“We are pleased to report our second quarter results. The

quarter reflected record net income, driven by continued organic

growth and an ongoing focus on efficiency and profitability. We

have seen meaningful customer acquisition and development

throughout the company, as well as positive movement in our margins

and continued stabilization of credit. Our bankers have focused on

core deposit growth, and generated a notable improvement in deposit

mix this quarter. We feel good about the quarter’s results, and our

team is optimistic and energized about our progress,” said Paul

Murphy, Cadence’s Chairman and Chief Executive Officer.

- Net income for the second quarter of

2017 was $29.0 million compared to $14.8 million in the second

quarter of 2016, a 95% increase, and an 11% increase compared to

first quarter of 2017 net income of $26.1 million.

- On a per-share basis, net income was

$0.35 per diluted common share for the second quarter of 2017,

compared to $0.20 in the second quarter a year earlier and $0.35 in

the first quarter of 2017. Earnings per share for the period ending

June 30, 2017 reflect increases in net income offset by the $0.03

dilutive effect of the common stock offering in the second quarter

of 2017.

- Annualized returns on average assets,

common equity and tangible common equity(1) for the second quarter

of 2017 were 1.19%, 9.29% and 12.63%, respectively, as compared to

0.65%, 5.47% and 7.90%, respectively, for the second quarter of

2016, and 1.10%, 9.71% and 13.96%, respectively, for the first

quarter of 2017.

- Net interest margin increased 39 basis

points to 3.71% in the second quarter of 2017 from 3.32% for the

second quarter of 2016, and increased 25 basis points from 3.46% in

the first quarter of 2017.

- Total assets were $9.8 billion at June

30, 2017, an increase of $589.8 million, or 6%, as compared to $9.2

billion as of June 30, 2016, and up $90.6 million, or 1%, from $9.7

billion as of March 31, 2017.

- Loans were $7.7 billion at June 30,

2017, an increase of $554.6 million, or 8%, as compared to $7.2

billion at June 30, 2016, and up $155.1 million, or 2%, from $7.6

billion as of March 31, 2017.

- Core deposits (total deposits excluding

brokered) of $7.2 billion at June 30, 2017 grew $813.7 million, or

13%, from June 30, 2016, and were $410.1 million higher, or 6%,

from March 31, 2017.

Period End Balance Sheet:

Cadence continued to enjoy solid growth, completing the second

quarter of 2017 with total assets of $9.8 billion, an increase of

$589.8 million, or 6.4%, from June 30, 2016, and an increase of

$90.6 million, or 0.9%, from March 31, 2017.

Loans at June 30, 2017 were $7.7 billion, an increase of $554.6

million, or 7.7%, compared with $7.2 billion at June 30, 2016,

reflecting growth primarily in our commercial and residential loan

portfolios. Linked quarter loans increased $155.1 million, or 2.1%,

from $7.6 billion at March 31, 2017, reflecting growth in

specialized, general commercial & industrial, and consumer

mortgage lending. Organic loan production as well as our pipeline

remain robust, with payoffs and paydowns impacting net growth in

the quarter.

Cadence’s energy lending portfolio continued to demonstrate

improving credit quality, with balances totaling $902.3 million, or

11.7%, of total loans at June 30, 2017, as compared to $903.9

million, or 11.9%, of total loans at March 31, 2017. At June 30,

2017, Midstream continued to make up the largest component of

energy loans at 54.7%, followed by Exploration and Production at

35.7% and Energy Services at 9.6%.

Core deposits were $7.2 billion at June 30, 2017, an increase of

12.8%, or $813.7 million, compared to June 30, 2016, and an

increase of 6.1%, or $410.2 million, compared to March 31, 2017.

The increases in core deposits were a result of expansion of

commercial deposit relationships and treasury management services

impacting noninterest bearing and interest bearing deposits, as

well as retail time deposit growth. As of June 30, 2017, brokered

deposits totaled $0.7 billion (9.4% of total deposits) as compared

to June 30, 2016 at $1.3 billion (16.9% of total deposits) and

March 31, 2017 at $1.1 billion (13.6% of total deposits). Total

deposits at June 30, 2017 were $7.9 billion, an increase of $257.7

million, or 3.4%, compared with $7.7 billion at June 30, 2016,

reflecting the growth in core deposits offset by $556.0 million, or

42.8%, reduction in brokered deposits. Linked quarter total

deposits increased $88.7 million, or 1.1%, from $7.8 billion at

March 31, 2017, due primarily to the core deposit growth supporting

proactive reductions in brokered deposits during the quarter, with

brokered deposits declining $321.5 million, or 30.2%, linked

quarter. Wholesale funds to total assets of 9.4% at June 30, 2017

improved meaningfully during the quarter as compared to 14.1% and

14.7% at June 30, 2016 and March 31, 2017, respectively.

On April 13, 2017, we executed on our initial public offering,

issuing 8.6 million shares with net proceeds adding $155.7 million

to tangible common equity during the quarter, and increasing

average diluted shares to 82.0 million for the second quarter of

2017, as compared to 75.3 million and 75.7 million in the second

quarter of 2016 and first quarter of 2017, respectively.

Results of Operations for the

Quarter:

Net income for the second quarter of 2017 was $29.0 million, up

95.2% from net income of $14.8 million in the second quarter of

2016, and up 10.9% from net income of $26.1 million in the first

quarter of 2017. The year-over-year net income improvement was

driven by continued earning asset and revenue growth, margin

improvement, flat expenses, and improved credit costs. The increase

in net income on a linked quarter basis was due primarily to

organic growth, a favorable impact of the recent short-term rate

increases on our net interest margin, and favorable recovery

results in acquired-credit-impaired loans. Pre-tax, pre-provision

earnings(1) were $49.2 million for the second quarter of 2017 as

compared to $44.5 million in the first quarter of 2017. On a

per-share basis, net income was $0.35 per diluted common share for

the second quarter of 2017, compared to $0.20 a year earlier and

$0.35 for the linked quarter. Earnings per share for the period

ending June 30, 2017 reflect increases in net income offset by the

$0.03 dilutive effect of the common stock offering in the second

quarter of 2017. The second quarter of 2017 annualized returns on

average assets, common equity and tangible common equity(1) were

1.19%, 9.29% and 12.63%, respectively, as compared to 0.65%, 5.47%

and 7.90%, respectively, for the second quarter of 2016, and 1.10%,

9.71% and 13.96% for the first quarter of 2017.

Net interest margin for the second quarter of 2017 was 3.71% as

compared to 3.32% for the second quarter of 2016 and 3.46% for the

first quarter of 2017. The increase resulted from deposit costs

lagging the change in earning asset yields due to short-term rate

increases during the periods, the impact of decreased

interest-sensitive brokered deposits and increased free-funding

sources during the periods as well as increased loan yields in both

the originated and acquired loan portfolios. Earning asset yields

for the second quarter of 2017 were 4.45%, up from 3.97% in the

second quarter of 2016 and 4.13% in the first quarter of 2017.

Total cost of deposits for the second quarter of 2017 was 59 basis

points versus 46 basis points in the prior year’s quarter and 49

basis points in the linked quarter. Total cost of funds for the

second quarter of 2017 was 81 basis points versus 69 basis points

in the prior year’s quarter and 71 basis points in the linked

quarter.

Net interest income for the second quarter of 2017 was $82.4

million as compared to $69.3 million during the same period in

2016, an increase of $13.1 million, or 19.0%. Linked quarter, net

interest income increased $7.6 million, or 10.2%, from $74.8

million in the first quarter of 2017. The increases were driven by

both solid loan growth during the periods and meaningful increases

in the yield on loans, with loan yields increasing to 4.74% for the

second quarter of 2017 versus 4.24% for the second quarter of 2016

and 4.34% for the first quarter of 2017. Yield on loans, excluding

acquired-impaired loans, were 4.36%, 3.93% and 4.14% for the second

quarter of 2017, second quarter of 2016 and first quarter of 2017,

respectively, demonstrating the interest-sensitivity inherent in

the loan portfolio. Interest income on loans, excluding

acquired-impaired loans, was $79.9 million for the second quarter

of 2017, an increase of $13.4 million, or 20.3%, from the second

quarter of 2016, and an increase of $6.0 million or 8.2% from the

first quarter of 2017. Total accretion for acquired credit-impaired

loans was $10.6 million in the second quarter of 2017, up $1.3

million from the second quarter of 2016 and up $3.6 million from

the first quarter of 2017. The increased accretion in the second

quarter of 2017 was due to accelerated timing of certain payoffs

and paydowns in acquired loans.

Noninterest income for the second quarter of 2017 was $23.0

million as compared to $23.1 million during the same period in

2016, a decrease of $0.1 million, or 0.5%. The year-over-year

change included an increase in service fees and revenue to $22.1

million at June 30, 2017 versus $20.0 million for June 30, 2016

reflecting broad based business line growth during the year,

partially offset by lower securities gains and other revenues in

the second quarter of 2017. Linked quarter, noninterest income

decreased $1.1 million or 4.6% from $24.1 million for the first

quarter of 2017. The quarter’s change included growth in mortgage

banking fees, offset primarily by the impact of first quarter 2017

seasonally higher trust and insurance revenues in the second

quarter of 2017. Assets under management grew $187.5 million, or

3.5%, during the quarter to $5.6 billion.

Noninterest expense for the second quarter of 2017 was $56.1

million as compared to $55.9 million during the same period in

2016, an increase of $0.2 million, or 0.5%. Salaries and employee

benefits expense of $34.7 million in the second quarter of 2017

increased $1.6 million, or 5.0%, compared to the second quarter of

2016, including a $1.0 million increase in certain long-term

incentive plan costs related to the increase in our common stock

value associated with our becoming a public company. These costs

were offset by lower FDIC insurance assessments, lower intangible

asset scheduled amortization and other expenses as a result of

targeted expense management efforts. Linked quarter, noninterest

expenses increased $1.8 million, or 3.3%, from $54.3 million for

the first quarter of 2017, including the $1.0 million in

incremental incentive compensation expense associated with the

second quarter valuation increase of Cadence Bancorporation

associated with its IPO.

The efficiency ratio(1) for the second quarter of 2017 was

53.27%, an improvement relative to both the second quarter of 2016

and first quarter of 2017 results of 60.49% and 54.95%,

respectively, reflecting ongoing focus on efficiency and revenue

growth.

Asset Quality:

Nonperforming assets (NPAs) declined during the quarter,

totaling $141.4 million, or 1.8%, of total loans, OREO and other

NPAs at June 30, 2017, down from $171.0 million, or 2.3%, at March

31, 2017, and down from $195.5 million, or 2.7%, at June 30, 2016.

The decline as compared to the prior year is due primarily to

resolutions, paydowns and general improvement of energy credits. At

June 30, 2017, $109.4 million, or 77.4%, of the nonperforming

assets (“NPAs”) related to the energy portfolio, down from $135.0

million at March 31, 2017. Additionally, of the $93.0 million in

energy nonperforming loans included in total nonperforming assets

at June 30, 2017, over 90% were paying in accordance with

contractual terms.

The allowance for credit losses (“ACL”) was $93.2 million, or

1.21% of total loans, at June 30, 2017, as compared to $87.1

million, or 1.22% of total loans, at June 30, 2016 and $88.3

million, or 1.17% of total loans, at March 31, 2017. At June 30,

2017, the allowance included reserves for the energy portfolio of

3.15% as compared to 2.80% at June 30, 2016 and 3.44% at March 31,

2017.

“With the momentum we have achieved year-to-date, we look

forward to and are positive about the outlook for Cadence,” stated

Mr. Murphy.

Supplementary Financial Tables:

Supplementary Financial Tables are included in this release

following the customary disclosure information.

Second Quarter 2017 Earnings Conference

Call:

Cadence Bancorporation executive management will host a

conference call to discuss second quarter 2017 results on Thursday,

July 27, 2017, at 10.00 a.m. CT / 11:00 a.m. ET. Slides to be

presented by management on the conference call can be viewed by

visiting www.cadencebank.com, clicking through the following links:

“Investor Relations”, “Events & Presentations” and “Event

Calendar”.

Conference Call Access:

To access the conference call, please dial one of the following

numbers approximately 10-15 minutes prior to the start time to

allow time for registration, and use the Elite Entry Number

provided below.

Dial in (toll free): 1-888-317-6003 International dial in:

1-412-317-6061 Canada (toll free): 1-866-284-3684 Participant Elite

Entry Number: 4925342

For those unable to participate in the live presentation, a

replay will be available through August 10, 2017. To access the

replay, please use the following numbers:

US Toll Free: 1-877-344-7529 International Toll:

1-412-317-0088 Canada Toll Free: 1-855-669-9658 Replay Access Code:

10110449 End Date: August 10, 2017

Webcast Access:

A webcast of the conference call as well as the slides to be

presented by management can be viewed by visiting

www.cadencebank.com, clicking through the following links:

“Investor Relations”, “Events & Presentations” and “Event

Calendar”.

About Cadence Bancorporation

Cadence Bancorporation (NYSE:CADE) is a $9.8 billion in assets

regional bank holding company headquartered in Houston, Texas.

Through its affiliates, Cadence operates 65 locations in Alabama,

Florida, Mississippi, Tennessee and Texas, and provides

corporations, middle-market companies, small businesses and

consumers with a full range of innovative banking and financial

solutions. Services and products include commercial and business

banking, treasury management, specialized lending, commercial real

estate, foreign exchange, wealth management, investment and trust

services, financial planning, retirement plan management, business

and personal insurance, consumer banking, consumer loans,

mortgages, home equity lines and loans, and credit cards. Clients

have access to leading-edge online and mobile solutions,

interactive teller machines, and 55,000 ATMs. The Cadence team of

1,200 associates is committed to exceeding customer expectations

and helping their clients succeed financially. Cadence Bank, N.A.,

Cadence Insurance, and Linscomb & Williams are direct or

indirect subsidiaries of Cadence Bancorporation.

Cautionary Statement Regarding Forward-Looking

Information

This communication contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect our current views

with respect to, among other things, future events and our results

of operations, financial condition and financial performance. These

statements are often, but not always, made through the use of words

or phrases such as “may,” “should,” “could,” “predict,”

“potential,” “believe,” “will likely result,” “expect,” “continue,”

“will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,”

“projection,” “would” and “outlook,” or the negative version of

those words or other comparable words of a future or

forward-looking nature. These forward-looking statements are not

historical facts, and are based on current expectations, estimates

and projections about our industry, management’s beliefs and

certain assumptions made by management, many of which, by their

nature, are inherently uncertain and beyond our control.

Accordingly, we caution you that any such forward-looking

statements are not guarantees of future performance and are subject

to risks, assumptions and uncertainties that are difficult to

predict. Although we believe that the expectations reflected in

these forward-looking statements are reasonable as of the date

made, actual results may prove to be materially different from the

results expressed or implied by the forward-looking statements.

Such factors include, without limitation, the “Risk Factors”

referenced in our Registration Statement on Form S-1 filed with the

Securities and Exchange Commission (SEC), other risks and

uncertainties listed from time to time in our reports and documents

filed with the SEC, including our Annual Reports on Form 10-K and

Quarterly Reports on Form 10-Q, and the following factors: business

and economic conditions generally and in the financial services

industry, nationally and within our current and future geographic

market areas; economic, market, operational, liquidity, credit and

interest rate risks associated with our business; lack of seasoning

in our loan portfolio; deteriorating asset quality and higher loan

charge-offs; the laws and regulations applicable to our business;

our ability to achieve organic loan and deposit growth and the

composition of such growth; increased competition in the financial

services industry, nationally, regionally or locally; our ability

to maintain our historical earnings trends; our ability to raise

additional capital to implement our business plan; material

weaknesses in our internal control over financial reporting;

systems failures or interruptions involving our information

technology and telecommunications systems or third-party servicers;

the composition of our management team and our ability to attract

and retain key personnel; the fiscal position of the U.S. federal

government and the soundness of other financial institutions; the

composition of our loan portfolio, including the identify of our

borrowers and the concentration of loans in energy-related

industries and in our specialized industries; the portion of our

loan portfolio that is comprised of participations and shared

national credits; and the amount of nonperforming and classified

assets we hold. Cadence can give no assurance that any goal or plan

or expectation set forth in forward-looking statements can be

achieved and readers are cautioned not to place undue reliance on

such statements. The forward-looking statements are made as of the

date of this communication, and Cadence does not intend, and

assumes no obligation, to update any forward-looking statement to

reflect events or circumstances after the date on which the

statement is made or to reflect the occurrence of unanticipated

events or circumstances, except as required by applicable law.

About Non-GAAP Financial Measures

Certain of the financial measures and ratios we present,

including “efficiency ratio,” “adjusted noninterest expenses,”

“adjusted operating revenue,” “tangible common equity ratio,”

“tangible book value per share” and “return on average tangible

common equity” and “pre-tax, pre-provision net earnings,” are

supplemental measures that are not required by, or are not

presented in accordance with, U.S. generally accepted accounting

principles (GAAP). We refer to these financial measures and ratios

as “non-GAAP financial measures.” We consider the use of select

non-GAAP financial measures and ratios to be useful for financial

and operational decision making and useful in evaluating

period-to-period comparisons. We believe that these non-GAAP

financial measures provide meaningful supplemental information

regarding our performance by excluding certain expenditures or

assets that we believe are not indicative of our primary business

operating results or by presenting certain metrics on a fully

taxable equivalent basis. We believe that management and investors

benefit from referring to these non-GAAP financial measures in

assessing our performance and when planning, forecasting, analyzing

and comparing past, present and future periods.

These non-GAAP financial measures should not be considered a

substitute for financial information presented in accordance with

GAAP and you should not rely on non-GAAP financial measures alone

as measures of our performance. The non-GAAP financial measures we

present may differ from non-GAAP financial measures used by our

peers or other companies. We compensate for these limitations by

providing the equivalent GAAP measures whenever we present the

non-GAAP financial measures and by including a reconciliation of

the impact of the components adjusted for in the non-GAAP financial

measure so that both measures and the individual components may be

considered when analyzing our performance. A reconciliation of

non-GAAP financial measures to the comparable GAAP financial

measures is included at the end of the financial statement tables

(Table 7).

(1) Considered a non-GAAP financial measure. See Table 7

“Reconciliation of Non-GAAP Financial Measures” for a

reconciliation of our non-GAAP measures to the most directly

comparable GAAP financial measure.

Table 1 - Selected Financial

Data

As of and for the Three Months Ended (In

thousands, except per share data)

June 30,2017

March 31,2017

December 31,2016

September 30,2016

June 30,2016

Statement of Operations Data: Interest

income $ 99,375 $ 89,619 $ 87,068 $ 84,654 $ 82,921 Interest

expense 16,991 14,861 14,570 14,228

13,672 Net interest income 82,384 74,758 72,498 70,426

69,249 Provision for credit losses 6,701 5,786

(5,222 ) 29,627 14,471 Net interest income after

provision 75,683 68,972 77,720 40,799 54,778 Noninterest income -

service fees and revenue 22,144 22,489 20,605 20,878 20,048 - other

noninterest income 845 1,616 1,755 1,913 3,058 Noninterest expense

56,134 54,321 55,394 54,876

55,868 Income before income taxes 42,538 38,756 44,686 8,714 22,016

Income tax expense 13,570 12,639 15,701

2,107 7,175 Net income $ 28,968 $ 26,117 $ 28,985 $ 6,607 $

14,841

Period-End Balance Sheet Data:

Investment securities,

available-for-sale

$ 1,079,935 $ 1,116,280 $ 1,139,347 $ 1,031,319 $ 980,526 Total

loans, net of unearned income 7,716,621 7,561,472 7,432,711

7,207,313 7,162,027 Allowance for credit losses 93,215 88,304

82,268 91,169 87,147 Total assets 9,811,557 9,720,937 9,530,888

9,444,010 9,221,807 Total deposits 7,930,383 7,841,710 8,016,749

7,917,289 7,672,657 Noninterest-bearing deposits 1,857,809

1,871,514 1,840,955 1,642,480 1,668,179 Interest-bearing deposits

6,072,574 5,970,196 6,175,794 6,274,809 6,004,478 Borrowings and

subordinated debentures 499,265 682,567 331,712 332,787 334,192

Total shareholders’ equity 1,304,054 1,105,976 1,080,498 1,111,783

1,116,076

Average Balance Sheet Data:

Investment securities,

available-for-sale

$ 1,099,307 $ 1,125,174 $ 1,060,821 $ 1,110,836 977,597 Total

loans, net of unearned income 7,650,048 7,551,173 7,375,446

7,225,365 7,180,357 Allowance for credit losses 90,366 82,258

95,042 93,132 91,211 Total assets 9,786,355 9,670,593 9,596,574

9,400,145 9,167,153 Total deposits 7,940,421 8,025,068 8,425,326

7,843,582 7,496,120 Noninterest-bearing deposits 1,845,447

1,857,657 1,784,422 1,697,633 1,655,761 Interest-bearing deposits

6,094,974 6,167,411 6,640,904 6,145,949 5,840,359 Borrowings and

subordinated debentures 510,373 474,976 500,045 368,192 512,837

Total shareholders’ equity 1,251,217 1,090,905 1,094,182 1,118,603

1,092,034

Table 1 (Continued) - Selected

Financial Data

As of and for the Three Months Ended (In

thousands, except per share data)

June 30,2017

March 31,2017

December 31,2016

September 30,2016

June 30,2016

Per Share Data:(3) Earnings Basic $ 0.35 $ 0.35 $

0.39 $ 0.09 $ 0.20 Diluted 0.35 0.35 0.38 0.09 0.20 Book value per

common share 15.59 14.75 14.41 14.82 14.88 Tangible book value (1)

11.64 10.33 9.97 10.37 10.40

Weighted average common shares

outstanding

Basic 81,918,956 75,000,000 75,000,000 75,000,000 75,000,000

Diluted 81,951,795 75,672,750 75,402,525 75,258,375 75,258,375

Performance Ratios: Return on average common equity (2) 9.29

% 9.71 % 10.54 % 2.35 % 5.47 %

Return on average tangible common equity

(1) (2)

12.63 13.96 15.16 3.36 7.90 Return on average assets (2) 1.19 1.10

1.20 0.28 0.65 Net interest margin (2) 3.71 3.46 3.31 3.27 3.32

Efficiency ratio (1) 53.27 54.95 58.40 58.87 60.49

Asset Quality

Ratios:

Total nonperforming assets ("NPAs") to

total loans and OREO and other NPAs

1.82 % 2.25 % 2.22 % 2.52 % 2.72 %

Total nonperforming loans to total

loans

1.36 1.77 1.73 2.13 2.26 Total ACL to total loans 1.21 1.17 1.11

1.26 1.22

ACL to total nonperforming loans

("NPLs")

88.81 65.80 63.80 59.34 53.84 Net charge-offs to average loans (2)

0.09 (0.01 ) 0.20 1.41 1.01

Capital Ratios: Total

shareholders’ equity to assets 13.29 % 11.38 % 11.34 % 11.77 %

12.10 %

Tangible common equity to tangible assets

(1)

10.27 8.25 8.13 8.54 8.78

Common equity tier 1 (CET1)

(transitional)

10.92 8.99 8.84 8.82 8.69 Tier 1 leverage capital 11.00 9.10 8.89

8.73 8.90 Tier 1 risk-based capital 11.31 9.36 9.19 9.17 9.00 Total

risk-based capital 13.41 11.43 11.22 11.38 11.10 (1) -

Considered a non-GAAP financial measure. See Table 7

"Reconciliation of Non-GAAP Financial Measures" for a

reconciliation of our non-GAAP measures to the most directly

comparable GAAP financial measure. (2) - Annualized. (3) -

75,000,000 of our outstanding shares are owned by our

parent-holding company Cadence Bancorp LLC

Table 2 - Average

Balances/Yield/Rates

Three Months Ended June 30, 2017

2016 Average Income/

Yield/ Average Income/

Yield/ (In thousands) Balance Expense

Rate Balance Expense Rate ASSETS

Interest-earning assets: Loans, net of

unearned income(1) Originated and ANCI loans $ 7,348,932 $ 79,904

4.36 % $ 6,793,328 $ 66,444 3.93 % ACI portfolio 301,116

10,525 14.02 387,029 9,231 9.59

Total loans 7,650,048 90,429 4.74 7,180,357 75,675 4.24 Investment

securities Taxable 688,464 4,178 2.43 729,213 4,169 2.30 Tax-exempt

(2) 410,843 5,208 5.08 248,384

3,003 4.86

Total investment securities 1,099,307 9,386 3.42 977,597 7,172 2.95

Federal funds sold and short-term

investments

312,287 688 0.88 302,508 493 0.66 Other investments 50,064

695 5.57 49,070 632 5.18 Total

interest-earning assets 9,111,706 101,198 4.45 8,509,532 83,972

3.97

Noninterest-earning assets: Cash and due from banks

59,220 50,196 Premises and equipment 65,392 69,920 Accrued interest

and other assets 640,403 628,716 Allowance for credit losses

(90,366 ) (91,211 ) Total assets $ 9,786,355 $ 9,167,153

LIABILITIES AND STOCKHOLDERS' EQUITY Interest-bearing

liabilities: Demand deposits $ 4,232,497 $ 6,354 0.60 % $

3,913,639 $ 4,086 0.42 % Savings deposits 186,307 119 0.26 179,079

105 0.24 Time deposits 1,676,170 5,298 1.27

1,747,641 4,360 1.00 Total

interest-bearing deposits 6,094,974 11,771 0.77 5,840,359 8,551

0.59 Other borrowings 375,681 2,896 3.09 378,919 2,842 3.02

Subordinated debentures 134,692 2,324 6.92

133,918 2,279 6.84 Total

interest-bearing liabilities 6,605,347 16,991 1.03 6,353,196 13,672

0.87

Noninterest-bearing liabilities: Demand deposits

1,845,447 1,655,761 Accrued interest and other liabilities

84,344 66,162 Total liabilities 8,535,138 8,075,119

Stockholders' equity 1,251,217

1,092,034 Total liabilities and stockholders' equity $ 9,786,355

$ 9,167,153 Net interest income/net interest spread 84,207

3.42 % 70,300 3.10 % Net yield on earning assets/net

interest margin 3.71 % 3.32 %

Taxable equivalent

adjustment: Investment securities (1,823 ) (1,051

) Net interest income $ 82,384 $ 69,249

(1) Nonaccrual loans are included in

loans, net of unearned income. No adjustment has been made for

these loans in the calculation of yields.

(2) Interest income and yields are presented on a fully taxable

equivalent basis using a tax rate of 35%.

Table 3 – Loan Interest Income

Detail

For the Three Months Ended, (In

thousands)

June 30, 2017

March 31, 2017

December 31, 2016

September 30, 2016

June 30, 2016

Loan Interest Income Detail Interest income on loans,

excluding ACI loans $ 79,904 $ 73,869 $ 71,237 $ 68,411 $ 66,444

Scheduled accretion for the period 6,075 6,331 6,845 7,296 8,028

Recovery income for the period 4,450 610 968

1,360 1,203 Accretion on acquired credit impaired

(ACI) loans 10,525 6,941 7,813 8,656

9,231 Loan interest income $ 90,429 $ 80,810 $ 79,050 $

77,067 $ 75,675 Loan yield, excluding ACI loans 4.36 % 4.14

% 4.03 % 3.96 % 3.93 % ACI loan yield 14.02 8.89

9.21 9.67 9.59 Total loan yield 4.74 %

4.34 % 4.26 % 4.24 % 4.24 %

For the Six Months Ended June 30,

For the Years Ended December 31, (In thousands)

2017 2016 2016

2015 Loan Interest Income Detail Interest income on

loans, excluding ACI loans $ 153,773 $ 129,336 $ 268,984 $ 216,422

Scheduled accretion for the period 12,406 16,728 30,870 46,042

Recovery income for the period 5,060 3,372

5,699 9,970 Total accretion income on purchased loans (ACI

loans) 17,466 20,100 36,569 56,012 Loan

interest income $ 171,239 $ 149,436 $ 305,553 $ 272,434 Loan

yield, excluding ACI loans 4.25 % 3.90 % 3.95 % 3.63 % ACI loan

yield 11.41 10.04 9.75 10.49 Total loan

yield 4.54 % 4.25 % 4.25 % 4.20 %

Table 4 - Allowance for Credit

Losses

For the Three Months Ended (In thousands)

June 30, 2017

March 31, 2017

December 31, 2016

September 30, 2016

June 30, 2016

Balance at beginning of period $ 88,304 $ 82,268 $ 91,169 $

87,147 $ 90,751 Charge-offs (2,879 ) (551 ) (3,922 ) (26,868 )

(18,206 ) Recoveries 1,089 801 243

1,263 131

Net (charge-offs) recoveries (1,790

) 250 (3,679 ) (25,605 ) (18,075 )

Provision for (reversal of) credit losses 6,701 5,786

(5,222 ) 29,627 14,471

Balance at end of

period $ 93,215 $ 88,304 $ 82,268 $ 91,169 $ 87,147

Table 5 -Noninterest Income

Three Months Ended (In thousands)

June 30, 2017

March 31, 2017

December 31, 2016

September 30, 2016

June 30, 2016

Noninterest Income Investment advisory revenue $ 5,061 $

4,916 $ 4,821 $ 4,733 $ 4,653 Trust services revenue 4,584 5,231

4,109 3,959 3,971 Service charges on deposit accounts 3,784 3,815

3,614 3,555 3,270 Credit-related fees 2,741 2,747 2,875 2,689 2,507

Insurance revenue 1,828 2,130 1,577 1,863 1,953 Bankcard fees 1,862

1,812 1,813 1,823 1,777 Mortgage banking revenue 1,213 866 1,019

1,459 1,101 Other service fees earned 1,071 972

777 797 816

Total service fees and

revenue 22,144 22,489 20,605 20,878

20,048 Securities (losses) gains, net (244 ) 81 1,267

1,386 1,019 Other 1,089 1,535 488 527

2,039

Total other noninterest income 845

1,616 1,755 1,913 3,058

Total

noninterest income (GAAP) 22,989 24,105 22,360 22,791 23,106

Less: Securities (losses) gains (244 ) 81

1,267 1,386 1,019

Adjusted noninterest

operating revenue (Non-GAAP measure) $ 23,233 $ 24,024 $ 21,093

$ 21,405 $ 22,087

Table 6 -Noninterest Expense

Three Months Ended (In thousands)

June 30, 2017

March 31, 2017

December 31, 2016

September 30, 2016

June 30, 2016

Noninterest Expenses Salaries and employee benefits $ 34,682

$ 34,267 $ 28,139 $ 31,086 $ 33,033 Premises and equipment 7,180

6,693 7,475 7,130 6,626 Intangible asset amortization 1,190 1,241

1,555 1,607 1,659 Net cost of operation of other real estate owned

427 296 1,117 1,126 107 Data processing 1,702 1,696 1,767 1,530

1,594 Special asset expenses 469 140 670 477 392 Consulting and

professional fees 1,502 1,139 2,288 2,040 1,092 Loan related

expenses 757 280 1,236 985 744 FDIC insurance 954 1,493 1,517 1,912

2,292 Communications 675 655 741 535 721 Advertising and public

relations 499 345 344 303 338 Legal expenses 508 432 662 337 978

Branch closure expenses 47 46 47 52 75 Other 5,542

5,598 7,836 5,756 6,217

Total noninterest

expenses $ 56,134 $ 54,321 $ 55,394 $ 54,876 $ 55,868

Table 7 - Reconciliation of Non-GAAP

Financial Measures

As of and for the Three Months Ended (In

thousands)

June 30, 2017

March 31, 2017

December 31, 2016

September 30, 2016

June 30, 2016

Efficiency ratio Noninterest expenses (numerator) $ 56,134 $

54,321 $ 55,394 $ 54,876 $ 55,868 Net interest income $ 82,384 $

74,758 $ 72,498 $ 70,426 $ 69,249 Noninterest income 22,989

24,105 22,360 22,791 23,106 Operating

revenue (denominator) $ 105,373 $ 98,863 $ 94,858 $ 93,217 $ 92,355

Efficiency ratio 53.27 % 54.95 % 58.40 %

58.87 % 60.49 %

Adjusted noninterest expenses and

operating revenue Noninterest expense $ 56,134 $ 54,321 $

55,394 $ 54,876 $ 55,868 Less: Branch closure expenses 47

46 47 52 75 Adjusted noninterest

expenses $ 56,087 $ 54,275 $ 55,347 $ 54,824 $ 55,793 Net interest

income $ 82,384 $ 74,758 $ 72,498 $ 70,426 $ 69,249 Noninterest

income 22,989 24,105 22,360 22,791 23,106 Less: Securities (losses)

gains, net (244 ) 81 1,267 1,386

1,019 Adjusted operating revenue $ 105,617 $ 98,782 $ 93,591 $

91,831 $ 91,336

Tangible common equity ratio Shareholders’

equity $ 1,304,054 $ 1,105,976 $ 1,080,498 $ 1,111,783 $ 1,116,076

Less: Goodwill and other intangible assets, net (330,261 )

(331,450 ) (332,691 ) (334,246 )

(335,852 ) Tangible common shareholders’ equity 973,793

774,526 747,807 777,537 780,224 Total

assets 9,811,557 9,720,937 9,530,888 9,444,010 9,221,807 Less:

Goodwill and other intangible assets, net (330,261 )

(331,450 ) (332,691 ) (334,246 ) (335,852 )

Tangible assets $ 9,481,296 $ 9,389,487 $ 9,198,197 $ 9,109,764 $

8,885,955 Tangible common equity ratio 10.27 % 8.25 %

8.13 % 8.54 % 8.78 %

Tangible book value

per share Shareholders’ equity $ 1,304,054 $ 1,105,976 $

1,080,498 $ 1,111,783 $ 1,116,076 Less: Goodwill and other

intangible assets, net (330,261 ) (331,450 )

(332,691 ) (334,246 ) (335,852 ) Tangible common

shareholders’ equity $ 973,793 $ 774,526 $ 747,807 $ 777,537 $

780,224 Common shares issued 83,625,000 75,000,000

75,000,000 75,000,000 75,000,000 Tangible book

value per share $ 11.64 $ 10.33 $ 9.97 $ 10.37 $ 10.40

Return on

average tangible common equity Average common equity $

1,251,217 $ 1,090,905 $ 1,094,182 $ 1,118,603 $ 1,092,034 Less:

Average intangible assets (330,977 ) (332,199 )

(333,640 ) (335,215 ) (336,856 ) Average

tangible common shareholders’ equity $ 920,240 $ 758,706 $ 760,542

$ 783,388 $ 755,178 Net income $ 28,968 $ 26,117 $ 28,985 $ 6,607 $

14,841 Return on average tangible common equity 12.63 %

13.96 % 15.16 % 3.36 % 7.90 %

Pre-tax, pre-provision net earnings Income before taxes $

42,538 $ 38,756 $ 44,686 $ 8,714 $ 22,016 Plus: Provision for

credit losses 6,701 5,786 (5,222 )

29,627 14,471 Pre-tax, pre-provision net earnings $ 49,239 $

44,542 $ 39,464 $ 38,341 $ 36,487

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170726006458/en/

Cadence BancorporationMedia contact:Danielle

Kernell, 713-871-4051danielle.kernell@cadencebank.comorInvestor

relations contact:Valerie Toalson, 713-871-4103 or

800-698-7878vtoalson@cadencebancorporation.com

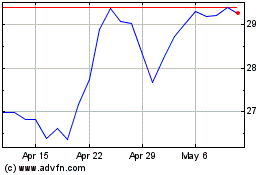

Cadence Bank (NYSE:CADE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cadence Bank (NYSE:CADE)

Historical Stock Chart

From Jul 2023 to Jul 2024