Pathfinder Bancorp, Inc. (“Company”) (NASDAQ: PBHC), the holding

company for Pathfinder Bank (“Bank”), announced an increase in

first quarter 2022 net income of $796,000, or 37.0%, as compared to

the first quarter of 2021. Net income for the quarter ended March

31, 2022 was $3.0 million, or $0.49 per basic and diluted common

share, compared to $2.2 million, or $0.36 per basic and diluted

common share, for the first quarter of 2021. First quarter 2022

total revenue (net interest income and total noninterest income) of

$11.1 million increased $665,000, or 6.4%, compared to the first

quarter of 2021.

First Quarter 2022 Performance

Highlights

- Total interest-earning assets on

March 31, 2022 of $1.25 billion increased by $12.2 million, or

1.0%, from $1.24 million at March 31, 2021 and $37.8 million, or

3.1%, from $1.21 billion at December 31, 2021.

- Total loans were $855.6 million at

the end of the first quarter of 2022 compared to $865.3 million one

year prior and $832.5 million at the end of December 31, 2021.

Excluding PPP-related loans, total loans grew by $56.7 million, or

7.2%, from March 31, 2021 and $29.2 million, or 3.6%, from year-end

2021.

- Total deposits on March 31, 2022

were $1.11 billion, an increase of $45.2 million, or 4.2%, compared

to $1.07 billion one year prior and $58.7 million, or 5.6%, from

$1.06 billion at December 31, 2021.

- A more beneficial deposit mix

contributed to a 28 basis point reduction in deposit funding costs

to 0.43% for the first quarter 2022, as compared to 0.71% in the

prior year’s first quarter. Total funding costs decreased 36 basis

points to 0.61% from the prior year’s first quarter.

- Total first quarter 2022 net

interest income of $9.5 million increased by $907,000, or 10.6%,

from the prior year period, while net interest margin expanded to

3.06%, up 21 basis points over the prior year period.

- Tangible book value per common

share of $17.45 is up 2.4% from $17.04 one year prior.

“Our Company delivered a solid performance in

the first quarter of 2022, achieving continued loan growth, further

improvement in profitability and strong asset quality,” said James

A. Dowd, President and CEO. “Coming off of record earnings in 2021,

Pathfinder is well-positioned for continued success and I am both

humbled and honored to lead our incredible team in our next phases

of growth.”

“For the first quarter of 2022, we grew total

revenue to $11.1 million, up 6.4% from the year-ago period. We also

further improved key earnings ratios, with a first quarter 2022

return on average assets of 0.90% and an annualized return on

average equity of 10.63%. These profitability metrics grew by 22

basis points and 201 basis points, respectively, from the prior

year quarterly period.”

“In light of our continued solid performance and

increased profitability, our Board of Directors raised our

quarterly cash dividend to $0.09 from the previous quarterly cash

dividend of $0.07. This $0.02, or 28.6% increase from the current

quarter compared to March 2021, reflects our ongoing commitment to

rewarding our shareholders.”

“Our improved profitability is in large part due

to the excellent performance of our team in serving both new and

existing customers throughout our Central New York footprint. Their

efforts drove loan growth during the three months ended March 31,

2022. At the same time, we have continued to improve our funding

mix and, as a result, believe that we are well-positioned for the

currently-forecasted rising interest rate environment.”

“As we have expected, noninterest expenses did

increase from the prior year period as we responded to inflationary

and wage pressures within our markets. We will maintain our focus

on effective expense management, while ensuring that we are

continuing to make prudent investments to unlock our longer-term

growth potential. Among those investments is our newest branch

location in the City of Syracuse, which we now expect to open early

in the third quarter of this year. The new branch in Syracuse’s

Southwest Corridor area will soon bring a broad range of community

banking services to an area that we believe is currently

underserved. In addition, this new branch will provide an

additional point of convenient service access for our growing

customer base in downtown Syracuse, where we already have

established a successful presence.”

“It is important that I take this opportunity to

thank Tom Schneider, our President and CEO for the past 22 years,

for his dedication and leadership in positioning the Company for

our improved level of operating performance while we continued to

both maintain and enhance our high standards for credit quality and

customer service. I would also like to thank Tom, on behalf of all

of the members of our senior team, for his guidance and friendship

that was extended to each of us during his tenure as our President

and CEO. We look forward to his continued contributions to our

corporate growth and development in the coming years, as Tom

assumes his new role as Pathfinder’s Director of Capital Markets

and Corporate Strategy.”

“Looking ahead, we are excited by the growth

opportunities we see for both the Company and the regions that we

serve. With strong loan and deposit pipelines and a highly capable

team that is committed to serving our Central New York customers

and communities, we are optimistic about our potential to continue

growing our Company and enhancing shareholder returns over the

long-term.”

Income Statement for the Quarter Ended

March 31, 2022

First quarter 2022 net interest income was $9.5

million, an increase of $907,000, or 10.6%, compared to $8.6

million for the same quarter in 2021. The increase in net interest

income between comparable quarters was primarily due to a 36 basis

point reduction in rates paid on interest-bearing liabilities,

reflecting the Company’s improved funding mix, which reduced total

interest expense for the first quarter of 2022 by $867,000, or

36.4%, to $1.5 million, from $2.4 million for the prior year

quarter. Interest and dividend income in the 2022 first quarter was

$11.0 million, compared to $10.9 million in the first quarter of

2021. The net interest margin for the first quarter of 2022 was

3.06%, reflecting a 21 basis point increase compared to 2.85% for

the first quarter of 2021. This improvement primarily reflects a 36

basis point decline in the average cost for interest-bearing

liabilities as well as a larger interest-earning asset base, which

partially offset the effects of a 10 basis point decline in the

average yield.

The following table details the components of

net interest income for the three months ended March 31, 2022 and

2021:

Components of Net Interest

Income

|

Unaudited |

|

For the three months ended |

|

| (In

thousands, except per share data) |

|

March 31, 2022 |

|

|

March 31, 2021 |

|

|

Change |

|

|

Interest and dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, including fees |

|

$ |

8,692 |

|

|

$ |

8,847 |

|

|

$ |

(155 |

) |

|

-1.8 |

% |

| Debt securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

2,120 |

|

|

|

1,976 |

|

|

|

144 |

|

|

7.3 |

% |

|

Tax-exempt |

|

|

118 |

|

|

|

29 |

|

|

|

89 |

|

|

306.9 |

% |

| Dividends |

|

|

48 |

|

|

|

87 |

|

|

|

(39 |

) |

|

-44.8 |

% |

| Federal

funds sold and interest earning deposits |

|

|

4 |

|

|

|

3 |

|

|

|

1 |

|

|

33.3 |

% |

|

Total interest and dividend income |

|

|

10,982 |

|

|

|

10,942 |

|

|

|

40 |

|

|

0.4 |

% |

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest on deposits |

|

|

965 |

|

|

|

1,527 |

|

|

|

(562 |

) |

|

-36.8 |

% |

| Interest on short-term

borrowings |

|

|

5 |

|

|

|

3 |

|

|

|

2 |

|

|

66.7 |

% |

| Interest on long-term

borrowings |

|

|

133 |

|

|

|

295 |

|

|

|

(162 |

) |

|

-54.9 |

% |

|

Interest on subordinated loans |

|

|

412 |

|

|

|

557 |

|

|

|

(145 |

) |

|

-26.0 |

% |

|

Total interest expense |

|

|

1,515 |

|

|

|

2,382 |

|

|

|

(867 |

) |

|

-36.4 |

% |

|

Net interest income |

|

|

9,467 |

|

|

|

8,560 |

|

|

|

907 |

|

|

10.6 |

% |

|

Provision for loan losses |

|

|

102 |

|

|

|

1,028 |

|

|

|

(926 |

) |

|

-90.1 |

% |

|

Net interest income after provision for loan losses |

|

$ |

9,365 |

|

|

$ |

7,532 |

|

|

$ |

1,833 |

|

|

24.3 |

% |

Paycheck Protection Program Discussion

From April 2020 to May 2021, the Company

participated in all phases of the Paycheck Protection Program

(“PPP”) as administered by the U.S. Small Business Administration

(the “SBA”). PPP loans are substantially guaranteed as to timely

repayment by the SBA and have unique forgiveness features whereby

loan principal amounts may be discharged, for the benefit of the

borrowers, by direct payments from the SBA to the lending

institution holding the indebtedness. The Company has received both

interest (calculated at a stated rate of 1%) and various levels of

fee income related to the origination of PPP loans. Information

related to the Company’s PPP loans are included in the following

tables:

|

Unaudited |

|

For the three months ended |

|

| (In

thousands, except number of loans) |

|

March 31, 2022 |

|

|

March 31, 2021 |

|

|

Number of PPP loans originated in the period |

|

|

- |

|

|

|

421 |

|

| Funded balance of PPP loans

originated in the period |

|

$ |

- |

|

|

$ |

34,487 |

|

| Number of PPP loans forgiven

in the period |

|

93 |

|

|

|

206 |

|

| Balance of PPP loans forgiven

in the period |

|

$ |

6,096 |

|

|

$ |

18,581 |

|

| Deferred PPP fee income

recognized in the period |

|

$ |

278 |

|

|

$ |

412 |

|

| |

|

|

|

|

|

|

|

|

| (In

thousands, except number of loans) |

|

March 31, 2022 |

|

|

March 31, 2021 |

|

| Unearned PPP deferred fee

income at end of period |

|

$ |

440 |

|

|

$ |

1,468 |

|

| (In

thousands, except number of loans) |

|

Number |

|

|

Balance |

|

|

Total PPP loans originated since inception |

|

|

1,177 |

|

|

$ |

111,721 |

|

| Total PPP loans forgiven since

inception |

|

|

1,025 |

|

|

$ |

98,429 |

|

| Total PPP loans remaining at

March 31, 2022 |

|

|

152 |

|

|

$ |

13,292 |

|

Provision for Loan Losses

The Company reported a provision for loan losses

of $102,000 for the first quarter of 2022, reflective of improving

asset quality metrics, partially offset by the effects on required

reserves related to year-over-year loan growth. This compares to a

provision for loan losses of $1.0 million for the first quarter of

2021. The credit sensitive portfolios continue to be carefully

monitored, and the Bank will consistently apply its proven

conservative loan classification and reserve building methodologies

to the analysis of these portfolios.

Noninterest Income

First quarter 2022 noninterest income was $1.6

million, a decrease of $242,000, or 13.1%, compared to $1.8 million

for the same three-month period in 2021. The decrease in

noninterest income, as compared to the same quarter of the previous

year, was primarily due to a $201,000 non-recurring gain, recorded

in the first quarter of 2021, related to the Bank’s sale of land

previously held for development. Noninterest income categorized as

recurring was $1.5 million for the first quarter of 2022,

reflecting a $188,000, or 14.6%, improvement over the first quarter

of the prior year. Recurring noninterest income excludes unrealized

gains on equity securities, gains on sales of loans, foreclosed

real estate, and premises and equipment, as well as losses on

investment securities.

The following table details the components of

noninterest income for the three months ended March 31, 2022 and

2021:

|

Unaudited |

|

For the three months ended |

|

|

(Dollars in thousands) |

|

March 31, 2022 |

|

|

March 31, 2021 |

|

|

Change |

|

|

Service charges on deposit accounts |

|

$ |

259 |

|

|

$ |

331 |

|

|

$ |

(72 |

) |

|

-21.8 |

% |

| Earnings and gain on bank

owned life insurance |

|

|

162 |

|

|

|

125 |

|

|

|

37 |

|

|

29.6 |

% |

| Loan servicing fees |

|

|

117 |

|

|

|

90 |

|

|

|

27 |

|

|

30.0 |

% |

| Debit card interchange

fees |

|

|

228 |

|

|

|

221 |

|

|

|

7 |

|

|

3.2 |

% |

| Insurance agency revenue |

|

|

299 |

|

|

|

280 |

|

|

|

19 |

|

|

6.8 |

% |

| Other

charges, commissions and fees |

|

|

413 |

|

|

|

243 |

|

|

|

170 |

|

|

70.0 |

% |

|

Noninterest income before (losses) gains |

|

|

1,478 |

|

|

|

1,290 |

|

|

|

188 |

|

|

14.6 |

% |

| Net gains on sales of

securities, fixed assets, loans and foreclosedreal estate |

|

|

57 |

|

|

|

321 |

|

|

|

(264 |

) |

|

-82.2 |

% |

| Gains

on marketable equity securities |

|

|

68 |

|

|

|

234 |

|

|

|

(166 |

) |

|

-70.9 |

% |

|

Total noninterest income |

|

$ |

1,603 |

|

|

$ |

1,845 |

|

|

$ |

(242 |

) |

|

-13.1 |

% |

Noninterest Expense

Total noninterest expense for the first quarter

of 2022 was $7.3 million, an increase of $616,000, or 9.3%,

compared to $6.6 million for the same three-month period in 2021.

The increase was primarily driven by increases in salaries and

employee benefits expense of $708,000, or 21.2%.

The $708,000 year-over-year increase in salaries

and employee benefits expense was comprised of a $239,000 reduction

in deferrals of personnel-related loan origination costs, a

$207,000, or 7.9%, increase in salaries, a $206,000 increase in

incentives expense and a $56,000 net increase in all other salaries

and employee benefits expenses.

The $239,000 reduction in personnel-related

costs deferred under generally accepted accounting principles in

the first quarter of 2022, as compared to the same quarter in 2021,

related to reduced levels of PPP loans loan originated in 2022 as

compared to the previous year. The Company originated $-0- PPP

loans in the first quarter of 2022, as compared to $34.5 million in

the first quarter of 2021.

The $207,000 increase in salaries expense was

primarily due to increases in individual salaries, effective in the

first quarter of 2022, as well as modest additions to staff

headcount. The Company increased its salary structure for

employees, where deemed to be appropriate, in late 2021 and early

2022 in order to effectively respond to inflationary and

competitive pressures within our marketplace relative to the

recruitment and retention of talent. The $206,000 increase in

incentives expense in the first quarter of 2022, as compared to the

same quarter in 2021, was primarily due to the relative timing of

incentive distributions made in 2021 and 2022 and overall

adjustments made to the Bank’s performance incentive plans. The

level of incentive expense in the first quarter of 2022 is

indicative of the quarterly level of such expenses expected for the

remainder of 2022.

Partially offsetting the increase in salaries

and employee benefits expense was a $126,000, or 18.6%, reduction

in data processing expenses, primarily the result of a reduction in

ATM processing fees that was in turn primarily driven by

third-party vendor refunds obtained through contract renegotiation

activities.

The following table details the components of

noninterest expense for the three months ended March 31, 2022 and

2021:

|

Unaudited |

|

For the three months ended |

|

|

|

|

(Dollars in thousands) |

|

March 31, 2022 |

|

|

March 31, 2021 |

|

|

Change |

|

|

Salaries and employee benefits |

|

$ |

4,049 |

|

|

$ |

3,341 |

|

|

$ |

708 |

|

|

|

21.2 |

% |

| Building and occupancy |

|

|

826 |

|

|

|

793 |

|

|

|

33 |

|

|

|

4.2 |

% |

| Data processing |

|

|

550 |

|

|

|

676 |

|

|

|

(126 |

) |

|

|

-18.6 |

% |

| Professional and other

services |

|

|

393 |

|

|

|

417 |

|

|

|

(24 |

) |

|

|

-5.8 |

% |

| Advertising |

|

|

187 |

|

|

|

246 |

|

|

|

(59 |

) |

|

|

-24.0 |

% |

| FDIC assessments |

|

|

222 |

|

|

|

198 |

|

|

|

24 |

|

|

|

12.1 |

% |

| Audits and exams |

|

|

141 |

|

|

|

202 |

|

|

|

(61 |

) |

|

|

-30.2 |

% |

| Insurance agency expense |

|

|

204 |

|

|

|

206 |

|

|

|

(2 |

) |

|

|

-1.0 |

% |

| Community service

activities |

|

|

62 |

|

|

|

88 |

|

|

|

(26 |

) |

|

|

-29.5 |

% |

| Foreclosed real estate

expenses |

|

|

13 |

|

|

|

6 |

|

|

|

7 |

|

|

|

116.7 |

% |

| Other

expenses |

|

|

605 |

|

|

|

463 |

|

|

|

142 |

|

|

|

30.7 |

% |

|

Total noninterest expenses |

|

$ |

7,252 |

|

|

$ |

6,636 |

|

|

$ |

616 |

|

|

|

9.3 |

% |

Balance Sheet on March 31,

2022

The Company’s total assets on March 31, 2022 were $1.33 billion,

an increase of $43.2 million, or 3.4%, from $1.29 billion on

December 31, 2021. This increase was primarily driven by an

increase in loans, along with increased available-for-sale and

held-to-maturity securities. Total loans of $855.6 million

increased by $23.1 million, or 2.8%, compared with $832.5 million

on December 31, 2021, as organic loan growth was partially offset

by PPP loan forgiveness. Investment securities totaled $367.4

million, an increase of $15.2 million, or 4.3%, compared to $352.2

million on December 31, 2021.

Total deposits on March 31, 2022 were $1.11

billion, an increase of $58.7 million, or 5.6%, from $1.06 billion

at December 31, 2021. Interest-bearing deposits of $909.3 million

at March 31, 2022 were up by $45.9 million, or 5.3% from year-end

2021, a result of municipal deposit inflows related to seasonal tax

collections, as well as increases in retail deposits.

Noninterest-bearing deposits totaled $204.7 million at March 31,

2022, an increase of $12.9 million, or 6.7%, from year-end 2021,

resulting from continued growth in business banking

relationships.

Shareholders’ equity was $109.1 million at March

31, 2022 compared to $110.3 million at December 31, 2021. The

modest $1.2 million, or 1.1%, decrease was primarily a result of a

$3.8 million increase in accumulated other comprehensive loss which

is due to unrealized loss on investment securities categorized as

available-for-sale, partially offset by a $2.4 million increase in

retained earnings.

Asset Quality

The Bank maintained strong asset quality metrics

for the first quarter of 2022. Annualized net loan charge-offs to

average loans were 0.01% for the first quarter 2022, compared with

0.05% for the first quarter of 2021 and 0.10% for the year ended

December 31, 2021. Nonperforming loans as a percentage of total

loans continued to improve, totaling 0.81% at March 31, 2022,

compared to 1.00% at December 31, 2021 and 2.47% at March 31, 2021.

The decrease in the nonperforming loan portfolio at March 31, 2022,

as compared to March 31, 2021, was primarily the result of loans

held in portfolio that resumed regular payment status following the

improvement in general business conditions in the second half of

2021.

The following table summarizes nonaccrual loans by category and

status at March 31, 2022:

| (In

thousands) |

|

LoanType |

CollateralType |

NumberofLoans |

|

|

LoanBalance |

|

|

AverageLoanBalance |

|

|

WeightedLTV atOrigination/Modification |

|

|

Status |

|

Secured residential mortgage: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate |

|

14 |

|

|

$ |

1,098 |

|

|

$ |

78 |

|

|

|

77 |

% |

|

Under active resolution management by the Bank. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Secured

commercial real estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

PrivateMuseum |

|

1 |

|

|

|

1,384 |

|

|

|

1,384 |

|

|

|

79 |

% |

|

The Bank is working on a

modification with the borrower. The borrower has substantial

deposits with the Bank. |

| |

Recreational |

|

1 |

|

|

|

1,233 |

|

|

|

1,233 |

|

|

|

49 |

% |

|

The loan is currently

classified as a Troubled Debt Restructuring (TDR). The due date for

this loan payment was September 1, 2021. |

| |

All other |

|

10 |

|

|

|

1,618 |

|

|

|

162 |

|

|

|

61 |

% |

|

Under active resolution

management by the Bank. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial

lines of credit: |

|

4 |

|

|

|

141 |

|

|

|

35 |

|

|

N/A |

|

|

Under active resolution

management by the Bank. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial

and industrial: |

|

10 |

|

|

|

1,191 |

|

|

|

119 |

|

|

N/A |

|

|

Under active resolution

management by the Bank. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer loans: |

|

9 |

|

|

|

1,283 |

|

|

|

143 |

|

|

N/A |

|

|

Under

active resolution management by the Bank. |

|

|

|

|

49 |

|

|

$ |

7,948 |

|

|

$ |

162 |

|

|

|

|

|

|

|

The allowance for loan losses to non-performing

loans at March 31, 2022 was 163.8%, compared with 64.2% at March

31, 2021. The change in the allowance for loans losses to

non-performing loans is reflective of the significant reductions in

nonaccrual loans discussed above.

Cash Dividend Declared

On March 28, 2022, the Company announced that

its Board of Directors declared a cash dividend of $0.09 per share

on the Company's voting common and non-voting common stock, and a

cash dividend of $0.09 per notional share for the issued warrant

relating to the fiscal quarter ended March 31, 2022. The dividend

represents an increase of $0.02 per share, or 28.6% over the

dividend declared for the quarter ended December 31, 2021. The

dividend will be payable to all shareholders of record on April 22,

2022 and will be paid on May 6, 2022. Based on the closing price of

the Company’s common stock of $21.98 on March 31, 2022, the implied

dividend yield is 1.6%. The quarterly cash dividend of $0.09

equates to a dividend payout ratio of 18.4%.

About Pathfinder Bancorp, Inc.

Pathfinder Bank is a New York State chartered

commercial bank headquartered in Oswego, whose deposits are insured

by the Federal Deposit Insurance Corporation. The Bank is a wholly

owned subsidiary of Pathfinder Bancorp, Inc., (NASDAQ SmallCap

Market; symbol: PBHC). The Bank has ten full-service offices

located in its market areas consisting of Oswego and Onondaga

County and one limited purpose office in Oneida County.

Forward-Looking Statement

Certain statements contained herein are “forward

looking statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. These forward-looking statements are

generally identified by use of the words "believe," "expect,"

"intend," "anticipate," "estimate," "project" or similar

expressions, or future or conditional verbs, such as “will,”

“would,” “should,” “could,” or “may.” This release may

contain certain forward-looking statements, which are based on

management's current expectations regarding economic, legislative,

and regulatory issues that may impact the Company's earnings in

future periods. Factors that could cause future results to vary

materially from current management expectations include, but are

not limited to, general economic conditions, changes in interest

rates, deposit flows, loan demand, real estate values, and

competition; changes in accounting principles, policies, or

guidelines; changes in legislation or regulation; and economic,

competitive, governmental, regulatory, and technological factors

affecting the Company's operations, pricing, products, and

services.

As the result of the COVID-19 pandemic and the

related adverse local and national economic consequences, we could

be subject to any of the following additional risks, any of which

could have a material, adverse effect on our business, financial

condition, liquidity, and results of operations:

- demand for our products and

services may decline, making it difficult to grow assets and

income;

- if the economy is unable to

substantially reopen, and high levels of unemployment continue for

an extended period of time, loan delinquencies, problem assets, and

foreclosures may increase, resulting in increased charges and

reduced income;

- collateral for

loans, especially real estate, may decline in value, which

could cause loan losses to increase;

- our allowance for loan losses may

have to be increased if borrowers experience financial difficulties

beyond forbearance periods, which will adversely affect our net

income;

- the net worth and liquidity of loan

guarantors may decline, impairing their ability to honor

commitments to us;

- as the result of the decline in the

Federal Reserve Board’s target federal funds rate to near 0%, the

yield on our assets may decline to a greater extent than the

decline in our cost of interest-bearing liabilities, reducing our

net interest margin and spread and reducing net income;

- a material decrease in net income

or a net loss over several quarters could result in a decrease in

the rate of our quarterly cash dividend;

- our cyber security risks are

increased as the result of an increase in the number of employees

working remotely;

- we rely on third party vendors for

certain services and the unavailability of a critical service due

to the COVID-19 outbreak could have an adverse effect on us;

and

- Federal Deposit Insurance

Corporation premiums may increase if the agency experiences

additional resolution costs.

The Company disclaims any obligation to revise

or update any forward-looking statements contained in this press

release to reflect future events or developments.

PATHFINDER BANCORP,

INC.FINANCIAL HIGHLIGHTS(Dollars

and shares in thousands except per share

amounts)

| |

|

For the three months |

|

| |

|

ended March 31, |

|

| |

|

(Unaudited) |

|

| |

|

2022 |

|

|

2021 |

|

|

Condensed Income Statement |

|

|

|

|

|

|

|

|

|

Interest and dividend income |

|

$ |

10,982 |

|

|

$ |

10,942 |

|

|

Interest expense |

|

|

1,515 |

|

|

|

2,382 |

|

|

Net interest income |

|

|

9,467 |

|

|

|

8,560 |

|

|

Provision for loan losses |

|

|

102 |

|

|

|

1,028 |

|

| |

|

|

9,365 |

|

|

|

7,532 |

|

|

Noninterest income excluding net gains on sales of securities,

fixed assets, loans and foreclosed real estate |

|

|

1,478 |

|

|

|

1,290 |

|

|

Net gains on sales of securities, fixed assets, loans and

foreclosed real estate |

|

|

57 |

|

|

|

321 |

|

|

Gains on marketable equity securities |

|

|

68 |

|

|

|

234 |

|

|

Noninterest income |

|

|

1,603 |

|

|

|

1,845 |

|

| |

|

|

|

|

|

|

|

|

|

Noninterest expense |

|

|

7,252 |

|

|

|

6,636 |

|

|

Income before income taxes |

|

|

3,716 |

|

|

|

2,741 |

|

|

Provision for income taxes |

|

|

721 |

|

|

|

549 |

|

| |

|

|

|

|

|

|

|

|

|

Net income attributable to noncontrolling interest

and Pathfinder Bancorp, Inc. |

|

$ |

2,995 |

|

|

$ |

2,192 |

|

|

Net income attributable to noncontrolling interest |

|

|

45 |

|

|

|

38 |

|

|

Net income attributable to Pathfinder Bancorp

Inc. |

|

$ |

2,950 |

|

|

$ |

2,154 |

|

|

Convertible preferred stock dividends |

|

|

- |

|

|

|

97 |

|

|

Warrant dividends |

|

|

11 |

|

|

|

9 |

|

|

Undistributed earnings allocated to preferred stock shares |

|

|

- |

|

|

|

439 |

|

|

Net income available to common shareholders |

|

$ |

2,939 |

|

|

$ |

1,609 |

|

| |

|

(Unaudited) |

|

| |

|

March 31, |

|

|

December 31, |

|

|

March 31, |

|

| |

|

2022 |

|

|

2021 |

|

|

2021 |

|

|

Selected Balance Sheet Data |

|

|

|

|

|

|

|

|

|

|

|

|

| Assets |

|

$ |

1,328,415 |

|

|

$ |

1,285,177 |

|

|

$ |

1,307,156 |

|

| Earning assets |

|

|

1,249,941 |

|

|

|

1,212,139 |

|

|

|

1,237,704 |

|

| Total loans |

|

|

855,601 |

|

|

|

832,459 |

|

|

|

865,307 |

|

| Deposits |

|

|

1,114,077 |

|

|

|

1,055,346 |

|

|

|

1,068,908 |

|

| Borrowed funds |

|

|

62,521 |

|

|

|

77,098 |

|

|

|

86,500 |

|

| Allowance for loan losses |

|

|

13,017 |

|

|

|

12,935 |

|

|

|

13,693 |

|

| Subordinated loans |

|

|

29,604 |

|

|

|

29,563 |

|

|

|

39,443 |

|

| Pathfinder Bancorp, Inc.

Shareholders' equity |

|

|

109,055 |

|

|

|

110,287 |

|

|

|

99,939 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Asset Quality Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loan charge-offs

(annualized) to average loans |

|

|

0.02 |

% |

|

|

0.12 |

% |

|

|

0.05 |

% |

| Allowance for loan losses to

period end loans |

|

|

1.52 |

% |

|

|

1.55 |

% |

|

|

1.58 |

% |

| Allowance for loan losses to

nonperforming loans |

|

|

163.78 |

% |

|

|

155.99 |

% |

|

|

64.16 |

% |

| Nonperforming loans to period

end loans |

|

|

0.93 |

% |

|

|

1.00 |

% |

|

|

2.47 |

% |

| Nonperforming assets to total

assets |

|

|

0.60 |

% |

|

|

0.65 |

% |

|

|

1.63 |

% |

PATHFINDER BANCORP,

INC.FINANCIAL HIGHLIGHTS(Dollars

and shares in thousands except per share amounts)

| |

|

For the three months |

|

| |

|

ended March 31, |

|

| |

|

(Unaudited) |

|

| |

|

2022 |

|

|

2021 |

|

|

Key Earnings Ratios |

|

|

|

|

|

|

|

|

|

Return on average assets |

|

|

0.90 |

% |

|

|

0.68 |

% |

|

Return on average common equity |

|

|

10.63 |

% |

|

|

10.50 |

% |

|

Return on average equity |

|

|

10.63 |

% |

|

|

8.62 |

% |

|

Net interest margin |

|

|

3.06 |

% |

|

|

2.85 |

% |

| |

|

|

|

|

|

|

|

|

| Share, Per Share and

Ratio Data |

|

|

|

|

|

|

|

|

|

Basic weighted average shares outstanding* |

|

|

4,535,967 |

|

|

|

4,442,231 |

|

|

Basic earnings per share* |

|

$ |

0.49 |

|

|

$ |

0.36 |

|

|

Diluted weighted average shares outstanding* |

|

|

4,535,967 |

|

|

|

4,442,231 |

|

|

Diluted earnings per share* |

|

$ |

0.49 |

|

|

$ |

0.36 |

|

|

Cash dividends per share |

|

$ |

0.09 |

|

|

$ |

0.07 |

|

|

Book value per common share at March 31, 2022 and 2021 |

|

$ |

18.23 |

|

|

$ |

18.07 |

|

|

Tangible book value per common share at March 31, 2022 and

2021 |

|

$ |

17.45 |

|

|

$ |

17.04 |

|

|

Tangible equity to tangible assets at March 31, 2022 and 2021 |

|

|

7.89 |

% |

|

|

7.31 |

% |

|

Tangible equity to tangible assets at March 31, 2022 and 2021,

adjusted |

|

|

7.97 |

% |

|

|

7.79 |

% |

| |

|

|

|

|

|

|

|

|

| Non-GAAP

Reconciliation |

|

|

|

|

|

|

|

|

|

Tangible book value per common share |

|

|

|

|

|

|

|

|

|

Total equity |

|

$ |

109,055 |

|

|

$ |

99,939 |

|

|

Intangible assets |

|

|

(4,648 |

) |

|

|

(4,665 |

) |

|

Convertible preferred equity |

|

|

- |

|

|

|

(17,901 |

) |

|

Common tangible equity |

|

|

104,407 |

|

|

|

77,373 |

|

|

Common shares outstanding |

|

|

5,983 |

|

|

|

4,541 |

|

|

Tangible book value per common share |

|

$ |

17.45 |

|

|

$ |

17.04 |

|

| |

|

|

|

|

|

|

|

|

|

Tangible common equity to tangible assets |

|

|

|

|

|

|

|

|

|

Tangible common equity |

|

$ |

104,407 |

|

|

$ |

95,274 |

|

|

Tangible assets |

|

$ |

1,323,767 |

|

|

$ |

1,302,491 |

|

| Tangible common equity to

tangible assets ratio |

|

|

7.89 |

% |

|

|

7.31 |

% |

| |

|

|

|

|

|

|

|

|

|

Tangible common equity to tangible assets,

adjusted |

|

|

|

|

|

|

|

|

|

Tangible common equity |

|

$ |

104,407 |

|

|

$ |

95,274 |

|

|

Tangible assets |

|

$ |

1,323,767 |

|

|

$ |

1,302,491 |

|

|

Less: Paycheck Protection Program (PPP) loans |

|

$ |

(13,292 |

) |

|

$ |

(79,674 |

) |

|

Total assets excluding PPP loans |

|

$ |

1,310,475 |

|

|

$ |

1,222,817 |

|

| Tangible common equity to

tangible assets ratio, excluding PPP loans |

|

|

7.97 |

% |

|

|

7.79 |

% |

* Basic and diluted earnings per share are

calculated based upon the two-class method for the three months

ended March 31, 2022 and 2021.Weighted average shares outstanding

do not include unallocated ESOP shares.

PATHFINDER BANCORP,

INC.FINANCIAL HIGHLIGHTS(Dollars

and shares in thousands except per share amounts)

The following table sets forth information

concerning average interest-earning assets and interest-bearing

liabilities and the yields and rates thereon. Interest income and

resultant yield information in the table has not been adjusted for

tax equivalency. Averages are computed on the daily average balance

for each month in the period divided by the number of days in the

period. Yields and amounts earned include loan fees. Nonaccrual

loans have been included in interest-earning assets for purposes of

these calculations.

| |

|

For the three months ended March 31, |

|

| |

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

Average |

|

|

|

|

|

|

|

|

|

Average |

|

| |

|

Average |

|

|

|

|

|

Yield / |

|

|

Average |

|

|

|

|

|

Yield / |

|

|

(Dollars in thousands) |

|

Balance |

|

|

Interest |

|

Cost |

|

|

Balance |

|

|

Interest |

|

Cost |

|

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

845,461 |

|

|

$ |

8,692 |

|

|

4.11 |

% |

|

$ |

849,676 |

|

|

$ |

8,847 |

|

|

4.16 |

% |

|

Taxable investment securities |

|

|

329,291 |

|

|

|

2,168 |

|

|

2.63 |

% |

|

|

308,259 |

|

|

|

2,063 |

|

|

2.68 |

% |

|

Tax-exempt investment securities |

|

|

32,721 |

|

|

|

118 |

|

|

1.44 |

% |

|

|

12,234 |

|

|

|

29 |

|

|

0.95 |

% |

|

Fed funds sold and interest-earning deposits |

|

|

31,830 |

|

|

|

4 |

|

|

0.05 |

% |

|

|

32,414 |

|

|

|

3 |

|

|

0.04 |

% |

|

Total interest-earning assets |

|

|

1,239,303 |

|

|

|

10,982 |

|

|

3.54 |

% |

|

|

1,202,583 |

|

|

|

10,942 |

|

|

3.64 |

% |

|

Noninterest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets |

|

|

91,622 |

|

|

|

|

|

|

|

|

|

|

82,353 |

|

|

|

|

|

|

|

|

|

Allowance for loan losses |

|

|

(13,031 |

) |

|

|

|

|

|

|

|

|

|

(13,057 |

) |

|

|

|

|

|

|

|

|

Net unrealized (losses) gains on available-for-sale securities |

|

|

(1,334 |

) |

|

|

|

|

|

|

|

|

|

1,314 |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

1,316,560 |

|

|

|

|

|

|

|

|

|

$ |

1,273,193 |

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOW accounts |

|

$ |

106,894 |

|

|

$ |

71 |

|

|

0.27 |

% |

|

$ |

94,951 |

|

|

$ |

57 |

|

|

0.24 |

% |

|

Money management accounts |

|

|

16,072 |

|

|

|

4 |

|

|

0.10 |

% |

|

|

15,597 |

|

|

|

4 |

|

|

0.10 |

% |

|

MMDA accounts |

|

|

261,898 |

|

|

|

246 |

|

|

0.38 |

% |

|

|

235,289 |

|

|

|

255 |

|

|

0.43 |

% |

|

Savings and club accounts |

|

|

138,585 |

|

|

|

48 |

|

|

0.14 |

% |

|

|

111,317 |

|

|

|

33 |

|

|

0.12 |

% |

|

Time deposits |

|

|

377,907 |

|

|

|

596 |

|

|

0.63 |

% |

|

|

399,176 |

|

|

|

1,178 |

|

|

1.18 |

% |

|

Subordinated loans |

|

|

29,578 |

|

|

|

387 |

|

|

5.23 |

% |

|

|

39,412 |

|

|

|

557 |

|

|

5.65 |

% |

|

Borrowings |

|

|

63,528 |

|

|

|

163 |

|

|

1.03 |

% |

|

|

85,070 |

|

|

|

298 |

|

|

1.40 |

% |

|

Total interest-bearing liabilities |

|

|

994,462 |

|

|

|

1,515 |

|

|

0.61 |

% |

|

|

980,812 |

|

|

|

2,382 |

|

|

0.97 |

% |

|

Noninterest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

|

|

199,164 |

|

|

|

|

|

|

|

|

|

|

180,442 |

|

|

|

|

|

|

|

|

|

Other liabilities |

|

|

11,904 |

|

|

|

|

|

|

|

|

|

|

11,944 |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

1,205,530 |

|

|

|

|

|

|

|

|

|

|

1,173,198 |

|

|

|

|

|

|

|

|

|

Shareholders' equity |

|

|

111,030 |

|

|

|

|

|

|

|

|

|

|

99,995 |

|

|

|

|

|

|

|

|

|

Total liabilities & shareholders' equity |

|

$ |

1,316,560 |

|

|

|

|

|

|

|

|

|

$ |

1,273,193 |

|

|

|

|

|

|

|

|

| Net

interest income |

|

|

|

|

|

$ |

9,467 |

|

|

|

|

|

|

|

|

|

$ |

8,560 |

|

|

|

|

| Net interest rate spread |

|

|

|

|

|

|

|

|

|

2.93 |

% |

|

|

|

|

|

|

|

|

|

2.67 |

% |

| Net

interest margin |

|

|

|

|

|

|

|

|

|

3.06 |

% |

|

|

|

|

|

|

|

|

|

2.85 |

% |

|

Ratio of average interest-earning assets to average

interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

124.62 |

% |

|

|

|

|

|

|

|

|

|

122.61 |

% |

PATHFINDER BANCORP,

INC.FINANCIAL HIGHLIGHTS(Dollars

and shares in thousands except per share amounts)

Net interest income can also be analyzed in

terms of the impact of changing interest rates on interest-earning

assets and interest bearing liabilities, and changes in the volume

or amount of these assets and liabilities. The following table

represents the extent to which changes in interest rates and

changes in the volume of interest-earning assets and

interest-bearing liabilities have affected the Company’s interest

income and interest expense during the years indicated. Information

is provided in each category with respect to: (i) changes

attributable to changes in volume (change in volume multiplied by

prior rate); (ii) changes attributable to changes in rate (changes

in rate multiplied by prior volume); and (iii) total increase or

decrease. Changes attributable to both rate and volume have been

allocated ratably. Tax-exempt securities have not been adjusted for

tax equivalency.

| |

|

Three months ended March 31, |

|

| |

|

2022 vs. 2021 |

|

| |

|

Increase/(Decrease) Due to |

|

| |

|

|

|

|

|

|

|

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

Increase |

|

| (In

thousands) |

|

Volume |

|

|

Rate |

|

|

(Decrease) |

|

|

Interest Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

(47 |

) |

|

$ |

(108 |

) |

|

$ |

(155 |

) |

|

Taxable investment securities |

|

|

312 |

|

|

|

(207 |

) |

|

|

105 |

|

|

Tax-exempt investment securities |

|

|

68 |

|

|

|

21 |

|

|

|

89 |

|

|

Interest-earning deposits |

|

|

- |

|

|

|

1 |

|

|

|

1 |

|

|

Total interest income |

|

|

333 |

|

|

|

(293 |

) |

|

|

40 |

|

|

Interest Expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

NOW accounts |

|

|

8 |

|

|

|

6 |

|

|

|

14 |

|

|

Money management accounts |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

MMDA accounts |

|

|

116 |

|

|

|

(125 |

) |

|

|

(9 |

) |

|

Savings and club accounts |

|

|

9 |

|

|

|

6 |

|

|

|

15 |

|

|

Time deposits |

|

|

(60 |

) |

|

|

(522 |

) |

|

|

(582 |

) |

|

Subordinated loans |

|

|

(137 |

) |

|

|

(8 |

) |

|

|

(145 |

) |

|

Borrowings |

|

|

(64 |

) |

|

|

(96 |

) |

|

|

(160 |

) |

|

Total interest expense |

|

|

(128 |

) |

|

|

(739 |

) |

|

|

(867 |

) |

|

Net change in net interest income |

|

$ |

461 |

|

|

$ |

446 |

|

|

$ |

907 |

|

The above information is preliminary and based

on the Company's data available at the time of presentation.

Investor/Media Contacts

James A. Dowd, President, CEOWalter F. Rusnak,

Senior Vice President, CFOTelephone: (315) 343-0057

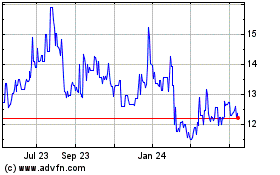

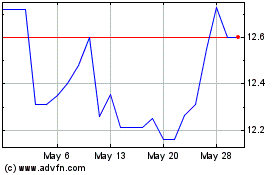

Pathfinder Bancorp (NASDAQ:PBHC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Pathfinder Bancorp (NASDAQ:PBHC)

Historical Stock Chart

From Jul 2023 to Jul 2024