Current Report Filing (8-k)

December 15 2021 - 4:06PM

Edgar (US Regulatory)

false

0001463361

0001463361

2021-12-15

2021-12-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 15, 2021

UNITY BIOTECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-38470

|

|

26-4726035

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

285 East Grand Ave.

South San Francisco, CA 94080

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (650) 416-1192

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.0001 per share

|

UBX

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On December 15, 2021, Unity Biotechnology, Inc. (“Unity” or the “Company”) entered into an amendment (the “Amendment”) to its Loan and Security Agreement dated August 3, 2020 (the “LSA”) with Hercules Capital, Inc. (the “Lender”). Under the terms of the Amendment, the Lender (including any of its assignees) has the option (the “Conversion Option”) for a period of six (6) months following the date of the Amendment to convert up to $5.0 million of the outstanding principal under the existing loan into shares of the Company’s common stock, par value $0.0001 per share (“Common Stock”). If the Conversion Option is exercised, the Lender (or its assignees) can convert into no more than 12% of the trading volume of the Common Stock for the five consecutive full trading days immediately preceding the delivery of the applicable conversion notice. In addition, the Lender (together with its assignees) may not deliver more than four conversion notices during any thirty consecutive calendar day period. The conversion price of the Common Stock issuable upon each exercise of the Conversion Option is equal to 85% of the most recent closing trade price preceding the delivery of the applicable conversion notice. The aggregate number of shares of Common Stock issuable pursuant to the Conversion Option may not exceed 19.9% of the Company’s outstanding Common Stock in accordance with Nasdaq Listing Rule 5635(d). The Lender (including any of its assignees) may not exercise the Conversion Option if, upon exercise, the issuance of shares of Common Stock would cause the Lender’s (including any of its assignees) beneficial ownership to exceed 4.99% of the outstanding Common Stock, unless the limitation is waived by the Lender (or its applicable assignee) on 61 days’ written notice. If the Conversion Option is exercised, the minimum cash the Company is required to maintain under the LSA covenant is reduced dollar for dollar by the amount of principal converted.

In addition, the Amendment provides that upon the occurrence of certain milestone events, the interest-only period under the LSA will be extended from September 1, 2022 to December 1, 2022, and upon the satisfaction of additional milestones, the extension will be through March 1, 2023 and then through June 1, 2023, respectively. The Amendment also contains customary representations, warranties and covenants.

The foregoing is a summary of the material terms of the Amendment and is qualified by the Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

UNITY BIOTECHNOLOGY, INC.

|

|

|

|

|

|

Date: December 15, 2021

|

By:

|

/s/ Anirvan Ghosh

|

|

|

|

Anirvan Ghosh, Ph.D.

|

|

|

|

Chief Executive Officer

|

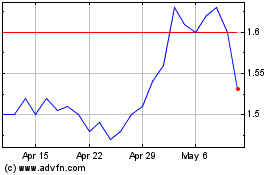

UNITY Biotechnology (NASDAQ:UBX)

Historical Stock Chart

From Jun 2024 to Jul 2024

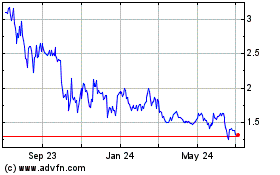

UNITY Biotechnology (NASDAQ:UBX)

Historical Stock Chart

From Jul 2023 to Jul 2024