UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 31, 2024

INTEGRATED WELLNESS ACQUISITION CORP

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-41131 |

|

98-1615488 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

59 N. Main Street

Florida, NY 10921

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (845) 651-5039

Not

Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each

class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable warrant |

|

WEL.U |

|

The New York Stock Exchange |

| Class A ordinary shares included as part of the units |

|

WEL |

|

The New York Stock Exchange |

| Redeemable warrants included as part of the units |

|

WEL.WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation

FD Disclosure.

On

May 31, 2024, Integrated Wellness Acquisition Corp., a Cayman Islands exempted company incorporated with limited liability (the “Company”),

issued a joint press release announcing that it entered into a business combination agreement, dated May 30, 2024 (the “Merger

Agreement”) with IWAC Georgia Merger Sub Inc., a Georgia corporation and a wholly-owned subsidiary of the Company (“Merger

Sub”), and Btab Ecommerce Group, Inc., a Georgia corporation (“Btab”). Pursuant to the Merger

Agreement, and subject to the terms and conditions set forth therein, upon the consummation of the transactions contemplated thereby (the

“Closing”), the Company will redomesticate from the Cayman Islands to Delaware, and Merger Sub will merge with

and into Btab, with Btab surviving as a wholly-owned subsidiary of the Company (the “Business Combination”).

A copy of the press release is furnished hereto as Exhibit 99.1 and is incorporated herein by reference.

The

information in this Item 7.01 and Exhibit 99.1 attached hereto is intended to be furnished and will not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

subject to the liabilities of that section, nor will it be deemed incorporated by reference in any filing under the Securities Act of

1933, as amended (the “Securities Act”) or the Exchange Act, except as expressly set forth by specific reference

in such filing.

Important Information

About the Business Combination and Where to Find It

In

connection with the Merger Agreement and the Business Combination, the Company intends to file with the Securities and Exchange Commission

(“SEC”) a Registration Statement on Form S-4, which will include a prospectus for the Company’s securities

and a proxy statement for the Company’s shareholders (the “Registration Statement”). The Registration

Statement has not been filed with or declared effective by the SEC. Promptly after the Registration Statement is declared effective by

the SEC, the Company will mail the definitive proxy statement and a proxy card to its shareholders. Investors and securityholders of the

Company and other interested persons are advised to read, when available, the preliminary proxy statement to be filed with the SEC, and

amendments thereto, and the definitive proxy statement in connection with the Company’s solicitation of proxies for the special

meeting to be held to approve the Merger Agreement and the Business Combination and other documents filed in connection with the proposed

Business Combination because these documents will contain important information about Btab, the Company, the combined company following

the consummation of the Business Combination, the Merger Agreement and the Business Combination. The definitive proxy statement will be

mailed to the Company’s shareholders as of a record date to be established in the future for voting on the Merger Agreement and

the Business Combination. The Registration Statement, including the definitive proxy statement, the preliminary proxy statement and other

relevant materials in connection with the Business Combination (when they become available), and any other documents filed by the Company

with the SEC, may be obtained free of charge at the SEC's website (www.sec.gov) or by writing to: Integrated Wellness Acquisition Corp,

148 N Main Street, Florida, NY 10921, Attention: Mr. Suren Ajjarapu.

Participants in

the Solicitation

The

Company, Btab and their respective directors, executive officers, other members of management and employees may be deemed participants

in the solicitation of proxies from the Company’s shareholders with respect to the Business Combination. Investors and securityholders

may obtain more detailed information regarding the names and interests in the Business Combination of the Company’s directors and

officers in the Company’s filings with the SEC, including, when filed with the SEC, the preliminary proxy statement and the amendments

thereto, the definitive proxy statement, and other documents filed with the SEC, and such information with respect to Btab’s directors

and executive officers will also be included in the proxy statement.

Forward-Looking

Statements

This

Current Report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws with

respect to the proposed Business Combination between the Company and Btab, including without limitation statements regarding the

anticipated benefits of the Business Combination, the anticipated timing of the Business Combination, the implied enterprise value,

future financial condition and performance of Btab and the combined company after the Closing and expected financial impacts of the

Business Combination, the satisfaction of closing conditions to the Business Combination, the pre-money valuation of Btab (which is

subject to certain inputs that may change prior to the Closing of the Business Combination and is subject to adjustment after the

Closing of the Business Combination), the level of redemptions of the Company’s public shareholders and the products and

markets and expected future performance and market opportunities of Btab. These forward-looking statements generally are identified

by the words “believe,” “project,” “expect,” “anticipate,” “estimate,”

“intend,” “strategy,” “future,” “opportunity,” “plan,”

“may,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result” and similar expressions, but the absence of these words does not mean that a

statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties.

Many

factors could cause actual future events to differ materially from the forward-looking statements in this Current Report on Form 8-K,

including but not limited to: (i) the risk that the proposed Business Combination may not be completed in a timely manner or at all, which

may adversely affect the price of the Company’s securities; (ii) the risk that the proposed Business Combination may not be completed

by the Company’s business combination deadline and the potential failure to obtain an extension of the business combination deadline

if sought by the Company; (iii) the failure to satisfy the conditions to the consummation of the Business Combination, including the approval

of the Merger Agreement by the shareholders of the Company; (iv) the occurrence of any event, change or other circumstance that could

give rise to the termination of the Merger Agreement; (v) the failure to achieve the minimum amount of cash available following any redemptions

by Company’s shareholders; (vi) redemptions exceeding a maximum threshold or the failure to meet the New York Stock Exchange’s

initial listing standards in connection with the consummation of the contemplated Business Combination; (vii) the effect of the announcement

or pendency of the Business Combination on Btab’s business relationships, operating results, and business generally; (viii) risks

that the proposed Business Combination disrupts current plans and operations of Btab; (ix) the outcome of any legal proceedings that may

be instituted against Btab or against the Company related to the Merger Agreement or the proposed Business Combination; (x) changes in

the markets in which Btab competes, including with respect to its competitive landscape, technology evolution or regulatory changes; (xi)

changes in domestic and global general economic conditions; (xii) risk that Btab may not be able to execute its growth strategies; (xiii)

risk that Btab may not be able to develop and maintain effective internal controls; (xiv) costs related to the Business Combination and

the failure to realize anticipated benefits of the Business Combination or to realize estimated pro forma results and underlying assumptions,

including with respect to estimated shareholder redemptions; (xv) the ability to recognize the anticipated benefits of the proposed Business

Combination and to achieve its commercialization and development plans, and identify and realize additional opportunities, which may be

affected by, among other things, competition, the ability of Btab to grow and manage growth economically and hire and retain key employees;

(xvi) Btab’s limited operating history, its limited financial resources, domestic or global economic conditions, activities of competitors,

and the presence of new or additional competition, and conditions of equity markets; and (xvii) those factors discussed in the Company’s

filings with the SEC and that that will be contained in the proxy statement relating to the proposed Business Combination.

The

foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties

that will be described in the “Risk Factors” section of the preliminary proxy statement and the amendments thereto, the definitive

proxy statement, and other documents to be filed by the Company from time to time with the SEC. These filings identify and address other

important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and while Btab and the Company may elect to update these forward-looking statements at some point in the future, they assume

no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise,

except as required by applicable law. Neither of Btab or the Company gives any assurance that Btab or the Company, or the combined company,

will achieve its expectations.

No Offer or Solicitation

This

Current Report on Form 8-K will not constitute a solicitation of a proxy, consent or authorization with respect to any securities or

in respect of the Business Combination. This Current Report on Form 8-K will also not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor will there be any sale of securities in any states or jurisdictions in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. No offering of securities will be made except by means of a prospectus meeting the requirements of Section 10 of the

Securities Act, or an exemption therefrom.

Item 9.01 Financial

Statements and Exhibits.

| (d) |

Exhibits. The following exhibit is furnished with this Form 8-K: |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Integrated Wellness Acquisition Corp |

|

| |

|

| By: |

/s/ Suren Ajjarapu |

|

| |

Name: Suren Ajjarapu |

|

| |

Title: Chief Executive Officer |

|

Dated: May 31, 2024

Exhibit 99.1

Btab Ecommerce

Group Signs Business Combination Agreement with Integrated Wellness Acquisition Corp.

SYDNEY,

Australia and New York, NY, May 31, 2024 -- Btab Ecommerce Group, Inc., an e-commerce company (OTC: BBTT) (“BBTT” or the

“Company”), and Integrated Wellness Acquisition Corp, a special purpose acquisition company (NYSE: WEL) (“WEL”

or “Integrated Wellness”), today announced that they have entered into a definitive business combination agreement (the "BCA")

providing for a business combination between WEL and BBTT (the "Transaction"). Upon completion of the Transaction, WEL will

be renamed Btab Ecommerce Holdings, Inc and is expected to continue to be listed on NYSE. The Transaction values BBTT at an equity value

of U.S. $250 million.

Transaction

Overview

Under

the terms of the BCA, a wholly owned subsidiary of WEL will merge with and into BBTT, with BBTT surviving the merger and becoming a wholly

owned subsidiary of WEL. WEL will issue 25,000,000 shares of its common stock, with each WEL share valued at $10 per share, to the BBTT

shareholders as merger consideration, in exchange for all of the issued and outstanding shares of BBTT stock. It is currently anticipated

that the transaction will close by the end of the fourth quarter of 2024.

The

description of the transaction contained herein is only a summary and is qualified in its entirety by reference to the definitive BCA

relating to the Transaction, a copy of which will be filed by WEL with the Securities and Exchange Commission (the “SEC”)

as an exhibit to a Current Report on Form 8-K.

Binson

Lau, BBTT’s Chief Executive Officer stated, “We look forward to concluding the closing the transaction as soon as feasible.

The planned business combination with WEL represents a significant milestone

in our growth strategy. This move underscores our commitment to expanding our reach and providing even greater support to small businesses

worldwide from our headquarters in Australia and by establishing an on-presence in key markets including the United States, United Kingdom,

and Asia. In doing so, we aspire to mirror the success stories of global players like Shopify. With the global e-commerce market projected

by some to reach $18.81 trillion by 2029, we aim to capitalize on this growth trajectory, particularly in underserved markets where small

businesses are eager to establish an online presence.”

BBTT’s

unique approach involves a range of services tailored to meet the diverse needs of small business owners. From product supply and sourcing

to marketing and sales platforms, and logistics support, BBTT ensures that entrepreneurs can focus on business growth without being overwhelmed

by the complexities of e-commerce operations.

BBTT’s

diverse platform offerings, including Btab Commerce, SocialSocial.Social, and specialized marketplaces like Marketplace Australia, Aussie

Markets and Chemist Deals, cater to a wide range of potential customers. By integrating social commerce elements, Btab’s hybrid

model combines the best of e-commerce and social networking, offering a unique value proposition to its customers.

Suren

Ajjarapu, Chief Executive Officer of Integrated Wellness, said, “It is gratifying to be working with Mr. Lau to help accelerate

BBTT’s growth strategy. This transaction will create for our WEL investors the opportunity to participate in BBTTs expected growth.

We look forward to working with BBTT to close the business combination agreement.”

WEL

will be preparing a combination registration statement/proxy statement to register the WEL shares to be issued as merger consideration

in the Transaction and to solicit the votes of the WEL shareholders to approve the Transaction, and an information statement to be provided

to the BBTT shareholders.

Advisors

Nelson

Mullins Riley & Scarborough LLP is serving as legal advisor to BBTT.

Ellenoff

Grossman & Schole, LLP is serving as legal advisor to WEL.

About

Btab Ecommerce Group, Inc.

Btab

Ecommerce Group (OTC: BBTT) is an e-commerce company that operates through its network in Australia, Asia, United States and United

Kingdom. It provides affordable ecommerce services and supplies technology and products to small businesses to allow them to compete

in an underserved market segment. The Company seeks to expand its reach into Europe and the Americas where it intends to provide

small businesses with products and services generally not currently commercially available to them. The Company believes the

e-commerce growth in Asia alone will be significant well into the next decade and beyond as increasing numbers of internet users

take advantage of online shopping and increasing spending power.

For

additional information visit https://btabcorp.com

About

Integrated Wellness Acquisition Corp

Integrated

Wellness Acquisition Corp (NYSE: WEL) is a special purpose acquisition company listed on the New York Stock Exchange formed for the purpose

of effecting a merger, share exchange, asset acquisition, share purchase, recapitalization, reorganization, or similar business combination

with one or more businesses. While Integrated Wellness may pursue an acquisition opportunity in any industry or sector, it intends to

focus on businesses in the health, nutrition, fitness, wellness, and beauty sectors and the products, devices, applications, and technology

driving growth within these verticals.

Participants

in the Solicitation

The

Company, WEL and their respective directors, executive officers, other members of management and employees may be deemed participants

in the solicitation of proxies from WEL’s shareholders with respect to the Transaction. Investors and securityholders may obtain

more detailed information regarding the names and interests in the Transaction of WEL’s directors and officers in WEL’s filings

with the SEC, including, when filed with the SEC, the preliminary proxy statement/prospectus and the amendments thereto, the definitive

proxy statement/prospectus, and other documents filed with the SEC, and such information with respect to the Company’s directors

and executive officers will also be included in the proxy statement/prospectus.

Forward-Looking

Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws with respect to the

Transaction between the Company and WEL, including without limitation statements regarding the anticipated benefits of the

Transaction, the anticipated timing of the Transaction, the implied enterprise value, future financial condition and performance of

the Company and the combined company after the closing of the Transaction and expected financial impacts of the Transaction, the

satisfaction of closing conditions to the Transaction, the pre-money valuation of the Company (which is subject to certain inputs

that may change prior to the closing of the Transaction and is subject to adjustment after the closing of the Transaction), the

level of redemptions of WEL’s public shareholders and the products and markets and expected future performance and market

opportunities of the Company. These forward-looking statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,”

“should,” “will,” “would,” “will be,” “will continue,” “will

likely result” and similar expressions, but the absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements are predictions, projections and other statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks and uncertainties.

Many

factors could cause actual future events to differ materially from the forward-looking statements in this press release, including

but not limited to: (i) the risk that the Transaction may not be completed in a timely manner or at all, which may adversely affect

the price of WEL’s securities; (ii) the risk that the Transaction may not be completed by WEL’s business combination

deadline and the potential failure to obtain an extension of the business combination deadline if sought by WEL; (iii) the failure

to satisfy the conditions to the consummation of the Transaction, including the approval of the BCA by the shareholders of WEL; (iv)

the occurrence of any event, change or other circumstance that could give rise to the termination of the BCA; (v) the failure to

achieve the minimum amount of cash available following any redemptions by WEL’s shareholders; (vi) redemptions exceeding a

maximum threshold or the failure to meet the New York Stock Exchange’s initial listing standards in connection with the

consummation of the contemplated Transaction; (vii) the effect of the announcement or pendency of the Transaction on the

Company’s business relationships, operating results, and business generally; (viii) risks that the Transaction disrupts

current plans and operations of the Company; (ix) the outcome of any legal proceedings that may be instituted against the Company or

against WEL related to the BCA or the proposed Transaction; (x) changes in the markets in which the Company competes, including with

respect to its competitive landscape, technology evolution or regulatory changes; (xi) changes in domestic and global general

economic conditions; (xii) risk that the Company may not be able to execute its growth strategies; (xiii) risk that the Company may

not be able to develop and maintain effective internal controls; (xiv) costs related to the Transaction and the failure to realize

anticipated benefits of the Transaction or to realize estimated pro forma results and underlying assumptions, including with respect

to estimated shareholder redemptions; (xv) the ability to recognize the anticipated benefits of the proposed Transaction and to

achieve its commercialization and development plans, and identify and realize additional opportunities, which may be affected by,

among other things, competition, the ability of the Company to grow and manage growth economically and hire and retain key

employees; (xvi) the Company’s limited operating history, its limited financial resources, domestic or global economic

conditions, activities of competitors, and the presence of new or additional competition, and conditions of equity markets; and

(xvii) those factors discussed in WEL’s filings with the SEC and that that will be contained in the proxy statement/prospectus

relating to the proposed Transaction.

The

foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties

that will be described in the “Risk Factors” section of the preliminary proxy statement/prospectus and the amendments thereto,

the definitive proxy statement/prospectus, and other documents to be filed by WEL from time to time with the SEC. These filings identify

and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained

in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and while WEL and the Company may elect to update these forward-looking statements at some

point in the future, they assume no obligation to update or revise these forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable law. Neither of WEL nor the Company gives any assurance that WEL or the

Company, or the combined company, will achieve its expectations.

Media

Contact

Mr.

Binson Lau

Chief

Executive Officer

Btab

Ecommerce Group, Inc.

Email:

info@btabcorp.com

Mr.

Suren Ajjarapu

Chief

Executive Officer

Integrated

Wellness Acquisition Corp

Email:

info@integratedwellnessspac.com

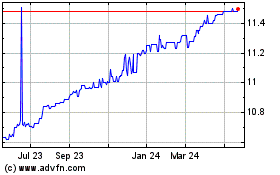

Integrated Wellness Acqu... (NYSE:WEL)

Historical Stock Chart

From May 2024 to Jun 2024

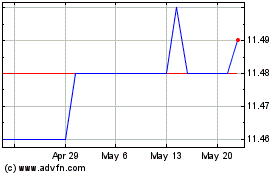

Integrated Wellness Acqu... (NYSE:WEL)

Historical Stock Chart

From Jun 2023 to Jun 2024