As

filed with the Securities and Exchange Commission on June 17, 2022

Registration

No. 333-

United

States

SECURITIES

AND EXCHANGE cOMMISSION

Washington,

D.C. 20549

fOrm

S-8

registration

statement under the securities act of 1933

PetVivo

Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

99-0363559

|

(State or Other Jurisdiction

of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification Number) |

5251

Edina Industrial Blvd., Edina, MN 55439

(Address

of Principal Executive Offices) (Zip Code)

PetVivo

Holdings, Inc.

2020

Equity Incentive Plan

(Full

title of the plan)

John

Lai

Chief

Executive Officer

5251

Edina Industrial Blvd.

Edina,

MN 55439

(952)

405-6216

(Name,

Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies

to:

Laura

M. Holm, Esq.

Patrick

Pazderka, Esq.

Fox

& Rothschild, LLP

Campbell

Mithun Tower

222

S. Ninth St., Suite 2000

Minneapolis

MN 55402-3338

(612)

607-7000

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

| |

Non-accelerated

filer ☐ |

|

Smaller

reporting company ☐ |

| |

|

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

EXPLANATORY

NOTE

PetVivo

Holdings, Inc. (the “Registrant” or the “Company”) has filed this Registration Statement on Form

S-8 (this “Registration Statement”) with the Securities and Exchange Commission (the “Commission”) under the

Securities Act of 1933, as amended (the “Securities Act”), to register shares of the Company’s common stock,

$0.001 par value per share (“Common Stock”), initially reserved for issuance under the PetVivo Holdings, Inc. 2020

Equity Incentive Plan (the “2020 Plan”), of which (i) 143,850 shares of the Company’s Common Stock are available

for issuance under the Plan as of the date of this Registration Statement, (ii) 285,073 shares are available for issuance upon exercise

of outstanding stock options granted under the Plan as of the date of this Registration Statement and (iii) such indeterminate number

of shares as may become available under the 2020 Plan as a result of the adjustment provisions thereof.

This

Registration Statement also includes a reoffer prospectus (the “Reoffer Prospectus”) prepared in accordance with General

Instruction C of Form S-8 and in accordance with the requirements of Part I of Form S-3. This Reoffer Prospectus may be used for the

reoffer and resale of shares of Common Stock on a continuous or delayed basis that may be deemed to be “control securities”

within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations promulgated

thereunder, that are issuable to certain of our executive officers, directors and employees identified in the Reoffer Prospectus. The

number of shares of Common Stock included in the Reoffer Prospectus represents shares of Common Stock issued or issuable to the Selling

Stockholders pursuant to equity awards granted under the 2020 Plan, including stock options, restricted stock units and restricted stock

awards, and does not necessarily represent a present intention to sell any or all such shares of Common Stock.

PART

I

Information

Required In The SECTION 10(a)

PROSPECTUS

Item

1. Plan Information.

The

document(s) containing the information specified in Part I of Form S-8 will be sent or given to participants in the 2020 Plan in accordance

with Rule 428(b)(1) under the Securities Act. Such documents are not required to be and are not being filed with the Commission either

as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act, but

constitute, along with the documents incorporated by reference into this Registration Statement pursuant to Item 3 of Part II hereof,

a prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item

2. Registrant Information and Employee Annual Information.

The

Company will furnish without charge to each person to whom the prospectus is delivered, upon the written or oral request of such person,

a copy of any and all of the documents incorporated by reference into this Registration Statement pursuant to Item 3 of Part II hereof,

other than exhibits to such documents (unless such exhibits are specifically incorporated by reference in such documents that are incorporated),

and the other documents required to be delivered to eligible participants in the 2020 Plan pursuant to Rule 428(b) under the Securities

Act. Those documents are incorporated by reference in the Section 10(a) prospectus. Requests should be directed to:

PetVivo

Holdings, Inc.

Robert

Folkes, Chief Financial Officer

5251

Edina Industrial Blvd.

Edina,

MN 55439

(952)

405-6216

PETVIVO

HOLDINGS, INC.

PetVivo

Holdings, Inc.

571,077

Shares of Common Stock

This

reoffer prospectus (“Reoffer Prospectus”) relates to the offer and sale from time to time by the selling stockholders

named in this Reoffer Prospectus (the “Selling Stockholders”), or their permitted transferees, of shares (the “Shares”)

of the Company’s common stock (“Common Stock”), of PetVivo Holdings, Inc. (the “Company”).

This Reoffer Prospectus covers the reoffer and resale of up to 571,077 shares of Common Stock issued or issuable to each Selling Stockholder

pursuant to awards granted by the Company to the Selling Stockholder under the PetVivo Holdings, Inc. 2020 Equity Incentive Plan (the

“2020 Plan”), including restricted stock units, restricted stock awards, stock options, and stock awards. We are not

offering any shares of Common Stock and will not receive any proceeds from the sale of the shares of Common Stock by the Selling Stockholders

pursuant to this Reoffer Prospectus. The Selling Stockholders include our directors, executive officers, and other employees, some of

which are “affiliates” of our company (as defined in Rule 405 under the Securities Act of 1933, as amended (“Securities

Act”).

Subject

to the satisfaction of any conditions to the vesting of the share of Common Stock offered hereby pursuant to the terms of the relevant

award agreements, the Selling Stockholders may sell the shares of our Common Stock from time to time as they may determine through public

or private transactions or through other means described in the section entitled “Plan of Distribution” at prevailing market

prices on the Nasdaq Capital Market, at prices different than prevailing market prices, or at privately negotiated prices. The Selling

Stockholders will bear all sales commissions and similar expenses. We will bear all expenses of registration incurred in connection with

this offering, including any other expenses incurred by us in connection with the registration and offering that are not borne by the

Selling Stockholders.

Our

Common Stock is listed for trading on the NASDAQ Capital Market under the symbol “PETV.” On June 16, 2022, the last reported

sales price of our Common Stock was $1.77 per share.

We

are an “emerging growth company” and a “smaller reporting company” as defined under the U.S. federal securities

laws, and, as such, we have elected to comply with certain reduced public company reporting requirements for this Reoffer Prospectus

and may elect to do so in future filings.

Investing

in our Common Stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks

of investing in our Common Stock in “Risk Factors” beginning on page 1 of this Reoffer Prospectus.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this Reoffer Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this Reoffer Prospectus is June 17, 2022

TABLE

OF CONTENTS

Neither

we nor the Selling Stockholders have authorized anyone to provide any information or to make any representations other than those contained

in this Reoffer Prospectus or any accompanying prospectus supplement that we have prepared. We and the Selling Stockholders take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. This Reoffer Prospectus is

an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No

dealer, salesperson, or other person is authorized to give any information or to represent anything not contained in this Reoffer Prospectus

or any applicable prospectus supplement. This Reoffer Prospectus is not an offer to sell securities, and it is not soliciting an offer

to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in

this Reoffer Prospectus, any prospectus supplement or incorporated by reference into this Reoffer Prospectus is accurate only as of the

respective dates of such information or as of the dates which are specified therein, regardless of the time of delivery of this Reoffer

Prospectus or any applicable prospectus supplement, or the time of any sale of shares of our Common Stock. Our business, financial condition,

results of operations, and prospects may have changed since those dates.

ABOUT

THIS REOFFER PROSPECTUS

This

Reoffer Prospectus contains important information you should know before investing, including important information about our company

and the Shares being offered. You should carefully read this Reoffer Prospectus, as well as the additional information contained in the

documents described under “Where You Can Find More Information” and “Incorporation of Certain Information by Reference”

in this Reoffer Prospectus, and in particular the periodic and current reporting documents we file with the SEC. You should rely only

on the information contained in this Reoffer Prospectus or incorporated herein by reference or in any accompanying prospectus supplement

by us or on our behalf. We have not authorized any other person to provide you with different information. If anyone provides you with

different or inconsistent information, you should not rely on it. We are not making an offer to sell the Shares in any jurisdiction where

the offer or sale is not permitted. You should assume that the information appearing in this Reoffer Prospectus is accurate only as of

the date hereof. Additionally, any information we have incorporated by reference in this Reoffer Prospectus is accurate only as of the

date of the document incorporated by reference, regardless of the time of delivery of this Reoffer Prospectus or any sale of securities.

Our business, financial condition, results of operations, and prospects may have changed since those dates.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Reoffer Prospectus includes forward-looking statements regarding, among other things, our plans, strategies and prospects, both business

and financial. These statements are based on our management’s beliefs and assumptions. Although we believe that our plans, intentions

and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve

or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties, and assumptions.

Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies,

events, or results of operations, are forward-looking statements. These statements may be preceded by, followed by, or include the words

“believes”, “estimates”, “expects”, “projects”, “forecasts”, “may”,

“will”, “should”, “seeks”, “plans”, “scheduled”, “anticipates”,

“intends” or similar expressions. From time to time, we also may provide oral and written forward-looking statements in other

materials we release to the public, such as press releases, presentations to securities analysts or investors, or other communications

by the Company. Any or all of our forward-looking statements in this report and in any public statements we make could be materially

different from actual results.

Accordingly,

we wish to caution investors that any forward-looking statements made by or on behalf of the Company are subject to uncertainties and

other factors that could cause actual results to differ materially from such statements. These uncertainties and other risk factors include,

but are not limited to, the risks and uncertainties set forth under “Risk Factors” in our prospectus filed with the SEC on

August 13, 2021 (“Prospectus”), pursuant to Rule 424(b) of the Securities Act, included in the registration statement

on Form S-1 (File No. 333-249452) as originally filed with the SEC on October 13, 2020, as amended.

We

also wish to caution investors that other factors might in the future prove to be important in affecting the Company’s results

of operations. New factors emerge from time to time; it is not possible for management to predict all such factors, nor can it assess

the impact of each such factor on the business or the extent to which any factor, or a combination of factors, may cause actual results

to differ materially from those contained in any forward-looking statements. We undertake no obligation to update publicly or revise

any forward-looking statements, whether as a result of new information, future events, or otherwise.

PROSPECTUS

SUMMARY

This

summary highlights information contained in greater detail elsewhere in this Reoffer Prospectus. This summary does not contain all of

the information you should consider in making your investment decision. You should read the entire Reoffer Prospectus carefully before

making an investment in our securities. You should carefully consider, among other things, our consolidated financial statements and

the related notes and the sections titled “Risk Factors,” “Business,” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” incorporated by reference in this Reoffer Prospectus.

The

Company

PetVivo

Holdings, Inc. (the “Company,” “PetVivo,” “we” or “us) is an emerging

biomedical device company focused on the manufacturing, commercialization and licensing of innovative medical devices and therapeutics

for animals. The Company has a pipeline of seventeen products for the treatment of animals. A portfolio of nineteen patents protects

the Company’s biomaterials, products, production processes and methods of use. The Company began commercialization of its lead

product Spryng™ with OsteoCushion™ Technology, a veterinarian-administered, intraarticular injection for the management of

lameness and other joint afflictions such as osteoarthritis in dogs and horses, in the second quarter of its fiscal year ended March

31, 2022.

In

August 2021, we received net proceeds of approximately $9.7 million in a registered public offering (“Public Offering”)

of 2.5 million units at a public offering price of $4.50 per unit. Each unit consisted of one share of our common stock and one warrant

to purchase one share of our common stock at an exercise price of $5.625 per share. The shares of common stock and warrants were transferable

separately immediately upon issuance. In connection with the Public Offering, the Company’s common stock and warrants were registered

under Section 12(b) of the Exchange Act and began trading on The Nasdaq Capital Market, LLC under the symbols “PETV” and

“PETVW,” respectively

Our

principal executive offices are located at 5251 Edina Industrial Blvd., Edina, Minnesota 55439. Our main telephone number is (952) 405-6216.

Our internet website is www.petvivo.com. The information contained in, or that can be accessed through, our website is not incorporated

by reference into, and is not a part of, this Reoffer Prospectus.

The

Offering

This

Reoffer Prospectus relates to the public offering, which is not being underwritten, by the Selling Stockholders listed in this Reoffer

Prospectus, of up to 571,077 shares of Common Stock that were issued or will be acquired by or

issuable to Selling Stockholders pursuant to restricted stock units, restricted stock awards, stock options or stock award agreements,

as applicable, between the Company and such Selling Stockholder under the 2020 Plan. Subject

to the satisfaction of any conditions to vesting of the shares of Common Stock offered hereby pursuant to the terms of the relevant award

agreements, the Selling Stockholders may from time to time sell, transfer, or otherwise dispose of any or all of the shares of Common

Stock covered by this Reoffer Prospectus through underwriters or dealers, directly to purchasers (or a single purchaser) or through broker-dealers

or agents. We will receive none of the proceeds from the sale of the shares of Common Stock by the Selling Stockholders. The Selling

Stockholders will bear all sales commissions and similar expenses in connection with this offering. We will bear all expenses of registration

incurred in connection with this offering, as well as any other expenses incurred by us in connection with the registration and offering

that are not borne by the Selling Stockholders.

RISK

FACTORS

An

investment in our Common Stock involves a high degree of risk and should be considered highly speculative. Before making an investment

decision, you should carefully consider the risks and uncertainties and all other information contained in this Reoffer Prospectus, including

the risks and uncertainties discussed under “Risk Factors” in our Prospectus filed with the SEC pursuant to Rule 424(b)(4)

under the Securities Act on August 13, 2021, as well as those discussed in our other filings with the SEC, together with the other information

contained in and incorporated by reference into this Reoffer Prospectus, before deciding whether to invest in our Common Stock. Our business,

operating results, financial condition or prospects could also be harmed by risks and uncertainties not currently known to us or that

we currently do not believe are material. If any of these risks actually occur, our business, prospects, financial condition, and results

of operations could be materially adversely affected. In that case, the trading price of our Common Stock could decline and you may lose

all or a part of your investment. Only those investors who can bear the risk of loss of their entire investment should invest in our

Common Stock.

The

risks we have described also include forward-looking statements, and our actual results may differ substantially from those discussed

in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of the shares of our Common Stock offered and sold by the Selling Stockholders pursuant to

this Reoffer Prospectus. All of the net proceeds from the sale of the shares of our Common Stock offered pursuant to this Reoffer Prospectus

will be received by the Selling Stockholders.

DESCRIPTION

OF SECURITIES

The

description of the Company’s common stock contained in the Registration Statement on Form 8-A filed with the SEC on August 5, 2021

(File No. 001-40715), pursuant to Section 12(b) of the Securities Exchange Act of 1934, as amended, including any amendments or reports

filed for the purpose of updating such description.

DETERMINATION

OF OFFERING PRICE

The

Selling Stockholders will determine at what price they may sell the offered shares of Common Stock, and such sales may be made at prevailing

market prices or at privately negotiated prices. See “Plan of Distribution” below for more information.

SELLING

STOCKHOLDERS

This

Reoffer Prospectus covers the reoffer and resale by the selling stockholders listed below of an aggregate of up to 571,077 shares of

our Common Stock previously granted under the 2020 Plan, which constitute “restricted securities” or “control securities”

within the meaning of Form S-8. In addition, non-affiliates who are not named in the table below holding less than 1,000 shares of restricted

Common Stock issued under the 2020 Plan may use this Reoffer Prospectus for the reoffer and resale of those shares.

The

following table sets forth information with respect to the Selling Stockholders and the shares of our Common Stock (i) beneficially owned

by the Selling Stockholders, and (ii) with respect to shares of Common Stock covered by this Reoffer Prospectus, shares subject to options,

restricted stock units, or stock awards held by the Selling Stockholders, in each case as of June 1, 2022 (the “Determination

Date”). In addition, non-affiliates not named in the table below holding less than 1,000 shares of Common Stock issued pursuant

to the 2020 Plan and deemed “restricted securities” may use this Prospectus for the reoffer and resale of those shares. The

percentage of beneficial ownership is calculated based on 9,988,361 shares of Common Stock, outstanding as of the Determination Date.

The Selling Stockholders may offer all, some, or none of the shares of Common Stock covered by this Reoffer Prospectus. Information concerning

the Selling Stockholders may change from time to time and, if necessary, we will amend or supplement this Reoffer Prospectus accordingly.

We cannot give an estimate as to the number of shares of Common Stock that will actually be held by the Selling Stockholders upon termination

of this offering, because the Selling Stockholders may offer some or all of their Common Stock under the offering contemplated by this

Reoffer Prospectus or acquire additional shares of Common Stock. We cannot advise you as to whether the Selling Stockholders will, in

fact, sell any or all of such shares of Common Stock.

We

have determined beneficial ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial

ownership for any other purpose. Shares of common stock that may be acquired by an individual or group pursuant to the exercise of options

or warrants or settlement of restricted stock units (sometimes referred to as a “RSU”) that are currently exercisable

or may become exercisable or settleable within sixty (60) days of the Determination Date are deemed to be outstanding for the purpose

of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purpose of computing

the percentage ownership of any other person shown in the table. Unless otherwise indicated below, the address of each Selling Stockholder

listed in the table below is c/o PetVivo Holdings, Inc., 5251 Edina Industrial Blvd., Edina, Minnesota 55439 and to our knowledge, the

persons and entities named in the tables have sole voting and sole investment power with respect to all securities that they beneficially

own, subject to community property laws where applicable.

| Name of Selling Stockholder | |

Position with the Company | |

Number of

Shares of Our

Common Stock

Beneficially

Owned Prior to

the Offering | | |

Number of

Shares of Our

Common Stock

that May be Sold (1) | | |

Number of

Shares of Our

Common Stock

Beneficially

Owned After

the Offering | | |

Percentage

of Shares of

Our Common

Stock

Beneficially

Owned After

The Offering (%) | |

| Jon Lai (2) | |

Chief Executive Officer and Director | |

| 1,084,807 | | |

| 150,000 | | |

| 1,034,807 | | |

| 10.33 | |

| Robert Folkes (3) | |

Chief Financial Officer | |

| 41,000 | | |

| 60,000 | | |

| 13,000 | | |

| * | |

| Randall Meyer (4) | |

Chief Operating Officer | |

| 576,991 | | |

| 65,000 | | |

| 555,325 | | |

| 5.55 | |

| John Dolan (5) | |

Chief Business Development Officer | |

| 581,767 | | |

| 65,000 | | |

| 560,101 | | |

| 5.56 | |

| Gregory Cash (6) | |

Director | |

| 62,149 | | |

| 26,612 | | |

| 42,890 | | |

| * | |

| David Deming (7) | |

Director | |

| 87,244 | | |

| 21,151 | | |

| 72,466 | | |

| * | |

| Joseph Jasper (8) | |

Director | |

| 65,767 | | |

| 15,073 | | |

| 57,334 | | |

| * | |

| Scott Johnson (9) | |

Director | |

| 200,941 | | |

| 20,534 | | |

| 186,534 | | |

| 1.86 | |

| James Martin (10) | |

Director | |

| 142,318 | | |

| 15,073 | | |

| 133,985 | | |

| 1.33 | |

| Robert Rudelius (11) | |

Director | |

| 189,468 | | |

| 15,073 | | |

| 181,135 | | |

| 1.81 | |

| Current Employees (12) | |

Employees | |

| 1,000 | | |

| 371,000 | | |

| 1,000 | | |

| * | |

| * |

Indicates beneficial ownership of less than 1% of the

number of shares of our Common Stock outstanding. |

| (1) |

The number of shares of Common Stock reflects all shares

of Common Stock acquired or issuable to a person pursuant to applicable equity grants previously made under the 2020 Plan irrespective

of whether such grants are exercisable or vested as of the Determination Date or will become exercisable or vested within 60 days

of the Determination Date. |

| (2) |

Mr. Lai owns 957,992 shares

directly and has warrants to purchase 134,315 shares that are vested or will vest within 60 days of the Determination Date. The shares

covered by this Reoffer Prospectus consist of 150,000 shares of Common Stock issued or issuable upon the settlement of an RSU award

granted pursuant to the 2020 Plan, of which 50,000 shares vested on March 31, 2022, 50,000 will vest on March 31, 2023 and 50,000

will vest on March 31, 2024, subject to Mr. Lai’s continued service through the vesting date. |

| (3) |

Mr. Folkes owns 41,000

shares directly. The shares covered by this Reoffer Prospectus consist of 88,000 shares of Common Stock issued or issuable upon the

settlement of two RSU Awards granted pursuant to the 2020 Plan, with 28,000 shares vested on March 31, 2022, 10,000 shares vesting

on January 1, 2023, 18,000 shares vesting on March 31, 2023, 14,000 shares vesting on January 1, 2024, and 18,000 shares vesting

on March 31, 2024, subject to Mr. Folkes’ continued service through the vesting date. |

| (4) |

Mr. Meyer owns 563,568

shares directly and includes warrants to purchase 13,423 shares that are vested or will vest within 60 days of the Determination

Date. The shares covered by this Reoffer Prospectus consist of 65,000 shares issued or issuable upon the settlement of RSU’s

granted under our 2020 Plan, of which 21,666 of the shares vested on March 31, 2022, 21,667 shares vesting on March 31, 2023, and

21,667 of the shares vesting on March 24, 2024, subject to Mr. Meyer’s continued service through the vesting date. |

| (5) |

Mr. Dolan owns 497,905

shares directly and has warrants to purchase 83,862 shares that are vested or will vest within 60 days of the Determination Date.

The shares covered by this Reoffer Prospectus consist of 65,000 shares issuable upon the settlement of RSU’s granted under

our 2020 Plan, of which 21,666 of the shares vested on March 31, 2022, 21,667 of the shares vesting on March 31, 2023, and 21,667

of the shares vesting on March 24, 2024, subject to Mr. Dolan’s continued service through the vesting date. |

| (6) |

Mr. Cash owns 35,050 shares

directly and has warrants to purchase 27,099 shares that are vested or will vest within 60 days of the Determination Date. The shares

covered by this Reoffer Prospectus consist of 26,612 shares with 19,259 shares vested as of March 31, 2022, and 7,353 shares issuable

upon exercise of options granted under the 2020 Plan, which will vest on September 30, 2022. |

| (7) |

Mr. Deming owns 29,890

shares directly or with his spouse and has warrants to purchase 57,354 shares that are vested or will vest within 60 days of the

Record Date. The shares covered by this Reoffer Prospectus consists of 21,151 shares, with 14,778 shares vested as of March 31, 2022,

and 6,373 shares issuable upon exercise of options granted under the 2020 Plan, which will vest on September 30, 2022. |

| (8) |

Mr. Jasper owns 17,542

shares directly and has warrants to purchase 48,225 shares that are vested or will vest within 60 days of the Determination Date.

The shares covered by this Reoffer Prospectus consist of 15,073 shares, with 8,333 shares vested as of March 31, 2022, and 6,740

shares issuable upon exercise of options granted under the 2020 Plan, which will vest on September 30, 2022. |

| (9) |

Mr. Johnson owns 175,565

shares directly and includes warrants to purchase 25,376 shares that are vested or will vest within 60 days of the Determination

Date. The shares covered by this Reoffer Prospectus consist of 20,534 shares, with 14,407 shares vested as of March 31, 2022, and

6,127 shares issuable upon exercise of options granted under the 2020 Plan, which will vest on September 30, 2022. |

| (10) |

Mr. Martin owns 102,518

shares directly, in his two IRA accounts, by Martinmoore Holdings, LLP, a company controlled by Mr. Martin who exercises sole voting

and dispositive power over the shares and has warrants to purchase 39,800 shares that are vested or will vest within 60 days of the

Determination Date. The shares covered by this Reoffer Prospectus consist of 15,073 shares, with 8,333 shares vested as of March

31, 2022, and 6,740 shares issuable upon exercise of options granted under the 2020 Plan, which will vest on September 30, 2022. |

| (11) |

Mr. Rudelius owns 145,333

shares directly, in his IRA, and by Noble Ventures, LLC, a company controlled by Mr. Rudelius, and has warrants to purchase 44,135

shares that are vested or will vest within 60 days of the Record Date. The shares covered by this Reoffer Prospectus consists of

15,073 shares, with 8,333 shares vested as of March 31, and 6,740 shares issuable upon exercise of options granted under the 2020

Plan, which will vest on September 30, 2022. |

| (12) |

Consists of 371,000 shares

issued or issuable upon exercise of 245,000 options, none of which are vested as of the Determination Date, and 126,000 restricted

stock units, with 10,000 RSU’s vested within 60 days of the Determination Date, which are held by the following 10 non-affiliated

persons (last name listed first: each of whom is a current employee and beneficially owns less than 1% of the shares of Common Stock):

Manning, Joseph; Middleton, Mark; Gregory, David; Siakel, Russell; Schumaker, Rachael; Smith, Cliff; Wilhelm, Joseph; Zieser, Ann;

Colahan, Gavin; Mills, Drew. |

Employment

Relationships

Each

of Mr. Lai, Mr. Folkes, Mr. Meyer, and Mr. Dolan have entered into employment agreements with the Company.

PLAN

OF DISTRIBUTION

The

purpose of this Reoffer Prospectus is to allow the Selling Stockholders to offer for sale and sell all or a portion of their shares of

our Common Stock acquired under the 2020 Plan. We will not receive any of the proceeds of the sale of the shares offered by this Reoffer

Prospectus. The aggregate proceeds to the Selling Stockholders from the sale of the shares will be the purchase price of the shares less

any discounts and commissions. Each Selling Stockholder reserves the right to accept or reject any proposed purchase of shares to be

made directly or through agents.

The

Selling Stockholders and any of their donees, pledgees, distributes, transferees, assignees, and successors-in-interest may, from time

to time, sell any or all of their shares offered by this Reoffer Prospectus on the Nasdaq Capital Market or in private transactions.

These sales may occur at fixed prices, at negotiated prices, at prevailing market prices on the Nasdaq Capital Market at the time of

sale, or at prices related to prevailing market prices. The Selling Stockholders or their permitted transferees may use any one or more

of the following methods when selling the shares offered by this Reoffer Prospectus:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

● |

block

trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as

principal to facilitate the transaction; |

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

broker-dealers

may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share; |

| |

● |

a

combination of any such methods of sale; and |

| |

● |

any

other method permitted pursuant to applicable law. |

In

connection with these sales, the Selling Stockholders or their permitted transferees may enter into hedging transactions with broker-dealers

or other financial institutions that in turn may:

| |

● |

engage

in short sales of shares of the Common Stock in the course of hedging their positions; |

| |

● |

engage

in short sales of shares of the Common Stock and deliver shares of the Common Stock to close out short positions; |

| |

● |

loan

or pledge shares of the Common Stock to broker-dealers or other financial institutions that in turn may sell shares of the Common

Stock; |

| |

● |

enter

into option or other transactions with broker-dealers or other financial institutions that require the delivery to the broker-dealer

or other financial institution of shares of the Common Stock, which the broker-dealer or other financial institution may resell under

this Reoffer Prospectus; or |

| |

● |

enter

into transactions in which a broker-dealer makes purchases as a principal for resale for its own account or through other types of

transactions. |

Broker-dealers

engaged by the Selling Stockholders may arrange for other broker-dealers to participate in resales. Broker-dealers may receive commissions

or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in

amounts to be negotiated. However, the Selling Stockholders and any broker-dealers involved in the sale or resale of the Shares may qualify

as “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. In addition, the broker-dealers’ commissions,

discounts, or concessions may qualify as underwriters’ compensation under the Securities Act.

The

Selling Stockholders will be subject to the Reoffer Prospectus delivery requirements of the Securities Act, unless exempted therefrom.

Our

Common Stock is listed for trading on the NASDAQ Capital Market under the symbol “PETV.”

Any

shares covered by this Reoffer Prospectus that qualify for sale under Rule 144 under the Securities Act may be sold under Rule 144 rather

than under this Reoffer Prospectus. The shares covered by this Reoffer Prospectus may also be sold to non-U.S. persons outside the U.S.

in accordance with Regulation S under the Securities Act rather than under this Reoffer Prospectus. The shares covered by this Reoffer

Prospectus may be sold in some States only through registered or licensed brokers or dealers. In addition, in some States, the shares

covered by this Reoffer Prospectus may not be sold unless they have been registered or qualified for sale or an exemption from registration

or qualification is available and complied with.

LEGAL

MATTERS

Certain

legal matters in connection with this offering, including the validity of the shares of our Common Stock offered hereby, will be passed

upon for us by Fox Rothschild, LLP, Minneapolis, Minnesota.

EXPERTS

The

audited financial statements of PetVivo Holdings, Inc., incorporated by reference in this Reoffer Prospectus and elsewhere in the registration

statement, have been so incorporated by reference in reliance upon the report of Assurance Dimensions, Inc., independent registered public

accountants, upon the authority of said firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form S-8 under the Securities Act with respect to the shares of our Common Stock

being offered by the Selling Stockholders pursuant to this Reoffer Prospectus. This Reoffer Prospectus, which constitutes part of the

registration statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules

which are part of the registration statement. Some items included in the registration statement are omitted from the prospectus in accordance

with the rules and regulations of the SEC. For further information with respect to us and the Common Stock offered in this Reoffer Prospectus,

we refer you to the registration statement and the accompanying exhibits.

A

copy of the registration statement and the accompanying exhibits and any other document we file with the SEC may be inspected without

charge at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549, and copies of all or any

part of the registration statement may be obtained from this office upon the payment of the fees prescribed by the SEC. The public may

obtain information on the operation of the public reference facilities in Washington, D.C. by calling the SEC at 1-800-SEC-0330. Our

filings with the SEC are available to the public from the SEC’s website at www.sec.gov.

We

are subject to the information and periodic reporting requirements of the Securities Exchange Act of 1934, as amended (which we refer

to as the “Exchange Act”), applicable to a company with securities registered pursuant to Section 12 of the Exchange Act.

In accordance therewith, we will file with the SEC our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K, proxy statements, amendments thereto, and other information. All documents filed with the SEC are available for inspection

and copying at the public reference room and website of the SEC referred to above. We maintain a website at www.selectinteriorconcepts.com.

You may access our periodic reports, proxy statements, and other information free of charge at this website as soon as reasonably practicable

after such material is electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed through,

our website is not incorporated by reference into, and is not a part of, this Reoffer Prospectus.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

SEC allows us to incorporate by reference into this Reoffer Prospectus information we file with the SEC, which means that we can disclose

important information to you by referring you to those documents. The information incorporated by reference is an important part of this

Reoffer Prospectus, and information that we file later with the SEC will automatically update and supersede this information. We incorporate

by reference in this Reoffer Prospectus the following documents filed by us with the SEC:

| |

(a) |

Our

Prospectus filed with the SEC on August 13, 2021, pursuant to Rule 424(b) of the Securities Act, included in the registration statement

on Form S-1 (File No. 333-249452 ) as originally filed with the SEC on October 13, 2020, as amended; |

| |

|

|

| |

(b) |

The

Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, filed with the SEC on August 16, 2021, as amended

on Form 10-Q-A filed on August 18, 2021; |

| |

|

|

| |

(c) |

The

Registrant’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2021, filed with the SEC on November 15, 2021; |

| |

|

|

| |

(d) |

The

Registrant’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2021, filed with the SEC on February 10, 2022; |

| |

|

|

| |

(e) |

The

Registrant’s Current Reports on Form 8-K, filed with the SEC on July 12, 2021, August 16, 2021, September 14, 2021, November 10, 2021, November 15, 2021, February 10, 2022, March 8, 2022, May 9, 2022 and June 7, 2022; |

| |

|

|

| |

(f) |

The

description of the Registrant’s Common Stock contained in the Registration Statement on Form 8-A, dated August 5, 2021, File

No. 001-40715, and any other amendment or report filed for the purpose of updating such description |

In

addition, all other documents filed (not furnished) by us pursuant to Section 13(a), Section 13(c), Section 14, or Section 15(d) of the

Exchange Act on or after the date of this Reoffer Prospectus and prior to the termination of this offering, shall be deemed to be incorporated

by reference into this Reoffer Prospectus and to be a part of this Reoffer Prospectus from the date of the filing of such documents;

provided, however, that documents or information deemed to have been furnished to and not filed with the SEC in accordance

with the rules of the SEC shall not be deemed incorporated by reference into this Reoffer Prospectus.

Any

statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded

for purposes of this Reoffer Prospectus to the extent that a statement contained herein or in any subsequently filed document which also

is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded

shall not be deemed, except as so modified or superseded, to constitute a part of this Reoffer Prospectus.

571,077

Shares of Common Stock

PetVivo

Holdings, Inc.

Reoffer

Prospectus

PART

II

Information

Required In The Registration Statement

Item

3. Incorporation of Documents by Reference.

The

rules of the Commission allow the Registrant to incorporate by reference information into this Registration Statement. This means that

the Registrant may disclose important information to you by referring you to another document.

The

following documents previously filed by the Registrant with the Commission are incorporated by reference into this Registration Statement:

| |

(a) |

The

Registrant’s Prospectus filed with the SEC on August 13, 2021, pursuant to Rule 424(b) of the Securities Act, included in the

registration statement on Form S-1 (File No. 333-249452) as originally filed with the SEC on October 13, 2020, as amended; |

| |

|

|

| |

(b) |

The

Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, filed with the SEC on August 13, 2021, as amended

on Form 10-Q-A filed on August 16, 2021; |

| |

|

|

| |

(c) |

The

Registrant’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2021, filed with the SEC on November 15, 2021; |

| |

|

|

| |

(d) |

The

Registrant’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2021, filed with the SEC on February 10, 2022; |

| |

|

|

| |

(e) |

The

Registrant’s Current Reports on Form 8-K, filed with the SEC on July 12, 2021, August 16, 2021, September 14, 2021, November 10, 2021, November 15, 2021, January 3, 2022, February 10, 2022; March 8, 2022, May 9, 2022 and June 7, 2022; |

| |

|

|

| |

(f) |

The

description of the Registrant’s Common Stock contained in the Registration Statement on Form 8-A, dated August 5, 2021, File

No. 001-40715, and any other amendment or report filed for the purpose of updating such description. |

In

addition, all documents filed with the Commission by the Registrant (other than portions of such documents which are furnished and not

filed) pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

subsequent to the date of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all

securities offered hereby have been sold or which deregisters all such securities then remaining unsold, shall be deemed to be incorporated

by reference in this Registration Statement and to be a part hereof from the time of filing of such documents.

Any

statement contained in the documents incorporated or deemed to be incorporated by reference in this Registration Statement shall be deemed

to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other

subsequently filed document which also is incorporated or deemed to be incorporated by reference in this Registration Statement modifies

or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this Registration Statement.

Item

4. Description of Securities.

Not

applicable.

Item

5. Interests of Named Experts and Counsel.

Not

applicable.

Item

6. Indemnification of Directors and Officers.

Nevada

Revised Statutes (“NRS”) Section 78.7502 provides that a corporation shall indemnify any director, officer, employee,

or agent of a corporation against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection with

any the defense to the extent that a director, officer, employee or agent of a corporation has been successful on the merits or otherwise

in defense of any action, suit or proceeding referred to Section 78.7502(1) or 78.7502(2), or in defense of any claim, issue or matter

therein.

NRS

78.7502(1) provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened,

pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, except an action by or

in the right of the corporation, by reason of the fact that he is or was a director, officer, employee, or agent of the corporation,

or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership,

joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines, and amounts paid in settlement

actually and reasonably incurred by him in connection with the action, suit, or proceeding if he: (a) is not liable pursuant to NRS 78.138;

or (b) acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation,

and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful.

NRS

Section 78.7502(2) provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to

any threatened, pending, or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason

of the fact that he is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the

corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against

expenses, including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by him in connection with the

defense or settlement of the action or suit if he: (a) is not liable pursuant to NRS 78.138; or (b) acted in good faith and in a manner

which he reasonably believed to be in or not opposed to the best interests of the corporation. Indemnification may not be made for any

claim, issue or matter as to which such a person has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals

there from, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that

the court in which the action or suit was brought or other court of competent jurisdiction determines upon application that in view of

all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

NRS

Section 78.747 provides that except as otherwise provided by specific statute, no director or officer of a corporation is individually

liable for a debt or liability of the corporation unless the director or officer acts as the alter ego of the corporation. The court

as a matter of law must determine the question of whether a director or officer acts as the alter ego of a corporation.

Our

articles of incorporation, as amended, and bylaws, as amended, provide that we shall indemnify our directors, officers, employees, and

agents to the full extent permitted by NRS, including in circumstances in which indemnification is otherwise discretionary under such

law.

These

indemnification provisions may be sufficiently broad to permit indemnification of our officers, directors, and other corporate agents

for liabilities (including reimbursement of expenses incurred) arising under the Securities Act of 1933.

Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers, and controlling

persons of our company pursuant to the foregoing provisions, or otherwise, we have been informed that in the opinion of the SEC such

indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

We

have the power to purchase and maintain insurance on behalf of any person who is or was one of our directors or officers, or is or was

serving at our request as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other business

against any liability asserted against the person or incurred by the person in any of these capacities, or arising out of the person’s

fulfilling one of these capacities, and related expenses, whether or not we would have the power to indemnify the person against the

claim under the provisions of the NRS. We currently maintain director and officer liability insurance on behalf of our directors and

officers.

Item

7. Exemption from Registration Claimed.

The

shares of our Common Stock that may be reoffered and resold by the Selling Stockholders pursuant to the reoffer prospectus included herein

were granted by the Company under the 2020 Plan and were deemed to be exempt from registration under the Securities Act in reliance on

Section 4(a)(2) of the Securities Act, as transactions by an issuer not involving a public offering. The recipients of shares in each

such transaction represented their intention to acquire the shares for investment purposes only and not with a view to or for sale in

connection with any distribution thereof, and appropriate restrictive legends were affixed to the instruments representing such shares

issued in such transactions. All recipients had adequate access, through their relationship with the Company, to information regarding

the Company.

Item

8. Exhibits.

The

following exhibits are filed with or incorporated by reference into this Registration Statement:

Item

9. Undertakings.

(a)

The undersigned Registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration

Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective Registration Statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or

any material change to such information in the Registration Statement;

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii)

do not apply if the Registration Statement is on Form S-8, and the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section

15(d) of the Exchange Act that are incorporated by reference in the Registration Statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(b)

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of

the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing

of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in

the Registration Statement shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling

persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of

the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In

the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or

paid by a director, officer, or controlling person of the Registrant in the successful defense of any action, suit, or proceeding) is

asserted by such director, officer, or controlling person in connection with the securities being registered, the Registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final

adjudication of such issue.

Signatures

Pursuant

to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Minneapolis, State of Minnesota, on June 17, 2022.

| |

PETVIVO

HOLDINGS, INC. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/

John Lai |

| |

|

John

Lai |

| |

|

Chief

Executive Officer and President |

POWER

OF ATTORNEY

We,

the undersigned officers and directors of PetVivo Holdings, Inc. constitute and appoint John Lai and Robert Folkes, and each of them

singly (with full power to each of them to act alone), our true and lawful attorneys-in-fact and agents, with full power of substitution

and resubstitution in each of them for him and in his name, place and stead, and in any and all capacities, to sign (i) any and all amendments

(including post-effective amendments) to this Registration Statement and (ii) any registration statement or post-effective amendment

thereto to be filed with the Securities and Exchange Commission pursuant to Rule 462(b) under the Securities Act of 1933, as amended,

and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission,

granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and

thing requisite or necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person,

hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or their or his substitute or substitutes,

may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in

the capacities and on the dates indicated.

| Name

and Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

John Lai |

|

President,

Chief Executive Officer and Director

(Principal

Executive Officer) |

|

June

17, 2022 |

| John

Lai |

|

|

|

|

| /s/

Robert Folkes |

|

Chief

Financial Officer

(Principal

Financial and Accounting Officer) |

|

June

17, 2022 |

| Robert

Folkes |

|

|

|

|

| |

|

|

|

|

| /s/

Greg Cash |

|

Chairman

of the Board |

|

June

17, 2022 |

| Greg

Cash |

|

|

|

|

| |

|

|

|

|

/s/

David Deming |

|

Director |

|

June

17, 2022 |

| David

Deming |

|

|

|

|

| |

|

|

|

|

| /s/

Joseph Jasper |

|

Director |

|

June

17, 2022 |

| Joseph

Jasper |

|

|

|

|

| |

|

|

|

|

| /s/

Scott Johnson |

|

Director |

|

June

17, 2022 |

| Scott

Johnson |

|

|

|

|

| |

|

|

|

|

| /s/

James Martin |

|

Director |

|

June

17, 2022 |

| James

Martin |

|

|

|

|

| |

|

|

|

|

| /s/

Robert Rudelius |

|

Director |

|

June

17, 2022 |

| Robert

Rudelius |

|

|

|

|

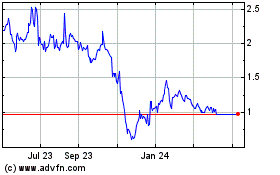

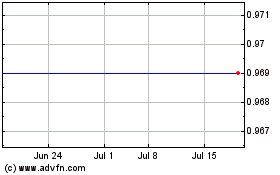

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Jul 2024 to Jul 2024

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Jul 2023 to Jul 2024