As filed with the Securities and Exchange Commission on August 14, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1) OF THE SECURITIES EXCHANGE ACT OF 1934

Western Asset High Income Fund II Inc.

(Name of Subject Company (issuer))

Western Asset High Income Fund II Inc.

(Name of Filing Person (offeror))

Common Stock

$0.001 Par

Value Per Share

(Title of Class of Securities)

95766J102

(CUSIP Number of

Class of Securities)

GEORGE P. HOYT

SECRETARY AND CHIEF LEGAL OFFICER

100 FIRST STAMFORD PLACE

STAMFORD, CT 06902

(203) 703-7026

(Name, Address and Telephone Number of Person Authorized to Receive Notices

and Communications on Behalf of the Person(s) Filing Statement)

Copy

to:

David W. Blass, Esq.

Ryan P. Brizek, Esq.

Simpson Thacher & Bartlett LLP

900 G Street, NW

Washington D.C. 20001

(202) 636-5500

CALCULATION OF

FILING FEE

|

|

|

|

|

|

|

|

Transaction Valuation

|

|

Amount of Filing Fee

|

|

|

|

|

Not Applicable

|

|

None

|

This filing relates solely to preliminary communications made before the commencement of a tender offer.

|

|

*

|

Set forth the amount on which the filing fee is calculated and state how it was determined.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Rule

0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

|

Amount Previously Paid:

|

|

Not applicable

|

|

Filing Party:

|

|

Not applicable

|

|

Form or Registration No.:

|

|

Not applicable

|

|

Date Filed:

|

|

Not applicable

|

|

|

☒

|

Check box if the filing relates solely to preliminary communications made before the commencement of a tender

offer.

|

Check the appropriate boxes to designate any transactions to which this statement relates:

|

|

|

|

|

|

|

|

|

☐

|

|

third party tender offer subject to Rule 14d-1

|

|

☐

|

|

going-private transaction subject to Rule 13e-3

|

|

☒

|

|

issuer tender offer subject to Rule 13e-4

|

|

☐

|

|

amendment to Schedule 13D under Rule 13d-2

|

Check the following box if the filing is a final amendment reporting the results of the tender offer. ☐

WESTERN ASSET HIGH INCOME

FUND II INC.

ANNOUNCES ADDITIONAL TENDER

OFFER DETAILS

NEW YORK –

(BUSINESS WIRE) – August 14, 2020. Western Asset High Income Fund II Inc. (NYSE: HIX) (the “Fund”)

announced today additional details concerning its previously announced cash tender offer for up to 35% of the Fund’s outstanding shares of common stock (the “Shares”) at a price per Share equal to 99.5% of the Fund’s net asset

value per Share as of the business day immediately following the expiration date of the tender offer (the “Offer”).

The

Fund currently intends to commence the Offer on or about October 19, 2020 with an expiration time of 11:59 p.m., New York City time, on or about November 16, 2020, unless extended. If the Offer expires on November 16, 2020, the net

asset value per Share for purposes of the Offer would be calculated as of the close of regular trading session on the New York Stock Exchange on November 17, 2020 (or if the Offer is extended, as of the close of the next trading day after the

day to which the Offer is extended). The Fund will repurchase Shares tendered and accepted in the Offer in exchange for cash. In the event the Offer is oversubscribed, Shares will be repurchased on a pro rata basis.

The Fund has not commenced the Offer described in this release. The Offer will be made, and the stockholders of the Fund will be notified, in

accordance with the Securities Exchange Act of 1934, as amended, the Investment Company Act of 1940, as amended, and other applicable rules and regulations, either by publication or mailing or both. This announcement is not a recommendation, an

offer to purchase or a solicitation of an offer to purchase shares of the Fund and the statements in this press release are not intended to constitute an offer to participate in any tender offer. The Offer will be made only by an Offer to Purchase

and the related Letter of Transmittal, and related documents. The Fund will file the tender offer documentation with the U.S. Securities and Exchange Commission (“SEC”). STOCKHOLDERS OF THE FUND SHOULD READ THESE DOCUMENTS WHEN THEY ARE

FILED AND BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE OFFER. These and other filed documents will be available to investors for free both at the website of the SEC and from the Fund. There can be no assurance that

any Share repurchases will reduce or eliminate the discount of the Fund’s market price per Share to the Fund’s net asset value per Share.

About the Fund

Western

Asset High Income Fund II Inc., a diversified, closed-end management investment company, is managed by Legg Mason Partners Fund Advisor, LLC, a wholly-owned subsidiary of Franklin Resources, Inc., and is sub-advised by Western Asset Management Company, LLC, Western Asset Management Company Limited and Western Asset Management Company Pte. Ltd., affiliates of the investment manager.

This press release may contain statements regarding plans and expectations for the future that constitute forward-looking statements within

the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on the Fund’s current plans and expectations, and are subject to risks and uncertainties that could cause actual results to differ materially from

those described in the forward-looking statements. Additional information concerning such risks and uncertainties are contained in the Fund’s filings with the SEC.

For more information about the Fund, please call Investor Relations: 1-888-777-0102, or consult the Fund’s web site at www.lmcef.com. The information contained on the Fund’s web site is not part of this press release. Hard copies of the Fund’s complete

audited financial statements are available free of charge upon request.

Category: Fund Announcement

Media Contact: Fund Investor

Services-1-888-777-0102

Source: Franklin Resources, Inc.

WESTERN ASSET HIGH INCOME

FUND II INC.

ANNOUNCES PLAN FOR TENDER

OFFER

NEW YORK – (BUSINESS

WIRE) – June 22, 2020. Western Asset High Income Fund II Inc. (NYSE: HIX) announced today that the Fund’s Board of Directors has authorized (subject to certain conditions) a cash

tender offer for up to 35% of the Fund’s outstanding shares of common stock (the “Shares”) at a price per Share equal to 99.5% of the Fund’s net asset value per Share as of the business day immediately following the expiration

date of the tender offer. The commencement of the tender offer will be announced at a later date. The tender offer will not expire prior to November 13, 2020, or such later date as determined by the Fund’s board of directors. The Fund will

repurchase Shares tendered and accepted in the tender offer in exchange for cash. In the event the tender offer is oversubscribed, Shares will be repurchased on a pro rata basis.

The commencement of the tender offer is pursuant to an agreement between the Fund and Saba Capital Management, L.P. (“Saba”) and

certain associated parties (the “Settlement Agreement”). During the effective period of the Settlement Agreement, Saba has agreed to (1) be bound by the terms of the Settlement Agreement, including certain standstill covenants, and

(2) vote its Shares on all proposals submitted to shareholders in accordance with the recommendation of the Fund’s board of directors. The Fund has been advised that Saba will file a copy of the Settlement Agreement with the U.S.

Securities and Exchange Commission (“SEC”) as an exhibit to its Schedule 13D.

The Fund has not commenced the tender offer

described in this release. This announcement is not a recommendation, an offer to purchase or a solicitation of an offer to sell shares of the Fund and the above statements are not intended to constitute an offer to participate in any tender offer.

Information about the tender offer, including its commencement, will be provided by future public announcements. Shareholders will be notified in accordance with the requirements of the Securities Exchange Act of 1934, as amended, and the Investment

Company Act of 1940, as amended, either by publication or mailing or both. The tender offer will be made only by an offer to purchase, a related letter of transmittal, and other documents to be filed with the SEC. Shareholders of the Fund should

read the offer to purchase and tender offer statement and related exhibits when those documents are filed and become available, as they will contain important information about the tender offer. These and other filed documents will be available to

investors for free both at the website of the SEC and from the Fund. There can be no assurance that any Share repurchases will reduce or eliminate the discount of the Fund’s market price per Share to the Fund’s net asset value per Share.

Western Asset High Income Fund II Inc., a diversified, closed-end management investment company,

is managed by Legg Mason Partners Fund Advisor, LLC, a wholly-owned subsidiary of Legg Mason, Inc. and is sub-advised by Western Asset Management Company, LLC, an affiliate of the investment manager.

This press release may contain statements regarding plans and expectations for the future that constitute forward-looking statements within

the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on each Fund’s current plans and expectations, and are subject to risks and uncertainties that could cause actual results to differ materially from

those described in the forward-looking statements. Additional information concerning such risks and uncertainties are contained in each Fund’s filings with the SEC.

For more information about the Fund, please call Investor Relations: 1-888-777-0102, or consult each Fund’s web site at www.lmcef.com. The information contained on each Fund’s web site is not part of this press release. Hard copies of each Fund’s complete

audited financial statements are available free of charge upon request.

Category: Fund Announcement

Media Contact: Fund Investor Services-1-888-777-0102

Source: Legg Mason, Inc.

Western Asset High Incom... (NYSE:HIX)

Historical Stock Chart

From Jun 2024 to Jul 2024

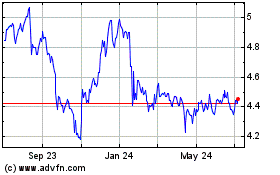

Western Asset High Incom... (NYSE:HIX)

Historical Stock Chart

From Jul 2023 to Jul 2024