UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21579

Nuveen Floating Rate Income Opportunity Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 917-7700

Date of fiscal year end: July 31

Date of reporting period: January 31, 2008

Form N-CSR is to be used by management investment companies to file reports with

the Commission not later than 10 days after the transmission to stockholders of

any report that is required to be transmitted to stockholders under Rule 30e-1

under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may

use the information provided on Form N-CSR in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR,

and the Commission will make this information public. A registrant is not

required to respond to the collection of information contained in Form N-CSR

unless the Form displays a currently valid Office of Management and Budget

("OMB") control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the

burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW,

Washington, DC 20549-0609. The OMB has reviewed this collection of information

under the clearance requirements of 44 U.S.C. SS. 3507.

ITEM 1. REPORTS TO SHAREHOLDERS

Semi-Annual Report

JANUARY 31, 2008

Nuveen Investments

CLOSED-END FUNDS

NUVEEN SENIOR

INCOME FUND

NSL

NUVEEN FLOATING

RATE INCOME FUND

JFR

NUVEEN FLOATING

RATE INCOME

OPPORTUNITY FUND

JRO

High Current Income from Portfolios of Senior Corporate Loans

NUVEEN INVESTMENTS LOGO

Life is complex.

Nuveen

makes things

e-simple.

It only takes a minute to sign up

for e-Reports. Once enrolled,

you'll receive an e-mail as soon as

your Nuveen Investments Fund

information is ready--no more

waiting for delivery by regular

mail. Just click on the link within

the e-mail to see the report, and

save it on your computer if you

wish.

Free e-Reports right to your e-mail!

www.investordelivery.com OR www.nuveen.com/accountaccess

If you received your Nuveen Fund If you received your Nuveen Fund

dividends and statements from your dividends and statements directly from

financial advisor or brokerage Nuveen.

account.

|

NUVEEN INVESTMENTS LOGO

Chairman's

LETTER TO SHAREHOLDERS

(TIMOTHY

SCHWERTFEGER

PHOTO) Timothy R. Schwertfeger Chairman of the Board

|

Dear Shareholder:

Once again, I am pleased to report that over the six-month period covered by

this report your Fund continued to provide you with attractive income. For more

details about the management strategy and performance of your Fund, please read

the Portfolio Managers' Comments, the Common Share Distribution and Share Price

Information, and the Performance Overview sections of this report.

With the recent volatility in the bond and stock market, many have begun to

wonder which way the market is headed, and whether they need to adjust their

holdings of investments. No one knows what the future will bring, which is why

we think a well-balanced portfolio that is structured and carefully monitored

with the help of an investment professional is an important component in

achieving your long-term financial goals. A well-diversified portfolio may

actually help to reduce your overall investment risk, and we believe that

investments like your Nuveen Investments Fund can be important building blocks

in a portfolio crafted to perform well through a variety of market conditions.

I also wanted to update you on some important news about Nuveen Investments.

Since the last shareholder report, a group led by Madison Dearborn Partners,

LLC, completed its acquisition of Nuveen Investments. This change in corporate

ownership had no impact on the investment objectives, portfolio management

strategies or dividend policy of your Fund.

We are grateful that you have chosen us as a partner as you pursue your

financial goals and we look forward to continuing to earn your trust in the

months and years ahead. At Nuveen Investments, our mission continues to be to

assist you and your financial advisor by offering investment services and

products that can help you to secure your financial objectives.

Sincerely,

(TIMOTHY SCHWERFEGER SIG)

Timothy R. Schwertfeger

Chairman of the Board

March 14, 2008

Portfolio Managers' COMMENTS

NUVEEN INVESTMENTS CLOSED-END FUNDS NSL, JFR, JRO

The Funds' investment portfolios have been managed by Gunther Stein and Lenny

Mason of Symphony Asset Management, LLC, an affiliate of Nuveen Investments,

since 2001. Gunther and Lenny have more than 25 years of combined investment

management experience, much of it in evaluating and purchasing senior corporate

loans and other high-yield debt.

Here Gunther and Lenny talk about their management strategies and the

performance of the Funds for the six-month period ended January 31, 2008.

WHAT KEY STRATEGIES WERE USED TO MANAGE THE FUNDS?

Throughout this six-month period, we continued to manage each Fund's portfolio

using fundamental analysis to select senior loans that we believed offered

strong asset coverage and attractive risk-adjusted return potential. We avoided

the senior loans of most automotive part suppliers as well as smaller

homebuilders and land developers, even though many loans in these sectors traded

at discounts throughout the year. We also avoided many loans to smaller

companies that were done to finance leveraged buyouts (LBO). We didn't believe

that there was sufficient value in many small-company loans to compensate for

potential illiquidity and volatility if earnings of the companies issuing them

should become challenged.

Discussions of specific investments are for illustrative purposes only and are

not intended as recommendations of individual investments. The views expressed

in this commentary represent those of the portfolio managers as of the date of

this report and are subject to change at any time, based on market conditions

and other factors. The Funds disclaim any obligation to advise shareholders of

such changes.

We also focused on adding quality new-issue senior loans, which often were

priced at a discount to par and were structured with strong covenant protection.

We continued to avoid the vast majority of second lien loans. Similar to

small-company loans, we didn't believe that second lien loans offered sufficient

additional yield to compensate investors for potentially increased volatility

and lower recovery rates.

Although the performance of all three portfolios suffered as a result of the

broad-based sell-off in loans over this period, we believe that market

dislocation provided an opportunity to buy loans in good companies with strong

covenants at attractive prices.

4

HOW DID THE FUNDS PERFORM OVER THIS SIX-MONTH PERIOD?

The performance of the Funds, as well as the performance of a widely followed

market index are presented in the accompanying table.

Total Returns on Net Asset Value*

For periods ended 1/31/08

SIX-MONTH 1-YEAR 5-YEAR

--------- ------ -------

NSL -3.81% -5.91% 7.87%

JFR -3.54% -6.44% NA

JRO -4.03% -6.68% NA

CSFB Leveraged Loan Index(1) -1.45% -2.11% 5.31%

|

*Six-month returns are cumulative; returns for one-year and five-year are

annualized.

Past performance does not guarantee future results. Current performance may be

higher or lower than the data shown. Returns do not reflect the deduction of

taxes that shareholders may have to pay on Fund distributions or upon the sale

of Fund shares.

For additional information, see the individual Performance Overview for your

Fund in this report.

1 The CSFB Leveraged Loan Index is a representative, unmanaged index of

tradeable, senior, U.S. dollar-denominated leveraged loans. It is not possible

to invest directly in an Index.

For the six-months ended January 31, 2008, the cumulative return on net asset

value for each Fund underperformed the CSFB Leveraged Loan Index.

The benchmark returns shows that the six-month period presented a very

challenging and unforgiving market environment. The Funds' underperformance was

due in part to its use of financial leverage because the cost of leverage

exceeded the returns generated by the Funds' investment portfolios.

Additionally, leverage tended to exacerbate the price declines suffered by the

Funds' holdings. However, leverage is a strategy that had contributed to

enhanced dividends and returns in the past, and we believe it retains the

potential to continue to so in the future.

All three Funds experienced downside pressure across their loan portfolios as a

result of the broad sell-off in loans. Given the liquidity-driven market

conditions during the second half of 2007, many of the large broadly-syndicated

LBO loans positions we had were under particularly heavy price pressure. There

were no individual company-specific events that negatively impacted performance

of any of the Funds. Rather, their performance was reflective of the loan market

in general, which was influenced heavily by supply and demand factors. Default

rates remained relatively low and fundamental factors remained relatively strong

throughout 2007 compared to historical levels.

RECENT DEVELOPMENTS IN THE AUCTION RATE PREFERRED MARKETS

Beginning in February 2008, after the close of this reporting period, more

shares for sale were submitted in the regularly scheduled auctions for the

Preferred shares issued by the Funds than there were offers to buy. This meant

that these auctions "failed to clear," and that many Preferred shareholders who

wanted to sell their shares in these auctions were unable to do so. This decline

in liquidity in auction preferred shares did not lower the credit quality of

these shares, and Preferred shareholders unable to sell their shares received

distributions at the "maximum rate" calculated in accordance with the

pre-established terms of the Preferred shares. At the time this report was

prepared, the Funds' managers could not predict when future auctions might

succeed in attracting sufficient buyers for the shares offered. The Funds'

managers are working diligently to develop mechanisms designed to improve the

liquidity of the Preferred shares, or refund them, but at present there is no

assurance that these efforts will succeed.

5

These developments do not affect the management or investment policies of the

Funds. However, one implication of these auction failures for common

shareholders is that the Funds' cost of leverage will be higher than it

otherwise would have been had the auctions continued to be successful. As a

result, the Funds' future common share earnings may be lower than they otherwise

would have been.

For current, up-to-date information please visit the Nuveen CEF Auction Rate

Preferred Resource Center,

http://www.nuveen.com/ResourceCenter/AuctionRatePreferred.aspx.

6

Common Share

Distribution and Share Price

INFORMATION

As noted earlier, these Funds use financial leverage to potentially enhance

opportunities for additional income for common shareholders. The Funds' use of

this leverage strategy continued to provide incremental income, although the

extent of this benefit was reduced to some degree by short-term interest rates

that remained relatively high during the earlier part of the period. This, in

turn, kept the Funds' borrowing costs high. This is one reason all three Funds

declared one monthly distribution decrease over the six-month period.

During certain periods, the Funds may pay dividends at a rate that may be more

or less than the amount of net investment income actually earned by the Fund

during the period. If a Fund has cumulatively earned more than it has paid in

dividends, it holds the excess in reserve as undistributed net investment income

(UNII) as part of the Fund's common share NAV. Conversely, if a Fund has

cumulatively paid dividends in excess of its earnings, the excess constitutes

negative UNII that is likewise reflected in the Fund's common share NAV. As of

January 31, 2008, all three Funds had positive UNII balances, based upon our

best estimate, for tax purposes. NSL and JFR had positive UNII balances and JRO

had a negative UNII balance for financial statement purposes.

As of January 31, 2008, the Funds were trading at discounts to their common

share NAVs as shown in the table below.

------------------------------------------------------------------------------------------

1/31/08 Six-Month

Discount Average Discount

------------------------------------------------------------------------------------------

NSL -2.72% -5.25%

JFR -6.72% -7.26%

JRO -5.24% -6.75%

------------------------------------------------------------------------------------------

|

7

NSL

PERFORMANCE Nuveen Senior

OVERVIEW Income Fund

as of January 31, 2008

|

PORTFOLIO ALLOCATION (AS A % OF TOTAL INVESTMENTS)

(PORTFOLIO ALLOCATION PIE CHART)

Other 0.4

Short-Term Investments 8.4

Corporate Bonds 2.7

Variable Rate Senior Loan Interests 88.5

|

2007-2008 MONTHLY DIVIDENDS PER SHARE

(MONTHLY DISTRIBUTIONS BAR CHART)

Feb 0.0585

Mar 0.0615

Apr 0.0615

May 0.0615

Jun 0.0615

Jul 0.0615

Aug 0.0615

Sep 0.0615

Oct 0.0615

Nov 0.0615

Dec 0.0580

Jan 0.0580

|

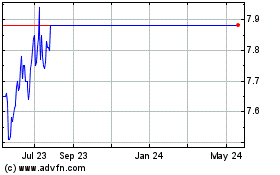

SHARE PRICE PERFORMANCE -- WEEKLY CLOSING PRICE

(SHARE PRICE CHART)

2/01/07 8.72

8.75

8.80

8.75

8.75

8.75

8.90

8.77

8.71

8.85

8.82

8.79

8.79

8.84

8.93

8.87

8.97

8.95

8.98

8.91

9.05

9.00

8.67

8.96

8.76

8.35

8.05

7.95

7.77

7.52

7.8899

7.65

7.90

7.77

7.83

8.02

7.99

8.04

7.75

7.51

7.58

7.33

7.02

7.11

7.20

7.08

7.03

6.94

6.97

7.14

7.44

7.39

7.12

1/31/08 7.15

|

FUND SNAPSHOT

-------------------------------------------------------------------------------------

Common Share Price $7.15

-------------------------------------------------------------------------------------

Common Share

Net Asset Value $7.35

-------------------------------------------------------------------------------------

Premium/(Discount) to NAV -2.72%

-------------------------------------------------------------------------------------

Latest Dividend $0.0580

-------------------------------------------------------------------------------------

Market Yield 9.73%

-------------------------------------------------------------------------------------

Net Assets Applicable to

Common Shares ($000) $219,177

-------------------------------------------------------------------------------------

|

AVERAGE ANNUAL TOTAL RETURN

(Inception 10/26/99)

-------------------------------------------------------------------------------------

ON SHARE PRICE ON NAV

-------------------------------------------------------------------------------------

6-Month (Cumulative) -7.13% -3.81%

-------------------------------------------------------------------------------------

1-Year -10.16% -5.91%

-------------------------------------------------------------------------------------

5-Year 6.52% 7.87%

-------------------------------------------------------------------------------------

Since Inception 4.13% 5.24%

-------------------------------------------------------------------------------------

|

INDUSTRIES

(as a % of total investments)

-------------------------------------------------------------------------------------

Media 13.1%

-------------------------------------------------------------------------------------

Hotels, Restaurants & Leisure 7.5%

-------------------------------------------------------------------------------------

Health Care Providers & Services 6.7%

-------------------------------------------------------------------------------------

Specialty Retail 5.2%

-------------------------------------------------------------------------------------

Building Products 4.9%

-------------------------------------------------------------------------------------

Diversified Telecommunication Services 4.1%

-------------------------------------------------------------------------------------

Chemicals 2.9%

-------------------------------------------------------------------------------------

Paper & Forest Products 2.8%

-------------------------------------------------------------------------------------

Containers & Packaging 2.7%

-------------------------------------------------------------------------------------

Real Estate Management & Development 2.7%

-------------------------------------------------------------------------------------

Metals & Mining 2.7%

-------------------------------------------------------------------------------------

Machinery 2.6%

-------------------------------------------------------------------------------------

Electric Utilities 2.4%

-------------------------------------------------------------------------------------

Airlines 2.2%

-------------------------------------------------------------------------------------

IT Services 2.0%

-------------------------------------------------------------------------------------

Aerospace & Defense 1.9%

-------------------------------------------------------------------------------------

Road & Rail 1.8%

-------------------------------------------------------------------------------------

Leisure Equipment & Products 1.7%

-------------------------------------------------------------------------------------

Semiconductors & Equipment 1.6%

-------------------------------------------------------------------------------------

Diversified Consumer Services 1.5%

-------------------------------------------------------------------------------------

Oil, Gas & Consumable Fuels 1.5%

-------------------------------------------------------------------------------------

Insurance 1.4%

-------------------------------------------------------------------------------------

Food Products 1.4%

-------------------------------------------------------------------------------------

Short-Term Investments 8.4%

-------------------------------------------------------------------------------------

Other 14.3%

-------------------------------------------------------------------------------------

|

TOP FIVE ISSUERS

(EXCLUDING SHORT-TERM INVESTMENTS)

(as a % of total investments)

------------------------------------------------------------------------------------

Univision Communications 2.4%

------------------------------------------------------------------------------------

Norwood Promotional Products 2.3%

------------------------------------------------------------------------------------

Tribune Company 2.0%

------------------------------------------------------------------------------------

Swift Transportation 2.0%

------------------------------------------------------------------------------------

Building Materials Corporation of America 1.8%

------------------------------------------------------------------------------------

|

8

JFR Nuveen Floating

PERFORMANCE Rate Income

OVERVIEW Fund

as of January 31, 2008

|

PORTFOLIO ALLOCATION (AS A % OF TOTAL INVESTMENTS)

(PORTFOLIO ALLOCATION PIE CHART)

Other 1.1

Short-Term Investments 8.6

Corporate Bonds 5.7

Variable Rate Senior Loan Interests 84.6

|

2007-2008 MONTHLY DIVIDENDS PER SHARE

(MONTHLY DISTRIBUTIONS BAR CHART)

Feb 0.0980

Mar 0.1005

Apr 0.1005

May 0.1005

Jun 0.1005

Jul 0.1005

Aug 0.1005

Sep 0.1005

Oct 0.1005

Nov 0.1005

Dec 0.0970

Jan 0.0970

|

SHARE PRICE PERFORMANCE -- WEEKLY CLOSING PRICE

(SHARE PRICE CHART)

2/01/07 14.05

14.23

14.21

14.18

14.13

13.85

14.06

13.99

14.15

14.07

14.35

14.40

14.38

14.36

14.31

14.37

14.39

14.52

14.46

14.29

14.40

14.59

14.25

14.36

13.99

13.17

12.62

12.60

12.62

12.05

12.45

12.40

12.60

12.40

12.57

12.61

12.62

12.67

12.28

12.35

12.30

11.82

11.47

11.40

11.64

11.70

11.55

11.30

11.42

11.80

11.90

11.44

11.25

1/31/08 11.24

|

FUND SNAPSHOT

-------------------------------------------------------------------------------------

Common Share Price $11.24

-------------------------------------------------------------------------------------

Common Share

Net Asset Value $12.05

-------------------------------------------------------------------------------------

Premium/(Discount) to NAV -6.72%

-------------------------------------------------------------------------------------

Latest Dividend $0.0970

-------------------------------------------------------------------------------------

Market Yield 10.36%

-------------------------------------------------------------------------------------

Net Assets Applicable to

Common Shares ($000) $570,977

-------------------------------------------------------------------------------------

|

AVERAGE ANNUAL TOTAL RETURN

(Inception 3/25/04)

-------------------------------------------------------------------------------------

ON SHARE PRICE ON NAV

-------------------------------------------------------------------------------------

6-Month (Cumulative) -8.30% -3.54%

-------------------------------------------------------------------------------------

1-Year -11.98% -6.44%

-------------------------------------------------------------------------------------

Since Inception -0.04% 2.69%

-------------------------------------------------------------------------------------

|

INDUSTRIES

(as a % of total investments)

-------------------------------------------------------------------------------------

Media 17.3%

-------------------------------------------------------------------------------------

Hotels, Restaurants & Leisure 7.6%

-------------------------------------------------------------------------------------

Health Care Providers & Services 6.2%

-------------------------------------------------------------------------------------

Diversified Telecommunication Services 5.3%

-------------------------------------------------------------------------------------

Chemicals 5.2%

-------------------------------------------------------------------------------------

Building Products 4.5%

-------------------------------------------------------------------------------------

Specialty Retail 4.0%

-------------------------------------------------------------------------------------

IT Services 2.8%

-------------------------------------------------------------------------------------

Real Estate Management & Development 2.7%

-------------------------------------------------------------------------------------

Containers & Packaging 2.7%

-------------------------------------------------------------------------------------

Electric Utilities 2.7%

-------------------------------------------------------------------------------------

Road & Rail 2.5%

-------------------------------------------------------------------------------------

Paper & Forest Products 2.4%

-------------------------------------------------------------------------------------

Semiconductors & Equipment 1.9%

-------------------------------------------------------------------------------------

Diversified Consumer Services 1.8%

-------------------------------------------------------------------------------------

Airlines 1.5%

-------------------------------------------------------------------------------------

Insurance 1.5%

-------------------------------------------------------------------------------------

Commercial Services & Supplies 1.4%

-------------------------------------------------------------------------------------

Software 1.4%

-------------------------------------------------------------------------------------

Independent Power Producers & Energy Traders 1.2%

-------------------------------------------------------------------------------------

Short-Term Investments 8.6%

-------------------------------------------------------------------------------------

Other 14.8%

-------------------------------------------------------------------------------------

|

TOP FIVE ISSUERS

(EXCLUDING SHORT-TERM INVESTMENTS)

(as a % of total investments)

------------------------------------------------------------------------------------

Univision Communications 2.8%

------------------------------------------------------------------------------------

Tribune Company 2.7%

------------------------------------------------------------------------------------

Swift Transportation 2.3%

------------------------------------------------------------------------------------

Intelsat Limited 2.3%

------------------------------------------------------------------------------------

Graham Packaging Company, L.P. 2.0%

------------------------------------------------------------------------------------

|

9

JRO Nuveen Floating

PERFORMANCE Rate Income

OVERVIEW Opportunity Fund

as of January 31, 2008

|

PORTFOLIO ALLOCATION (AS A % OF TOTAL INVESTMENTS)

(PORTFOLIO ALLOCATION PIE CHART)

Other 0.1

Short-Term Investments 4.8

Corporate Bonds 9.2

Variable Rate Senior Loan Interests 85.9

|

2007-2008 MONTHLY DIVIDENDS PER SHARE

(MONTHLY DISTRIBUTIONS BAR CHART)

Feb 0.1015

Mar 0.1045

Apr 0.1045

May 0.1045

Jun 0.1045

Jul 0.1045

Aug 0.1045

Sep 0.1045

Oct 0.1045

Nov 0.1045

Dec 0.1020

Jan 0.1020

|

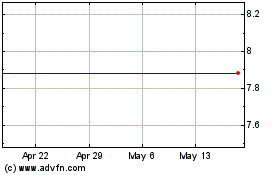

SHARE PRICE PERFORMANCE -- WEEKLY CLOSING PRICE

(SHARE PRICE CHART)

2/01/07 14.13

14.26

14.39

14.22

14.21

14.07

14.18

14.03

14.06

14.15

14.36

14.38

14.38

14.49

14.59

14.65

14.65

14.72

14.76

14.54

14.76

14.86

14.28

14.53

14.04

13.39

12.77

12.71

12.68

12.08

12.55

12.52

12.75

12.59

12.69

12.64

12.72

12.73

12.35

12.43

12.40

11.90

11.59

11.47

11.76

11.75

11.56

11.48

11.50

11.84

12.02

11.75

11.40

1/31/08 11.39

|

FUND SNAPSHOT

-------------------------------------------------------------------------------------

Common Share Price $11.39

-------------------------------------------------------------------------------------

Common Share

Net Asset Value $12.02

-------------------------------------------------------------------------------------

Premium/(Discount) to NAV -5.24%

-------------------------------------------------------------------------------------

Latest Dividend $0.1020

-------------------------------------------------------------------------------------

Market Yield 10.75%

-------------------------------------------------------------------------------------

Net Assets Applicable to

Common Shares ($000) $341,558

-------------------------------------------------------------------------------------

|

AVERAGE ANNUAL TOTAL RETURN

(Inception 7/27/04)

-------------------------------------------------------------------------------------

ON SHARE PRICE ON NAV

-------------------------------------------------------------------------------------

6-Month (Cumulative) -8.12% -4.03%

-------------------------------------------------------------------------------------

1-Year -11.00% -6.68%

-------------------------------------------------------------------------------------

Since Inception 0.08% 2.63%

-------------------------------------------------------------------------------------

|

INDUSTRIES

(as a % of total investments)

-------------------------------------------------------------------------------------

Media 19.4%

-------------------------------------------------------------------------------------

Diversified Telecommunication Services 6.8%

-------------------------------------------------------------------------------------

Health Care Providers & Services 5.8%

-------------------------------------------------------------------------------------

Hotels, Restaurants & Leisure 5.8%

-------------------------------------------------------------------------------------

Chemicals 4.5%

-------------------------------------------------------------------------------------

Building Products 4.4%

-------------------------------------------------------------------------------------

Containers & Packaging 3.9%

-------------------------------------------------------------------------------------

Specialty Retail 3.5%

-------------------------------------------------------------------------------------

Paper & Forest Products 3.1%

-------------------------------------------------------------------------------------

Real Estate Management & Development 3.0%

-------------------------------------------------------------------------------------

Electric Utilities 2.9%

-------------------------------------------------------------------------------------

Road & Rail 2.8%

-------------------------------------------------------------------------------------

IT Services 2.6%

-------------------------------------------------------------------------------------

Oil, Gas & Consumable Fuels 2.2%

-------------------------------------------------------------------------------------

Semiconductors & Equipment 2.1%

-------------------------------------------------------------------------------------

Diversified Consumer Services 1.9%

-------------------------------------------------------------------------------------

Software 1.9%

-------------------------------------------------------------------------------------

Airlines 1.8%

-------------------------------------------------------------------------------------

Household Products 1.4%

-------------------------------------------------------------------------------------

Metals & Mining 1.1%

-------------------------------------------------------------------------------------

Short-Term Investments 4.8%

-------------------------------------------------------------------------------------

Other 14.3%

-------------------------------------------------------------------------------------

|

TOP FIVE ISSUERS

(EXCLUDING SHORT-TERM INVESTMENTS)

(as a % of total investments)

------------------------------------------------------------------------------------

Intelsat Limited 3.0%

------------------------------------------------------------------------------------

Cablevision Systems Corporation 2.7%

------------------------------------------------------------------------------------

Tribune Company 2.7%

------------------------------------------------------------------------------------

Univision Communications 2.5%

------------------------------------------------------------------------------------

Swift Transportation 2.5%

------------------------------------------------------------------------------------

|

10

SHAREHOLDER MEETING REPORT

The annual meeting of shareholders was held in the offices of Nuveen

Investments on October 12, 2007; the meeting for Nuveen Floating Rate

Income Fund (JFR) and Nuveen Floating Rate Income Opportunity Fund

(JRO) was subsequently adjourned to October 22, 2007.

NSL JFR JRO

-----------------------------------------------------------------------------------------------------------

Common and Common and Common and

Preferred Preferred Preferred

shares voting shares voting shares voting

together together together

as a class as a class as a class

-----------------------------------------------------------------------------------------------------------

TO APPROVE A NEW INVESTMENT MANAGEMENT AGREEMENT:

For 16,151,695 22,176,193 14,162,668

Against 587,476 868,624 391,572

Abstain 361,824 781,218 388,673

Broker Non-Votes 5,961,402 8,645,893 5,715,896

-----------------------------------------------------------------------------------------------------------

Total 23,062,397 32,471,928 20,658,809

-----------------------------------------------------------------------------------------------------------

TO APPROVE A NEW SUB-ADVISORY AGREEMENT BETWEEN NUVEEN ASSET

MANAGEMENT AND SYMPHONY ASSET MANAGEMENT LLC.:

For 15,991,175 21,992,048 14,084,279

Against 649,300 976,063 407,158

Abstain 460,520 857,924 451,476

Broker Non-Votes 5,961,402 8,645,893 5,715,896

-----------------------------------------------------------------------------------------------------------

Total 23,062,397 32,471,928 20,658,809

-----------------------------------------------------------------------------------------------------------

APPROVAL OF THE BOARD MEMBERS WAS REACHED AS FOLLOWS:

Judith M. Stockdale

For 22,476,662 31,412,571 20,213,607

Withhold 585,735 1,059,357 445,202

-----------------------------------------------------------------------------------------------------------

Total 23,062,397 32,471,928 20,658,809

-----------------------------------------------------------------------------------------------------------

Carole E. Stone

For 22,484,364 31,411,622 20,214,232

Withhold 578,033 1,060,306 444,577

-----------------------------------------------------------------------------------------------------------

Total 23,062,397 32,471,928 20,658,809

-----------------------------------------------------------------------------------------------------------

TO RATIFY THE SELECTION OF ERNST & YOUNG LLP AS THE

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE

CURRENT FISCAL YEAR:

For 22,558,389 31,437,748 20,179,079

Against 231,247 402,294 207,273

Abstain 272,761 631,886 272,457

-----------------------------------------------------------------------------------------------------------

Total 23,062,397 32,471,928 20,658,809

-----------------------------------------------------------------------------------------------------------

|

11

NSL

Nuveen Senior Income Fund

Portfolio of INVESTMENTS

January 31, 2008 (Unaudited)

WEIGHTED

PRINCIPAL AVERAGE

AMOUNT (000) DESCRIPTION (1) COUPON MATURITY (2) RATINGS (3) VALUE

---------------------------------------------------------------------------------------------------------------------------------

VARIABLE RATE SENIOR LOAN INTERESTS - 152.8% (88.5% OF TOTAL INVESTMENTS) (4)

AEROSPACE & DEFENSE - 3.3% (1.9% OF TOTAL INVESTMENTS)

$ 669 DAE Aviation Holdings, Inc., Asset Sale 7.750% 7/31/09 BB- $ 668,638

756 DAE Aviation Holdings, Inc., Term Loan B-1 7.848% 7/31/14 BB- 753,212

572 DAE Aviation Holdings, Inc., Term Loan B-2 6.990% 7/31/13 BB- 570,255

2,502 Midwestern Aircraft, Term Loan B 5.676% 12/30/11 BBB- 2,486,615

2,385 Vought Aircraft Industries, Inc., Term Loan 7.340% 12/22/11 Ba3 2,258,029

545 Vought Aircraft Industries, Inc., Tranche B, 7.100% 12/22/10 Ba3 516,364

Letter of Credit

---------------------------------------------------------------------------------------------------------------------------------

7,429 Total Aerospace & Defense 7,253,113

---------------------------------------------------------------------------------------------------------------------------------

AIRLINES - 3.8% (2.2% OF TOTAL INVESTMENTS)

2,000 Delta Air Lines, Inc., Credit Linked Deposit 6.719% 4/30/12 Ba2 1,845,833

1,990 Delta Air Lines, Inc., Term Loan 8.082% 4/30/14 B 1,811,729

1,980 Northwest Airlines, Inc., DIP Term Loan 5.990% 8/21/13 BB 1,815,001

3,156 United Air Lines, Inc., Term Loan B 6.784% 2/01/14 BB- 2,851,050

---------------------------------------------------------------------------------------------------------------------------------

9,126 Total Airlines 8,323,613

---------------------------------------------------------------------------------------------------------------------------------

AUTO COMPONENTS - 1.9% (1.1% OF TOTAL INVESTMENTS)

459 Gen Tek Inc., Additional Term Loan B 6.990% 2/28/11 BB- 447,109

1,707 Gen Tek Inc., Term Loan B 6.440% 2/28/11 BB- 1,662,536

2,000 Goodyear Tire & Rubber Company, Term Loan 6.430% 4/30/14 Ba1 1,832,500

1,301 Metalforming Technologies, Inc., Term Loan A, (5) 0.000% 9/30/07 N/R 247,278

(6)

506 Metalforming Technologies, Inc., Term Loan B, 0.000% 9/30/07 N/R 96,169

(PIK) (5) (6)

---------------------------------------------------------------------------------------------------------------------------------

5,973 Total Auto Components 4,285,592

---------------------------------------------------------------------------------------------------------------------------------

BUILDING PRODUCTS - 7.8% (4.5% OF TOTAL INVESTMENTS)

877 Atrium Companies, Inc., Term Loan 7.465% 5/31/12 BB- 787,262

5,970 Building Materials Corporation of America, Term 6.688% 2/22/14 BB 4,844,289

Loan, DD1

2,000 Building Materials Corporation of America, Term 9.563% 9/15/14 Caa1 1,373,333

Loan, Second Lien

2,438 Euramax Holdings, Inc., Term Loan 7.063% 6/29/12 B1 2,100,604

1,935 Nortek, Inc., Term Loan B 5.534% 8/27/11 Ba2 1,789,875

2,429 Stile Acquisition Corporation, Canadian Term Loan 5.649% 4/05/13 BB- 2,103,174

2,433 Stile Acquisition Corporation, Term Loan B 5.651% 4/05/13 BB- 2,106,757

1,975 TFS Acquisition, Term Loan 8.330% 8/11/13 B+ 1,896,000

---------------------------------------------------------------------------------------------------------------------------------

20,057 Total Building Products 17,001,294

---------------------------------------------------------------------------------------------------------------------------------

CAPITAL MARKETS - 0.6% (0.4% OF TOTAL INVESTMENTS)

1,534 Ameritrade Holdings Corporation, Term Loan B 4.770% 12/31/12 Ba1 1,472,635

---------------------------------------------------------------------------------------------------------------------------------

CHEMICALS - 5.0% (2.9% OF TOTAL INVESTMENTS)

400 Celanese Holdings LLC, Credit Linked Deposit 4.600% 4/02/14 BB+ 377,389

1,588 Celanese Holdings LLC, Term Loan 6.479% 4/02/14 BB+ 1,498,234

2,963 Hexion Specialty Chemicals, Inc., Term Loan C-4 7.188% 5/05/13 Ba3 2,790,099

716 Huntsman International LLC, Term Loan 5.035% 4/19/14 BB+ 679,796

1,990 ISP Chemco, Inc., Term Loan 6.683% 6/04/14 BB- 1,856,919

1,940 Rockwood Specialties Group, Inc., Term Loan E 4.744% 7/30/12 BB+ 1,846,907

2,000 Univar, Inc., Term Loan 7.887% 10/10/14 B+ 1,945,000

---------------------------------------------------------------------------------------------------------------------------------

11,597 Total Chemicals 10,994,344

---------------------------------------------------------------------------------------------------------------------------------

COMMERCIAL SERVICES & SUPPLIES - 1.8% (1.0% OF TOTAL INVESTMENTS)

1,845 Acco Brands Corporation, Term Loan B 6.382% 8/17/12 Ba1 1,725,075

393 Allied Waste North America, Inc., Letter of 6.000% 3/28/14 BBB- 368,840

Credit

653 Allied Waste North America, Inc., Term Loan B 5.888% 3/28/14 BBB- 613,373

796 Rental Services Corporation, Term Loan 8.150% 11/27/13 B- 687,076

665 Workflow Holdings Corporation, Term Loan 7.751% 11/30/11 BB- 565,211

---------------------------------------------------------------------------------------------------------------------------------

4,352 Total Commercial Services & Supplies 3,959,575

---------------------------------------------------------------------------------------------------------------------------------

|

12

WEIGHTED

PRINCIPAL AVERAGE

AMOUNT (000) DESCRIPTION (1) COUPON MATURITY (2) RATINGS (3) VALUE

---------------------------------------------------------------------------------------------------------------------------------

COMMUNICATIONS EQUIPMENT - 0.7% (0.4% OF TOTAL INVESTMENTS)

$ 2,000 IPC Systems, Inc., Term Loan, Second Lien, WI/DD TBD TBD B3 $ 1,555,000

---------------------------------------------------------------------------------------------------------------------------------

CONTAINERS & PACKAGING - 4.7% (2.7% OF TOTAL INVESTMENTS)

454 Bluegrass Container Company LLC, Delayed Term 6.566% 6/30/13 BB 441,706

Loan

485 Bluegrass Container Company LLC, Delayed Term 8.396% 12/31/13 B 483,030

Loan

1,515 Bluegrass Container Company LLC, Term Loan 8.396% 12/31/13 B 1,509,470

1,516 Bluegrass Container Company LLC, Term Loan B 6.678% 6/30/13 BB 1,476,229

5,480 Graham Packaging Company, L.P., Term Loan 7.253% 10/07/11 B+ 5,095,987

437 Smurfit-Stone Container Corporation, 6.700% 11/01/10 BB 418,214

Deposit-Funded Commitment

283 Smurfit-Stone Container Corporation, Term Loan B 7.058% 11/01/11 BB 270,634

472 Smurfit-Stone Container Corporation, Term Loan C 7.023% 11/01/11 BB 452,101

169 Smurfit-Stone Container Corporation, Term Loan 6.688% 11/01/11 BB 161,712

C-1

---------------------------------------------------------------------------------------------------------------------------------

10,811 Total Containers & Packaging 10,309,083

---------------------------------------------------------------------------------------------------------------------------------

DIVERSIFIED CONSUMER SERVICES - 2.6% (1.5% OF TOTAL INVESTMENTS)

3,990 Cengage Learning Acquisitions, Inc., Term Loan 6.205% 7/05/14 B+ 3,602,084

2,273 West Corporation, Term Loan 5.854% 10/24/13 BB- 2,103,117

---------------------------------------------------------------------------------------------------------------------------------

6,263 Total Diversified Consumer Services 5,705,201

---------------------------------------------------------------------------------------------------------------------------------

DIVERSIFIED TELECOMMUNICATION SERVICES - 7.1% (4.1% OF TOTAL INVESTMENTS)

1,995 Alltel Communications, Inc., Term Loan B3 6.773% 5/18/15 BB- 1,822,100

1,985 Crown Castle Operating Company, Term Loan 6.330% 1/26/14 BB+ 1,841,796

2,000 Intelsat, Term Loan 7.131% 2/01/14 B 1,959,166

1,950 Intelsat, Tranche B, Term Loan 6.350% 7/01/13 BB 1,831,343

995 Intelsat, Tranche B-2, Term Loan 6.600% 12/03/13 BB 871,303

2,267 Level 3 Financing, Inc., Term Loan 6.611% 3/13/14 B+ 2,102,333

5,000 Qwest Corporation, Term Loan B 6.950% 6/30/10 BBB- 5,104,168

5,000 WCI Capital Corporation, Term Loan B, (5) (6) 0.000% 9/30/07 N/R 52,083

---------------------------------------------------------------------------------------------------------------------------------

21,192 Total Diversified Telecommunication Services 15,584,292

---------------------------------------------------------------------------------------------------------------------------------

ELECTRIC UTILITIES - 4.1% (2.4% OF TOTAL INVESTMENTS)

665 Astoria Generating Company, Term Loan 6.911% 2/23/13 BB- 636,936

4,243 Calpine Corporation, DIP Term Loan 7.080% 3/29/09 N/R 3,797,517

556 Calpine Corporation, DIP Revolver, (7) (8) 1.513% 3/29/09 N/R (33,333)

2,993 TXU Corporation, Term Loan B-2 8.396% 10/10/14 Ba3 2,759,561

1,995 TXU Corporation, Term Loan B-3 8.396% 10/10/14 Ba3 1,846,282

---------------------------------------------------------------------------------------------------------------------------------

10,452 Total Electric Utilities 9,006,963

---------------------------------------------------------------------------------------------------------------------------------

ELECTRICAL EQUIPMENT - 1.9% (1.1% OF TOTAL INVESTMENTS)

3,000 Allison Transmission Holdings, Inc., Term Loan, TBD TBD BB- 2,638,392

WI/DD

1,496 Sensus Metering Systems, Inc., Term Loan B-1 6.672% 12/17/10 BB 1,428,348

97 Sensus Metering Systems, Inc., Term Loan B-2 6.878% 12/17/10 BB 92,801

---------------------------------------------------------------------------------------------------------------------------------

4,593 Total Electrical Equipment 4,159,541

---------------------------------------------------------------------------------------------------------------------------------

ELECTRONIC EQUIPMENT & INSTRUMENTS - 0.8% (0.5% OF TOTAL INVESTMENTS)

1,970 Sensata Technologies B.V., Term Loan 5.056% 4/27/13 BB 1,775,814

---------------------------------------------------------------------------------------------------------------------------------

ENERGY EQUIPMENT & SERVICES - 1.0% (0.6% OF TOTAL INVESTMENTS)

2,471 Dresser-Rand Group, Inc., Term Loan 7.409% 5/04/14 B+ 2,220,836

---------------------------------------------------------------------------------------------------------------------------------

FOOD PRODUCTS - 2.4% (1.4% OF TOTAL INVESTMENTS)

465 Dole Food Company, Inc., Deposit-Funded 6.377% 4/12/13 BB- 424,884

Commitment

1,028 Dole Food Company, Inc., Term Loan B 6.703% 4/12/13 BB- 939,259

3,427 Dole Food Company, Inc., Term Loan C 6.552% 4/12/13 BB- 3,130,862

772 Michael Foods, Inc., Term Loan B 6.849% 11/21/10 BB- 757,484

---------------------------------------------------------------------------------------------------------------------------------

5,692 Total Food Products 5,252,489

---------------------------------------------------------------------------------------------------------------------------------

GAS UTILITIES - 0.9% (0.5% OF TOTAL INVESTMENTS)

2,000 Energy Transfer Partners LP, Term Loan 6.648% 2/08/12 BBB- 1,939,500

---------------------------------------------------------------------------------------------------------------------------------

HEALTH CARE EQUIPMENT & SUPPLIES - 0.9% (0.5% OF TOTAL INVESTMENTS)

990 Symbion, Inc., Term Loan A 6.505% 8/01/13 Ba3 933,841

990 Symbion, Inc., Term Loan B 6.505% 8/01/14 Ba3 933,841

---------------------------------------------------------------------------------------------------------------------------------

1,980 Total Health Care Equipment & Supplies 1,867,682

---------------------------------------------------------------------------------------------------------------------------------

|

13

NSL

Nuveen Senior Income Fund (continued)

Portfolio of INVESTMENTS January 31, 2008 (Unaudited)

WEIGHTED

PRINCIPAL AVERAGE

AMOUNT (000) DESCRIPTION (1) COUPON MATURITY (2) RATINGS (3) VALUE

---------------------------------------------------------------------------------------------------------------------------------

HEALTH CARE PROVIDERS & SERVICES - 11.6% (6.7% OF TOTAL INVESTMENTS)

$ 2,000 Community Health Systems Inc., Term Loan, WI/DD TBD TBD BB $ 1,850,770

3,292 DaVita Inc., Term Loan B-1 5.568% 10/05/12 BB+ 3,128,809

1,980 HCA, Inc., Term Loan 7.080% 11/18/13 BB 1,834,439

3,985 Health Management Associates, Inc., Term Loan, 6.559% 2/28/14 Ba2 3,516,264

DD1

842 HealthSouth Corporation, Term Loan 6.915% 3/10/13 BB- 789,121

464 IASIS Healthcare LLC, Delayed Term Loan, (7) 5.552% 3/14/14 Ba2 303,423

124 IASIS Healthcare LLC, Letter of Credit 3.213% 3/14/14 Ba2 113,072

1,347 IASIS Healthcare LLC, Term Loan 5.248% 3/14/14 Ba2 1,231,656

3,910 LifeCare, Term Loan B 9.080% 8/11/12 B2 3,431,019

2,143 Psychiatric Solutions, Inc., Term Loan B 6.173% 12/03/12 BB- 2,068,105

2,918 Select Medical Corporation, Term Loan 6.993% 2/24/12 Ba2 2,725,432

4,859 Vanguard Health Holding Company II LLC, 5.521% 9/23/11 Ba3 4,513,063

Replacement

---------------------------------------------------------------------------------------------------------------------------------

27,864 Total Health Care Providers & Services 25,505,173

---------------------------------------------------------------------------------------------------------------------------------

HOTELS, RESTAURANTS & LEISURE - 13.0% (7.5% OF TOTAL INVESTMENTS)

4,913 24 Hour Fitness Worldwide, Inc., Term Loan B 6.949% 6/08/12 Ba3 4,470,375

1,775 Ameristar Casinos, Inc., Term Loan B 7.428% 11/10/12 BB+ 1,752,391

774 CBRL Group, Inc., Term Loan B-1 6.400% 4/28/13 BB 729,106

93 CBRL Group, Inc., Term Loan B-2 6.393% 4/28/13 BB 88,279

3,900 CCM Merger, Inc., Term Loan B 6.901% 7/13/12 BB- 3,646,532

1,970 Cedar Fair LP, Term Loan 5.271% 8/30/12 BB 1,847,737

353 Isle of Capri Casinos, Inc., Delayed Term Loan A 5.035% 7/26/14 BB+ 310,588

468 Isle of Capri Casinos, Inc., Delayed Term Loan B 6.580% 7/26/14 BB+ 412,047

1,171 Isle of Capri Casinos, Inc., Term Loan 6.580% 7/26/14 BB+ 1,030,118

71 OSI Restaurant Partners LLC, Revolver 4.878% 6/14/13 BB- 60,212

893 OSI Restaurant Partners LLC, Term Loan 5.563% 6/14/14 BB- 755,837

3,910 Penn National Gaming, Inc., Term Loan B 5.656% 10/03/12 BBB- 3,827,890

1,000 QCE LLC, Term Loan 10.580% 11/05/13 N/R 866,667

124 Seminole Gaming, Delayed Term Loan B-1 6.505% 3/05/14 BBB 120,329

424 Seminole Gaming, Delayed Term Loan B-2 6.688% 3/05/14 BBB 410,444

433 Seminole Gaming, Delayed Term Loan B-3 5.563% 3/05/14 BBB 419,661

995 Travelport LLC, Delayed Term Loan 7.080% 8/23/13 BB- 908,871

268 Travelport LLC, Letter of Credit 7.080% 8/23/13 BB- 247,549

1,334 Travelport LLC, Term Loan 7.080% 8/23/13 BB- 1,233,733

800 Venetian Casino Resort LLC (Las Vegas Sands, 0.750% 5/23/14 BB (89,250)

Inc.) Delayed Term Loan, (7) (8)

3,184 Venetian Casino Resort LLC, Term Loan 6.580% 5/23/14 BB 2,828,785

2,629 Wintergames Holdings, Term Loan 6.609% 4/24/08 N/R 2,586,381

---------------------------------------------------------------------------------------------------------------------------------

31,482 Total Hotels, Restaurants & Leisure 28,464,282

---------------------------------------------------------------------------------------------------------------------------------

HOUSEHOLD DURABLES - 2.1% (1.2% OF TOTAL INVESTMENTS)

4,444 Shea Homes, Inc., Term Loan 6.830% 10/27/11 N/R 3,610,547

998 William Carter Company, Term Loan B 4.751% 7/14/12 BBB- 961,516

---------------------------------------------------------------------------------------------------------------------------------

5,442 Total Household Durables 4,572,063

---------------------------------------------------------------------------------------------------------------------------------

HOUSEHOLD PRODUCTS - 1.9% (1.1% OF TOTAL INVESTMENTS)

1,691 Prestige Brands, Inc., Term Loan B 6.978% 4/06/11 BB- 1,643,838

2,516 Solo Cup Company, Term Loan 8.409% 2/27/11 B1 2,441,999

---------------------------------------------------------------------------------------------------------------------------------

4,207 Total Household Products 4,085,837

---------------------------------------------------------------------------------------------------------------------------------

INDEPENDENT POWER PRODUCERS & ENERGY TRADERS - 1.7% (1.0% OF TOTAL INVESTMENTS)

329 Covanta Energy Corporation, Synthetic Letter of 6.203% 2/09/14 BB 310,263

Credit

666 Covanta Energy Corporation, Term Loan B 6.575% 2/09/14 BB 628,328

966 NRG Energy, Inc., Credit Linked Deposit 6.480% 2/01/13 Ba1 890,156

2,093 NRG Energy, Inc., Term Loan 6.580% 2/01/13 Ba1 1,928,014

---------------------------------------------------------------------------------------------------------------------------------

4,054 Total Independent Power Producers & Energy 3,756,761

Traders

---------------------------------------------------------------------------------------------------------------------------------

INSURANCE - 2.4% (1.4% OF TOTAL INVESTMENTS)

5,918 Conseco, Inc., Term Loan 5.271% 10/10/13 Ba3 5,360,493

---------------------------------------------------------------------------------------------------------------------------------

IT SERVICES - 3.4% (2.0% OF TOTAL INVESTMENTS)

2,993 First Data Corporation, Term Loan B-1 7.630% 9/24/14 BB- 2,709,914

5,093 SunGard Data Systems, Inc., Term Loan B 6.898% 2/28/14 BB 4,732,616

---------------------------------------------------------------------------------------------------------------------------------

8,086 Total IT Services 7,442,530

---------------------------------------------------------------------------------------------------------------------------------

|

14

WEIGHTED

PRINCIPAL AVERAGE

AMOUNT (000) DESCRIPTION (1) COUPON MATURITY (2) RATINGS (3) VALUE

---------------------------------------------------------------------------------------------------------------------------------

LEISURE EQUIPMENT & PRODUCTS - 2.9% (1.7% OF TOTAL INVESTMENTS)

$ 2,734 Bombardier Recreational Products, Inc., Term Loan 6.430% 6/28/13 B+ $ 2,595,191

3,686 Wimar OpCo LLC, Term Loan 9.250% 1/03/12 B2 3,654,386

---------------------------------------------------------------------------------------------------------------------------------

6,420 Total Leisure Equipment & Products 6,249,577

---------------------------------------------------------------------------------------------------------------------------------

MACHINERY - 4.5% (2.6% OF TOTAL INVESTMENTS)

1,990 Maxim Crane Works, LP, Term Loan 6.600% 6/29/14 BB- 1,800,950

1,156 Navistar International Corporation, Synthetic 5.066% 1/19/12 BB- 1,049,630

Letter of Credit

3,178 Navistar International Corporation, Term Loan 6.501% 1/19/12 BB- 2,886,482

1,975 Oshkosh Truck Corporation, Term Loan 6.900% 12/06/13 BBB- 1,834,505

557 Rexnord Corporation, Incremental Term Loan 7.401% 7/19/13 Ba2 535,695

1,869 Rexnord Corporation, Term Loan 6.427% 7/19/13 Ba2 1,797,214

---------------------------------------------------------------------------------------------------------------------------------

10,725 Total Machinery 9,904,476

---------------------------------------------------------------------------------------------------------------------------------

MEDIA - 21.6% (12.5% OF TOTAL INVESTMENTS)

4,500 American Media Operations, Inc., Term Loan 8.250% 1/13/13 B1 4,230,000

1,778 Carmike Cinemas, Inc., Term Loan 8.650% 5/19/12 B1 1,662,142

1,985 Cequel Communications LLC, Term Loan B 6.668% 11/05/13 BB- 1,735,973

1,000 Charter Communications Operating Holdings LLC, 7.343% 3/06/14 B+ 771,667

Holdco Term Loan

1,300 Charter Communications Operating Holdings LLC, 5.260% 3/06/14 B+ 1,138,125

Term Loan

1,950 CSC Holdings, Inc., Term Loan 6.896% 3/29/13 BB 1,798,875

2,985 Discovery Communications Holdings LLC, Term Loan 6.830% 5/14/14 N/R 2,843,213

2,970 Idearc, Inc., Term Loan 6.830% 11/17/14 BBB- 2,714,850

2,940 Metro-Goldwyn-Mayer Studios, Inc., Term Loan B 8.108% 4/08/12 N/R 2,627,381

4,938 Neilsen Finance LLC, Term Loan 6.964% 8/09/13 Ba3 4,576,802

1,898 Philadelphia Newspapers, Term Loan 7.920% 6/29/13 N/R 1,689,075

2,567 Regal Cinemas Corporation, Term Loan 6.330% 10/27/13 Ba2 2,382,784

6,965 Tribune Company, Term Loan B 7.910% 6/04/14 BB- 5,252,481

1,867 Tribune Company, Term Loan X 7.396% 6/04/09 BB- 1,748,251

268 Univision Communications, Inc., Delayed Term 1.000% 9/29/14 Ba3 (46,952)

Loan, (7) (8)

2,000 Univision Communications, Inc., Term Loan 5.771% 3/29/09 B3 1,893,750

7,732 Univision Communications, Inc., Term Loan, Second 5.495% 9/29/14 Ba3 6,379,328

Lien

427 Valassis Communications, Inc. Delayed Draw Term, 1.000% 3/02/14 BB (44,800)

(7) (8)

1,362 Valassis Communications, Inc. Tranche B, Term 6.580% 3/02/14 BB 1,218,572

Loan

2,874 WMG Acquisition Corporation, Term Loan 6.727% 2/28/11 Ba2 2,694,488

---------------------------------------------------------------------------------------------------------------------------------

54,306 Total Media 47,266,005

---------------------------------------------------------------------------------------------------------------------------------

METALS & MINING - 4.6% (2.7% OF TOTAL INVESTMENTS)

1,980 Aleris International, Inc., Term Loan 6.000% 12/19/13 BB- 1,661,551

1,862 Amsted Industries, Inc., Delayed Draw Term Loan 6.356% 4/08/13 BB 1,810,741

2,561 Amsted Industries, Inc., Term Loan 6.383% 4/08/13 BB 2,480,813

1,990 Edgen Murray II LP, Term Loan 7.807% 5/11/14 B 1,781,050

2,797 John Maneely Company, Term Loan, DD1 7.767% 12/08/13 B+ 2,403,525

---------------------------------------------------------------------------------------------------------------------------------

11,190 Total Metals & Mining 10,137,680

---------------------------------------------------------------------------------------------------------------------------------

OIL, GAS & CONSUMABLE FUELS - 2.6% (1.5% OF TOTAL INVESTMENTS)

550 Big West Oil LLC, Delayed Draw Term Loan, (7) (8) 1.500% 5/15/14 BB (27,500)

445 Big West Oil LLC, Term Loan 5.500% 5/15/14 BB 422,750

301 Coffeyville Resources LLC, Credit Linked Deposit 7.379% 12/28/10 BB- 288,198

978 Coffeyville Resources LLC, Term Loan D 7.479% 12/28/13 BB- 937,564

774 Targa Resources, Inc., Synthetic Letter of Credit 6.955% 10/31/12 Ba3 743,613

1,380 Targa Resources, Inc., Term Loan B 6.903% 10/31/12 Ba3 1,325,304

2,000 Venoco Inc., Term Loan 8.938% 9/20/11 B 1,910,000

---------------------------------------------------------------------------------------------------------------------------------

6,428 Total Oil, Gas & Consumable Fuels 5,599,929

---------------------------------------------------------------------------------------------------------------------------------

PAPER & FOREST PRODUCTS - 4.0% (2.3% OF TOTAL INVESTMENTS)

3,920 Georgia-Pacific Corporation, Term Loan B 6.866% 12/21/12 BB+ 3,628,450

1,543 Georgia-Pacific Corporation, Term Loan B-2 6.836% 12/24/12 BB+ 1,428,081

3,990 Wilton Products, Term Loan 8.138% 11/16/14 N/R 3,710,700

---------------------------------------------------------------------------------------------------------------------------------

9,453 Total Paper & Forest Products 8,767,231

---------------------------------------------------------------------------------------------------------------------------------

|

15

NSL

Nuveen Senior Income Fund (continued)

Portfolio of INVESTMENTS January 31, 2008 (Unaudited)

WEIGHTED

PRINCIPAL AVERAGE

AMOUNT (000) DESCRIPTION (1) COUPON MATURITY (2) RATINGS (3) VALUE

---------------------------------------------------------------------------------------------------------------------------------

PHARMACEUTICALS - 0.9% (0.5% OF TOTAL INVESTMENTS)

$ 858 Stiefel Laboratories, Inc., Delayed Term Loan 6.693% 12/28/13 BB- $ 823,782

1,122 Stiefel Laboratories, Inc., Term Loan 6.693% 12/28/13 BB- 1,077,018

---------------------------------------------------------------------------------------------------------------------------------

1,980 Total Pharmaceuticals 1,900,800

---------------------------------------------------------------------------------------------------------------------------------

REAL ESTATE INVESTMENT TRUST - 1.3% (0.7% OF TOTAL INVESTMENTS)

3,571 LandSource Holding Company LLC, Term Loan 7.761% 2/27/13 N/R 2,787,695

---------------------------------------------------------------------------------------------------------------------------------

REAL ESTATE MANAGEMENT & DEVELOPMENT - 4.6% (2.7% OF TOTAL INVESTMENTS)

3,721 Capital Automotive LP, Term Loan 6.390% 12/15/10 BB+ 3,566,291

3,500 LNR Property Corporation, Term Loan B 7.630% 7/12/11 BB 3,237,500

3,980 Realogy Corporation Delayed Draw Term Loan 7.505% 10/01/13 BB- 3,355,659

---------------------------------------------------------------------------------------------------------------------------------

11,201 Total Real Estate Management & Development 10,159,450

---------------------------------------------------------------------------------------------------------------------------------

ROAD & RAIL - 3.1% (1.8% OF TOTAL INVESTMENTS)

8,837 Swift Transportation Company, Inc., Term Loan 8.188% 5/10/14 BB- 6,857,127

---------------------------------------------------------------------------------------------------------------------------------

SEMICONDUCTORS & EQUIPMENT - 0.8% (0.5% OF TOTAL INVESTMENTS)

1,980 Freescale Semiconductor, Inc., Term Loan 6.381% 11/29/13 Ba1 1,686,713

---------------------------------------------------------------------------------------------------------------------------------

SOFTWARE - 1.2% (0.7% OF TOTAL INVESTMENTS)

2,780 Dealer Computer Services, Inc., Term Loan 6.843% 10/26/12 BB 2,557,207

---------------------------------------------------------------------------------------------------------------------------------

SPECIALTY RETAIL - 9.0% (5.2% OF TOTAL INVESTMENTS)

708 Blockbuster, Inc., Tranche A, Term Loan 8.894% 8/20/09 B 666,978

1,240 Blockbuster, Inc., Tranche B, Term Loan 9.212% 8/20/11 B 1,157,796

970 Burlington Coat Factory Warehouse Corporation, 7.320% 5/28/13 B2 837,114

Term Loan

988 CSK Automotive, Term Loan 11.625% 7/29/10 Ba3 854,241

3,878 Michaels Stores, Inc., Term Loan 7.583% 10/31/13 B 3,329,364

1,122 Micro Warehouse, Inc., Term Loan B, (5) (6) (9) 0.000% 1/30/07 N/R 165,826

3,905 Norwood Promotional Products, Inc., Term Loan A 9.500% 8/17/09 N/R 3,885,543

6,220 Norwood Promotional Products, Inc., Term Loan B 6.000% 8/17/11 N/R 4,198,463

988 Sally Holdings LLC, Term Loan 7.520% 11/16/13 BB- 935,127

4,000 TRU 2005 RE Holding Co I LLC, Term Loan 7.613% 12/08/08 B3 3,762,500

---------------------------------------------------------------------------------------------------------------------------------

24,019 Total Specialty Retail 19,792,952

---------------------------------------------------------------------------------------------------------------------------------

TEXTILES, APPAREL & LUXURY GOODS - 0.9% (0.5% OF TOTAL INVESTMENTS)

2,001 Visant Holding Corporation, Term Loan C 6.718% 7/29/10 Ba1 1,964,180

---------------------------------------------------------------------------------------------------------------------------------

TRADING COMPANIES & DISTRIBUTORS - 1.7% (1.0% OF TOTAL INVESTMENTS)

1,980 Ashtead Group Public Limited Company, Term Loan 6.688% 8/31/11 BB+ 1,871,100

393 Brenntag Holdings GMBH & Co. KG, Acquisition 5.794% 1/20/14 B+ 363,926

Facility

1,607 Brenntag Holdings GMBH & Co. KG, Facility B2 5.794% 1/20/14 B+ 1,489,407

---------------------------------------------------------------------------------------------------------------------------------

3,980 Total Trading Companies & Distributors 3,724,433

---------------------------------------------------------------------------------------------------------------------------------

WIRELESS TELECOMMUNICATION SERVICES - 1.7% (1.0% OF TOTAL INVESTMENTS)

4,000 Asurion Corporation, Term Loan 7.878% 7/03/14 N/R 3,650,000

---------------------------------------------------------------------------------------------------------------------------------

$ 379,416 TOTAL VARIABLE RATE SENIOR LOAN INTERESTS (COST 334,859,161

$373,242,305)

=================================================================================================================================

|

PRINCIPAL

AMOUNT (000) DESCRIPTION (1) COUPON MATURITY RATINGS (3) VALUE

-----------------------------------------------------------------------------------------------------------------------------

CORPORATE BONDS - 4.5% (2.7% OF TOTAL INVESTMENTS)

MEDIA - 0.9% (0.6% OF TOTAL INVESTMENTS)

$ 2,000 Cablevision Systems Corporation, Floating Rate 7.541% 4/01/09 B+ $ 2,010,000

Note, 144A

-----------------------------------------------------------------------------------------------------------------------------

PAPER & FOREST PRODUCTS - 0.9% (0.5% OF TOTAL INVESTMENTS)

2,000 Verso Paper Holdings LLC., Floating Rate Note, 6.862% 8/01/14 B+ 1,910,000

3.750% plus three-month LIBOR

-----------------------------------------------------------------------------------------------------------------------------

SEMICONDUCTORS & EQUIPMENT - 1.9% (1.1% OF TOTAL INVESTMENTS)

100 Avago Technologies Finance Pte. Ltd., Floating 8.612% 6/01/13 BB- 101,125

Rate Note, 5.500% plus three-month LIBOR

5,000 NXP BV, Floating Rate Note, 2.750% Plus 5.862% 10/15/13 BB- 4,168,750

three-month LIBOR

-----------------------------------------------------------------------------------------------------------------------------

5,100 Total Semiconductors & Equipment 4,269,875

-----------------------------------------------------------------------------------------------------------------------------

|

16

PRINCIPAL

AMOUNT (000) DESCRIPTION (1) COUPON MATURITY RATINGS (3) VALUE

-----------------------------------------------------------------------------------------------------------------------------

TEXTILES, APPAREL & LUXURY GOODS - 0.8% (0.5% OF TOTAL INVESTMENTS)

$ 2,000 HanesBrands Inc., Floating Rate Note, 3.375% 6.416% 12/15/14 B2 $ 1,820,000

plus six-month LIBOR

-----------------------------------------------------------------------------------------------------------------------------

$ 11,100 TOTAL CORPORATE BONDS (COST $11,100,000) 10,009,875

=============================================================================================================================

|

SHARES DESCRIPTION (1) VALUE

------------------------------------------------------------------------------------------------------------------------------

COMMON STOCKS - 0.6% (0.4% OF TOTAL INVESTMENTS)

AUTO COMPONENTS - 0.0% (0.0% OF TOTAL INVESTMENTS)

511 Gen Tek Inc., (6) 14,180

279,642 Metalforming Technologies Inc., (5) (6) (9) --

------------------------------------------------------------------------------------------------------------------------------

Total Auto Components 14,180

-----------------------------------------------------------------------------------------------------------------

BUILDING PRODUCTS - 0.6% (0.4% OF TOTAL INVESTMENTS)

35,644 Armstrong World Industries Inc., (6) 1,308,491

------------------------------------------------------------------------------------------------------------------------------

TOTAL COMMON STOCKS (COST $1,393,369) 1,322,671

=================================================================================================================

|

SHARES DESCRIPTION (1) VALUE

------------------------------------------------------------------------------------------------------------------------------

WARRANTS - 0.1% (0.0% OF TOTAL INVESTMENTS)

545 Gen Tek Inc., Warrant Class B $ 12,540

268 Gen Tek Inc., Warrant Class C 7,745

5,672 Reliant Energy Inc., Warrant Class A 113,440

------------------------------------------------------------------------------------------------------------------------------

TOTAL WARRANTS (COST $40,254) 133,725

=================================================================================================================

|

PRINCIPAL

AMOUNT (000) DESCRIPTION (1) COUPON MATURITY VALUE

-------------------------------------------------------------------------------------------------------------------------------

SHORT-TERM INVESTMENTS - 14.6% (8.4% OF TOTAL INVESTMENTS)

$ 31,908 Repurchase Agreement with Fixed Income Clearing 1.550% 2/01/08 $ 31,907,813

Corporation, dated 1/31/08, repurchase price

$31,909,187, collateralized by $4,870,000 U.S.

Treasury Notes, 4.750%, due 11/15/08, value

$5,016,100, $26,700,000 U.S. Treasury Notes,

3.875%, due 5/15/09, value $27,534,375

========== ----------------------------------------------------------------------------------------------------------------

TOTAL SHORT-TERM INVESTMENTS (COST $31,907,813) 31,907,813

================================================================================================================

TOTAL INVESTMENTS (COST $417,683,741) - 172.6% 378,233,245

================================================================================================================

BORROWINGS - (47.0)% (10) (103,000,000)

================================================================================================================

OTHER ASSETS LESS LIABILITIES - (4.6)% (10,056,049)

================================================================================================================

PREFERRED SHARES, AT LIQUIDATION VALUE - (21.0)% (46,000,000)

(10)

================================================================================================================

NET ASSETS APPLICABLE TO COMMON SHARES - 100% $ 219,177,196

================================================================================================================

|

17

NSL

Nuveen Senior Income Fund (continued)

Portfolio of INVESTMENTS January 31, 2008 (Unaudited)

(1) All percentages shown in the Portfolio of Investments are based on net assets applicable

to Common shares unless otherwise noted.

(2) Senior Loans generally are subject to mandatory and/or optional prepayment. Because of

these mandatory prepayment conditions and because there may be significant economic

incentives for a Borrower to prepay, prepayments of Senior Loans may occur. As a result,

the actual remaining maturity of Senior Loans held may be substantially less than the

stated maturities shown.

(3) Ratings: Using the higher of Standard & Poor's Group ("Standard & Poor's") or Moody's

Investor Service, Inc. ("Moody's") rating. Ratings below BBB by Standard & Poor's or Baa

by Moody's are considered to be below investment grade.

(4) Senior Loans generally pay interest at rates which are periodically adjusted by reference

to a base short-term, floating lending rate plus an assigned fixed rate. These floating

lending rates are generally (i) the lending rate referenced by the London Inter-Bank

Offered Rate ("LIBOR"), or (ii) the prime rate offered by one or more major United States

banks.

Senior Loans may be considered restricted in that the Fund ordinarily is contractually

obligated to receive approval from the Agent Bank and/or Borrower prior to the disposition

of a Senior Loan.

(5) At or subsequent to January 31, 2008, this issue was under the protection of the Federal

Bankruptcy Court.

(6) Non-income producing. Non-income producing, in the case of a Senior Loan, generally

denotes that the issuer has defaulted on the payment of principal or interest or has filed

for bankruptcy.

(7) Position or portion of position represents an unfunded Senior Loan commitment outstanding

at January 31, 2008.

(8) Negative value represents unrealized depreciation on unfunded Senior Loan commitment

outstanding at January 31, 2008.

(9) Investment valued of fair value using methods determined in good faith by, or at the

discretion of, the Board of Trustees.

(10) Borrowings and Preferred Shares, at Liquidation Value as a percentage of total investments

are (27.2)% and (12.2)%, respectively.

N/R Not rated.

DD1 Portion of investment purchased on a delayed delivery basis.

WI/DD Purchased on a when-issued or delayed delivery basis.

144A Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as

amended. These investments may only be resold in transactions exempt from registration

which are normally those transactions with qualified institutional buyers.

PIK In lieu of cash payment, interest accrued on "Payment in Kind" investment increases

principal outstanding.

TBD Senior Loan purchased on a when-issued or delayed-delivery basis. Certain details

associated with this purchase are not known prior to the settlement date of the

transaction. In addition, Senior Loans typically trade without accrued interest and

therefore a weighted average coupon rate is not available prior to settlement. At

settlement, if still unknown, the Borrower or counterparty will provide the Fund with the

final weighted average coupon rate and maturity date.

|

See accompanying notes to financial statements.

18

JFR

Nuveen Floating Rate Income Fund

Portfolio of INVESTMENTS

January 31, 2008 (Unaudited)

WEIGHTED

PRINCIPAL AVERAGE

AMOUNT (000) DESCRIPTION (1) COUPON MATURITY (2) RATINGS (3) VALUE

-----------------------------------------------------------------------------------------------------------------------------------

VARIABLE RATE SENIOR LOAN INTERESTS - 144.6% (84.6% OF TOTAL INVESTMENTS) (4)

AEROSPACE & DEFENSE - 1.7% (1.0% OF TOTAL INVESTMENTS)

$ 5,004 Midwestern Aircraft, Term Loan B 5.676% 12/30/11 BBB- $ 4,973,231

2,300 Transdigm, Inc., Term Loan B 6.858% 6/23/13 BB- 2,216,625

2,385 Vought Aircraft Industries, Inc., Term Loan 7.340% 12/22/11 Ba3 2,258,029

545 Vought Aircraft Industries, Inc., Tranche B, 7.100% 12/22/10 Ba3 516,364

Letter of Credit

-----------------------------------------------------------------------------------------------------------------------------------

10,234 Total Aerospace & Defense 9,964,249

-----------------------------------------------------------------------------------------------------------------------------------

AIRLINES - 2.7% (1.5% OF TOTAL INVESTMENTS)

2,504 ACTS Aero Technical Support & Services, Inc., 7.305% 10/01/14 N/R 2,351,862

Term Loan

7,920 Northwest Airlines, Inc., DIP Term Loan 5.990% 8/21/13 BB 7,260,003

6,240 United Air Lines, Inc., Term Loan B 6.784% 2/01/14 BB- 5,637,303