Form 424B3 - Prospectus [Rule 424(b)(3)]

July 12 2024 - 5:12PM

Edgar (US Regulatory)

| July 12, 2024 | Registration

Statement Nos. 333-270004 and 333-270004-01; Rule 424(b)(3) |

JPMorgan Chase Financial Company LLC

Structured Investments

Review Notes Linked to the MerQube US Large-Cap Vol

Advantage Index due May 17, 2029

Fully and Unconditionally Guaranteed by JPMorgan Chase

& Co.

Notwithstanding anything to the contrary set forth in

the pricing supplement dated May 14, 2024, related to the notes referred to above (the “pricing supplement”), the Call Value

and the Payment at Maturity are as set forth below:

Call

Value: The Call Value with respect to each Review Date is set forth below:

| · | first through sixteenth Review Dates: 100.00% of the Initial Value |

| · | final Review Date: 50.00% of the Initial Value |

Payment at Maturity:

If the notes have not been automatically called (and therefore

the Final Value is less than the Barrier Amount), your payment at maturity per $1,000 principal amount note will be calculated as follows:

$1,000 + ($1,000 × Index

Return)

If the notes have not been automatically called (and

therefore the Final Value is less than the Barrier Amount), you will lose more than 50.00% of your principal amount at maturity and could

lose all of your principal amount at maturity.

CUSIP: 48134X6R1

Investing in the notes involves a number of risks. See “Risk

Factors” beginning on page S-2 of the accompanying prospectus supplement, Annex A to the accompanying prospectus addendum, “Risk

Factors” beginning on page PS-11 of the accompanying product supplement, “Risk Factors” beginning on page US-4 of the

accompanying underlying supplement and “Selected Risk Considerations” beginning on page PS-6 of the pricing supplement.

Neither the Securities and Exchange Commission (the “SEC”)

nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this amendment,

the pricing supplement or the accompanying product supplement, underlying supplement, prospectus supplement, prospectus and prospectus

addendum. Any representation to the contrary is a criminal offense.

The notes are not bank deposits, are not insured by the Federal

Deposit Insurance Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank.

You should read this amendment together with the pricing supplement

and the related product supplement, underlying supplement, prospectus supplement and prospectus and prospectus addendum, each of which

can be accessed via the hyperlinks below. Please also see “Additional Terms Specific to the Notes” in the pricing supplement.

· Pricing supplement dated May 14, 2024:

http://www.sec.gov/Archives/edgar/data/1665650/000121390024044353/ea174463_424b2.htm

· Product supplement no. 4-I dated April 13, 2023:

http://www.sec.gov/Archives/edgar/data/19617/000121390023029539/ea152803_424b2.pdf

· Underlying supplement no. 5-II dated March 5, 2024:

http://www.sec.gov/Archives/edgar/data/19617/000121390024020078/ea0200816-01_424b2.pdf

· Prospectus supplement and prospectus, each dated April 13, 2023:

http://www.sec.gov/Archives/edgar/data/19617/000095010323005751/crt_dp192097-424b2.pdf

· Prospectus addendum dated June 3, 2024:

http://www.sec.gov/Archives/edgar/data/1665650/000095010324007599/dp211753_424b3.htm

Amendment no. 1 to pricing supplement dated May 14, 2024

to product supplement no. 4-I dated April 13, 2023, underlying supplement no. 5-II dated March 5, 2024, the prospectus and prospectus

supplement, each dated April 13, 2023, and the prospectus addendum dated June 3, 2024

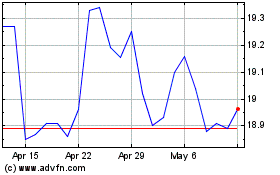

JP Morgan Chase (NYSE:JPM-M)

Historical Stock Chart

From Jul 2024 to Aug 2024

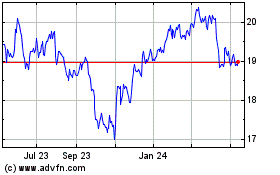

JP Morgan Chase (NYSE:JPM-M)

Historical Stock Chart

From Aug 2023 to Aug 2024