RMK Strategic Income Fund, Inc. Notified by NYSE of Non-Compliance With Continued Listing Standards

October 17 2008 - 4:15PM

Marketwired

RMK Strategic Income Fund, Inc. (the "Fund") (NYSE: RSF) today

announced that on October 16, 2008 the Fund received a letter from

the New York Stock Exchange ("NYSE") advising it that the Fund is

not in compliance with the NYSE's continued listing standard

related to maintaining a consecutive thirty day average closing

stock price of over $1.00 per share.

On October 16, 2008, the Fund's thirty day average closing stock

price was $0.92. Under NYSE rules, the Fund has six months from the

date of the NYSE notice to cure the average price deficiency,

during which time the Fund's shares of common stock will continue

to be listed and traded on the NYSE. If these conditions are not

met during the six-month cure period, NYSE Regulation indicated

that it will commence suspension and delisting procedures. On

October 17, 2008, the Fund notified the NYSE within the required 10

business day period following the receipt of the notification that

the Fund intends to cure the price deficiency.

Forward-Looking Information

This news release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements that are based on various

assumptions (some of which are beyond our control) may be

identified by reference to a future period or periods or by the use

of forward-looking terminology, such as "may," "will," "believe,"

"expect," "anticipate," "continue," "should," "intend," or similar

terms or variations on those terms or the negative of those terms.

Although we believe that the expectations contained in any

forward-looking statement are based on reasonable assumptions, we

can give no assurance that our expectations will be attained. We do

not undertake, and specifically disclaim any obligation, to

publicly release any update or supplement to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements.

The Fund uses its web site as a channel of distribution of

material company information. Financial and other material

information regarding the Fund is routinely posted on and

accessible at

http://www.hyperionbrookfield.com/strategies/retail_funds.htm.

RMK Strategic Income Fund, Inc. is managed by Hyperion

Brookfield Asset Management, Inc, a registered investment advisor

located in New York City. The firm was founded in 1989 to provide

relative value driven fixed income investment strategies, such as

core fixed income, high yield, and specialized MBS. Hyperion

Brookfield manages approximately $19 billion for a client base

including pension funds, financial institutions, mutual funds,

insurance companies and foundations. Hyperion Brookfield is a

subsidiary of Brookfield Asset Management, Inc., a global asset

manager focused on property, power and other infrastructure assets

with approximately US$95 billion of assets under management. For

more information, please visit our website at

www.hyperionbrookfield.com.

Contacts: RMK Strategic Income Fund, Inc. Three World Financial

Center 200 Vesey Street, 10th Floor New York, NY, 10281-1010 1-800

HYPERION

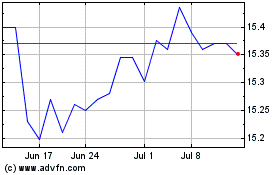

RiverNorth Capital and I... (NYSE:RSF)

Historical Stock Chart

From Jun 2024 to Jul 2024

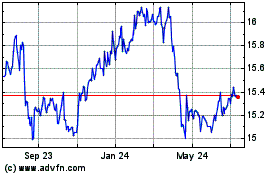

RiverNorth Capital and I... (NYSE:RSF)

Historical Stock Chart

From Jul 2023 to Jul 2024