Cadence Bancorporation (NYSE:CADE) (“Cadence”) today announced

net income for the quarter ended March 31, 2019 of $58.2 million,

or $0.44 per diluted common share (“per share”), compared to $32.3

million, or $0.39 per share for the quarter ended December 31,

2018, and $38.8 million or $0.46 per share for the quarter ended

March 31, 2018. The first quarter of 2019 included merger related

expenses of $22.0 million or $0.13 per diluted common share.

“This has been an active and exciting quarter for Cadence. We

finalized our merger with State Bank on January 1 and completed the

systems and branding conversions during the quarter. I am pleased

with our expanded footprint and the diversity it brings to our

business model. We have seen numerous examples of great leadership

from our bankers in Georgia, which we believe will lead to growing

business opportunities throughout that market. It is nice to report

a strong start to the year with better earnings than expected. On

an adjusted basis, we earned $0.57 cents per share(1) which is a

19.7% adjusted return on tangible common equity(1); 1.72% adjusted

return on assets(1); and a 45.7% adjusted efficiency ratio(1). Our

credit metrics are positive also. We charged-off $550,000 or 2

basis points (annualized) for the quarter. Nonperforming assets

declined to 0.63% at March 31 from 0.81% at fiscal year-end.

Overall, it is a good start to the year,” stated Paul B. Murphy,

Jr., Chairman and Chief Executive Officer of Cadence

Bancorporation.

Highlights:

- Adjusted net income(1), excluding

non-routine income and expenses(2) primarily related to the merger,

was $75.0 million for the first quarter of 2019, an increase of

$33.0 million or 79% compared to the first quarter of 2018 and an

increase of $33.5 million or 81% compared to the fourth quarter of

2018.

- Adjusted EPS(1) for the first quarter

of 2019 of $0.57 increased $0.07 compared to adjusted EPS for both

the prior year and linked quarters of $0.50.

- Annualized returns on average assets,

and tangible common equity(1) for the first quarter of 2019 were

1.34% and 15.54%, respectively, compared to 1.44% and 15.76%,

respectively, for the first quarter of 2018, and 1.05% and 11.85%,

respectively, for the fourth quarter of 2018.

- Adjusted annualized returns on average

assets(1) and adjusted tangible common equity(1) for the first

quarter of 2019 were 1.72% and 19.69%, respectively, compared to

1.56% and 17.00%, respectively, for the first quarter of 2018 and

1.34% and 15.15%, respectively, for the fourth quarter of

2018.

- First quarter of 2019 efficiency ratio

was 56.7% and the adjusted efficiency ratio(1) was 45.7%, resulting

from strong revenue growth coupled with expense management.

- Nonperforming assets (“NPAs”) as a

percent of total loans, OREO and other NPAs declined to 0.63% at

March 31, 2019 compared to 0.84% and 0.81% at March 31, 2018 and

December 31, 2018, respectively. Net charge-offs for the first

quarter of 2019 were $550 thousand or 2 basis points on an

annualized basis.

(1)

Considered a non-GAAP financial measure. See Table 7

“Reconciliation of Non-GAAP Financial Measures” for a

reconciliation of our non-GAAP measures to the most directly

comparable GAAP financial measure.

(2)

See Table 7 for a detail of non-routine

income and expenses.

Balance Sheet:

Total assets were $17.5 billion as of March 31, 2019, an

increase of $4.7 billion, or 37.1%, from December 31, 2018, and an

increase of $6.5 billion, or 58.7%, from March 31, 2018.

Merger with State Bank Financial Corporation (“State

Bank”). Effective January 1, 2019, State Bank merged into

Cadence, with Cadence issuing 49.2 million shares to State Bank

shareholders resulting in a total purchase price of $826 million.

This merger added the additional assets and liabilities as shown in

the table below, which included goodwill of $173.3 million, core

deposit intangibles of $111.9 million or 3.28% of core deposits, an

unfunded loan commitment mark of $26.8 million. The loan fair value

adjustments totaled $99.0 million, made up of a credit risk

adjustment of $71.2 million or 2.1% of total loans, and a market

risk adjustment of $27.8 million. Note that the loan and unfunded

commitment marks accrete into revenue and the core deposit

intangible amortizes into expense over time as described in the

footnotes below. The estimated fair values will be subject to

refinement as additional information relative to the closing date

fair values becomes available through the measurement period for a

maximum of one year from consummation.

(Dollars in thousands)

As RecordedbyState

Bank

Reversal ofLegacy

StateBankAmounts

Fair ValueAdjustments

As Recordedby Cadence

Assets Cash and cash equivalents $ 414,342 $ - $ -

$

414,342 Investment securities available-for-sale 668,517 - (652 )

667,865 Loans, net 3,487,618 83,908 (99,001 ) A 3,472,525 Premises

and equipment, net 55,151 - 10,495 65,646 Cash surrender value of

life insurance 69,252 - - 69,252 Intangible assets 92,918 (92,918 )

117,038

B

117,038 Other assets 63,612 (2,342 ) (18,024

)

43,246

Total assets acquired $ 4,851,410 $ (11,352 )

$ 9,856 $ 4,849,914

Liabilities Deposits $ 4,100,340 $ - $

(3,675 ) $ 4,096,665 Short term borrowings 23,899 - - 23,899 Other

liabilities 49,105 - 27,173 C 76,278

Total liabilities assumed 4,173,344 -

23,498 4,196,842 Net identifiable assets acquired over

liabilities assumed 678,066 (11,352

)

$ (13,642 ) $ 653,072 Goodwill

173,308 D 173,308

Net assets acquired over liabilities

assumed

$ 678,066 $ (11,352 ) $ 159,666 $ 826,380

Fair Value Adjustments:

A. Represents the mark on the total balance

of loans, which is comprised of a $20.3 million mark to the book

balance on acquired credit impaired (“ACI”) loans and a $78.6

million mark on acquired non-credit impaired (“ANCI”) loans. Based

on the expected cash flows, the ACI loans have an accretable

difference of $43 million and will accrete into interest income

over the expected life of the loan or pool of loans over

approximately seven years. The $78.6 million mark on ANCI loans

will accrete into interest income using either the effective yield

or the straight-line method over the contractual lives of the

loans, or approximately seven years.

B. Represents a core deposit intangible

(“CDI”) of $111.9 million and a customer list intangible of $5.1

million. The CDI and customer list intangible amortize into

interest expense and noninterest expense, respectively, using an

accelerated method over a ten-year period.

C. Primarily represents $26.8 million as the

fair value of unfunded loan commitments. The fair value for

revolving lines and undrawn lines amortize using the straight-line

method over the life of the loan, or approximately 48 months. The

fair value of multi-advance loans amortizes using the effective

yield method over the life of the loan, or approximately 29 months.

Amortization of both of these adjustments do not begin until some

or all the unfunded amount becomes funded.

D. Represents excess of purchase price over

the combined fair value adjustments.

Loans. Loans at March 31, 2019 totaled $13.6 billion as

compared to $8.6 billion and $10.1 billion at March 31, 2018 and

December 31, 2018, respectively. Excluding the impact of the loans

acquired from State Bank, loans increased $1.6 billion or 18.6%

since March 31, 2018, and $245.9 million, or 2.4% from January 1,

2019 to March 31, 2019. These increases reflect continued organic

demand.

Total deposits. Deposits at March 31, 2019 totaled $14.2

billion as compared to $9.0 billion and $10.7 billion at March 31,

2018 and December 31, 2018, respectively. Excluding the impact of

deposits assumed from State Bank, deposits increased by $1.1

billion or 9.8% from March 31, 2018 and decreased by $606.1 million

or 5.7% from December 31, 2018. The year-over- year deposit

increase was driven by growth in core customer deposits (total

deposits excluding brokered deposits) of $1.0 billion, or 12.4%,

from March 31, 2018. The linked quarter decrease included a decline

of core deposits of $424.4 million, or 3.2%, from December 31,

2018, which included $311.8 million that State Bank had on deposit

at Cadence as noninterest-bearing deposits at December 31, 2018

that were eliminated out of deposits, as well as cyclical deposit

declines typical in the first quarter of the year.

Shareholders’ equity was $2.3 billion at March 31, 2019,

an increase of $945.6 million from March 31, 2018, and an increase

of $864.5 million from December 31, 2018.

- Tangible common shareholders’ equity(1)

was $1.7 billion at March 31, 2019, an increase of $670.5 million

from March 31, 2018, and an increase of $576.5 million from

December 31, 2018. The first quarter 2019 increase resulted from

common stock issued of $826.1 million in the State Bank merger (net

of issuance costs), net income of $58.2 million and an increase of

$60.8 million in other comprehensive income which resulted from

increased fair values of derivatives and of securities. These items

were partially offset by an increase of $284.3 million in

intangible assets, dividends of $22.7 million and the repurchase of

3.0 million common shares at an average price of $19.60 per share,

or $58.8 million during the quarter as part of the share repurchase

program announced in October 2018.

- Tangible book value per share(1) was

$13.23 as of March 31, 2019, an increase of $0.91 from $12.32 as of

March 31, 2018, and a decrease of $0.39 or from $13.62 as of

December 31, 2018.

- Total outstanding shares in the quarter

increased to 128.8 million shares due to the issuance of 49.2

million shares in connection with the State Bank merger, partially

offset by the repurchase of 3.0 million shares during the

quarter.

(1)

Considered a non-GAAP financial measure.

See Table 7 “Reconciliation of Non-GAAP Financial Measures” for a

reconciliation of our non-GAAP measures to the most directly

comparable GAAP financial measure.

Asset Quality:

Credit quality reflected continued overall credit

stability in the loan portfolio. For the quarter ended March 31,

2019, net charge-offs were $0.6 million or 2 basis points on an

annualized basis, compared to $0.4 million or 2 basis points and

$0.2 million or 1 basis point for the quarters ended March 31, 2018

and December 31, 2018, respectively.

- NPAs totaled $86.0 million, $72.7

million and $82.4 million as of March 31, 2019, March 31, 2018 and

December 31, 2018, respectively. NPAs as a percent of total loans,

OREO and other NPAs declined to 0.63% at March 31, 2019 compared to

0.84% and 0.81% at March 31, 2018 and December 31, 2018,

respectively.

- The allowance for credit losses (“ACL”)

was $105.0 million, or 0.77% of total loans, as of March 31, 2019,

as compared to $91.5 million, or 1.06% of total loans, as of March

31, 2018, $94.4 million, or 0.94% of total loans, as of December

31, 2018. The decline in the percentage of the ACL to total loans

is due to recording the State Bank $3.5 billion loan portfolio at

fair value, which results in no ACL recorded for those loans upon

merger.

- Loan loss provision was $11.2 million

for the first quarter of 2019 compared to $4.4 million in the prior

year’s quarter and $8.4 million in the linked quarter. The first

quarter 2019 provision was driven by the quarter’s net loan growth

and an increase in specific reserves for certain credits.

Total Revenue:

Total operating revenue(1) for the first quarter of 2019 was

$200.0 million, up 72.2% from the same period in 2018 and up 61.1%

from the linked quarter. The revenue increases reflect strong loan

growth during the period as well as the impact of the State Bank

acquisition.

Net interest income for the first quarter of 2019 was

$169.3 million, an increase of $78.2 million or 85.8%, from the

same period in 2018, and an increase of $66.1 million or 64.1%,

from the fourth quarter of 2018. Our fully tax-equivalent NIM was

up significantly in the first quarter of 2019 to 4.21% as compared

to 3.64% for the first quarter of 2018 and 3.55% for the fourth

quarter of 2018.

Earning asset yields for the first quarter of 2019 were 5.52%,

up 101 basis points from 4.51% in the first quarter of 2018, and up

57 basis points from 4.95% in the fourth quarter of 2018. The

current quarter’s increase in earning asset yields reflects the

impact of the State Bank assets including purchase accounting

accretion, combined with an increase in originated earning asset

yields during the first quarter of 2019.

- Yield on originated loans increased to

5.46% for the first quarter of 2019, as compared to 4.79% and 5.20%

for the first quarter of 2018 and fourth quarter of 2018,

respectively.

- Approximately 69% of the total loan

portfolio is floating at March 31, 2019. On February 28, 2019,

Cadence entered into a $4.0 billion notional interest rate collar

with a five-year term designed to reduce the impact of interest

rate sensitivity of this portfolio. The yield on originated loans

was impacted 1 basis point, (2) basis points and (9) basis points

for the first quarter of 2019, first quarter of 2018 and fourth

quarter of 2018, respectively, by the effect of our interest rate

derivatives.

- Total accretion for ANCI loans was

$12.5 million in the first quarter of 2019 compared to $0.2 million

for the first quarter of 2018 and ($0.3) million for the fourth

quarter of 2018. The first quarter 2019 accretion is predominantly

related to loans acquired from State Bank.

- Total accretion for ACI loans was $6.3

million in the first quarter of 2019 compared to $5.6 million from

the first quarter of 2018 and $5.6 million in the fourth quarter of

2018. The first quarter 2019 accretion includes $1.3 million

related to loans acquired from State Bank.

- Total cost of funds for the first

quarter of 2019 was 1.42% compared to 0.94% for the first quarter

of 2018 and 1.51% in the linked quarter.

- Total cost of deposits for the first

quarter of 2019 was 1.30% compared to 0.75% for the first quarter

of 2018, and 1.34% for the linked quarter.

- The current quarter’s decrease in

deposit costs reflected the impact of the State Bank deposits,

partially offset by an approximate 12 bp increase in legacy deposit

costs during the first quarter of 2019.

Noninterest income for the first quarter of 2019 was

$30.7 million, an increase of $5.7 million or 22.7%, from the same

period of 2018, and an increase of $9.7 million, or 46.0%, from the

fourth quarter of 2018. Total service fees and revenue for the

first quarter of 2019 were $27.9 million, an increase of $4.0

million or 16.9% from the same period of 2018, and an increase of

$6.7 million or 31.7% from the fourth quarter of 2018. The year

over year increase in fees was driven by:

- Increase of $1.1 million in service

charges on deposits due primarily to the increase in number of

deposit accounts.

- Increase of $1.3 million in credit

related fees related to loan growth and leading loan

transactions.

- New revenue sources of payroll

processing and insurance ($1.9 million) and SBA income ($1.4

million) which resulted from the State Bank merger.

- Decrease of other service fees of $1.7

million due primarily to reduction in insurance revenue due to the

sale of insurance company assets in the second quarter of

2018.

The linked quarter increase resulted primarily from:

- Increase of $1.3 million in service

charges on deposits due to the increase in the number of deposit

accounts, primarily from the State Bank merger.

- Increase of $1.1 million in bankcard

fees which resulted from additional customers from the State Bank

merger.

- Previously mentioned new revenue

sources of payroll processing and insurance of $1.9 million and SBA

income of $1.4 million.

Other noninterest income increased by $1.6 million from the

first quarter of 2018 and by $2.9 million from the linked quarter.

These increases resulted primarily from increases in BOLI income

and earnings from limited partnerships, combined with stable net

profits interest valuation in the first quarter of 2019, as

compared to writedowns in the comparative quarters.

Noninterest expense for the first quarter of 2019 was

$113.4 million, an increase of $51.5 million or 83.1% from $61.9

million for the same period in 2018, and an increase of $40.7

million or 56.0% from $72.7 million for the fourth quarter of 2018.

The increase resulted primarily from:

- Merger related expenses of $22.0

million related to the State Bank merger

- Increase of $16.1 million and $10.0

million for the prior year period and linked quarter, respectively,

in salaries and benefits due primarily to increased numbers of

employees.

- Increase of $5.3 million and $5.5

million for the prior year period and linked quarter, respectively,

in intangible asset amortization due to the amortization of the

State Bank core deposit intangible asset.

- Increase of $5.5 million and $3.6

million for the prior year period and linked quarter, respectively,

in other noninterest expenses due to business growth and the State

Bank merger.

Adjusted noninterest expenses(1), which exclude the impact of

non-routine items(2), were $91.4 million for the first quarter of

2019, up $33.1 million or 56.9% from $58.3 million for the first

quarter of 2018 and up $30.6 million or 50.3% from $60.9 million

for the fourth quarter of 2018. Non-routine expenses in the first

quarter of 2019 comprised $22.0 million in State Bank merger

related expenses. For the fourth quarter of 2018, non-routine

expenses included $9.8 million in compensation expense and $2.0

million in merger related expenses. For the first quarter of 2018,

non-routine expenses included $1.4 million in secondary offering

expenses and $2.3 million in legacy acquired bank litigation

costs.

Our efficiency ratio(1) for the first quarter of 2019 was

56.7% compared to 53.4% for the first quarter of 2018 and 58.6% for

the fourth quarter of 2018. The efficiency ratio in all quarters

was impacted by the noted non-routine expenses. Excluding

non-routine revenues and expenses, the adjusted efficiency ratio(1)

was 45.7%, 50.2%, and 49.0% for the first quarter of 2019, first

quarter of 2018, and fourth quarter of 2018, respectively. The

first quarter of 2019 adjusted efficiency ratio is reflective of

efficiencies already gained through the State Bank merger, combined

with strong revenue growth.

(1) Considered a non-GAAP financial measure. See Table 7

“Reconciliation of Non-GAAP Financial Measures” for a

reconciliation of our non-GAAP measures to the most directly

comparable GAAP financial measure. (2)

See Table 7 for a detail of non-routine

income and expenses.

Taxes:

The effective tax rate for the quarter ended March 31, 2019, was

22.7% compared to 24.9% for the quarter ended December 31, 2018,

and 22.0% for the quarter ended March 31, 2018.

Supplementary Financial Tables

(Unaudited):

Supplementary Financial Tables (Unaudited) are included in this

release following the customary disclosure information.

First Quarter 2019 Earnings Conference

Call:

Cadence Bancorporation executive management will host a

conference call to discuss first quarter 2019 results on Monday,

April 29, 2019, at 12:00 p.m. CT / 1:00 p.m. ET. Slides to be

presented by management on the conference call can be viewed by

visiting www.cadencebancorporation.com and selecting “Events &

Presentations” then “Presentations.”

Conference Call Access:

To access the conference call, please dial one of the following

numbers approximately 10-15 minutes prior to the start time to

allow time for registration and use the Elite Entry Number provided

below.

Dial in (toll free): 1-888-317-6003 International dial in:

1-412-317-6061 Canada (toll free): 1-866-284-3684 Participant Elite

Entry Number: 2919550

For those unable to participate in the live

presentation, a replay will be available through May 13, 2019. To

access the replay, please use the following numbers:

US Toll Free: 1-877-344-7529 International Toll:

1-412-317-0088 Canada Toll Free: 1-855-669-9658 Replay Access Code:

10130277 End Date: May 13, 2019

Webcast

Access:

A webcast of the conference call presented by management can be

viewed by visiting www.cadencebancorporation.com and selecting

“Events & Presentations” then “Event Calendar.” Slides are

available under the “Presentations” tab.

About Cadence Bancorporation

Cadence Bancorporation (NYSE: CADE), headquartered in Houston,

Texas, is a regional financial holding company with $17.4 billion

in assets as of March 31, 2019. Cadence operates 98 branch

locations in Alabama, Florida, Georgia, Mississippi, Tennessee and

Texas, and provides corporations, middle-market companies, small

businesses and consumers with a full range of innovative banking

and financial solutions. Services and products include

commercial and business banking, treasury management, specialized

lending, asset-based lending, commercial real estate, SBA lending,

foreign exchange, wealth management, investment and trust services,

financial planning, retirement plan management, business insurance,

consumer banking, consumer loans, mortgages, home equity lines and

loans, and credit cards. Clients have access to leading-edge

online and mobile solutions, interactive teller machines, and more

than 55,000 ATMs. The Cadence team of 1,800 associates is

committed to exceeding customer expectations and helping their

clients succeed financially.

Cautionary Statement Regarding Forward-Looking

Information

This communication contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect our current views

with respect to, among other things, future events and our results

of operations, financial condition and financial performance. These

statements are often, but not always, made through the use of words

or phrases such as “may,” “should,” “could,” “predict,”

“potential,” “believe,” “will likely result,” “expect,” “continue,”

“will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,”

“projection,” “would” and “outlook,” or the negative version of

those words or other comparable words of a future or

forward-looking nature. These forward-looking statements are not

historical facts, and are based on current expectations, estimates

and projections about our industry, management’s beliefs and

certain assumptions made by management, many of which, by their

nature, are inherently uncertain and beyond our control.

Accordingly, we caution you that any such forward-looking

statements are not guarantees of future performance and are subject

to risks, assumptions and uncertainties that are difficult to

predict. Although we believe that the expectations reflected in

these forward-looking statements are reasonable as of the date

made, actual results may prove to be materially different from the

results expressed or implied by the forward-looking statements.

Such factors include, without limitation, the “Risk Factors”

referenced in our Registration Statement on Form S-3 filed with the

Securities and Exchange Commission (the “SEC”) on May 21, 2018, and

our Registration Statement on Form S-4 filed with the SEC on July

20, 2018, other risks and uncertainties listed from time to time in

our reports and documents filed with the SEC, including our Annual

Reports on Form 10-K and Quarterly Reports on Form 10-Q, and the

following factors: business and economic conditions generally and

in the financial services industry, nationally and within our

current and future geographic market areas; economic, market,

operational, liquidity, credit and interest rate risks associated

with our business; deteriorating asset quality and higher loan

charge-offs; the laws and regulations applicable to our business;

our ability to achieve organic loan and deposit growth and the

composition of such growth; increased competition in the financial

services industry, nationally, regionally or locally; our ability

to maintain our historical earnings trends; our ability to raise

additional capital to implement our business plan; material

weaknesses in our internal control over financial reporting;

systems failures or interruptions involving our information

technology and telecommunications systems or third-party servicers;

the composition of our management team and our ability to attract

and retain key personnel; the fiscal position of the U.S. federal

government and the soundness of other financial institutions; the

composition of our loan portfolio, including the identity of our

borrowers and the concentration of loans in energy-related

industries and in our specialized industries; the portion of our

loan portfolio that is comprised of participations and shared

national credits; the amount of nonperforming and classified assets

we hold; the possibility that the anticipated benefits of the

merger with State Bank are not realized when expected or at all,

including as a result of the impact of, or problems arising from,

the integration of the two companies or as a result of the strength

of the economy and competitive factors in the areas where Cadence

and State Bank do business. Cadence can give no assurance that any

goal or plan or expectation set forth in forward-looking statements

can be achieved and readers are cautioned not to place undue

reliance on such statements. The forward-looking statements are

made as of the date of this communication, and Cadence does not

intend, and assumes no obligation, to update any forward-looking

statement to reflect events or circumstances after the date on

which the statement is made or to reflect the occurrence of

unanticipated events or circumstances, except as required by

applicable law.

About Non-GAAP Financial Measures

Certain of the financial measures and ratios we present,

including “efficiency ratio,” “adjusted efficiency ratio,”

“adjusted noninterest expenses,” “adjusted operating revenue,”

“tangible common equity ratio,” “tangible book value per share,”

“return on average tangible common equity,” “adjusted return on

average tangible common equity,” “adjusted return on average

assets,” “adjusted diluted earnings per share” and “pre-tax,

pre-provision net earnings,” are supplemental measures that are not

required by, or are not presented in accordance with, U.S.

generally accepted accounting principles (GAAP). We refer to these

financial measures and ratios as “non-GAAP financial measures.” We

consider the use of select non-GAAP financial measures and ratios

to be useful for financial and operational decision making and

useful in evaluating period-to-period comparisons. We believe that

these non-GAAP financial measures provide meaningful supplemental

information regarding our performance by excluding certain

expenditures or assets that we believe are not indicative of our

primary business operating results or by presenting certain metrics

on a fully taxable equivalent basis. We believe that management and

investors benefit from referring to these non-GAAP financial

measures in assessing our performance and when planning,

forecasting, analyzing and comparing past, present and future

periods.

These non-GAAP financial measures should not be considered a

substitute for financial information presented in accordance with

GAAP and you should not rely on non-GAAP financial measures alone

as measures of our performance. The non-GAAP financial measures we

present may differ from non-GAAP financial measures used by our

peers or other companies. We compensate for these limitations by

providing the equivalent GAAP measures whenever we present the

non-GAAP financial measures and by including a reconciliation of

the impact of the components adjusted for in the non-GAAP financial

measure so that both measures and the individual components may be

considered when analyzing our performance. A reconciliation of

non-GAAP financial measures to the comparable GAAP financial

measures is included at the end of the financial statement tables

(Table 7).

Table 1 - Selected Financial

Data

As of and for the Three Months Ended (In

thousands, except share and per share data)

March 31,2019

December 31,2018

September 30,2018

June 30,2018

March 31,2018

Statement of Income Data:

Interest income

$

222,185 $ 143,857 $ 131,753 $ 123,963 $ 113,093 Interest expense

52,896 40,711 33,653 28,579

21,982 Net interest income 169,289 103,146 98,100 95,384 91,111

Provision for credit losses 11,210 8,422

(1,365

)

1,263 4,380 Net interest income after provision

158,079 94,724 99,465 94,121 86,731 Noninterest income - service

fees and revenue 27,939 21,217 20,490 21,395 23,904 Noninterest

income - other noninterest income 2,725 (210 ) 3,486 3,277 1,079

Noninterest expense 113,440 72,697 61,231

62,435 61,939 Income before income taxes 75,303

43,034 62,210 56,358 49,775 Income tax expense 17,102

10,709 15,074 8,384 10,950 Net income $ 58,201

$ 32,325 $ 47,136 $ 47,974 $ 38,825 Weighted average common shares

outstanding Basic 130,485,521 83,375,485 83,625,000 83,625,000

83,625,000 Diluted 130,549,319 83,375,485 84,660,256 84,792,657

84,674,807 Earnings Basic $ 0.44 $ 0.39 $ 0.56 $ 0.57 $ 0.46

Diluted 0.44 0.39 0.56 0.57 0.46

Period-End Balance Sheet

Data: Investment securities $ 1,754,839 $ 1,187,252 $ 1,206,387

$ 1,049,710 $ 1,251,834 Total loans, net of unearned income

13,624,954 10,053,923 9,443,819 8,975,755 8,646,987 Allowance for

credit losses 105,038 94,378 86,151 90,620 91,537 Total assets

17,452,911 12,730,285 11,759,837 11,305,528 10,999,382 Total

deposits 14,199,223 10,708,689 9,558,276 9,331,055 9,048,971

Noninterest-bearing deposits 3,210,321 2,454,016 2,094,856

2,137,407 2,040,977 Interest-bearing deposits 10,988,902 8,254,673

7,463,420 7,193,648 7,007,994 Borrowings and subordinated

debentures 717,278 471,770 662,658 471,453 471,335 Total

shareholders’ equity 2,302,823 1,438,274 1,414,826 1,389,956

1,357,103

Average Balance Sheet Data: Investment securities

$ 1,748,714 $ 1,187,947 $ 1,141,704 $ 1,183,055 $ 1,234,226 Total

loans, net of unearned income 13,798,386 9,890,419 9,265,754

8,848,820 8,443,951 Allowance for credit losses 97,065 87,996

92,783 93,365 89,097 Total assets 17,634,267 12,249,819 11,585,969

11,218,432 10,922,275 Total deposits 14,579,771 10,038,180

9,489,268 9,135,359 9,012,390 Noninterest-bearing deposits

3,334,399 2,210,793 2,153,097 2,058,255 2,128,595 Interest-bearing

deposits 11,245,372 7,827,387 7,336,171 7,077,104 6,883,795

Borrowings and subordinated debentures 554,281 652,813 567,864

595,087 444,556 Total shareholders’ equity 2,241,652 1,412,643

1,395,061 1,358,770 1,342,445

Table 1 (Continued) - Selected

Financial Data

As of and for the Three Months Ended (In

thousands, except share and per share data)

March 31,2019

December 31,2018

September 30,2018

June 30,2018

March 31,2018

Per Share Data: Book value per common share $ 17.88 $ 17.43

$ 16.92 $ 16.62 $ 16.23 Tangible book value (1) 13.23 13.62 13.15

12.85 12.32 Cash dividends declared 0.175 0.150 0.150 0.125 0.125

Dividend payout ratio 39.77 % 38.46 %

26.79 % 21.93 % 27.17 %

Performance Ratios: Return on

average common equity (2) 10.53 % 9.08 % 13.40 % 14.16 % 11.73 %

Return on average tangible common equity (1) (2) 15.54 11.85 17.50

18.79 15.76 Return on average assets (2) 1.34 1.05 1.61 1.72 1.44

Net interest margin (2) 4.21 3.55 3.58 3.66 3.64 Efficiency ratio

(1) 56.73 58.55 50.16 52.00 53.35 Adjusted efficiency ratio (1)

45.73 48.99 48.36 50.74 50.22

Asset Quality Ratios: Total

nonperforming assets ("NPAs") to total loans and OREO and other

NPAs 0.63 % 0.81 % 0.66 % 0.63 % 0.84 % Total nonperforming loans

to total loans 0.57 0.74 0.50 0.44 0.60 Total ACL to total loans

0.77 0.94 0.91 1.01 1.06 ACL to total nonperforming loans ("NPLs")

135.01 127.12 182.52 230.60 175.30 Net charge-offs to average loans

(2) 0.02 0.01 0.13 0.10 0.02

Capital Ratios: Total

shareholders’ equity to assets 13.2 % 11.3 % 12.0 % 12.3 % 12.3 %

Tangible common equity to tangible assets (1) 10.1 9.1 9.6 9.8 9.7

Common equity tier 1 (3) 10.4 9.8 10.4 10.5 10.4 Tier 1 leverage

capital (3) 10.0 10.1 10.7 10.7 10.6 Tier 1 risk-based capital (3)

10.4 10.1 10.7 10.9 10.8 Total risk-based capital (3) 11.9 11.8

12.4 12.7 12.6 (1) Considered a non-GAAP financial measure.

See Table 7 "Reconciliation of Non-GAAP Financial Measures" for a

reconciliation of our non-GAAP measures to the most directly

comparable GAAP financial measure. (2) Annualized. (3) Current

quarter regulatory capital ratios are estimates.

Table 2 - Average

Balances/Yield/Rates

For the Three Months Ended March 31, 2019

2018 Average Income/

Yield/ Average Income/

Yield/ (In thousands) Balance Expense

Rate Balance Expense Rate ASSETS

Interest-earning assets:

Loans, net of unearned income (1)

Originated loans $ 9,811,821 $ 132,065 5.46 % $ 7,993,461 $ 94,378

4.79 % ANCI portfolio 3,684,905 67,337 7.41 196,017 2,790 5.77 ACI

portfolio 301,660 6,349 8.54 254,503

5,623 8.96 Total loans 13,798,386 205,751 6.05 8,443,981 102,791

4.94 Investment securities Taxable 1,531,514 10,796 2.86 827,227

5,118 2.51 Tax-exempt (2) 217,200 2,202 4.11

406,999 4,134 4.12 Total investment securities 1,748,714

12,998 3.01 1,234,226 9,252 3.04 Federal funds sold and short-term

investments 763,601 3,281 1.74 515,017 1,529 1.20 Other investments

58,139 618 4.31 48,986 389 3.22 Total

interest-earning assets 16,368,840 222,648 5.52 10,242,210 113,961

4.51

Noninterest-earning assets: Cash and due from banks

118,833 92,878 Premises and equipment 128,990 62,973 Accrued

interest and other assets 1,114,669 613,311 Allowance for credit

losses (97,065 ) (89,097 ) Total assets $ 17,634,267

$ 10,922,275

LIABILITIES AND SHAREHOLDERS' EQUITY

Interest-bearing liabilities: Demand deposits $ 8,011,001 $

29,259 1.48 % $ 4,795,114 $ 9,025 0.76 % Savings deposits 248,651

226 0.37 179,662 114 0.26 Time deposits 2,985,720

17,186 2.33 1,909,019 7,491 1.59 Total

interest-bearing deposits 11,245,372 46,671 1.68 6,883,795 16,630

0.98 Other borrowings 418,347 3,695 3.58 309,323 2,956 3.88

Subordinated debentures 135,934 2,530 7.55

135,233 2,396 7.19 Total interest-bearing liabilities

11,799,653 52,896 1.82 7,328,351 21,982 1.22

Noninterest-bearing

liabilities: Demand deposits 3,334,399 2,128,595 Accrued

interest and other liabilities 258,563 122,884 Total

liabilities 15,392,615 9,579,830

Shareholders' equity

2,241,652 1,342,445 Total liabilities and shareholders'

equity $ 17,634,267 $ 10,922,275 Net interest income/net interest

spread 169,752 3.70 % 91,979 3.29 % Net yield on

earning assets/net interest margin 4.21 % 3.64 %

Taxable equivalent adjustment: Investment securities

(463 ) (868 ) Net interest income $ 169,289 $ 91,111

(1) Nonaccrual loans are included in loans, net of unearned

income. No adjustment has been made for these loans in the

calculation of yields. (2) Interest income and yields are presented

on a fully taxable equivalent basis using a tax rate of 21%.

For the Three Months EndedMarch

31, 2019

For the Three Months

EndedDecember 31, 2018

Average Income/ Yield/

Average Income/ Yield/ (In

thousands) Balance Expense Rate

Balance Expense Rate ASSETS

Interest-earning assets:

Loans, net of unearned income (1)

Originated loans $ 9,811,821 $ 132,065 5.46 % $ 9,356,318 $ 122,678

5.20 % ANCI portfolio 3,684,905 67,337 7.41 326,463 4,298 5.22 ACI

portfolio 301,660 6,349 8.54 207,638

5,580 10.66 Total loans 13,798,386 205,751 6.05 9,890,419 132,556

5.32 Investment securities Taxable 1,531,514 10,796 2.86 980,403

6,909 2.80 Tax-exempt (2) 217,200 2,202 4.11

207,544 2,202 4.21 Total investment securities

1,748,714 12,998 3.01 1,187,947 9,111 3.04 Federal funds sold and

short-term investments 763,601 3,281 1.74 437,565 2,092 1.90 Other

investments 58,139 618 4.31 58,388

559 3.80 Total interest-earning assets 16,368,840 222,648

5.52 11,574,319 144,318 4.95

Noninterest-earning assets:

Cash and due from banks 118,833 73,878 Premises and equipment

128,990 63,258 Accrued interest and other assets 1,114,669 626,360

Allowance for credit losses (97,065 ) (87,996 ) Total

assets $ 17,634,267 $ 12,249,819

LIABILITIES AND STOCKHOLDERS'

EQUITY Interest-bearing liabilities: Demand deposits $

8,011,001 $ 29,259 1.48 % $ 5,242,091 $ 20,024 1.52 % Savings

deposits 248,651 226 0.37 174,156 163 0.37 Time deposits

2,985,720 17,186 2.33 2,411,140 13,792 2.27

Total interest-bearing deposits 11,245,372 46,671 1.68 7,827,387

33,979 1.72 Other borrowings 418,347 3,695 3.58 517,051 4,266 3.27

Subordinated debentures 135,934 2,530 7.55

135,762 2,466 7.21 Total interest-bearing liabilities

11,799,653 52,896 1.82 8,480,200 40,711 1.90

Noninterest-bearing

liabilities: Demand deposits 3,334,399 2,210,793 Accrued

interest and other liabilities 258,563 146,183 Total

liabilities 15,392,615 10,837,176

Stockholders' equity

2,241,652 1,412,643 Total liabilities and

stockholders' equity $ 17,634,267 $ 12,249,819 Net interest

income/net interest spread 169,752 3.70 % 103,607

3.05 % Net yield on earning assets/net interest margin 4.21

% 3.55 %

Taxable equivalent adjustment: Investment

securities (463 ) (461 ) Net interest income $

169,289 $ 103,146 (1) Nonaccrual loans are included in

loans, net of unearned income. No adjustment has been made for

these loans in the calculation of yields. (2) Interest income and

yields are presented on a fully taxable equivalent basis using a

tax rate of 21%.

Table 3 - Loan Interest Income

Detail

For the Three Months Ended, (In thousands)

March 31,2019

December 31,2018

September 30,2018

June 30,2018

March 31,2018

Loan Interest Income Detail Interest income on originated

loans $ 132,065 $ 122,674 $ 112,419 $ 105,536 $ 94,378 ANCI loans:

interest income 54,859 4,571 3,219 2,405 2,617 ANCI loans:

accretion 12,478 (273 ) 176 189 172 ACI loans: scheduled accretion

for the period 5,844 4,724 4,881 5,016 5,192 ACI loans: recovery

income for the period 505 860 362 594

431 Loan interest income $ 205,751 $ 132,556 $ 121,057 $

113,740

$

102,790 Originated loan yield 5.46 % 5.20 % 5.11 % 5.02

%

4.79 % ANCI loan yield 7.41 5.22 4.46 5.93 5.77 ACI loan yield

8.54 10.67 9.08 9.28 8.96 Total

loan yield 6.05 % 5.32 % 5.18 % 5.16 %

4.94 %

Table 4 - Allowance for Credit

Losses

For the Three Months Ended (In thousands)

March 31,2019

December 31,2018

September 30,2018

June 30,2018

March 31,2018

Balance at beginning of period $ 94,378 $ 86,151 $ 90,620 $ 91,537

$ 87,576 Charge-offs (938 ) (318 ) (3,265 )

(3,650 ) (812 ) Recoveries 388 123 161

1,470 393 Net charge-offs (550 ) (195 )

(3,104 ) (2,180 ) (419 ) Provision for (reversal of)

credit losses 11,210 8,422 (1,365 )

1,263 4,380 Balance at end of period $ 105,037 $ 94,378 $

86,151 $ 90,620 $ 91,537

Table 5 - Noninterest Income

For the Three Months Ended (In thousands)

March 31,2019

December 31,2018

September 30,2018

June 30,2018

March 31,2018

Noninterest Income Investment advisory

revenue $ 5,642 $ 5,170 $ 5,535 $ 5,343 $ 5,299 Trust services

revenue 4,335 4,182 4,449 4,114 5,015 Service charges on deposit

accounts 5,130 3,856 3,813 3,803 3,960 Credit-related fees 4,870

5,191 3,549 3,807 3,577 Payroll processing and insurance revenue

1,859 - - - - Bankcard fees 2,213 1,073 1,078 1,915 1,884 SBA

income 1,449 - - - - Mortgage banking revenue 579 398 747 650 577

Other service fees 1,862 1,347 1,319

1,763 3,592

Total service fees and revenue

27,939 21,217 20,490 21,395 23,904

Securities (losses) gains, net (12 ) (54 ) 2 (1,813 ) 12 Other

2,737 (156 ) 3,484 5,090 1,067

Total other noninterest income 2,725 (210 )

3,486 3,277 1,079

Total noninterest

income $ 30,664 $ 21,007 $ 23,976 $ 24,672 $ 24,983

Table 6 - Noninterest Expense

For the Three Months Ended (In thousands)

March 31,2019

December 31,2018

September 30,2018

June 30,2018

March 31,2018

Noninterest Expenses Salaries and

employee benefits $ 53,471 $ 43,495 $ 35,790 $ 38,268 $ 37,353

Premises and equipment 10,959 8,212 7,544 7,131 7,591 Merger

related expenses 22,000 2,049 178 756 - Intangible asset

amortization 6,073 598 650 715 792 Data processing 2,593 2,117

1,989 2,304 2,365 Consulting and professional fees 2,229 3,675

4,266 2,409 2,934 Loan related expenses 910 1,424 821 645 255 FDIC

insurance 1,752 1,230 1,237 1,223 955 Communications 998 684 682

703 704 Advertising and public relations 781 928 679 575 341 Legal

expenses 158 395 242 468 2,627 Other 11,516 7,889

7,153 7,238 6,022

Total noninterest

expenses $ 113,440 $ 72,697 $ 61,231 $ 62,435 $ 61,939

Table 7 - Reconciliation of Non-GAAP

Financial Measures

As of and for the Three Months Ended (In

thousands, except share and per share data)

March 31,2019

December 31,2018

September 30,2018

June 30,2018

March 31,2018

Efficiency ratio Noninterest expenses (numerator) $ 113,440

$ 72,697 $ 61,231 $ 62,435 $ 61,939 Net interest income $ 169,289 $

103,146 $ 98,100 $ 95,384 $ 91,111 Noninterest income 30,664

21,007 23,976 24,672 24,983 Operating

revenue (denominator) $ 199,953 $ 124,153 $ 122,076 $ 120,056 $

116,094 Efficiency ratio 56.73 % 58.55 % 50.16

% 52.00 %

53.35 %

Adjusted efficiency ratio Noninterest

expenses $ 113,440 $ 72,697 $ 61,231 $ 62,435 $ 61,939 Less: Merger

related expenses 22,000 2,049 178 756 — Less: Secondary offerings

expenses — — 2,022 1,165 1,365 Plus: Specially designated bonuses —

9,795 — — — Less: Other non-routine expenses (2) — —

— 1,145 2,278 Adjusted noninterest expenses

(numerator) $ 91,440 $ 60,853 $ 59,031 $ 59,369 $ 58,296 Net

interest income $ 169,289 $ 103,146 $ 98,100 $ 95,384 $ 91,111

Noninterest income 30,664 21,007 23,976 24,672 24,983 Less: Gain on

sale of insurance assets — — — 4,871 — Less: Securities (losses)

gains, net (12 ) (54 ) 2 (1,813 )

12 Adjusted noninterest income 30,676 21,061

23,974 21,614 24,971 Adjusted operating

revenue (denominator) $ 199,965 $ 124,207 $ 122,074 $ 116,998 $

116,082 Adjusted efficiency ratio 45.73 % 48.99 %

48.36 % 50.74 % 50.22 %

Tangible common

equity ratio Shareholders’ equity $ 2,302,823 $ 1,438,274 $

1,414,826 $ 1,389,956 $ 1,357,103 Less: Goodwill and other

intangible assets, net (598,674 ) (314,400 )

(314,998 ) (315,648 ) (327,247 ) Tangible common

shareholders’ equity 1,704,149 1,123,874

1,099,828 1,074,308 1,029,856 Total assets 17,452,911

12,730,285 11,759,837 11,305,528 10,999,382 Less: Goodwill and

other intangible assets, net (598,674 ) (314,400 )

(314,998 ) (315,648 ) (327,247 ) Tangible

assets $ 16,854,237 $ 12,415,885 $ 11,444,839 $ 10,989,880 $

10,672,135 Tangible common equity ratio 10.11 % 9.05

% 9.61 % 9.78 % 9.65 %

Tangible book value

per share Shareholders’ equity $ 2,302,823 $ 1,438,274 $

1,414,826 $ 1,389,956 $ 1,357,103 Less: Goodwill and other

intangible assets, net (598,674 ) (314,400 )

(314,998 ) (315,648 ) (327,247 ) Tangible common

shareholders’ equity $ 1,704,149 $ 1,123,874 $ 1,099,828 $

1,074,308 $ 1,029,856 Common shares outstanding 128,762,201

82,497,009 83,625,000 83,625,000

83,625,000 Tangible book value per share $ 13.23 $ 13.62 $ 13.15 $

12.85 $ 12.32 (1)

Annualized

(2) Other non-routine expenses for the second quarter of 2018

included expenses related to the sale of the assets of our

insurance company. Non-routine expenses for the first quarter of

2018 represent legal costs associated with litigation related to a

pre-acquisition matter of a legacy acquired bank that has been

resolved.

Table 7 (Continued) – Reconciliation of

Non-GAAP Measures

As of and for the Three Months Ended (In

thousands, except share and per share data)

March 31,2019

December 31,2018

September 30,2018

June 30,2018

March 31,2018

Return on average tangible common equity Average common

equity $ 2,241,652 $ 1,412,643 $ 1,395,061 $ 1,358,770 $ 1,342,445

Less: Average intangible assets (602,446 ) (314,759 )

(315,382 ) (323,255 )

(327,727 ) Average tangible common shareholders’ equity $

1,639,206 $ 1,097,884 $ 1,079,679 $ 1,035,515 $ 1,014,718 Net

income $ 58,201 $ 32,325 $ 47,136 $ 47,974 $ 38,825 Plus:

Intangible asset amortization 4,628 459 498

548 607 Tangible net income $ 62,829 $ 32,784 $

47,634 $ 48,522 $ 39,432 Return on average tangible common

equity(2) 15.54 % 11.85 % 17.50 % 18.79

% 15.76 %

Adjusted return on average tangible common

equity Average tangible common shareholders’ equity $ 1,639,206

$ 1,097,884 $ 1,079,679 $ 1,035,515 $ 1,014,718 Tangible net income

$ 62,829 $ 32,784 $ 47,634 $ 48,522 $ 39,432 Non-routine items:

Plus: Merger related expenses 22,000 2,049 178 756 — Plus:

Secondary offerings expenses —

—

2,022 1,165 1,365 Plus: Specially designated bonuses — 9,795

—

— — Plus: Other non-routine expenses(2) —

—

—

1,145 2,278 Less: Gain on sale of insurance assets — —

—

4,871

—

Less: Securities gains (losses), net (12 ) (54 ) 2 (1,813 ) 12 Tax

expense: Less: Benefit of legacy loan bad debt deduction for tax —

— — 5,991 — Less: Income tax effect of tax deductible non-routine

items 5,239 2,759 34 (166 ) 529

Total non-routine items, after tax 16,773 9,139

2,164 (5,817 )

3,102 Adjusted tangible net income available to common

shareholders $ 79,602 $ 41,923 $ 49,798 $ 42,705 $ 42,534 Adjusted

return on average tangible common equity(1) 19.69 %

15.15 % 18.30 % 16.54 % 17.00 %

Adjusted

return on average assets Average assets $ 17,634,267 $

12,249,819 $ 11,585,969 $ 11,218,432 $ 10,922,274 Net income $

58,201 $ 32,325 $ 47,136 $ 47,974 $ 38,825 Return on average assets

1.34 % 1.05 % 1.61 % 1.72 % 1.44

% Net income $ 58,201 $ 32,325 $ 47,136 $ 47,974 $ 38,825 Total

non-routine items, after tax 16,773 9,139

2,164 (5,817 ) 3,102 Adjusted net income $ 74,974 $

41,464 $ 49,300 $ 42,157 $ 41,927 Adjusted return on average assets

1.72 % 1.34 % 1.69 % 1.51 % 1.56

%

Adjusted diluted earnings per share Diluted weighted

average common shares outstanding 130,549,319

83,375,485 84,660,256 84,792,657 84,674,807

Net income allocated to common stock $ 58,028 $ 32,293 $ 47,080 $

47,914 $ 38,825 Total non-routine items, after tax 16,773

9,139 2,164 (5,817 ) 3,102 Adjusted net

income allocated to common stock $ 74,801 $ 41,432 $ 49,244 $

42,097 $ 41,927 Adjusted diluted earnings per share $ 0.57 $ 0.50 $

0.58 $ 0.50 $ 0.50

Adjusted pre-tax, pre-provision net

earnings Income before taxes $ 75,303 $ 43,034 $ 62,210 $

56,358 $ 49,775 Plus: Provision for credit losses 11,210 8,422

(1,365 ) 1,263 4,380 Plus: Total non-routine items before taxes

22,012 11,898 2,198 8 3,631

Adjusted pre-tax, pre-provision net earnings $ 108,525 $ 63,354 $

63,043 $ 57,629 $ 57,786 (1) Annualized (2)

Other non-routine expenses for the second

quarter of 2018 included expenses related to the sale of the assets

of our insurance company. Non-routine expenses for the first

quarter of 2018 represent legal costs associated with litigation

related to a pre-acquisition matter of a legacy acquired bank that

has been resolved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190429005340/en/

Media contact:Danielle

Kernell713-871-4051danielle.kernell@cadencebank.com

Investor relations contact:Valerie Toalson713-871-4103 or

800-698-7878vtoalson@cadencebancorporation.com

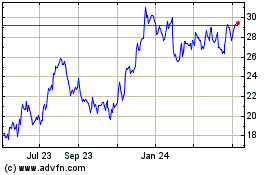

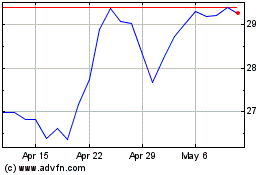

Cadence Bank (NYSE:CADE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cadence Bank (NYSE:CADE)

Historical Stock Chart

From Jul 2023 to Jul 2024