Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

November 28 2023 - 12:39PM

Edgar (US Regulatory)

|

|

|

| Schedule of Investments (unaudited)

September 30, 2023 |

|

BlackRock 2037 Municipal Target Term Trust (BMN)

(Percentages shown are based on Net Assets) |

|

|

|

|

|

|

|

|

|

| Security |

|

Par

(000) |

|

|

Value |

|

|

|

|

| Municipal Bonds |

|

|

|

|

|

|

|

|

|

|

|

| Arizona — 1.6% |

|

|

|

|

|

|

|

|

| Arizona Industrial Development Authority, RB, 5.00%, 07/01/38(a) |

|

$ |

460 |

|

|

$ |

414,878 |

|

| Salt Verde Financial Corp., RB, 5.00%, 12/01/37 |

|

|

2,000 |

|

|

|

1,953,774 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,368,652 |

|

|

|

|

| California — 3.2% |

|

|

|

|

|

|

| California Community Choice Financing Authority, RB, 5.23%, 02/01/54(b) |

|

|

625 |

|

|

|

624,601 |

|

| California Enterprise Development Authority, RB, 7.60%,

11/15/37(a) |

|

|

1,000 |

|

|

|

929,367 |

|

| California Public Finance Authority, RB, 5.00%, 11/15/36(a)

|

|

|

1,000 |

|

|

|

897,810 |

|

| California School Finance Authority, Refunding RB, 5.25%, 08/01/38 |

|

|

125 |

|

|

|

116,750 |

|

| California Statewide Communities Development Authority, RB, Series A, 5.00%, 12/01/41(a) |

|

|

2,500 |

|

|

|

2,310,850 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,879,378 |

|

|

|

|

| Colorado — 7.9% |

|

|

|

|

|

|

| City & County of Denver Colorado Airport System Revenue, Refunding ARB, Series D, AMT, 5.00%,

11/15/42 |

|

|

4,000 |

|

|

|

4,030,176 |

|

| Colorado Health Facilities Authority, Refunding RB, Series A, 4.00%, 08/01/39 |

|

|

750 |

|

|

|

667,468 |

|

| Denver Convention Center Hotel Authority, Refunding RB, 5.00%, 12/01/40 |

|

|

2,000 |

|

|

|

1,862,268 |

|

| E-470 Public Highway Authority, Refunding RB, Series A, 5.00%,

09/01/40 |

|

|

3,800 |

|

|

|

3,815,724 |

|

| Eagle County Airport Terminal Corp., ARB, Series B, AMT, 5.00%, 05/01/41 |

|

|

1,000 |

|

|

|

1,001,880 |

|

| Southlands Metropolitan District No. 1, Refunding GO, Series

A-1, 5.00%, 12/01/37 |

|

|

500 |

|

|

|

461,194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,838,710 |

|

|

|

|

| District of Columbia — 0.7% |

|

|

|

|

|

|

| District of Columbia, RB, Series A, AMT, 5.50%, 02/28/37 |

|

|

1,000 |

|

|

|

1,052,991 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Florida — 1.8% |

|

|

|

|

|

|

| County of Miami-Dade Seaport Department, Refunding RB, Series A, AMT, 5.00%, 10/01/42 |

|

|

2,000 |

|

|

|

1,969,362 |

|

| Florida Development Finance Corp., RB, AMT,

6.13%, 07/01/32(a)(b) |

|

|

400 |

|

|

|

396,405 |

|

| Village Community Development District No. 15, SAB, 4.85%, 05/01/38(a) |

|

|

400 |

|

|

|

372,845 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,738,612 |

|

|

|

|

| Illinois — 10.0% |

|

|

|

|

|

|

| Chicago Board of Education, GO, Series C, 5.25%, 12/01/39 |

|

|

2,650 |

|

|

|

2,573,783 |

|

| Chicago Midway International Airport, Refunding ARB, Series A, AMT, 2nd Lien, 5.00%, 01/01/34 |

|

|

1,500 |

|

|

|

1,476,500 |

|

| City of Chicago Illinois, GO, Series A, 5.50%, 01/01/41 |

|

|

1,855 |

|

|

|

1,880,705 |

|

| Illinois Finance Authority, RB, Series A, 6.50%, 05/15/42 . |

|

|

250 |

|

|

|

240,808 |

|

| Illinois Finance Authority, Refunding RB 4.00%, 08/15/41 |

|

|

1,170 |

|

|

|

1,043,405 |

|

| Series A, 5.00%, 05/15/41 |

|

|

310 |

|

|

|

252,602 |

|

|

|

|

|

|

|

|

|

|

| Security |

|

Par

(000) |

|

|

Value |

|

|

|

|

| Illinois (continued) |

|

|

|

|

|

|

| Illinois Housing Development Authority, RB, S/F Housing, Series G, (FHLMC, FNMA, GNMA), 4.85%,

10/01/42 |

|

$ |

5,000 |

|

|

$ |

4,783,560 |

|

| Metropolitan Pier & Exposition Authority, RB, Series A, (NPFGC), 0.00%, 06/15/37(c) |

|

|

2,000 |

|

|

|

993,770 |

|

| State of Illinois, GO, 5.00%, 02/01/39 |

|

|

1,850 |

|

|

|

1,774,159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,019,292 |

|

|

|

|

| Kansas — 0.2% |

|

|

|

|

|

|

| City of Manhattan Kansas, Refunding RB, Series A, 4.00%, 06/01/26 |

|

|

315 |

|

|

|

299,948 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Louisiana — 0.6% |

|

|

|

|

|

|

| Louisiana Housing Corp., RB, S/F Housing, Series B, (FHLMC, FNMA, GNMA), 4.60%, 12/01/42 |

|

|

1,000 |

|

|

|

940,597 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Maryland — 3.6% |

|

|

|

|

|

|

| Maryland Community Development Administration, RB, S/F Housing, (FHLMC, FNMA, GNMA), 4.95%, 09/01/42 |

|

|

4,000 |

|

|

|

3,935,540 |

|

| Maryland Economic Development Corp., RB, Class B, AMT, 5.00%, 12/31/40 |

|

|

1,500 |

|

|

|

1,447,119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,382,659 |

|

|

|

|

| Massachusetts — 0.6% |

|

|

|

|

|

|

| Massachusetts Development Finance Agency, RB, 5.00%, 07/01/42 |

|

|

1,000 |

|

|

|

930,883 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Michigan — 8.1% |

|

|

|

|

|

|

| Michigan Finance Authority, Refunding RB 5.00%, 11/15/41 |

|

|

1,000 |

|

|

|

998,029 |

|

| Series A, 5.00%, 12/01/42 |

|

|

4,865 |

|

|

|

4,915,217 |

|

| Michigan State Housing Development Authority, RB, S/F Housing |

|

|

|

|

|

|

|

|

| Series D, 5.10%, 12/01/37 |

|

|

2,250 |

|

|

|

2,264,074 |

|

| Series D, 5.20%, 12/01/40 |

|

|

2,750 |

|

|

|

2,769,214 |

|

| Wayne County Airport Authority, ARB, Series D, 5.00%, 12/01/40 |

|

|

1,230 |

|

|

|

1,235,109 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,181,643 |

|

|

|

|

| Minnesota — 1.0% |

|

|

|

|

|

|

| Minnesota Housing Finance Agency, RB, S/F Housing, Series N, (FHLMC, FNMA, GNMA), 5.10%, 07/01/42 |

|

|

1,500 |

|

|

|

1,501,441 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mississippi — 0.1% |

|

|

|

|

|

|

| Mississippi Business Finance Corp., RB, AMT, 7.75%,

07/15/47(b) |

|

|

250 |

|

|

|

184,880 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Missouri — 0.9% |

|

|

|

|

|

|

| St Louis County Industrial Development Authority, RB, Series A, 5.00%, 09/01/38 |

|

|

1,500 |

|

|

|

1,336,895 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nevada(a) — 0.7% |

|

|

|

|

|

|

| City of North Las Vegas Nevada, SAB |

|

|

|

|

|

|

|

|

| 5.50%, 06/01/37 |

|

|

500 |

|

|

|

500,686 |

|

| 5.75%, 06/01/42 |

|

|

500 |

|

|

|

503,559 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,004,245 |

|

|

|

|

| New Jersey — 5.6% |

|

|

|

|

|

|

| New Jersey Economic Development Authority, RB, Series A, 5.00%, 06/15/42 |

|

|

1,500 |

|

|

|

1,512,596 |

|

|

|

|

| Schedule of Investments (unaudited) (continued)

September 30, 2023 |

|

BlackRock 2037 Municipal Target Term Trust (BMN)

(Percentages shown are based on Net Assets) |

|

|

|

|

|

|

|

|

|

| Security |

|

Par

(000) |

|

|

Value |

|

|

|

|

| New Jersey (continued) |

|

|

|

|

|

|

| New Jersey Transportation Trust Fund Authority, RB, 5.00%, 06/15/42 |

|

$ |

2,700 |

|

|

$ |

2,744,593 |

|

| South Jersey Port Corp., Refunding ARB, Series S, 5.00%, 01/01/39 |

|

|

1,350 |

|

|

|

1,360,908 |

|

| South Jersey Transportation Authority, Refunding RB, Series A, 5.00%, 11/01/39 |

|

|

3,000 |

|

|

|

2,902,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,520,465 |

|

|

|

|

| New Mexico — 0.6% |

|

|

|

|

|

|

| City of Santa Fe New Mexico, Refunding RB, 5.00%, 05/15/32 |

|

|

1,000 |

|

|

|

899,011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| New York — 8.4% |

|

|

|

|

|

|

| Build NYC Resource Corp., RB, 5.00%, 06/01/32(a)

|

|

|

400 |

|

|

|

384,540 |

|

| Metropolitan Transportation Authority, RB, Series B, 5.25%, 11/15/37 |

|

|

1,000 |

|

|

|

1,003,158 |

|

| Metropolitan Transportation Authority, Refunding RB |

|

|

|

|

|

|

|

|

| Series B, 5.00%, 11/15/40 |

|

|

1,000 |

|

|

|

1,000,563 |

|

| Series C, 5.00%, 11/15/42 |

|

|

500 |

|

|

|

496,023 |

|

| Monroe County Industrial Development Corp., RB, Series A, 5.00%, 12/01/37 |

|

|

1,670 |

|

|

|

1,645,327 |

|

| New York City Housing Development Corp., RB, M/F Housing,

Class F-1, Sustainability Bonds, 4.60%, 11/01/42 |

|

|

1,500 |

|

|

|

1,401,735 |

|

| New York Convention Center Development Corp., Refunding RB, 5.00%, 11/15/40 |

|

|

2,500 |

|

|

|

2,508,100 |

|

| New York State Environmental Facilities Corp., RB, AMT, 5.13%, 09/01/50(a)(b) |

|

|

250 |

|

|

|

242,571 |

|

| New York Transportation Development Corp., ARB, AMT, 5.00%, 01/01/36 |

|

|

1,500 |

|

|

|

1,479,102 |

|

| New York Transportation Development Corp., RB, AMT, 5.00%, 10/01/40 |

|

|

1,500 |

|

|

|

1,434,864 |

|

| Onondaga Civic Development Corp., RB, 5.00%, 07/01/40 |

|

|

1,075 |

|

|

|

1,029,815 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,625,798 |

|

|

|

|

| North Carolina — 1.0% |

|

|

|

|

|

|

| North Carolina Medical Care Commission, Refunding RB, 5.00%, 10/01/30 |

|

|

500 |

|

|

|

474,995 |

|

| North Carolina Turnpike Authority, Refunding RB, Series A, 5.00%, 07/01/42 |

|

|

995 |

|

|

|

1,000,535 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,475,530 |

|

|

|

|

| Ohio — 3.2% |

|

|

|

|

|

|

| County of Franklin Ohio, RB, 5.00%, 05/15/40 |

|

|

3,140 |

|

|

|

3,154,711 |

|

| State of Ohio, RB, AMT, 5.00%, 12/31/39 |

|

|

1,680 |

|

|

|

1,623,780 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,778,491 |

|

|

|

|

| Oklahoma — 2.3% |

|

|

|

|

|

|

| Tulsa Airports Improvement Trust, Refunding RB, AMT, 5.00%, 06/01/35(b) |

|

|

2,490 |

|

|

|

2,474,500 |

|

| Tulsa County Industrial Authority, Refunding RB, 5.25%, 11/15/37 |

|

|

1,000 |

|

|

|

955,909 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,430,409 |

|

|

|

|

| Oregon — 1.2% |

|

|

|

|

|

|

| Port of Portland Oregon Airport Revenue, ARB, Series 24B, AMT, 5.00%, 07/01/42 |

|

|

1,835 |

|

|

|

1,804,453 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Security |

|

Par

(000) |

|

|

Value |

|

|

|

|

| Pennsylvania — 11.3% |

|

|

|

|

|

|

|

|

| Allentown Neighborhood Improvement Zone Development Authority, Refunding RB, 5.00%, 05/01/42 |

|

$ |

2,580 |

|

|

$ |

2,363,159 |

|

| General Authority of Southcentral Pennsylvania, Refunding RB, 5.00%, 06/01/39 |

|

|

5,000 |

|

|

|

5,114,760 |

|

| Montgomery County Industrial Development Authority, Refunding RB, 5.00%, 11/15/36 |

|

|

350 |

|

|

|

338,745 |

|

| Pennsylvania Economic Development Financing Authority, RB, AMT, 5.50%, 06/30/43 |

|

|

5,000 |

|

|

|

5,150,100 |

|

| Pennsylvania Higher Educational Facilities Authority, Refunding RB, 5.00%, 05/01/41 |

|

|

1,500 |

|

|

|

1,455,513 |

|

| Pennsylvania Turnpike Commission, RB, Sub-Series B-1, 5.00%, 06/01/42 |

|

|

1,500 |

|

|

|

1,511,952 |

|

| Philadelphia Gas Works Co., Refunding RB, 5.00%, 08/01/42 |

|

|

1,170 |

|

|

|

1,171,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17,105,230 |

|

|

|

|

| Puerto Rico — 5.6% |

|

|

|

|

|

|

| Commonwealth of Puerto Rico, GO, Series A-1, Restructured, 5.75%,

07/01/31 |

|

|

3,447 |

|

|

|

3,598,730 |

|

| Puerto Rico Highway & Transportation Authority, RB, CAB, Series B, Restructured,

0.00%, 07/01/32(c) |

|

|

2,875 |

|

|

|

1,849,985 |

|

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, RB |

|

|

|

|

|

|

|

|

| Series A-2, Convertible, Restructured, 4.33%, 07/01/40 |

|

|

1,500 |

|

|

|

1,336,792 |

|

| Series A1, Restructured, 4.55%, 07/01/40 |

|

|

1,750 |

|

|

|

1,598,982 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,384,489 |

|

|

|

|

| South Carolina — 1.6% |

|

|

|

|

|

|

| Patriots Energy Group Financing Agency, RB, Series A1, 5.25%, 10/01/54(b) |

|

|

805 |

|

|

|

809,019 |

|

| South Carolina Public Service Authority, RB, Series E, 5.50%, 12/01/42 |

|

|

1,500 |

|

|

|

1,560,960 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,369,979 |

|

|

|

|

| Tennessee — 3.5% |

|

|

|

|

|

|

| Metropolitan Government Nashville & Davidson County Health & Educational Facilities Board,

Refunding RB 5.00%, 10/01/38 |

|

|

1,000 |

|

|

|

928,158 |

|

| Series A, 5.00%, 10/01/41 |

|

|

1,000 |

|

|

|

908,248 |

|

| Tennergy Corp., RB, Series A, 5.50%, 10/01/53(b)

|

|

|

2,500 |

|

|

|

2,576,850 |

|

| Tennessee Energy Acquisition Corp., RB, Series A, 5.00%, 05/01/52(b) |

|

|

925 |

|

|

|

923,020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,336,276 |

|

|

|

|

| Texas — 4.8% |

|

|

|

|

|

|

| Central Texas Turnpike System, RB, Series C, 5.00%, 08/15/42 |

|

|

1,500 |

|

|

|

1,501,854 |

|

| Harris County Cultural Education Facilities Finance Corp., Refunding RB, 5.00%, 01/01/27 |

|

|

730 |

|

|

|

699,041 |

|

| New Hope Cultural Education Facilities Finance Corp., RB, 5.00%, 08/15/39(a) |

|

|

425 |

|

|

|

381,779 |

|

| San Antonio Water System, Refunding RB, Series A, Junior Lien, 4.00%, 05/15/40 |

|

|

810 |

|

|

|

743,698 |

|

| Tarrant County Cultural Education Facilities Finance Corp., Refunding RB 5.00%, 11/15/40 |

|

|

1,500 |

|

|

|

1,238,226 |

|

| Series A-1, 5.00%, 10/01/44 |

|

|

3,020 |

|

|

|

2,713,672 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,278,270 |

|

|

|

|

| S C H E D U L E O F I

N V E S T M E N T S |

|

2 |

|

|

|

| Schedule of Investments (unaudited) (continued)

September 30, 2023 |

|

BlackRock 2037 Municipal Target Term Trust (BMN)

(Percentages shown are based on Net Assets) |

|

|

|

|

|

|

|

|

|

| Security |

|

Par

(000) |

|

|

Value |

|

|

|

|

| Vermont — 0.8% |

|

|

|

|

|

|

|

|

| Vermont Economic Development Authority, RB, AMT, 4.63%,

04/01/36(a)(b) |

|

$ |

1,300 |

|

|

$ |

1,242,856 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Washington — 2.5% |

|

|

|

|

|

|

| University of Washington, Refunding RB, Series C, 4.00%, 12/01/40 |

|

|

2,500 |

|

|

|

2,282,580 |

|

| Washington State Housing Finance Commission, Refunding RB, Series A, 5.00%, 07/01/38 |

|

|

1,590 |

|

|

|

1,554,991 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,837,571 |

|

|

|

|

| Wisconsin — 2.1% |

|

|

|

|

|

|

| Public Finance Authority, Refunding RB 5.25%, 05/15/42(a)

|

|

|

1,230 |

|

|

|

1,110,038 |

|

| Series B, AMT, 5.00%, 07/01/42 |

|

|

1,500 |

|

|

|

1,399,065 |

|

| Wisconsin Health & Educational Facilities Authority, Refunding RB, 5.00%, 11/01/27 |

|

|

745 |

|

|

|

696,215 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,205,318 |

|

|

|

|

| Wyoming — 1.2% |

|

|

|

|

|

|

| Wyoming Community Development Authority, Refunding RB, S/F Housing, Series 1, 4.40%, 12/01/43 |

|

|

2,000 |

|

|

|

1,818,178 |

|

|

|

|

|

|

|

|

|

|

| Total Long-Term Investments — 96.7%

(Cost: $149,023,697) |

|

|

|

|

|

|

145,773,150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Security |

|

Shares |

|

|

Value |

|

|

|

|

| Short-Term Securities |

|

|

|

|

|

|

|

|

|

|

|

| Money Market Funds — 2.2% |

|

|

|

|

|

|

|

|

| BlackRock Liquidity Funds, MuniCash, Institutional Class, 3.95%(d)(e) |

|

|

3,358,553 |

|

|

$ |

3,358,553 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Short-Term Securities — 2.2%

(Cost: $3,358,316) |

|

|

|

|

|

|

3,358,553 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments — 98.9%

(Cost: $152,382,013) |

|

|

|

|

|

|

149,131,703 |

|

| Other Assets Less Liabilities — 1.1% |

|

|

|

|

|

|

1,624,473 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Assets — 100.0% |

|

|

|

|

|

$ |

150,756,176 |

|

|

|

|

|

|

|

|

|

|

| (a) |

Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities

may be resold in transactions exempt from registration to qualified institutional investors. |

| (b) |

Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of period

end. Security description also includes the reference rate and spread if published and available. |

| (d) |

Affiliate of the Trust. |

| (e) |

Annualized 7-day yield as of period end.

|

For Trust compliance purposes, the

Trust’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment

adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

Affiliates

Investments in issuers considered to be

affiliate(s) of the Trust during the period ended September 30, 2023 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Affiliated Issuer |

|

Value at

12/31/22 |

|

|

Purchases

at Cost |

|

|

Proceeds

from Sales |

|

|

Net

Realized

Gain (Loss) |

|

|

Change in

Unrealized

Appreciation

(Depreciation) |

|

|

Value at

09/30/23 |

|

|

Shares

Held at

09/30/23 |

|

|

Income |

|

|

Capital Gain

Distributions

from

Underlying

Funds |

|

|

|

|

|

|

|

|

|

|

|

| BlackRock Liquidity Funds, MuniCash, Institutional Class |

|

$ |

95,787 |

|

|

$ |

3,264,060 |

(a) |

|

$ |

— |

|

|

$ |

(1,531 |

) |

|

$ |

237 |

|

|

$ |

3,358,553 |

|

|

|

3,358,553 |

|

|

$ |

101,496 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(a) |

Represents net amount purchased (sold). |

|

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value

hierarchy consisting of three broad levels for financial reporting purposes as follows:

| |

• |

|

Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the

Trust has the ability to access; |

| |

• |

|

Level 2 – Other observable inputs (including, but not limited to, quoted prices for similar assets or

liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield

curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs); and |

| |

• |

|

Level 3 – Unobservable inputs based on the best information available in the circumstances, to the extent

observable inputs are not available (including the Valuation Committee’s assumptions used in determining the fair value of financial instruments). |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the

lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into

different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Investments classified within Level 3 have significant unobservable inputs used by the Valuation Committee in determining the price for Fair Valued Investments. Level 3 investments include equity or debt issued by privately held companies

or

|

|

|

| Schedule of Investments (unaudited) (continued)

September 30, 2023 |

|

BlackRock 2037 Municipal Target Term Trust (BMN) |

Fair Value Hierarchy as of Period End (continued)

funds. There may not be a secondary market, and/or there are a limited number of investors. The categorization of a value determined for financial instruments is based on the pricing transparency

of the financial instruments and is not necessarily an indication of the risks associated with investing in those securities. For information about the Trust’s policy regarding valuation of financial instruments, refer to its most recent

financial statements.

The following table summarizes the Trust’s financial instruments categorized in the fair value hierarchy. The breakdown

of the Trust’s financial instruments into major categories is disclosed in the Schedule of Investments above.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-Term Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Municipal Bonds |

|

$ |

— |

|

|

$ |

145,773,150 |

|

|

$ |

— |

|

|

$ |

145,773,150 |

|

| Short-Term Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Money Market Funds |

|

|

3,358,553 |

|

|

|

— |

|

|

|

— |

|

|

|

3,358,553 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

3,358,553 |

|

|

$ |

145,773,150 |

|

|

$ |

— |

|

|

$ |

149,131,703 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Portfolio Abbreviation |

|

|

| AMT |

|

Alternative Minimum Tax |

|

|

| ARB |

|

Airport Revenue Bonds |

|

|

| CAB |

|

Capital Appreciation Bonds |

|

|

| FHLMC |

|

Federal Home Loan Mortgage Corp. |

|

|

| FNMA |

|

Federal National Mortgage Association |

|

|

| GNMA |

|

Government National Mortgage Association |

|

|

| GO |

|

General Obligation Bonds |

|

|

| M/F |

|

Multi-Family |

|

|

| NPFGC |

|

National Public Finance Guarantee Corp. |

|

|

| RB |

|

Revenue Bond |

|

|

| S/F |

|

Single-Family |

|

|

| SAB |

|

Special Assessment Bonds |

|

|

|

| S C H E D U L E O F I

N V E S T M E N T S |

|

4 |

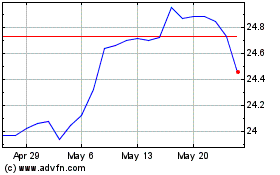

BlackRock 2037 Municipal... (NYSE:BMN)

Historical Stock Chart

From Jun 2024 to Jul 2024

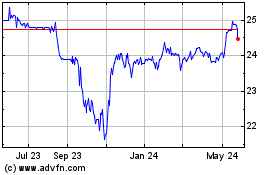

BlackRock 2037 Municipal... (NYSE:BMN)

Historical Stock Chart

From Jul 2023 to Jul 2024