WIA and WIW Declare December 2010 Dividends

December 01 2010 - 5:28PM

Business Wire

Western Asset/Claymore Inflation-Linked Securities & Income

Fund (NYSE: WIA) and Western Asset/Claymore Inflation-Linked

Opportunities & Income Fund (NYSE: WIW) announced today that

they have declared their monthly dividends of $0.035 per share and

$0.0365 per share, respectively.

The monthly dividend of $0.035 for WIA represents an annualized

distribution rate of 3.23% based upon the closing market price of

$13.02 on November 30, 2010. This monthly dividend represents a

decrease of approximately 7.89% as compared to WIA’s prior monthly

dividend amount.

The monthly dividend of $0.0365 for WIW represents an annualized

distribution rate of 3.45% based upon the closing market price of

$12.71 on November 30, 2010. This monthly dividend represents a

decrease of approximately 8.75% as compared to WIW’s prior monthly

dividend amount.

The monthly dividend amounts for WIA and WIW were modified in an

effort to better align the Funds’ current earnings rates with

current dividends, while also considering the relatively benign

near-term outlook for inflation. While the benefit from inflation

accretion in the coming months may be minimal, the Funds’

management believes inflation remains a long-term concern.

The December 2010 dividend for WIA and WIW will be paid on

December 30, 2010 to shareholders of record as of December 23, 2010

and the ex-dividend date will be December 21, 2010.

Past performance is not indicative of future performance.

If it is determined that a notification is required, pursuant to

Section 19(a) of the Investment Company Act of 1940, as amended,

such notice will be posted to such Fund’s website after the close

of business three business days prior to the payable date. If a

distribution rate is largely comprised of sources other than

income, it may not be reflective of that Fund’s performance.

Western Asset is one of the world’s premier fixed-income

managers. With offices in Pasadena, Hong Kong, London, Melbourne,

New York, São Paolo, Singapore and Tokyo, Western Asset offers

institutional and retail clients a full range of fixed-income

products. By devoting all of its resources to fixed income, Western

Asset is able to provide a full commitment to its clients in every

area of the firm. Western Asset’s long performance track record and

global presence has them positioned to continue their commitment to

excellence in fixed-income management and client service. As of

September 30, 2010, Western Asset had approximately $469 billion in

assets under management.

Claymore Advisors, LLC has changed its name to Guggenheim Funds

Investment Advisors, LLC and Claymore Securities, Inc. has changed

its name to Guggenheim Funds Distributors, Inc. The change marks

the next phase of business integration following the acquisition of

Claymore by Guggenheim Partners, LLC (“Guggenheim Partners”)

announced on October 15, 2009. The Guggenheim Funds business will

continue to support the current product lineup of exchange-traded

funds (ETFs), unit investment trusts (UITs) and closed-end funds

(CEFs), with their respective strategies and investment policies

remaining unchanged.

Guggenheim Funds Investment Advisors, LLC acts as the Investment

Adviser for WIW and Guggenheim Funds Distributors, Inc. acts as the

Servicing Agent for WIA. Guggenheim Funds Distributors, Inc. and

its affiliates (together, “Guggenheim Funds”) offers strategic

investment solutions for financial advisors and their valued

clients. As an innovator in exchange-traded funds (ETFs), unit

investment trusts (UITs) and closed-end funds (CEFs), Guggenheim

Funds often leads its peers with creative investment strategy

solutions. Guggenheim Funds and its affiliates provide supervision,

management or servicing of assets with a commitment to consistently

delivering exceptional service. Guggenheim Funds is a wholly-owned

subsidiary of Guggenheim Partners, a global, diversified financial

services firm with more than $100 billion in assets under

supervision. Guggenheim Partners, through its affiliates, provides

investment management, investment advisory, insurance, investment

banking, and capital markets services. The firm is headquartered in

Chicago and New York with a global network of offices throughout

the United States, Europe, and Asia.

There can be no assurance that the Fund will achieve its

investment objectives. The net asset value of the Fund will

fluctuate with the value of the underlying securities. It is

important to note that closed-end funds trade on their market

value, not net asset value, and closed-end funds often trade at a

discount to their net asset value. Past performance is not

indicative of future performance. An investment in the Fund is

subject to certain risks and other considerations. Such risks and

considerations include, but are not limited to: Market Discount

Risk; Interest Rate Risk; Risks Relating to U.S. TIPS; Risks

Relating to Inflation-Linked Securities; Credit Risk; Lower Grade

and Unrated Securities Risk; Leverage Risk; Issuer Risk; Smaller

Company Risk; Country Risk; Emerging Markets Risk; Prepayment Risk;

Reinvestment Risk; Derivatives Risk; Inflation/Deflation Risk;

Turnover Risk; Management Risk and Market Disruption and

Geopolitical Risk.

Investors should consider the investment objectives and

policies, risk considerations, charges and expenses of any

investment before they invest. For this and more information,

please contact a securities representative or Guggenheim Funds

Distributors, Inc., 2455 Corporate West Drive, Lisle, Illinois

60532, 800-345-7999.

Member FINRA/SIPC (12/10)

NOT FDIC-INSURED | NOT BANK-GUARANTEED | MAY

LOSE VALUE

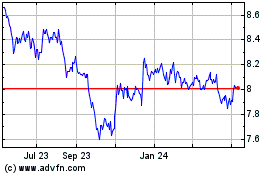

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Jun 2024 to Jul 2024

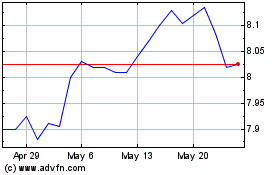

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Jul 2023 to Jul 2024