Saul Centers, Inc. Announces Tax Treatment of 2006 Dividends

January 09 2007 - 4:32PM

PR Newswire (US)

BETHESDA, Md., Jan. 9 /PRNewswire-FirstCall/ -- Saul Centers, Inc.

(NYSE:BFS), an equity real estate investment trust (REIT),

announced today the income tax treatment for its 2006 dividends.

The Company declared and paid four quarterly dividends totaling

$1.68 per share of Common Stock during 2006. For tax purposes,

86.0% of the dividends ($1.4448 per share) is characterized as

ordinary income, while 14.0% ($0.2352 per share) is characterized

as return of capital. The Company declared and paid four dividends

totaling $2.00 per depositary share of its 8% Preferred Stock

during 2006. For tax purposes, 100.0% of the dividends are

characterized as ordinary income. The information will be reported

to shareholders on Form 1099-DIV. Saul Centers is a self-managed,

self-administered equity real estate investment trust headquartered

in Bethesda, Maryland. Saul Centers currently operates and manages

a real estate portfolio of 46 community and neighborhood shopping

centers and office properties totaling approximately 7.7 million

square feet of leasable area. Over 80% of the Company's cash flow

is generated from properties in the metropolitan Washington,

DC/Baltimore area. DATASOURCE: Saul Centers, Inc. CONTACT: Scott V.

Schneider of Saul Centers, Inc., +1-301-986-6220 Web site:

http://www.saulcenters.com/

Copyright

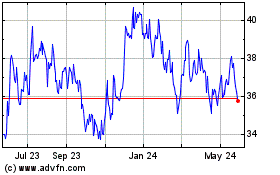

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

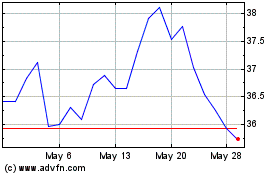

Saul Centers (NYSE:BFS)

Historical Stock Chart

From Jul 2023 to Jul 2024