Gildan Activewear Inc. (TSX: GIL)(NYSE: GIL)

- Fourth Quarter EPS of U.S. $0.41 and Full Year EPS of U.S.

$1.45 Before Income Tax Charge and Restructuring Charges

- Company Plans for Fiscal 2009 Based on Negative Outlook for

Industry

Gildan Activewear Inc. (TSX: GIL)(NYSE: GIL) today announced its

financial results for its fourth fiscal quarter and fiscal year

ended October 5, 2008. The Company also provided earnings guidance

for fiscal 2009 based on assuming a continuation of current

negative market conditions, which are significantly impacting its

results in the first quarter of fiscal 2009.

The Company believes that, while the current outlook for

business conditions in fiscal 2009 is uniquely challenging, the

economic upheaval in the industry will create opportunities for

Gildan to build further on its leadership position in the U.S.

screenprint channel, and continue to expand its presence in

international markets and the U.S. mass-market retail channel. The

Company continues to feel confident that its competitive strengths,

including its large-scale, vertically-integrated,

strategically-located manufacturing facilities, together with its

strong cash flow generation and low financial leverage, position it

well to successfully achieve its long-term strategic growth

objectives.

Fourth Quarter Sales and Earnings

Gildan reported net earnings of U.S. $21.4 million and diluted

EPS of U.S. $0.18 for the fourth quarter of fiscal 2008, compared

to net earnings of U.S. $40.9 million, or U.S. $0.34 per share,

during the fourth quarter of fiscal 2007. Fourth quarter results in

fiscal 2008 included restructuring and other charges of U.S. $1.0

million after tax. Comparative results for fiscal 2007 included

restructuring and other charges of U.S. $4.9 million after tax, or

U.S. $0.04 per share. Restructuring and other charges in both years

were primarily related to the restructuring and ongoing carrying

costs pursuant to the closure of Canadian and U.S. manufacturing

facilities.

Before reflecting the impact of restructuring charges in both

fiscal years, adjusted net earnings were U.S. $22.4 million in the

fourth quarter of fiscal 2008, compared to adjusted net earnings of

U.S. $45.8 million in the fourth quarter of fiscal 2007. The U.S.

$23.4 million decrease in adjusted net earnings was due to a U.S.

$26.9 million, or U.S. $0.22 per share, one-time income tax charge

resulting from the settlement of the Canada Revenue Agency ("CRA")

audit, which is described in a separate press release issued today.

Excluding the impact of the tax charge, adjusted net earnings in

the fourth quarter of fiscal 2008 were U.S. $49.3 million, or U.S.

$0.41 per share. Compared to the fourth quarter of last year,

higher activewear selling prices, higher activewear unit sales

volumes, increased manufacturing efficiencies from the

consolidation of textile facilities and the accretive impact of the

acquisition of V.I. Prewett & Son, Inc. ("Prewett") were

partially offset by higher cotton and energy costs, more

unfavourable activewear product-mix, higher selling, general and

administrative and depreciation expenses and the non-recurrence of

income tax benefits in the amount of U.S. $1.9 million recognized

in the fourth quarter of fiscal 2007 relating to a prior taxation

year which became statute-barred during fiscal 2007.

Sales in the fourth quarter of fiscal 2008 amounted to U.S.

$324.7 million, up 27.4% from U.S. $254.9 million in the fourth

quarter of last year. The increase in sales revenues was due to the

impact of the acquisition of Prewett, an approximate 10.2% increase

in activewear unit selling prices and an 8.5% increase in unit

sales volumes for activewear and underwear. The growth in

activewear unit sales in the fourth quarter was due to continuing

market share penetration in all product categories in the U.S.

wholesale distributor channel, as overall industry shipments from

U.S. wholesale distributors to screenprinters declined by 3.1% in

the quarter, while unit sales of Gildan products increased by 7.2%

in spite of inventory constraints during the quarter which limited

Gildan's ability to service demand in the U.S. screenprint channel,

as well as demand in Europe. The overall decline in U.S. industry

shipments primarily reflected lower demand for promotional white

T-shirts. The table below summarizes data from the S.T.A.R.S.

report produced by ACNielsen Market Decisions, which tracks unit

volume shipments from U.S. wholesale distributors to U.S.

screenprinters, for the quarter ended September 30, 2008.

Gildan Industry

Gildan Gildan Unit Growth Unit Growth

Market Share Market Share Q4 2008 vs. Q4 2008 vs.

Q4 2008 Q4 2007 Q4 2007 Q4 2007

---------------------------------------------------------------------------

53.4% 48.2% All activewear 7.2% (3.1%)

products

54.4% 49.1% T-shirts 7.8% (2.5%)

49.9% 45.5% Fleece 5.2% (4.2%)

37.8% 35.7% Sport shirts (8.7%) (13.8%)

Gross margins of 32.1% in the fourth quarter of fiscal 2008 were

essentially flat compared to last year. The positive gross margin

impact of higher activewear selling prices and favourable

manufacturing efficiencies from the consolidation of textile

facilities was offset by higher cotton and energy costs,

unfavourable product-mix and a higher proportion of U.S.

manufactured socks due to the acquisition of Prewett, which provide

lower gross margins than the Company's activewear products and

socks produced in Gildan's new sock manufacturing facility in

Honduras.

Selling, general and administrative expenses were U.S. $39.1

million, or 12.1% of sales, compared to U.S. $27.9 million, or

10.9% of sales in the fourth quarter of fiscal 2007. The increase

in selling, general and administrative expenses was due to the

acquisition of Prewett, higher distribution and transportation

expenses, a provision of U.S. $1.5 million for non-collection of

accounts receivable, and higher corporate infrastructure costs. The

increase of U.S. $5.4 million in depreciation and amortization

expenses was primarily due to the ramp-up of major capacity

expansion projects and the acquisition of Prewett, including the

amortization of acquired intangible assets.

The Company recorded an income tax expense of U.S. $25.3 million

in the fourth quarter of fiscal 2008, compared to an income tax

recovery of U.S. $4.6 million in the fourth quarter of fiscal 2007.

The current year expense includes a one-time income tax charge of

U.S. $26.9 million, or U.S. $0.22 per share, related to the

settlement of the CRA audit. The fourth quarter of fiscal 2007

included a one-time income-tax recovery of U.S. $1.9 million

relating to a prior taxation year which became statute-barred

during fiscal 2007.

Full Year Sales and Earnings

Sales for fiscal 2008 were U.S. $1,249.7 million, up 29.6 % from

U.S. $964.4 million in fiscal 2007. The increase in sales was due

to a U.S. $151.5 million increase in sock sales, primarily due to

the acquisition of Prewett, an increase of approximately 6.7% in

activewear selling prices and a 10.2% increase in unit sales

volumes for activewear and underwear.

Net earnings were U.S. $144.6 million, or U.S. $1.19 per share

on a diluted basis, in fiscal 2008, compared to net earnings of

U.S. $130.0 million, or U.S. $1.07 per share in fiscal 2007.

Results included restructuring and other charges of U.S. $4.9

million after tax, or U.S. $0.04 per share, in fiscal 2008 and U.S.

$27.3 million after tax, or U.S. $0.22 per share, in fiscal

2007.

Before reflecting restructuring and other charges in both years,

adjusted net earnings were U.S. $149.5 million, compared to

adjusted net earnings of U.S. $157.3 million in fiscal 2007. The

decrease in adjusted net earnings was due to a one-time income tax

charge of U.S. $26.9 million related to the settlement of the CRA

audit. Excluding the one-time income tax charge, adjusted earnings

and adjusted earnings per share in fiscal 2008 were U.S. $176.4 and

U.S. $1.45, respectively. Compared to fiscal 2007, higher cotton

and energy costs, production inefficiencies in the Dominican

Republic facility, increased selling, general and administrative,

depreciation and interest expenses, and the non-recurrence of

income tax benefits totaling U.S. $7.6 million relating to a prior

taxation year which became statute-barred in fiscal 2007 were more

than offset by the favourable impact of higher activewear selling

prices, growth in activewear unit sales volumes, favourable

manufacturing efficiencies resulting from the consolidation of

textile facilities, and the accretive impact of the Prewett

acquisition.

Adjusted diluted EPS of U.S. $1.45 excluding the income tax

charge and the restructuring charges were at the low end of the

Company's most recent EPS guidance range of U.S. $1.45- U.S. $1.50,

which did not assume the income tax charge related to the

settlement of the CRA audit. The Company was at the low end of its

guidance range due to lower than projected results in the fourth

quarter. In the fourth quarter, favourable activewear selling

prices, due to lower than projected promotional discounts, were

more than offset by lower activewear unit sales, as a result of

inventory constraints, more unfavourable activewear product-mix due

to a lower than anticipated proportion of sport shirts and fleece,

lower than planned sock sales due to a weak back-to-school season

in retail, and a doubtful account provision of U.S. $1.5

million.

Fiscal 2008 Cash Flows

The Company generated free cash flows of U.S. $148.4 million in

fiscal 2008. Cash flows from operating activities for fiscal 2008

amounted to U.S. $238.9 million, which, together with increased

accounts payable of U.S. $27.7 million, was used to finance a U.S.

$32.1 million increase in inventories, capital expenditures of U.S

$97.0 million mainly related to major textile sand sock

manufacturing capacity expansion projects and the acquisition of

Prewett, effective October 15, 2007, for a purchase price of U.S.

$126.8 million, plus a contingent payment of U.S. $10.0

million.

Outlook for Fiscal 2009

Industry demand in the U.S. screenprint channel during the first

two months of the first quarter of fiscal 2009 has been extremely

weak, mirroring the rapid and severe downturn in overall economic

and stock market performance and sentiment during October and

November, which has resulted in a dramatic curtailment of consumer

and corporate spending. According to the S.T.A.R.S. report for the

month of October, overall industry shipments from U.S. wholesale

distributors to screenprinters across all product categories

declined by 12.5% compared to October 2007. Although the S.T.A.R.S.

report indicates that Gildan achieved significant increases in

market share, the Company's unit volume shipments to distributors

in October declined from last year, due to the decline in end-use

demand combined with high inventories at the distributor level in

the context of the current market conditions.

Although final S.T.A.R.S. data for the month of November is not

yet available, market conditions in the U.S. screenprint channel

have deteriorated further. Preliminary S.T.A.R.S. data for November

indicate that overall industry shipments in the month declined from

last year by close to 20%. Consequently, Gildan expects its sales

and EPS in the first quarter of fiscal 2009 to decline materially

from the first quarter of last year as a result of lower unit

shipments and severe promotional discounting in the month of

December, combined with significantly higher cotton costs compared

with the first quarter of fiscal 2008, and the consumption of

inventories produced when energy and commodity costs were at peak

levels. Based on these assumptions, the Company is currently

forecasting first quarter fiscal 2009 adjusted EPS of approximately

U.S. $0.00-U.S. $0.05, compared with adjusted EPS of U.S. $0.23 in

the first quarter of fiscal 2008.

While the first quarter is seasonally the lowest sales quarter

of the fiscal year and as such may not be indicative of full year

trends, the Company is currently planning for the balance of fiscal

2009 on the basis of assuming a continuing negative outlook for

industry demand in the U.S. screenprint channel throughout the

year. The Company's current planning scenario for fiscal 2009

assumes that overall industry unit shipments in the U.S.

screenprint channel will decline by approximately 10% compared with

fiscal 2008, and that the ensuing unfavourable industry

supply/demand balance will result in significant discounting of

industry selling prices, which has already started to occur.

Based on the assumption of continuing unfavourable market

conditions and the assumptions set out below, the Company is

initiating EPS guidance for fiscal 2009 with a wide range of U.S.

$1.10-U.S. $1.30 in fiscal 2009, before restructuring charges which

are not expected to be material.

The Company's EPS guidance assumes an increase of approximately

8% in Gildan's activewear and underwear unit volumes compared with

fiscal 2008, to approximately 48 million dozens, as the Company is

implementing strategies to maximize its unit volume growth in its

target markets, including an increasing focus on servicing its

international markets, for the balance of the year. In addition,

the Company expects EPS in fiscal 2009 to be favourably impacted by

the improved performance of the Dominican Republic facility in line

with the Company's expectations, together with lower projected

energy costs. However, these positive factors are now forecast to

be more than offset by significant selling price discounting, which

is expected to result in a reduction in average activewear selling

prices of 7%-9% in fiscal 2009 compared to fiscal 2008, and by the

impact of higher cotton costs, which are expected to increase by

approximately 10% in fiscal 2009 compared to fiscal 2008.

The Company is assuming weaker market conditions in fiscal 2009

in the mass-market retail channel. However, the Company will

continue its efforts to optimize its product-mix and cost structure

for mass-market retail, and to successfully manage the transition

to major new retailer private label brands, in order to be well

positioned to pursue its growth strategy in retail when new

production capacity comes on-stream in fiscal 2010. The Company's

guidance takes into account the projected impact of cost reduction

initiatives arising from the consolidation of sock manufacturing,

and also assumes the non-recurrence of acquisition integration

issues and charges which occurred in fiscal 2008. No selling price

increases in socks are assumed in fiscal 2009.

In the event these assumptions are not realized, or that

economic conditions are less or more favourable than assumed in the

Company's forecast, EPS may be lower or higher than projected.

In the assumed economic environment, the Company will place

emphasis on careful management of its capital expenditures in

fiscal 2009. The Company intends to undertake an incremental

capacity expansion of its Dominican Republic textile facility, at a

low capital cost, and is also incrementally expanding its Rio Nance

I textile facility in Honduras. These expansions of existing

facilities will increase annual production capacity by

approximately 7-8 million dozens, and allow the Company to support

its projected sales growth while preserving liquidity and

proceeding more slowly and cautiously with its major capital

investment in its new Rio Nance 5 textile facility in Honduras.

However, the Company has not changed its plans to construct both

Rio Nance 5 and its second sock facility in Honduras, which are

integral to its long-term strategic growth and cost reduction

initiatives. The Company today announced plans to phase out sock

finishing operations in the U.S. by the end of June and consolidate

operations in Honduras, in order to remain globally competitive in

the current economic conditions. Gildan regrets the impact on its

U.S. employees affected by this consolidation. Any costs associated

with the closure of sock finishing facilities will be accounted for

as restructuring and other charges in fiscal 2009.

Gildan is now projecting total capital expenditures of

approximately U.S. $115 million in fiscal 2009, compared with its

previous estimate of approximately U.S. $160 million. The Company's

objective in fiscal 2009 is to remain cash positive after taking

account of capital expenditures, approximately U.S. $70 million of

projected additional working capital to support its planned growth

in fiscal 2010 and the cash payments required following the

settlement of the CRA audit.

Disclosure of Outstanding Share Data

As of November 30, 2008, there were 120,544,242 common shares

issued and outstanding along with 1,098,381 stock options and

958,002 dilutive restricted share units (Treasury RSUs)

outstanding. Each stock option entitles the holder to purchase one

common share at the end of the vesting period at a pre-determined

option price. Each Treasury RSU entitles the holder to receive one

common share at the end of the vesting period, without any monetary

consideration being paid to the Company. However, the vesting of

50% of the restricted share grant is dependent upon the financial

performance of the Company, relative to a benchmark group of

Canadian publicly-listed companies.

Information for shareholders

Gildan Activewear Inc. will hold a conference call to discuss

these results today at 8:30 AM Eastern Time. The conference call

can be accessed by dialing 800-261-3417 (Canada & U.S.) or

617-614-3673 (international) and entering passcode 68524462, or by

live sound webcast on Gildan's Internet site ("Investor Relations"

section) at the following address: www.gildan.com. If you are

unable to participate in the conference call, a replay will be

available starting that same day at 10:30 AM EST by dialing

888-286-8010 (Canada & U.S.) or 617-801-6888 (international)

and entering passcode 38418101, until Thursday, December 18, 2008

at midnight, or by sound web cast on Gildan's Internet site for 30

days.

Profile

Gildan is a vertically-integrated marketer and manufacturer of

quality branded basic apparel. The Company is the leading supplier

of activewear for the screenprint channel in the U.S. and Canada.

It is also a leading supplier to this market in Europe, and is

establishing a growing presence in Mexico and the Asia-Pacific

region. The Company sells T-shirts, sport shirts and fleece in

large quantities to wholesale distributors as undecorated "blanks",

which are subsequently decorated by screenprinters with designs and

logos. Consumers ultimately purchase the Company's products, with

the Gildan label, in venues such as sports, entertainment and

corporate events, and travel and tourism destinations. The

Company's products are also utilized for work uniforms and other

end-uses to convey individual, group and team identity. The Company

is also a leading supplier of private label and Gildan branded

socks primarily sold to mass-market retailers. In addition, Gildan

has an objective to become a significant supplier of men's and

boys' underwear and undecorated activewear products to mass-market

retailers in North America.

Forward-Looking Statements

Certain statements included in this press release, in particular

in the "Outlook" section, constitute "forward-looking statements"

within the meaning of the U.S. Private Securities Litigation Reform

Act of 1995 and Canadian securities legislation and regulations,

and are subject to important risks, uncertainties and assumptions.

This forward-looking information includes, amongst others,

information with respect to our objectives and the strategies to

achieve these objectives, as well as information with respect to

our beliefs, plans, expectations, anticipations, estimates and

intentions. Forward-looking statements generally can be identified

by the use of conditional or forward-looking terminology such as

"may", "will", "expect", "intend", "estimate", "project", "

assume", "anticipate", "plan", "foresee", "believe" or "continue"

or the negatives of these terms or variations of them or similar

terminology. We refer you to the Company's filings with the

Canadian securities regulatory authorities and the U.S. Securities

and Exchange Commission, as well as the "Risks and Uncertainties"

section of the 2007 Annual MD&A, as subsequently updated in our

first, second and third quarter 2008 MD&A, for a discussion of

the various factors that may affect the Company's future results.

Material factors and assumptions that were applied in drawing a

conclusion or making a forecast or projection are also set out

throughout this press release, in particular in the "Outlook"

section.

Forward-looking information is inherently uncertain and results

or events predicted in such forward-looking information may differ

materially from actual results or events. Material factors, which

could cause actual results or events to differ materially from a

conclusion, forecast or projection in such forward-looking

information, include, but are not limited to: general economic

conditions such as commodity prices, currency exchange rates,

interest rates and other factors over which we have no control; the

impact of economic and business conditions, industry trends and

other external, political and social factors in the countries in

which we operate; the intensity of competitive activity; changes in

environmental, tax, trade, employment and other laws and

regulations; our ability to implement our strategies and plans; our

ability to complete and successfully integrate acquisitions; our

reliance on a small number of significant customers; changes in

consumer preferences, customer demand for our products and our

ability to maintain customer relationships and grow our business;

the fact that our customers do not commit to minimum quantity

purchases; the seasonality of our business; our ability to attract

and retain key personnel; our reliance on computerized information

systems; changes in accounting policies and estimates; and

disruption to manufacturing and distribution activities due to

labour disruptions, bad weather, natural disasters and other

unforeseen adverse events.

These factors may cause the Company's actual performance and

financial results in future periods to differ materially from any

estimates or projections of future performance or results expressed

or implied by such forward-looking statements. Forward-looking

statements do not take into account the effect that transactions or

non-recurring or other special items announced or occurring after

the statements are made have on the Company's business. For

example, they do not include the effect of business dispositions,

acquisitions, other business transactions, asset writedowns or

other charges announced or occurring after forward-looking

statements are made. The financial impact of such transactions and

non-recurring and other special items can be complex and

necessarily depends on the facts particular to each of them.

We believe that the expectations represented by our

forward-looking statements are reasonable, yet there can be no

assurance that such expectations will prove to be correct. The

purpose of the forward-looking statements is to provide the reader

with a description of management's expectations regarding the

Company's fiscal 2009 financial performance and may not be

appropriate for other purposes. Furthermore, unless otherwise

stated, the forward-looking statements contained in this press

release are made as of the date of this press release, and we do

not undertake any obligation to update publicly or to revise any of

the included forward-looking statements, whether as a result of new

information, future events or otherwise unless required by

applicable legislation or regulation. The forward-looking

statements contained in this press release are expressly qualified

by this cautionary statement.

Non-GAAP Financial Measures

This release includes reference to certain non-GAAP financial

measures such as adjusted net earnings, adjusted diluted earnings

per share and free cash flow. These non-GAAP measures do not have

any standardized meanings prescribed by Canadian GAAP and are

therefore unlikely to be comparable to similar measures presented

by other companies. Accordingly, they should not be considered in

isolation. The terms and definitions of the non-GAAP measures used

in this press release and a reconciliation of each non-GAAP measure

to the most directly comparable GAAP measure are provided

below.

Adjusted net earnings and adjusted diluted earnings per share

are calculated as net earnings and earnings per share excluding

restructuring and other charges, as discussed in Note 1 to the

unaudited interim consolidated financial statements. The Company

uses and presents these non-GAAP measures to assess its operating

performance from one period to the next without the variation

caused by restructuring and other charges that could potentially

distort the analysis of trends in our business performance.

Excluding these items does not imply they are necessarily

non-recurring.

(in US$millions, except per share amounts)

--------------------------------------------------------------------------

Q4 2008 Q4 2007 YTD 2008 YTD 2007

--------------------------------------------------------------------------

Net earnings 21.4 40.9 144.6 130.0

Restructuring and other charges 1.6 5.7 5.5 28.0

Less: income tax effect thereon (0.6) (0.8) (0.6) (0.7)

--------------------------------------------------------------------------

Adjusted net earnings 22.4 45.8 149.5 157.3

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Diluted EPS 0.18 0.34 1.19 1.07

Restructuring and other

charges, net of tax 0.01 0.04 0.04 0.22

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Adjusted diluted EPS 0.18 0.38 1.23 1.29

--------------------------------------------------------------------------

Certain minor rounding variances exist between the financial statements and

this summary.

Free cash flow is defined as cash from operating activities

including net changes in non-cash working capital balances, less

cash flow used in investing activities excluding business

acquisitions. We consider free cash flow to be an important

indicator of the financial strength and performance of our

business, because it shows how much cash is available after capital

expenditures to repay debt and to reinvest in our business. We

believe this measure is commonly used by investors and analysts

when valuing a business and its underlying assets.

(in US$millions) Q4 2008 Q4 2007 YTD 2008 YTD 2007

--------------------------------------------------------------------------

Cash flows from

operating activities 70.5 19.1 238.9 91.2

Cash flows from investing

activities (14.4) (31.0) (227.3) (134.7)

Add back:

Acquisition of Prewett - - 126.8 -

Restricted cash related

to acquisition - - 10.0 -

--------------------------------------------------------------------------

Free cash flow 56.1 (11.9) 148.4 (43.5)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Certain minor rounding variances exist between the financial statements and

this summary.

Gildan Activewear Inc.

Consolidated Balance Sheets

(in thousands of U.S. dollars)

October 5, September 30,

2008 2007

-------------------------------------------------------------------------

(audited) (audited)

Assets

Current assets:

Cash and cash equivalents $12,357 $9,250

Accounts receivable 222,158 206,088

Inventories 316,172 239,963

Prepaid expenses and deposits 10,413 7,959

Future income taxes - 2,610

-------------------------------------------------------------------------

561,100 465,870

Property, plant and equipment 436,516 377,617

Intangible assets 59,954 2,024

Other assets 18,067 11,426

Assets held for sale (note 1) 10,497 6,610

Goodwill (note 2) 6,709 -

Future income taxes 9,283 10,939

-------------------------------------------------------------------------

Total assets $1,102,126 $874,486

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Liabilities and Shareholders' Equity

Current liabilities:

Accounts payable and accrued liabilities $155,669 $116,683

Income taxes payable (note 3) 46,627 2,949

Current portion of long-term debt 3,556 3,689

-------------------------------------------------------------------------

205,852 123,321

Long-term debt (note 4) 49,448 55,971

Future income taxes (note 3) 27,331 24,612

Non-controlling interest in consolidated

joint venture 7,162 6,932

Shareholders' equity:

Share capital 89,377 88,061

Contributed surplus 6,728 3,953

Retained earnings 689,980 545,388

Accumulated other comprehensive income 26,248 26,248

-------------------------------------------------------------------------

716,228 571,636

-------------------------------------------------------------------------

Total shareholders' equity 812,333 663,650

Total liabilities and shareholders' equity $1,102,126 $874,486

-------------------------------------------------------------------------

-------------------------------------------------------------------------

See accompanying condensed notes to consolidated financial statements.

Gildan Activewear Inc.

Consolidated Statements of Earnings and Comprehensive Income

(In thousands of U.S. dollars, except per share data)

Three months ended Twelve months ended

October 5, September 30, October 5, September 30,

2008 2007 2008 2007

--------------------------------------------------------------------------

(unaudited) (unaudited) (audited) (audited)

Sales $324,717 $254,856 $1,249,711 $964,429

Cost of sales 220,555 172,722 847,392 655,280

--------------------------------------------------------------------------

Gross profit 104,162 82,134 402,319 309,149

Selling, general

and administrative

expenses 39,143 27,899 151,453 110,979

Restructuring and

other charges (note 1) 1,560 5,673 5,489 28,012

--------------------------------------------------------------------------

Earnings before the

undernoted items 63,459 48,562 245,377 170,158

Depreciation and

amortization 15,683 10,256 58,932 38,777

Interest, net 1,158 1,397 7,223 4,898

Non-controlling

interest of

consolidated joint

venture (127) 653 230 1,278

--------------------------------------------------------------------------

Earnings before

income taxes 46,745 36,256 178,992 125,205

Income tax expense

(recovery) (note 3) 25,324 (4,610) 34,400 (4,815)

--------------------------------------------------------------------------

Net earnings and

comprehensive income $21,421 $40,866 $144,592 $130,020

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Basic EPS $0.18 $0.34 $1.20 $1.08

Diluted EPS $0.18 $0.34 $1.19 $1.07

Weighted average

number of shares

outstanding (in

thousands)

Basic 120,531 120,401 120,479 120,340

Diluted 121,558 121,577 121,622 121,538

See accompanying condensed notes to consolidated financial statements.

Gildan Activewear Inc.

Consolidated Statements of Cash Flows

(In thousands of U.S. dollars)

Three months ended Twelve months ended

October 5, September 30, October 5, September 30,

2008 2007 2008 2007

--------------------------------------------------------------------------

(unaudited) (unaudited) (audited) (audited)

Cash flows from

(used in) operating

activities:

Net earnings $21,421 $40,866 $144,592 $130,020

Adjustments for:

Depreciation and

amortization 15,683 10,256 58,932 38,777

Restructuring

charges related to

assets held for sale

and property, plant

and equipment (note 1) 840 907 2,174 5,523

Loss on disposal of

assets held for sale

and property, plant

and equipment 382 352 1,369 332

Stock-based

compensation costs 882 665 2,965 1,814

Future income taxes (16,040) (5,709) (15,837) (8,919)

Non-controlling interest (127) 653 230 1,278

Unrealized foreign

exchange (gain) loss (2,523) 1,785 (2,270) 3,226

--------------------------------------------------------------------------

20,518 49,775 192,155 172,051

Changes in non-cash

working capital

balances:

Accounts receivable 27,060 (20,126) 8,223 (36,392)

Inventories (24,676) (8,425) (32,135) (39,310)

Prepaid expenses

and deposits 1,045 1,614 (881) (2,202)

Accounts payable

and accrued

liabilities 8,918 (4,446) 27,740 (3,327)

Income taxes payable 37,646 681 43,802 343

--------------------------------------------------------------------------

70,511 19,073 238,904 91,163

Cash flows from

(used in) financing

activities:

(Decrease) increase

in amounts drawn

under revolving

long-term credit

facility (55,000) 19,000 (4,000) 49,000

Decrease in bank

indebtedness (1,478) (3,500) (2,739) (3,500)

Repayment of other

long-term debt (435) (2,253) (2,656) (23,201)

Proceeds from the

issuance of shares 178 367 1,138 1,316

Repurchase of

shares (12) (65) (12) (65)

--------------------------------------------------------------------------

(56,747) 13,549 (8,269) 23,550

Cash flows from

(used in) investing

activities:

Purchase of property,

plant and equipment (17,239) (25,967) (97,030) (134,282)

Acquisition of V.I.

Prewett & Son, Inc.

(note 2) - - (126,819) -

Restricted cash

related to

acquistion (note 2) - - (10,000) -

Proceeds from the

sale of assets held

for sale 2,612 244 3,736 6,668

Net decrease(increase)

in other assets 255 (5,289) 2,787 (7,075)

--------------------------------------------------------------------------

(14,372) (31,012) (227,326) (134,689)

Effect of exchange

rate changes on cash

and cash equivalents

denominated in

foreign currencies (230) 103 (202) 219

--------------------------------------------------------------------------

Net (decrease)

increase in cash and

cash equivalents

during the period (838) 1,713 3,107 (19,757)

Cash and cash

equivalents,

beginning of period 13,195 7,537 9,250 29,007

--------------------------------------------------------------------------

Cash and cash

equivalents, end of

period $12,357 $9,250 $12,357 $9,250

--------------------------------------------------------------------------

--------------------------------------------------------------------------

See accompanying condensed notes to consolidated financial statements.

Gildan Activewear Inc.

Consolidated Statement of Shareholders' Equity

Years ended October 5, 2008 and September 30, 2007

(in thousands of U.S. dollars)

Share Capital Contri-

---------------------- buted

Number Amount surplus

--------------------------------------------------------------------------

Balance, October 1, 2006 120,227,668 $86,584 $2,365

Stock-based compensation related to

stock options and Treasury restricted

share units - - 1,814

Shares issued under employee share

purchase plan 18,279 530 -

Shares issued pursuant to exercise of

stock options 149,034 786 -

Shares issues pursuant to exercise of

Treasury restricted share units 26,917 - -

Ascribed value credited to share capital

from exercise of stock options and

Treasury restricted share units - 226 (226)

Share repurchases (2,437) (65) -

Net earnings - - -

--------------------------------------------------------------------------

Balance, September 30, 2007 120,419,461 88,061 3,953

Stock-based compensation related to

stock options and Treasury restricted

share units - - 2,965

Shares issued under employee share

purchase plan 21,313 720 -

Shares issued pursuant to exercise of

stock options 81,356 418 -

Shares issued pursuant to the

exercise of Treasury restricted

share units 14,779 - -

Ascribed value credited to share capital

from exercise of stock options and

Treasury restricted share units - 190 (190)

Share repurchases (408) (12) -

Net earnings - - -

--------------------------------------------------------------------------

Balance, October 5, 2008 120,536,501 $89,377 $6,728

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Accumulated Total

other share-

comprehensive Retained holders'

income earnings equity

--------------------------------------------------------------------------

Balance, October 1, 2006 $26,248 $415,368 $530,565

Stock-based compensation related to

stock options and Treasury restricted

share units - - 1,814

Shares issued under employee share

purchase plan - - 530

Shares issued pursuant to exercise of

stock options - - 786

Shares issues pursuant to exercise of

Treasury restricted share units - - -

Ascribed value credited to share capital

from exercise of stock options and

Treasury restricted share units - - -

Share repurchases - - (65)

Net earnings - 130,020 130,020

--------------------------------------------------------------------------

Balance, September 30, 2007 26,248 545,388 663,650

Stock-based compensation related to

stock options and Treasury restricted

share units - - 2,965

Shares issued under employee share

purchase plan - - 720

Shares issued pursuant to exercise of

stock options - - 418

Shares issued pursuant to the

exercise of Treasury restricted

share units - - -

Ascribed value credited to share capital

from exercise of stock options and

Treasury restricted share units - - -

Share repurchases - - (12)

Net earnings - 144,592 144,592

--------------------------------------------------------------------------

Balance, October 5, 2008 $26,248 $689,980 $812,333

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Gildan Activewear Inc. - Condensed notes to consolidated

financial statements

(tabular amounts in thousands of U.S. dollars)

For complete notes to the consolidated financial statements, please refer

to filings with the various securities regulatory authorities which are

expected to be available on December 22, 2008.

1. Restructuring, Other Charges and Assets Held for Sale

The following table summarizes the components of restructuring and

other charges:

Three months ended Twelve months ended

October September October September

5, 30, 5, 30,

2008 2007 2008 2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Severance $- $260 $400 $13,619

Accelerated depreciation - 601 - 3,493

Impairment loss and

write-down of property, plant

and equipment and assets held

for sale 1,000 - 2,700 3,560

Net (gain) loss on disposal

of assets held for sale (160) 306 (526) (1,530)

Other exit costs 1,275 4,506 3,470 8,870

Charge (credit) to comply with

employment contract (555) - (555) -

--------------------------------------------------------------------------

--------------------------------------------------------------------------

$1,560 $5,673 $5,489 $28,012

--------------------------------------------------------------------------

--------------------------------------------------------------------------

In fiscal 2006 and 2007, the Company announced the closure,

relocation and consolidation of manufacturing and distribution

facilities in Canada, the United States and Mexico, as well as the

relocation of its corporate office. The costs incurred in

connection with these announcements have been recorded as

restructuring and other charges, and included severance and other

costs, asset impairment losses, and accelerated depreciation

resulting from the reduction in the estimated remaining economic

lives of property, plant and equipment at these facilities. In the

fourth quarter of fiscal 2008, the Company recorded a $1.0 million

write-down on the assets held for sale located in Canada. Other

exit costs relate primarily to costs incurred in connection with

the closures noted above, including carrying and dismantling costs

associated with assets held for sale. The Company incurred

additional carrying costs relating to the closed facilities being

held for sale, which were accounted for as restructuring charges as

incurred during fiscal 2008. In the third quarter of fiscal 2008,

the Company recorded restructuring charges of $2.1 million,

consisting of an impairment on property, plant and equipment of

$1.7 million and severance costs of $0.4 million, related to the

planned consolidation of its Haiti sewing operations which is

expected to be finalized in the first half of fiscal 2009.

Assets held for sale of $10.5 million as at October 5, 2008

(September 30, 2007 - $6.6 million) include property, plant and

equipment at these various locations and are recorded at the lower

of their carrying value or fair value less costs to sell.

Additional carrying costs related to these closed facilities and

any gains or losses on the disposition of the assets held for sale

will be accounted for as restructuring charges as incurred.

2. Business Acquisition

On October 15, 2007, the Company acquired 100% of the capital

stock of V.I. Prewett & Son, Inc. ("Prewett"), a U. S. supplier

of basic family socks primarily to U.S. mass-market retailers.

Prewett's corporate headquarters are located in Fort Payne,

Alabama. The acquisition is intended to enhance further the

Company's position as a full-product supplier of socks, activewear

and underwear for the retail channel.

The aggregate purchase price of $128.0 million was comprised of

cash consideration of $125.3 million, a fixed payment of $1.2

million payable in 2009 and transaction costs of $1.5 million. The

purchase agreement provides for an additional purchase

consideration of up to $10.0 million contingent on specified future

events. This amount was paid into escrow by the Company and is

included in "Other assets" on the consolidated balance sheet. Any

further purchase price consideration paid by the Company will be

accounted for as additional goodwill.

The Company accounted for this acquisition using the purchase

method and the results of Prewett have been consolidated with those

of the Company from the date of acquisition.

The Company has allocated the purchase price to the assets

acquired based on their fair values and taking into account all

relevant information available at that time.

The following table summarizes the estimated fair value of assets

acquired and liabilities assumed at the date of acquisition:

--------------------------------------------------------

--------------------------------------------------------

Assets acquired:

Accounts receivable $28,228

Inventories 44,074

Prepaid expenses 1,573

Property, plant and equipment 26,202

Customer contracts and customer relationships 61,000

Other assets 196

--------------------------------------------------------

161,273

Liabilities assumed:

Bank indebtedness (2,739)

Accounts payable and accrued liabilities (12,800)

Future income taxes (24,428)

--------------------------------------------------------

(39,967)

--------------------------------------------------------

Net identifiable assets acquired 121,306

Goodwill 6,709

--------------------------------------------------------

Purchase price $128,015

--------------------------------------------------------

--------------------------------------------------------

Consideration:

Cash $125,294

Transaction costs 1,525

Fixed payment payable in 2009 1,196

--------------------------------------------------------

$128,015

--------------------------------------------------------

--------------------------------------------------------

Immediately following the acquisition, the Company repaid the

entire amount of bank indebtedness assumed at the date of

acquisition.

Goodwill recorded in connection with this acquisition is not

deductible for tax purposes.

3. Canada Revenue Agency Audit

The Canada Revenue Agency ("CRA") has been conducting an audit

of the Company's income tax returns for its 2000, 2001, 2002 and

2003 fiscal years, the scope of which included a review of transfer

pricing and the allocation of income between the Company's Canadian

legal entity and its foreign subsidiaries. In the third quarter of

fiscal 2008, management met with the CRA for the first time to

discuss preliminary transfer pricing audit issues and, in

particular, explain the roles and responsibilities performed in the

Company's foreign subsidiaries where the majority of its taxable

income is earned. On December 10, 2008, the Company reached a final

agreement with the CRA and concluded the audit for the 2000, 2001,

2002 and 2003 fiscal years. In connection with the terms of the

agreement, the Company agreed to a tax reassessment related to the

restructuring of its international wholesale business and the

related transfer of the Company's assets to its Barbados

subsidiary, which occurred in fiscal 1999. Based on the results of

the audit, the Company continues to believe its income tax

provisions for fiscal years subsequent to the periods covered by

the audit are appropriate. The terms of the agreement have been

accounted for in the fourth quarter of fiscal 2008 through a charge

to income tax expense of $26.9 million and a reclassification of

$17.3 million of future income tax liabilities to income taxes

payable. There were no penalties assessed as part of the agreement,

and there were no other significant income tax adjustments to

reported taxable income for the years under audit.

4. Long Term Debt

As at October 5, 2008, long-term debt includes $45.0 million

(September 30, 2007 - $49.0 million) drawn on the Company's $400

million revolving long-term credit facility, which matures in June

2013. The facility is unsecured.

5. Comparative Figures

Certain comparative figures have been reclassified in order to

conform to the current period's presentation.

Contacts: Gildan Activewear Inc. Laurence G. Sellyn, Executive

Vice-President, Chief Financial and Administrative Officer

514-343-8805 lsellyn@gildan.com Gildan Activewear Inc. Patrice

Ouimet, Vice-President, Corporate Development and Enterprise Risk

Management 514-340-8933 pouimet@gildan.com Gildan Activewear Inc.

Benoit Leroux, Director, Corporate Development 514-343-8898

bleroux@gildan.com

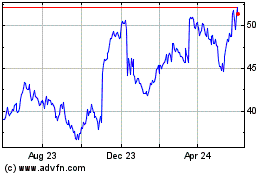

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Jul 2023 to Jul 2024