Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (n-q)

September 24 2013 - 3:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment

Company Act file number 811-05723

Name of Fund: BlackRock Emerging Markets Fund, Inc.

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Emerging Markets Fund Inc.,

55 East 52

nd

Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 10/31/2013

Date of reporting period:

07/31/2013

Item 1 – Schedule of Investments

|

|

|

|

|

Schedule of Investments

July 31, 2013 (Unaudited)

|

|

BlackRock

Emerging Markets Fund, Inc.

(Percentages shown are based on Net Assets)

|

|

|

|

|

|

|

|

|

|

|

|

Common Stocks

|

|

Shares

|

|

|

Value

|

|

|

Brazil — 17.6%

|

|

|

|

|

|

|

|

|

|

BB Seguridade Participacoes SA (a)

|

|

|

712,370

|

|

|

$

|

5,758,039

|

|

|

BM&FBovespa SA

|

|

|

941,964

|

|

|

|

5,078,641

|

|

|

BR Malls Participacoes SA

|

|

|

433,972

|

|

|

|

3,846,369

|

|

|

BRF - Brasil Foods SA

|

|

|

262,575

|

|

|

|

5,593,681

|

|

|

Cia de Concessoes Rodoviarias

|

|

|

885,997

|

|

|

|

6,951,738

|

|

|

Cyrela Brazil Realty SA

|

|

|

481,410

|

|

|

|

3,437,512

|

|

|

Embraer SA

|

|

|

670,879

|

|

|

|

5,704,979

|

|

|

Eurasia Drilling Co., Ltd. - GDR

|

|

|

110,729

|

|

|

|

4,373,795

|

|

|

Itau Unibanco Holdings SA, Preference Shares - ADR

|

|

|

1,030,279

|

|

|

|

13,136,057

|

|

|

Localiza Rent a Car SA

|

|

|

254,325

|

|

|

|

3,623,101

|

|

|

Mills Estruturas e Servicos de Engenharia SA (a)

|

|

|

406,255

|

|

|

|

5,075,182

|

|

|

Natura Cosmeticos SA

|

|

|

160,123

|

|

|

|

3,225,131

|

|

|

Vale SA

|

|

|

521,275

|

|

|

|

7,087,887

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

72,892,112

|

|

|

Chile — 1.2%

|

|

|

|

|

|

|

|

|

|

SACI Falabella

|

|

|

479,063

|

|

|

|

4,908,193

|

|

|

China — 11.7%

|

|

|

|

|

|

|

|

|

|

Anhui Conch Cement Co. Ltd., Class H

|

|

|

1,460,000

|

|

|

|

4,314,426

|

|

|

Bank of China Ltd., Class H

|

|

|

30,943,200

|

|

|

|

12,956,110

|

|

|

China Galaxy Securities Co. Ltd., Class H (a)

|

|

|

7,665,400

|

|

|

|

4,497,082

|

|

|

CNOOC Ltd.

|

|

|

3,631,000

|

|

|

|

6,562,408

|

|

|

CNOOC Ltd. - ADR

|

|

|

20,335

|

|

|

|

3,657,046

|

|

|

Jiangxi Copper Co. Ltd., Class H

|

|

|

1,154,455

|

|

|

|

1,945,641

|

|

|

PetroChina Co. Ltd.

|

|

|

3,090,000

|

|

|

|

3,609,497

|

|

|

Tencent Holdings Ltd.

|

|

|

172,462

|

|

|

|

7,807,011

|

|

|

Want Want China Holdings Ltd.

|

|

|

2,620,000

|

|

|

|

3,545,231

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

48,894,452

|

|

|

Hong Kong — 10.6%

|

|

|

|

|

|

|

|

|

|

AIA Group Ltd.

|

|

|

1,964,400

|

|

|

|

9,298,167

|

|

|

China Overseas Land & Investment Ltd.

|

|

|

2,546,000

|

|

|

|

7,328,655

|

|

|

China Railway Construction Corp.

|

|

|

2,588,000

|

|

|

|

2,630,542

|

|

|

ENN Energy Holdings Ltd.

|

|

|

628,000

|

|

|

|

3,475,791

|

|

|

Haier Electronics Group Co. Ltd.

|

|

|

3,153,000

|

|

|

|

5,681,810

|

|

|

Kunlun Energy Co. Ltd.

|

|

|

2,500,000

|

|

|

|

3,678,270

|

|

|

Samsonite International SA

|

|

|

1,551,600

|

|

|

|

4,246,596

|

|

|

Sands China Ltd.

|

|

|

1,470,400

|

|

|

|

7,947,190

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44,287,021

|

|

|

India — 6.9%

|

|

|

|

|

|

|

|

|

|

Dr Reddy’s Laboratories Ltd. - ADR

|

|

|

150,785

|

|

|

|

5,619,757

|

|

|

Financial Technologies India Ltd.

|

|

|

164,706

|

|

|

|

1,464,641

|

|

|

ICICI Bank Ltd. - ADR

|

|

|

119,135

|

|

|

|

3,905,245

|

|

|

ITC Ltd.

|

|

|

1,243,066

|

|

|

|

6,988,780

|

|

|

Tata Motors Ltd. - ADR

|

|

|

282,958

|

|

|

|

6,802,310

|

|

|

Yes Bank Ltd.

|

|

|

734,474

|

|

|

|

3,908,916

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28,689,649

|

|

|

Indonesia — 4.5%

|

|

|

|

|

|

|

|

|

|

Bank Mandiri Persero Tbk PT

|

|

|

6,341,500

|

|

|

|

5,488,634

|

|

|

Gudang Garam Tbk PT

|

|

|

844,500

|

|

|

|

3,474,806

|

|

|

Indocement Tunggal Prakarsa Tbk PT

|

|

|

2,358,500

|

|

|

|

4,782,353

|

|

|

Telekomunikasi Indonesia Tbk PT

|

|

|

4,462,084

|

|

|

|

5,162,128

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18,907,921

|

|

|

Ireland — 1.4%

|

|

|

|

|

|

|

|

|

|

Dragon Oil Plc

|

|

|

638,057

|

|

|

|

6,002,366

|

|

|

Italy — 1.4%

|

|

|

|

|

|

|

|

|

|

Prada SpA

|

|

|

622,300

|

|

|

|

5,802,509

|

|

|

Malaysia — 0.7%

|

|

|

|

|

|

|

|

|

|

Malayan Banking Bhd

|

|

|

866,100

|

|

|

|

2,737,863

|

|

|

Mexico — 6.1%

|

|

|

|

|

|

|

|

|

|

Cemex SAB de CV

|

|

|

5,028,630

|

|

|

|

5,795,262

|

|

|

Fomento Economico Mexicano SAB de CV - ADR

|

|

|

63,438

|

|

|

|

6,311,447

|

|

|

Grupo Financiero Banorte SA de CV, Series O

|

|

|

853,515

|

|

|

|

5,422,696

|

|

|

Grupo Televisa SA - ADR

|

|

|

223,411

|

|

|

|

6,054,438

|

|

|

Wal-Mart de Mexico SA de CV, Series V

|

|

|

667,388

|

|

|

|

1,826,170

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25,410,013

|

|

|

Netherlands — 2.1%

|

|

|

|

|

|

|

|

|

|

Yandex NV (a)

|

|

|

273,862

|

|

|

|

8,900,515

|

|

|

Panama — 1.5%

|

|

|

|

|

|

|

|

|

|

Copa Holdings SA, Class A

|

|

|

43,962

|

|

|

|

6,118,192

|

|

|

Peru — 1.2%

|

|

|

|

|

|

|

|

|

|

Credicorp Ltd.

|

|

|

40,288

|

|

|

|

4,785,812

|

|

|

Philippines — 1.0%

|

|

|

|

|

|

|

|

|

|

Philippine Long Distance Telephone Co.

|

|

|

58,255

|

|

|

|

4,068,968

|

|

|

Russia — 5.3%

|

|

|

|

|

|

|

|

|

|

Lukoil OAO - ADR

|

|

|

52,243

|

|

|

|

3,106,369

|

|

|

Magnit OJSC - GDR

|

|

|

78,173

|

|

|

|

4,497,546

|

|

|

Mail.ru Group Ltd. - GDR

|

|

|

161,541

|

|

|

|

5,161,235

|

|

|

Sberbank - ADR

|

|

|

800,611

|

|

|

|

9,190,769

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21,955,919

|

|

|

South Africa — 1.6%

|

|

|

|

|

|

|

|

|

|

Shoprite Holdings Ltd.

|

|

|

339,853

|

|

|

|

5,746,823

|

|

|

Standard Bank Group Ltd.

|

|

|

93,068

|

|

|

|

1,040,672

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,787,495

|

|

|

South Korea — 8.3%

|

|

|

|

|

|

|

|

|

|

Hyundai Motor Co.

|

|

|

24,407

|

|

|

|

5,046,720

|

|

|

LG Household & Health Care Ltd.

|

|

|

11,599

|

|

|

|

6,107,472

|

|

|

Samsung Electronics Co. Ltd.

|

|

|

15,821

|

|

|

|

18,028,290

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BLACKROCK EMERGING MARKETS FUND, INC.

|

|

JULY 31, 2013

|

|

1

|

|

|

|

|

|

Schedule of Investments (continued)

|

|

BlackRock

Emerging Markets Fund, Inc.

(Percentages shown are based on Net Assets)

|

|

|

|

|

|

|

|

|

|

|

|

Common Stocks

|

|

Shares

|

|

|

Value

|

|

|

South Korea (concluded)

|

|

|

|

|

|

|

|

|

|

Samsung Heavy Industries Co. Ltd.

|

|

|

149,250

|

|

|

$

|

5,301,206

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34,483,688

|

|

|

Taiwan — 7.0%

|

|

|

|

|

|

|

|

|

|

Delta Electronics, Inc.

|

|

|

788,000

|

|

|

|

3,822,377

|

|

|

Hermes Microvision, Inc.

|

|

|

109,903

|

|

|

|

3,403,312

|

|

|

HON HAI Precision Industry Co. Ltd.

|

|

|

2,400,363

|

|

|

|

6,215,288

|

|

|

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR

|

|

|

934,510

|

|

|

|

15,867,980

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29,308,957

|

|

|

Thailand — 3.3%

|

|

|

|

|

|

|

|

|

|

Advanced Info Service PCL

|

|

|

391,800

|

|

|

|

3,567,508

|

|

|

Kasikornbank PCL - NVDR

|

|

|

821,000

|

|

|

|

4,785,382

|

|

|

Siam Cement PCL - NVDR

|

|

|

364,800

|

|

|

|

5,334,877

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,687,767

|

|

|

Turkey — 0.8%

|

|

|

|

|

|

|

|

|

|

Turkiye Garanti Bankasi AS

|

|

|

850,732

|

|

|

|

3,320,069

|

|

|

United States — 2.7%

|

|

|

|

|

|

|

|

|

|

Cognizant Technology Solutions Corp., Class A (a)

|

|

|

106,362

|

|

|

|

7,699,545

|

|

|

First Cash Financial Services, Inc. (a)

|

|

|

68,772

|

|

|

|

3,672,425

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,371,970

|

|

|

Total Common Stocks – 96.9%

|

|

|

|

|

|

|

403,321,451

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participation Notes

|

|

Par

(000)

|

|

|

|

|

|

Switzerland — 1.7%

|

|

|

|

|

|

|

|

|

|

UBS AG (Shinhan Financial Group Co. Ltd. due 2/22/16) (a)

|

|

$

|

189,414

|

|

|

|

6,910,978

|

|

|

|

|

Shares

|

|

|

|

|

|

Total Long-Term Investments

(Cost – $378,630,221) – 98.6%

|

|

|

|

|

|

|

410,232,429

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-Term Securities

|

|

|

|

|

|

|

|

Money Market Funds — 0.6%

|

|

|

|

|

|

|

|

|

|

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.04% (b)(c)

|

|

|

2,449,847

|

|

|

|

2,449,847

|

|

|

|

|

|

|

|

|

Par

(000)

|

|

|

|

|

|

Time Deposits — 0.3%

|

|

|

|

|

|

|

|

|

|

Brown Brothers Harriman & Co., 0.01%, 8/01/13

|

|

HKD

|

9,046

|

|

|

|

1,166,392

|

|

|

Total Short-Term Securities

(Cost – $3,616,239) – 0.9%

|

|

|

|

|

|

|

3,616,239

|

|

|

Total Investments (Cost – $382,246,460*) – 99.5%

|

|

|

|

413,848,668

|

|

|

Other Assets Less Liabilities – 0.5%

|

|

|

|

2,419,081

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets – 100.0%

|

|

|

$

|

416,267,749

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

As of July 31, 2013, gross unrealized appreciation and gross unrealized depreciation based on cost for federal income tax purposes were as follows:

|

|

|

|

|

|

|

|

Tax cost

|

|

$

|

390,030,199

|

|

|

|

|

|

|

|

|

Gross unrealized appreciation

|

|

$

|

51,565,046

|

|

|

Gross unrealized depreciation

|

|

|

(27,746,577

|

)

|

|

|

|

|

|

|

|

Net unrealized appreciation

|

|

$

|

23,818,469

|

|

|

|

|

|

|

|

|

|

|

Notes to Schedule of Investments

|

|

(a)

|

|

Non-income producing security.

|

|

(b)

|

|

Investments in issuers considered to be an affiliate of the Fund during the period ended July 31, 2013, for purposes of Section 2(a)(3) of the Investment Company

Act of 1940, as amended, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Affiliate

|

|

Shares

Held at

October 31, 2012

|

|

|

Net

Activity

|

|

|

Shares

Held at

July 31, 2013

|

|

|

Income

|

|

|

BlackRock Liquidity Funds, TempFund, Institutional Class

|

|

|

12,893,760

|

|

|

|

(10,443,913

|

)

|

|

|

2,449,847

|

|

|

$

|

10,434

|

|

|

(c)

|

|

Represents the current yield as of report date.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

|

|

BLACKROCK EMERGING MARKETS FUND, INC.

|

|

JULY 31, 2013

|

|

|

|

|

|

|

|

Schedule of Investments (continued)

|

|

BlackRock

Emerging Markets Fund, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

To simplify the listings of portfolio holdings in the Schedule of Investments, the names and descriptions of many of the securities have been abbreviated according to the

following list:

|

|

ADR

|

|

American Depositary Receipts

|

|

|

|

|

|

|

GDR

|

|

Global Depositary Receipts

|

|

|

|

|

|

|

HKD

|

|

Hong Kong Dollar

|

|

|

|

|

|

|

PCL

|

|

Public Company Limited

|

|

|

|

|

|

|

PEN

|

|

Peruvian Nuevo Sol

|

|

|

|

|

|

|

USD

|

|

US Dollar

|

|

|

|

|

|

|

ZAR

|

|

South African Rand

|

|

|

|

|

|

Ÿ

|

|

Foreign currency exchange contracts as of July 31, 2013 were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency

Purchased

|

|

|

Currency

Sold

|

|

|

Counterparty

|

|

Settlement

Date

|

|

Unrealized

Appreciation

|

|

|

USD

|

|

|

34,930

|

|

|

PEN

|

|

|

97,349

|

|

|

Brown Brothers Harriman & Co.

|

|

8/01/13

|

|

$

|

112

|

|

|

USD

|

|

|

445,304

|

|

|

ZAR

|

|

|

4,374,440

|

|

|

State Street Corp.

|

|

8/01/13

|

|

|

1,896

|

|

|

USD

|

|

|

415,551

|

|

|

ZAR

|

|

|

4,069,018

|

|

|

Citibank NA

|

|

8/02/13

|

|

|

3,102

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

5,110

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ÿ

|

|

Fair Value Measurements — Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs to

valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial reporting purposes as follows:

|

|

Ÿ

|

|

Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access

|

|

Ÿ

|

|

Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted

prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss

severities, credit risks and default rates) or other market-corroborated inputs)

|

|

Ÿ

|

|

Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available

(including the Fund’s own assumptions used in determining the fair value of investments and derivative financial instruments)

|

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3

measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such

cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the

fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the

investment and derivative financial instruments and is not necessarily an indication of the risks associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments and derivative financial

instruments, please refer to the Fund’s most recent financial statements as contained in its semi-annual report.

The following tables

summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy as of July 31, 2013:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long Term Investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stocks:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brazil

|

|

$

|

72,892,112

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

72,892,112

|

|

|

Chile

|

|

|

4,908,193

|

|

|

|

—

|

|

|

|

—

|

|

|

|

4,908,193

|

|

|

China

|

|

|

8,154,128

|

|

|

$

|

40,740,324

|

|

|

|

—

|

|

|

|

48,894,452

|

|

|

Hong Kong

|

|

|

—

|

|

|

|

44,287,021

|

|

|

|

—

|

|

|

|

44,287,021

|

|

|

India

|

|

|

16,327,312

|

|

|

|

12,362,337

|

|

|

|

—

|

|

|

|

28,689,649

|

|

|

Indonesia

|

|

|

—

|

|

|

|

18,907,921

|

|

|

|

—

|

|

|

|

18,907,921

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BLACKROCK EMERGING MARKETS FUND, INC.

|

|

JULY 31, 2013

|

|

3

|

|

|

|

|

|

Schedule of Investments (concluded)

|

|

BlackRock

Emerging Markets Fund, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Common Stocks (continued):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ireland

|

|

|

—

|

|

|

$

|

6,002,366

|

|

|

|

—

|

|

|

$

|

6,002,366

|

|

|

Italy

|

|

|

—

|

|

|

|

5,802,509

|

|

|

|

—

|

|

|

|

5,802,509

|

|

|

Malaysia

|

|

|

—

|

|

|

|

2,737,863

|

|

|

|

—

|

|

|

|

2,737,863

|

|

|

Mexico

|

|

$

|

25,410,013

|

|

|

|

—

|

|

|

|

—

|

|

|

|

25,410,013

|

|

|

Netherlands

|

|

|

8,900,515

|

|

|

|

—

|

|

|

|

—

|

|

|

|

8,900,515

|

|

|

Panama

|

|

|

6,118,192

|

|

|

|

—

|

|

|

|

—

|

|

|

|

6,118,192

|

|

|

Peru

|

|

|

4,785,812

|

|

|

|

—

|

|

|

|

—

|

|

|

|

4,785,812

|

|

|

Philippines

|

|

|

—

|

|

|

|

4,068,968

|

|

|

|

—

|

|

|

|

4,068,968

|

|

|

Russia

|

|

|

8,267,604

|

|

|

|

13,688,315

|

|

|

|

—

|

|

|

|

21,955,919

|

|

|

South Africa

|

|

|

—

|

|

|

|

6,787,495

|

|

|

|

—

|

|

|

|

6,787,495

|

|

|

South Korea

|

|

|

—

|

|

|

|

34,483,688

|

|

|

|

—

|

|

|

|

34,483,688

|

|

|

Taiwan

|

|

|

15,867,980

|

|

|

|

13,440,977

|

|

|

|

—

|

|

|

|

29,308,957

|

|

|

Thailand

|

|

|

3,567,508

|

|

|

|

10,120,259

|

|

|

|

—

|

|

|

|

13,687,767

|

|

|

Turkey

|

|

|

—

|

|

|

|

3,320,069

|

|

|

|

—

|

|

|

|

3,320,069

|

|

|

United States

|

|

|

11,371,970

|

|

|

|

—

|

|

|

|

—

|

|

|

|

11,371,970

|

|

|

Participation Notes

|

|

|

—

|

|

|

|

—

|

|

|

$

|

6,910,978

|

|

|

|

6,910,978

|

|

|

Short-Term Securities

|

|

|

2,449,847

|

|

|

|

1,166,392

|

|

|

|

—

|

|

|

|

3,616,239

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

189,021,186

|

|

|

$

|

217,916,504

|

|

|

$

|

6,910,978

|

|

|

$

|

413,848,668

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Derivative Financial Instruments

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency exchange contracts

|

|

$

|

5,110

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

5,110

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

Derivative financial instruments are foreign currency exchange contracts, which are valued at the unrealized/depreciation on the instrument.

|

|

|

|

|

|

Certain of the Fund’s assets are held at carrying amount, which approximates fair value for financial reporting

purposes. As of July 31, 2013, foreign currency at value of $1,006,343 is categorized as Level 1 within the disclosure hierarchy.

There were

no transfers between Level 1 and Level 2 during the period ended July 31, 2013.

A reconciliation of Level 3 investments is presented when

the Fund had a significant amount of Level 3 investments at the beginning and/or end of the period in relation to net assets. The following table is a reconciliation of Level 3 investments for which significant unobservable inputs were used in

determining fair value:

|

|

|

|

|

|

|

|

|

|

|

|

|

Participation

Notes

|

|

|

Total

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

Opening Balance, as of October 31, 2012

|

|

|

—

|

|

|

|

—

|

|

|

Transfers into Level 3

|

|

|

—

|

|

|

|

—

|

|

|

Transfers out of Level 3

|

|

|

—

|

|

|

|

—

|

|

|

Accrued discounts/premiums

|

|

|

—

|

|

|

|

—

|

|

|

Net realized gain (loss)

|

|

$

|

(21,015

|

)

|

|

$

|

(21,015

|

)

|

|

Net change in unrealized

appreciation/depreciation

1

|

|

|

(322,005

|

)

|

|

|

(322,005

|

)

|

|

Purchases

|

|

|

7,475,544

|

|

|

|

7,475,544

|

|

|

Sales

|

|

|

(221,546

|

)

|

|

|

(221,546

|

)

|

|

|

|

|

|

|

|

Closing Balance, as of July 31, 2013

|

|

$

|

6,910,978

|

|

|

$

|

6,910,978

|

|

|

|

|

|

|

|

|

|

1

|

|

The change in unrealized appreciation/depreciation on investments still held as of July 31, 2013 was $(322,005).

|

The Fund’s investments that are categorized as Level 3 were valued utilizing third party pricing information without adjustment. Such valuations are

based on unobservable inputs. A significant change in third party information inputs could result in a significantly lower or higher value of such Level 3 investments.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

BLACKROCK EMERGING MARKETS FUND, INC.

|

|

JULY 31, 2013

|

|

|

Item 2 – Controls and Procedures

|

|

|

|

|

2(a) –

|

|

The registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under

the Investment Company Act of 1940, as amended (the “1940 Act”)) are effective as of a date within 90 days of the filing of this report based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act

and Rule 15d-15(b) under the Securities Exchange Act of 1934, as amended.

|

|

|

|

|

2(b) –

|

|

There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the registrant’s last fiscal quarter that have materially

affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

|

Item 3 – Exhibits

Certifications – Attached hereto

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

BlackRock Emerging Markets Fund Inc.

|

|

|

|

|

By:

|

|

/s/ John M. Perlowski

|

|

|

|

John M. Perlowski

|

|

|

|

Chief Executive Officer (principal executive officer) of

|

|

|

|

BlackRock Emerging Markets Fund Inc.

|

|

|

|

|

Date:

|

|

September 24, 2013

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has

been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

|

By:

|

|

/s/ John M. Perlowski

|

|

|

|

John M. Perlowski

|

|

|

|

Chief Executive Officer (principal executive officer) of

|

|

|

|

BlackRock Emerging Markets Fund Inc.

|

|

|

|

|

Date:

|

|

September 24, 2013

|

|

|

|

|

By:

|

|

/s/ Neal J. Andrews

|

|

|

|

Neal J. Andrews

|

|

|

|

Chief Financial Officer (principal financial officer) of

|

|

|

|

BlackRock Emerging Markets Fund Inc.

|

Date: September 24, 2013

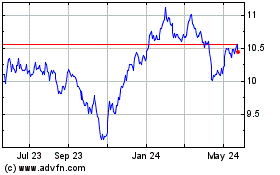

BlackRock Credit Allocat... (NYSE:BTZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

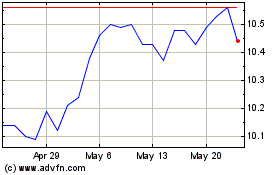

BlackRock Credit Allocat... (NYSE:BTZ)

Historical Stock Chart

From Jul 2023 to Jul 2024