UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

|

Investment Company Act file number

|

811-09092

|

|

|

|

First Eagle Variable Funds

|

|

(Exact name of registrant as specified in charter)

|

|

|

|

1345 Avenue of the Americas

New York, New York

|

|

10105

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

|

|

|

Robert Bruno

First Eagle Variable Funds

1345 Avenue of the Americas

New York, New York 10105

|

|

(Name and address of agent for service)

|

|

|

|

Registrant’s telephone number, including area code:

|

(212) 632-2700

|

|

|

|

|

Date of fiscal year end:

|

December 31

|

|

|

|

|

Date of reporting period:

|

March 31, 2013

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. Schedule of Investments.

— The schedule of investments for the three-month period ended March 31, 2013, is filed herewith.

FIRST EAGLE

Overseas Variable Fund

Schedule of Investments

·

Period Ended March 31, 2013 (unaudited)

|

SHARES

|

|

DESCRIPTION

|

|

COST

|

|

VALUE

|

|

|

|

|

|

|

|

|

|

|

|

International Common Stocks — 76.38%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia 0.90%

|

|

|

|

|

|

|

267,829

|

|

Newcrest Mining Limited

|

|

$

|

8,301,711

|

|

$

|

5,592,019

|

|

|

|

|

|

|

|

|

|

|

|

Austria 1.49%

|

|

|

|

|

|

|

120,698

|

|

OMV AG

|

|

4,936,209

|

|

5,133,125

|

|

|

344,128

|

|

Wienerberger AG

|

|

5,226,110

|

|

4,097,445

|

|

|

|

|

|

|

10,162,319

|

|

9,230,570

|

|

|

Belgium 0.67%

|

|

|

|

|

|

|

34,494

|

|

Groupe Bruxelles Lambert SA

|

|

2,959,008

|

|

2,637,697

|

|

|

16,497

|

|

Sofina SA

|

|

1,625,340

|

|

1,490,956

|

|

|

|

|

|

|

4,584,348

|

|

4,128,653

|

|

|

Bermuda 1.08%

|

|

|

|

|

|

|

103,180

|

|

Jardine Matheson Holdings Limited

|

|

3,050,550

|

|

6,717,018

|

|

|

|

|

|

|

|

|

|

|

|

Canada 4.75%

|

|

|

|

|

|

|

145,710

|

|

Potash Corporation of Saskatchewan, Inc.

|

|

5,766,737

|

|

5,719,118

|

|

|

138,128

|

|

Agnico-Eagle Mines Limited

|

|

4,802,671

|

|

5,662,365

|

|

|

146,600

|

|

Canadian Natural Resources Limited

|

|

4,154,790

|

|

4,697,257

|

|

|

432,584

|

|

Penn West Petroleum Limited

|

|

7,186,941

|

|

4,654,604

|

|

|

140,863

|

|

Cenovus Energy, Inc.

|

|

3,214,000

|

|

4,365,344

|

|

|

79,158

|

|

Goldcorp, Inc.

|

|

2,559,229

|

|

2,662,084

|

|

|

75,229

|

|

EnCana Corporation

|

|

1,552,890

|

|

1,463,956

|

|

|

107,519

|

|

Catalyst Paper Corporation (a)(b)

|

|

2,181

|

|

260,196

|

|

|

|

|

|

|

29,239,439

|

|

29,484,924

|

|

|

France 10.23%

|

|

|

|

|

|

|

108,128

|

|

Sanofi

|

|

8,107,747

|

|

10,987,981

|

|

|

187,122

|

|

Total SA

|

|

9,437,605

|

|

8,960,752

|

|

|

273,961

|

|

Bouygues SA

|

|

10,564,875

|

|

7,431,480

|

|

|

75,015

|

|

Sodexo

|

|

2,043,749

|

|

6,991,227

|

|

|

222,461

|

|

Carrefour SA

|

|

5,902,856

|

|

6,090,099

|

|

|

25,284

|

|

Robertet SA (a)

|

|

2,892,149

|

|

4,443,796

|

|

|

364,800

|

|

Société Télévision Francaise 1

|

|

6,165,469

|

|

4,089,644

|

|

|

52,842

|

|

Neopost SA (a)

|

|

4,579,686

|

|

3,165,865

|

|

|

26,147

|

|

Wendel SA (a)

|

|

508,531

|

|

2,767,339

|

|

|

27,856

|

|

Laurent-Perrier

|

|

2,065,828

|

|

2,185,451

|

|

|

26,499

|

|

NSC Groupe (c)

|

|

2,015,953

|

|

2,121,450

|

|

|

37,280

|

|

Société Foncière Financière et de Participations (a)

|

|

4,333,462

|

|

1,529,314

|

|

|

29,618

|

|

Legrand SA

|

|

921,935

|

|

1,291,698

|

|

|

8,655

|

|

BioMerieux

|

|

671,300

|

|

816,279

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Schedule of Investments.

FIRST EAGLE VARIABLE FUNDS

·

QUARTERLY NQ REPORT

·

March 31, 2013

1

|

SHARES

|

|

DESCRIPTION

|

|

COST

|

|

VALUE

|

|

|

|

|

|

|

|

|

|

|

|

International Common Stocks — 76.38% — (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

France 10.23% — (continued)

|

|

|

|

|

|

|

9,682

|

|

Gaumont SA

|

|

$

|

835,117

|

|

$

|

456,135

|

|

|

8,840

|

|

Sabeton SA (a)

|

|

100,102

|

|

144,262

|

|

|

|

|

|

|

61,146,364

|

|

63,472,772

|

|

|

Germany 4.25%

|

|

|

|

|

|

|

142,342

|

|

HeidelbergCement AG

|

|

7,346,007

|

|

10,229,562

|

|

|

352,458

|

|

Deutsche Wohnen AG

|

|

3,292,170

|

|

6,406,997

|

|

|

97,337

|

|

Daimler AG

|

|

4,685,509

|

|

5,296,334

|

|

|

141,511

|

|

Hamburger Hafen und Logistik AG

|

|

5,016,211

|

|

3,088,504

|

|

|

24,274

|

|

Fraport AG

|

|

913,552

|

|

1,360,636

|

|

|

|

|

|

|

21,253,449

|

|

26,382,033

|

|

|

Greece 0.60%

|

|

|

|

|

|

|

519,986

|

|

Jumbo SA (a)

|

|

3,834,854

|

|

3,706,272

|

|

|

|

|

|

|

|

|

|

|

|

Hong Kong 0.54%

|

|

|

|

|

|

|

189,670

|

|

Guoco Group Limited (a)

|

|

2,199,025

|

|

2,319,917

|

|

|

246,000

|

|

Great Eagle Holdings Limited

|

|

766,574

|

|

1,001,385

|

|

|

|

|

|

|

2,965,599

|

|

3,321,302

|

|

|

Ireland 0.90%

|

|

|

|

|

|

|

252,125

|

|

CRH PLC

|

|

4,349,815

|

|

5,559,925

|

|

|

|

|

|

|

|

|

|

|

|

Israel 0.42%

|

|

|

|

|

|

|

201,457

|

|

Israel Chemicals Limited

|

|

2,079,265

|

|

2,601,945

|

|

|

|

|

|

|

|

|

|

|

|

Italy 0.54%

|

|

|

|

|

|

|

397,580

|

|

Italcementi S.p.A. RSP

|

|

3,849,944

|

|

1,171,239

|

|

|

68,340

|

|

Italcementi S.p.A.

|

|

1,275,606

|

|

397,217

|

|

|

45,886

|

|

Italmobiliare S.p.A. RSP (a)

|

|

2,342,059

|

|

573,823

|

|

|

25,533

|

|

Italmobiliare S.p.A. (a)

|

|

2,256,914

|

|

476,251

|

|

|

79,000

|

|

Recordati S.p.A.

|

|

524,615

|

|

714,994

|

|

|

|

|

|

|

10,249,138

|

|

3,333,524

|

|

|

Japan 28.53%

|

|

|

|

|

|

|

70,660

|

|

SMC Corporation

|

|

8,344,041

|

|

13,655,775

|

|

|

43,210

|

|

Keyence Corporation

|

|

7,894,994

|

|

13,228,957

|

|

|

231,860

|

|

Secom Company Limited

|

|

10,027,701

|

|

11,941,764

|

|

|

76,980

|

|

Fanuc Corporation

|

|

6,396,270

|

|

11,775,722

|

|

|

124,860

|

|

Shimano, Inc.

|

|

3,048,145

|

|

10,193,737

|

|

|

227,400

|

|

KDDI Corporation

|

|

7,067,123

|

|

9,488,094

|

|

|

428,000

|

|

MS&AD Insurance Group Holdings

|

|

12,165,802

|

|

9,477,240

|

|

|

172,680

|

|

Astellas Pharma, Inc.

|

|

6,658,082

|

|

9,288,411

|

|

|

428,700

|

|

NKSJ Holdings, Inc.

|

|

11,510,327

|

|

8,973,215

|

|

|

63,480

|

|

Hirose Electric Company Limited

|

|

6,526,585

|

|

8,347,482

|

|

|

289,760

|

|

Mitsubishi Estate Company Limited

|

|

4,235,516

|

|

8,165,768

|

|

|

153,400

|

|

Nissin Foods Holdings Company Limited

|

|

5,408,937

|

|

7,036,473

|

|

|

350,760

|

|

Hoya Corporation

|

|

7,530,659

|

|

6,584,907

|

|

|

214,330

|

|

MISUMI Group, Inc.

|

|

3,667,582

|

|

5,910,195

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Schedule of Investments.

FIRST EAGLE VARIABLE FUNDS

·

QUARTERLY NQ REPORT

·

March 31, 2013

2

|

SHARES

|

|

DESCRIPTION

|

|

COST

|

|

VALUE

|

|

|

|

|

|

|

|

|

|

|

|

International Common Stocks — 76.38% — (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Japan 28.53% — (continued)

|

|

|

|

|

|

|

88,800

|

|

Ono Pharmaceutical Company Limited

|

|

$

|

3,336,067

|

|

$

|

5,484,512

|

|

|

205,490

|

|

Nomura Research Institute Limited

|

|

3,935,334

|

|

5,303,813

|

|

|

361,980

|

|

Kansai Paint Company Limited

|

|

2,725,268

|

|

4,009,601

|

|

|

131,694

|

|

Secom Joshinetsu Company Limited

|

|

2,607,153

|

|

3,359,898

|

|

|

139,048

|

|

Chofu Seisakusho Company Limited

|

|

2,330,173

|

|

3,164,683

|

|

|

138,180

|

|

As One Corporation

|

|

2,630,694

|

|

3,162,555

|

|

|

162,919

|

|

Nitto Kohki Company Limited

|

|

3,241,765

|

|

3,126,063

|

|

|

371,400

|

|

Japan Wool Textile Company Limited

|

|

2,780,876

|

|

2,874,234

|

|

|

148,700

|

|

T. Hasegawa Company Limited

|

|

2,196,668

|

|

2,200,387

|

|

|

121,710

|

|

Nagaileben Company Limited

|

|

1,035,783

|

|

1,854,049

|

|

|

27,920

|

|

Shin-Etsu Chemical Company Limited

|

|

1,299,151

|

|

1,843,130

|

|

|

1,118

|

|

NTT DoCoMo, Inc.

|

|

1,687,242

|

|

1,659,113

|

|

|

51,930

|

|

Daiichikosho Company Limited

|

|

711,897

|

|

1,410,451

|

|

|

25,394

|

|

SK Kaken Company Limited

|

|

654,403

|

|

1,320,720

|

|

|

81,060

|

|

OSG Corporation

|

|

506,209

|

|

1,114,176

|

|

|

43,800

|

|

Seikagaku Corporation

|

|

309,117

|

|

473,992

|

|

|

9,110

|

|

Kobayashi Pharmaceutical Company Limited

|

|

418,710

|

|

442,571

|

|

|

18,800

|

|

Shingakukai Company Limited

|

|

106,264

|

|

67,750

|

|

|

13,180

|

|

Sansei Yusoki Company Limited

|

|

77,137

|

|

53,802

|

|

|

|

|

|

|

133,071,675

|

|

176,993,240

|

|

|

Malaysia 0.75%

|

|

|

|

|

|

|

3,947,290

|

|

Genting Malaysia Berhad

|

|

3,363,197

|

|

4,678,364

|

|

|

|

|

|

|

|

|

|

|

|

Mexico 2.99%

|

|

|

|

|

|

|

418,205

|

|

Grupo Televisa S.A.B., ADR

|

|

7,753,651

|

|

11,128,435

|

|

|

119,710

|

|

Industrias Peñoles S.A.B. de C.V.

|

|

661,696

|

|

5,623,317

|

|

|

86,919

|

|

Fresnillo PLC

|

|

341,260

|

|

1,790,032

|

|

|

|

|

|

|

8,756,607

|

|

18,541,784

|

|

|

Netherlands 0.31%

|

|

|

|

|

|

|

263,553

|

|

TNT Express NV

|

|

2,778,254

|

|

1,931,893

|

|

|

|

|

|

|

|

|

|

|

|

Norway 0.55%

|

|

|

|

|

|

|

424,764

|

|

Orkla ASA

|

|

2,981,701

|

|

3,398,170

|

|

|

|

|

|

|

|

|

|

|

|

Singapore 2.32%

|

|

|

|

|

|

|

1,309,830

|

|

Haw Par Corporation Limited

|

|

3,785,660

|

|

8,154,090

|

|

|

4,065,310

|

|

ComfortDelGro Corporation Limited

|

|

4,719,225

|

|

6,261,384

|

|

|

|

|

|

|

8,504,885

|

|

14,415,474

|

|

|

South Africa 1.04%

|

|

|

|

|

|

|

553,133

|

|

Gold Fields Limited, ADR

|

|

5,860,382

|

|

4,286,781

|

|

|

235,367

|

|

Harmony Gold Mining Company Limited, ADR

|

|

2,356,639

|

|

1,508,702

|

|

|

115,754

|

|

Sibanye Gold Limited, ADR (a)

|

|

796,571

|

|

654,010

|

|

|

|

|

|

|

9,013,592

|

|

6,449,493

|

|

|

South Korea 2.51%

|

|

|

|

|

|

|

92,672

|

|

KT&G Corporation

|

|

5,113,871

|

|

6,288,636

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Schedule of Investments.

FIRST EAGLE VARIABLE FUNDS

·

QUARTERLY NQ REPORT

·

March 31, 2013

3

|

SHARES

|

|

DESCRIPTION

|

|

COST

|

|

VALUE

|

|

|

|

|

|

|

|

|

|

|

|

International Common Stocks — 76.38% — (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

South Korea 2.51% — (continued)

|

|

|

|

|

|

|

20,820

|

|

Nong Shim Company Limited

|

|

$

|

4,057,784

|

|

$

|

5,744,868

|

|

|

1,360

|

|

Lotte Confectionery Company Limited

|

|

605,175

|

|

2,153,802

|

|

|

60,950

|

|

Fursys, Inc.

|

|

1,479,507

|

|

1,380,496

|

|

|

|

|

|

|

11,256,337

|

|

15,567,802

|

|

|

Spain 0.70%

|

|

|

|

|

|

|

85,811

|

|

Red Electrica Corporation SA

|

|

4,090,765

|

|

4,317,710

|

|

|

|

|

|

|

|

|

|

|

|

Sweden 1.13%

|

|

|

|

|

|

|

233,754

|

|

Investor AB, Class ‘A’

|

|

4,657,344

|

|

6,625,153

|

|

|

12,577

|

|

Investor AB, Class ‘B’

|

|

234,678

|

|

363,808

|

|

|

|

|

|

|

4,892,022

|

|

6,988,961

|

|

|

Switzerland 3.84%

|

|

|

|

|

|

|

151,480

|

|

Nestlé SA

|

|

4,865,833

|

|

10,957,958

|

|

|

129,778

|

|

Pargesa Holding SA

|

|

7,721,848

|

|

8,813,690

|

|

|

427

|

|

Lindt & Spruengli AG PC (a)

|

|

1,208,579

|

|

1,643,658

|

|

|

9,593

|

|

Rieter Holding AG (a)

|

|

1,167,779

|

|

1,627,474

|

|

|

11,283

|

|

Autoneum Holding AG (a)

|

|

520,295

|

|

754,974

|

|

|

|

|

|

|

15,484,334

|

|

23,797,754

|

|

|

Thailand 1.71%

|

|

|

|

|

|

|

11,310,192

|

|

Thai Beverage PCL

|

|

1,840,464

|

|

5,563,436

|

|

|

611,105

|

|

Bangkok Bank PCL, NVDR

|

|

2,002,395

|

|

4,632,587

|

|

|

20,000

|

|

OHTL PCL (c)

|

|

88,922

|

|

382,449

|

|

|

|

|

|

|

3,931,781

|

|

10,578,472

|

|

|

Turkey 0.57%

|

|

|

|

|

|

|

322,623

|

|

Yazicilar Holding AS

|

|

2,303,936

|

|

3,562,632

|

|

|

|

|

|

|

|

|

|

|

|

United Kingdom 3.06%

|

|

|

|

|

|

|

246,940

|

|

GlaxoSmithKline PLC

|

|

4,684,146

|

|

5,769,994

|

|

|

185,270

|

|

Berkeley Group Holdings PLC

|

|

2,201,896

|

|

5,742,943

|

|

|

1,347,139

|

|

WM Morrison Supermarkets PLC

|

|

6,024,897

|

|

5,650,964

|

|

|

72,000

|

|

Anglo American PLC

|

|

2,138,291

|

|

1,850,203

|

|

|

|

|

|

|

15,049,230

|

|

19,014,104

|

|

|

Total International Common Stocks

|

|

386,695,167

|

|

473,766,810

|

|

|

|

|

|

|

|

|

|

|

|

International Preferred Stock — 0.24%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

South Korea 0.24%

|

|

|

|

|

|

|

1,949

|

|

Samsung Electronics Company Limited

|

|

250,410

|

|

1,520,521

|

|

|

|

|

|

|

|

|

|

|

|

OUNCES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commodity — 5.29%

|

|

|

|

|

|

|

20,548

|

|

Gold bullion (a)

|

|

18,141,049

|

|

32,804,880

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Schedule of Investments.

FIRST EAGLE VARIABLE FUNDS

·

QUARTERLY NQ REPORT

·

March 31, 2013

4

|

PRINCIPAL

|

|

DESCRIPTION

|

|

COST

|

|

VALUE

|

|

|

|

|

|

|

|

|

|

|

|

International Corporate Bonds — 0.31%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada 0.31%

|

|

|

|

|

|

|

1,863,261

USD

|

|

Catalyst Paper Corporation 11.00% due 10/30/17 (b)(d)

|

|

$

|

2,596,592

|

|

$

|

1,490,609

|

|

|

395,862

USD

|

|

Catalyst Paper Corporation FRN 13.00% due 09/13/16 (b)(c)(e)(f)

|

|

341,998

|

|

410,707

|

|

|

Total International Corporate Bonds

|

|

2,938,590

|

|

1,901,316

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Paper — 16.74%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International Commercial Paper — 2.84%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada 0.07%

|

|

|

|

|

|

|

462,000

USD

|

|

Suncor Energy, Inc. 0.30% due 04/10/13

|

|

461,965

|

|

461,965

|

|

|

|

|

|

|

|

|

|

|

|

Germany 0.21%

|

|

|

|

|

|

|

1,300,000

USD

|

|

Siemens Company 0.12% due 04/22/13

|

|

1,299,909

|

|

1,299,909

|

|

|

|

|

|

|

|

|

|

|

|

Italy 0.76%

|

|

|

|

|

|

|

1,149,000

USD

|

|

Eni S.p.A. 0.41% due 04/05/13

|

|

1,148,949

|

|

1,148,949

|

|

|

3,557,000

USD

|

|

Eni S.p.A. 0.42% due 04/04/13

|

|

3,556,878

|

|

3,556,878

|

|

|

|

|

|

|

|

|

|

|

|

Japan 0.43%

|

|

|

|

|

|

|

2,658,000

USD

|

|

Honda Corporation 0.14% due 06/07/13

|

|

2,657,308

|

|

2,657,192

|

|

|

|

|

|

|

|

|

|

|

|

Panama 0.12%

|

|

|

|

|

|

|

722,000

USD

|

|

Carnival Corporation 0.28% due 04/01/13

|

|

722,000

|

|

722,000

|

|

|

|

|

|

|

|

|

|

|

|

Switzerland 0.55%

|

|

|

|

|

|

|

1,125,000

USD

|

|

Nestlé SA 0.11% due 04/01/13

|

|

1,125,000

|

|

1,125,000

|

|

|

1,306,000

USD

|

|

Nestlé SA 0.14% due 06/25/13

|

|

1,305,568

|

|

1,305,543

|

|

|

976,000

USD

|

|

Nestlé SA 0.15% due 06/03/13

|

|

975,744

|

|

975,634

|

|

|

|

|

|

|

|

|

|

|

|

United Arab Emirates 0.26%

|

|

|

|

|

|

|

1,608,000

USD

|

|

Xstrata Finance Dubai Limited 0.37% due 04/15/13

|

|

1,607,775

|

|

1,607,775

|

|

|

|

|

|

|

|

|

|

|

|

United Kingdom 0.44%

|

|

|

|

|

|

|

976,000

USD

|

|

AstraZeneca PLC 0.10% due 04/11/13

|

|

975,973

|

|

975,973

|

|

|

1,776,000

USD

|

|

AstraZeneca PLC 0.14% due 04/22/13

|

|

1,775,855

|

|

1,775,855

|

|

|

|

|

|

|

|

|

|

|

|

Total International Commercial Paper

|

|

17,612,924

|

|

17,612,673

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Commercial Paper — 13.90%

|

|

|

|

|

|

|

$

|

250,000

|

|

Abbott Laboratories 0.10% due 04/22/13

|

|

249,985

|

|

249,985

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Schedule of Investments.

FIRST EAGLE VARIABLE FUNDS

·

QUARTERLY NQ REPORT

·

March 31, 2013

5

|

PRINCIPAL

|

|

DESCRIPTION

|

|

COST

|

|

VALUE

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Commercial Paper — 13.90% — (continued)

|

|

|

|

|

|

|

$

|

1,408,000

|

|

Abbott Laboratories 0.11% due 04/02/13

|

|

$

|

1,407,996

|

|

$

|

1,407,996

|

|

|

900,000

|

|

Abbott Laboratories 0.11% due 04/23/13

|

|

899,939

|

|

899,939

|

|

|

1,029,000

|

|

Abbott Laboratories 0.13% due 05/28/13

|

|

1,028,788

|

|

1,028,788

|

|

|

1,209,000

|

|

Air Products & Chemicals, Inc. 0.11% due 04/30/13

|

|

1,208,893

|

|

1,208,893

|

|

|

3,968,000

|

|

BHP Billiton Finance USA Limited 0.12% due 04/12/13

|

|

3,967,854

|

|

3,967,854

|

|

|

1,587,000

|

|

BHP Billiton Finance USA Limited 0.14% due 05/17/13

|

|

1,586,716

|

|

1,586,716

|

|

|

683,000

|

|

Brown-Forman Corporation 0.18% due 04/05/13

|

|

682,986

|

|

682,986

|

|

|

2,767,000

|

|

Caterpillar Financial Services Company 0.15% due 06/20/13

|

|

2,766,078

|

|

2,766,007

|

|

|

1,444,000

|

|

Chevron Corporation 0.09% due 04/29/13

|

|

1,443,899

|

|

1,443,899

|

|

|

1,890,000

|

|

Chevron Corporation 0.11% due 05/03/13

|

|

1,889,815

|

|

1,889,815

|

|

|

976,000

|

|

Church & Dwight Company, Inc. 0.33% due 05/02/13

|

|

975,723

|

|

975,723

|

|

|

2,408,000

|

|

Coca-Cola Company 0.10% due 04/18/13

|

|

2,407,886

|

|

2,407,886

|

|

|

250,000

|

|

Coca-Cola Company 0.10% due 04/19/13

|

|

249,988

|

|

249,988

|

|

|

790,000

|

|

Coca-Cola Company 0.18% due 04/01/13

|

|

790,000

|

|

790,000

|

|

|

1,778,000

|

|

Danaher Corporation 0.14% due 04/22/13

|

|

1,777,855

|

|

1,777,855

|

|

|

1,589,000

|

|

Deere & Company 0.12% due 05/03/13

|

|

1,588,831

|

|

1,588,831

|

|

|

1,529,000

|

|

Deere & Company 0.13% due 04/05/13

|

|

1,528,978

|

|

1,528,978

|

|

|

1,778,000

|

|

Deere & Company 0.13% due 04/08/13

|

|

1,777,955

|

|

1,777,955

|

|

|

515,000

|

|

Devon Energy Corporation 0.24% due 04/05/13

|

|

514,986

|

|

514,986

|

|

|

2,309,000

|

|

Devon Energy Corporation 0.27% due 05/01/13

|

|

2,308,480

|

|

2,308,480

|

|

|

250,000

|

|

Devon Energy Corporation 0.29% due 04/04/13

|

|

249,994

|

|

249,994

|

|

|

1,111,000

|

|

Devon Energy Corporation 0.29% due 04/08/13

|

|

1,110,937

|

|

1,110,937

|

|

|

325,000

|

|

Devon Energy Corporation 0.33% due 04/03/13

|

|

324,994

|

|

324,994

|

|

|

958,000

|

|

Devon Energy Corporation 0.33% due 04/04/13

|

|

957,974

|

|

957,974

|

|

|

1,463,000

|

|

Exxon Mobil Corporation 0.04% due 04/09/13

|

|

1,462,987

|

|

1,462,987

|

|

|

1,544,000

|

|

Google, Inc. 0.12% due 06/04/13

|

|

1,543,671

|

|

1,543,526

|

|

|

250,000

|

|

Google, Inc. 0.15% due 05/02/13

|

|

249,968

|

|

249,968

|

|

|

1,406,000

|

|

Hasbro, Inc. 0.25% due 04/01/13

|

|

1,406,000

|

|

1,406,000

|

|

|

1,944,000

|

|

Johnson & Johnson 0.06% due 04/02/13

|

|

1,943,997

|

|

1,943,997

|

|

|

839,000

|

|

Kimberly Clark 0.10% due 04/22/13

|

|

838,951

|

|

838,951

|

|

|

1,206,000

|

|

Kimberly Clark 0.10% due 05/13/13

|

|

1,205,859

|

|

1,205,859

|

|

|

2,632,000

|

|

Merck & Company, Inc. 0.08% due 04/05/13

|

|

2,631,977

|

|

2,631,977

|

|

|

1,690,000

|

|

Merck & Company, Inc. 0.08% due 04/08/13

|

|

1,689,974

|

|

1,689,974

|

|

|

1,111,000

|

|

Merck & Company, Inc. 0.08% due 04/15/13

|

|

1,110,965

|

|

1,110,965

|

|

|

2,721,000

|

|

MetLife 0.15% due 05/16/13

|

|

2,720,490

|

|

2,720,490

|

|

|

2,889,000

|

|

PepsiCo, Inc. 0.05% due 04/26/13

|

|

2,888,900

|

|

2,888,900

|

|

|

5,124,000

|

|

Pfizer, Inc. 0.09% due 04/18/13

|

|

5,123,782

|

|

5,123,782

|

|

|

1,984,000

|

|

Philip Morris International, Inc. 0.07% due 06/06/13

|

|

1,983,745

|

|

1,983,702

|

|

|

1,055,000

|

|

Precision Castparts Corporation 0.12% due 04/01/13

|

|

1,055,000

|

|

1,055,000

|

|

|

567,000

|

|

Precision Castparts Corporation 0.15% due 04/15/13

|

|

566,967

|

|

566,967

|

|

|

2,573,000

|

|

Unilever Capital Corporation 0.09% due 04/03/13

|

|

2,572,987

|

|

2,572,987

|

|

|

3,112,000

|

|

United Healthcare Company 0.20% due 04/01/13

|

|

3,112,000

|

|

3,112,000

|

|

|

4,109,000

|

|

United Healthcare Company 0.31% due 06/05/13

|

|

4,106,700

|

|

4,106,522

|

|

|

866,000

|

|

United Parcel Service, Inc. 0.06% due 04/04/13

|

|

865,996

|

|

865,996

|

|

|

1,286,000

|

|

United Parcel Service, Inc. 0.10% due 04/02/13

|

|

1,285,996

|

|

1,285,996

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Schedule of Investments.

FIRST EAGLE VARIABLE FUNDS

·

QUARTERLY NQ REPORT

·

March 31, 2013

6

|

PRINCIPAL

|

|

DESCRIPTION

|

|

COST

|

|

VALUE

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Commercial Paper — 13.90% — (continued)

|

|

|

|

|

|

|

$

|

3,968,000

|

|

Wal-Mart Stores, Inc. 0.09% due 04/16/13

|

|

$

|

3,967,851

|

|

$

|

3,967,851

|

|

|

2,927,000

|

|

Wal-Mart Stores, Inc. 0.13% due 06/10/13

|

|

2,926,260

|

|

2,925,973

|

|

|

2,836,000

|

|

Wal-Mart Stores, Inc. 0.13% due 06/11/13

|

|

2,835,273

|

|

2,835,005

|

|

|

464,000

|

|

Walt Disney Company 0.13% due 04/15/13

|

|

463,977

|

|

463,977

|

|

|

945,000

|

|

WellPoint, Inc. 0.23% due 06/03/13

|

|

944,620

|

|

944,462

|

|

|

992,000

|

|

WellPoint, Inc. 0.26% due 06/14/13

|

|

991,470

|

|

991,391

|

|

|

Total U.S. Commercial Paper

|

|

86,193,893

|

|

86,192,664

|

|

|

Total Commercial Paper

|

|

103,806,817

|

|

103,805,337

|

|

|

Total Investments — 98.96%

|

|

$

|

511,832,033

|

|

$

|

613,798,864

|

|

|

Other Assets in Excess of Liabilities — 1.04%

|

|

|

|

6,475,282

|

|

|

Net Assets — 100.00%

|

|

|

|

$

|

620,274,146

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

Non-income producing security/commodity.

|

|

(b)

|

Represents securities that are subject to legal or contractual restrictions on resale. At March 31, 2013, the value of these securities amounted to $2,161,512 or 0.35% of net assets.

|

|

(c)

|

Security is deemed illiquid. At March 31, 2013, the value of these securities amounted to $2,914,606 or 0.47% of net assets.

|

|

(d)

|

Payment-in-kind security.

|

|

(e)

|

Floating rate security. Rate shown is the rate in effect at March 31, 2013.

|

|

(f)

|

All or a portion of the security is exempt from registration under the Securities Act of 1933. Rule 144A securities may only be sold to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933.

|

At March 31, 2013, cost is substantially identical for both book and federal income tax purposes. Net unrealized appreciation consisted of:

|

Gross unrealized appreciation

|

|

$

|

140,031,140

|

|

|

Gross unrealized depreciation

|

|

(38,064,309

|

)

|

|

Net unrealized appreciation

|

|

$

|

101,966,831

|

|

Abbreviations used in this schedule include:

|

ADR

|

—

|

American Depository Receipt

|

|

FRN

|

—

|

Floating Rate Note

|

|

NVDR

|

—

|

Non-Voting Depository Receipt

|

|

PC

|

—

|

Participation Certificate

|

|

PCL

|

—

|

Public Company Limited

|

|

PLC

|

—

|

Public Limited Company

|

|

RSP

|

—

|

Represents Non-Voting Shares

|

Currencies

|

USD

|

—

|

United States Dollar

|

|

RESTRICTED SECURITIES

|

|

ACQUISITION DATE

|

|

COST

|

|

CARRYING VALUE

PER

SHARE/PRINCIPAL

|

|

|

Catalyst Paper Corporation

|

|

09/17/12

|

|

$

|

2,181

|

|

$

|

2.42

|

|

|

Catalyst Paper Corporation 11.00% due 10/30/17

|

|

09/17/12

|

|

2,596,592

|

|

0.80

|

|

|

Catalyst Paper Corporation FRN 13.00% due 09/13/16

|

|

08/31/12

|

|

341,998

|

|

1.04

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Schedule of Investments.

FIRST EAGLE VARIABLE FUNDS

·

QUARTERLY NQ REPORT

·

March 31, 2013

7

Foreign Currency Exchange Contracts - Sales

|

SETTLEMENT DATES

THROUGH

|

|

FOREIGN CURRENCY

TO BE DELIVERED

|

|

U.S. $

TO BE RECEIVED

|

|

U.S. $ VALUE

AT MARCH 31,

2013

|

|

UNREALIZED

APPRECIATION

AT MARCH 31,

2013

|

|

UNREALIZED

DEPRECIATION

AT MARCH 31,

2013

|

|

|

04/17/13

|

|

3,209,000

|

|

Euro

|

|

$

|

4,144,520

|

|

$

|

4,113,834

|

|

$

|

30,686

|

|

$

|

—

|

|

|

06/19/13

|

|

5,689,000

|

|

Euro

|

|

7,388,222

|

|

7,296,488

|

|

91,734

|

|

—

|

|

|

07/17/13

|

|

6,759,000

|

|

Euro

|

|

8,835,432

|

|

8,670,844

|

|

164,588

|

|

—

|

|

|

08/21/13

|

|

9,144,000

|

|

Euro

|

|

11,859,533

|

|

11,727,780

|

|

131,753

|

|

—

|

|

|

09/18/13

|

|

2,737,000

|

|

Euro

|

|

3,579,038

|

|

3,513,134

|

|

65,904

|

|

—

|

|

|

04/17/13

|

|

603,942,000

|

|

Japanese Yen

|

|

7,732,685

|

|

6,416,326

|

|

1,316,359

|

|

—

|

|

|

06/19/13

|

|

1,240,549,000

|

|

Japanese Yen

|

|

14,920,829

|

|

13,185,575

|

|

1,735,254

|

|

—

|

|

|

07/17/13

|

|

1,599,884,000

|

|

Japanese Yen

|

|

18,244,875

|

|

17,008,951

|

|

1,235,924

|

|

—

|

|

|

08/21/13

|

|

2,307,457,000

|

|

Japanese Yen

|

|

26,445,723

|

|

24,530,852

|

|

1,914,871

|

|

—

|

|

|

09/18/13

|

|

1,747,957,000

|

|

Japanese Yen

|

|

18,254,472

|

|

18,594,296

|

|

—

|

|

(339,824

|

)

|

|

|

|

|

|

|

|

$

|

121,405,329

|

|

$

|

115,058,080

|

|

$

|

6,687,073

|

|

$

|

(339,824

|

)

|

Foreign Currency Exchange Contracts - Purchases

|

SETTLEMENT DATES

THROUGH

|

|

FOREIGN CURRENCY

TO BE RECEIVED

|

|

U.S. $

TO BE DELIVERED

|

|

U.S. $ VALUE

AT MARCH 31,

2013

|

|

UNREALIZED

APPRECIATION

AT MARCH 31,

2013

|

|

UNREALIZED

DEPRECIATION

AT MARCH 31,

2013

|

|

|

07/17/13

|

|

822,134,000

|

|

Japanese Yen

|

|

$

|

9,047,315

|

|

$

|

8,740,407

|

|

$

|

—

|

|

$

|

(306,908

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INDUSTRY DIVERSIFICATION FOR PORTFOLIO HOLDINGS

|

|

|

PERCENT OF

NET ASSETS

|

|

|

International Common Stocks

|

|

|

|

|

Consumer Discretionary

|

|

10.07

|

%

|

|

Consumer Staples

|

|

8.69

|

|

|

Energy

|

|

4.72

|

|

|

Financials

|

|

10.26

|

|

|

Health Care

|

|

7.53

|

|

|

Industrials

|

|

15.35

|

|

|

Information Technology

|

|

5.91

|

|

|

Materials

|

|

11.35

|

|

|

Telecommunication Services

|

|

1.80

|

|

|

Utilities

|

|

0.70

|

|

|

Total International Common Stocks

|

|

76.38

|

|

|

International Preferred Stock

|

|

|

|

|

Information Technology

|

|

0.24

|

|

|

Total International Preferred Stock

|

|

0.24

|

|

|

Commodity

|

|

5.29

|

|

|

International Corporate Bonds

|

|

|

|

|

Materials

|

|

0.31

|

|

|

Total International Corporate Bonds

|

|

0.31

|

|

|

Commercial Paper

|

|

|

|

|

International Commercial Paper

|

|

2.84

|

|

See Notes to Schedule of Investments.

FIRST EAGLE VARIABLE FUNDS

·

QUARTERLY NQ REPORT

·

March 31, 2013

8

|

U.S. Commercial Paper

|

|

13.90

|

%

|

|

Total Commercial Paper

|

|

16.74

|

|

|

Total Investments

|

|

98.96

|

%

|

See Notes to Schedule of Investments.

FIRST EAGLE VARIABLE FUNDS

·

QUARTERLY NQ REPORT

·

March 31, 2013

9

FIRST EAGLE OVERSEAS VARIABLE FUND

NOTES TO SCHEDULE OF INVESTMENTS (unaudited)

First Eagle Variable Funds (the “Trust”) is an open-end, diversified management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). The Trust consists of one portfolio, First Eagle Overseas Variable Fund (the “Fund”). The Trust is a Delaware statutory trust and was until March 31, 2004 a Maryland Corporation operating under the name First Eagle Variable Funds, Inc. The First Eagle Overseas Variable Fund seeks long-term growth of capital by investing primarily in equities issued by non—U.S. corporations.

First Eagle Investment Management, LLC (the “Adviser”), a subsidiary of Arnhold and S. Bleichroeder Holdings, Inc. (“ASB Holdings”), manages the Fund.

The following is a summary of significant accounting policies adhered to by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”).

Investment valuation

— The Fund computes its net asset value once daily as of the close of trading on each day the New York Stock Exchange (“NYSE”) is open for trading. The net asset value per share is computed by dividing the total current value of the assets of the Fund, less its liabilities, by the total number of shares outstanding at the time of such computation.

A portfolio security, other than a bond, which is traded on a U.S. national securities exchange or a securities exchange abroad is normally valued at the price of the last sale on the exchange as of the close of business on the date on which assets are valued. If there are no sales on such date, such portfolio investment will be valued at the mean between the closing bid and asked prices (and if there is only a bid or only an asked price on such date, valuation will be at such bid or asked price for long or short positions, respectively). Securities, other than bonds, traded in the over-the-counter market are valued at the mean between the last bid and asked prices prior to the time of valuation (and if there is only a bid or only an asked price on such date, valuation will be at such bid or asked price for long or short positions, respectively), except if such unlisted security traded on the NASDAQ, in which case it is valued at its last sale price (or, if available, the NASDAQ Official Closing Price).

All bonds, whether listed on an exchange or traded in the over-the-counter market (and except for short-term investments as described in the next sentence), for which market quotations are readily available are valued at the mean between the last bid and asked prices received from dealers in the over-the-counter market in the United States or abroad, except that when no asked price is available, bonds are valued at the last bid price alone. Broker-Dealers or pricing services use multiple valuation techniques to determine value. In instances where sufficient market activity exists, dealers or pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the dealers or pricing services also utilize proprietary valuation models which may consider market transactions in comparable securities and the various relationships between securities in determining value and/or market characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon-rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair values. Short-term investments maturing in sixty days or less are valued at cost plus interest earned (or discount amortized, as the case may be), which is deemed to approximate value.

Commodities (such as physical metals) are valued at the spot price at the time trading on the New York Stock Exchange closes (normally 4:00 p.m. E.S.T.).

Forward contracts are valued at the current cost of covering or offsetting such contracts.

Effective March 1, 2013, the Fund changed to 4:00 p.m. E.S.T. foreign exchange rates to convert foreign security prices into U.S. dollars. Any security that is listed or traded on more than one exchange (or traded in multiple markets) is valued at the relevant quotation on the exchange or market deemed to be the primary trading venue for that security. In the absence of such a quotation, a quotation from the exchange or market deemed by the Adviser to be the secondary trading venue for the particular security shall be used. The Fund uses pricing services to identify the market prices of publicly traded securities in its portfolios. When market prices are determined to be “stale” as a result of limited market activity for a particular holding, or in other circumstances when market prices are unavailable, such as for private placements, or determined to be unreliable for a particular holding, such holdings may be “fair valued” in accordance with procedures approved by the Board of Trustees (“Board”). Additionally, with respect to foreign holdings, specifically in circumstances leading the Adviser to believe that significant events occurring after the close of a foreign market have materially affected

10

the value of the Fund’s holdings in that market, such holdings may be fair valued to reflect the events in accordance with procedures approved by the Board. The determination of whether a particular foreign investment should be fair valued will be based on review of a number of factors, including developments in foreign markets, the performance of U.S. securities markets and security-specific events. The values assigned to the Fund’s holdings therefore may differ on occasion from reported market values.

The Fund has adopted procedures under which movements in the prices for U.S. securities (beyond specified thresholds) occurring after the close of a foreign market may require fair valuation of securities traded in that foreign market. The values assigned to the Fund’s holdings therefore may differ on occasion from reported market values. The Trust and the Adviser believe relying on the procedures as just described will result in prices that are more reflective of the actual market value of portfolio securities held by the Fund as of 4:00 p.m. E.S.T.

The Fund adopted provisions surrounding fair value measurements and disclosures that define fair value, establishes a framework for measuring fair value in GAAP and expands disclosures about fair value measurements. This applies to fair value measurements that are already required or permitted by other accounting standards and is intended to increase consistency of those measurements and applies broadly to securities and other types of assets and liabilities.

The Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs or assumptions to valuation techniques used to measure fair value. These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

Level 1 - Quoted prices in active markets for identical securities.

Level 2 - Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 - Other significant unobservable inputs (including the Fund’s own assumption in determining the fair value of investments).

The significant unobservable inputs that may be used in determining valuations for investments identified within Level 3 are market comparables and the enterprise value of a company. Indications of value and quotations may be observable at any given time, but are currently treated by the Fund as unobservable. Significant changes in any of the unobservable inputs may significantly impact the fair value measurement. The impact is based on the relationship between each unobservable input and the fair value measurement.

Significant increases (decreases) in enterprise multiples may increase (decrease) the fair value measurement. Significant increases (decreases) in the discount for marketability, probability of insolvency and probability of default may decrease (increase) the fair value measurement.

Fair valuation of securities, other financial investments or other assets (collectively, “securities”) held by the Fund shall be determined in good faith by or under the direction of the Board, generally acting through its designated Valuation Committee or Valuation Panel (collectively, the “Committees”). The Committees’ responsibilities include making determinations regarding Level 3 fair value measurements and providing the results to the Board, in accordance with the Fund’s valuation policies.

It is the policy of the Fund to recognize significant transfers between Levels 1, 2 and 3 and to disclose those transfers as of the date of the underlying event which caused the movement.

The following is a summary of the Fund’s inputs used to value the Fund’s investments as of March 31, 2013:

11

|

DESCRIPTION

|

|

LEVEL 1

|

|

LEVEL 2(a)

|

|

LEVEL 3

|

|

TOTAL

|

|

|

Assets:†

|

|

|

|

|

|

|

|

|

|

|

International Common Stocks

|

|

$

|

471,262,911

|

|

$

|

2,503,899

|

|

$

|

—

|

|

$

|

473,766,810

|

|

|

International Preferred Stock

|

|

1,520,521

|

|

—

|

|

—

|

|

1,520,521

|

|

|

Commodity *

|

|

32,804,880

|

|

—

|

|

—

|

|

32,804,880

|

|

|

International Corporate Bonds

|

|

—

|

|

1,901,316

|

|

—

|

|

1,901,316

|

|

|

International Commercial Paper

|

|

—

|

|

17,612,673

|

|

—

|

|

17,612,673

|

|

|

U.S. Commercial Paper

|

|

—

|

|

86,192,664

|

|

—

|

|

86,192,664

|

|

|

Foreign Currency Contracts **

|

|

—

|

|

6,687,073

|

|

—

|

|

6,687,073

|

|

|

Total

|

|

$

|

505,588,312

|

|

$

|

114,897,625

|

|

$

|

—

|

|

$

|

620,485,937

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

Foreign Currency Contracts **

|

|

$

|

—

|

|

$

|

646,732

|

|

$

|

—

|

|

$

|

646,732

|

|

|

Total

|

|

$

|

—

|

|

$

|

646,732

|

|

$

|

—

|

|

$

|

646,732

|

|

|

(a)

|

Transfer into/out of Level 2 represent value as of the beginning of the period.

|

|

International common stocks and an international preferred stock valued at $412,769,291 and $2,219,419 respectively, were transferred from Level 2 to Level 1 during the three-month period ended March 31, 2013. At December 31, 2012, these securities were valued based on fair value adjustment factors; at March 31, 2013, these securities were valued using quoted market prices in active markets. There were no transfers from Level 1 to Level 2 as of the three-month period ended March 31, 2013.

|

|

†

|

See Schedule of Investments for additional detailed categorizations.

|

|

*

|

Represents gold bullion.

|

|

**

|

Foreign currency contracts are valued at net unrealized appreciation (depreciation) on the investment.

|

Forward currency contracts

— In connection with portfolio purchases and sales of securities denominated in foreign currencies, the Fund has entered into forward currency contracts. The Fund enters into foreign exchanged contracts primarily to manage and/or gain exposure to certain foreign currencies. The Fund’s currency transactions include portfolio hedging on portfolio positions. Portfolio hedging is the use of a forward contract (or other cash management position) with respect to one or more portfolio security positions denominated or quoted in a particular currency. Currency exchange transactions involve currencies of the different countries that the Fund invests in and serve as hedges against possible variations in the exchange rates between these currencies and the U.S. dollar. The Fund engages in portfolio hedging with respect to the currency of a particular country in amounts approximating actual or anticipated positions in securities denominated in that currency. Hedging can reduce exposure to currency exchange movements, but cannot eliminate that exposure. It is possible to lose money under a hedge.

The Fund could be exposed to risk if the value of the currency changes unfavorably, if the counterparties to the contracts are unable to meet the terms of their contracts or if the Fund is unable to enter into a closing position. Forward currency contracts outstanding at period end, if any, are listed after the Fund’s portfolio. Outstanding contracts at period end are indicative of the volume of activity during the period.

The Fund adopted provisions surrounding disclosures and derivative instruments and hedging activities which require qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments, and disclosures about currency-risk-related contingent features in derivative agreements.

At March 31, 2013, the Fund had the following foreign forward currency contracts grouped into appropriate risk categories illustrated below:

|

|

|

|

|

|

|

GAIN OR (LOSS) ON

DERIVATIVES RECOGNIZED

IN INCOME

|

|

|

RISK TYPE

|

|

ASSET DERIVATIVE

FAIR VALUE

|

|

LIABILITY DERIVATIVE

FAIR VALUE

|

|

REALIZED

GAIN

|

|

CHANGE IN

APPRECIATION

|

|

|

Foreign Currency

|

|

$

|

6,687,073

|

|

$

|

646,732

|

|

$

|

6,570,941

|

|

$

|

803,499

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12

Item 2. Controls and Procedures.

a)

The registrant’s Principal Executive Officer and Principal Financial Officer concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act) were effective as of a date within 90 days prior to the filing date of this report (the “Evaluation Date”), based on their evaluation of the effectiveness of the registrant’s disclosure controls and procedures as of the Evaluation Date.

b)

There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d)) that occurred during the registrant’s last fiscal quarter that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 3. Exhibits.

(a) Certifications of the Principal Executive Officer and Principal Financial Officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act (17 CFR 270.30a-2(a))are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

First Eagle Variable Funds

|

|

|

|

By

|

/s/ John P. Arnhold

|

|

|

|

John P. Arnhold, President

|

|

|

|

|

|

|

|

Date: May 20, 2013

|

|

|

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

By

|

/s/ John P. Arnhold

|

|

|

|

John P. Arnhold, Principal Executive Officer

|

|

Date: May 20, 2013

|

|

|

|

|

|

/s/ Joseph T. Malone

|

|

|

|

Joseph T. Malone, Principal Financial Officer

|

|

Date: May 20, 2013

|

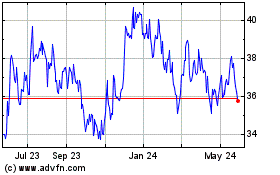

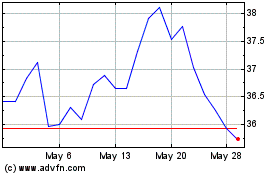

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2024 to Aug 2024

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Aug 2023 to Aug 2024