2009 will be to maintain its

strong financing position and ensure that it continues to be in a

position to take advantage of any strategic growth opportunities

that may arise.

Consequently, in the current economic environment, Gildan

intends to prudently manage its receivable and inventory levels and

its capital expenditures. Inventories will be carefully monitored

in relation to market conditions as they evolve, and the Company

will evaluate the need for production downtime as required to align

inventories with sales demand. The Company is continuing to defer

construction of its Rio Nance 5 facility until the economic outlook

in support of further major capacity expansion becomes clearer. In

addition, the Company has decided to proceed cautiously on other

expansion projects and defer the ramp-up of its second sock

manufacturing facility in Honduras. Gildan plans to transfer its

U.S. sock finishing operations to an existing leased facility in

Honduras in order to achieve planned manufacturing efficiencies

without incurring major capital costs or creating significant new

industry overcapacity. The Rio Nance 4 building will be utilized as

a distribution centre while sock capacity expansion requirements

are re-assessed. Capital expenditures for fiscal 2009 are now

projected at approximately U.S. $80 million, compared with the

Company's most recent forecast of U.S. $115 million.

Disclosure of Outstanding Share Data

As of January 31st, 2009, there were 120,637,793 common shares

issued and outstanding along with 1,081,328 stock options and

890,112 dilutive restricted share units (Treasury RSUs)

outstanding. Each stock option entitles the holder to purchase one

common share at the end of the vesting period at a pre-determined

option price. Each Treasury RSU entitles the holder to receive one

common share at the end of the vesting period, without any monetary

consideration being paid to the Company. However, the vesting of

50% of the restricted share grant is dependent upon the financial

performance of the Company, relative to a benchmark group of

Canadian publicly-listed companies.

Information for shareholders

This release should be read in conjunction with Gildan's 2009

First Quarter MD&A dated February 11, 2009 (available at

http://gildan.com/corporate/IR/quarterlyReports.cfm) which is

incorporated by reference in this release, filed by Gildan with the

Canadian securities regulatory authorities and with the U.S.

Securities and Exchange Commission.

Gildan Activewear Inc. will hold a conference call to discuss

these results today at 5:00 PM EST. The conference call can be

accessed by dialing 800-261-3417 (Canada & U.S.) or

617-614-3673 (international) and entering passcode 13357882, or by

live sound webcast on Gildan's Internet site ("Investor Relations"

section) at the following address:

http://gildan.com/corporate/IR/webcastPresentations.cfm. If you are

unable to participate in the conference call, a replay will be

available starting that same day at 8:00 PM EST by dialing

888-286-8010 (Canada & U.S.) or 617-801-6888 (international)

and entering passcode 68475073, until Wednesday, February 18, 2009

at midnight, or by sound webcast on Gildan's Internet site for 30

days.

Profile

Gildan is a vertically-integrated marketer and manufacturer of

quality branded basic apparel. The Company is the leading supplier

of activewear for the screenprint channel in the U.S. and Canada.

It is also a leading supplier to this market in Europe, and is

establishing a growing presence in Mexico and the Asia-Pacific

region. The Company sells T-shirts, sport shirts and fleece in

large quantities to wholesale distributors as undecorated "blanks",

which are subsequently decorated by screenprinters with designs and

logos. Consumers ultimately purchase the Company's products, with

the Gildan label, in venues such as sports, entertainment and

corporate events, and travel and tourism destinations. The

Company's products are also utilized for work uniforms and other

end-uses to convey individual, group and team identity. The Company

is also a leading supplier of private label and Gildan branded

socks primarily sold to mass-market retailers. In addition, Gildan

has an objective to become a significant supplier of men's and

boys' underwear and undecorated activewear products to mass-market

retailers in North America.

Forward-Looking Statements

Certain statements included in this press release, in particular

in the "Outlook" section, constitute "forward-looking statements"

within the meaning of the U.S. Private Securities Litigation Reform

Act of 1995 and Canadian securities legislation and regulations,

and are subject to important risks, uncertainties and assumptions.

This forward-looking information includes, amongst others,

information with respect to our objectives and the strategies to

achieve these objectives, as well as information with respect to

our beliefs, plans, expectations, anticipations, estimates and

intentions. Forward-looking statements generally can be identified

by the use of conditional or forward-looking terminology such as

"may", "will", "expect", "intend", "estimate", "project", "

assume", "anticipate", "plan", "foresee", "believe" or "continue"

or the negatives of these terms or variations of them or similar

terminology. We refer you to the Company's filings with the

Canadian securities regulatory authorities and the U.S. Securities

and Exchange Commission, as well as the "Risks and Uncertainties"

section and the risks described under the section "Financial Risk

Management" of the 2008 Annual MD&A, as subsequently updated in

our first quarter 2009 interim MD&A, for a discussion of the

various factors that may affect the Company's future results.

Material factors and assumptions that were applied in drawing a

conclusion or making a forecast or projection are also set out

throughout this press release, in particular in the "Outlook"

section.

Forward-looking information is inherently uncertain and results

or events predicted in such forward-looking information may differ

materially from actual results or events. Material factors, which

could cause actual results or events to differ materially from a

conclusion, forecast or projection in such forward-looking

information, include, but are not limited to: general economic

conditions such as commodity prices, currency exchange rates,

interest rates and other factors over which we have no control; the

impact of economic and business conditions, industry trends and

other external, political and social factors in the countries in

which we operate; the intensity of competitive activity; changes in

environmental, tax, trade, employment and other laws and

regulations; our ability to implement our strategies and plans; our

ability to complete and successfully integrate acquisitions; our

reliance on a small number of significant customers; changes in

consumer preferences, customer demand for our products and our

ability to maintain customer relationships and grow our business;

the fact that our customers do not commit to minimum quantity

purchases; the seasonality of our business; our ability to attract

and retain key personnel; our reliance on computerized information

systems; changes in accounting policies and estimates; and

disruption to manufacturing and distribution activities due to

labour disruptions, bad weather, natural disasters and other

unforeseen adverse events.

These factors may cause the Company's actual performance and

financial results in future periods to differ materially from any

estimates or projections of future performance or results expressed

or implied by such forward-looking statements. Forward-looking

statements do not take into account the effect that transactions or

non-recurring or other special items announced or occurring after

the statements are made have on the Company's business. For

example, they do not include the effect of business dispositions,

acquisitions, other business transactions, asset writedowns or

other charges announced or occurring after forward-looking

statements are made. The financial impact of such transactions and

non-recurring and other special items can be complex and

necessarily depends on the facts particular to each of them.

We believe that the expectations represented by our

forward-looking statements are reasonable, yet there can be no

assurance that such expectations will prove to be correct. The

purpose of the forward-looking statements is to provide the reader

with a description of management's expectations regarding the

Company's fiscal 2009 financial performance and may not be

appropriate for other purposes. Furthermore, unless otherwise

stated, the forward-looking statements contained in this press

release are made as of the date of this press release, and we do

not undertake any obligation to update publicly or to revise any of

the included forward-looking statements, whether as a result of new

information, future events or otherwise unless required by

applicable legislation or regulation. The forward-looking

statements contained in this press release are expressly qualified

by this cautionary statement.

Non-GAAP Financial Measures

This release includes reference to certain non-GAAP financial

measures such as free cash flow and net indebtedness. These

non-GAAP measures do not have any standardized meanings prescribed

by Canadian GAAP and are therefore unlikely to be comparable to

similar measures presented by other companies. Accordingly, they

should not be considered in isolation. The terms and definitions of

the non-GAAP measures used in this press release and a

reconciliation of each non-GAAP measure to the most directly

comparable GAAP measure are provided below.

Free cash flow

Free cash flow is defined as cash from operating activities

including net changes in non-cash working capital balances, less

cash flow used in investing activities excluding business

acquisitions. We consider free cash flow to be an important

indicator of the financial strength and performance of our

business, because it shows how much cash is available after capital

expenditures to repay debt and to reinvest in our business. We

believe this measure is commonly used by investors and analysts

when valuing a business and its underlying assets.

(in US$ millions) Q1 2009 Q1 2008

---------------------------------------------------------------------

Cash flows from operating activities 15.9 103.4

Cash flows from investing activities (12.1) (169.2)

Add back:

Acquisition of Prewett - 126.8

Restricted cash related to acquisition (0.9) 10.0

---------------------------------------------------------------------

Free cash flow 2.9 71.0

---------------------------------------------------------------------

---------------------------------------------------------------------

Certain minor rounding variances exist between the financial statements

and this summary.

Net indebtedness

We consider total indebtedness and net indebtedness to be important

indicators of the financial leverage of the Company.

(in US$ millions) Q1 2009 Q4 2008 Q1 2008

---------------------------------------------------------------------

Current portion of long-term debt 3.0 3.6 4.6

Long-term debt 48.2 49.4 126.2

---------------------------------------------------------------------

Total indebtedness 51.2 53.0 130.8

Cash and cash equivalents (14.4) (12.4) (13.6)

---------------------------------------------------------------------

Net indebtedness 36.8 40.6 117.2

---------------------------------------------------------------------

---------------------------------------------------------------------

Gildan Activewear Inc.

Interim Consolidated Balance Sheets

(in thousands of US dollars)

January 4, 2009 October 5, 2008 December 30, 2007

--------------------------------------------------------------------------

(unaudited) (audited) (unaudited)

(Recast-note 3) (Recast-note 3)

Current assets:

Cash and cash

equivalents $14,377 $12,357 $13,598

Accounts receivable 98,842 222,158 152,001

Inventories (note 5) 386,378 316,172 294,541

Prepaid expenses and

deposits 8,550 10,413 8,775

Future income taxes - - 3,864

--------------------------------------------------------------------------

508,147 561,100 472,779

Property, plant and

equipment 435,230 436,516 413,303

Intangible assets 59,154 59,954 65,663

Other assets 14,996 17,277 18,377

Assets held for sale

(note 8) 10,497 10,497 12,681

Goodwill 6,709 6,709 -

Future income taxes 8,751 9,283 10,489

--------------------------------------------------------------------------

Total assets $1,043,484 $1,101,336 $993,292

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Current liabilities:

Accounts payable and

accrued liabilities $124,647 $155,669 $118,880

Income taxes payable 17,394 46,627 5,613

Current portion of

long-term debt 3,050 3,556 4,589

--------------------------------------------------------------------------

145,091 205,852 129,082

Long-term debt 48,195 49,448 126,231

Future income taxes 26,516 27,331 40,760

Non-controlling interest

in consolidated joint

venture 6,773 7,162 7,223

Contingencies (note 12)

Shareholders' equity:

Share capital 90,389 89,377 88,463

Contributed surplus 6,733 6,728 4,505

Retained earnings 693,539 689,190 570,780

Accumulated other

comprehensive income 26,248 26,248 26,248

--------------------------------------------------------------------------

719,787 715,438 597,028

--------------------------------------------------------------------------

816,909 811,543 689,996

--------------------------------------------------------------------------

Total liabilities and

shareholders' equity $1,043,484 $1,101,336 $993,292

--------------------------------------------------------------------------

--------------------------------------------------------------------------

See accompanying notes to interim consolidated financial statements.

Gildan Activewear Inc.

Interim Consolidated Statements of Earnings and Comprehensive Income

(In thousands of US dollars, except per share data)

Three months ended

January 4, 2009 December 30, 2007

--------------------------------------------------------------------------

(unaudited) (unaudited)

(Recast-notes

1 and 3)

Net sales $183,995 $250,457

Cost of sales 145,105 184,886

--------------------------------------------------------------------------

Gross profit 38,890 65,571

Selling, general and administrative

expenses 33,479 31,698

Restructuring and other charges (note 8) 925 823

--------------------------------------------------------------------------

Operating income 4,486 33,050

Financial expense, net (note 11(b)) 189 2,739

Non-controlling interest in consolidated

joint venture (389) 291

--------------------------------------------------------------------------

Earnings before income taxes 4,686 30,020

Income taxes 337 2,080

--------------------------------------------------------------------------

Net earnings and comprehensive income $4,349 $27,940

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Basic EPS (note 9) $0.04 $0.23

Diluted EPS (note 9) $0.04 $0.23

See accompanying notes to interim consolidated financial statements.

Gildan Activewear Inc.

Interim Consolidated Statements of Cash Flows

(In thousands of US dollars)

Three months ended

January 4, 2009 December 30, 2007

--------------------------------------------------------------------------

(unaudited) (unaudited)

(Recast-note 3)

Cash flows from (used in) operating

activities:

Net earnings $4,349 $27,940

Adjustments for:

Depreciation and amortization

(note 10(b)) 15,887 12,381

Variation of depreciation included

in inventories (note 10(b)) (4,415) (1,421)

Restructuring charges related to

assets held for sale and property,

plant and equipment - (289)

Loss on disposal of assets held for

sale and property, plant and

equipment 21 59

Stock-based compensation costs 747 678

Future income taxes (178) (1,235)

Non-controlling interest (389) 291

Unrealized net gain on foreign exchange and

forward foreign exchange contracts (1,224) (239)

--------------------------------------------------------------------------

14,798 38,165

Changes in non-cash working capital

balances:

Accounts receivable 119,735 83,347

Inventories (65,791) (9,734)

Prepaid expenses and deposits 1,863 554

Accounts payable and accrued liabilities (30,768) (11,506)

Income taxes payable (23,935) 2,568

--------------------------------------------------------------------------

15,902 103,394

Cash flows from (used in) financing

activities:

Increase in amounts drawn under

revolving long-term credit facility - 71,000

Decrease in bank indebtedness - (1,261)

Increase in other long-term debt 36 1,561

Repayment of other long-term debt (1,795) (1,401)

Proceeds from the issuance of shares 270 276

--------------------------------------------------------------------------

(1,489) 70,175

Cash flows from (used in) investing

activities:

Purchase of property, plant and equipment (13,663) (34,150)

Acquisition of V.I. Prewett & Son, Inc. - (126,819)

Restricted cash related to acquisition 939 (10,000)

Proceeds on disposal of assets held for

sale 212 421

Net decrease in other assets 376 1,381

--------------------------------------------------------------------------

(12,136) (169,167)

Effect of exchange rate changes on cash

and cash equivalents denominated in

foreign currencies (257) (54)

--------------------------------------------------------------------------

Net increase in cash and cash equivalents

during the period 2,020 4,348

Cash and cash equivalents, beginning of

period 12,357 9,250

--------------------------------------------------------------------------

Cash and cash equivalents, end of period $14,377 $13,598

--------------------------------------------------------------------------

--------------------------------------------------------------------------

See accompanying notes to interim consolidated financial statements.

Gildan Activewear Inc.

Interim Consolidated Statement of Shareholders' Equity

Three months ended January 4, 2009 and December 30, 2007

(in thousands or thousands of US dollars)

Accumulated

other Total

Share capital Contri- compre- share-

---------------- buted hensive Retained holders'

Number Amount surplus income earnings equity

--------------------------------------------------------------------------

Balance,

September 30,

2007, as

previously

reported 120,419 $88,061 $3,953 $26,248 $545,388 $663,650

Cumulative

effect of

adopting a

new

accounting

policy

(note 3) - - - - (2,548) (2,548)

--------------------------------------------------------------------------

Balance,

September 30,

2007, as

recast 120,419 88,061 3,953 26,248 542,840 661,102

Stock-based

Compensation

related to

stock options

and Treasury

restricted

share units - - 678 - - 678

Shares issued

under employee

share

purchase plan 2 52 - - - 52

Shares issued

pursuant to

exercise of

stock options 28 224 - - - 224

Shares issued

pursuant to

exercise of

Treasury

Restricted

share units 8 - - - - -

Ascribed value

credited to

share capital

from exercise

of Treasury

restricted

share units - 126 (126) - - -

Net earnings,

recast

(note 3) - - - - 27,940 27,940

--------------------------------------------------------------------------

Balance,

December 30,

2007, as

recast

(unaudited) 120,457 $88,463 $4,505 $26,248 $570,780 $689,996

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Accumulated

other Total

Share capital Contri- compre- share-

---------------- buted hensive Retained holders'

Number Amount surplus income earnings equity

--------------------------------------------------------------------------

Balance,

October 5,

2008, as

previously

reported 120,536 $89,377 $6,728 $26,248 $689,980 $812,333

Cumulative

effect of

adopting a

new

accounting

policy

(note 3) - - - - (790) (790)

--------------------------------------------------------------------------

Balance,

October 5,

2008, as

recast 120,536 89,377 6,728 26,248 689,190 811,543

Stock-based

Compensation

related to

stock

options and

Treasury

restricted

share units - - 747 - - 747

Shares issued

under

employee

share

purchase plan 10 265 - - - 265

Shares issued

pursuant to

exercise of

stock options 2 5 - - - 5

Shares issued

pursuant to

exercise of

Treasury

Restricted

share units 81 - - - - -

Ascribed value

credited to

share capital

from exercise

of Treasury

restricted

share units - 742 (742) - - -

Net earnings - - - - 4,349 4,349

--------------------------------------------------------------------------

Balance,

January 4,

2009

(unaudited) 120,629 $90,389 $6,733 $26,248 $693,539 $816,909

--------------------------------------------------------------------------

--------------------------------------------------------------------------

See accompanying notes to interim consolidated financial statements.

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

(For the period ended January 4, 2009)

(Tabular amounts in thousands or thousands of US dollars, except per share

data or unless otherwise noted)

(unaudited)

1. Basis of presentation

The accompanying unaudited interim consolidated financial

statements have been prepared in accordance with Canadian generally

accepted accounting principles for interim financial information

and include all normal and recurring entries that are necessary for

a fair presentation of the statements. Accordingly, they do not

include all of the information and footnotes required by Canadian

generally accepted accounting principles for complete financial

statements, and should be read in conjunction with the Company's

annual consolidated financial statements for the year ended October

5, 2008.

The Company's revenues and income are subject to seasonal

variations. Consequently, the results of operations for the first

fiscal quarter are traditionally not indicative of the results to

be expected for the full fiscal year.

All amounts in the attached notes are unaudited unless

specifically identified.

Statement of earnings classification:

Effective the first quarter of fiscal 2009, the Company changed

certain classifications of its Statement of Earnings and

Comprehensive Income with retrospective application to comparative

figures presented for prior periods. These new classifications

align the results of operations by function and incorporate

presentation requirements under Canadian Institute of Chartered

Accountants (CICA) Handbook Section 3031, Inventories, which has

been adopted effective the first quarter of fiscal 2009. Pursuant

to the requirements of Section 3031, depreciation expense related

to manufacturing activities is included in Cost of sales. The

remaining depreciation and amortization expense has been

reclassified to Selling, general and administrative expenses.

Depreciation and amortization expense is therefore no longer

presented as a separate caption on the Statement of Earnings and

Comprehensive Income. In addition, the Company reclassified certain

other items in its Statement of Earnings and Comprehensive Income.

Outbound freight, previously classified within Selling, general and

administrative expenses, is now reported within Cost of sales.

Also, a new caption is now presented for Financial expenses and

income, which includes interest income and expenses, foreign

exchange gains and losses (including mark-to-market adjustments of

forward foreign exchange contracts), and other financial charges.

Interest expense net of interest income was previously reported as

a separate caption, while foreign exchange gains and losses

(including mark-to-market adjustments of forward foreign exchange

contracts) were previously included in Cost of sales. Other

financial charges were previously reflected in Selling, general and

administrative expenses. These changes in classification have

resulted in a decrease of $13.4 million and $0.9 million in Gross

profit and Selling, general and administrative expenses,

respectively, compared to the amounts previously reported for the

first quarter of fiscal 2008. For the period ended December 30,

2007, the decrease of $13.4 million in Gross profit is due to

reclassifications of $9.5 million of depreciation and amortization

expense, $3.6 million of outbound freight and $0.3 million of

foreign exchange gains and other financial income. There has been

no impact on net earnings as a result of these changes in

classification.

2. Significant accounting policies:

Except for the adoption of the new accounting standards

described in Note 3 below and the Statement of earnings

classification changes in Note 1 above, the Company applied the

same accounting policies in the preparation of the interim

consolidated financial statements, as disclosed in Note 1(a) and

Note 2 of its audited consolidated financial statements for the

year ended October 5, 2008.

3. Adoption of new accounting standards:

Inventories:

Effective the commencement of its 2009 fiscal year, the Company

adopted CICA Handbook Section 3031, Inventories, which replaces

Section 3030, Inventories, and harmonizes the Canadian standards

related to inventories with International Financial Reporting

Standards (IFRS). This Section, which was issued in June 2007,

provides changes to the measurement of, and more extensive guidance

on, the determination of cost, including allocation of overhead;

narrows the permitted cost formulas; requires impairment testing;

clarifies that major spare parts not in use should be included in

property, plant and equipment; and expands the disclosure

requirements to increase transparency. The Company compared the

requirements of this new Section with its current measurement and

determination of costs and concluded that the new Section did not

have a significant impact on the results of operations. The Company

previously included and will continue to include the amount of

depreciation related to manufacturing activities as a component of

the cost of inventories. However, the new Section requires

depreciation expense related to inventories which have been sold to

be presented in Cost of sales. As a result, effective the first

quarter of fiscal 2009, depreciation expense related to

manufacturing activities has been reclassified to Cost of sales.

See the section, Statement of earnings classification, in Note 1

above and Note 5 for the new disclosure requirements related to the

adoption of Section 3031.

General Standards of Financial Statement Presentation:

Effective the commencement of its 2009 fiscal year, the Company

adopted the amendment of CICA Handbook Section 1400, General

Standards of Financial Statement Presentation, which is effective

for interim periods beginning on or after October 1, 2008 and which

includes requirements to assess and disclose the Company's ability

to continue as a going concern. The adoption of the amended Section

did not have an impact on the interim consolidated financial

statements of the Company.

Goodwill and intangible assets:

In February 2008, the CICA issued Handbook Section 3064,

Goodwill and Intangible Assets, replacing Section 3062, Goodwill

and Other Intangible Assets, and Section 3450, Research and

Development Costs. Section 3064 establishes revised standards for

the recognition, measurement, presentation and disclosure of

goodwill and intangible assets. The new Section also provides

guidance for the treatment of preproduction and start-up costs and

requires that these costs be expensed as incurred. This Section

applies to interim and annual financial statements relating to the

Company's fiscal year beginning on October 6, 2008 and has been

adopted on a retrospective basis effective from the first quarter

of fiscal 2009.

Prior to the adoption of Section 3064, the Company deferred and

amortized plant start-up costs on a straight-line basis over two

years. The impact of adopting this Section, on a retrospective

basis, is an increase of $0.5 million in net earnings for the

three-month period ended December 30, 2007, with no change in the

reported basic and diluted earnings per share, and a decrease of

$0.8 million and $2.5 million in shareholders' equity at October 5,

2008 and September 30, 2007, respectively.

4. New Accounting Pronouncements:

Credit risk and the fair value of financial assets and financial

liabilities:

On January 20, 2009, the Emerging Issues Committee (EIC) of the

Canadian Accounting Standards Board (AcSB) issued EIC Abstract 173,

Credit Risk and Fair Value of Financial Assets and Financial

Liabilities, which establishes that an entity's own credit risk and

the credit risk of the counterparty should be taken into account in

determining the fair value of financial assets and financial

liabilities, including derivative instruments. EIC 173 should be

applied retrospectively without restatement of prior years to all

financial assets and liabilities measured at fair value in interim

and annual financial statements for periods ending on or after

January 20, 2009 and is applicable to the Company for its second

quarter of fiscal 2009 with retrospective application, if any, to

the beginning of its current fiscal year. The Company is currently

assessing the impact of EIC 173 on its consolidated financial

statements.

Business combinations:

In January 2009, the CICA issued Handbook Section 1582, Business

Combinations, which replaces Section 1581, Business Combinations,

and provides the equivalent to IFRS 3, Business Combinations

(January 2008). The new Section expands the definition of a

business subject to an acquisition and establishes significant new

guidance on the measurement of consideration given, and the

recognition and measurement of assets acquired and liabilities

assumed in a business combination. The new Section requires that

all business acquisitions be measured at the full fair value of the

acquired entity at the acquisition date even if the business

combination is achieved in stages, or if less than 100 percent of

the equity interest in the acquiree is owned at the acquisition

date. The measurement of equity consideration given in a business

combination will no longer be based on the average of the fair

value of the shares a few days before and after the day the terms

and conditions have been agreed to and the acquisition announced,

but rather at the acquisition date. Subsequent changes in fair

value of contingent consideration classified as a liability will be

recognized in earnings and not as an adjustment to the purchase

price. Restructuring and other direct costs of a business

combination are no longer considered part of the acquisition

accounting. Instead, such costs will be expensed as incurred,

unless they constitute the costs associated with issuing debt or

equity securities. The Section applies prospectively to business

combinations for which the acquisition date is on or after the

beginning of the first annual reporting period beginning on or

after January 1, 2011. Earlier adoption is permitted. This new

Section will only have an impact on our consolidated financial

statements for future acquisitions that will be made in periods

subsequent to the date of adoption.

Consolidated financial statements and non-controlling

interests:

In January 2009, the CICA issued Handbook Section 1601,

Consolidated Financial Statements, and Handbook Section 1602,

Non-Controlling Interests, which together replace Section 1600,

Consolidated Financial Statements. These two Sections are the

equivalent to the corresponding provisions of International

Accounting Standard 27, Consolidated and Separate Financial

Statements (January 2008). Section 1602 applies to the accounting

for non-controlling interests and transactions with non-controlling

interest holders in consolidated financial statements. The new

Sections require that, for each business combination, the acquirer

measure any non-controlling interest in the acquiree either at fair

value or at the non-controlling interest's proportionate share of

the acquiree's identifiable net assets. The new Sections also

require non-controlling interest to be presented as a separate

component of shareholders' equity. Under Section 1602,

non-controlling interest in income is not deducted in arriving at

consolidated net income or other comprehensive income. Rather, net

income and each component of other comprehensive income are

allocated to the controlling and non-controlling interests based on

relative ownership interests. These Sections apply to interim and

annual consolidated financial statements relating to fiscal years

beginning on or after January 1, 2011, and should be adopted

concurrently with Section 1582. The Company is currently assessing

the future impact of these new Sections on its consolidated

financial statements.

International Financial Reporting Standards:

In February 2008, Canada's Accounting Standards Board (AcSB)

confirmed that IFRS, as issued by the International Accounting

Standards Board, will replace Canadian generally accepted

accounting principles for publicly accountable enterprises

effective for fiscal years beginning on or after January 1, 2011.

As a result, the Company will be required to change over to IFRS

for its fiscal 2012 interim and annual financial statements with

comparative information for fiscal 2011.

5. Inventories:

Inventories were comprised of the following:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

January 4, 2009 October 5, 2008 December 30, 2007

--------------------------------------------------------------------------

Raw materials and

spare parts

inventories $59,449 $59,742 $47,495

Work in process 30,639 29,086 32,956

Finished goods 296,290 227,344 214,090

--------------------------------------------------------------------------

Total $386,378 $316,172 $294,541

--------------------------------------------------------------------------

--------------------------------------------------------------------------

The amount of inventory recognized as an expense and included in

Cost of sales for the three-month periods ended January 4, 2009 and

December 30, 2007 was $142.9 million and $181.3 million,

respectively, which included an expense of $0.5 million and $1.7

million, respectively, related to the write-down of slow-moving

inventory.

6. Stock-based compensation:

The Company's Long Term Incentive Plan (the "LTIP") includes

stock options and restricted share units. The LTIP allows the Board

of Directors to grant stock options, dilutive restricted share

units ("Treasury RSUs") and non-dilutive restricted share units

("Non-Treasury RSUs") to officers and other key employees of the

Company and its subsidiaries.

Changes in outstanding stock options were as follows:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Weighted average

Number exercise price

--------------------------------------------------------------------------

(in Canadian dollars)

Options outstanding, October 5, 2008 878 $14.23

Granted 233 23.49

Exercised (2) 4.32

Forfeited (18) 30.96

--------------------------------------------------------------------------

Options outstanding, January 4, 2009 1,091 $15.94

--------------------------------------------------------------------------

--------------------------------------------------------------------------

As at January 4, 2009, 657 of the outstanding options were

exercisable at the weighted average price of CA$7.72. Based on the

Black-Scholes option pricing model, the grant date weighted average

fair value of the options granted during the first quarter ended

January 4, 2009 was CA$9.99.

Changes in outstanding Treasury RSUs were as follows:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Weighted average

Number fair value per unit

--------------------------------------------------------------------------

Treasury RSUs outstanding, October 5, 2008 979 $17.43

Granted 50 16.98

Settled through the issuance of common

shares (81) 9.21

Forfeited (38) 27.70

--------------------------------------------------------------------------

Treasury RSUs outstanding, January 4, 2009 910 $17.70

--------------------------------------------------------------------------

--------------------------------------------------------------------------

As at January 4, 2009, none of the awarded and outstanding

Treasury RSUs were vested.

The compensation expense recorded for the three-month periods

ended January 4, 2009 and December 30, 2007, respectively, was $0.7

million and $0.7 million, in respect of the Treasury RSUs and stock

options. The counterpart has been recorded as contributed surplus.

When the shares are issued to the employees, the amounts previously

credited to contributed surplus are reclassified to share

capital.

Changes in outstanding Non-Treasury RSUs were as follows:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Number

--------------------------------------------------------------------------

Non-Treasury RSUs outstanding, October 5, 2008 99

Granted 106

Settled (1)

Forfeited (7)

--------------------------------------------------------------------------

Non-Treasury RSUs outstanding, January 4, 2009 197

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Non-Treasury RSUs have the same features as Treasury RSUs,

except that their vesting period is a maximum of three years and

they will be settled in cash at the end of the vesting period. The

settlement amount will be based on the Company's stock price at the

vesting date. As of January 4, 2009, the weighted average fair

value per non-Treasury RSU was $12.20. No common shares are issued

from treasury under such awards and they are therefore

non-dilutive. As of January 4, 2009, none of the awarded and

outstanding non-Treasury RSUs were vested.

The compensation (recovery) expense recorded for the three-month

periods ended January 4, 2009 and December 30, 2007, respectively,

was $(0.2) million and $0.3 million, in respect of the non-Treasury

RSUs. The counterpart has been recorded in Accounts payable and

accrued liabilities.

7. Guarantees:

The Company, and some of its subsidiaries, have granted

corporate guarantees, irrevocable standby letters of credit and

surety bonds, to third parties to indemnify them in the event the

Company and some of its subsidiaries do not perform their

contractual obligations. As at January 4, 2009, the maximum

potential liability under these guarantees was $9.9 million, of

which $3.9 million was for surety bonds and $6.0 million was for

corporate guarantees and standby letters of credit. The standby

letters of credit mature at various dates up to fiscal 2010, the

surety bonds are automatically renewed on an annual basis and the

corporate guarantees mature at various dates up to fiscal 2010.

As at January 4, 2009, the Company has recorded no liability

with respect to these guarantees, as the Company does not expect to

make any payments for the aforementioned items. Management has

determined that the fair value of the non-contingent obligations

requiring performance under the guarantees in the event that

specified triggering events or conditions occur approximates the

cost of obtaining the standby letters of credit and surety

bonds.

8. Restructuring and other charges and assets held for sale:

In fiscal 2006 and 2007, the Company announced the closure,

relocation and consolidation of manufacturing and distribution

facilities in Canada, the United States and Mexico, as well as the

relocation of its corporate office. In addition, in the third

quarter of fiscal 2008, the Company announced the planned

consolidation of its Haiti sewing operation to be finalized in the

first half of fiscal 2009. The costs incurred in connection with

these initiatives have been recorded as restructuring and other

charges.

Restructuring charges of $0.9 million in the first quarter of

fiscal 2009 include $0.3 million of additional severance relating

to the closures noted above, and $0.6 million of exit costs, mainly

for the closure of the Haiti sewing facility. Restructuring charges

of $0.8 million in the first quarter of fiscal 2008 were composed

of $1.1 million of other exit costs, primarily related to the

closures noted above, including carrying and dismantling costs

associated with assets held for sale less a gain of $0.3 million

recognized on the disposal of assets held for sale.

Assets held for sale of $10.5 million as at January 4, 2009

(October 5, 2008 - $10.5 million; December 30, 2007 - $12.7

million) include property, plant and equipment at these various

locations. The Company expects to incur additional carrying costs

relating to these assets, which will be accounted for as

restructuring charges as incurred during fiscal 2009, until all

property, plant and equipment related to the closures are disposed

of. Any gains or losses on the disposition of the assets held for

sale will also be accounted for as restructuring charges as

incurred.

9. Earnings per share:

A reconciliation between basic and diluted earnings per share is

as follows:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Three months ended

January 4, 2009 December 30, 2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Basic earnings per share:

Basic weighted average number of

common shares outstanding 120,573 120,428

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Basic earnings per share $0.04 $0.23

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Diluted earnings per share:

Basic weighted average number of

common shares outstanding 120,573 120,428

Plus impact of stock options and

Treasury RSUs 835 1,228

--------------------------------------------------------------------------

Diluted weighted average number of

common shares outstanding 121,408 121,656

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Diluted earnings per share $0.04 $0.23

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Excluded from the above calculation for the three months ended

January 4, 2009 are 467 stock options and 189 Treasury RSUs, which

were deemed to be anti-dilutive. All stock options and Treasury

RSUs outstanding for the three months ended December 30, 2007 were

dilutive.

10. Other information:

(a) Supplemental cash flow disclosure:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Three months ended

January 4, 2009 December 30, 2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Cash paid during the period for:

Interest $947 $2,826

Income taxes 24,014 917

--------------------------------------------------------------------------

--------------------------------------------------------------------------

--------------------------------------------------------------------------

--------------------------------------------------------------------------

January 4, 2009 October 5, 2008 December 30, 2007

(audited)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Balance of non-cash

transactions:

Additions to

property, plant

and equipment

included in

Accounts payable

and accrued

liabilities $1,823 $1,720 $1,662

Ascribed value

credited to share

capital from

issuance of

Treasury RSUs 742 190 126

Proceeds on disposal

of long-lived assets

in Other assets 1,236 1,382 1,723

Proceeds on disposal of

long-lived assets in

Accounts receivable - - 1,050

Business acquisition in

Accounts payable and

accrued liabilities 1,196 1,196 -

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Cash and cash equivalents

consist of:

Cash balances with banks $10,130 $8,068 $6,495

Short-term investments,

bearing interest at

rates up to 0.3% at

January 4, 2009, up to

2.22% at October 5, 2008

and up to 4.5% at

December 30, 2007 4,247 4,289 7,103

--------------------------------------------------------------------------

$14,377 $12,357 $13,598

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(b) Depreciation and amortization:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Three months ended

January 4, 2009 December 30, 2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Depreciation and amortization of

property, plant and equipment and

intangible assets $15,887 $12,381

Adjustment for the variation of

depreciation of property, plant and

equipment included in inventories at

the beginning and end of the period (4,415) (1,421)

--------------------------------------------------------------------------

Depreciation and amortization included

in the interim consolidated statements

of earnings and comprehensive income $11,472 $10,960

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Consists of:

Depreciation of property, plant and

equipment $10,550 $10,211

Amortization of intangible assets 800 737

Amortization of deferred financing

costs and other 122 12

--------------------------------------------------------------------------

Depreciation and amortization included

in the interim consolidated statements

of earnings and comprehensive income $11,472 $10,960

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(c) The Company recorded bad debt expense of $1.8 million and

nil for the three-month periods ended January 4, 2009 and December

30, 2007, respectively. Bad debt expense is included in Selling,

general and administrative expenses in the interim consolidated

statements of earnings and comprehensive income.

(d) The Company expensed $2.0 million and $1.4 million in Cost

of sales for the three months ended January 4, 2009 and December

30, 2007, respectively, representing management's best estimate of

the cost of statutory severance and pre-notice benefit obligations

relating to employees located in the Caribbean Basin and Central

America.

11. Financial instruments:

Disclosures relating to exposure to risks, in particular credit

risk, liquidity risk, foreign currency risk and interest rate risk,

are included in the section entitled "Financial Risk Management" of

the Management's Discussion and Analysis of the Company's

operations, performance and financial condition as at and for the

three months ended January 4, 2009, which is included in the Gildan

Q1 2009 Quarterly Report to Shareholders along with these interim

consolidated financial statements. Accordingly, these disclosures

are incorporated into these interim consolidated financial

statements by cross-reference.

(a) Financial instruments - carrying values and fair values:

The fair values of financial assets and liabilities, together

with the carrying amounts included in the consolidated balance

sheet, are as follows:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

January 4, 2009 October 5, 2008

Carrying Fair Carrying Fair

amount value amount value

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Financial assets

Available-for-sale financial

assets:

Cash and cash equivalents $14,377 $14,377 $12,357 $12,357

Loans and receivables:

Accounts receivable - trade 84,171 84,171 206,276 206,276

Accounts receivable - other 14,671 14,671 15,882 15,882

Long-term receivable

included in Other assets 1,623 1,623 1,748 1,748

Restricted cash related to

Prewett acquisition included

in Other assets 9,061 9,061 10,000 10,000

Forward foreign exchange

contracts included in Other

assets 232 232 929 929

Financial liabilities

Other financial liabilities:

Accounts payable and accrued

liabilities 122,503 122,503 155,669 155,669

Long-term debt - bearing

interest at variable rates:

Revolving long-term credit

facility 45,000 45,000 45,000 45,000

Other long-term debt 5,195 5,195 6,319 6,319

Long-term debt - bearing

interest at fixed rates 1,050 1,050 1,685 1,685

Forward foreign exchange

contracts included in

Accounts payable and accrued

liabilities 2,144 2,144 - -

--------------------------------------------------------------------------

--------------------------------------------------------------------------

The Company has determined that the fair value of its short-term

financial assets and liabilities approximates their respective

carrying amounts as at the balance sheet dates because of the

short-term maturity of those instruments. The fair values of the

long-term receivable and the restricted cash related to the

acquisition of Prewett, and the Company's interest-bearing

financial liabilities also approximate their respective carrying

amounts. The fair value of forward foreign exchange contracts was

determined using observable market inputs.

(b) Financial expense, net:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Three months ended

January 4, 2009 December 30, 2007

--------------------------------------------------------------------------

Interest expense (i) $930 $2,794

Bank and other financial charges 239 262

Foreign exchange gain (ii) (980) (317)

--------------------------------------------------------------------------

$189 $2,739

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(i) Interest expense:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Three months ended

January 4, 2009 December 30, 2007

--------------------------------------------------------------------------

Interest expense on long-term

indebtedness $883 $2,955

Interest expense on short-term

indebtedness 71 15

Interest income on available-for-sale

financial assets (20) (180)

Interest income on loans and receivables (20) (20)

Other interest expense 16 24

--------------------------------------------------------------------------

$930 $2,794

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Interest income on available-for-sale financial assets consists

of interest earned from cash and cash equivalents invested in

short-term deposits. Interest income on loans and receivables

relates to interest earned on the Company's long-term receivable

included in Other assets.

(ii) Foreign exchange gain:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Three months ended

January 4, 2009 December 30, 2007

--------------------------------------------------------------------------

Loss (gain) relating to financial assets

and liabilities, including income taxes

payable $(3,281) $524

Unrealized loss (gain) relating to the

mark-to-market value of forward foreign

exchange contracts 2,842 (848)

Realized loss (gain) relating to forward

foreign exchange contracts (541) 7

--------------------------------------------------------------------------

$(980) $(317)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(c) Forward foreign exchange contracts:

The following table summarizes the Company's derivative

financial instruments relating to commitments to buy and sell

foreign currencies through forward foreign exchange contracts as at

January 4, 2009 and October 5, 2008:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Notional

foreign Average Notional Carrying and

January 4, currency exchange US fair value

2009 Maturity amount rate equivalent Asset Liability

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Buy CAD/

Sell USD 0-6 months 22,726 0.8856 $20,126 $- $(1,422)

6-12 months 24,420 0.8546 20,868 4 (722)

Sell EUR/

Buy USD 0-6 months 2,650 1.4743 3,907 228 -

--------------------------------------------------------------------------

$44,901 $232 $(2,144)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Notional

foreign Average Notional Carrying and

October 5, currency exchange US fair value

2008 Maturity amount rate equivalent Asset Liability

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Buy CAD/Sell

USD 0-6 months 5,483 0.9302 $5,100 $- $-

Buy EUR/Sell

GPB 0-6 months 962 1.3740 1,322 - -

Sell EUR/

Buy USD 0-6 months 5,650 1.4591 8,244 472 -

Sell GBP/

Buy USD 0-6 months 2,951 1.9177 5,659 457 -

--------------------------------------------------------------------------

$20,325 $929 $-

--------------------------------------------------------------------------

--------------------------------------------------------------------------

12. Contingencies:

The Company and certain of its senior officers have been named

as defendants in a number of proposed class action lawsuits filed

in the United States District Court for the Southern District of

New York. These U.S. lawsuits have been consolidated, and a

consolidated amended complaint has been filed. A proposed class

action has also been filed in the Ontario Superior Court of Justice

and a petition for authorization to commence a class action has

been filed in the Quebec Superior Court. Each of these U.S. and

Canadian lawsuits, which have yet to be certified as a class action

by the respective courts at this stage, seek to represent a class

comprised of persons who acquired the Company's common shares

between August 2, 2007 and April 29, 2008 and allege, among other

things, that the defendants misrepresented the Company's financial

condition and its financial prospects in its financial guidance

concerning the 2008 fiscal year, which was subsequently revised on

April 29, 2008. The U.S. lawsuits are based on United States

federal securities laws. In addition to pursuing common law claims,

the Ontario action proposes to seek leave from the Ontario court to

also bring statutory misrepresentation civil liability claims under

Ontario's Securities Act and an amended complaint along with

affidavit evidence for leave to pursue such statutory liability

claims and class certification have been filed. The Company

strongly contests the basis upon which these actions are predicated

and intends to vigorously defend its position. However, due to the

inherent uncertainties of litigation, it is not possible to predict

the final outcome of these lawsuits or determine the amount of any

potential losses, if any. No provision for contingent loss has been

recorded in the interim consolidated financial statements.

13. Segmented information:

The Company manufactures and sells activewear, socks and

underwear. The Company operates in one business segment, being

high-volume, basic, frequently replenished, non-fashion

apparel.

The Company has two customers accounting for at least 10% of

total net sales. For the three-month period ended January 4, 2009,

Customer A accounted for 24.6% of total net sales and Customer B

accounted for 23.5%. For the three-month period ended December 30,

2007, Customer A accounted for 21.2% of total net sales and

Customer B accounted for 23.3%.

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Three months ended

January 4, 2009 December 30, 2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Net sales were derived from customers

located in the following geographic

areas:

United States $169,630 $229,709

Canada 4,724 9,936

Europe and other 9,641 10,812

--------------------------------------------------------------------------

$183,995 $250,457

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Net sales by major product group:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Activewear and underwear $115,843 $168,448

Socks 68,152 82,009

--------------------------------------------------------------------------

$183,995 $250,457

--------------------------------------------------------------------------

--------------------------------------------------------------------------

--------------------------------------------------------------------------

--------------------------------------------------------------------------

January 4, 2009 October 5, 2008 December 30, 2007

--------------------------------------------------------------------------

Property, plant and (audited)

equipment by

geographic area are

as follows:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Caribbean Basin and

Central America $327,620 $325,670 $315,079

United States 80,378 83,264 83,573

Canada and other 27,232 27,582 14,651

--------------------------------------------------------------------------

$435,230 $436,516 $413,303

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Goodwill and intangible assets relate to acquisitions located in

the United States.

Contacts: Gildan Activewear Inc. Laurence G. Sellyn, Executive

Vice-President, Chief Financial and Administrative Officer

514-343-8805 lsellyn@gildan.com Gildan Activewear Inc. Patrice

Ouimet, Vice-President, Corporate Development and Enterprise Risk

Management 514-340-8933 pouimet@gildan.com Gildan Activewear Inc.

Benoit Leroux, Director, Corporate Development 514-343-8898

bleroux@gildan.com

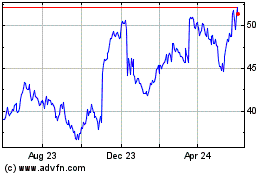

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Jul 2023 to Jul 2024