0001295947false00012959472023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 3, 2023

PRESTIGE CONSUMER HEALTHCARE INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-32433 | | 20-1297589 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

660 White Plains Road, Tarrytown, New York 10591

(Address of Principal Executive Offices) (Zip Code)

(914) 524-6800

(Registrant's telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | | | | | | | | |

| Securities registered or to be registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | PBH | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02 Results of Operations and Financial Condition.

On August 3, 2023, Prestige Consumer Healthcare Inc. (the “Company”) announced financial results for the fiscal quarter ended June 30, 2023. A copy of the press release announcing the Company's earnings results for the fiscal quarter ended June 30, 2023 is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On August 3, 2023, representatives of the Company began making presentations to investors regarding the Company's financial results for the quarter ended June 30, 2023 using slides attached to this Current Report on Form 8-K as Exhibit 99.2 (the “Investor Presentation”) and incorporated herein by reference. The Company expects to use the Investor Presentation, in whole or in part, and possibly with modifications, in connection with presentations to investors, analysts and others during the fiscal year ended March 31, 2024.

By filing this Current Report on Form 8-K and furnishing the information contained herein, the Company makes no admission as to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation FD.

The information contained in the Investor Presentation is summary information that is intended to be considered in the context of the Company's Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

The information presented in Items 2.02 and 7.01 of this Current Report on Form 8-K and Exhibits 99.1 and 99.2 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act or specifically incorporates it by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

See Exhibit Index immediately following the signature page.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Dated: August 3, 2023 | PRESTIGE CONSUMER HEALTHCARE INC. | |

| | | | |

| | By: | /s/ Christine Sacco | |

| | | Christine Sacco | |

| | | Chief Financial Officer | |

| | | |

| | | |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

Exhibit 99.1

Prestige Consumer Healthcare Inc. Reports First Quarter Fiscal 2024 Results

◦Revenue of $279.3 Million in Q1, up 0.8% versus Prior Year and up 1.8% excluding Foreign Currency

◦Reduced Leverage Ratio to 3.2x at Quarter End and Completed $25 Million Share Repurchase Program

◦Reaffirming Full-Year Fiscal 2024 Revenue, Earnings, and Cash Flow Outlook

TARRYTOWN, N.Y.--(GLOBE NEWSWIRE)-August 3, 2023-- Prestige Consumer Healthcare Inc. (NYSE:PBH) today reported financial results for its first quarter ended June 30, 2023.

“We are pleased with our first quarter results that delivered a strong start to the year. Solid Q1 revenue and profit growth were slightly ahead of our expectations, thanks to our leading and diversified portfolio of brands. Our strategic priority of disciplined capital deployment remains unchanged, and during Q1 we completed our share repurchase program while further reducing debt and leverage,” said Ron Lombardi, Chief Executive Officer of Prestige Consumer Healthcare.

First Fiscal Quarter Ended June 30, 2023

Reported revenues in the first quarter of fiscal 2024 of $279.3 million increased 0.8% from $277.1 million in the first quarter of fiscal 2023. Revenues increased 1.8% excluding the impact of foreign currency. The solid revenue performance for the quarter was broad-based across North America, partially offset by a slight decline in the International OTC segments versus the prior year comparable period.

Reported net income for the first quarter of fiscal 2024 totaled $53.3 million, compared to the prior year first quarter’s net income of $55.3 million. Diluted earnings per share of $1.06 for the first quarter of fiscal 2024 compared to $1.09 in the prior year comparable period.

Free Cash Flow and Balance Sheet

The Company's net cash provided by operating activities for first quarter fiscal 2024 was $48.1 million, compared to $58.2 million during the prior year comparable period. Non-GAAP free cash flow in the first quarter of fiscal 2024 was $46.6 million compared to $57.2 million in the prior year first quarter, with the change attributable to the timing of working capital expenditures.

In the first quarter fiscal 2024, the Company repurchased approximately 0.4 million shares at a total investment of $25.0 million, completing its previously authorized share repurchase program.

The Company's net debt position as of June 30, 2023 was approximately $1.3 billion, resulting in a covenant-defined leverage ratio of 3.2x.

Segment Review

North American OTC Healthcare: Segment revenues of $246.1 million for the first quarter fiscal 2024 increased 1.5% compared to the prior year comparable quarter's segment revenues of $242.5 million. The revenue performance for the quarter was driven by strong performance across many brands and led by the Dermatological and Gastrointestinal categories.

International OTC Healthcare: Fiscal first quarter 2024 revenues were $33.2 million compared to $34.5 million reported in the prior year comparable period. The slight decline in revenue versus the prior year first quarter was driven by a $1.9 million currency headwind.

Commentary Reaffirming Outlook for Fiscal 2024

Ron Lombardi, Chief Executive Officer, stated, “Our strong start to fiscal ’24 is fueled by robust growth in multiple categories such as Dermatological and Gastrointestinal, and highlights the impact of our long-standing brand-building across our diverse portfolio. Meanwhile, we continued to generate strong profitability and free cash flow that allowed us to reduce our leverage to 3.2x at the end of Q1, even with our $25 million share repurchase that drove additional shareholder value.”

“We are reaffirming our fiscal 2024 outlook that includes solid sales and earnings growth that builds off our record fiscal 2023 performance. We remain focused on executing our proven business strategy and leveraging our diverse portfolio of brands to create shareholder value,” Mr. Lombardi concluded. | | | | | |

| Reaffirmed Fiscal 2024 Outlook |

Revenue | $1,135 to $1,140 million |

Organic Revenue Growth | 1% to 2% |

Diluted E.P.S. | $4.27 to $4.32 |

Free Cash Flow | $240 million or more |

Fiscal First Quarter 2024 Conference Call, Accompanying Slide Presentation and Replay

The Company will host a conference call to review its first quarter fiscal 2024 results today, August 3, 2023 at 8:30 a.m. ET. The Company provides a live Internet webcast, a slide presentation to accompany the call, as well as an archived replay, all of which can be accessed from the Investor Relations page of the Company's website at www.prestigeconsumerhealthcare.com. To participate in the conference call via phone, participants may register for the call here to receive dial-in details and a unique pin. While not required, it is recommended to join 10 minutes prior to the event start. The slide presentation can be accessed from the Investor Relations page of the website by clicking on Webcasts and Presentations.

A conference call replay will be available for approximately one week following completion of the live call and can be accessed on the Company’s Investor Relations page.

Non-GAAP and Other Financial Information

In addition to financial results reported in accordance with generally accepted accounting principles (GAAP), we have provided certain non-GAAP financial information in this release to aid investors in understanding the Company's performance. Each non-GAAP financial measure is defined and reconciled to its most closely related GAAP financial measure in the “About Non-GAAP Financial Measures” section at the end of this earnings release.

Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of the federal securities laws that are intended to qualify for the Safe Harbor from liability established by the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" generally can be identified by the use of forward-looking terminology such as "guidance," "outlook," "projected," “focus,” “priority,” "may,"

"will," "would," "expect," "anticipate," "believe,” or "continue" (or the negative or other derivatives of each of these terms) or similar terminology. The "forward-looking statements" include, without limitation, statements regarding the Company's future operating results including revenues, organic growth, diluted earnings per share, and free cash flow, the Company’s priority of disciplined capital deployment, and the Company’s ability to create shareholder value. These statements are based on management's estimates and assumptions with respect to future events and financial performance and are believed to be reasonable, though are inherently uncertain and difficult to predict. Actual results could differ materially from those expected as a result of a variety of factors, including the impact of business and economic conditions, including as a result of labor shortages, inflation and geopolitical instability, consumer trends, the impact of the Company’s advertising and marketing and new product development initiatives, customer inventory management initiatives, fluctuating foreign exchange rates, competitive pressures, and the ability of the Company’s manufacturing operations and third party manufacturers and logistics providers and suppliers to meet demand for its products and to avoid inflationary cost increases and disruption as a result of labor shortages. A discussion of other factors that could cause results to vary is included in the Company's Annual Report on Form 10-K for the year ended March 31, 2023 and other periodic reports filed with the Securities and Exchange Commission.

About Prestige Consumer Healthcare Inc.

Prestige Consumer Healthcare is a leading consumer healthcare products company with sales throughout the U.S. and Canada, Australia, and in certain other international markets. The Company’s diverse portfolio of brands include Monistat® and Summer’s Eve® women's health products, BC® and Goody's® pain relievers, Clear Eyes® and TheraTears® eye care products, DenTek® specialty oral care products, Dramamine® motion sickness treatments, Fleet® enemas and glycerin suppositories, Chloraseptic® and Luden's® sore throat treatments and drops, Compound W® wart treatments, Little Remedies® pediatric over-the-counter products, Boudreaux’s Butt Paste® diaper rash ointments, Nix® lice treatment, Debrox® earwax remover, Gaviscon® antacid in Canada, and Hydralyte® rehydration products and the Fess® line of nasal and sinus care products in Australia. Visit the Company's website at www.prestigeconsumerhealthcare.com.

Prestige Consumer Healthcare Inc.

Condensed Consolidated Statements of Income and Comprehensive Income

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | | | Three Months Ended June 30, |

| (In thousands, except per share data) | | | | | | 2023 | | 2022 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Total Revenues | | | | | | $ | 279,309 | | | $ | 277,059 | |

| | | | | | | | |

| Cost of Sales | | | | | | | | |

| Cost of sales excluding depreciation | | | | | | 122,654 | | | 114,996 | |

| Cost of sales depreciation | | | | | | 1,982 | | | 1,944 | |

| Cost of sales | | | | | | 124,636 | | | 116,940 | |

| Gross profit | | | | | | 154,673 | | | 160,119 | |

| | | | | | | | |

| Operating Expenses | | | | | | | | |

| Advertising and marketing | | | | | | 36,231 | | | 39,951 | |

| General and administrative | | | | | | 27,687 | | | 26,714 | |

| Depreciation and amortization | | | | | | 5,561 | | | 6,440 | |

| | | | | | | | |

| | | | | | | | |

| Total operating expenses | | | | | | 69,479 | | | 73,105 | |

| Operating income | | | | | | 85,194 | | | 87,014 | |

| | | | | | | | |

| Other expense | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Interest expense, net | | | | | | 17,719 | | | 15,292 | |

| | | | | | | | |

| Other (income) expense, net | | | | | | (1,238) | | | 825 | |

| Total other expense, net | | | | | | 16,481 | | | 16,117 | |

| Income before income taxes | | | | | | 68,713 | | | 70,897 | |

| Provision for income taxes | | | | | | 15,437 | | | 15,625 | |

| Net income | | | | | | $ | 53,276 | | | $ | 55,272 | |

| | | | | | | | |

| Earnings per share: | | | | | | | | |

| Basic | | | | | | $ | 1.07 | | | $ | 1.10 | |

| Diluted | | | | | | $ | 1.06 | | | $ | 1.09 | |

| | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | |

| Basic | | | | | | 49,767 | | | 50,264 | |

| Diluted | | | | | | 50,196 | | | 50,730 | |

| | | | | | | | |

| Comprehensive income, net of tax: | | | | | | | | |

| Currency translation adjustments | | | | | | (646) | | | (9,519) | |

| | | | | | | | |

| Net loss on termination of pension plan | | | | | | — | | | (790) | |

| | | | | | | | |

| Total other comprehensive loss | | | | | | (646) | | | (10,309) | |

| Comprehensive income | | | | | | $ | 52,630 | | | $ | 44,963 | |

Prestige Consumer Healthcare Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

(In thousands) | June 30, 2023 | | March 31, 2023 |

| | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 54,580 | | | $ | 58,489 | |

Accounts receivable, net of allowance of $24,928 and $20,205, respectively | 157,950 | | | 167,016 | |

| Inventories | 169,849 | | | 162,121 | |

| | | |

| Prepaid expenses and other current assets | 9,379 | | | 4,117 | |

| | | |

| Total current assets | 391,758 | | | 391,743 | |

| | | |

| Property, plant and equipment, net | 69,979 | | | 70,412 | |

| Operating lease right-of-use assets | 13,443 | | | 14,923 | |

| Finance lease right-of-use assets, net | 3,535 | | | 4,200 | |

| Goodwill | 527,458 | | | 527,553 | |

| Intangible assets, net | 2,336,137 | | | 2,341,893 | |

| Other long-term assets | 3,267 | | | 3,005 | |

| | | |

| Total Assets | $ | 3,345,577 | | | $ | 3,353,729 | |

| | | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities | | | |

| | | |

| | | |

| Accounts payable | 57,861 | | | 62,743 | |

| Accrued interest payable | 15,188 | | | 15,688 | |

| Operating lease liabilities, current portion | 6,600 | | | 6,926 | |

| Finance lease liabilities, current portion | 2,855 | | | 2,834 | |

| Other accrued liabilities | 64,767 | | | 72,524 | |

| | | |

| Total current liabilities | 147,271 | | | 160,715 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Long-term debt, net | 1,316,711 | | | 1,345,788 | |

| | | |

| Deferred income tax liabilities | 383,955 | | | 380,434 | |

| Long-term operating lease liabilities, net of current portion | 8,217 | | | 9,876 | |

| Long-term finance lease liabilities, net of current portion | 945 | | | 1,667 | |

| Other long-term liabilities | 8,183 | | | 8,165 | |

| Total Liabilities | 1,865,282 | | | 1,906,645 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total Stockholders' Equity | 1,480,295 | | | 1,447,084 | |

| Total Liabilities and Stockholders' Equity | $ | 3,345,577 | | | $ | 3,353,729 | |

Prestige Consumer Healthcare Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited) | | | | | | | | | | | |

| | Three Months Ended June 30, |

| (In thousands) | 2023 | | 2022 |

| Operating Activities | | | |

| Net income | $ | 53,276 | | | $ | 55,272 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 7,543 | | | 8,384 | |

| | | |

| Loss on disposal of property and equipment | — | | | 13 | |

| Deferred income taxes | 4,272 | | | 1,213 | |

| Amortization of debt origination costs | 983 | | | 828 | |

| | | |

| Stock-based compensation costs | 4,146 | | | 3,857 | |

| | | |

| | | |

| | | |

| | | |

| Non-cash operating lease cost | 1,244 | | | 1,493 | |

| | | |

| Other | — | | | 446 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 5,632 | | | (7,079) | |

| Inventories | (7,711) | | | (14,415) | |

| Prepaid expenses and other current assets | (5,181) | | | (3,227) | |

| Accounts payable | (5,599) | | | 2,542 | |

| Accrued liabilities | (8,519) | | | 10,524 | |

| Operating lease liabilities | (1,745) | | | (1,602) | |

| | | |

| Other | (254) | | | (2) | |

| Net cash provided by operating activities | 48,087 | | | 58,247 | |

| | | |

| Investing Activities | | | |

| Purchases of property, plant and equipment | (1,477) | | | (1,047) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other | 3,800 | | | — | |

| | | |

| | | |

| Net cash provided by (used in) investing activities | 2,323 | | | (1,047) | |

| | | |

| Financing Activities | | | |

| | | |

| | | |

| | | |

| Term loan repayments | (30,000) | | | (15,000) | |

| | | |

| Borrowings under revolving credit agreement | — | | | 20,000 | |

| Repayments under revolving credit agreement | — | | | (10,000) | |

| | | |

| Payments of finance leases | (699) | | | (686) | |

| Proceeds from exercise of stock options | 7,028 | | | 1,489 | |

| | | |

| | | |

| Fair value of shares surrendered as payment of tax withholding | (5,508) | | | (5,450) | |

| Repurchase of common stock | (25,000) | | | (37,727) | |

| Net cash used in financing activities | (54,179) | | | (47,374) | |

| | | |

| Effects of exchange rate changes on cash and cash equivalents | (140) | | | (1,142) | |

| Increase (decrease) in cash and cash equivalents | (3,909) | | | 8,684 | |

| Cash and cash equivalents - beginning of period | 58,489 | | | 27,185 | |

| Cash and cash equivalents - end of period | $ | 54,580 | | | $ | 35,869 | |

| | | |

| Interest paid | $ | 17,582 | | | $ | 3,562 | |

| Income taxes paid | $ | 11,964 | | | $ | 1,799 | |

Prestige Consumer Healthcare Inc.

Condensed Consolidated Statements of Income

Business Segments

(Unaudited)

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2023 |

| (In thousands) | North American OTC Healthcare | | International OTC Healthcare | | | | Consolidated |

| Total segment revenues* | $ | 246,143 | | | $ | 33,166 | | | | | $ | 279,309 | |

| Cost of sales | 110,076 | | | 14,560 | | | | | 124,636 | |

| Gross profit | 136,067 | | | 18,606 | | | | | 154,673 | |

| Advertising and marketing | 31,401 | | | 4,830 | | | | | 36,231 | |

| Contribution margin | $ | 104,666 | | | $ | 13,776 | | | | | $ | 118,442 | |

| Other operating expenses | | | | | | | 33,248 | |

| Operating income | | | | | | | $ | 85,194 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

*Intersegment revenues of $1.4 million were eliminated from the North American OTC Healthcare segment. | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2022 |

| (In thousands) | North American OTC Healthcare | | International OTC Healthcare | | | | Consolidated |

| Total segment revenues* | $ | 242,518 | | | $ | 34,541 | | | | | $ | 277,059 | |

| Cost of sales | 102,921 | | | 14,019 | | | | | 116,940 | |

| Gross profit | 139,597 | | | 20,522 | | | | | 160,119 | |

| Advertising and marketing | 35,412 | | | 4,539 | | | | | 39,951 | |

| Contribution margin | $ | 104,185 | | | $ | 15,983 | | | | | $ | 120,168 | |

| Other operating expenses | | | | | | | 33,154 | |

| Operating income | | | | | | | $ | 87,014 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

* Intersegment revenues of $0.5 million were eliminated from the North American OTC Healthcare segment.

About Non-GAAP Financial Measures

In addition to financial results reported in accordance with GAAP, we disclose certain Non-GAAP financial measures ("NGFMs"), including, but not limited to, Non-GAAP Organic Revenues, Non-GAAP Organic Revenue Change Percentage, Non-GAAP EBITDA, Non-GAAP EBITDA Margin, Non-GAAP Free Cash Flow, and Net Debt.

We use these NGFMs internally, along with GAAP information, in evaluating our operating performance and in making financial and operational decisions. We believe that the presentation of these NGFMs provides investors with greater transparency, and provides a more complete understanding of our business than could be obtained absent these disclosures, because the supplemental data relating to our financial condition and results of operations provides additional ways to view our operation when considered with both our GAAP results and the reconciliations below. In addition, we believe that the presentation of each of these NGFMs is useful to investors for period-to-period comparisons of results in assessing shareholder value, and we use these NGFMs internally to evaluate the performance of our personnel and also to evaluate our operating performance and compare our performance to that of our competitors.

These NGFMs are not in accordance with GAAP, should not be considered as a measure of profitability or liquidity, and may not be directly comparable to similarly titled NGFMs reported by other companies. These NGFMs have limitations and they should not be considered in isolation from or as an alternative to their most closely related GAAP measures reconciled below. Investors should not rely on any single financial measure when evaluating our business. We recommend investors review the GAAP financial measures included in this earnings release. When viewed in conjunction with our GAAP results and the reconciliations below, we believe these NGFMs provide greater transparency and a more complete understanding of factors affecting our business than GAAP measures alone.

NGFMs Defined

We define our NGFMs presented herein as follows:

•Non-GAAP Organic Revenues: GAAP Total Revenues excluding the impact of foreign currency exchange rates in the periods presented.

•Non-GAAP Organic Revenue Change Percentage: Calculated as the change in Non-GAAP Organic Revenues from prior year divided by prior year Non-GAAP Organic Revenues.

•Non-GAAP EBITDA: GAAP Net Income before interest expense, net, provision for income taxes, and depreciation and amortization.

•Non-GAAP EBITDA Margin: Calculated as Non-GAAP EBITDA divided by GAAP Total Revenues.

•Non-GAAP Free Cash Flow: Calculated as GAAP Net cash provided by operating activities less cash paid for capital expenditures.

•Net Debt: Calculated as total principal amount of debt outstanding ($1,330,000 at June 30, 2023) less cash and cash equivalents ($54,580 at June 30, 2023). Amounts in thousands.

The following tables set forth the reconciliations of each of our NGFMs (other than Net Debt, which is reconciled above) to their most directly comparable financial measures presented in accordance with GAAP.

Reconciliation of GAAP Total Revenues to Non-GAAP Organic Revenues and related Non-GAAP Organic Revenue Change percentage:

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, |

| | | | | 2023 | | 2022 |

| (In thousands) | | | | | | | |

| GAAP Total Revenues | | | | | $ | 279,309 | | | $ | 277,059 | |

| Revenue Change | | | | | 0.8 | % | | |

| Adjustments: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Impact of foreign currency exchange rates | | | | | — | | | (2,724) | |

| | | | | | | |

| Total adjustments | | | | | — | | | (2,724) | |

| Non-GAAP Organic Revenues | | | | | $ | 279,309 | | | $ | 274,335 | |

| Non-GAAP Organic Revenue Change | | | | | 1.8 | % | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Reconciliation of GAAP Net Income to Non-GAAP EBITDA and related Non-GAAP EBITDA Margin: | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, |

| | | | | 2023 | | 2022 |

| (In thousands) | | | | | | | |

| GAAP Net Income | | | | | $ | 53,276 | | | $ | 55,272 | |

| Interest expense, net | | | | | 17,719 | | | 15,292 | |

| Provision for income taxes | | | | | 15,437 | | | 15,625 | |

| Depreciation and amortization | | | | | 7,543 | | | 8,384 | |

| Non-GAAP EBITDA | | | | | $ | 93,975 | | | $ | 94,573 | |

| Non-GAAP EBITDA Margin | | | | | 33.6 | % | | 34.1 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

|

Reconciliation of GAAP Net Income to Non-GAAP Free Cash Flow: | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, |

| | | | | 2023 | | 2022 |

| (In thousands) | | | | | | | |

| GAAP Net Income | | | | | $ | 53,276 | | | $ | 55,272 | |

| Adjustments: | | | | | | | |

| Adjustments to reconcile net income to net cash provided by operating activities as shown in the Statement of Cash Flows | | | | | 18,188 | | | 16,234 | |

| Changes in operating assets and liabilities as shown in the Statement of Cash Flows | | | | | (23,377) | | | (13,259) | |

| Total adjustments | | | | | (5,189) | | | 2,975 | |

| GAAP Net cash provided by operating activities | | | | | 48,087 | | | 58,247 | |

| | | | | | | |

| Purchases of property and equipment | | | | | (1,477) | | | (1,047) | |

| Non-GAAP Free Cash Flow | | | | | $ | 46,610 | | | $ | 57,200 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Outlook for Fiscal Year 2024:

Reconciliation of Projected GAAP Net cash provided by operating activities to Projected Non-GAAP Free Cash Flow:

| | | | | | | | | |

| | |

| | | |

| (In millions) | | | |

| Projected FY'24 GAAP Net cash provided by operating activities | | | $ | 250 | |

| Additions to property and equipment for cash | | | (10) | |

| Projected FY'24 Non-GAAP Free Cash Flow | | | $ | 240 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

First Quarter FY 2024 Results August 3rd, 2023 Exhibit 99.2

F I R S T Q U A R T E R F Y 2 4 R E S U L T S Safe Harbor Disclosure This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements regarding the Company’s expected financial performance, including revenues, organic revenue growth, diluted EPS, free cash flow, and leverage; the Company’s execution on its brand-building strategy; the Company’s expected growth; and the Company’s capital allocation strategy, including its focus on reducing debt. Words such as “anticipate,” “continue,” “positioned,” “will,” “expect,” “project,” “may,” “should,” “could,” “would,” and similar expressions identify forward-looking statements. Such forward-looking statements represent the Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include, among others, the impact of geopolitical instability, including on economic and business conditions; consumer trends; disruptions to manufacturing, distribution and supply chain and related price increases; labor shortages; competitive pressures; the impact of the Company’s advertising and promotional and new product development initiatives; customer inventory management initiatives; the ability to pass along rising costs to customers without impacting sales; fluctuating foreign exchange rates; and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K for the year ended March 31, 2023. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this presentation. Except to the extent required by applicable law, the Company undertakes no obligation to update any forward-looking statement contained in this presentation, whether as a result of new information, future events, or otherwise. All adjusted GAAP numbers presented are footnoted and reconciled to their closest GAAP measurement in the attached reconciliation schedule or in our August 3, 2023 earnings release in the “About Non-GAAP Financial Measures” section.

F I R S T Q U A R T E R F Y 2 4 R E S U L T S Agenda for Today’s Discussion I. Performance Update II. Financial Overview III. FY 24 Outlook 3

F I R S T Q U A R T E R F Y 2 4 R E S U L T S I. Performance Update

F I R S T Q U A R T E R F Y 2 4 R E S U L T S Business Momentum Continued in First Quarter FY 24 ◼ Solid quarterly Revenue of $279.3 million, up 1.8% vs. PY organically(1) ◼ Continued strong performance enabled by benefits of leading & diversified portfolio ◼ Continue to execute proven brand-building strategy ◼ Gross Margin improved sequentially ◼ Continued consistent EBITDA margin(2) ◼ Solid financial profile and resulting Free Cash Flow(2) generation ◼ Completed $25MM share repurchase authorization ◼ Debt reduction remains a key part of capital allocation strategy ◼ Continued focus on disciplined capital allocation resulting in leverage of 3.2x(3) Q1 FY 24 Sales Drivers Disciplined Capital Allocation Superior Earnings and FCF 5

F I R S T Q U A R T E R F Y 2 4 R E S U L T S Dramamine: A History of Robust Digital Campaign Support 6 Interactive Campaigns Leading to Meaningful Brand Growth; ~12% CAGR Since FY19* Put an “N” to It (2018) Let’s Get Going (2020) Take Dramamine, Take Control (2021) Ditch the Drama (2023) *IRI MULO + C + Amazon for 52 weeks ending 3/31/23

F I R S T Q U A R T E R F Y 2 4 R E S U L T S Nix: Brand-Building Drives Increased Share of Lice Category Benefitting from Continued Innovation 7 IRI MULO+C + OCR Amazon1P week ending 5/21/23 Consumers Trading Up to Items that Offer Increased Convenience & Peace of Mind Strategic Innovation Addressing Spectrum of Consumer Needs Treatment & Prevention Removal Kit All-in-One Lice Treatments Nix Outperforming Category 39% 17% Q1 FY24 22% 31% Q1 FY19 Q1 FY24 Dollar Sales Growth Market Share +900 BPS Investments Capturing Growth as Lice Incidences Return Towards Pre-COVID Levels

F I R S T Q U A R T E R F Y 2 4 R E S U L T S II. Financial Overview

F I R S T Q U A R T E R F Y 2 4 R E S U L T S Q1 FY 24 Performance Highlights Q1 FY 24 Q1 FY 23 Dollar values in millions, except per share data. $279.3 $94.0 $1.06 $277.1 $94.6 $1.09 Revenue EBITDA Diluted EPS 0.8% (0.6%) (2.6%) Organic Revenue(1) of $279.3 million, up 1.8% vs. PY Diluted EPS of $1.06, down 2.6% vs. PY EBITDA(2) of $94.0 million, down 0.6% vs. PY 9 (2)

F I R S T Q U A R T E R F Y 2 4 R E S U L T S Q1 FY 24 Q1 FY 23 % Chg Total Revenue 279.3$ 277.1$ 0.8% Gross Profit 154.7 160.1 (3.4%) % Gross Margin 55.4% 57.8% A&M 36.2 40.0 (9.3%) % Total Revenue 13.0% 14.4% G&A 27.7 26.7 3.6% % Total Revenue 9.9% 9.6% D&A (excl. COGS) 5.6 6.4 (13.6%) Operating Income 85.2$ 87.0$ (2.1%) % Margin 30.5% 31.4% Diluted EPS 1.06$ 1.09$ (2.6%) EBITDA (2) 94.0$ 94.6$ (0.6%) % Margin 33.6% 34.1% 3 Months Ended Comments ◼ Organic Revenue(1) up 1.8% vs. PY – Gains led by Skin Care, GI categories – International segment up slightly excluding currency – Continued robust growth in eCommerce ◼ Gross Margin of 55.4% up sequentially ◼ A&M of 13.0% of Revenue, below PY due to quarterly timing ◼ G&A of 9.9% of Revenue, as expected ◼ Diluted EPS of $1.06 down 2.6% vs. PY FY 24 First Quarter Consolidated Financial Summary Dollar values in millions, except per share data 10

F I R S T Q U A R T E R F Y 2 4 R E S U L T S $46.6 $57.2 Free Cash Flow Free Cash Flow Comments ◼ Q1 Free Cash Flow(2) of $46.6 million down vs. PY, affected by timing of working capital – Maintaining full-year outlook – Strong business attributes continue to drive Free Cash Flow(2) ◼ Net Debt at June 30 of $1.3 billion(2); leverage ratio(3) of 3.2x at end of Q1 ◼ Completed $25MM share repurchase program; repurchased ~425k shares Industry Leading Free Cash Flow Trends Q1 FY 24 Q1 FY 23 (18.5%) (2) Dollar values in millions 11

F I R S T Q U A R T E R F Y 2 4 R E S U L T S III. FY 24 Outlook

F I R S T Q U A R T E R F Y 2 4 R E S U L T S Outlook: Staying the Strategic Course to Create Value ◼ Strategy delivering with growing and well-positioned business ◼ Agile brand-building positions portfolio for further growth ◼ Revenue of $1,135 million to $1,140 million — Organic growth of 1% to 2% ex-FX — Organic growth of 2% to 3% when excluding strategic exit of private label business ◼ Diluted EPS of $4.27 to $4.32 ◼ Free Cash Flow(4) of $240 million or more ◼ Continue to execute disciplined capital allocation strategy ◼ Anticipate Net Debt / EBITDA of less than 3.0x by year-end FY 24 13 Top Line Trends Free Cash Flow & Allocation EPS

F I R S T Q U A R T E R F Y 2 4 R E S U L T S Q&A

F I R S T Q U A R T E R F Y 2 4 R E S U L T S Appendix (1) Organic Revenue is a Non-GAAP financial measure and is reconciled to the most closely related GAAP financial measure in the attached Reconciliation Schedules and / or our earnings release dated August 3, 2023 in the “About Non-GAAP Financial Measures” section. (2) EBITDA & EBITDA Margin, Free Cash Flow, and Net Debt are Non-GAAP financial measures and are reconciled to their most closely related GAAP financial measures in the attached Reconciliation Schedules and / or in our earnings release dated August 3, 2023 in the “About Non GAAP Financial Measures” section. (3) Leverage ratio reflects covenant defined Net Debt / EBITDA. (4) Free Cash Flow for FY 24 is a projected Non-GAAP financial measure, is reconciled to projected GAAP Net Cash Provided by Operating Activities in the attached Reconciliation Schedules and / or in our earnings release in the “About Non-GAAP Financial Measures” section and is calculated based on projected Net Cash Provided by Operating Activities less projected capital expenditures 15

F I R S T Q U A R T E R F Y 2 4 R E S U L T S EBITDA Margin 16 Reconciliation Schedules Organic Revenue Change Three Months Ended June 30, 2023 2022 (In Thousands) GAAP Total Revenues 279,309$ 277,059$ Revenue Change 0.8% Adjustments: Impact of foreign currency exchange rates - (2,724) Total adjustments -$ (2,724)$ Non-GAAP Organic Revenues 279,309$ 274,335$ Non-GAAP Organic Revenue Change 1.8% Three Months Ended June 30, 2023 2022 (In Thousands) GAAP Net Income 53,276$ 55,272$ Interest expense, net 17,719 15,292 Provision for income taxes 15,437 15,625 Depreciation and amortization 7,543 8,384 Non-GAAP EBITDA 93,975$ 94,573$ Non-GAAP EBITDA Margin 33.6% 34.1%

F I R S T Q U A R T E R F Y 2 4 R E S U L T S 17 Reconciliation Schedules (Continued) Free Cash Flow Projected Free Cash Flow Three Months Ended June 30, 2023 2022 (In Thousands) GAAP Net Income 53,276$ 55,272$ Adjustments: Adjustments to reconcile net income to net cash provided by operating activities as shown in the Statement of Cash Flows 18,188 16,234 Changes in operating assets and liabilities as shown in the Statement of Cash Flows (23,377) (13,259) Total adjustments (5,189) 2,975 GAAP Net cash provided by operating activities 48,087 58,247 Purchase of property and equipment (1,477) (1,047) Non-GAAP Free Cash Flow 46,610$ 57,200$ (In millions) Projected FY'24 GAAP Net Cash provided by operating activities 250$ Additions to property and equipment for cash (10) Projected Non-GAAP Free Cash Flow 240$

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

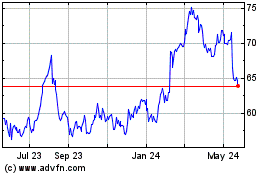

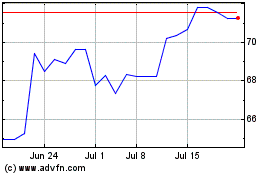

Prestige Consumer Health... (NYSE:PBH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Prestige Consumer Health... (NYSE:PBH)

Historical Stock Chart

From Jul 2023 to Jul 2024