Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

April 13 2022 - 6:01AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Issuer Free Writing Prospectus dated April 12, 2022

Relating to Preliminary Prospectus Supplement dated April 5,

2022 and

Prospectus dated January 25, 2022

Registration No. 333-261239

RiverNorth Opportunities Fund,

Inc.

$85,000,000

6.00% Series A Perpetual Preferred

Stock

Pricing Term Sheet

April 12, 2022

The following sets forth the final

terms of the 6.00% Series A Perpetual Preferred Stock, par value $0.0001 per share (the “Series A Preferred Shares”) and

should only be read together with the preliminary prospectus supplement dated April 5, 2022, together with the accompanying

prospectus dated January 25, 2022, relating to the Series A Preferred Shares (the “Preliminary Prospectus”), and

supersedes the information in the Preliminary Prospectus to the extent inconsistent with the information in the Preliminary

Prospectus. In all other respects, this pricing term sheet is qualified in its entirety by reference to the Preliminary Prospectus.

Terms used herein but not defined herein shall have the respective meanings as set forth in the Preliminary Prospectus. All

references to dollar amounts are references to U.S. dollars.

| Issuer: |

RiverNorth Opportunities Fund, Inc. (the “Fund”) |

| Securities: |

Series A Perpetual Preferred Stock |

| Type of Security: |

Fixed-rate cumulative preferred stock |

| Title of the Securities: |

6.00% Series A Perpetual Preferred Stock, par value $0.0001 per share |

| Liquidation Preference: |

$25.00 per share |

| Expected Rating:* |

Moody’s: A1 |

| Initial Aggregate Principal Amount Being Offered: |

$85,000,000 |

| Number of Preferred Shares |

3,400,000 |

| Over Allotment Option: |

Up to 510,000 additional shares exercisable

within 30 days of the date hereof solely to cover over allotments,

if any. |

| Initial Public Offering Price: |

100% of aggregate principal amount ($25 per Preferred

Share) |

| Listing: |

The Fund has applied to list the Series A Preferred Shares on the New York Stock Exchange (“NYSE”). If the application is approved, the Series A Preferred Shares are expected to commence trading on the NYSE under the symbol “RIVPRA” within thirty days of the date of issuance. |

| Underwriting Discount: |

$0.7875 per share (or $2,677,500 total) |

| Proceeds, net of commissions, before Expenses: |

$82,322,500 |

| Trade Date: |

April 12, 2022 |

| Settlement Date: |

April 20, 2022 |

| Dividend Rate: |

6.00% (cumulative from April 20, 2022) |

| Dividend Payment Dates: |

Every February 15, May 15, August 15 and November 15 (or, in each case, if such date is not a business day, the next succeeding business day) (each, a “Dividend Payment Date”), commencing on May 15, 2022. |

| Dividend Periods: |

The first period for which dividends on the Series A Preferred Shares will be calculated (each period, a “Dividend Period”) will commence upon the closing of the offering and each subsequent Dividend Period will be the period from and including a Dividend Payment Date to, but excluding, the next Dividend Payment Date |

| Optional Redemption: |

On or after May 15, 2027, the Fund may redeem in whole or from time to time in part outstanding Series A Preferred Shares at a redemption price per share equal to the $25.00 per share liquidation preference plus an amount equal to all unpaid dividends and distributions accumulated through the date fixed for redemption (whether or not earned or declared by the Fund, but excluding interest thereon). |

| CUSIP / ISIN: |

76881Y 208 / US76881Y2081 |

| Underwriters: |

UBS Securities LLC; Morgan Stanley & Co. LLC; RBC Capital Markets, LLC |

| * | A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision

or withdrawal at any time. |

This pricing term sheet and the Preliminary

Prospectus are not offers to sell or the solicitation of offers to buy, nor will there be any sale of the Series A Preferred Shares referred

to in this pricing term sheet, in any jurisdiction where such offer, solicitation or sale would be unlawful prior to the registration

or qualification under the securities laws of such jurisdiction.

Investors are advised to carefully

consider the investment objective, risks and charges and expenses of the Fund before investing. The preliminary prospectus supplement,

dated April 5, 2022, and accompanying prospectus, dated January 25, 2022, each of which has been filed with the Securities and Exchange

Commission (the SEC), contain a description of these matters and other important information about the Company and should be read carefully

before investing.

The Fund has filed a registration

statement (including a prospectus with the SEC) and related prospectus supplement for the offering to which this communication relates.

Before you invest, you should read the prospectus in that registration statement, the prospectus supplement, and other documents the Fund

has filed with the SEC for more complete information about the Fund and this offering. You may get these documents for free by visiting

EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Fund or the underwriters participating

in the offering will arrange to send you the prospectus or prospectus supplement if you request it by calling UBS Securities LLC toll-free

at 1-888-827- 7275, Morgan Stanley & Co. LLC toll-free at 1-866-718-1649 or RBC Capital Markets, LLC toll-free at 1-866-375-6829.

Any disclaimers or other notices that may appear below are

not applicable to this communication and should be disregarded. Such disclaimers or other notices were automatically generated as a result

of this communication being sent via Bloomberg or another email system.

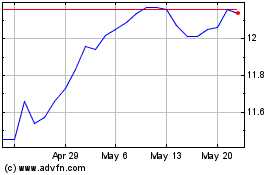

RiverNorth Opportunities (NYSE:RIV)

Historical Stock Chart

From Jun 2024 to Jul 2024

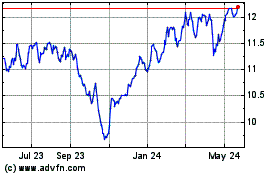

RiverNorth Opportunities (NYSE:RIV)

Historical Stock Chart

From Jul 2023 to Jul 2024