0001515940falseN-200015159402022-11-012023-10-310001515940ck0001515940:CreditFacilityMember2023-10-31iso4217:USDiso4217:USDxbrli:shares0001515940ck0001515940:CreditFacilityMember2022-10-310001515940ck0001515940:CreditFacilityMember2021-10-310001515940ck0001515940:CreditFacilityMember2020-10-310001515940ck0001515940:CreditFacilityMember2019-10-310001515940ck0001515940:CreditFacilityMember2018-10-310001515940ck0001515940:CreditFacilityMember2017-10-310001515940ck0001515940:CreditFacilityMember2016-10-310001515940ck0001515940:CreditFacilityMember2015-10-310001515940ck0001515940:CreditFacilityMember2014-10-310001515940ck0001515940:SeriesAMandatorilyRedeemablePreferredSharesMember2023-10-310001515940ck0001515940:SeriesAMandatorilyRedeemablePreferredSharesMember2022-11-012023-10-310001515940ck0001515940:SeriesAMandatorilyRedeemablePreferredSharesMember2022-10-310001515940ck0001515940:SeriesAMandatorilyRedeemablePreferredSharesMember2021-11-012022-10-310001515940ck0001515940:SeriesAMandatorilyRedeemablePreferredSharesMember2021-10-310001515940ck0001515940:SeriesAMandatorilyRedeemablePreferredSharesMember2020-11-012021-10-310001515940ck0001515940:SeriesAMandatorilyRedeemablePreferredSharesMember2020-10-310001515940ck0001515940:SeriesAMandatorilyRedeemablePreferredSharesMember2019-11-012020-10-310001515940ck0001515940:SeriesAMandatorilyRedeemablePreferredSharesMember2019-10-310001515940ck0001515940:SeriesAMandatorilyRedeemablePreferredSharesMember2018-11-012019-10-310001515940ck0001515940:CreditFacilityMember2022-11-012023-10-31xbrli:pure00015159402023-08-012023-10-3100015159402023-05-012023-07-3100015159402023-02-012023-04-3000015159402022-11-012023-01-3100015159402022-08-012022-10-3100015159402022-05-012022-07-3100015159402022-02-012022-04-3000015159402021-11-012022-01-3100015159402021-08-012021-10-310001515940ck0001515940:InvestmentAndMarketRiskMember2022-11-012023-10-310001515940ck0001515940:MarketDiscountRiskMember2022-11-012023-10-310001515940ck0001515940:FixedIncomeInstrumentsRiskMember2022-11-012023-10-310001515940us-gaap:InterestRateRiskMember2022-11-012023-10-310001515940ck0001515940:SeniorLoansRiskMember2022-11-012023-10-310001515940us-gaap:CreditRiskContractMember2022-11-012023-10-310001515940ck0001515940:LeverageRiskMember2022-11-012023-10-310001515940ck0001515940:SpecialRiskForHoldersOfSubscriptionRightsMember2022-11-012023-10-310001515940ck0001515940:PotentialDilutionInRightsOfferingsRiskMember2022-11-012023-10-310001515940ck0001515940:SubordinatedAndUnsecuredOrPartiallySecuredLoansRiskMember2022-11-012023-10-310001515940ck0001515940:MezzanineSecuritiesRiskMember2022-11-012023-10-310001515940ck0001515940:BelowInvestmentGradeInstrumentsRiskMember2022-11-012023-10-310001515940ck0001515940:StressedAndDistressedInvestmentsRiskMember2022-11-012023-10-310001515940ck0001515940:ShortSellingRiskMember2022-11-012023-10-310001515940ck0001515940:PrepaymentRisk1Member2022-11-012023-10-310001515940ck0001515940:CreditDerivativesRiskMember2022-11-012023-10-310001515940ck0001515940:DerivativesRiskMember2022-11-012023-10-310001515940ck0001515940:RegulatoryRiskMember2022-11-012023-10-310001515940ck0001515940:FundsClearingBrokerAndCentralClearingCounterpartyRiskMember2022-11-012023-10-310001515940ck0001515940:StructuredProductsRiskMember2022-11-012023-10-310001515940ck0001515940:AssetBackedSecuritiesRiskMember2022-11-012023-10-310001515940ck0001515940:MortgageBackedSecuritiesRiskMember2022-11-012023-10-310001515940ck0001515940:RepurchaseAgreementsRiskMember2022-11-012023-10-310001515940ck0001515940:ReverseRepurchaseAgreementsAndDollarRollsRiskMember2022-11-012023-10-310001515940ck0001515940:SwapRiskMember2022-11-012023-10-310001515940ck0001515940:OptionsAndFuturesRiskMember2022-11-012023-10-310001515940ck0001515940:InvestmentCompaniesRiskMember2022-11-012023-10-310001515940ck0001515940:MoneyMarketFundsRiskMember2022-11-012023-10-310001515940ck0001515940:CounterpartyAndPrimeBrokerageRiskMember2022-11-012023-10-310001515940ck0001515940:LenderLiabilityRiskMember2022-11-012023-10-310001515940ck0001515940:BorrowerFraudCovenantLiteLoansBreachOfCovenantRiskMember2022-11-012023-10-310001515940ck0001515940:DistressedDebtLitigationBankruptcyAndOtherProceedingsRiskMember2022-11-012023-10-310001515940ck0001515940:ConvertibleSecuritiesRiskMember2022-11-012023-10-310001515940ck0001515940:WhenIssuedSecuritiesAndForwardCommitmentsRiskMember2022-11-012023-10-310001515940ck0001515940:EquitySecuritiesRiskMember2022-11-012023-10-310001515940ck0001515940:USGovernmentDebtSecuritiesRiskMember2022-11-012023-10-310001515940ck0001515940:NonUSSecuritiesRiskMember2022-11-012023-10-310001515940ck0001515940:EmergingMarketsRiskMember2022-11-012023-10-310001515940ck0001515940:ForeignCurrencyRiskMember2022-11-012023-10-310001515940ck0001515940:EurozoneRiskMember2022-11-012023-10-310001515940ck0001515940:EuropeanMarketInfrastructureRegulationRiskMember2022-11-012023-10-310001515940ck0001515940:LIBORReplacementAndFloatingRateBenchmarkRiskMember2022-11-012023-10-310001515940ck0001515940:LegalAndRegulatoryRiskMember2022-11-012023-10-310001515940ck0001515940:OFACAndFCPAConsiderationsRiskMember2022-11-012023-10-310001515940ck0001515940:EventDrivenInvestingRiskMember2022-11-012023-10-310001515940ck0001515940:ValuationRiskMember2022-11-012023-10-310001515940ck0001515940:LiquidityRiskMember2022-11-012023-10-310001515940ck0001515940:InflationDeflationRiskMember2022-11-012023-10-310001515940ck0001515940:ConflictsOfInterestRiskMember2022-11-012023-10-310001515940ck0001515940:UncertainTaxTreatmentRiskMember2022-11-012023-10-310001515940ck0001515940:ComplexTransactionsContingentLiabilitiesGuaranteesAndIndemnitiesRiskMember2022-11-012023-10-310001515940ck0001515940:AvailabilityOfInvestmentOpportunitiesCompetitionRiskMember2022-11-012023-10-310001515940ck0001515940:DependenceOnKeyPersonnelRiskMember2022-11-012023-10-310001515940ck0001515940:MaterialRisksOfSignificantMethodsOfAnalysisMember2022-11-012023-10-310001515940ck0001515940:MarketDevelopmentsRiskMember2022-11-012023-10-310001515940ck0001515940:MarketDisruptionsFromNaturalDisastersOrGeopoliticalRisksMember2022-11-012023-10-310001515940ck0001515940:GovernmentInterventionInTheFinancialMarketsRiskMember2022-11-012023-10-310001515940ck0001515940:PortfolioTurnoverRiskMember2022-11-012023-10-310001515940ck0001515940:AntiTakeoverProvisionsRiskMember2022-11-012023-10-310001515940ck0001515940:DurationRiskMember2022-11-012023-10-310001515940ck0001515940:RisksRelatingToFundsRICStatusMember2022-11-012023-10-310001515940ck0001515940:RICRelatedRisksOfInvestmentsGeneratingNonCashTaxableIncomeMember2022-11-012023-10-310001515940ck0001515940:CybersecurityRiskMember2022-11-012023-10-310001515940ck0001515940:MisconductOfEmployeesAndOfThirdPartyServiceProvidersRiskMember2022-11-012023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-22543)

KKR Income Opportunities Fund

(Exact name of registrant as specified in charter)

555 California Street, 50th Floor

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

Lori Hoffman

KKR Credit Advisors (US) LLC

555 California Street, 50th Floor

San Francisco, CA 94104

(Name and address of agent for service)

(415) 315-3620

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2023

Date of reporting period: October 31, 2023

Item 1. Reports to Stockholders.

KKR Income Opportunities Fund

Annual Report

October 31, 2023

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

| | | | | |

| Table of Contents | |

| |

Management’s Discussion of Fund Performance | |

| |

| Performance Information | 4 |

| |

| |

| |

| |

| |

| |

| |

| |

| Report of Independent Registered Public Accounting Firm | |

| |

| |

| |

| |

| |

| |

| Trustees and Officers | |

| Summary of Common Shareholder Fees and Expenses | |

| Price Range of Common Shares | |

| Dividend Reinvestment Plan | |

| Additional Information | |

| Approval of Investment Advisory Agreement | |

| Privacy Notice | |

| |

The KKR Income Opportunities Fund (the “Fund”) files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT within sixty days after the end of the period. The Fund’s Forms N-PORT are available on the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov or on request by calling 1-800-SEC-0330.A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent year ended June 30 will be available (i) without charge, upon request, by calling 855-862-6092; and (ii) on the Commission’s website at www.sec.gov.

INFORMATION ABOUT THE FUND’S TRUSTEES

The proxy statements and annual reports include information about the Fund’s Trustees and are available without charge, upon request, by calling 855-862-6092 and by visiting the Commission’s website at www.sec.gov or the Fund’s website at www.kkrfunds.com/kio.

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

Management’s Discussion of Fund Performance

Looking Back on the Markets – October 31, 2023

As we reflect on the past year, we have seen a continued trend of credit markets being in flux. Rising rates, geopolitical tensions, and deteriorating credit fundamentals have all posed headwinds for credit markets as investors navigate this volatile and opaque environment. However, the path forward for the asset class is becoming a little clearer. We see a trend in which private credit is becoming a more permanent allocation for investors, and we believe that flexibility and certainty of execution will continue to be attractive for borrowers even after syndicated markets reopen. While private credit has been getting a great deal of attention lately in both the press and investment circles, we think it is a mistake to ignore opportunities in liquid credit. We think the permanence of private credit does nothing to diminish the need for public credit markets. Both have a place in a healthy, functioning borrowing system and can serve different purposes. Public credit allows for quick deployment, and the relatively high yields currently available in public markets have the potential to cushion against price volatility. The liquidity of public markets creates the potential to shift quickly when market conditions change. As capital markets reopen, we think the change in the investment environment is likely to be both significant and swift. We believe this vintage of new deals will be attractive and that taking advantage of new issuances across private credit and public credit will lead to differentiated outcomes, particularly if lenders are able to expand the new issue premium with call protection or call premiums. This is most evident in high yield bonds, private junior debt, and other subordinated capital solutions. In short, we think it will remain a good time to be a lender.

As for the capital markets, we see some green shoots emerging. U.S. initial public offering, or IPO, activity has ticked up. Our debt capital markets team has seen a ramp-up in syndicated public debt markets and expects this trend to continue in the remaining months of 2023, and we have noticed that our clients have more appetite for allocating to credit in both liquid and private markets. We think that the interest rate outlook is a tad bit clearer, and that while credit fundamentals have not yet bottomed, they may be closer to doing so. Though there will no doubt be bumps in the road from here, we note that at this point in the calendar, there is pressure to get invested and to do deals. Fear of missing out is a powerful motivator.

Overall, as we look prospectively, the fragility, uncertainty, and volatility that have become consistent features of the market environment make it hard to interpret signals: Is a pipeline of new capital markets activity the sign we’ve been waiting for? Or are bank failures and credit downgrades the alarm we’ve been anticipating? We tend to lean toward the former, but those questions are only going to be perfectly clear in hindsight. We continue to believe waiting is the wrong approach. It takes time to deploy into private credit, but commitments need to be made now to access future deal flow. Meanwhile, liquid credit offers an opportunity to put money to work immediately. We believe that factors such as rate stabilization, increased market activity and demand for capital should provide a clearer view to how the short term will play out. Our idea is: Just start.

Traded Credit Markets

In the earlier part of this year, liquid credit markets offered a rare opportunity to take advantage of high yields, wide spreads, and prices ticking back up on the strength of rising market confidence across public markets. We saw public credit markets perform well and investor sentiment improved following the large valuation reset we saw in 2022. On a year-to-date basis, by the end of October 2023, the S&P 500 was up +10.7%, but the U.S. leveraged loan market was up +10.2% and U.S. high yield bond market was up +4.7% with far less risk. In hindsight, adding publicly traded assets to a private credit allocation would have not only helped those on the sidelines get capital deployed quickly, it would have also been accretive to a portfolio in terms of both returns and diversification.

That said, opportunity has not disappeared from public markets. While timing the ideal entry point is very difficult, we think the relatively high yield available can be good buffers against price volatility. To our team’s way of thinking, a downward move in rates will trigger an upward price movement in high yield and make the floating nature of loans less attractive. So long as one has capital to deploy and the flexibility to act when a move is imminent and fixed-rate debt becomes more attractive, we think it makes sense to take advantage of the income available today.

We’re excited about the opportunity ahead of us in traded credit. Given risks on the horizon (slowing growth, margin pressures, increasing cost of capital, etc.), we do see potential for spread volatility in the coming months. However, we think a few factors are important to consider when evaluating spreads. High yield market spreads as of October 31, 2023 are 442 basis points. To put into context, on a historical basis, spreads have been tighter than that level 62% of the time over the last 10 years. Spreads are attractive, but not outright “cheap”. One factor that we believe is often overlooked is the composition of the market over time – there has been a noticeable shift in the high yield market over

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

the last ten years towards a much “cleaner” high yield market – from a ratings perspective, more of the market is BB rated than ever before (~50% BB in the US and ~60% in Europe) and more high yield issuance has been secured than ever before (vs. unsecured). If you adjust for these quality factors, spread today is incrementally more attractive versus history. We also think it’s worth considering both the entry price and overall yields available in the market, both of which are historically quite attractive. Both US bank loans and high yield bond yields are in the top 1% of where they have been over the past 10-years (more return available than 99% of days over the past 10 years). The average dollar price in the high yield market of 86 cents as of October 31, 2023 is similarly attractive (top 4% price entry point). We are positioning the portfolio to take advantage of the returns on offer in the market doing the “simple” things and are ready with dry powder to take advantage of any volatility that may (or may not) come.

Fund Description & Performance

KKR Income Opportunities Fund (“KIO” or, the “Fund”) is a diversified, closed-end fund that trades on the New York Stock Exchange (“NYSE”) under the symbol “KIO.” The Fund’s primary investment objective is to seek a high level of current income with a secondary objective of capital appreciation. The Fund seeks to achieve its investment objectives by employing a dynamic strategy of investing in a targeted portfolio of loans and fixed-income instruments (including derivatives) of US and non-US issuers and implementing hedging strategies in order to seek to achieve attractive risk-adjusted returns. Under normal market conditions, KIO will invest at least 80% of its Managed Assets in loans and fixed-income instruments or other instruments, including derivative instruments, with similar economic characteristics. The Fund expects to invest primarily in first and second lien secured loans, unsecured loans and high-yield corporate debt instruments of varying maturities.

On February 16, 2023, KIO successfully completed a 1-for-3 rights offering, which was significantly oversubscribed. The offering afforded shareholders an opportunity to purchase additional shares of the fund at a discounted share price of $10.75. It also allowed the fund to invest the additional capital into a very attractive market environment, offering the potential for high income and capital appreciation. Supported by this more attractive market environment and increased capital base from the rights offering, KIO announced a 15.7% increase in its monthly dividend for the month of March to 12.15 cents per share.

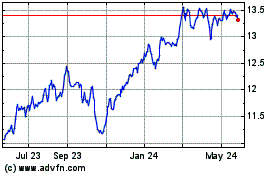

With respect to performance, following a challenging 2022, the Fund has recovered even amidst mixed sentiment and performance within the broader closed-end fund market. On a share price basis, KIO had total returns, net of fees and inclusive of dividends, of +15.51% on a 12-month basis through October 31, 20231. The discount to net asset value (“NAV”) tightened by 1.09% over the 12-month period to -10.06% as of October 31, 2023.

On a NAV basis, the Fund’s strategy has delivered total returns, net of fees and inclusive of dividends, of +12.85% over the last 12 months and through October 31, 2023, which compares to the +5.81% of the high yield market and +11.92% of the leveraged loan market during that same period2. As we reflect on the past 12-month period, the market environment has been a volatile one and has required a selective investment approach in choosing the right names to navigate these various market headwinds driven from rising rates, inflation concerns, and recessionary fears, but have nonetheless seen a recovery following their lows of 2022. The positive out performance we have seen within the Fund is attributable to our strong security selection against the benchmark, derived from choosing the right names, with a heightened focus on durability of cash flow and downside protection.

Diving deeper into unleveraged NAV performance drivers, positions within the leisure, services and retail sectors were the Fund’s top contributors YTD as of October 31, 2023. On an asset class basis, exposure in high yield bonds and leveraged loans have driven the majority of contribution followed by structured credit and convertible bond positions. From a rating perspective, the strategy’s overweight to CCC names have driven most of the positive performance followed by allows to B-rated names, while BB-rated names have detracted on the margin.

KIO’s investments represented obligations and equity interests in 223 positions across a diverse group of industries. The top ten issuers represented 39.2% of the Fund’s net assets while the top five industry groups represented 47.4% of the Fund’s net assets. The Fund’s Securities and Exchange Commission 30-day yield was 12.52%.

1 Source: Bloomberg. Performance assumes dividends are reinvested into KIO security.

2 Source: Bloomberg, KKR Credit. The high yield market is represented by the ICE BofA U.S. High Yield Index and the leveraged loan market is represented by the Morningstar LSTA U.S. Leveraged Loan Total Return Index

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

The Fund’s portfolio is comprised of the following:

| | | | | | | | |

| Investments in securities | % of net assets as of October 31, 2023 |

| | |

| Leveraged Loans | 58.2 | % |

| High Yield Securities | 81.1 | % |

| Asset Backed Securities | 8.2 | % |

| Equity and Other Investments | 2.3 | % |

| Money Market Fund | 1.6 | % |

| Total investments in securities | 151.4 | % |

Business Updates

We thank you for your partnership and continued investment in KIO. We look forward to continued communications and will keep you apprised of the progress of KIO specifically and the leveraged finance marketplace generally. Fund information is available on our website at kkrfunds.com/kio.

Disclosures

The Bank of America Merrill Lynch High Yield Master II Index is a market-value weighted index of below investment grade US dollar-denominated corporate bonds publicly issued in the US domestic market. “Yankee” bonds (debt of foreign issuers issued in the US domestic market) are included in the Bank of America Merrill Lynch High Yield Master II Index provided that the issuer is domiciled in a country having investment grade foreign currency long-term debt rating. Qualifying bonds must have maturities of one year or more, a fixed coupon schedule and minimum outstanding of US$100.0 million. In addition, issues having a credit rating lower than BBB3, but not in default, are also included.

The Morningstar LSTA US Leveraged Loan Total Return Index is a market value-weighted index designed to measure the performance of the US leveraged loan market based upon market weightings, spreads and interest payments. The index was rolled out in 2000 and it was back-loaded with four years of data dating to 1997.

It is not possible to invest directly in an index.

Past performance is not an indication of future results. Returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, expense limitations and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when sold, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. An investment in the Fund involves risk, including the risk of loss of principal. For a discussion of the Fund’s risks, see Risk Considerations, Note 3 to the financial statements. Call 855-330-3927 or visit www.kkrfunds.com/kio for performance results current to the most recent calendar quarter-end.

Must be preceded or accompanied by a prospectus.

An imbalance in supply and demand in the income market may result in valuation uncertainties and greater volatility, less liquidity, widening credit spreads and a lack of price transparency in the market. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non–payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. Borrowing to increase investments (leverage) will exaggerate the effect of any increase or decrease in the value of Fund investments. Investments rated below investment grade (typically referred to as “junk”) are generally subject to greater price volatility and illiquidity than higher rated investments. As interest rates rise, the value of certain income investments is likely to decline. Senior loans are subject to prepayment risk. Investments in foreign instruments or currencies can involve greater risk and volatility than US investments because of adverse market economic, political, regulatory, geopolitical or other conditions. Changes in the value of investments entered for hedging purposes may not match those of the position being hedged. The Fund may engage in other investment practices that may involve additional risks.

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns Year Ended October 31, 2023 | | One Year | | Five Year | | Ten Year | | Value of $10,000 investment at 10/31/2013 as of 10/31/2023 |

KKR Income Opportunities Fund — Market Price Return | | 15.51 | % | | 3.56 | % | | 5.51 | % | | $ | 17,099 | |

KKR Income Opportunities Fund — NAV Return | | 12.85 | % | | 3.15 | % | | 4.85 | % | | $ | 16,058 | |

ICE BofA Merrill Lynch High Yield Master II Index® | | 5.90 | % | | 2.90 | % | | 3.79 | % | | $ | 14,508 | |

Past performance is not an indication of future results. The above graph and average annual total returns table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

Schedule of Investments

(Stated in United States Dollars, unless otherwise noted) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate &

Spread | Interest

Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Leveraged Loans - 58.17% | | | | | | | | |

| | | | | | | | |

| Aerospace & Defense - 0.75% | | | | | | | | |

| Amentum Services Inc | TL 2L B 12/21 | SOFR + 7.60% | 12.93% | 2/15/2030 | USD | 1,965,870 | $ | 1,868,559 | | (b) |

| Vertex Aerospace Services Corp | TL 1L B 12/21 | SOFR + 3.35% | 8.67% | 12/6/2028 | USD | 681,577 | 681,321 | |

| | | | | | | | |

| Alternative Carriers - 2.38% | | | | | | | | |

| Level 3 Financing Inc | TL 1L 11/19 | SOFR + 1.75% | 7.19% | 3/1/2027 | USD | 8,694,340 | 8,142,467 | (a) |

| | | | | | | | |

| Apparel, Accessories & Luxury Goods - 3.91% | | | | | | | |

| Varsity Brands Inc | TL 1L 02/23 | SOFR + 5.11% | 10.44% | 12/15/2026 | USD | 13,942,884 | 13,367,810 | |

| | | | | | | | |

| Application Software - 5.31% | | | | | | | | |

| Solera LLC | TL 2L 06/21 (PIK Toggle) | SOFR + 9.10% | 14.52% | 6/4/2029 | USD | 11,526,703 | 11,526,703 | (b) (d) |

| TIBCO Software Inc | TL 1L B 09/22 | SOFR + 4.60% | 9.99% | 3/30/2029 | USD | 6,966,393 | 6,634,688 | |

| | | | | | | | |

| Automotive Parts & Equipment - 5.02% | | | | | | | | |

| Innovative XCessories & Services LLC | TL 1L 02/20 | SOFR + 4.35% | 9.85% | 3/5/2027 | USD | 6,426,866 | 5,282,081 | |

| Parts Authority Inc | TL 1L 10/20 | SOFR + 4.01% | 9.39% | 10/28/2027 | USD | 5,647,034 | 5,369,397 | |

| Rough Country LLC | TL 2L 07/21 | SOFR + 6.35% | 11.73% | 7/30/2029 | USD | 841,950 | 795,643 | |

| Truck Hero Inc | TL 1L 01/21 | SOFR + 3.86% | 9.19% | 1/31/2028 | USD | 4,828,783 | 4,621,556 | |

| Wheel Pros Inc | TL 1L 09/23 (FILO) | SOFR + 8.88% | 14.31% | 5/11/2028 | USD | 507,569 | 548,385 | |

| Wheel Pros Inc | TL 1L 09/23 (NewCo) | SOFR + 4.50% | 9.95% | 5/11/2028 | USD | 695,362 | 564,982 | |

| | | | | | | | |

| Broadcasting - 3.95% | | | | | | | | |

| NEP Broadcasting LLC | TL 1L 05/20 | SOFR + 8.36% | 13.69% | 6/1/2025 | USD | 1,573,785 | 1,573,785 | (a) (b) |

| NEP Broadcasting LLC | TL 1L B 09/18 | SOFR + 3.36% | 8.69% | 10/20/2025 | USD | 4,421,482 | 4,019,215 | (a) |

| NEP Broadcasting LLC | TL 1L B 09/18 EUR | EURIBOR + 3.50% | 7.37% | 10/20/2025 | EUR | 2,161,124 | 2,045,783 | (a) |

| NEP Broadcasting LLC | TL 2L 09/18 | SOFR + 7.11% | 12.44% | 10/19/2026 | USD | 7,494,510 | 5,886,937 | (a) |

| | | | | | | | |

| Broadline Retail - 1.03% | | | | | | | | |

| AutoScout24 GmbH | TL 1L B 02/20 EUR | EURIBOR + 2.75% | 6.91% | 3/31/2027 | EUR | 605,290 | 603,757 | | |

| AutoScout24 GmbH | TL 2L 01/20 EUR | EURIBOR + 6.00% | 10.14% | 3/31/2028 | EUR | 838,804 | 849,453 | | |

| Belk Inc | TL 1L 02/21 (FLFO) | PRIME + 6.50% | 15.00% | 7/31/2025 | USD | 459,875 | 396,872 | | (a) |

| Belk Inc | TL 1L EXIT 02/21 PIK Toggle (FLSO) | | | 7/31/2025 | USD | 8,654,756 | 1,658,814 | | (a) (d) (e) |

| | | | | | | | |

| Building Products - 0.88% | | | | | | | | |

| DiversiTech Holdings Inc | TL 2L B 12/21 | SOFR + 7.01% | 12.40% | 12/21/2029 | USD | 1,381,023 | 1,249,826 | | |

| VC GB Holdings Inc (Visual Comfort) | TL 2L 06/21 | SOFR + 7.01% | 12.40% | 7/23/2029 | USD | 1,927,630 | 1,773,420 | | |

| | | | | | | | |

See accompanying notes to financial statements.

5

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate &

Spread | Interest

Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Cable & Satellite - 1.45% | | | | | | | | |

| Astound Broadband (RCN/Radiate) | TL 1L B 10/21 | SOFR + 3.36% | 8.69% | 9/25/2026 | USD | 4,888,433 | $ | 4,058,328 | | |

| Virgin Media Inc | TL 1L 09/19 | SOFR + 2.61% | 7.95% | 1/31/2028 | USD | 947,006 | 921,560 | | |

| | | | | | | | |

| Casinos & Gaming - 0.12% | | | | | | | | |

| Entain PLC | TL 1L B2 10/22 | SOFR + 3.60% | 8.99% | 10/31/2029 | USD | 392,589 | 393,163 | | |

| | | | | | | | |

| Construction & Engineering - 2.75% | | | | | | | | |

| Brand Energy & Infrastructure Services Inc | TL 1L B 07/23 | SOFR + 5.50% | 10.87% | 8/1/2030 | USD | 1,338,511 | 1,294,079 | | |

| Total Safety US Inc | TL 1L B 07/19 | SOFR + 6.26% | 11.50% | 8/16/2025 | USD | 4,941,867 | 4,713,305 | | (a) |

| USIC Holdings Inc | TL 2L 05/21 | SOFR + 6.61% | 11.94% | 5/14/2029 | USD | 431,521 | 398,078 | | |

| Yak Access LLC | TL 1L 03/23 | SOFR + 6.50% | 11.98% | 3/10/2028 | USD | 3,393,205 | 3,016,559 | | |

| | | | | | | | |

| Construction Machinery & Heavy Transportation Equipment - 2.28% | | | | | | | |

| Accuride Corp | TL 1L B 07/23 | 1.62% PIK, SOFR + 5.25% | 12.19% | 5/18/2026 | USD | 5,393,394 | 4,752,929 | | (d) |

| American Trailer Works Inc | TL 1L 02/21 | SOFR + 3.85% | 9.17% | 3/3/2028 | USD | 3,229,070 | 3,046,095 | | |

| | | | | | | | |

| Data Processing & Outsourced Services - 2.07% | | | | | | | |

| West Corp | TL 1L B3 01/23 | SOFR + 4.25% | 9.63% | 4/10/2027 | USD | 7,546,092 | 7,085,441 | | |

| | | | | | | | |

| Diversified Metals & Mining - 0.63% | | | | | | | | |

| Foresight Energy LLC | TL 1L A 06/20 (Exit) | SOFR + 8.10% | 13.49% | 6/30/2027 | USD | 2,151,311 | 2,151,311 | | (a) (b) |

| | | | | | | | |

| Diversified Support Services - 0.24% | | | | | | | | |

| Access CIG LLC | TL 2L 02/18 | SOFR + 7.75% | 13.41% | 2/27/2026 | USD | 842,063 | 825,222 | | |

| | | | | | | | |

| Education Services - 0.50% | | | | | | | | |

| Jostens Inc | TL 1L 12/18 | SOFR + 5.76% | 11.15% | 12/19/2025 | USD | 1,700,280 | 1,703,995 | | |

| | | | | | | | |

| Financial Exchanges & Data - 0.18% | | | | | | | | |

| IntraFi Network LLC | TL 2L 11/21 | SOFR + 6.35% | 11.67% | 11/5/2029 | USD | 623,220 | 598,291 | | (a) |

| | | | | | | | |

| Health Care Equipment - 3.65% | | | | | | | | |

| Drive DeVilbiss Healthcare LLC | TL 1L 03/21 | 4.00% PIK, SOFR + 9.50% | 14.89% | 6/1/2025 | USD | 7,743,306 | 6,155,929 | | (d) |

| Drive DeVilbiss Healthcare LLC | TL 1L 09/22 (PIK) | 9.00% PIK, SOFR + 10.00% | 15.39% | 6/1/2025 | USD | 1,071,640 | 1,071,640 | | (b) (d) |

| Orchid Orthopedic Solutions LLC | TL 1L 02/19 | SOFR + 4.76% | 10.15% | 3/5/2026 | USD | 5,599,056 | 5,251,915 | | |

| | | | | | | | |

| Health Care Facilities - 0.13% | | | | | | | | |

| ScionHealth | TL 1L B 12/21 | SOFR + 5.36% | 10.69% | 12/23/2028 | USD | 1,716,310 | 431,935 | | |

| | | | | | | | |

| Health Care Services - 0.27% | | | | | | | | |

| CHG Healthcare Services Inc | TL 1L 09/21 | SOFR + 3.36% | 8.69% | 9/29/2028 | USD | 915,656 | 907,246 | | |

| Paradigm Acquisition Corp | TL 2L 10/18 LC | SOFR + 7.60% | 12.92% | 10/26/2026 | USD | 6,120 | 5,707 | | |

| | | | | | | | |

See accompanying notes to financial statements.

6

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate &

Spread | Interest

Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Health Care Technology - 0.37% | | | | | | | | |

| GoodRx Inc | TL 1L 10/18 | SOFR + 2.85% | 8.17% | 10/10/2025 | USD | 1,268,179 | $ | 1,268,573 | | |

| | | | | | | | |

| Hotels, Resorts & Cruise Lines - 0.60% | | | | | | | | |

| Playa Resorts Holding BV | TL 1L B 11/22 | SOFR + 4.25% | 9.58% | 1/5/2029 | USD | 1,274,273 | 1,271,291 | | |

| Travel + Leisure Co | TL 1L 12/22 | SOFR + 4.10% | 9.49% | 12/14/2029 | USD | 767,268 | 769,309 | | |

| | | | | | | | |

| Human Resource & Employment Services - 0.76% | | | | | | | |

| SIRVA Worldwide Inc | TL 1L 07/18 | SOFR + 5.76% | 11.00% | 8/4/2025 | USD | 1,779,146 | 1,609,015 | | |

| SIRVA Worldwide Inc | TL 2L 07/18 | SOFR + 9.76% | 15.16% | 8/3/2026 | USD | 1,149,740 | 994,525 | | |

| | | | | | | | |

| Industrial Machinery & Supplies & Components - 2.40% | | | | | | | |

| Chart Industries Inc | TL 1L B 09/23 | SOFR + 3.35% | 8.66% | 3/15/2030 | USD | 1,516,819 | 1,516,190 | | |

| Dexko Global Inc | Dexko Global Inc - TL 1L 10/21 EUR | EURIBOR + 4.00% | 7.97% | 10/4/2028 | EUR | 1,120,372 | 1,120,093 | | |

| Dexko Global Inc | TL 1L B 09/21 EUR (AL-KO) EUR | EURIBOR + 4.00% | 7.97% | 10/4/2028 | EUR | 762,083 | 761,893 | | |

| Engineered Machinery Holdings Inc | TL 2L 08/21 | SOFR + 6.26% | 11.65% | 5/21/2029 | USD | 289,880 | 284,082 | | |

| ProMach Group Inc | TL 1L B 08/21 | SOFR + 4.11% | 9.44% | 8/31/2028 | USD | 543,767 | 543,365 | | |

| SPX FLOW Inc | TL 1L B 03/22 | SOFR + 4.60% | 9.92% | 4/5/2029 | USD | 2,787,357 | 2,766,633 | | (a) |

| WireCo WorldGroup Inc | TL 1L B 10/21 | SOFR + 4.36% | 9.70% | 11/13/2028 | USD | 1,213,794 | 1,206,966 | | |

| | | | | | | | |

| IT Consulting & Other Services - 3.71% | | | | | | | | |

| PSAV Inc (aka Encore) | TL 1L B1 12/20 | 0.25% PIK, SOFR + 3.60% | 8.92% | 3/3/2025 | USD | 6,676,445 | 6,292,149 | | (d) |

| PSAV Inc (aka Encore) | TL 1L B3 12/20 | 10.00% PIK, 5.00% | 15.00% | 10/15/2026 | USD | 2,288,298 | 2,295,449 | | (d) |

| PSAV Inc (aka Encore) | TL 2L 02/18 | SOFR + 7.36% | 12.69% | 9/1/2025 | USD | 4,609,840 | 4,102,758 | | |

| | | | | | | | |

| Leisure Facilities - 2.71% | | | | | | | | |

| Aimbridge Acquisition Co Inc | TL 1L B 09/20 | SOFR + 4.86% | 10.19% | 2/2/2026 | USD | 7,691 | 7,441 | | |

| Aimbridge Acquisition Co Inc | TL 1L B 10/19 | SOFR + 3.86% | 9.19% | 2/2/2026 | USD | 6,790,233 | 6,518,623 | | |

| ClubCorp Club Operations Inc | TL 1L B 08/17 | LIBOR + 2.75% | 8.18% | 9/18/2024 | USD | 2,744,255 | 2,670,517 | | |

| Life Time Fitness Inc | TL 1L B 05/23 | SOFR + 5.18% | 10.61% | 1/15/2026 | USD | 91,710 | 91,905 | | |

| | | | | | | | |

| Leisure Products - 0.14% | | | | | | | | |

| Topgolf Callaway Brands Corp | TL 1L B 03/23 | SOFR + 3.60% | 8.92% | 3/15/2030 | USD | 463,436 | 461,893 | | |

| | | | | | | | |

| Life Sciences Tools & Services - 1.63% | | | | | | | | |

| PAREXEL International Corp | TL 2L 07/21 | SOFR + 6.61% | 11.94% | 11/15/2029 | USD | 5,637,180 | 5,570,098 | | (b) |

| | | | | | | | |

| Oil & Gas Storage & Transportation - 1.13% | | | | | | | | |

| Brazos Midstream Holdings LLC | TL 1L B 01/23 | SOFR + 3.75% | 9.08% | 2/11/2030 | USD | 1,104,112 | 1,101,440 | | |

| Oryx Midstream Services LLC | TL 1L B 01/23 | SOFR + 3.36% | 8.69% | 10/5/2028 | USD | 1,810,939 | 1,810,441 | | |

| UGI Energy Services LLC | TL 1L B 02/23 | SOFR + 3.35% | 8.67% | 2/22/2030 | USD | 941,079 | 941,446 | | |

| | | | | | | | |

See accompanying notes to financial statements.

7

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate &

Spread | Interest

Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Publishing - 0.44% | | | | | | | | |

| Emerald Expositions Holding Inc | TL 1L B 05/17 | SOFR + 5.10% | 10.42% | 5/22/2026 | USD | 1,493,435 | $ | 1,496,242 | | |

| | | | | | | | |

| Specialty Chemicals - 5.93% | | | | | | | | |

| | | | | | | | |

| Champion/DSM engg | TL 1L B1 03/23 | EURIBOR + 5.50% | 9.45% | 3/29/2030 | EUR | 1,942,190 | 1,904,924 | | |

| Champion/DSM engg | TL 1L B1 03/23 (USD) | SOFR + 5.50% | 10.88% | 3/29/2030 | USD | 7,757,109 | 7,151,123 | | |

| Flint Group GmbH | TL 1L 03/23 Super Senior | EURIBOR + 8.00% | 11.97% | 6/30/2026 | EUR | 112,303 | 120,539 | | (a) |

| Flint Group GmbH | TL 1L 09/23 PIK (HoldCo) EUR | 6.90% PIK, EURIBOR + 7.00% | 10.97% | 12/31/2027 | EUR | 387,960 | 292,822 | | (a) (d) |

| Flint Group GmbH | TL 1L B 09/23 (OpCo) EUR | 0.75% PIK, EURIBOR + 4.25% | 9.00% | 12/31/2026 | EUR | 799,372 | 788,962 | | (a) (d) |

| Flint Group GmbH | TL 2L 09/23 PIK (HoldCo) EUR | 6.90% PIK, EURIBOR + 7.00% | 10.97% | 12/31/2027 | EUR | 517,365 | 89,360 | | (a) (d) |

| Vantage Specialty Chemicals Inc | TL 1L B 02/23 | SOFR + 4.75% | 10.08% | 10/26/2026 | USD | 8,532,889 | 8,227,112 | | |

| | | | | | | | |

| Systems Software - 0.77% | | | | | | | | |

| Dedalus Finance GmbH | TL 1L B 06/21 EUR | EURIBOR + 3.75% | 7.71% | 7/17/2027 | EUR | 1,696,332 | 1,711,289 | | |

| SolarWinds Holdings Inc | TL 1L B 11/22 | SOFR + 3.75% | 9.07% | 2/17/2027 | USD | 936,563 | 934,610 | | |

| | | | | | | | |

| Trading Companies & Distributors - 0.14% | | | | | | | | |

| Univar Inc | TL 1L B 06/23 | SOFR + 4.50% | 9.81% | 8/1/2030 | USD | 482,875 | 482,057 | | |

| TOTAL LEVERAGED LOANS (Amortized cost $209,051,780) | | | | | | $ | 199,139,741 | | |

| | | | | | | | |

See accompanying notes to financial statements.

8

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Maturity Date | Currency | Par | Fair Value | Footnotes |

| High Yield Securities - 81.10% | | | | | | |

| | | | | | |

| Advertising - 0.09% | | | | | | |

| Outfront Media Capital LLC / Outfront Media Capital Corp | 5.000% 08/2027 | 8/15/2027 | USD | 346,000 | $ | 307,642 | | (f) |

| | | | | | |

| Aerospace & Defense - 0.25% | | | | | | |

| Aviation Capital Group LLC | 5.500% 12/2024 144A | 12/15/2024 | USD | 410,000 | 403,550 | | (f) |

| Rolls-Royce PLC | 4.625% 02/2026 144A | 2/16/2026 | EUR | 415,000 | 433,871 | | (f) |

| | | | | | |

| Alternative Carriers - 1.62% | | | | | | |

| Level 3 Financing Inc | 3.750% 07/2029 144A | 7/15/2029 | USD | 4,611,000 | 2,349,769 | | (a) (f) |

| Zayo Group LLC | 4.000% 03/2027 144A | 3/1/2027 | USD | 4,221,000 | 3,181,822 | | (f) |

| | | | | | |

| Apparel, Accessories & Luxury Goods - 0.19% | | | | | | |

| Hanesbrands Inc | 4.875% 05/2026 144A | 5/15/2026 | USD | 319,000 | 293,445 | | (f) |

| Varsity Brands Inc | SOFR + 8.000% 12/2024 144A | 12/22/2024 | USD | 364,000 | 364,000 | | (b) (f) |

| | | | | | |

| Application Software - 1.51% | | | | | | |

| Cision Ltd | 9.500% 02/2028 144A | 2/15/2028 | USD | 6,449,000 | 3,402,815 | | (f) |

| Cvent Holding Corp | 8.000% 06/2030 144A | 6/15/2030 | USD | 1,363,000 | 1,323,848 | | (f) |

| TeamSystem SpA | 3.500% 02/2028 144A | 2/15/2028 | EUR | 478,000 | 432,822 | | (f) |

| | | | | | |

| Automotive Parts & Equipment - 3.21% | | | | | | |

| Forvia SE | 2.625% 06/2025 REGS | 6/15/2025 | EUR | 426,000 | 435,758 | | (f) |

| IHO Verwaltungs GmbH | 3.750% 09/2026 144A | 9/15/2026 | EUR | 436,000 | 434,356 | | (d) (f) |

| Patrick Industries Inc | 1.750% 12/2028 (Convertible) | 12/1/2028 | USD | 2,097,000 | 1,982,714 | | |

| Power Solutions | 4.375% 05/2026 144A | 5/15/2026 | EUR | 426,000 | 432,204 | | (f) |

| Truck Hero Inc | 6.250% 02/2029 144A | 2/1/2029 | USD | 5,080,000 | 4,046,144 | | (f) |

| Wheel Pros Inc | 6.500% 05/2028 144A | 5/11/2028 | USD | 5,638,000 | 3,235,084 | | (b) (f) |

| ZF Finance GmbH | 3.000% 09/2025 SUN REGS | 9/21/2025 | EUR | 400,000 | 406,366 | | (f) |

| | | | | | |

| Automotive Retail - 1.16% | | | | | | |

| Mavis Discount Tire Inc | 6.500% 05/2029 144A | 5/15/2029 | USD | 4,846,000 | 3,964,908 | | (f) |

| | | | | | |

| Biotechnology - 1.35% | | | | | | |

| Grifols SA | 1.625% 02/2025 144A | 2/15/2025 | EUR | 4,120,000 | 4,193,957 | | (f) |

| Grifols SA | 3.200% 05/2025 144A EUR | 5/1/2025 | EUR | 424,000 | 430,663 | | (f) |

| | | | | | |

| Building Products - 10.55% | | | | | | |

| Acproducts Inc (aka Cabinetworks) | 6.375% 05/2029 144A | 5/15/2029 | USD | 11,955,000 | 7,310,781 | | (f) |

| LBM Borrower LLC | 6.250% 01/2029 144A | 1/15/2029 | USD | 3,520,000 | 2,784,478 | | (f) |

| Oldcastle Buildingenvelope Inc | 9.500% 04/2030 144A | 4/15/2030 | USD | 12,065,000 | 10,656,026 | | (f) |

| PrimeSource Building Products Inc | 5.625% 02/2029 144A | 2/1/2029 | USD | 4,654,000 | 3,411,525 | | (f) |

| PrimeSource Building Products Inc | 6.750% 08/2029 144A | 8/1/2029 | USD | 4,980,000 | 3,803,518 | | (f) |

| Specialty Building Products Holdings LLC | 6.375% 09/2026 144A | 9/30/2026 | USD | 426,000 | 396,734 | | (f) |

See accompanying notes to financial statements.

9

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Maturity Date | Currency | Par | Fair Value | Footnotes |

| SRS Distribution Inc | 6.000% 12/2029 144A | 12/1/2029 | USD | 7,576,000 | $ | 6,315,126 | | (f) |

| SRS Distribution Inc | 6.125% 07/2029 144A | 7/1/2029 | USD | 1,706,000 | 1,430,336 | | (f) |

| | | | | | |

| Cable & Satellite - 4.60% | | | | | | |

| Astound Broadband (RCN/Radiate) | 6.500% 09/2028 144A | 9/15/2028 | USD | 4,251,000 | 2,108,666 | | (f) |

| Block Communications Inc | 4.875% 03/2028 144A | 3/1/2028 | USD | 5,431,000 | 4,464,418 | | (f) |

| Cable One Inc | 0.000% 03/2026 | 3/15/2026 | USD | 6,731,000 | 5,522,786 | | (c) |

| Cablevision Lightpath LLC | 5.625% 09/2028 144A | 9/15/2028 | USD | 1,048,000 | 785,301 | | (f) |

| CSC Holdings LLC (Altice USA) | 5.000% 11/2031 144A | 11/15/2031 | USD | 806,000 | 412,776 | | (f) |

| CSC Holdings LLC (Altice USA) | 5.750% 01/2030 144A | 1/15/2030 | USD | 4,702,000 | 2,467,373 | | (f) |

| | | | | | |

| Casinos & Gaming - 0.29% | | | | | | |

| Cirsa Funding Luxembourg SA | 5.000% 03/2027 144A | 3/15/2027 | EUR | 449,000 | 432,444 | | (f) |

| Scientific Games International Inc | 7.500% 09/2031 144A | 9/1/2031 | USD | 589,000 | 575,779 | | (f) |

| | | | | | |

| Commercial Printing - 1.70% | | | | | | |

| Multi-Color Corp | 10.500% 07/2027 144A | 7/15/2027 | USD | 3,714,000 | 3,219,188 | | (f) |

| Multi-Color Corp | 5.875% 10/2028 144A | 11/1/2028 | USD | 1,197,000 | 1,015,201 | | (f) |

| Multi-Color Corp | 8.250% 11/2029 144A | 11/1/2029 | USD | 432,000 | 321,570 | | (f) |

| Multi-Color Corp | 9.500% 11/2028 144A | 11/1/2028 | USD | 1,302,000 | 1,259,962 | | (f) |

| | | | | | |

| Commodity Chemicals - 0.92% | | | | | | |

| Ineos Quattro Holdings Ltd | 2.500% 01/2026 144A | 1/15/2026 | EUR | 455,000 | 449,264 | | (f) |

| SI Group Inc | 6.750% 05/2026 144A | 5/15/2026 | USD | 6,041,000 | 2,693,773 | | (f) |

| | | | | | |

| Construction & Engineering - 4.82% | | | | | | |

| Brand Energy & Infrastructure Services Inc | 10.375% 06/2029 144A | 8/1/2030 | USD | 6,393,000 | 6,353,044 | | (f) |

| Maxim Crane Works LP / Maxim Finance Corp | 11.500% 09/2028 144A | 9/1/2028 | USD | 9,934,000 | 9,707,008 | | (f) |

| thyssenkrupp Elevator AG | 4.375% 07/2027 144A | 7/15/2027 | EUR | 455,000 | 437,130 | | (f) |

| | | | | | |

| Consumer Electronics - 0.09% | | | | | | |

| Energizer Holdings Inc | 6.500% 12/2027 144A | 12/31/2027 | USD | 313,000 | 292,105 | | (f) |

| | | | | | |

| Consumer Finance - 0.12% | | | | | | |

| Navient Corp | 5.875% 10/2024 | 10/25/2024 | USD | 413,000 | 403,705 | | |

| | | | | | |

| Data Processing & Outsourced Services - 0.81% | | | | | | |

| Xerox Business Services /Conduent | 6.000% 11/2029 144A | 11/1/2029 | USD | 3,338,000 | 2,755,557 | | (f) |

| | | | | | |

| Diversified Chemicals - 0.21% | | | | | | |

| Chemours Co/The | 4.000% 05/2026 | 5/15/2026 | EUR | 447,000 | 437,532 | | |

| Chemours Co/The | 5.375% 05/2027 | 5/15/2027 | USD | 320,000 | 289,405 | | |

| | | | | | |

| Diversified Support Services - 0.20% | | | | | | |

| Allied Universal Holdco LLC | 6.625% 07/2026 144A | 7/15/2026 | USD | 316,000 | 296,195 | | (f) |

| Techem Energy Services GmbH/Germany | 6.000% 07/2026 144A | 7/30/2026 | EUR | 371,022 | 381,752 | | (f) |

| | | | | | |

See accompanying notes to financial statements.

10

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Electric Utilities - 0.12% | | | | | | |

| Electricite de France SA | 4.000% SUN REGS | | EUR | 400,000 | $ | 412,859 | | (f) |

| | | | | | |

| Electronic Components - 1.64% | | | | | | |

| CommScope Inc | 6.000% 03/2026 144A | 3/1/2026 | USD | 257,000 | 216,222 | | (f) |

| CommScope Inc | 6.000% 06/2025 144A | 6/15/2025 | USD | 8,957,000 | 5,387,680 | | (f) |

| | | | | | |

| Food Retail - 0.13% | | | | | | |

| Burger King France SAS | 7.750% 11/2027 144A | 11/1/2027 | EUR | 427,000 | 426,855 | | (d) (f) |

| | | | | | |

| Health Care Facilities - 0.30% | | | | | | |

| CHS/Community Health Systems, Inc. | 6.875% 04/2028 144A | 4/1/2028 | USD | 2,365,000 | 1,027,924 | | (f) |

| | | | | | |

| Hotels, Resorts & Cruise Lines - 11.3% | | | | | | |

| Carnival Corp | 6.000% 05/2029 144A | 5/1/2029 | USD | 4,931,000 | 4,169,735 | | (f) |

| Marriott Ownership Resorts Inc | 0.000% 01/2026 | 1/15/2026 | USD | 2,250,000 | 1,939,500 | | (c) |

| NCL Corp Ltd | 1.125% 02/2027 | 2/15/2027 | USD | 9,778,000 | 7,625,227 | | |

| NCL Corp Ltd | 3.625% 12/2024 144A | 12/15/2024 | USD | 13,111,000 | 12,412,466 | | (f) |

| Viking Cruises Ltd | 6.250% 05/2025 144A | 5/15/2025 | USD | 414,000 | 404,936 | | (f) |

| Viking Cruises Ltd | 7.000% 02/2029 144A | 2/15/2029 | USD | 3,548,000 | 3,213,938 | | (f) |

| Viking Cruises Ltd | 9.125% 07/2031 144A | 7/15/2031 | USD | 9,057,000 | 8,906,654 | | (f) |

| | | | | | |

| Industrial Conglomerates - 0.92% | | | | | | |

| Unifrax I LLC / Unifrax Holding Co | 5.250% 09/2028 144A | 9/30/2028 | USD | 2,959,000 | 2,002,080 | | (f) |

| Unifrax I LLC / Unifrax Holding Co | 7.500% 09/2029 144A | 9/30/2029 | USD | 2,137,000 | 1,145,592 | | (f) |

| | | | | | |

| Industrial Machinery & Supplies & Components - 3.09% | | | | | |

| Renk AG/Frankfurt am Main | 5.750% 07/2025 144A | 7/15/2025 | EUR | 413,000 | 431,512 | | (f) |

| SPX FLOW Inc | 8.750% 04/2030 144A | 4/1/2030 | USD | 11,070,000 | 10,160,876 | | (a) (f) |

| | | | | | |

| Insurance Brokers - 3.47% | | | | | | |

| National Financial Partners Corp | 6.875% 08/2028 144A | 8/15/2028 | USD | 13,892,000 | 11,881,200 | | (f) |

| | | | | | |

| Integrated Telecommunication Services - 0.13% | | | | | | |

| Eircom Holdings Ireland Ltd | 2.625% 02/2027 SSN REGS | 2/15/2027 | EUR | 467,000 | 438,258 | | (f) |

| | | | | | |

| Leisure Facilities - 4.19% | | | | | | |

| Cedar Fair LP | 5.375% 04/2027 | 4/15/2027 | USD | 433,000 | 401,329 | | |

| Merlin Entertainments PLC | 4.500% 11/2027 144A | 11/15/2027 | EUR | 2,000,000 | 1,814,096 | | (f) |

| Merlin Entertainments PLC | 6.625% 11/2027 144A | 11/15/2027 | USD | 5,811,000 | 5,205,697 | | (f) |

| Six Flags Entertainment Corp | 7.250% 05/2031 144A | 5/15/2031 | USD | 7,519,000 | 6,925,864 | | (f) |

| | | | | | |

| Metal, Glass & Plastic Containers - 0.13% | | | | | | |

| Trivium Packaging Finance BV | 3.750% 08/2026 144A | 8/15/2026 | EUR | 448,000 | 430,054 | | (f) |

| | | | | | |

| Oil & Gas Equipment & Services - 0.23% | | | | | | |

See accompanying notes to financial statements.

11

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Archrock Partners LP / Archrock Partners Finance Corp | 6.875% 04/2027 144A | 4/1/2027 | USD | 412,000 | $ | 396,483 | | (f) |

| Solaris Midstream Holdings LLC | 7.625% 04/2026 144A | 4/1/2026 | USD | 421,000 | 401,981 | | (f) |

| | | | | | |

| Oil & Gas Exploration & Production - 0.95% | | | | | | |

| Matador Resources Co | 5.875% 09/2026 | 9/15/2026 | USD | 2,686,000 | 2,590,684 | | |

| Sitio Royalties Corp | 7.875% 11/2028 144A | 11/1/2028 | USD | 660,000 | 651,694 | | (f) |

| | | | | | |

| Oil & Gas Storage & Transportation - 5.58% | | | | | | |

| Genesis Energy | 6.500% 10/2025 | 10/1/2025 | USD | 2,842,000 | 2,779,044 | | |

| Genesis Energy | 8.000% 01/2027 | 1/15/2027 | USD | 356,000 | 342,174 | | |

| Genesis Energy | 8.875% 04/2030 | 4/15/2030 | USD | 1,420,000 | 1,373,894 | | |

| Global Partners LP / GLP Finance Corp | 7.000% 08/2027 | 8/1/2027 | USD | 420,000 | 396,230 | | |

| NGL Energy Partners LP / NGL Energy Finance Corp | 7.500% 02/2026 144A | 2/1/2026 | USD | 13,630,000 | 13,317,341 | | (f) |

| Rockies Express Pipeline LLC | 3.600% 05/2025 144A | 5/15/2025 | USD | 316,000 | 299,361 | | (f) |

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp | 6.000% 03/2027 144A | 3/1/2027 | USD | 317,000 | 290,348 | | (f) |

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp | 7.500% 10/2025 144A | 10/1/2025 | USD | 300,000 | 295,853 | | (f) |

| | | | | | |

| Other Specialty Retail - 3.68% | | | | | | |

| Alain Afflelou SA | 4.250% 05/2026 144A | 5/19/2026 | EUR | 440,000 | 438,618 | | (f) |

| Douglas Holding AG | 6.000% 04/2026 144A | 4/8/2026 | EUR | 5,417,000 | 5,481,060 | | (f) |

| Douglas Holding AG | 8.250% 10/2026 SUN 144A | 10/1/2026 | EUR | 6,803,643 | 6,662,268 | | (d) (f) |

| | | | | | |

| Passenger Airlines - 4.49% | | | | | | |

| Air France-KLM | 3.875% 07/2026 SUNs | 7/1/2026 | EUR | 400,000 | 403,812 | | (f) |

| American Airlines Group Inc | 3.750% 03/2025 144A | 3/1/2025 | USD | 11,463,000 | 10,705,775 | | (f) |

| JetBlue Airways Corp | 0.500% 04/2026 144A (Convertible) | 4/1/2026 | USD | 6,812,000 | 4,248,934 | | |

| | | | | | |

| Pharmaceuticals - 0.13% | | | | | | |

| Nidda Healthcare Holding AG | 7.500% 08/2026 144A | 8/21/2026 | EUR | 408,000 | 433,718 | | (f) |

| | | | | | |

| Real Estate Services - 1.86% | | | | | | |

| Anywhere Real Estate Group LLC | 0.250% 06/2026 (Convertible) | 6/15/2026 | USD | 4,295,000 | 3,205,577 | | |

| Redfin Corp | 0.000% 10/2025 | 10/15/2025 | USD | 3,864,000 | 3,149,143 | | (c) |

| | | | | | |

| Restaurants - 2.14% | | | | | | |

| Golden Nugget Inc. | 6.750% 07/2030 144A | 1/15/2030 | USD | 9,187,000 | 7,309,370 | | (f) |

| | | | | | |

| Security & Alarm Services - 0.76% | | | | | | |

| Verisure Holding AB | 3.875% 07/2026 144A | 7/15/2026 | EUR | 2,592,000 | 2,600,788 | | (f) |

| | | | | | |

| Trading Companies & Distributors - 2.23% | | | | | | |

| AerCap Holdings | 6.500% 06/2045 144A | 6/15/2045 | USD | 2,029,000 | 1,992,593 | | (f) |

| Neon Holdings Inc (GPD Cos Inc) | 10.125% 04/2026 144A | 4/1/2026 | USD | 3,350,000 | 3,020,906 | | (f) |

| White Cap Construction Supply Inc | 8.250% 03/2026 144A (9% PIK Toggle) | 3/15/2026 | USD | 2,795,000 | 2,625,723 | | (d) (f) |

| TOTAL HIGH YIELD SECURITIES (Amortized cost $318,203,669) | | | | $ | 277,640,122 | | |

See accompanying notes to financial statements.

12

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Reference Rate & Spread | Interest Rate | Maturity Date | Currency | Par | Fair Value | Footnotes |

| Asset Backed Securities - 8.22% | | | | | | | | |

| | | | | | | | |

| Specialized Finance - 8.22% | | | | | | | | |

| Adagio X Eur Clo DAC | Adagio X EUR CLO D | EURIBOR + 0.00% | 0.00% | 10/20/2037 | EUR | 458,000 | $ | 484,323 | | (b) (f) (h) |

| AGL CLO Ltd | AGL 2023-24A D | SOFR + 5.50% | 10.89% | 7/25/2036 | USD | 1,137,230 | 1,163,447 | | (b) (f) |

| AGL CLO Ltd | AGL 2023-24A E | SOFR + 8.65% | 8.42% | 7/25/2036 | USD | 1,250,000 | 1,258,330 | | (b) (f) |

| AMMC CLO 22 Ltd | AMMC 2018-22A D | SOFR + 2.70% | 8.34% | 4/25/2031 | USD | 606,540 | 589,849 | | (b) (f) |

| Anchorage Capital CLO 4-R Ltd | ANCHC 2014-4RA D | SOFR + 2.60% | 8.25% | 1/28/2031 | USD | 1,145,000 | 1,125,465 | | (b) (f) |

| Apidos CLO XLV Ltd | APID 2023-45A D | SOFR + 5.20% | 10.58% | 4/26/2036 | USD | 391,780 | 393,371 | | (b) (f) |

| Apidos CLO XLVI Ltd | APID 2023-46A D | SOFR + 5.00% | 10.42% | 10/24/2036 | USD | 317,550 | 317,654 | | (b) (f) |

| Arbour CLO III DAC | ARBR 3A DRR | EURIBOR + 3.10% | 7.07% | 7/15/2034 | EUR | 678,000 | 663,749 | | (b) (f) |

| Ares LXVIII CLO Ltd | ARES 2023-68A D | SOFR + 5.75% | 11.13% | 4/25/2035 | USD | 991,910 | 1,016,160 | | (b) (f) |

| Ballyrock CLO Ltd | BALLY 2019-2A CR | SOFR + 3.15% | 8.79% | 11/20/2030 | USD | 250,000 | 248,966 | | (b) (f) |

| Birch Grove CLO 6 Ltd | BGCLO 2023-6A D | SOFR + 5.83% | 11.11% | 7/20/2035 | USD | 1,120,730 | 1,127,089 | | (b) (f) |

| Bluemountain Euro 2021-2 CLO DAC | BLUME 2021-2A D | EURIBOR + 3.10% | 7.07% | 10/15/2035 | EUR | 351,254 | 345,015 | | (b) (f) |

| Bosphorus CLO IV DAC | BOPHO 4A D | EURIBOR + 2.60% | 6.45% | 12/15/2030 | EUR | 1,111,000 | 1,113,924 | | (b) (f) |

| Cairn Clo XVII DAC | CRNCL 2023-17A D | EURIBOR + 5.30% | 9.20% | 10/18/2036 | EUR | 338,000 | 357,287 | | (b) (f) |

| Carbone Clo Ltd | CRBN 2017-1A C | SOFR + 2.60% | 8.28% | 1/20/2031 | USD | 367,030 | 351,378 | | (b) (f) |

| Dillon's Park CLO DAC | DILPK 1A D | EURIBOR + 3.00% | 6.97% | 10/15/2034 | EUR | 374,000 | 363,232 | | (b) (f) |

| Empower CLO Ltd | EMPWR 2023-1A D | SOFR + 5.50% | 10.88% | 4/25/2036 | USD | 1,500,000 | 1,535,537 | | (b) (f) |

| Empower CLO Ltd | EMPWR 2023-2A D | SOFR + 5.40% | 10.74% | 7/15/2036 | USD | 341,268 | 342,979 | | (b) (f) |

| Glenbrook Park Clo DAC | GLNBR 1A D | EURIBOR + 5.75% | 9.44% | 7/21/2036 | EUR | 500,000 | 529,407 | | (b) (f) |

| Henley CLO III DAC | HNLY 3A DR | EURIBOR + 3.30% | 7.26% | 12/25/2035 | EUR | 769,000 | 743,451 | | (b) (f) |

| Henley CLO IX DAC | HNLY 9A D | EURIBOR + 6.12% | 10.11% | 4/20/2032 | EUR | 477,000 | 506,319 | | (b) (f) |

| Madison Park Euro Funding XV DAC | MDPKE 15A DR | EURIBOR + 4.50% | 8.47% | 7/15/2036 | EUR | 321,000 | 330,070 | | (b) (f) |

| Madison Park Funding Ltd | MDPK 2023-63A D | SOFR + 5.50% | 10.91% | 4/21/2035 | USD | 946,840 | 966,078 | | (b) (f) |

| Madison Park Funding XI Ltd | MDPK 2013-11A DR | SOFR + 3.25% | 8.92% | 7/23/2029 | USD | 1,690,300 | 1,655,124 | | (b) (f) |

| Madison Park Funding XXVIII Ltd | MDPK 2018-28A E | SOFR + 5.25% | 10.91% | 7/15/2030 | USD | 957,530 | 913,072 | | (b) (f) |

| Magnetite XXXI Ltd | MAGNE 2021-31A E | SOFR + 6.00% | 11.66% | 7/15/2034 | USD | 1,500,000 | 1,427,288 | | (b) (f) |

| Oaktree CLO 2023-1 Ltd | OAKCL 2023-1A D | SOFR + 5.25% | 10.64% | 4/15/2036 | USD | 558,213 | 565,461 | | (b) (f) |

| Palmer Square European CLO 2022-2 DAC | PLMER 2022-2A D | EURIBOR + 6.26% | 10.24% | 1/15/2036 | EUR | 691,000 | 737,483 | | (b) (f) |

| Palmer Square European CLO 2023-1 DAC | PLMER 2023-1A D | EURIBOR + 6.20% | 9.25% | 7/15/2036 | EUR | 1,000,000 | 1,003,032 | | (b) (f) |

| Palmer Square Loan Funding 2023-1 Ltd | PSTAT 2023-1A D | SOFR + 8.00% | 13.23% | 7/20/2031 | USD | 2,000,000 | 2,004,015 | | (b) (f) |

| Providus Clo VI DAC | PRVD 6A D | EURIBOR + 3.20% | 7.02% | 5/20/2034 | EUR | 553,000 | 545,505 | | (b) (f) |

| RAD CLO 21 Ltd | RAD 2023-21A E | SOFR + 7.90% | 0.00% | 1/25/2033 | USD | 431,432 | 431,521 | | (b) (f) (h) |

| ROMARK CLO LLC | RCF 2021-2A E | 7.08% | 7.08% | 10/25/2039 | USD | 1,200,000 | 951,487 | | (b) (f) |

| Shackleton CLO Ltd | SHACK 2019-15A D1R | SOFR + 3.45% | 9.11% | 1/15/2032 | USD | 366,700 | 355,814 | | (b) (f) |

| Sutton Park CLO DAC | STNPK 1A C | EURIBOR + 3.30% | 7.08% | 11/15/2031 | EUR | 1,178,000 | 1,187,470 | | (b) (f) |

| TRESTLES CLO III LTD | TREST 2020-3A D | LIBOR + 3.25% | 8.91% | 1/20/2033 | USD | 500,000 | 496,357 | | (b) (f) |

| TOTAL ASSET BACKED SECURITIES (Amortized cost $27,884,503) | | | | | | $ | 28,146,709 | | |

See accompanying notes to financial statements.

13

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Asset | Rate | Currency | Shares | Fair Value | Footnotes | |

| Equity & Other Investments - 2.28% | | | | | | | |

| | | | | | | |

| Construction & Engineering - 0.05% | | | | | | | |

| Yak Access LLC | Common Stock | | USD | 9,358 | $ | 749 | | (a) (e) | |

| Yak Access LLC | Preferred Stock | | USD | 2,244,306 | 168,323 | | (a) (e) | |

| | | | | | | |

| Diversified Metals & Mining - 1.91% | | | | | | | |

| Foresight Energy LLC | Common Stock | | USD | 320,381 | 6,547,618 | | (a) (b) (e) | |

| | | | | | | |

| Oil & Gas Equipment & Services - 0.18% | | | | | | | |

| Proserv Group Parent LLC | Common Stock | | USD | 114,010 | 197,899 | | (b) (e) | |

| Proserv Group Parent LLC | Preferred Stock | | USD | 36,249 | 409,048 | | (b) (e) | |

| | | | | | | |

| Packaged Foods & Meats - 0.00% | | | | | | | |

| CTI Foods Holding Co LLC | Common Stock | | USD | 955 | — | | (a) (b) (e) | |

| | | | | | | |

| Health Care Facilities - 0.15% | | | | | | | |

| Quorum Health Corp | Trade Claim | | USD | 3,964,000 | 497,086 | | (b) (e) | |

| TOTAL EQUITY & OTHER INVESTMENTS (Cost $9,604,946) | | | | | $ | 7,820,723 | | | |

| | | | | | | |

| TOTAL INVESTMENTS (Cost $564,744,898) - 149.77% | | | | | $ | 512,747,295 | | | |

| | | | | | | |

| Money Market Funds - 1.60% | | | | | | | |

| U.S. Government Securities - 1.60% | | | | | | | |

| Morgan Stanley Institutional Liquidity Fund - Government Portfolio | | 5.21% | USD | 5,475,292 | 5,475,292 | | (g) | |

| TOTAL MONEY MARKET FUNDS (Cost $5,475,292) | | | | | $ | 5,475,292 | | | |

| | | | | | | |

| TOTAL INVESTMENTS INCLUDING MONEY MARKET (Cost $570,220,190) - 151.37% | | | $ | 518,222,587 | | | |

| LIABILITIES EXCEEDING OTHER ASSETS, NET - (51.37%) | | | | | (175,864,028) | | | |

| NET ASSETS - 100.00% | | | | | $ | 342,358,559 | | | |

| | | | | | | | |

| TL | | Term loan. |

| | |

| 1L | | First lien. |

| 2L | | Second lien. |

| (a) | | Security considered restricted. |

| (b) | | Value determined using significant unobservable inputs. |

| (c) | | Zero coupon bond. |

| (d) | | Represents a payment-in-kind (“PIK”) security which may pay interest/dividend in additional par/shares. |

| (e) | | Non-income producing security. |

| (f) | | Securities exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold to qualified institutional buyers in transactions exempt from registration. |

| (g) | | Rate represents the money market fund’s average 7-day yield as of October 31, 2023. |

| (h) | | Securities purchased on a when-issued basis. Rates do not take effect until settlement date. |

See accompanying notes to financial statements.

14

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

Statement of Assets and Liabilities

As of October 31, 2023

| | | | | |

| Assets | |

| Investments, at fair value (cost $564,744,898) | $ | 512,747,295 | |

| Cash and cash equivalents | 5,755,955 | |

Foreign currencies, at value (cost $5,877,969) | 5,868,998 | |

| Dividends and interest receivable | 7,948,366 | |

| Receivable for investments sold | 24,089,790 | |

| Other assets | 90,662 | |

| Total assets | 556,501,066 | |

| |

| Liabilities | |

| Credit facility | 155,362,318 | |

Mandatorily redeemable preferred shares (net of deferred offering costs of $479,352) | 49,520,648 | |

| Payable for investments purchased | 6,836,125 | |

| Trustees’ fees payable | 515,272 | |

| Investment advisory fees payable | 1,248,245 | |

| Other accrued expenses | 659,899 | |

| Total liabilities | 214,142,507 | |

| |

| Commitments and Contingencies (Note 7) | |

| Net assets | $ | 342,358,559 | |

| |

| Net Assets | |

Paid-in capital — (unlimited shares authorized — $0.001 par value) | $ | 431,511,578 | |

| Accumulated deficit | (89,153,019) | |

| Net assets | $ | 342,358,559 | |

| |

Net asset value, price per share (27,120,420 shares) | $ | 12.62 | |

See accompanying notes to financial statements.

15

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

Statement of Operations

For the Year Ended October 31, 2023

| | | | | |

| Investment income | |

| Interest income | $ | 49,229,918 | |

| Payment-in-kind interest income | 2,563,055 | |

| |

| Other income | 1,263,907 | |

| Total investment income | 53,056,880 | |

| Expenses | |

| Credit facility interest expense | 6,327,638 | |

| Investment advisory fees | 5,413,550 | |

| Preferred shares interest expense | 1,979,815 | |

| Term loan fees | 634,550 | |

| Legal fees | 439,982 | |

| Administration fees | 140,986 | |

| Shareholder reporting expense | 122,433 | |

| Trustees' fees | 120,698 | |

| Other expenses | 576,236 | |

| Total expenses | 15,755,888 | |

| |

| Net investment income | 37,300,992 | |

| |

| Realized and unrealized gains (losses) | |

| Net realized losses on | |

| Investments | (17,218,206) | |

| Foreign currency transactions | (879,088) | |

| Net realized losses | (18,097,294) | |

| Net change in unrealized appreciation (depreciation) of | |

| Investments | 33,099,339 | |

| Foreign currency translation | 1,671,313 | |

| Deferred Trustees’ fees | (135,063) | |

| Net change in unrealized appreciation | 34,635,589 | |

| Net realized and unrealized gains | 16,538,295 | |

| Net increase in net assets resulting from operations | $ | 53,839,287 | |

See accompanying notes to financial statements.

16

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

Statements of Changes in Net Assets

| | | | | | | | |

| Year Ended October 31, 2023 | Year Ended October 31, 2022 |

| Increase (decrease) in net assets resulting from operations | | |

| Net investment income | $ | 37,300,992 | | $ | 27,468,926 | |

| Net realized losses | (18,097,294) | | (3,984,886) | |

| Net change in unrealized appreciation (depreciation) | 34,635,589 | | (85,525,198) | |

| Net increase (decrease) in net assets resulting from operations | 53,839,287 | | (62,041,158) | |

| | |

| Distributions to shareholders | | |

| Net investment income | (34,903,980) | | (25,628,796) | |

| Total distributions to shareholders | (34,903,980) | | (25,628,796) | |

| | |

| Shareholder transactions | | |

| Proceeds from rights offering (6,780,105 shares), net of offering costs | 69,825,942 | | — | |

| Increase from shareholder transactions | 69,825,942 | | — | |

| Net increase (decrease) in net assets | 88,761,249 | | (87,669,954) | |

| Net assets | | |

| Beginning of year (20,340,315 and 20,340,315 shares, respectively) | 253,597,310 | | 341,267,264 | |

| End of year (27,120,420 and 20,340,315 shares, respectively) | $ | 342,358,559 | | $ | 253,597,310 | |

See accompanying notes to financial statements.

17

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

Statement of Cash Flows

| | | | | |

| Year Ended October 31, 2023 |

| Cash Flows from Operating Activities: | |

| Net increase in net assets resulting from operations | $ | 53,839,287 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | |

| Purchases of investments | (357,993,958) | |

| Proceeds from sales and repayments of investments | 282,621,338 | |

| Net change in unrealized appreciation on investments | (33,099,339) | |

| Net realized loss on investments | 17,218,206 | |

| Net accretion of premiums and discounts | (7,393,962) | |

| Payment-in-kind interest | (2,563,055) | |

| Net change in unrealized appreciation on foreign currency translation | (1,671,313) | |

| Net realized loss on investments (foreign currency related) | 1,239,634 | |

| Net change in unrealized depreciation on deferred Trustees’ fees | 135,063 | |

| Amortization of deferred offering costs | 79,822 | |

| Changes in assets and liabilities: | |

| Increase in receivable for investments sold | (17,158,127) | |

| Increase in payable for investments purchased | 4,240,069 | |

| Decrease in dividends and interest receivable | 614,058 | |

| Increase in investment advisory fees payable | 111,208 | |

| Increase in Trustees' fees payable | 98,197 | |

| Increase in other assets | (90,662) | |

| Increase in other accrued expenses | 46,026 | |

| Net cash used in operating activities | (59,727,508) | |

| Cash Flows from Financing Activities | |

| Net proceeds from rights offering | 69,825,942 | |

| Proceeds from credit facility | 58,774,154 | |

| Cash dividends paid to shareholders | (34,903,980) | |

| Paydown of credit facility | (27,000,000) | |

| |

| Net cash provided by financing activities | 66,696,116 | |

| |

| Effect of exchange rate changes on cash | 21,887 | |

| Net increase in cash and cash equivalents | 6,990,495 | |

| |

| Cash and Cash Equivalents | |

| Beginning balance | 4,634,458 | |

| Ending balance | $ | 11,624,953 | |

| |

| Supplemental disclosure of cash flow information: | |

| Cash paid for interest expense | $ | 8,178,111 | |

See accompanying notes to financial statements.

18

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

Financial Highlights

| | | | | | | | | | | | | | | | | |

| Year Ended October 31 |

| 2023 | 2022 | 2021 | 2020 | 2019 |

Per share operating performance (1) | | | | | |

| Net asset value, beginning of year | $12.47 | $16.78 | $14.86 | $15.57 | $17.24 |

| Income (loss) from investment operations | | | | | |

| Net investment income | 1.49 | 1.35 | 1.40 | 1.39 | 1.49 |

| Net realized and unrealized gains (losses) | 0.77 | (4.40) | 1.78 | (0.60) | (1.66) |

| Total from investment operations | 2.26 | (3.05) | 3.18 | 0.79 | (0.17) |

| | | | | |

| Distributions from | | | | | |

| Net investment income | (1.40) | (1.26) | (1.26) | (1.50) | (1.50) |

| Total distributions | (1.40) | (1.26) | (1.26) | (1.50) | (1.50) |

| Dilutive effect of rights offering | (0.71) | — | — | — | — |

| Net asset value, end of year | $12.62 | $12.47 | $16.78 | $14.86 | $15.57 |

Total return (2) | 15.51% | (27.01)% | 36.24% | (3.58)% | 7.55% |

| | | | | |

| Ratios to average net assets | | | | | |

| Expenses | 4.95% | 3.56% | 3.12% | 3.73% | 3.38% |

| Net investment income | 11.72% | 9.08% | 8.49% | 9.65% | 9.07% |

| Supplemental data | | | | | |

| Market value/price | $11.35 | $11.08 | $16.67 | $13.25 | $15.39 |

| Price discount | (10.06)% | (11.15)% | (0.66)% | (10.83)% | (1.16)% |

| Net assets, end of year (000’s) | $342,359 | $253,597 | $341,267 | $302,336 | $316,670 |

| Portfolio turnover rate | 58% | 32% | 79% | 73% | 62% |

1 Per share calculations were performed using average shares.

2 Total return is computed based on NYSE market price of the Fund’s shares and excludes the effect of brokerage commissions. Distributions are assumed to be reinvested at the prices obtained under the Fund’s dividend reinvestment plan.

See accompanying notes to financial statements.

19

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

Notes to Financial Statements

1.Organization

KKR Income Opportunities Fund (the “Fund”) was organized on March 17, 2011 as a statutory trust under the laws of the State of Delaware. The Fund is a closed-end registered management investment company, which commenced operations on July 25, 2013. The Fund seeks to generate a high level of current income, with a secondary objective of capital appreciation. The Fund is diversified for purposes of the Investment Company Act of 1940, as amended (the “1940 Act”). KKR Credit Advisors (US) LLC serves as the Fund’s investment adviser (the “Adviser”).

2.Summary of Significant Accounting Policies

Basis of Presentation — The accompanying financial statements are presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and are stated in United States (“U.S.”) dollars. The Fund is an investment company following accounting and reporting guidance in Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services — Investment Companies. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in these financial statements. Actual results could differ from those estimates.

Valuation of Investments — The Board of Trustees (the “Board”) of the Fund has adopted valuation policies and procedures to ensure investments are valued in a manner consistent with GAAP as required by the 1940 Act. The Board designated the Adviser as the valuation designee to perform fair valuations pursuant to Rule 2a-5 under the Investment Company Act of 1940 (the “Valuation Designee”). The Valuation Designee has primary responsibility for implementing the Fund’s valuation policies and procedures.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where available, fair value is based on observable market prices or parameters, or derived from such prices or parameters. Where observable prices or inputs are not available, valuation models are applied. These valuation techniques involve some level of management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity for disclosure purposes.

Assets and liabilities recorded at fair value on the Statement of Assets and Liabilities are categorized based upon the level of judgment associated with the inputs used to measure their value. Hierarchical levels, as defined under GAAP, are directly related to the amount of subjectivity associated with the inputs to fair valuations of these assets and liabilities, and are as follows:

Level 1 — Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date.

Level 2 — Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs include quoted prices for similar instruments in active markets, and inputs other than quoted prices that are observable for the asset or liability.

Level 3 — Inputs are unobservable for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability.

A significant decrease in the volume and level of activity for the asset or liability is an indication that transactions or quoted prices may not be representative of fair value because in such market conditions there may be increased instances of transactions that are not orderly. In those circumstances, further analysis of transactions or quoted prices is needed, and a significant adjustment to the transactions or quoted prices may be necessary to estimate fair value.

The availability of observable inputs can vary depending on the financial asset or liability and is affected by a wide variety of factors, including, for example, the type of product, whether the product is new, whether the product is

| | | | | | | | |

| Income Opportunities Fund | October 31, 2023 |

| |

traded on an active exchange or in the secondary market, and the current market condition. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by the Fund in determining fair value is greatest for instruments categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement in its entirety falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The Fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and consideration of factors specific to the asset. The variability of the observable inputs affected by the factors described above may cause transfers between Levels 1, 2 and/or 3.

Many financial assets and liabilities have bid and ask prices that can be observed in the marketplace. Bid prices reflect the highest price that the Fund and others are willing to pay for an asset. Ask prices represent the lowest price that the Fund and others are willing to accept for an asset. For financial assets and liabilities whose inputs are based on bid-ask prices, the Fund does not require that fair value always be a predetermined point in the bid-ask range. The Fund’s policy is to allow for mid-market pricing and adjust to the point within the bid-ask range that meets the Fund’s best estimate of fair value.

Depending on the relative liquidity in the markets for certain assets, the Fund may transfer assets to Level 3 if it determines that observable quoted prices, obtained directly or indirectly, are not available.

Investments are generally valued based on quotations from third party pricing services, unless such a quotation is unavailable or is determined to be unreliable or inadequately representing the fair value of the particular assets. In that case, valuations are based on either valuation data obtained from one or more other third party pricing sources, including broker dealers selected by the Adviser, or will reflect the Valuation Committee’s good faith determination of fair value based on other factors considered relevant. For assets classified as Level 3, valuations are based on various factors including financial and operating data of the company, company specific developments, market valuations of comparable companies and model projections.

For the year ended October 31, 2023, there have been no significant changes to the Fund’s fair value methodologies.

Investment Transactions — Investment transactions are accounted for on the trade date, the date the order to buy or sell is executed. Amortization and accretion is calculated using the effective interest method over the holding period of the investment. Realized gains and losses are calculated on the specific identified cost basis.

Cash and Cash Equivalents — Cash and cash equivalents includes cash on hand, cash held in banks and highly liquid investments with original maturities of three or fewer months. Cash equivalents consist solely of money market funds with financial institutions. As of October 31, 2023, the Fund was invested in the Morgan Stanley Institutional Liquidity Government Portfolio — Institutional Class.