PRINCIPAL REAL ESTATE INCOME FUND

|

|

|

|

|

|

|

STATEMENT OF INVESTMENTS

|

|

|

|

|

|

July 31, 2013 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

|

Shares

|

|

|

Value

(Note 2)

|

|

|

COMMON STOCKS (33.70%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate Management/Services (2.13%)

|

|

|

|

|

|

|

|

|

|

Atrium European Real Estate, Ltd.

|

|

|

68,800

|

|

|

$

|

386,249

|

|

|

Citycon OYJ

|

|

|

338,400

|

|

|

|

1,071,456

|

|

|

Fabege AB

|

|

|

36,300

|

|

|

|

409,048

|

|

|

Hyprop Investments, Ltd.

|

|

|

96,100

|

|

|

|

729,602

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,596,355

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate Operating/Development (1.25%)

|

|

|

|

|

|

|

|

|

|

Agile Property Holdings, Ltd.

|

|

|

348,000

|

|

|

|

365,697

|

|

|

Country Garden Holdings Co., Ltd.

|

|

|

1,395,000

|

|

|

|

787,831

|

|

|

Sino Land Co., Ltd.

|

|

|

260,000

|

|

|

|

367,425

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,520,953

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REITS-Apartments (1.74%)

|

|

|

|

|

|

|

|

|

|

Advance Residence Investment Corp.

|

|

|

174

|

|

|

|

352,052

|

|

|

Camden Property Trust

|

|

|

10,300

|

|

|

|

726,562

|

|

|

Campus Crest Communities, Inc.

|

|

|

92,100

|

|

|

|

1,045,335

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,123,949

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REITS-Diversified (11.97%)

|

|

|

|

|

|

|

|

|

|

Cambridge Industrial Trust

|

|

|

1,961,000

|

|

|

|

1,033,852

|

|

|

Challenger Diversified Property Group

|

|

|

317,800

|

|

|

|

714,138

|

|

|

Champion Real Estate Investment Trust

|

|

|

1,633,000

|

|

|

|

718,001

|

|

|

Digital Realty Trust, Inc.

|

|

|

17,800

|

|

|

|

984,162

|

|

|

Dundee Real Estate Investment Trust, Class A

|

|

|

53,700

|

|

|

|

1,612,412

|

|

|

EPR Properties

|

|

|

28,300

|

|

|

|

1,425,754

|

|

|

Frasers Commercial Trust

|

|

|

1,028,000

|

|

|

|

1,055,624

|

|

|

Land Securities Group PLC

|

|

|

26,600

|

|

|

|

384,018

|

|

|

Liberty Property Trust

|

|

|

28,700

|

|

|

|

1,096,627

|

|

|

Mirvac Group

|

|

|

485,300

|

|

|

|

715,389

|

|

|

Retail Properties of America, Inc., Class A

|

|

|

49,400

|

|

|

|

696,046

|

|

|

Stockland

|

|

|

443,300

|

|

|

|

1,426,491

|

|

|

Suntec Real Estate Investment Trust

|

|

|

589,000

|

|

|

|

736,916

|

|

|

Top REIT, Inc.

|

|

|

100

|

|

|

|

424,369

|

|

|

Unibail-Rodamco SE

|

|

|

1,600

|

|

|

|

387,718

|

|

|

Wereldhave NV

|

|

|

16,300

|

|

|

|

1,152,545

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14,564,062

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REITS-Health Care (2.63%)

|

|

|

|

|

|

|

|

|

|

Medical Properties Trust, Inc.

|

|

|

73,300

|

|

|

|

1,070,180

|

|

|

Primary Health Properties PLC

|

|

|

144,900

|

|

|

|

747,259

|

|

|

Senior Housing Properties Trust

|

|

|

55,100

|

|

|

|

1,385,765

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,203,204

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REITS-Hotel (1.58%)

|

|

|

|

|

|

|

|

|

|

Hospitality Properties Trust

|

|

|

40,900

|

|

|

|

1,165,241

|

|

|

Summit Hotel Properties, Inc.

|

|

|

74,400

|

|

|

|

752,928

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,918,169

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REITS-Mortgage (1.32%)

|

|

|

|

|

|

|

|

|

|

CYS Investments, Inc.

|

|

|

193,100

|

|

|

|

1,602,730

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

|

Shares

|

|

|

Value

(Note 2)

|

|

|

REITS-Office Property (2.49%)

|

|

|

|

|

|

|

|

|

|

Brandywine Realty Trust

|

|

|

52,000

|

|

|

$

|

724,880

|

|

|

Highwoods Properties, Inc.

|

|

|

20,100

|

|

|

|

729,228

|

|

|

Mori Trust Sogo REIT, Inc.

|

|

|

42

|

|

|

|

360,760

|

|

|

Societe de la Tour Eiffel

|

|

|

12,200

|

|

|

|

795,934

|

|

|

Workspace Group PLC

|

|

|

60,600

|

|

|

|

416,323

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,027,125

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REITS-Shopping Centers (7.95%)

|

|

|

|

|

|

|

|

|

|

Charter Hall Retail REIT

|

|

|

410,200

|

|

|

|

1,423,217

|

|

|

Federation Centres, Ltd.

|

|

|

680,700

|

|

|

|

1,431,726

|

|

|

Hammerson PLC

|

|

|

49,000

|

|

|

|

394,698

|

|

|

Japan Retail Fund Investment Corp.

|

|

|

183

|

|

|

|

360,729

|

|

|

Kite Realty Group Trust

|

|

|

122,100

|

|

|

|

704,517

|

|

|

Ramco-Gershenson Properties Trust

|

|

|

46,300

|

|

|

|

717,187

|

|

|

RioCan Real Estate Investment Trust

|

|

|

59,500

|

|

|

|

1,410,019

|

|

|

Starhill Global REIT

|

|

|

1,082,000

|

|

|

|

698,147

|

|

|

Vastned Retail NV

|

|

|

35,400

|

|

|

|

1,508,202

|

|

|

Westfield Group

|

|

|

101,000

|

|

|

|

1,018,597

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,667,039

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Storage/Warehousing (0.64%)

|

|

|

|

|

|

|

|

|

|

Safestore Holdings PLC

|

|

|

380,400

|

|

|

|

776,888

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL COMMON STOCKS

(Cost $41,014,756)

|

|

|

|

|

|

|

41,000,474

|

|

|

|

|

|

|

PREFERRED STOCK (0.83%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REITS-Apartments (0.07%)

|

|

|

|

|

|

|

|

|

|

Apartment Investment & Management Co., Series Z, 7.000%

|

|

|

3,012

|

|

|

|

77,333

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REITS-Hotels (0.21%)

|

|

|

|

|

|

|

|

|

|

Hersha Hospitality Trust, Series B, 8.000%

|

|

|

9,900

|

|

|

|

254,925

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REITS-Office Property (0.20%)

|

|

|

|

|

|

|

|

|

|

SL Green Realty Corp., Series I, 6.500%

|

|

|

10,200

|

|

|

|

244,800

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REITS-Regional Malls (0.35%)

|

|

|

|

|

|

|

|

|

|

Glimcher Realty Trust, Series G, 8.125%

|

|

|

7,241

|

|

|

|

183,704

|

|

|

Pennsylvania Real Estate Investment Trust, Series B, 7.375%

|

|

|

9,800

|

|

|

|

245,588

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

429,292

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL PREFERRED STOCK

(Cost $1,020,509)

|

|

|

|

|

|

|

1,006,350

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rate

|

|

|

Maturity

Date

|

|

|

Principal

Amount

|

|

|

Value

(Note 2)

|

|

|

COMMERCIAL MORTGAGE BACKED SECURITIES (64.68%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Mortgage Backed Securities-Other (44.83%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank of America Commercial Mortgage Trust, Series 2008-1

(a)

|

|

|

6.438

|

%

|

|

|

01/10/18

|

|

|

|

5,000,000

|

|

|

$

|

5,221,900

|

|

|

Commercial Mortgage Trust, Pass-Through Certificates, Series 2007-C1

|

|

|

5.416

|

%

|

|

|

02/15/40

|

|

|

|

10,000,000

|

|

|

|

9,280,820

|

|

|

Commercial Mortgage Trust, Series 2007-CD4

(a)

|

|

|

5.398

|

%

|

|

|

12/11/49

|

|

|

|

7,500,000

|

|

|

|

5,387,925

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rate

|

|

|

Maturity

Date

|

|

|

Principal

Amount

|

|

|

Value

(Note 2)

|

|

|

Commercial Mortgage Backed Securities-Other (44.83%) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Mortgage Trust, Series 2007-GG9

(a)

|

|

|

5.505

|

%

|

|

|

02/10/17

|

|

|

$

|

7,500,000

|

|

|

$

|

6,320,355

|

|

|

FHLMC Multifamily Structured Pass Through Certificates, Series

2012-K706

(a)(b)

|

|

|

1.966

|

%

|

|

|

12/25/18

|

|

|

|

28,580,000

|

|

|

|

2,399,262

|

|

|

FHLMC Multifamily Structured Pass Through Certificates, Series

2012-K707

(a)(b)

|

|

|

1.869

|

%

|

|

|

01/25/19

|

|

|

|

27,555,000

|

|

|

|

2,226,830

|

|

|

FHLMC Multifamily Structured Pass Through Certificates, Series

2012-K709

(a)(b)

|

|

|

1.760

|

%

|

|

|

04/25/40

|

|

|

|

30,601,130

|

|

|

|

2,434,503

|

|

|

FHLMC Multifamily Structured Pass Through Certificates, Series

2012-K710

(a)(b)

|

|

|

1.717

|

%

|

|

|

06/25/42

|

|

|

|

27,830,000

|

|

|

|

2,212,402

|

|

|

Goldman Sachs Commercial Mortgage Securities, Series 2013-GC13 D

(a)

|

|

|

4.208

|

%

|

|

|

07/10/46

|

|

|

|

3,000,000

|

|

|

|

2,380,482

|

|

|

JP Morgan Chase Commercial Mortgage Securities Trust, Series 2006-CIBC17

(a)

|

|

|

5.489

|

%

|

|

|

12/12/43

|

|

|

|

3,899,000

|

|

|

|

2,486,739

|

|

|

JPMorgan Chase Commercial Mortgage Securities Trust, Series 2006-CIBC16

|

|

|

5.623

|

%

|

|

|

05/12/45

|

|

|

|

5,000,000

|

|

|

|

4,692,985

|

|

|

Wachovia Bank Commercial Mortgage Trust, Series 2006-C29

(a)

|

|

|

5.368

|

%

|

|

|

11/15/48

|

|

|

|

5,000,000

|

|

|

|

4,672,010

|

|

|

Wachovia Bank Commercial Mortgage Trust, Series 2007-C30

(a)

|

|

|

5.413

|

%

|

|

|

12/15/43

|

|

|

|

5,000,000

|

|

|

|

4,830,215

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

54,546,428

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Mortgage Backed Securities-Subordinated (19.85%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank of America Commercial Mortgage Trust, Series 2006-6

|

|

|

5.480

|

%

|

|

|

10/10/45

|

|

|

|

3,000,000

|

|

|

|

2,504,214

|

|

|

JPMorgan Chase Commercial Mortgage Securities Trust, Series

2006-CIBC14

(a)

|

|

|

5.682

|

%

|

|

|

12/12/44

|

|

|

|

5,060,000

|

|

|

|

4,730,032

|

|

|

JPMorgan Chase Commercial Mortgage Securities Trust, Series 2006-LDP8

(a)

|

|

|

5.618

|

%

|

|

|

05/15/45

|

|

|

|

2,000,000

|

|

|

|

1,776,904

|

|

|

Merrill Lynch Commercial Mortgage Trust, Series 2005-CIP1

(a)

|

|

|

5.357

|

%

|

|

|

08/12/15

|

|

|

|

5,000,000

|

|

|

|

4,705,395

|

|

|

Merrill Lynch-CFC Commercial Mortgage Trust, Series 2006-2

(a)(c)

|

|

|

5.899

|

%

|

|

|

06/12/46

|

|

|

|

2,000,000

|

|

|

|

1,848,866

|

|

|

Merrill Lynch-CFC Commercial Mortgage Trust, Series 2006-3

(a)

|

|

|

5.554

|

%

|

|

|

09/12/16

|

|

|

|

2,500,000

|

|

|

|

1,904,323

|

|

|

Morgan Stanley Bank of America Merrill Lynch Commercial Mortgage Trust, Series

2013-C8

(a)(c)

|

|

|

4.172

|

%

|

|

|

02/15/23

|

|

|

|

3,000,000

|

|

|

|

2,480,715

|

|

|

UBS-Barclays Commercial Mortgage Trust, Series 2013-C6

(a)(c)

|

|

|

4.355

|

%

|

|

|

04/10/23

|

|

|

|

5,000,000

|

|

|

|

4,195,325

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,145,774

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL COMMERCIAL MORTGAGE BACKED SECURITIES

(Cost $77,585,863)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

78,692,202

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7-Day Yield

|

|

Shares

|

|

|

Value

(Note 2)

|

|

|

SHORT TERM INVESTMENTS (2.29%)

|

|

|

|

|

|

|

|

|

|

|

|

State Street Institutional Liquid Reserves Fund, Institutional Class

|

|

0.075%

|

|

|

2,784,886

|

|

|

|

2,784,886

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL SHORT TERM INVESTMENTS

(Cost $2,784,886)

|

|

|

|

|

|

|

|

|

2,784,886

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS (101.50%)

(Cost $122,406,014)

|

|

|

|

|

|

|

|

$

|

123,483,912

|

|

|

|

|

|

|

|

Liabilities in Excess of Other Assets (-1.50%)

|

|

|

|

|

|

|

|

|

(1,828,757

|

)

|

|

NET ASSETS (100.00%)

|

|

|

|

|

|

|

|

$

|

121,655,155

|

|

|

(a)

|

Interest rate will change at a future date. Interest rate shown reflects the rate in effect at July 31, 2013.

|

|

(b)

|

Interest only security.

|

|

(c)

|

Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified

institutional buyers. At period end, the aggregate market value of those securities was $8,524,906 representing 7.01% of net assets.

|

Common Abbreviations:

AB - Aktiebolag is the Swedish equivalent of the term corporation.

FHLMC - Federal Home Loan Mortgage Corporation.

NV -

Naamloze vennootshap (Dutch: Limited Liability Company).

OYJ - Osakeyhtio is the Finnish equivalent of a public stock company.

PLC - Public Limited Comapny.

REIT - Real Estate

Investment Trust.

SE - Societas Europea: a European Public Limited Company.

Holdings are subject to change.

See Notes to Quarterly

Statement of Investments.

Geographic Breakdown as of July 31, 2013

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Value

|

|

|

% Market Value

*

|

|

|

Australia

|

|

$

|

6,729,558

|

|

|

|

5.45

|

%

|

|

Canada

|

|

|

3,022,431

|

|

|

|

2.45

|

%

|

|

Cayman Islands

|

|

|

365,697

|

|

|

|

0.30

|

%

|

|

China

|

|

|

787,831

|

|

|

|

0.64

|

%

|

|

Finland

|

|

|

1,071,456

|

|

|

|

0.87

|

%

|

|

France

|

|

|

1,183,652

|

|

|

|

0.96

|

%

|

|

Great Britain

|

|

|

2,719,186

|

|

|

|

2.20

|

%

|

|

Hong Kong

|

|

|

1,085,426

|

|

|

|

0.88

|

%

|

|

Japan

|

|

|

1,497,910

|

|

|

|

1.21

|

%

|

|

Jersey

|

|

|

386,249

|

|

|

|

0.31

|

%

|

|

Netherlands

|

|

|

2,660,747

|

|

|

|

2.15

|

%

|

|

Singapore

|

|

|

3,524,539

|

|

|

|

2.85

|

%

|

|

South Africa

|

|

|

729,602

|

|

|

|

0.59

|

%

|

|

Sweden

|

|

|

409,048

|

|

|

|

0.33

|

%

|

|

United States

|

|

|

97,310,580

|

|

|

|

78.81

|

%

|

|

|

|

$

|

123,483,912

|

|

|

|

100.00

|

%

|

|

*

|

Percentages are based on total investments.

|

PRINCIPAL REAL ESTATE INCOME FUND

Notes to Quarterly Statement of Investments

July 31, 2013 (unaudited)

NOTE 1. ORGANIZATION

The Principal Real Estate Income Fund (the

‘‘Fund’’) is a Delaware statutory trust registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the ‘‘1940 Act’’).

The Fund’s investment objective is to seek to provide high current income, with capital appreciation as a secondary investment objective, by investing in

commercial real estate-related securities. There can be no assurance that the Fund will achieve its investment objective. An investment in the Fund may not be appropriate for all investors.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates:

The

preparation of the Statement of Investments in accordance with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and

disclosures in the Statement of Investments. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the Statement of Investments

may differ from the value the Fund’s ultimately realize upon sale of the securities.

Portfolio Valuation:

The net asset value per Common Share of the

Fund is determined no less frequently than daily, on each day that the NYSE is open for trading, as of the close of regular trading on the NYSE (normally 4:00 p.m. New York time). The Fund’s net asset value per Common Share is calculated in the

manner authorized by the Trustees of the Fund. Net asset value is computed by dividing the value of the Fund’s total assets, less its liabilities by the number of shares outstanding.

The Trustees of the Fund have established the following procedures for valuation of the Fund’s assets under normal market conditions. Marketable securities listed

on foreign or U.S. securities exchanges generally are valued at closing sale prices or, if there were no sales, at the mean between the closing bid and asked prices therefore on the exchange where such securities are principally traded. Marketable

securities listed in the NASDAQ National Market System are valued at the NASDAQ official closing price. Unlisted or listed securities for which closing sale prices are not available are valued at the mean between the latest bid and asked prices. An

option is valued at the price provided by an independent pricing service approved by the Board of Trustees. Over-the-counter options are valued at the mean between the latest bid and asked prices provided by dealers. Financial futures contracts

listed on commodity exchanges and exchange-traded options are valued at closing settlement prices.

The Fund values commercial mortgage backed securities and other

debt securities not traded in an organized market on the basis of valuations provided by dealers or by an independent pricing service, approved by the Board of Trustees, which uses information with respect to transactions in such securities,

quotations from dealers, market transactions for comparable securities, various relationships between securities and yield to maturity in determining value. Debt securities having a remaining maturity of sixty days or less when purchased and debt

securities originally purchased with maturities in excess of sixty days but which currently have maturities of sixty days or less are valued at amortized cost. If the independent pricing service is unable to provide a price for a security, if the

price provided by the independent pricing service is deemed unreliable, or if events occurring after the close of the market for a security but before the time as of which the Fund values its Common Shares would materially affect net asset value,

such security will be valued at its fair value as determined in good faith under procedures approved by the Board of Trustees.

When applicable, fair value of an investment is determined by the Board of Trustees or a committee of the Board of Trustees

or a designee of the Board of Trustees. In fair valuing the Fund’s investments, consideration is given to several factors, which may include, among others, the following: the fundamental business data relating to the issuer, borrower, or

counterparty; an evaluation of the forces which influence the market in which the investments are purchased and sold; the type, size and cost of the investment; the information as to any transactions in or offers for the investment; the price and

extent of public trading in similar securities (or equity securities) of the issuer, or comparable companies; the coupon payments; the quality, value and saleability of collateral, if any, securing the investment; the business prospects of the

issuer, borrower, or counterparty, as applicable, including any ability to obtain money or resources from a parent or affiliate and an assessment of the issuer’s, borrower’s, or counterparty’s management; the prospects for the

industry of the issuer, borrower, or counterparty, as applicable, and multiples (of earnings and/or cash flow) being paid for similar businesses in that industry; and other relevant factors.

Security Transactions:

Security transactions are recorded on trade date. Cost is determined and gains/ (losses) are based upon the specific identification method

for both financial statement and federal income tax purposes.

Income Recognition:

Interest income is recorded on an accrual basis. Corporate actions and

dividend income are recorded on the ex-date.

Fair Value Measurements:

The Fund discloses the classification of its fair value measurements following a

three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or

unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect

the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of

the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not

necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

Level 1

– Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at

the measurement date;

Level 2

– Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other

than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and

Level 3

–

Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date.

The following is a summary of the inputs used to value the Fund’s investments as of July 31, 2013. The Fund recognizes transfers between the levels as of the

beginning of the annual period in which the transfer occurred.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments in Securities at Value*

|

|

Level 1 -

Quoted Prices

|

|

|

Level 2 -

Other

Significant

Observable

Inputs

|

|

|

Level 3 -

Significant

Unobservable

Inputs

|

|

|

Total

|

|

|

Common Stocks

|

|

$

|

41,000,474

|

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

41,000,474

|

|

|

Commercial Mortgage Backed Securities

|

|

|

–

|

|

|

|

78,692,202

|

|

|

|

–

|

|

|

|

78,692,202

|

|

|

Preferred Stocks

|

|

|

1,006,350

|

|

|

|

–

|

|

|

|

–

|

|

|

|

1,006,350

|

|

|

Short Term Investments

|

|

|

2,784,886

|

|

|

|

–

|

|

|

|

–

|

|

|

|

2,784,886

|

|

|

Total

|

|

$

|

44,791,710

|

|

|

$

|

78,692,202

|

|

|

$

|

–

|

|

|

$

|

123,483,912

|

|

|

*

|

See Statement of Investments for sector, industry and country classifications.

|

For the period ended July 31, 2013,

the Fund did not have any securities which used significant unobservable inputs (Level 3) in determining fair value.

Commercial Mortgage Backed Securities

(“CMBS”):

As part of its investments in commercial real estate-related securities, the Fund will invest in CMBS which are subject to certain risks associated with direct investments in CMBS. A CMBS is a type of mortgage-backed security

that is secured by a loan (or loans) on one or more interests in commercial real estate property. Investments in CMBS are subject to the various risks which relate to the pool of underlying assets in which the CMBS represents an interest. CMBS may

be backed by obligations (including certificates of participation in obligations) that are principally secured by commercial real estate loans or interests therein having multi-family or commercial use. Securities backed by commercial real estate

assets are subject to securities market risks as well as risks similar to those of direct ownership of commercial real estate loans because those securities derive their cash flows and value from the performance of the commercial real estate

underlying such investments and/or the owners of such real estate.

Real Estate Investment Trusts (“REITs”):

As part of its investments in real

estate related securities, the Fund will invest in REITs and are subject to certain risks associated with direct investment in REITs. REITs possess certain risks which differ from an investment in common stocks. REITs are financial vehicles that

pool investors’ capital to acquire, develop and/or finance real estate and provide services to their tenants. REITs may concentrate their investments in specific geographic areas or in specific property types, e.g., regional malls, shopping

centers, office buildings, apartment buildings and industrial warehouses. REITs may be affected by changes in the value of their underlying properties and by defaults by borrowers or tenants. REITs depend generally on their ability to generate cash

flow to make distributions to shareowners, and certain REITs have self-liquidation provisions by which mortgages held may be paid in full and distributions of capital returns may be made at any time.

As REITs generally pay a higher rate of dividends than most other operating companies, to the extent application of the Fund’s investment strategy results in the

Fund investing in REIT shares, the percentage of the Fund’s dividend income received from REIT shares will likely exceed the percentage of the Fund’s portfolio that is comprised of REIT shares. Distributions received by the Fund from REITs

may consist of dividends, capital gains and/or return of capital.

The performance of a REIT may be affected by its failure to qualify for tax-free pass-through of

income under the Internal Revenue Code of 1986, as amended (the “Code”), or its failure to maintain exemption from registration under the 1940 Act. Due to the Fund’s investments in REITs, the Fund may also make distributions in excess

of the Fund’s earnings and capital gains. Distributions, if any, in excess of the Fund’s earnings and profits will first reduce the adjusted tax basis of a holder’s Common Shares and, after that basis has been reduced to zero, will

constitute capital gains to the Common Shareholder.

Concentration Risk:

The Fund invests in companies in the real estate industry, which may include CMBS,

REITs, REIT-like structures, and other securities that are secured by, or otherwise have exposure to, real estate. Any fund that concentrates in a particular segment of the market will generally be more volatile than a fund that invests more

broadly. Any market price movements, regulatory changes, or

economic conditions affecting CMBS, REITs, REIT-like structures, and real estate more generally, will have a significant impact on the Fund’s performance.

Foreign Currency Risk:

The Fund expects to invest in securities denominated or quoted in currencies other than the U.S. dollar; changes in foreign currency

exchange rates may affect the value of securities owned by the Fund, the unrealized appreciation or depreciation of investments and gains on and income from investments. Currencies of certain countries may be volatile and therefore may affect the

value of securities denominated in such currencies, which means that the Fund’s net asset value could decline as a result of changes in the exchange rates between foreign currencies and the U.S. dollar. These risks often are heightened for

investments in smaller, emerging capital markets.

3. Tax Basis Information

Tax Basis of Investments:

As of July 31, 2013, the aggregate cost of investments, gross unrealized appreciation/ (depreciation) and net unrealized

appreciation/ (depreciation) for Federal tax purposes was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF

INVESTMENTS

|

|

GROSS UNREALIZED

APPRECIATION

|

|

|

GROSS UNREALIZED

(DEPRECIATION)

|

|

|

NET UNREALIZED

APPRECIATION /

(DEPRECIATION)

|

|

|

$ 122,406,014

|

|

$

|

2,170,707

|

|

|

$

|

(1,092,809

|

)

|

|

$

|

1,077,898

|

|

Item 2 - Controls and Procedures.

|

|

(a)

|

The Registrant’s Principal Executive Officer and Principal Financial Officer have evaluated the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of

1940) within 90 days of this filing and have concluded that the Registrant’s disclosure controls and procedures were effective, as of that date.

|

|

|

(b)

|

There was no change in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) during Registrant’s last fiscal quarter that has

materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

|

Item 3 – Exhibits.

Separate

certifications for the Registrant’s Principal Executive Officer and Principal Financial Officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached as

Ex99.CERT.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused

this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

PRINCIPAL REAL ESTATE INCOME FUND

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Thomas A. Carter

|

|

|

|

|

|

|

|

Thomas A. Carter

|

|

|

|

|

|

|

|

President

(principal executive officer)

|

|

|

|

|

|

|

|

|

|

|

Date:

|

|

September 26, 2013

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940,

this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Thomas A. Carter

|

|

|

|

|

|

|

|

Thomas A. Carter

|

|

|

|

|

|

|

|

President

(principal executive officer)

|

|

|

|

|

|

|

|

|

|

|

Date:

|

|

September 26, 2013

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Patrick D. Buchanan

|

|

|

|

|

|

|

|

Patrick D. Buchanan

|

|

|

|

|

|

|

|

Treasurer

(principal financial officer)

|

|

|

|

|

|

|

|

|

|

|

Date:

|

|

September 26, 2013

|

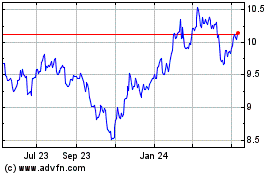

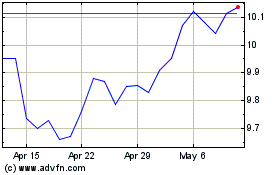

Principal Real Estate In... (NYSE:PGZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Principal Real Estate In... (NYSE:PGZ)

Historical Stock Chart

From Jul 2023 to Jul 2024