0001636222FALSE00016362222023-10-312023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2023

WINGSTOP INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-37425 | 47-3494862 |

| (State or other jurisdiction of incorporation or organization) | Commission File Number | (IRS Employer Identification No.) |

| | |

| 15505 Wright Brothers Drive | | |

Addison, Texas | | 75001 |

| (Address of principal executive offices) | | (Zip Code) |

(972) 686-6500

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | WING | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition |

The following information is furnished pursuant to Item 2.02, “Results of Operations and Financial Condition.” Consequently, it shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such filing.

On November 1, 2023, Wingstop Inc. (the “Company,” “we,” “our,” or “us”) issued a press release reporting the Company’s financial results for its fiscal third quarter ended September 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein in its entirety. The press release uses the U.S. generally accepted accounting principles (“GAAP”) measures of net income and earnings per diluted share and the following non-GAAP financial measures: EBITDA, Adjusted EBITDA, Adjusted net income and Adjusted earnings per diluted share. A discussion of these non-GAAP financial measures, including a discussion of the usefulness and purpose of each measure, is included below.

EBITDA and Adjusted EBITDA. EBITDA and Adjusted EBITDA are supplemental measures of our performance that are not required by, or presented in accordance with, GAAP. EBITDA and Adjusted EBITDA are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income or any other performance measure derived in accordance with GAAP, or as alternatives to cash flows from operating activities as a measure of our liquidity.

We define “EBITDA” as net income before interest expense, net, income tax expense (benefit), and depreciation and amortization. We define “Adjusted EBITDA” as EBITDA further adjusted for losses on debt extinguishment and financing transactions, transaction costs, costs and fees associated with investments in our strategic initiatives, and stock-based compensation expense. We present EBITDA and Adjusted EBITDA because we consider them to be important supplemental measures of our performance and believe they are frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry. Management believes that investors’ understanding of our performance is enhanced by including these non-GAAP financial measures as a reasonable basis for comparing our ongoing results of operations. Many investors are interested in understanding the performance of our business by comparing our results from ongoing operations on a period-over-period basis and would ordinarily add back non-cash expenses such as depreciation and amortization, as well as items that are not part of normal day-to-day operations of our business.

Management uses EBITDA and Adjusted EBITDA:

•as a measurement of operating performance because we believe they assist management in comparing the operating performance of our restaurants on a consistent basis, as they remove the impact of items not directly resulting from our core operations;

•for planning purposes, including the preparation of our internal annual operating budget and financial projections;

•to evaluate the performance and effectiveness of our operational strategies;

•to evaluate our capacity to fund capital expenditures and expand our business; and

•to calculate incentive compensation payments for our employees, including assessing performance under our annual incentive compensation plan.

By providing these non-GAAP financial measures, together with a reconciliation to the most comparable GAAP measure, we believe we are enhancing investors’ understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing our strategic initiatives. EBITDA and Adjusted EBITDA have limitations as analytical tools and should not be considered in isolation, or as an alternative to, or a substitute for, net income or other financial statement data presented in our consolidated financial statements as indicators of financial performance. Some of the limitations include, but are not limited to, the following:

•such measures do not reflect our cash expenditures, or future requirements for capital expenditures or contractual commitments;

•such measures do not reflect changes in, or cash requirements for, our working capital needs;

•such measures do not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our debt;

•such measures do not reflect our tax expense or the cash requirements to pay our taxes;

•although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and such measures do not reflect any cash requirements for such replacements; and

•other companies in our industry may calculate such measures differently than we do, limiting their usefulness as comparative measures.

Due to these and other limitations, EBITDA and Adjusted EBITDA should not be considered as measures of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using these non-GAAP measures only as performance measures and supplementally. As noted in the press release attached hereto as Exhibit 99.1, Adjusted EBITDA includes adjustments for losses on debt extinguishment and financing transactions, transaction costs, costs and fees associated with investments in our strategic initiatives, and stock-based compensation expense. We believe these adjustments are appropriate because the amounts recognized can vary significantly from period-to-period, do not directly relate to the ongoing operations of our restaurants, and complicate comparisons of our internal operating results and operating results of other restaurant companies over time.

Adjusted Net Income and Adjusted Earnings Per Diluted Share. Adjusted net income represents net income adjusted for losses on debt extinguishment and financing transactions, transaction costs, costs and fees associated with investments in our strategic initiatives, and related tax adjustments that management believes are not indicative of the Company’s core operating results or business outlook over the long-term. Adjusted earnings per diluted share is defined as adjusted net income divided by weighted average diluted share count. Adjusted net income and adjusted earnings per diluted share are supplemental measures of operating performance that do not represent and should not be considered alternatives to net income and earnings per diluted share, as determined by GAAP. These measures have not been prepared in accordance with Article 11 of Regulation S-X promulgated under the Securities Act. Management believes adjusted net income and adjusted earnings per diluted share supplement GAAP measures and enable management to more effectively evaluate the Company’s performance period-over-period and relative to competitors.

We caution investors that amounts presented in accordance with our definitions may not be comparable to similar measures disclosed by our competitors because not all companies and analysts calculate certain non-GAAP measures in the same manner.

Quarterly Dividend

On October 31, 2023, the Company’s Board of Directors (the “Board”) declared a quarterly cash dividend of $0.22 per share of common stock. The dividend is payable on December 8, 2023 to stockholders of record as of the close of business on November 17, 2023. The declaration of any future dividends is subject to the Board’s discretion.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

| | | | | |

| (d) | Exhibits |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. | | | | | | | | | | | | | | |

| | | | Wingstop Inc. |

| | | | |

| | | | |

| Date: | November 1, 2023 | | By: | /s/ Alex R. Kaleida |

| | | | Chief Financial Officer (Principal Financial and Accounting Officer) |

FOR IMMEDIATE RELEASE

Wingstop Inc. Reports Fiscal Third Quarter 2023 Financial Results

Increases Same-Store Sales Outlook to Approximately 16% for Fiscal Year 2023

Dallas, November 1, 2023 - (PR NEWSWIRE) - Wingstop Inc. (NASDAQ: WING) today announced financial results for the fiscal third quarter ended September 30, 2023.

Highlights for the fiscal third quarter 2023 compared to the fiscal third quarter 2022:

▪System-wide sales increased 26.5% to $885.0 million

▪53 net new openings in the fiscal third quarter 2023

▪Domestic same store sales increased 15.3%

▪Domestic restaurant AUVs increased to $1.8 million

▪Digital sales increased to 66.9%

▪Total revenue increased 26.4% to $117.1 million

▪Net income increased 46.0% to $19.5 million, or $0.65 per diluted share

▪Adjusted net income and adjusted earnings per diluted share, both non-GAAP measures, increased 53.3% to $20.5 million, or $0.69 per diluted share

▪Adjusted EBITDA, a non-GAAP measure, increased 36.7% to $38.5 million

Adjusted EBITDA, adjusted net income, and adjusted earnings per diluted share are non-GAAP measures. Reconciliations of adjusted EBITDA, adjusted net income, and adjusted earnings per diluted share to the most directly comparable financial measure presented in accordance with accounting principles generally accepted in the United States ("GAAP") are set forth in the schedule accompanying this release. See “Non-GAAP Financial Measures.”

“Our third quarter results showcase the multi-year strategies we are executing against, delivering 15.3% domestic same-store sales growth in the quarter, primarily driven by transaction growth. We are measuring record levels in brand health metrics, demonstrating the underlying momentum at Wingstop, and putting us on a path to deliver our 20th consecutive year of domestic same-store sales growth,” said Michael Skipworth, President and Chief Executive Officer. “This consistent growth, coupled with the strength of our unit economics, gives us the confidence in our 2023 global development outlook and our long-term vision of scaling Wingstop into a Top 10 Global Restaurant Brand.”

Key operating metrics for the fiscal third quarter 2023 compared to the fiscal third quarter 2022:

| | | | | | | | | | | |

| Thirteen Weeks Ended |

| September 30, 2023 | | September 24, 2022 |

| Number of system-wide restaurants open at end of period | 2,099 | | | 1,898 | |

| Number of domestic franchise restaurants open at end of period | 1,791 | | | 1,631 | |

| Number of international franchise restaurants open at end of period | 262 | | | 225 | |

| System-wide sales (in millions) | $ | 885 | | | $ | 700 | |

| Domestic AUV (in thousands) | $ | 1,755 | | | $ | 1,591 | |

| Domestic same store sales growth | 15.3 | % | | 6.9 | % |

| Company-owned domestic same store sales growth | 6.0 | % | | 4.3 | % |

| Net income (in thousands) | $ | 19,511 | | | $ | 13,368 | |

| Adjusted net income (in thousands) | $ | 20,499 | | | $ | 13,368 | |

| Adjusted EBITDA (in thousands) | $ | 38,483 | | | $ | 28,155 | |

Fiscal third quarter 2023 financial results

Total revenue for the fiscal third quarter 2023 increased to $117.1 million from $92.7 million in the fiscal third quarter last year. Royalty revenue, franchise fees and other increased $12.8 million due to domestic same store sales growth of 15.3% and net new franchise development. Advertising fees increased $7.8 million due to a 26.5% increase in system-wide sales in the fiscal third quarter 2023. Company-owned restaurant sales increased $3.8 million due to an increase of $2.1 million related to the addition of four net new company-owned restaurants since the prior fiscal third quarter, as well as a 6.0% increase in company-owned same store sales driven primarily by an increase in transactions.

Cost of sales increased to $17.6 million from $15.7 million in the fiscal third quarter of the prior year. As a percentage of company-owned restaurant sales, cost of sales decreased to 73.6% from 78.0% in the prior year comparable period. The decrease was primarily driven by food, beverage and packaging costs benefiting from a 13.5% decrease in the cost of bone-in chicken wings as compared to the prior fiscal third quarter.

Selling, general & administrative (“SG&A”) increased $6.4 million to $23.0 million from $16.7 million in the fiscal third quarter of the prior year. The increase in SG&A expense was driven by an increase in incentive compensation and performance-based stock compensation expense of $2.8 million primarily related to the Company’s current fiscal year performance, an increase in headcount related expenses of $1.7 million to support the growth in our business, and an increase in consulting fees of $1.3 million associated with the Company’s strategic initiatives.

Interest expense, net was $4.5 million, a decrease of $1.2 million compared to $5.7 million of interest expense, net in the comparable period in 2022. The decrease was driven by $1.0 million in additional interest income earned during the thirteen weeks ended September 30, 2023.

As previously announced, during the fiscal third quarter of 2023, our board of directors approved a share repurchase program with authorization to purchase up to $250.0 million of our outstanding shares of common stock. Pursuant to that program, the Company also entered into an accelerated share repurchase agreement (the “ASR Agreement”) to repurchase $125.0 million of its common stock.

During the fiscal third quarter of 2023, the Company made an initial payment of $125.0 million and received and retired 567,151 shares of its common stock under the ASR Agreement, representing an estimated 75% of the total shares expected to be delivered under the ASR Agreement, based on the closing price on the date of initial delivery of $165.30. The delivery of any remaining shares will occur at the final settlement of the transactions under the ASR Agreement, which is scheduled in the fiscal fourth quarter of 2023. As of September 30, 2023, the Company had a total remaining authorized amount for share repurchases under the program of approximately $125.0 million.

Financial Outlook

Based on year-to-date results, the Company is providing updated guidance for 2023, which is a 52-week fiscal year:

•Approximately 16% domestic same store sales growth, previously 10% to 12%; and

•SG&A of $94.5 - $95.5 million, previously $91.0 - $93.0 million.

Additionally, the Company is reiterating the following guidance for 2023:

•240 to 250 global net new units;

•Stock-based compensation expense of approximately $14.0 - $15.0 million; and

•Depreciation and amortization of between $14.0 - $15.0 million for 2023.

Restaurant Development

As of September 30, 2023, there were 2,099 Wingstop restaurants system-wide. This included 1,837 restaurants in the United States, of which 1,791 were franchised restaurants and 46 were company-owned, and 262 franchised restaurants were in international markets. During the fiscal third quarter 2023, there were 53 net system-wide Wingstop restaurant openings.

Quarterly Dividend

In recognition of the Company’s strong cash flow generation and our commitment to returning value to stockholders, on October 31, 2023, our board of directors approved a quarterly dividend payable to Wingstop stockholders of $0.22 per share of common stock, resulting in a total dividend of approximately $6.5 million. This dividend will be paid on December 8, 2023 to stockholders of record as of November 17, 2023.

The following definitions apply to these terms as used in this release:

Domestic average unit volume (“AUV”) consists of the average annual sales of all restaurants that have been open for a trailing 52-week period or longer. This measure is calculated by dividing sales during the applicable period for all restaurants being measured by the number of restaurants being measured. Domestic AUV includes revenue from both company-owned and franchised restaurants. Domestic AUV allows management to assess our domestic company-owned and franchised restaurant economics. Changes in domestic AUV are primarily driven by increases in same store sales and are also influenced by opening new restaurants.

Domestic same store sales reflects the change in year-over-year sales for the same store restaurant base. We define the same store restaurant base to include those restaurants open for at least 52 full weeks. This measure highlights the performance of existing restaurants, while excluding the impact of new restaurant openings and permanent closures. We review same store sales for domestic company-owned restaurants as well as system-wide domestic restaurants. Domestic same store sales growth is driven by increases in transactions and average transaction size. Transaction size increases are driven by price increases or favorable mix shift from either an increase in items purchased or shifts into higher priced items.

System-wide sales represents net sales for all of our company-owned and franchised restaurants, as reported by franchisees. This measure allows management to better assess changes in our royalty revenue, our overall store

performance, the health of our brand and the strength of our market position relative to competitors. Our system-wide sales growth is driven by new restaurant openings as well as increases in same store sales.

Adjusted EBITDA is defined as net income before interest expense, net, income tax expense (benefit), and depreciation and amortization (EBITDA), further adjusted for losses on debt extinguishment and financing transactions, transaction costs, costs and fees associated with investments in our strategic initiatives, and stock-based compensation expense. Beginning in the first quarter of 2023, gains and losses on disposal of assets are no longer presented as an adjustment to EBITDA, in our calculation of Adjusted EBITDA. Prior period amounts have been excluded from EBITDA adjustments to conform to the current presentation.

Adjusted net income is defined as net income adjusted for losses on debt extinguishment and financing transactions, transaction costs, costs and fees associated with investments in our strategic initiatives, and related tax adjustments that management believes are not indicative of the Company’s core operating results or business outlook over the long-term.

Adjusted earnings per diluted share is defined as adjusted net income divided by weighted average diluted share count.

We caution investors that amounts presented in accordance with our definitions above may not be comparable to similar measures disclosed by our competitors because not all companies and analysts calculate certain non-GAAP measurements in the same manner.

Conference Call and Webcast

The Company will host a conference call today to discuss the fiscal third quarter 2023 financial results at 10:00 AM Eastern Time. The conference call can be joined telephonically by dialing 1-877-259-5243 or 1-412-317-5176 (international) and asking for the Wingstop conference call. A replay will be available two hours after the call and can be accessed by dialing 1-877-344-7529 or 1-412-317-0088 (international), then entering the replay code 8628191. The replay will be available through Wednesday, November 8, 2023.

The conference call will also be webcast live and later archived on the investor relations section of Wingstop’s corporate website at ir.wingstop.com under the ‘News & Events’ section.

About Wingstop

Founded in 1994 and headquartered in Dallas, TX, Wingstop Inc. (NASDAQ: WING) operates and franchises more than 2,050 locations worldwide. The Wing Experts are dedicated to Serving the World Flavor through an unparalleled guest experience and use of a best-in-class technology platform, all while offering classic and boneless wings, tenders, and chicken sandwiches, always cooked to order and hand sauced-and-tossed in fans’ choice of 11 bold, distinctive flavors. Wingstop’s menu also features signature sides including fresh-cut, seasoned fries and freshly-made ranch and bleu cheese dips.

In fiscal year 2022, Wingstop’s system-wide sales increased 16.8% to approximately $2.7 billion, marking the 19th consecutive year of same store sales growth. With a vision of becoming a Top 10 Global Restaurant Brand, Wingstop’s system is comprised of independent franchisees, or brand partners, who account for approximately 98% of Wingstop’s total restaurant count of 2,099 as of September 30, 2023.

A key to this business success and consumer fandom stems from The Wingstop Way, which includes a core value system of being Authentic, Entrepreneurial, Service-minded, and Fun. The Wingstop Way extends to the brand’s environmental, social and governance platform as Wingstop seeks to provide value to all guests.

Rounding out a strong year in 2022, the Company made Technomic 500’s “Fastest Growing Franchise” list, was ranked #16 on Entrepreneur Magazine’s “Franchise 500,” won Fast Casual’s Excellence in Food Safety award, and was named to Fast Company’s “The World’s Most Innovative Companies” list ranking #4 in the dining category.

For more information visit www.wingstop.com or www.wingstop.com/own-a-wingstop and follow @Wingstop on Twitter, Instagram, Facebook, and TikTok. Learn more about Wingstop’s involvement in its local communities at www.wingstopcharities.org.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use non-GAAP financial measures, including those indicated above. By providing non-GAAP financial measures, together with a reconciliation to the most comparable GAAP measure, we believe we are enhancing investors’ understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing our strategic initiatives. These measures are not intended to be considered in isolation or as substitutes for, or superior to, financial measures prepared and presented in accordance with GAAP. The non-GAAP measures used in this press release may be different from the measures used by other companies. A reconciliation of each measure to the most directly comparable GAAP measure is available in this news release. In addition, the Current Report on Form 8-K furnished to the Securities and Exchange Commission (the “SEC”) concurrent with the issuance of this press release includes a more detailed description of each of these non-GAAP financial measures, together with a discussion of the usefulness and purpose of such measures.

Forward-looking Statements

This news release includes statements of our expectations, intentions, plans and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to come within the safe harbor protection provided by those sections. These statements, which involve risks and uncertainties, relate to the discussion of our business strategies and our expectations concerning future operations, margins, profitability, trends, liquidity and capital resources and to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “may,” “will,” “should,” “expect,” “intend,” “plan,” “outlook,” “guidance,” “anticipate,” “believe,” “think,” “estimate,” “seek,” “predict,” “can,” “could,” “project,” “potential” or, in each case, their negative or other variations or comparable terminology, although not all forward-looking statements are accompanied by such terms. Examples of forward-looking statements in this news release include, but are not limited to, our 2023 fiscal year outlook for domestic same store sales growth, SG&A expense, stock-based compensation expense, depreciation and amortization, and unit growth. These forward-looking statements are made based on expectations and beliefs concerning future events affecting us and are subject to uncertainties, risks, and factors relating to our operations and business environments, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed or implied by these forward-looking statements. Please refer to the risk factors discussed in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which can be found at the SEC’s website www.sec.gov. The discussion of these risks is specifically incorporated by reference into this news release.

When considering forward-looking statements in this news release or that we make in other reports or statements, you should keep in mind the cautionary statements in this news release and future reports we file with the SEC. New risks and uncertainties arise from time to time, and we cannot predict when they may arise or how they may affect us. Any forward-looking statement in this news release speaks only as of the date on which it was made. Except as required by law, we assume no obligation to update or revise any forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Media Contact

Maddie Lupori

Media@wingstop.com

Investor Contact

Kristen Thomas

IR@wingstop.com

WINGSTOP INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(amounts in thousands, except share and per share data)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| (Unaudited) | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 77,983 | | | $ | 184,496 | |

| Restricted cash | 11,444 | | | 13,296 | |

| Accounts receivable, net | 11,951 | | | 9,461 | |

| Prepaid expenses and other current assets | 5,907 | | | 4,252 | |

| Advertising fund assets, restricted | 25,558 | | | 15,167 | |

| Total current assets | 132,843 | | | 226,672 | |

| Property and equipment, net | 84,344 | | | 66,851 | |

| Goodwill | 65,175 | | | 62,514 | |

| Trademarks | 32,700 | | | 32,700 | |

| Customer relationships, net | 8,059 | | | 9,015 | |

| Other non-current assets | 28,555 | | | 26,438 | |

| Total assets | $ | 351,676 | | | $ | 424,190 | |

| Liabilities and stockholders' deficit | | | |

| Current liabilities | | | |

| Accounts payable | $ | 5,104 | | | $ | 5,219 | |

| Other current liabilities | 36,670 | | | 34,726 | |

| Current portion of debt | — | | | 7,300 | |

| Advertising fund liabilities | 25,558 | | | 15,167 | |

| Total current liabilities | 67,332 | | | 62,412 | |

| Long-term debt, net | 711,867 | | | 706,846 | |

| Deferred revenues, net of current | 28,769 | | | 27,052 | |

| Deferred income tax liabilities, net | 2,980 | | | 4,180 | |

| Other non-current liabilities | 16,170 | | | 14,561 | |

| Total liabilities | 827,118 | | | 815,051 | |

| Commitments and contingencies | | | |

| Stockholders' deficit | | | |

Common stock, $0.01 par value; 100,000,000 shares authorized; 29,414,920 and 29,932,668 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | 294 | | | 300 | |

| Additional paid-in-capital | 1,238 | | | 2,797 | |

| Retained deficit | (476,413) | | | (393,321) | |

| Accumulated other comprehensive loss | (561) | | | (637) | |

| Total stockholders' deficit | (475,442) | | | (390,861) | |

| Total liabilities and stockholders' deficit | $ | 351,676 | | | $ | 424,190 | |

WINGSTOP INC. AND SUBSIDIARIES

Consolidated Statements of Operations

(amounts in thousands, except per share data)

| | | | | | | | | | | | | | | |

| Thirteen Weeks Ended | | |

| September 30,

2023 | | September 24,

2022 | | | | |

| (Unaudited) | | (Unaudited) | | | | |

| Revenue: | | | | | | | |

| Royalty revenue, franchise fees and other | $ | 53,200 | | | $ | 40,363 | | | | | |

| Advertising fees | 39,951 | | | 32,146 | | | | | |

| Company-owned restaurant sales | 23,953 | | | 20,163 | | | | | |

| Total revenue | 117,104 | | | 92,672 | | | | | |

| Costs and expenses: | | | | | | | |

Cost of sales (1) | 17,622 | | | 15,724 | | | | | |

| Advertising expenses | 42,381 | | | 33,106 | | | | | |

| Selling, general and administrative | 23,047 | | | 16,686 | | | | | |

| Depreciation and amortization | 3,384 | | | 2,836 | | | | | |

| Loss on disposal of assets | 18 | | | 239 | | | | | |

| Total costs and expenses | 86,452 | | | 68,591 | | | | | |

| Operating income | 30,652 | | | 24,081 | | | | | |

| Interest expense, net | 4,520 | | | 5,742 | | | | | |

| | | | | | | |

| Other (income) expense | (19) | | | 290 | | | | | |

| Income before income tax expense | 26,151 | | | 18,049 | | | | | |

| Income tax expense | 6,640 | | | 4,681 | | | | | |

| Net income | $ | 19,511 | | | $ | 13,368 | | | | | |

| | | | | | | |

| Earnings per share | | | | | | | |

| Basic | $ | 0.66 | | | $ | 0.45 | | | | | |

| Diluted | $ | 0.65 | | | $ | 0.45 | | | | | |

| | | | | | | |

| Weighted average shares outstanding | | | | | | | |

| Basic | 29,750 | | | 29,915 | | | | | |

| Diluted | 29,818 | | | 29,967 | | | | | |

| | | | | | | |

| Dividends per share | $ | 0.22 | | | $ | 0.19 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(1) Cost of sales includes all operating expenses of company-owned restaurants, including advertising expenses, and excludes depreciation and amortization, which are presented separately.

WINGSTOP INC. AND SUBSIDIARIES

Unaudited Supplemental Information

Cost of Sales Margin Analysis

(amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended |

| September 30, 2023 | | September 24, 2022 |

| In dollars | | As a % of company-owned restaurant sales | | In dollars | | As a % of company-owned restaurant sales |

| Cost of sales: | | | | | | | |

| Food, beverage and packaging costs | $ | 7,910 | | | 33.0 | % | | $ | 7,504 | | | 37.2 | % |

| Labor costs | 5,646 | | | 23.6 | % | | 4,652 | | | 23.1 | % |

| Other restaurant operating expenses | 4,645 | | | 19.4 | % | | 4,009 | | | 19.9 | % |

| Vendor rebates | (579) | | | (2.4) | % | | (441) | | | (2.2) | % |

| Total cost of sales | $ | 17,622 | | | 73.6 | % | | $ | 15,724 | | | 78.0 | % |

WINGSTOP INC. AND SUBSIDIARIES

Unaudited Supplemental Information

Restaurant Count

| | | | | | | | | | | | | | | |

| Thirteen Weeks Ended | | |

| September 30,

2023 | | September 24,

2022 | | | | |

| Domestic Franchised Activity: | | | | | | | |

| Beginning of period | 1,749 | | | 1,600 | | | | | |

| Openings | 42 | | | 32 | | | | | |

| Closures | — | | | — | | | | | |

| Acquired by Company | — | | | (1) | | | | | |

| | | | | | | |

| Restaurants end of period | 1,791 | | | 1,631 | | | | | |

| | | | | | | |

| Domestic Company-Owned Activity: | | | | | | | |

| Beginning of period | 45 | | | 39 | | | | | |

| Openings | 1 | | | 2 | | | | | |

| Closures | — | | | — | | | | | |

| Acquired by Company | — | | | 1 | | | | | |

| | | | | | | |

| Restaurants end of period | 46 | | | 42 | | | | | |

| | | | | | | |

| Total Domestic Restaurants | 1,837 | | | 1,673 | | | | | |

| | | | | | | |

| International Franchised Activity: | | | | | | | |

| Beginning of period | 252 | | | 219 | | | | | |

| Openings | 13 | | | 9 | | | | | |

| Closures | (3) | | | (3) | | | | | |

| | | | | | | |

| Restaurants end of period | 262 | | | 225 | | | | | |

| | | | | | | |

| Total System-wide Restaurants | 2,099 | | | 1,898 | | | | | |

WINGSTOP INC. AND SUBSIDIARIES

Non-GAAP Financial Measures - EBITDA and Adjusted EBITDA

(Unaudited)

(amounts in thousands)

| | | | | | | | | | | | | | | |

| Thirteen Weeks Ended | | |

| September 30,

2023 | | September 24,

2022 | | | | |

| Net income | $ | 19,511 | | | $ | 13,368 | | | | | |

| Interest expense, net | 4,520 | | | 5,742 | | | | | |

| Income tax expense | 6,640 | | | 4,681 | | | | | |

| Depreciation and amortization | 3,384 | | | 2,836 | | | | | |

| EBITDA | $ | 34,055 | | | $ | 26,627 | | | | | |

| Additional adjustments: | | | | | | | |

| | | | | | | |

| | | | | | | |

Consulting fees (a) | 1,300 | | | — | | | | | |

Stock-based compensation expense (b) | 3,128 | | | 1,528 | | | | | |

| Adjusted EBITDA | $ | 38,483 | | | $ | 28,155 | | | | | |

(a) Represents non-recurring consulting fees that are not part of our ongoing operations and are incurred to execute discrete, project-based strategic initiatives, which are included in Selling, general and administrative on the Consolidated Statements of Operations. The costs incurred in the thirteen weeks ended September 30, 2023 include consulting fees relating to a comprehensive review of our long-term growth strategy for our domestic business to explore potential future initiatives, and which review is expected to be completed in fiscal year 2023. Given the magnitude and scope of the strategic review initiative that is not expected to recur in the foreseeable future, the Company considers the incremental consulting fees incurred with respect to the initiative not reflective of the ongoing costs to operate its business.

(b) Includes non-cash, stock-based compensation.

WINGSTOP INC. AND SUBSIDIARIES

Non-GAAP Financial Measures - Adjusted Net Income and Adjusted EPS

(Unaudited)

(amounts in thousands, except per share data)

| | | | | | | | | | | | | | | |

| Thirteen Weeks Ended | | |

| September 30,

2023 | | September 24,

2022 | | | | |

| Numerator: | | | | | | | |

| Net income | $ | 19,511 | | | $ | 13,368 | | | | | |

| Adjustments: | | | | | | | |

| | | | | | | |

| | | | | | | |

Consulting fees (a) | 1,300 | | | — | | | | | |

Tax effect of adjustments (b) | (312) | | | — | | | | | |

| Adjusted net income | $ | 20,499 | | | $ | 13,368 | | | | | |

| | | | | | | |

| Denominator: | | | | | | | |

| Weighted-average shares outstanding - diluted | 29,818 | | | 29,967 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted earnings per diluted share | $ | 0.69 | | | $ | 0.45 | | | | | |

(a)Represents non-recurring consulting fees that are not part of our ongoing operations and are incurred to execute discrete, project-based strategic initiatives, which are included in Selling, general and administrative on the Consolidated Statements of Operations. The costs incurred in the thirteen weeks ended September 30, 2023 include consulting fees relating to a comprehensive review of our long-term growth strategy for our domestic business to explore potential future initiatives, and which review is expected to be completed in fiscal year 2023. Given the magnitude and scope of the strategic review initiative that is not expected to recur in the foreseeable future, the Company considers the incremental consulting fees incurred with respect to the initiative not reflective of the ongoing costs to operate its business.

(b)Represents the tax effect of the aforementioned adjustments to reflect corporate income taxes at an assumed effective tax rate of 24% for the period ended September 30, 2023, which includes provisions for U.S. federal income taxes, and assumes the respective statutory rates for applicable state and local jurisdictions.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

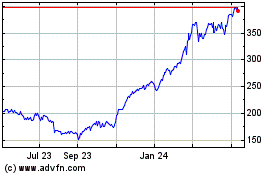

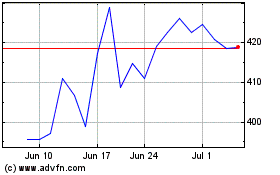

Wingstop (NASDAQ:WING)

Historical Stock Chart

From Jun 2024 to Jul 2024

Wingstop (NASDAQ:WING)

Historical Stock Chart

From Jul 2023 to Jul 2024