0001517767false424B2 0001517767 2023-10-19 2023-10-19 0001517767 ck0001517767:RisksRelatingToAnInvestmentInTheSeriesAPreferredSharesMember 2023-10-19 2023-10-19 0001517767 ck0001517767:RisksRelatedToTheOfferingMember 2023-10-19 2023-10-19 0001517767 ck0001517767:SeriesAPreferredSharesMember 2023-10-19 2023-10-19

pursuant to Rule 424(b)(2)

1933 Act File No. 333-272426

(to Prospectus dated September 29, 2023, as supplemented from time to time)

CARLYLE CREDIT INCOME FUND

8.75% Series A Preferred Shares due 2028

Liquidation Preference $25 per share

Carlyle Credit Income Fund, or the “

,” is a

non-diversified,

closed-end

management investment company that has

registered

as an investment company

under

the Investment Company Act of 1940, as amended, or the “1940 Act.”

Prior to July 27, 2023, the Fund was known as Vertical Capital Income Fund.

. The Fund’s primary investment objective is to generate current income, with a secondary objective to generate capital appreciation.

Principal Investment Strategies

. We seek to achieve our investment objectives by investing primarily in equity and junior debt tranches of collateralized loan obligations, or “

,” that are collateralized by a portfolio consisting primarily of below investment grade U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors. We may also invest in other related securities and instruments or other securities and instruments that our Adviser believes are consistent with our investment objectives, including senior debt tranches of CLOs, loan accumulation facilities, or “

,” and securities issued by other securitization vehicles, such as collateralized bond obligations, or “

.” LAFs are short- to medium-term facilities often provided by the bank that will serve as the placement agent or arranger on a CLO transaction. LAFs typically incur leverage between four and six times equity value prior to a CLO’s pricing. The CLO securities in which we primarily seek to invest are unrated or rated below investment grade and are considered speculative with respect to timely payment of interest and repayment of principal. Unrated and below investment grade securities are also sometimes referred to as “junk” securities. In addition, the CLO equity and junior debt securities in which we invest are highly leveraged (with CLO equity securities typically being leveraged ten times), which magnifies our risk of loss on such investments. See “

Risk Factors — Risks Related to Our Investments — We may leverage our portfolio, which would magnify the potential for gain or loss on amounts invested and will increase the risk of investing in us

” in the accompanying prospectus.

Under normal circumstances, we invest at least 80% of the aggregate of the Fund’s net assets and borrowings for investment purposes in credit and credit-related instruments. For purposes of this policy, the Fund considers credit and credit-related instruments to include, without limitation: (i) equity and debt tranches of CLOs, LAFs and securities issued by other securitization vehicles, such as CBOs; (ii) secured and unsecured floating rate and fixed rate loans; (iii) investments in corporate debt obligations, including bonds, notes, debentures, commercial paper and other obligations of corporations to pay interest and repay principal; (iv) debt issued by governments, their agencies, instrumentalities, and central banks; (v) commercial paper and short-term notes; (vi) convertible debt securities; (vii) certificates of deposit, bankers’ acceptances and time deposits; and (viii) other credit-related instruments. The Fund’s investments in derivatives, other investment companies, and other instruments designed to obtain indirect exposure to credit and credit-related instruments will be counted towards its 80% investment policy to the extent such instruments have similar economic characteristics to the investments included within that policy.

Our 80% policy with respect to investments in credit and credit-related instruments is not fundamental and may be changed by our board of trustees without shareholder approval. Shareholders will be provided with sixty (60) days’ notice in the manner prescribed by the SEC before making any change to this policy.

. Our investment adviser is Carlyle Global Credit Investment Management L.L.C. (“

” or the “

”). CGCIM is registered as an investment adviser with the U.S. Securities and Exchange Commission (the “

”) under the Investment Advisers Act of 1940, as amended (the “

”). CGCIM is a majority-owned subsidiary of Carlyle Investment Management L.L.C. (“

” and together with CGCIM, “

”).

. We are offering 1,200,000 8.75% Series A Preferred Shares due 2028, or the “

Series A Preferred Shares

.” We are required to redeem all the outstanding Series A Preferred Shares on October 31, 2028, at a redemption price of $25 per share, or the “Liquidation Preference,” plus accumulated but unpaid dividends, if any, to, but excluding, the Mandatory Redemption Date (as defined below). At any time on or after October 31, 2025, we may, at our sole option, redeem the outstanding Series A Preferred Shares at a redemption price per share equal to the Liquidation Preference plus accumulated but unpaid dividends, if any, to, but excluding, the Redemption Date. In addition, if we fail to maintain asset coverage (as defined in Section 18(h) of the 1940 Act) of at least 200%, we will be required to redeem the number of our preferred shares (which at our discretion may include any number or portion of the Series A Preferred Shares) that, when combined with any debt securities redeemed for failure to maintain the asset coverage required by the indenture governing such securities (if applicable), (1) results in us having asset coverage of at least 200%, or (2) if fewer, the maximum number of preferred shares that can be redeemed out of funds legally available for such redemption. In connection with any redemption for failure to maintain such asset coverage, we may, in our sole option, redeem such additional number preferred shares that will result in asset coverage up to and including 285%. We intend to pay monthly dividends of the Series A Preferred Shares at an annual rate of 8.75% of the Liquidation Preference, or $2.1875 per share per year, beginning o

n November 30, 2

023. The Series A Preferred Shares will rank senior in right of payment to our common shares, will rank equally in right of payment with any preferred shares we may issue in the future and will be subordinated in right of payment to our existing and future indebtedness. Each holder of the Series A Preferred Shares will be entitled to one vote on each matter submitted to a vote of our shareholders, and the holders of all of our outstanding preferred shares and common shares will generally vote together as a single class. The holders of the Series A Preferred Shares (together with any additional series of preferred shares we may issue in the future) are entitled as a class to elect two of our trustees and, if dividends on any outstanding shares of our preferred shares are in arrears by two years or more, to elect a majority of our trustees (and to continue to be so represented until all dividends in arrears have been paid or otherwise provided for).

We intend to list the Series A Preferred Shares on the New York Stock Exchange (“

”) under the symbol “CCIA” so that trading will begin within 30 days after the date of this prospectus supplement, subject to notice of issuance. Our common shares trade on the NYSE under the symbol “CCIF.” The Series A Preferred Shares have no history of public trading. Even if the Series A Preferred Shares are listed on an exchange as anticipated, such shares may be thinly traded and you may experience losses if you sell on the secondary market under these conditions. We may borrow funds to make investments. As a result, we would be exposed to the risk of borrowing (also known as leverage), which may be considered a speculative investment technique. Leverage increases the volatility of investments and magnifies the potential for loss on amounts invested thereby increasing the risk associated with investing in our Series A Preferred Shares. We determine the net asset value, or “NAV,” per share of our common shares on a monthly basis. The unaudited NAV per share of our common shares on September 30, 2023 (the last date prior to the date of this prospectus supplement as of which we determined our NAV) was $8.42.

Investing in the Series A Preferred Shares involves a high degree of risk, including the risk of a substantial loss of investment. Before purchasing any Series A Preferred Shares, you should read the discussion of the principal risks of investing in the Series A Preferred Shares, which are summarized in “

Risk Factors” beginning on page S-17 of

this

prospectus supplement and page 24 of the accompanying prospectus.

This prospectus supplement, the accompanying prospectus, any free writing prospectus, and the documents incorporated by

reference

in this prospectus supplement and the accompanying prospectus contains important information you should know before investing in our securities. Please read these documents before you invest and retain them for future reference. We file annual and semi-annual shareholder reports, proxy statements and other information with the Securities and Exchange Commission, or the “SEC.” To obtain this information free of charge or make other inquiries pertaining to us, please visit our website (

www.carlylecreditincomefund.com

) or call (866)

277-8243

(toll-free). You may also obtain a copy of any information regarding us filed with the SEC from the SEC’s website (

). Information on our website and the SEC’s website is not incorporated into or a part of this prospectus supplement.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Public offering price |

|

$ |

25.00 |

|

|

$ |

30,000,000 |

|

| Sales load (underwriting discounts and commissions) |

|

$ |

0.75 |

|

|

$ |

900,000 |

|

Proceeds to us (before expenses) (2)(3) |

|

$ |

24.25 |

|

|

$ |

29,100,000 |

|

(1) |

We have granted the underwriters an option to purchase up to an additiona l 180,000 S eries A Preferred Shares at the public offering price, less the sales load payable by us, for 30 days after the date of this prospectus supplement solely to cover overallotments, if any. If the underwriters exercise this option in full, the total sales load paid by us will be $1,035,000, and total proceeds to us, before expenses, will be $33,465,000. |

(2) |

Total offering expenses payable by us, excluding sales load, are estimated to be $300,000. |

(3) |

The proceeds to us before expenses will be reduced b y the $0. 218750 per share distribution on the Series A Preferred Shares to be paid on November 30, 2 023 for any shares issued pursuant to the underwriters’ overallotment option after the November 10, 2023 record date. |

The underwriters expect to deliver the Series A Preferred Shares on or about October 24, 2023.

Joint Book-Running Managers

The date of this prospectus supplement is October 19, 2023

|

|

|

|

|

| |

|

Page |

|

| |

|

|

S-2 |

|

| |

|

|

S-3 |

|

| |

|

|

S-12 |

|

| |

|

|

S-17 |

|

| |

|

|

S-20 |

|

| |

|

|

S-21 |

|

| |

|

|

S-22 |

|

| |

|

|

S-23 |

|

| |

|

|

S-32 |

|

| |

|

|

S-37 |

|

| |

|

|

S-40 |

|

| |

|

|

S-40 |

|

| |

|

|

S-40 |

|

| |

|

|

S-40 |

|

|

|

|

|

|

| |

|

Page |

|

| |

|

|

1 |

|

| |

|

|

18 |

|

| |

|

|

21 |

|

| |

|

|

24 |

|

| |

|

|

69 |

|

| |

|

|

70 |

|

| |

|

|

71 |

|

| |

|

|

81 |

|

| |

|

|

82 |

|

| |

|

|

86 |

|

| |

|

|

95 |

|

| |

|

|

97 |

|

| |

|

|

100 |

|

| |

|

|

101 |

|

| |

|

|

104 |

|

| |

|

|

105 |

|

| |

|

|

106 |

|

| |

|

|

108 |

|

| |

|

|

121 |

|

| |

|

|

123 |

|

| |

|

|

133 |

|

| |

|

|

135 |

|

| |

|

|

137 |

|

| |

|

|

141 |

|

| |

|

|

142 |

|

| |

|

|

144 |

|

| |

|

|

145 |

|

| |

|

|

146 |

|

| |

|

|

147 |

|

S-1

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific details regarding this offering of Series A Preferred Shares and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which provides general information about us and the securities we may offer from time to time, some of which do not apply to this offering. To the extent the information contained in this prospectus supplement differs from the information contained in the accompanying prospectus or the information included in any document filed prior to the date of this prospectus supplement and incorporated by reference in this prospectus supplement and the accompanying prospectus, the information in this prospectus supplement shall control. Generally, when we refer to this “prospectus,” we are referring to both this prospectus supplement and the accompanying prospectus combined, together with any free writing prospectus that we have authorized for use in connection with this offering.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS, INCLUDING THE DOCUMENTS INCORPORATED BY REFERENCE HEREIN AND THEREIN, AND ANY FREE WRITING PROSPECTUS PREPARED BY, OR ON BEHALF OF, US THAT RELATES TO THIS OFFERING OF SERIES A PREFERRED SHARES. WE HAVE NOT, AND THE UNDERWRITERS HAVE NOT, AUTHORIZED ANY OTHER PERSON TO PROVIDE YOU WITH DIFFERENT OR ADDITIONAL INFORMATION. IF ANYONE PROVIDES YOU WITH DIFFERENT OR ADDITIONAL INFORMATION, YOU SHOULD NOT RELY ON IT. WE ARE NOT, AND THE UNDERWRITERS ARE NOT, MAKING AN OFFER TO SELL THE SERIES A PREFERRED SHARES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. YOU SHOULD ASSUME THAT THE INFORMATION APPEARING IN THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS, INCLUDING THE DOCUMENTS INCORPORATED BY REFERENCE HEREIN AND THEREIN, AND ANY FREE WRITING PROSPECTUS PREPARED BY OR ON BEHALF OF US THAT RELATES TO THIS OFFERING IS ACCURATE ONLY AS OF ITS RESPECTIVE DATE, REGARDLESS OF THE TIME OF DELIVERY OF THIS PROSPECTUS SUPPLEMENT, THE ACCOMPANYING PROSPECTUS, ANY FREE WRITING PROSPECTUS OR ANY SALES OF THE SERIES A PREFERRED SHARES. OUR BUSINESS, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND PROSPECTS MAY HAVE CHANGED SINCE THOSE DATES.

S-2

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights some of the information included elsewhere, or incorporated by reference, in this prospectus supplement or the accompanying prospectus. It is not complete and may not contain all the information that you may want to consider before making any investment decision regarding the Series A Preferred Shares offered hereby. To understand the terms of the Series A Preferred Shares offered hereby before making any investment decision, you should read carefully this entire prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein or therein, and any free writing prospectus related to the offering, including “Risk Factors,” “Additional Information,” “Incorporation by Reference,” and “Use of Proceeds” and the financial statements contained elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. Together, these documents describe the specific terms of the Series A Preferred Shares we are offering.

Except where the context suggests otherwise, the terms:

| |

• |

|

” refer to Carlyle Credit Income Fund, a Delaware statutory trust (f/k/a Vertical Capital Income Fund), and is registered under the Investment Company Act of 1940, as amended (the “ ”), as a non-diversified, closed-end management investment company. The Fund was previously named Vertical Capital Income Fund. |

| |

• |

|

” refer to Carlyle Global Credit Investment Management L.L.C., a majority-owned subsidiary of Carlyle Investment Management L.L.C. (“ ”, and together with CGCIM, “ ”), and an SEC-registered investment adviser. |

| |

• |

|

” refers to the profile of expected asset returns across a range of potential macroeconomic scenarios, and does not imply that a particular strategy or investment should be considered low-risk. |

| |

• |

|

Unless otherwise noted, the information contained in this prospectus supplement assumes the underwriters’ overallotment option is not exercised. |

Carlyle Credit Income Fund

The Fund is a

non-diversified,

closed-end

management investment company that has registered as an investment company under 1940 Act. We have elected to be treated, and intend to qualify annually, as a regulated investment company, or “

,” under Subchapter M of the Internal Revenue Code of 1986, as amended, or the “

.”

The Fund’s primary investment objective is to generate current income, with a secondary objective to generate capital appreciation. We seek to achieve our investment objectives by investing primarily in equity and junior debt tranches of collateralized loan obligations, or “

,” that are collateralized by a portfolio consisting primarily of below investment grade U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors. We may also invest in other related securities and instruments or other securities and instruments that the Adviser believes are consistent with our investment objectives, including senior debt tranches of CLOs, loan accumulation facilities, or “

,” and securities issued by other securitization vehicles, such as collateralized bond obligations, or “

.” LAFs are short- to medium-term facilities often provided by the bank that will serve as the placement agent or arranger on a CLO transaction. LAFs typically incur leverage between four and six times equity value prior to a CLO’s pricing. The CLO securities in which we primarily seek to invest are unrated or rated below investment grade and are considered speculative with respect to timely payment of interest and repayment of principal. Unrated and below investment grade securities are also sometimes referred to as “junk” securities. In addition, the CLO equity and junior debt securities in which we invest are highly leveraged (with CLO equity securities typically being leveraged ten times), which magnifies our

S-3

risk of loss on such investments. See “

Risk Factors — Risks Related

to Our Investments — We may leverage our portfolio, which would magnify the potential for gain or loss on amounts invested and will increase the risk of investing in us

” in the accompanying prospectus.

Under normal circumstances, we invest at least 80% of the aggregate of the Fund’s net assets and borrowings for investment purposes in credit and credit-related instruments. For purposes of this policy, the Fund considers credit and credit-related instruments to include, without limitation: (i) equity and debt tranches of CLOs, LAFs and securities issued by other securitization vehicles, such as CBOs; (ii) secured and unsecured floating rate and fixed rate loans; (iii) investments in corporate debt obligations, including bonds, notes, debentures, commercial paper and other obligations of corporations to pay interest and repay principal; (iv) debt issued by governments, their agencies, instrumentalities, and central banks; (v) commercial paper and short-term notes; (vi) convertible debt securities; (vii) certificates of deposit, bankers’ acceptances and time deposits; and (viii) other credit-related instruments. The Fund’s investments in derivatives, other investment companies, and other instruments designed to obtain indirect exposure to credit and credit-related instruments will be counted towards its 80% investment policy to the extent such instruments have similar economic characteristics to the investments included within that policy.

Our 80% policy with respect to investments in credit and credit-related instruments is not fundamental and may be changed by our board of trustees without shareholder approval. Shareholders will be provided with sixty (60) days’ notice in the manner prescribed by the SEC before making any change to this policy. These investment objectives and strategies are not fundamental policies of ours and may be changed by our board of trustees, or the “

,” without prior approval of our shareholders. See “

Regulation as a

Closed-End

Management Investment Company

” in the accompanying prospectus.

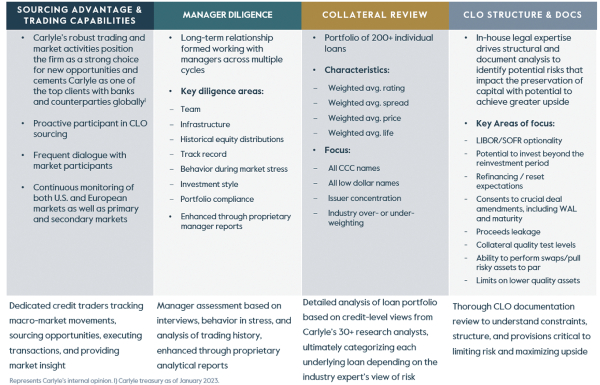

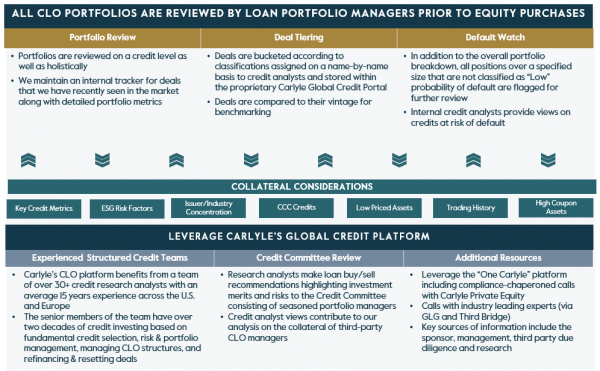

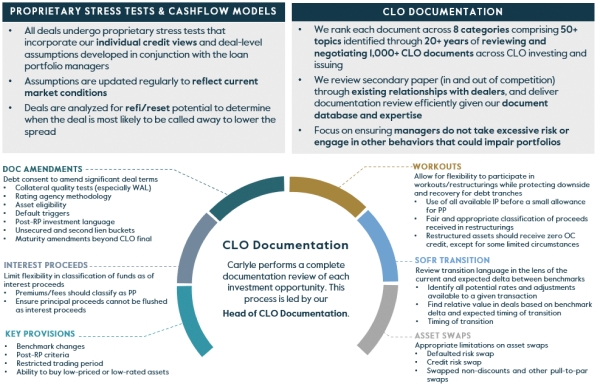

The Adviser pursues a differentiated strategy within the CLO market focused on:

| |

• |

|

proactive sourcing and identification of investment opportunities; |

| |

• |

|

utilization of the Adviser’s methodical investment analysis and due diligence process; |

| |

• |

|

active involvement at the CLO structuring and formation stage; and |

| |

• |

|

taking, in many instances, significant stakes in CLO equity and junior debt tranches. |

In conducting its investment activities, the Fund believes that it will benefit from the significant scale and resources of Carlyle and its affiliates.

The Fund seeks to source opportunities through Carlyle’s extensive global relationships and proprietary network and through the deep infrastructure Carlyle has developed in each of the Fund’s credit strategies, including:

| |

• |

|

Carlyle’s well-established sponsor, bank and lending relationships cultivated over 30+ years, including ~1,000 lending relationships across the firm. |

| |

• |

|

Scale of capital with over $146 billion under management in Carlyle’s Global Credit group and 230+ dedicated credit investment professionals. |

| |

• |

|

A broad network of dealer, investor, and manager relationships that Carlyle has developed during its 20+-year track record managing CLOs. |

| |

• |

|

Integrated efforts with cross-platform sourcing capabilities and referrals from both internal and external Carlyle networks. |

S-4

| |

• |

|

Ability to leverage OneCarlyle platform 1 with nearly 700 origination and underwriting resources and global knowledge base across Global Credit and Private Equity. |

We believe that the Adviser’s (1) direct and often longstanding relationships with CLO collateral managers, CLO primary desks of investment banks, and CLO secondary trading desks of investment banks and broker-dealers, (2) CLO structural expertise and (3) relative scale in the CLO market will enable us to source and execute investments with attractive economics and terms relative to other CLO opportunities.

When we make a significant primary market investment in a particular CLO tranche, we generally expect to be able to influence the CLO’s key terms and conditions. We may acquire a majority position in a CLO tranche directly, or we may benefit from the advantages of a majority position where both we and other accounts managed by the Adviser collectively hold a majority position, subject to any restrictions on our ability to invest alongside such other accounts. See “

” in the accompanying prospectus.

We seek to construct a portfolio of CLO securities that provides varied exposure across a number of key categories, including:

| |

• |

|

number of borrowers underlying each CLO; |

| |

• |

|

industry type of a CLO’s underlying borrowers; |

| |

• |

|

number and investment style of CLO collateral managers; and |

The Adviser has a long-term investment horizon and invests primarily with a

mentality. However, on an ongoing basis, the Adviser actively monitors each investment and may sell positions if circumstances change from the time of investment or if the Adviser believes it is in our best interest to do so.

In accordance with the requirements of the 1940 Act, we have adopted a policy to invest at least 80% of our assets in the particular type of investments suggested by our name. Accordingly, under normal circumstances, we invest at least 80% of the aggregate of its net assets and borrowings for investment purposes in credit and credit-related instruments. For purposes of this policy, the Fund considers credit and credit-related instruments to include, without limitation: (i) equity and debt tranches of CLOs, LAFs and securities issued by other securitization vehicles, such as CBOs; (ii) secured and unsecured floating rate and fixed rate loans; (iii) investments in corporate debt obligations, including bonds, notes, debentures, commercial paper and other obligations of corporations to pay interest and repay principal; (iv) debt issued by governments, their agencies, instrumentalities, and central banks; (v) commercial paper and short-term notes; (vi) convertible debt securities; (vii) certificates of deposit, bankers’ acceptances and time deposits; and (viii) other credit-related instruments. The Fund’s investments in derivatives, other investment companies, and other instruments designed to obtain indirect exposure to credit and credit-related instruments will be counted towards its 80% investment policy to the extent such instruments have similar economic characteristics to the investments included within that policy.

1 |

The OneCarlyle platform consists of Carlyle’s global network of professionals, senior advisors, portfolio company resources, and industry contacts. Within the firm, the platform includes 1,000 Investor Services professionals who are dedicated resources to Carlyle’s asset management business. Additionally, Carlyle’s Global Credit business operates its three business segments, Liquid Credit, Private Credit and Real Assets Credit, in an integrated manner which Carlyle believes provides significant competitive advantages through shared information, resources and investment capabilities. |

S-5

Our 80% policy with respect to investments in credit and credit-related instruments is not fundamental and may be changed by the Board without prior approval of our shareholders. Shareholders will be provided with sixty (60) days’ notice in the manner prescribed by the SEC before making any change to this policy.

Carlyle Global Credit Investment Management L.L.C.

CGCIM serves as the Fund’s investment adviser. CGCIM is registered as an investment adviser with the SEC under the Advisers Act. CGCIM is a majority-owned subsidiary of CIM.

Carlyle is a global investment firm with more than $373 billion of assets under management as of December 31, 2022, across 543 active investment vehicles. The firm also has a large and diversified investor base with more than 2,900 active fund investors located in 88 countries.

Carlyle combines global vision with local insight, relying on a team of nearly 700 investment professionals operating out of 29 offices in 17 countries to uncover superior opportunities in Africa, Asia, Australia, Europe, Latin America, the Middle East and North America.

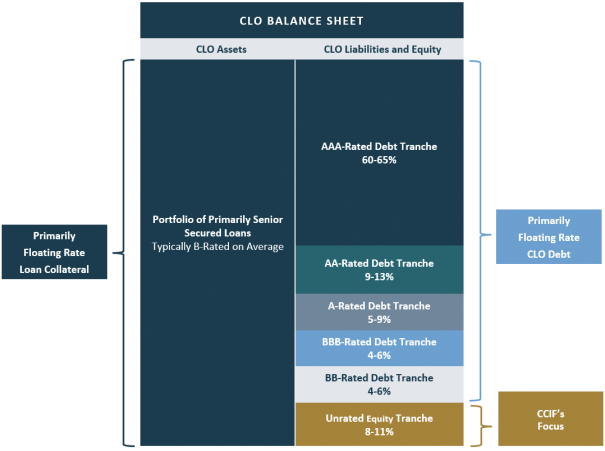

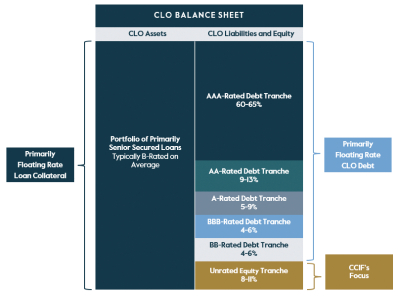

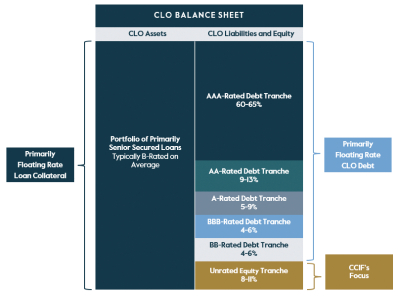

Our investment portfolio will be comprised primarily of investments in the equity and junior debt tranches of CLOs that are collateralized by a portfolio consisting primarily of below investment grade U.S. senior secured loans with a large number of distinct underlying borrowers across various industry sectors. CLOs are generally backed by an asset or a pool of assets that serve as collateral. Most CLOs are issued in multiple tranches, offering investors various maturity and credit risk characteristics, often categorized as senior, mezzanine and subordinated/equity according to their degree of risk. Generally, a CLO’s indenture requires that the maturity dates of a CLO’s assets, typically five to eight years from the date of issuance of a senior secured loan, be shorter than the maturity date of the CLO’s liabilities, typically 12 to 13 years from the date of issuance. If there are defaults or the relevant collateral otherwise underperforms, scheduled payments to senior tranches of such securities take precedence over those of junior tranches which are the focus of our investment strategy, and scheduled payments to junior tranches have a priority in right of payment to subordinated/equity tranches. While the vast majority of the portfolio of most CLOs consists of senior secured loans, many CLOs enable the CLO collateral manager to invest up to 10% of the portfolio in assets that are not first lien senior secured loans, including second lien loans, unsecured loans, senior secured bonds and senior unsecured bonds.

CLOs are generally required to hold a portfolio of assets that is highly diversified by underlying borrower and industry and that is subject to a variety of asset concentration limitations. Most CLOs are

non-static,

revolving structures that generally allow for reinvestment over a specific period of time (the “

”) which is typically up to five years. The terms and covenants of a typical CLO structure are, with certain exceptions, based primarily on the cash flow generated by, and the par value (as opposed to the market price or fair value) of, the collateral. These covenants include collateral coverage tests, interest coverage tests and collateral quality tests.

A CLO funds the purchase of a portfolio of primarily senior secured loans via the issuance of CLO equity and debt securities, typically in the form of multiple, primarily floating rate, debt tranches. The CLO debt tranches typically are rated “AAA” (or its equivalent) at the most senior level down to “BB” or “B” (or its equivalent), which is below investment grade, at the junior level by Moody’s Investors Service, Inc., or “

,” S&P Global Ratings, or “

,” and/or Fitch Ratings, Inc., or “

.” The interest rate on the CLO debt tranches is the lowest at the

AAA-level

and generally increases at each level down the rating scale. The CLO equity tranche is unrated and typically represents approximately 8% to 11% of a CLO’s capital structure. Below investment grade and unrated securities are sometimes referred to as “junk” securities. The diagram below

S-6

is for illustrative purposes only and highlights a hypothetical structure intended to depict a typical CLO. A minority of CLOs also include a

B-rated

debt tranche (in which we may invest), and the structure of CLOs in which we invest may otherwise vary from this example. The left column represents the CLO’s assets, which support the liabilities and equity in the right column. The right column shows the various classes of debt and equity issued by the hypothetical CLO in order of seniority as to rights in payments from the assets. The percentage ranges appearing below the rating of each class represents the percent such class comprises of the overall “capital stack” (i.e., total debt and equity issued by the CLO).

CLOs have two

schedules (commonly called “waterfalls”), which are detailed in a CLO’s indenture and govern how cash generated from a CLO’s underlying collateral is distributed to the CLO’s equity and debt investors. The interest waterfall applies to interest payments received on a CLO’s underlying collateral.

The principal waterfall applies to cash generated from principal on the underlying collateral, primarily through loan repayments and the proceeds from loan sales. Through the interest waterfall, any excess interest-related cash flow available after the required quarterly interest payments to CLO debt investors are made and certain CLO expenses (such as administration and collateral management fees) are paid is then distributed to the CLO’s equity investors each quarter, subject to compliance with certain tests.

A CLO’s indenture typically requires that the maturity dates of a CLO’s assets, typically five to eight years from the date of issuance of a senior secured loan, be shorter than the maturity date of the CLO’s liabilities, typically 12 to 13 years from the date of issuance. However, CLO investors do face reinvestment risk with

S-7

respect to a CLO’s underlying portfolio. In addition, in most CLO transactions, CLO debt investors are subject to prepayment risk in that the holders of a majority of the equity tranche can direct a call or refinancing of a CLO, which would cause the CLO’s outstanding CLO debt securities to be repaid at par. See “

Risk Factors — Risks Related to Our Investments — We and our investments are subject to reinvestment risk

” in the accompanying prospectus.

Below is a summary of the Fund’s unaudited schedule of investments as of August 31, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carlyle Credit Income Fund As of August 31, 2023 (expressed in U.S. Dollars) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

522 Funding CLO 2021-7, Ltd. |

|

Subordinate Notes (Estimated yield 19.36%,4/23/2034) |

|

|

7/27/2023 |

|

|

$ |

4,505,000 |

|

|

$ |

2,883,200 |

|

|

$ |

2,910,322 |

|

|

|

3.29 |

% |

| Aimco CLO 14, Ltd. |

|

Subordinate Notes (Estimated yield 15.92%,4/20/2034) |

|

|

7/17/2023 |

|

|

|

5,850,000 |

|

|

|

4,434,946 |

|

|

|

4,530,643 |

|

|

|

5.12 |

% |

| Ares LVI CLO, Ltd. |

|

Subordinate Notes (Estimated yield 18.42%,10/25/2034) |

|

|

8/24/2023 |

|

|

|

3,900,000 |

|

|

|

2,710,500 |

|

|

|

2,753,263 |

|

|

|

3.11 |

% |

Bain Capital Credit CLO 2021-1, Ltd. |

|

Subordinate Notes (Estimated yield 23.03%,4/18/2034) |

|

|

7/17/2023 |

|

|

|

4,150,000 |

|

|

|

2,511,497 |

|

|

|

2,559,766 |

|

|

|

2.89 |

% |

| Ballyrock CLO 15, Ltd. |

|

Subordinate Notes (Estimated yield 15.70,4/15/2034) |

|

|

8/16/2023 |

|

|

|

5,000,000 |

|

|

|

3,731,250 |

|

|

|

3,718,468 |

|

|

|

4.20 |

% |

| Ballyrock CLO 18, Ltd. |

|

Subordinate Notes (Estimated yield 15.63%,1/15/2035) |

|

|

8/16/2023 |

|

|

|

2,500,000 |

|

|

|

1,921,875 |

|

|

|

1,924,009 |

|

|

|

2.17 |

% |

| |

|

Subordinate Notes (Estimated yield 19.58%,4/25/2034) |

|

|

7/19/2023 |

|

|

|

3,400,000 |

|

|

|

2,235,830 |

|

|

|

2,299,001 |

|

|

|

2.60 |

% |

| Benefit Street Partners CLO XXIII, Ltd. |

|

Subordinate Notes (Estimated yield 19.50%,4/25/2034) |

|

|

8/2/2023 |

|

|

|

10,000,000 |

|

|

|

7,625,000 |

|

|

|

7,749,394 |

|

|

|

8.75 |

% |

| BlueMountain CLO XXXV, Ltd. |

|

Subordinate Notes (Estimated yield 17.28%,7/22/2035) |

|

|

8/7/2023 |

|

|

|

7,800,295 |

|

|

|

5,990,978 |

|

|

|

5,993,127 |

|

|

|

6.77 |

% |

| Elmwood CLO 16, Ltd. |

|

Subordinate Notes (Estimated yield 14.70%,4/20/2034) |

|

|

8/10/2023 |

|

|

|

6,000,000 |

|

|

|

5,197,500 |

|

|

|

5,298,104 |

|

|

|

5.99 |

% |

| Elmwood CLO VI, Ltd. |

|

Subordinate Notes (Estimated yield 14.83%,10/20/2034) |

|

|

7/17/2023 |

|

|

|

2,000,000 |

|

|

|

1,483,518 |

|

|

|

1,584,700 |

|

|

|

1.79 |

% |

| Elmwood CLO VII, Ltd. |

|

Subordinate Notes (Estimated yield 16.16%,1/17/2034) |

|

|

7/17/2023 |

|

|

|

2,000,000 |

|

|

|

1,478,631 |

|

|

|

1,577,649 |

|

|

|

1.78 |

% |

| Madison Park Funding LXII, Ltd. |

|

Subordinate Notes (Estimated yield 19.69%,7/17/2036) |

|

|

7/25/2023 |

|

|

|

12,000,000 |

|

|

|

8,803,200 |

|

|

|

8,992,137 |

|

|

|

10.16 |

% |

| Neuberger Berman Loan Advisers CLO 38, Ltd. |

|

Subordinate Notes (Estimated yield 19.01%,10/20/2035) |

|

|

8/1/2023 |

|

|

|

9,500,000 |

|

|

|

6,056,250 |

|

|

|

6,156,464 |

|

|

|

6.95 |

% |

| Octagon 55, Ltd. |

|

Subordinate Notes (Estimated yield 21.07%,7/20/2034) |

|

|

7/19/2023 |

|

|

|

8,500,000 |

|

|

|

5,028,175 |

|

|

|

5,097,220 |

|

|

|

5.76 |

% |

| OHA Credit Partners XIII, Ltd. |

|

Subordinate Notes (Estimated yield 18.56%,10/21/2034) |

|

|

7/17/2023 |

|

|

|

2,950,000 |

|

|

|

1,707,814 |

|

|

|

2,022,849 |

|

|

|

2.29 |

% |

| |

|

Subordinate Notes (Estimated yield 21.12%,7/19/2034) |

|

|

8/2/2023 |

|

|

|

5,500,000 |

|

|

|

4,578,750 |

|

|

|

4,685,140 |

|

|

|

5.29 |

% |

| |

|

Subordinate Notes (Estimated yield 19.77%,10/20/2034) |

|

|

8/3/2023 |

|

|

|

4,000,000 |

|

|

|

3,130,000 |

|

|

|

3,131,221 |

|

|

|

3.54 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

$ |

71,508,914 |

|

|

$ |

72,983,477 |

|

|

|

82.45 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S-8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

CLO-Subordinated Fee Note |

|

|

|

|

|

|

|

|

|

| Neuberger Berman Loan Advisers CLO 38, Ltd. |

|

SBPF (Estimated yield 21.70%,10/20/2035) |

|

|

8/1/2023 |

|

|

|

69,788 |

|

|

|

55,837 |

|

|

|

55,464 |

|

|

|

0.06 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

$ |

55,837 |

|

|

$ |

55,464 |

|

|

|

0.06 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Loan ID: 202022 |

|

— |

|

|

— |

|

|

|

— |

|

|

$ |

4,000,000 |

|

|

$ |

2,000,000 |

|

|

|

2.26 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

$ |

4,000,000 |

|

|

$ |

2,000,000 |

|

|

|

2.26 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| US BANK MMDA |

|

|

|

|

|

|

|

$ |

9,184,190 |

|

|

$ |

9,184,190 |

|

|

$ |

9,184,190 |

|

|

|

10.38 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments- 95.15% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Cost $84,752,820) |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

84,223,131 |

|

|

|

|

|

| |

|

|

|

|

| Other Assets in Excess of Liabilities - 4.85% |

|

|

|

|

|

|

|

|

|

|

|

4,293,827 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets as of August 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

88,516,958 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing and Hedging Strategy

. Subject to prevailing market conditions, the Fund may add financial leverage if, immediately after such borrowing, it would have asset coverage (as defined in the 1940 Act) of 300% or more (for leverage obtained through debt) or 200% or more (for leverage obtained through preferred shares). For example, if the Fund has $100 in Net Assets (as defined below), it may utilize leverage through obtaining debt of up to $50, resulting in $150 in total assets (or 300% asset coverage). In addition, if the Fund has $100 in Net Assets, it may issue $100 in preferred shares, resulting in $200 in total assets (or 200% asset coverage). “

” means the total assets of the Fund minus the Fund’s liabilities. The Fund may use leverage opportunistically and may choose to increase or decrease its leverage, or use different types or combinations of leveraging instruments, at any time based on the Fund’s assessment of market conditions and the investment environment. Over the long term, we expect to operate under normal market conditions generally with leverage within a range of 25% to 40% of total assets, although the actual amount of our leverage will vary over time. Certain instruments that create leverage are considered to be senior securities under the 1940 Act.

In the event we fail to meet our applicable asset coverage ratio requirements, we may not be able to incur additional debt and/or issue preferred shares, and could be required by law or otherwise to sell a portion of our investments to repay some debt or redeem preferred shares (if any) when it is disadvantageous to do so, which could have a material adverse effect on our operations, and we may not be able to make certain distributions or pay dividends of an amount necessary to continue to qualify for treatment as a RIC for U.S. federal income tax purposes.

We expect that we will, or that we may need to, raise additional capital in the future to fund our continued growth, and we may do so by entering into a credit facility, issuing preferred shares or debt securities or through other leveraging instruments. Subject to the limitations under the 1940 Act, we may incur additional leverage

S-9

opportunistically and may choose to increase or decrease our leverage. In addition, we may borrow for temporary, emergency or other purposes as permitted under the 1940 Act, which indebtedness would be in addition to the asset coverage requirements described above. By leveraging our investment portfolio, we may create an opportunity for increased net income and capital appreciation. However, the use of leverage also involves significant risks and expenses, which will be borne entirely by our shareholders, and our leverage strategy may not be successful. For example, the more leverage is employed, the more likely a substantial change will occur in our NAV. Accordingly, any event that adversely affects the value of an investment would be magnified to the extent leverage is utilized. See “

Risk Factors — Risks Related to Our Investments — We may leverage our portfolio, which would magnify the potential for gain or loss on amounts invested and will increase the risk of investing in us

” in the accompanying prospectus.

. We may engage in “

,” as described below, from time to time. To the extent we engage in Derivative Transactions, we expect to do so to hedge against interest rate, credit, currency and/or other risks, or for other investment or risk management purposes. We may use Derivative Transactions for investment purposes to the extent consistent with our investment objectives if the Adviser deems it appropriate to do so. We may purchase and sell a variety of derivative instruments, including exchange-listed and

or “OTC,” options, futures, options on futures, swaps and similar instruments, various interest rate transactions, such as swaps, caps, floors or collars, and credit transactions and credit default swaps. We also may purchase and sell derivative instruments that combine features of these instruments. Collectively, we refer to these financial management techniques as “Derivative Transactions.” Our use of Derivative Transactions, if any, will generally be deemed to create leverage for us and involves significant risks. No assurance can be given that our strategy and use of derivatives will be successful, and our investment performance could diminish compared with what it would have been if Derivative Transactions were not used. See “

Risk Factors — Risks Related to Our Investments — We are subject to risks associated with any hedging or Derivative Transactions in which we participate

” in the accompanying prospectus.

Temporary Defensive Position

. We may take a temporary defensive position and invest all or a substantial portion of our total assets in cash or cash equivalents, government securities or short-term fixed income securities during periods in which we believe that adverse market, economic, political or other conditions make it advisable to maintain a temporary defensive position. As the CLOs and LAFs in which we invest are generally illiquid in nature, we may not be able to dispose of such investments and take a defensive position. To the extent that we invest defensively, we likely will not achieve our investment objectives.

Operating and Regulatory Structure

We are a

non-diversified

closed-end

management investment company that has registered as an investment company under the 1940 Act. As a registered

closed-end

management investment company, we are required to meet certain regulatory tests. See “

Regulation as a

Closed-End

Management Investment Company

” in the accompanying prospectus. In addition, we have elected to be treated, and intend to qualify annually, as a RIC under Subchapter M of the Code.

Tender Offer and New Issuance

On January 12, 2023, the Fund entered into a definitive agreement (the “

”) with the Adviser pursuant to which, among other things, CGCIM would become the investment adviser to the Fund (the “

”). See “

Prospectus Summary—Carlyle Credit Income Fund

” in the accompanying prospectus for a description of the Transaction and the Transaction Agreement.

S-10

Following the closing of the Transaction and pursuant to the Transaction Agreement, (i) CG Subsidiary Holdings L.L.C., an affiliate of the Adviser (the “

”) commenced a tender offer on July 18, 2023 to purchase up to $25,000,000 of outstanding Fund common shares at the then-current net asset value per common share (the “

”), and (ii) following the close of the Tender Offer, the Purchaser will invest $15,000,000 into the Fund through the purchase of newly issued Fund common shares at a price equal to the greater of the then-current net asset value per common share and the net asset value per common share that represents the tender offer purchase price (the “

”), and through acquiring common shares in private purchases (the “

”).

The Tender Offer expired on August 28, 2023, and the Purchaser accepted for purchase 3,012,049 common shares at a purchase price of $8.30 per common share for an aggregate purchase price of $25,000,006.70, excluding fees and expenses relating to the Tender Offer.

On September 12, 2023, the Fund closed the New Issuance and issued and sold 1,269,537 common shares to the Purchaser at a purchase price of $8.52 per common share, which price represented the net asset value per common share as of the closing of the New Issuance, for an aggregate purchase price of $10,816,451.40.

On September 12, 2023, the Purchaser closed the Private Purchase and acquired 504,042 common shares from existing shareholders of the Fund at a purchase price of $8.30 per common share, for an aggregate purchase price of $4,183,548.60.

On September 12, 2023, the Fund declared a monthly dividend for the Fund’s common shares of $0.0994 per share for each of September, October, and November 2023. The dividends are payable on September 29, 2023, October 31, 2023, and November 30, 2023, respectively, to shareholders of record as of September 22, 2023, October 19, 2023, and November 17, 2023, respectively. The monthly dividend represents an annualized yield of 14.0% based on $8.52 net asset value as of August 31, 2023.

On October 4, 2023, the Fund entered into an equity distribution agreement by and among the Fund, CGCIM, Ladenburg Thalmann & Co. Inc., B. Riley Securities, Inc. and Oppenheimer & Co. Inc., in connection with an

offering of up to $75.0 million of common shares of the Fund.

Our Corporate Information

The principal office of the Fund is located at One Vanderbilt Avenue, Suite 3400, New York, NY 10017 and its telephone number is (866)

277-8243.

S-11

| |

Carlyle Credit Income Fund |

| |

1,200,000 shares of Series A Preferred Shares. An additional 180,000 shares of Series A Preferred Shares will be issuable pursuant to an overallotment option granted to the underwriters. |

| |

We intend to use the net proceeds from the sale of the shares of Series A Preferred Shares to acquire investments in accordance with our investment objectives and strategies described in this prospectus supplement and in the accompanying prospectus, to make distributions to our shareholders and for general working capital purposes. See “” in this prospectus supplement. |

| |

We intend to list the Series A Preferred Shares on the NYSE under the symbol “CCIA.” Trading in Series A Preferred Shares on the NYSE is expected to begin within 30 days after the date of this prospectus supplement. Prior to the expected commencement of trading, the underwriters may, but are not obligated, to make a market in Series A Preferred Shares. |

| |

In the event of a liquidation, dissolution or winding up of our affairs, holders of Series A Preferred Shares will be entitled to receive a liquidation distribution equal to the Liquidation Preference of $25 per share, plus an amount equal to accumulated but unpaid dividends, if any, on such shares (whether or not earned or declared, but excluding interest on such dividends) to, but excluding, the date fixed for such redemption. |

| |

We intend to pay monthly dividends on the Series A Preferred Shares at a fixed annual rate of 8.75% of the Liquidation Preference ($2.1875 per share per year), or the “Dividend Rate.” Our board of trustees may determine not to pay, or may be precluded from paying, such dividends if our board of trustees believes it is not in the best interest of our shareholders or if we fail to maintain the asset coverage required by the 1940 Act. If we fail to redeem the Series A Preferred Shares as required on the Mandatory Redemption Date or fail to pay any dividend on the payment date for such dividend, the Dividend Rate will increase by 2% per annum until we redeem the Series A Preferred Shares or pay the dividend, as applicable. See “ - Dividends -Adjustment to Fixed Dividend Rate - Default Period |

|

Cumulative cash dividends on each share of Series A Preferred Shares will be payable monthly, when, as and if declared, or under authority granted, by our board of trustees out of funds legally available for such payment. The first period for which dividends on |

S-12

| |

the shares of Series A Preferred Shares offered pursuant to this prospectus supplement will be calculated (each such period, a “ ”) will commence upon the closing of the offering, or the “Date of Original Issue,” and will end on, but exclude, November 30, 2023. Only holders of Series A Preferred Shares on the record date for a Dividend Period (as defined below) will be entitled to receive dividends and distributions payable with respect to such Dividend Period, and holders of Series A Preferred Shares who sell shares before such a record date and purchasers of Series A Preferred Shares who purchase shares after such a record date should take the effect of the foregoing provisions into account in evaluating the price to be received or paid for such Series A Preferred Shares. See “ Our Series A Preferred Shares - Dividends - Dividend Periods ” in this prospectus supplement. |

| |

The Series A Preferred Shares will rank: |

| |

• |

|

senior to our common shares in priority of payment of dividends and as to the distribution of assets upon dissolution, liquidation or the winding-up of our affairs; |

| |

• |

|

equal in priority with all other series of preferred shares we may issue in the future as to priority of payment of dividends and as to distributions of assets upon dissolution, liquidation or the winding-up of our affairs; and |

| |

• |

|

subordinate in right of payment to the holders of our existing and future indebtedness. |

|

Subject to the asset coverage requirements of the 1940 Act, we may issue additional series of preferred shares (or additional Series A Preferred Shares), but we may not issue additional classes of shares that rank senior or junior to the Series A Preferred Shares as to priority of payment of dividends or as to the distribution of assets upon dissolution, liquidation or winding-up of our affairs. |

Mandatory Term Redemption |

We are required to redeem all outstanding shares of the Series A Preferred Shares on October 31, 2028, or the “Mandatory Redemption Date,” at a redemption price equal to the Liquidation Preference plus an amount equal to accumulated but unpaid dividends, if any, on such shares (whether or not earned or declared, but excluding interest on such dividends) to, but excluding, the Mandatory Redemption Date. See “Series A Preferred Shares |

|

We cannot effect any modification of or repeal our obligation to redeem the Series A Preferred Shares on the Mandatory Redemption Date without the prior unanimous approval of the holders of the Series A Preferred Shares. |

| |

We may use leverage as and to the extent permitted by the 1940 Act. We are permitted to obtain leverage using any form of financial |

S-13

| |

leverage instruments, including funds borrowed from banks or other financial institutions, margin facilities, notes or preferred shares and leverage attributable to reverse repurchase agreements or similar transactions. See “ Prospectus Supplement Summary Financing and Hedging Strategy ” in this prospectus supplement. We expect that we will, or that we may need to, raise additional capital in the future to fund our continued growth, and we may do so by entering into a credit facility, issuing additional preferred shares or debt securities or through other leveraging instruments. |

| |

Certain instruments that create leverage are considered to be senior securities under the 1940 Act. With respect to senior securities that are stocks (i.e., shares of preferred stock, including the Series A Term Preferred Stock), we are required to have an asset coverage of at least 200%, as measured at the time of the issuance of any such shares of preferred stock and calculated as the ratio of our total assets (less all liabilities and indebtedness not represented by senior securities) over the aggregate amount of our outstanding senior securities representing indebtedness plus the aggregate liquidation preference of any outstanding shares of preferred stock. |

|

With respect to senior securities representing indebtedness (i.e., borrowing or deemed borrowing), other than temporary borrowings as defined under the 1940 Act, we are required to have an asset coverage of at least 300%, as measured at the time of borrowing and calculated as the ratio of our total assets (less all liabilities and indebtedness not represented by senior securities) over the aggregate amount of our outstanding senior securities representing indebtedness. |

Mandatory Redemption for Asset Coverage |

If we fail to maintain asset coverage (as defined in Section 18(h) of the 1940 Act) of at least 200% as of the close of business on the last business day of any calendar quarter and such failure is not cured by the close of business on the date that is 30 calendar days following the filing date of our Annual Report on Form N-CSR, Semiannual Report on Form N-CSRS or Reports on Form N-PORT, as applicable, for that quarter, or the “Asset Coverage Cure Date,” then we will be required to redeem, within 90 calendar days of the Asset Coverage Cure Date, the number of our preferred shares (which at our discretion may include any number or portion of the Series A Preferred Shares), that, when combined with any debt securities redeemed for failure to maintain the asset coverage required by the indenture governing such securities (if applicable), (1) results in us having asset coverage of at least 200%, or (2) if fewer, the maximum number of preferred shares that can be redeemed out of funds legally available for such redemption. In connection with any redemption for failure to maintain such asset coverage, we may, in our sole option, redeem such additional number of preferred shares that will result in asset coverage up to and including 285%. |

S-14

|

If Series A Preferred Shares are to be redeemed for failure to maintain asset coverage of at least 200%, such shares will be redeemed at a redemption price equal to the Liquidation Preference plus accumulated but unpaid dividends, if any, on such shares (whether or not declared, but excluding interest on accumulated but unpaid dividends, if any) to, but excluding, the date fixed for such redemption. See “Description of Our Series A Preferred Shares — Redemption — Redemption for Failure to Maintain Asset Coverage |

| |

At any time on or after October 31, 2025, we may, in our sole option, redeem the outstanding Series A Preferred Shares in whole or, from time to time, in part, out of funds legally available for such redemption, at the Liquidation Preference plus an amount equal to accumulated but unpaid dividends, if any, on such shares (whether or not earned or declared, but excluding interest on such dividends) to, but excluding, the date fixed for such redemption. See “Description of Our Series A Preferred Shares — Redemption — Optional Redemption |

| |

Except as otherwise provided in our Supplement to the Amended and Restated Declaration of Trust (the “”) or as otherwise required by law, (1) each holder of Series A Preferred Shares will be entitled to one vote for each share of Series A Preferred Shares held on each matter submitted to a vote of our shareholders and (2) the holders of all outstanding preferred shares, including the Series A Preferred Shares, and common shares will vote together as a single class; provided that holders of preferred shares (including the Series A Preferred Shares) voting separately as a class, will be entitled to elect two (2) of our trustees, or the “Preferred Trustees,” and, if we fail to pay dividends on any outstanding preferred shares, including the Series A Preferred Shares, in an amount equal to two (2) full years of dividends, and continuing until such failure is cured, will be entitled to elect a majority of our trustees. One of the Preferred Trustees will be up for election in 2024 and the other Preferred Trustee will be up for election in 2025. |

|

Holders of shares of the Series A Preferred Shares will also vote separately as a class on any matter that materially and adversely affects any preference, right or power of holders of the Series A Preferred Shares. |

|

See “Description of Our Series A Preferred Shares — Voting Rights” |

| |

The Series A Preferred Shares have no conversion rights. |

Redemption and Paying Agent |

We intend to enter into an amendment to our Transfer Agency Agreement with Equiniti Trust Company, LLC, or the “Redemption and Paying Agent.” Under this amendment, the Redemption and |

S-15

| |

Paying Agent will serve as transfer agent and registrar, dividend disbursing agent and redemption and paying agent with respect to the Series A Preferred Shares. |

U.S. Federal Income Taxes |

We have elected to be treated, and intend to qualify annually, as a RIC under Subchapter M of the Code. Prospective investors are urged to consult their own tax advisors regarding the tax implications associated with acquiring holding and disposing of an investment in the Series A Preferred Shares in light of their personal investment circumstances. |

| |

Investing in the Series A Preferred Shares involves risks. You should carefully consider the information set forth under the caption “” in this prospectus supplement and the accompanying prospectus before deciding to invest in the Series A Preferred Shares. |

| |

We have filed with the SEC a registration statement on Form N-2 under the Securities Act, which contains additional information about us and the Series A Preferred Shares being offered by this prospectus supplement and the accompanying prospectus. We file annual and semi-annual reports, proxy statements and other information with the SEC. Our SEC filings are also available to the public at the SEC’s website at www.sec.gov. This information is also available free of charge by writing us at Carlyle Credit Income Fund., One Vanderbilt Avenue, Suite 3400, New York, NY 10017, by telephone at (866) 277-8243, or on our website at www.carlylecreditincomefund.com. |

S-16

Investing in the Series A Preferred Shares involves a number of significant risks. In addition to the risks described below and in “

” in the accompanying prospectus, you should carefully consider all other information contained in this prospectus supplement, the accompanying prospectus, any free writing prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus before making a decision to purchase the Series A Preferred Shares. The risks and uncertainties described below and in the accompanying prospectus are not the only ones facing us. Additional risks and uncertainties not presently known to us, or not presently deemed material by us, may also impair our operations and performance.

If any of the following risks actually occur, our business, financial condition or results of operations could be materially adversely affected. If that happens, our net asset value and the trading price of the Series A Preferred Shares could decline and you may lose all or part of your investment.

The risks described below specifically relate to this offering. Please see the “Risk Factors” section of the accompanying prospectus for additional risks of investing in the Series A Preferred Shares.

Risks Relating to an Investment in the Series A Preferred Shares

Prior to this offering, there has been no public market for the Series A Preferred Shares, and we cannot assure you that the market price of the Series A Preferred Shares will not decline following the offering.

We intend to list the Series A Preferred Shares on the NYSE so that trading on the exchange will begin within 30 days from the date of this prospectus supplement, subject to notice of issuance. During a period of up to 30 days from the date of this prospectus supplement, the Series A Preferred Shares will not be listed on any securities exchange. Prior to the expected commencement of trading, the underwriters may, but are not obligated to, make a market in the Series A Preferred Shares. Consequently, an investment in the Series A Preferred Shares during this period will be illiquid, and the holders may not be able to sell such securities. If a secondary market does develop during this period, holders of the Series A Preferred Shares may be able to sell such shares only at substantial discounts from Liquidation Preference.

If we are unable to list the Series A Preferred Shares on a national securities exchange, the holders of such securities may be unable to sell them at all, or if they are able to, only at substantial discounts from the Liquidation Preference. Even if the Series A Preferred Shares are listed on the NYSE as anticipated, there is a risk that the market for such shares may be thinly traded and relatively illiquid compared to the market for other types of securities, with the spread between the bid and asked prices considerably greater than the spreads of other securities with comparable terms and features.

A downgrade, suspension or withdrawal of the credit rating assigned by a rating agency to us or the Series A Preferred Shares, if any, or change in the debt markets could cause the liquidity or market value of the Series A Preferred Shares to decline significantly.

Any credit rating is an assessment by rating agencies of our ability to pay our debts when due. Consequently, real or anticipated changes in any credit ratings will generally affect the market value of the Series A Preferred Shares. These credit ratings may not reflect the potential impact of risks relating to the structure or marketing of the Series A Preferred Shares. Credit ratings are not a recommendation to buy, sell or hold any security, and may be revised or withdrawn at any time by the issuing organization in its sole discretion. Neither we nor any underwriter undertakes any obligation to obtain or maintain any credit ratings or to advise holders of Series A Preferred Shares of any changes in any credit ratings. There can be no assurance that any credit ratings will remain for any given period of time or that such credit ratings will not be lowered or withdrawn entirely by the rating agencies if in their judgment future circumstances relating to the basis of the credit ratings, such as adverse changes in our Fund, so warrant. The conditions of the financial markets and prevailing interest rates have fluctuated in the past and are likely to fluctuate in the future, which could have an adverse effect on the market prices of the Series A Preferred Shares.

S-17

The Series A Preferred Shares is subject to a risk of early redemption and holders may not be able to reinvest their funds.

We may voluntarily redeem some or all of the outstanding shares of Series A Preferred Shares on or after October 31, 2025. We also may be forced to redeem some or all of the outstanding shares of Series A Preferred Shares to meet regulatory requirements and the asset coverage requirements of such shares. Any such redemption may occur at a time that is unfavorable to holders of the Series A Preferred Shares. We may have an incentive to redeem the Series A Preferred Shares voluntarily before the Mandatory Redemption Date if market conditions allow us to issue other preferred shares or debt securities at a rate that is lower than the Dividend Rate on the Series A Preferred Shares. See “

Description of Our Series A Preferred Shares

” in this prospectus supplement. If we redeem shares of the Series A Preferred Shares before the Mandatory Redemption Date, the holders of such redeemed shares face the risk that the return on an investment purchased with proceeds from such redemption may be lower than the return previously obtained from the investment in Series A Preferred Shares.

Holders of the Series Preferred A Shares bear dividend risk.

We may be unable to pay dividends on the Series A Preferred Shares under some circumstances. The terms of any future indebtedness we may incur could preclude the payment of dividends in respect of equity securities, including our preferred stock, under certain conditions.

There is a risk of delay in our redemption of the Series A Preferred Shares, and we may fail to redeem such securities as required by their terms.

We generally make investments in CLO vehicles whose securities are not traded in any public market. Substantially all of the CLO investments we presently hold and the CLO investments we expect to acquire in the future are, and will be, subject to legal and other restrictions on resale and will otherwise be less liquid than publicly traded securities. The illiquidity of our investments may make it difficult for us to obtain cash equal to the value at which we record our investments quickly if a need arises. If we are unable to obtain sufficient liquidity prior to the Mandatory Redemption Date, we may be forced to engage in a partial redemption or to delay a required redemption. If such a partial redemption or delay were to occur, the market price of shares of our preferred stock might be adversely affected.

A liquid secondary trading market may not develop for the Series A Preferred Shares.

Although we have applied to list the Series A Preferred Shares on the NYSE, we cannot predict the trading patterns of the Series A Preferred Shares, and a liquid secondary market may not develop. Holders of the Series A Preferred Shares may be able to sell such shares only at substantial discounts from the Liquidation Preference. There is a risk that the Series A Preferred Shares may be thinly traded, and the market for such shares may be relatively illiquid compared to the market for other types of securities, with the spread between the bid and asked prices considerably greater than the spreads of other securities with comparable terms and features.

Risks Related to the Offering

Management will have broad discretion as to the use of the proceeds, if any, from this offering and may not use the proceeds effectively.

We cannot specify with certainty all of the particular uses of the net proceeds, if any, of this offering. Our management will have significant flexibility in applying the net proceeds from this offering, and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. Investors may not agree with our decisions, and our use of the proceeds may not yield any return on your investment. Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. Our

S-18

management may use the net proceeds for purposes that may not improve our financial condition or market value. Our failure to apply the net proceeds of this offering effectively could impair our ability to pursue our growth strategy or could require us to raise additional capital. Pending their use, we intend to invest the net proceeds from the offering in temporary investments, such as cash, cash equivalents, U.S. government securities and other high-quality debt investments that mature in one year or less. These investments may not yield a favorable return to our shareholders. The sale of the Series A Preferred Shares by the Fund (or the perception that such sales may occur), particularly if sold at a discount to the then-current market price of the Series A Preferred Shares, may have an adverse effect on the market price of the Series A Preferred Shares.

S-19

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

All statements contained in or incorporated by reference into this prospectus supplement or the accompanying prospectus, other than historical facts, may constitute “forward-looking

statements

.” These statements may relate to, among other things, future events or our future operating results, actual and potential conflicts of interest with the Adviser and its affiliates, and the adequacy of our financing sources and working capital, among other factors. In some cases, you can identify forward-looking statements by terminology such as “estimate,” “may,” “might,” “believe,” “will,” “provided,” “anticipate,” “future,” “could,” “growth,” “plan,” “project,” “intend,” “expect,” “should,” “would,” “if,” “seek,” “possible,” “potential,” “likely” or the negative or other variations of such terms or comparable terminology. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Such factors include:

| |

• |

|

changes in the economy and the capital markets; |

| |

• |

|

risks associated with negotiation and consummation of pending and future transactions; |

| |

• |

|

changes in our investment objectives and strategy; |

| |

• |

|