Patriot National Bancorp, Inc. (“Patriot,” “Bancorp” or the

“Company”) (NASDAQ: PNBK), the parent company of Patriot Bank, N.A.

(the “Bank”), today announced a pre-tax loss of $2.29 million, and

net loss of $1.66 million, or $0.42 per fully diluted share for the

quarter ended June 30, 2019, even as bank assets, loans, deposits

and investment in its retail and SBA lending network continues to

expand.

The quarterly loss results from an increase in

the provision for loan losses of $2.9 million in the quarter and

$3.1 million, year-to-date, largely associated with a $2.3 million

charge-off on a single non-performing commercial loan. This

resulted in a year-to-date net loss of $1.33 million, or $0.34 per

fully diluted share, as compared to a net income of $2.1 million,

or $0.54 per fully diluted shares in the prior year.

The second quarter and full-year results also

reflect an increase in operating expenses associated with the

organic build-up and expansion of the Bank’s SBA lending business,

deposit initiatives, and costs incurred in conjunction with

strengthened institutional infrastructure, processes, controls and

documentation to address regulatory requirements.

During the quarter, loans receivable increased

$23.2 million (up 3%) as new loan originations continued at a

strong pace, and total deposits increased $14.7 million (up 2%).

Patriot recognized a gain on the sale of SBA loans of

$367,000, compared with $456,000 in the prior quarter and $66,000

in the second quarter of 2018. The Bank continues to maintain

strong capital ratios and earnings which are expected to return to

normalized levels in future periods.

Richard Muskus, Patriot’s

President stated: “The results for the quarter reflect the

impact of a single customer credit problem that we have fully

charged off. We have taken a prudent, proactive approach with

this non-performing loan at this point and are moving forward to

pursue all available options to obtain a recovery on this credit

and the assets it is securitized by.”

In 2019 Patriot instituted enhanced governance

policies, procedures and practices, invested in strengthened

institutional infrastructure, expanded banking locations into the

New Haven and Orange, Connecticut markets and made material

advancements in building out its SBA business. These

activities are intended to bolster performance in future quarters

by investing in the Bank’s future growth.

Mr. Muskus added: “Patriot’s

continued retail location expansion into urban centers across

southern Connecticut has now resulted in the Bank having a presence

in every major community along the busy I-95 corridor, from

downtown Greenwich to downtown New Haven, Connecticut, plus a quite

dynamic market in the community of Scarsdale, NY. Patriot’s

investment in repositioning and adding to its now 12-retail and

four SBA lending locations, better positions the institution to

cater to busy, youthful downtown environments and customers who

want banking options that match their active lifestyle.”

Growth in loan originations continued, as

evidenced by total loans outstanding reaching $812 million, a 3%

increase from the prior quarter and 7% higher than the second

quarter of 2018. Contributions from SBA operations were

significant for the last two consecutive quarters and new depositor

initiatives in the second half are expected to reduce funding costs

and strengthen operating performance.

Patriot also announced today the declaration of

its ninth consecutive quarterly dividend of $0.01 per share. The

record date for this quarterly dividend will be September 3, 2019,

with a dividend payment date of September 13, 2019.

Financial Results

As of June 30, 2019, total assets were $977.8

million, as compared to $953.1 million at March 31, 2019 and

$930.2 million at June 30, 2018, for a total asset growth of 5%

over the past 12 months. Net loans receivable totaled $803.3

million, up 3% over $780.7 million at March 31, 2019, and up 7%

over $750.8 million at June 30, 2018. Deposits

continued to grow to $767.6 million at June 30, 2019, as

compared to $752.8 million at March 31, 2019 and $712.3 million at

June 30, 2018.

Net interest income was $6.5 million in the

second quarter of 2019, an increase of 3% from the prior quarter,

and a decline of 7% from the second quarter of 2018. For the

year-to-date period, the net interest income was $12.9 million, a

decrease of 9% from the prior year. The recent decline in net

interest income was due to higher deposit costs, the impact of

non-performing and reduced rate loans, lower loan fees, and the

impact of subordinated debt costs raised in June of 2018.

Net interest margin was 2.93% for the second

quarter of 2019, as compared to 2.87% in the prior quarter and

3.34% for the second quarter of 2018.

The provision for loan losses in the second

quarter of 2019 was $2.9 million, as compared to $165,000 in the

prior quarter and $50,000 for the second quarter of 2018. The

year-to-date provision for loan losses was $3.1 million, as

compared to $235,000 for the prior year. The increase in provision

for loan losses in the second quarter of 2019 was primarily due to

a large provision booked in the quarter associated with a single

loan stemming from operating cash flow weaknesses and collateral

shortfall.

Non-interest income was $829,000 in the second

quarter of 2019, 1% higher than the prior quarter, and 115% higher

than the second quarter of 2018. The year-to-date non-interest

income was $1.7 million in 2019, 133% higher than the prior year.

The increase in non-interest income was primarily due to realized

gains on the sale of SBA loans.

Non-interest expense was $6.7 million in the

second quarter of 2019, 3% higher than the last quarter, and 13%

higher than the second quarter of 2018. The year-to-date

non-interest expense was $13.2 million, 13% higher than the prior

year.

The increase in 2019 was primarily due to an

increase in salaries and benefits associated with the build-up of

the SBA lending team, the completion of the acquisition of Prime

Bank expanding Patriot’s presence in New Haven County, and

increased headcount supporting new deposit initiatives and the

expansion of credit, finance and compliance support functions.

The income tax benefit was $632,000 in the

second quarter of 2019, represented an effective tax rate of

28%.

As of June 30, 2019, shareholders’ equity

was $68.3 million, a decrease of $1.4 million as compared to March

31, 2019. Patriot’s book value per share decreased to $17.41

at June 30, 2019, as compared to $17.77 at March 31, 2019.

The Bank’s capital ratios continue to be strong,

as the Bank maintains its “well capitalized” regulatory status. As

of June 30, 2019, the Bank’s Tier 1 leverage ratio was 9.61%, Tier

1 risk-based capital ratio was 10.66% and total risk-based capital

ratio was 11.65%.

Patriot Bank is headquartered in Stamford and operates 12

locations: in Scarsdale, NY; and Darien, Fairfield, Greenwich,

Milford, Norwalk, Orange, Stamford, Westport, with Express Banking

locations at Bridgeport/ Housatonic Community College, downtown New

Haven and Trumbull at Westfield Mall. It also maintains SBA

lending offices in Atlanta, Jacksonville, Indianapolis, and

Stamford.

About the Company

Founded in 1994, and now celebrating its 25th

year, Patriot National Bancorp, Inc. (“Patriot” or “Bancorp”) is

the parent holding company of Patriot Bank N.A. (“Bank”), a

nationally chartered bank headquartered in Stamford, CT.

Patriot operates with full service branches in Connecticut and

New York and provides lending products and services nationally.

Patriot’s mission is to serve its local community and

nationwide customer base by providing a growing array of banking

solutions to meet the needs of individuals and

small businesses owners. Patriot places great value in the

integrity of its people and how it conducts business. An

emphasis on building strong client relationships and community

involvement are cornerstones of our philosophy as we seek to

maximize shareholder value.

“Safe Harbor” Statement Under Private

Securities Litigation Reform Act of 1995 Certain

statements contained in Bancorp’s public statements, including this

one, may be forward looking and subject to a variety of risks and

uncertainties. These factors include, but are not limited to, (1)

changes in prevailing interest rates which would affect the

interest earned on Bancorp’s interest earning assets and the

interest paid on its interest bearing liabilities, (2) the timing

of repricing of Bancorp’s interest earning assets and interest

bearing liabilities, (3) the effect of changes in governmental

monetary policy, (4) the components of Bancorp’s periodic earnings

and assets, (5) the fact that certain of the income recognized by

Bancorp in any quarter may not be repeated in future periods, (6)

the effect of changes in regulations applicable to Bancorp and the

Bank and the conduct of its business, (7) changes in competition

among financial service companies, including possible further

encroachment of non-banks on services traditionally provided by

banks, (8) the ability of competitors that are larger than Bancorp

to provide products and services which it is impracticable for

Bancorp to provide, (9) the state of the economy and real estate

values in Bancorp’s market areas, and the consequent effect on the

quality of Bancorp’s loans, (10) recent governmental initiatives

that are expected to have a profound effect on the financial

services industry and could dramatically change the competitive

environment of the Bancorp, (11) other legislative or regulatory

changes, including those related to residential mortgages, changes

in accounting standards, and Federal Deposit Insurance Corporation

(“FDIC”) premiums that may adversely affect Bancorp, (12) the

application of generally accepted accounting principles,

consistently applied, (13) the fact that one period of

reported results may not be indicative of future periods,

(14) the state of the economy in the greater New York

metropolitan area and its particular effect on Bancorp customers,

vendors and communities and other such factors, including risk

factors, as may be described in Bancorp’s other filings with the

SEC.

| Contacts: |

|

|

|

| Patriot Bank, N.A. |

Richard Muskus |

Joseph Perillo |

Michael Carrazza |

| 900 Bedford Street |

President |

Chief Financial Officer |

CEO and Chairman |

| Stamford, CT 06901 |

203-252-5939 |

203-252-5954 |

203-251-8230 |

| www.BankPatriot.com |

|

|

|

| PATRIOT

NATIONAL BANCORP, INC. AND SUBSIDIARY |

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

| Dollars in

thousands |

June 30,

2019 |

|

March 31,

2019 |

|

June 30,

2018 |

| |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

| Cash and due from

banks: |

|

|

|

|

|

|

Noninterest bearing deposits and cash |

$ |

5,578 |

|

|

$ |

6,661 |

|

|

$ |

4,839 |

|

|

Interest bearing deposits |

|

45,538 |

|

|

|

49,971 |

|

|

|

80,290 |

|

| |

|

Total cash and cash equivalents |

|

51,116 |

|

|

|

56,632 |

|

|

|

85,129 |

|

| Investment

securities: |

|

|

|

|

|

|

Available-for-sale securities, at fair value |

|

43,839 |

|

|

|

40,275 |

|

|

|

23,982 |

|

|

Other investments, at cost |

|

4,963 |

|

|

|

4,963 |

|

|

|

4,962 |

|

| |

|

Total investment

securities |

|

48,802 |

|

|

|

45,238 |

|

|

|

28,944 |

|

| |

|

|

|

|

|

|

|

| Federal Reserve

Bank stock, at cost |

|

2,922 |

|

|

|

2,892 |

|

|

|

2,564 |

|

| Federal Home Loan

Bank stock, at cost |

|

4,513 |

|

|

|

4,513 |

|

|

|

5,807 |

|

| |

|

|

|

|

|

|

|

| Gross loans

receivable |

|

811,777 |

|

|

|

788,536 |

|

|

|

757,329 |

|

| Allowance for loan

losses |

|

(8,458 |

) |

|

|

(7,823 |

) |

|

|

(6,525 |

) |

| |

Net loans

receivable |

|

803,319 |

|

|

|

780,713 |

|

|

|

750,804 |

|

| |

|

|

|

|

|

|

|

| Loans held for

sale |

|

4,283 |

|

|

|

- |

|

|

|

- |

|

| Accrued interest

and dividends receivable |

|

3,678 |

|

|

|

3,621 |

|

|

|

3,306 |

|

| Premises and

equipment, net |

|

35,249 |

|

|

|

35,335 |

|

|

|

35,715 |

|

| Other real estate

owned |

|

1,954 |

|

|

|

2,945 |

|

|

|

991 |

|

| Deferred tax

asset, net |

|

11,132 |

|

|

|

10,357 |

|

|

|

11,085 |

|

| Goodwill |

|

1,107 |

|

|

|

1,107 |

|

|

|

2,100 |

|

| Core deposit

intangible, net |

|

661 |

|

|

|

680 |

|

|

|

534 |

|

| Other assets |

|

9,031 |

|

|

|

9,075 |

|

|

|

3,256 |

|

| |

Total

assets |

$ |

977,767 |

|

|

$ |

953,108 |

|

|

$ |

930,235 |

|

| |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

| Deposits: |

|

|

|

|

|

| |

Noninterest

bearing deposits |

$ |

84,295 |

|

|

$ |

82,248 |

|

|

$ |

83,808 |

|

| |

Interest bearing

deposits |

|

683,271 |

|

|

|

670,573 |

|

|

|

628,504 |

|

| |

|

Total deposits |

|

767,566 |

|

|

|

752,821 |

|

|

|

712,312 |

|

| |

|

|

|

|

|

|

|

| Federal Home Loan

Bank and correspondent bank borrowings |

|

100,000 |

|

|

|

90,000 |

|

|

|

110,000 |

|

| Senior

notes, net |

|

11,815 |

|

|

|

11,796 |

|

|

|

11,740 |

|

| Subordinated debt,

net |

|

9,738 |

|

|

|

9,731 |

|

|

|

9,576 |

|

| Junior

subordinated debt owed to unconsolidated trust, net |

|

8,098 |

|

|

|

8,096 |

|

|

|

8,090 |

|

| Note payable |

|

1,291 |

|

|

|

1,339 |

|

|

|

1,484 |

|

| Advances from

borrowers for taxes and insurance |

|

3,239 |

|

|

|

1,922 |

|

|

|

2,876 |

|

| Accrued expenses

and other liabilities |

|

7,730 |

|

|

|

7,754 |

|

|

|

5,796 |

|

| |

|

Total

liabilities |

|

909,477 |

|

|

|

883,459 |

|

|

|

861,874 |

|

| |

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

|

|

| Preferred

stock |

|

- |

|

|

|

- |

|

|

|

- |

|

| Common stock |

|

40 |

|

|

|

40 |

|

|

|

40 |

|

| Additional paid-in

capital |

|

107,198 |

|

|

|

107,143 |

|

|

|

106,982 |

|

| Accumulated

deficit |

|

(37,210 |

) |

|

|

(35,517 |

) |

|

|

(36,808 |

) |

| Treasury stock, at

cost |

|

(1,179 |

) |

|

|

(1,179 |

) |

|

|

(1,179 |

) |

| Accumulated other

comprehensive loss |

|

(559 |

) |

|

|

(838 |

) |

|

|

(674 |

) |

| |

|

Total shareholders'

equity |

|

68,290 |

|

|

|

69,649 |

|

|

|

68,361 |

|

| |

|

|

|

|

|

|

|

| |

Total

liabilities and shareholders' equity |

$ |

977,767 |

|

|

$ |

953,108 |

|

|

$ |

930,235 |

|

| |

|

|

|

|

|

|

|

| PATRIOT

NATIONAL BANCORP, INC. AND SUBSIDIARY |

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF INCOME (LOSS) |

|

|

|

|

|

|

|

|

| (Unaudited) |

Three Months Ended |

|

Six Months Ended |

| Dollars in

thousands, except per share data |

June 30, 2019 |

|

March 31, 2019 |

|

June 30, 2018 |

|

June 30, 2019 |

|

June 30, 2018 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest

and Dividend Income |

|

|

|

|

|

|

|

|

|

| |

Interest and fees

on loans |

$ |

10,274 |

|

|

$ |

9,741 |

|

$ |

9,201 |

|

$ |

20,015 |

|

|

$ |

17,975 |

| |

Interest on

investment securities |

|

398 |

|

|

|

379 |

|

|

291 |

|

|

777 |

|

|

|

557 |

| |

Dividends on

investment securities |

|

114 |

|

|

|

118 |

|

|

128 |

|

|

232 |

|

|

|

249 |

| |

Other interest

income |

|

237 |

|

|

|

333 |

|

|

270 |

|

|

570 |

|

|

|

421 |

| |

|

Total interest and

dividend income |

|

11,023 |

|

|

|

10,571 |

|

|

9,890 |

|

|

21,594 |

|

|

|

19,202 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest

Expense |

|

|

|

|

|

|

|

|

|

| |

Interest on

deposits |

|

3,533 |

|

|

|

3,264 |

|

|

1,997 |

|

|

6,797 |

|

|

|

3,654 |

| |

Interest on

Federal Home Loan Bank borrowings |

|

426 |

|

|

|

439 |

|

|

502 |

|

|

865 |

|

|

|

759 |

| |

Interest on senior

debt |

|

228 |

|

|

|

229 |

|

|

228 |

|

|

457 |

|

|

|

457 |

| |

Interest on

subordinated debt |

|

279 |

|

|

|

289 |

|

|

112 |

|

|

568 |

|

|

|

211 |

| |

Interest on note

payable and other |

|

8 |

|

|

|

6 |

|

|

10 |

|

|

14 |

|

|

|

17 |

| |

|

Total interest

expense |

|

4,474 |

|

|

|

4,227 |

|

|

2,849 |

|

|

8,701 |

|

|

|

5,098 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net interest

income |

|

6,549 |

|

|

|

6,344 |

|

|

7,041 |

|

|

12,893 |

|

|

|

14,104 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Provision

for loan losses |

|

2,937 |

|

|

|

165 |

|

|

50 |

|

|

3,102 |

|

|

|

235 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net interest income after provision for loan

losses |

|

3,612 |

|

|

|

6,179 |

|

|

6,991 |

|

|

9,791 |

|

|

|

13,869 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest Income |

|

|

|

|

|

|

|

|

|

| |

Loan application,

inspection and processing fees |

|

28 |

|

|

|

14 |

|

|

12 |

|

|

42 |

|

|

|

20 |

| |

Deposit fees and

service charges |

|

116 |

|

|

|

127 |

|

|

132 |

|

|

243 |

|

|

|

266 |

| |

Gains on sale of

loans |

|

367 |

|

|

|

456 |

|

|

66 |

|

|

823 |

|

|

|

66 |

| |

Rental income |

|

192 |

|

|

|

130 |

|

|

83 |

|

|

322 |

|

|

|

167 |

| |

Other income |

|

126 |

|

|

|

95 |

|

|

93 |

|

|

221 |

|

|

|

189 |

| |

|

Total non-interest

income |

|

829 |

|

|

|

822 |

|

|

386 |

|

|

1,651 |

|

|

|

708 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest Expense |

|

|

|

|

|

|

|

|

|

| |

Salaries and

benefits |

|

3,608 |

|

|

|

3,184 |

|

|

2,854 |

|

|

6,792 |

|

|

|

5,623 |

| |

Occupancy and

equipment expenses |

|

744 |

|

|

|

917 |

|

|

776 |

|

|

1,661 |

|

|

|

1,517 |

| |

Data processing

expenses |

|

361 |

|

|

|

370 |

|

|

322 |

|

|

731 |

|

|

|

639 |

| |

Professional and

other outside services |

|

803 |

|

|

|

771 |

|

|

457 |

|

|

1,574 |

|

|

|

1,029 |

| |

Project

Expenses |

|

(15 |

) |

|

|

80 |

|

|

592 |

|

|

65 |

|

|

|

1,115 |

| |

Advertising and

promotional expenses |

|

77 |

|

|

|

115 |

|

|

59 |

|

|

192 |

|

|

|

137 |

| |

Loan

administration and processing expenses |

|

43 |

|

|

|

14 |

|

|

30 |

|

|

57 |

|

|

|

43 |

| |

Regulatory

assessments |

|

395 |

|

|

|

315 |

|

|

298 |

|

|

710 |

|

|

|

550 |

| |

Insurance

expenses |

|

54 |

|

|

|

41 |

|

|

53 |

|

|

95 |

|

|

|

108 |

| |

Material and

communications |

|

131 |

|

|

|

134 |

|

|

110 |

|

|

265 |

|

|

|

223 |

| |

Other operating

expenses |

|

527 |

|

|

|

569 |

|

|

410 |

|

|

1,096 |

|

|

|

768 |

| |

|

Total non-interest

expense |

|

6,728 |

|

|

|

6,510 |

|

|

5,961 |

|

|

13,238 |

|

|

|

11,752 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Loss) income before income

taxes |

|

(2,287 |

) |

|

|

491 |

|

|

1,416 |

|

|

(1,796 |

) |

|

|

2,825 |

| |

|

|

|

|

|

|

|

|

|

|

|

| (Benefit)

provision for Income Taxes |

|

(632 |

) |

|

|

168 |

|

|

380 |

|

|

(464 |

) |

|

|

724 |

| |

|

Net (loss)

income |

$ |

(1,655 |

) |

|

$ |

323 |

|

$ |

1,036 |

|

$ |

(1,332 |

) |

|

$ |

2,101 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Basic (loss) earnings per

share |

$ |

(0.42 |

) |

|

$ |

0.08 |

|

$ |

0.27 |

|

$ |

(0.34 |

) |

|

$ |

0.54 |

| |

|

Diluted (loss) earnings per

share |

$ |

(0.42 |

) |

|

$ |

0.08 |

|

$ |

0.26 |

|

$ |

(0.34 |

) |

|

$ |

0.54 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL

RATIOS AND OTHER DATA |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Three Months Ended |

|

Six Months Ended |

| |

|

|

|

|

June 30,

2019 |

|

March 31,

2019 |

|

June 30,

2018 |

|

June 30,

2019 |

|

June 30,

2018 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarterly

Performance Data: |

|

|

|

|

|

|

|

|

|

|

| |

|

Net (loss)

income |

|

$ |

(1,655 |

) |

|

$ |

323 |

|

|

$ |

1,036 |

|

|

$ |

(1,332 |

) |

|

$ |

2,101 |

|

| |

|

Return on average

assets |

|

|

-0.69 |

% |

|

|

0.14 |

% |

|

|

0.46 |

% |

|

|

-0.28 |

% |

|

|

0.48 |

% |

| |

|

Return on average

equity |

|

|

-9.44 |

% |

|

|

1.87 |

% |

|

|

6.06 |

% |

|

|

-3.82 |

% |

|

|

6.21 |

% |

| |

|

Net interest

margin |

|

|

2.93 |

% |

|

|

2.87 |

% |

|

|

3.34 |

% |

|

|

2.90 |

% |

|

|

3.44 |

% |

| |

|

Efficiency

ratio |

|

|

91.19 |

% |

|

|

90.85 |

% |

|

|

80.27 |

% |

|

|

91.02 |

% |

|

|

79.34 |

% |

| |

|

Efficiency ratio

excluding project costs |

|

|

91.39 |

% |

|

|

89.73 |

% |

|

|

72.30 |

% |

|

|

90.57 |

% |

|

|

71.81 |

% |

| |

|

% increase

loans |

|

|

2.95 |

% |

|

|

1.05 |

% |

|

|

4.52 |

% |

|

|

4.02 |

% |

|

|

5.24 |

% |

| |

|

% increase

deposits |

|

|

1.96 |

% |

|

|

1.28 |

% |

|

|

8.72 |

% |

|

|

3.27 |

% |

|

|

11.76 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset

Quality: |

|

|

|

|

|

|

|

|

|

|

| |

|

Nonaccrual

loans |

|

$ |

19,405 |

|

|

$ |

28,029 |

|

|

$ |

6,464 |

|

|

$ |

19,405 |

|

|

$ |

6,464 |

|

| |

|

Other real estate

owned |

|

$ |

1,954 |

|

|

$ |

2,945 |

|

|

$ |

991 |

|

|

$ |

1,954 |

|

|

$ |

991 |

|

| |

|

Total nonperforming assets |

|

$ |

21,359 |

|

|

$ |

30,974 |

|

|

$ |

7,455 |

|

|

$ |

21,359 |

|

|

$ |

7,455 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nonaccrual loans /

loans |

|

|

2.39 |

% |

|

|

3.55 |

% |

|

|

0.85 |

% |

|

|

2.39 |

% |

|

|

0.85 |

% |

| |

|

Nonperforming

assets / assets |

|

|

2.18 |

% |

|

|

3.25 |

% |

|

|

0.80 |

% |

|

|

2.18 |

% |

|

|

0.80 |

% |

| |

|

Allowance for loan

losses |

|

$ |

8,458 |

|

|

$ |

7,823 |

|

|

$ |

6,525 |

|

|

$ |

8,458 |

|

|

$ |

6,525 |

|

| |

|

Valuation

reserve |

|

$ |

1,416 |

|

|

$ |

1,384 |

|

|

$ |

1,702 |

|

|

$ |

1,416 |

|

|

$ |

1,702 |

|

| |

|

Allowance for loan

losses with valuation reserve |

|

$ |

9,874 |

|

|

$ |

9,207 |

|

|

$ |

8,227 |

|

|

$ |

9,874 |

|

|

$ |

8,227 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Allowance for loan

losses / loans |

|

|

1.04 |

% |

|

|

0.99 |

% |

|

|

0.86 |

% |

|

|

1.04 |

% |

|

|

0.86 |

% |

| |

|

Allowance /

nonaccrual loans |

|

|

43.59 |

% |

|

|

27.91 |

% |

|

|

100.94 |

% |

|

|

43.59 |

% |

|

|

100.94 |

% |

| |

|

Allowance for loan losses and valuation reserve / loans |

|

|

1.21 |

% |

|

|

1.17 |

% |

|

|

1.08 |

% |

|

|

1.21 |

% |

|

|

1.08 |

% |

| |

|

Allowance for loan losses and valuation reserve / nonaccrual

loans |

|

|

50.88 |

% |

|

|

32.85 |

% |

|

|

127.27 |

% |

|

|

50.88 |

% |

|

|

127.27 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Gross loan

charge-offs |

|

$ |

2,307 |

|

|

$ |

- |

|

|

$ |

13 |

|

|

$ |

2,307 |

|

|

$ |

13 |

|

| |

|

Gross loan

(recoveries) |

|

$ |

(5 |

) |

|

$ |

(49 |

) |

|

$ |

(3 |

) |

|

$ |

(54 |

) |

|

$ |

(6 |

) |

| |

|

Net loan

charge-offs (recoveries) |

|

$ |

2,302 |

|

|

$ |

(49 |

) |

|

$ |

10 |

|

|

$ |

2,253 |

|

|

$ |

7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital

Data and Capital Ratios |

|

|

|

|

|

|

|

|

|

|

| |

|

Book value per

share (1) |

|

$ |

17.41 |

|

|

$ |

17.77 |

|

|

$ |

17.51 |

|

|

$ |

17.41 |

|

|

$ |

17.51 |

|

| |

|

Shares

outstanding |

|

|

3,922,610 |

|

|

|

3,919,610 |

|

|

|

3,904,578 |

|

|

|

3,922,610 |

|

|

|

3,904,578 |

|

|

Bank Capital Ratios: |

|

|

|

|

|

|

|

|

|

|

| |

|

Leverage

ratio |

|

|

9.61 |

% |

|

|

9.79 |

% |

|

|

10.03 |

% |

|

|

9.61 |

% |

|

|

10.03 |

% |

| |

|

Tier 1

capital |

|

|

10.66 |

% |

|

|

10.99 |

% |

|

|

11.05 |

% |

|

|

10.66 |

% |

|

|

11.05 |

% |

| |

|

Total risk based

capital |

|

|

11.65 |

% |

|

|

11.91 |

% |

|

|

11.85 |

% |

|

|

11.65 |

% |

|

|

11.85 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Book

value per share represents shareholders' equity divided by

outstanding shares. |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

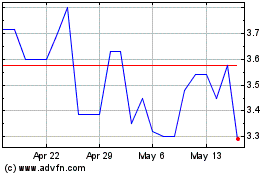

Patriot National Bancorp (NASDAQ:PNBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Patriot National Bancorp (NASDAQ:PNBK)

Historical Stock Chart

From Jul 2023 to Jul 2024