P.A.M. Transportation Services, Inc. Announces Results for the

Third Quarter Ended September 30, 2003 TONTITOWN, Ark., Oct. 27

/PRNewswire-FirstCall/ -- P.A.M. Transportation Services, Inc.

today reported net income of $2,964,507 or diluted and basic

earnings per share of $.26 for the quarter ended September 30,

2003, and $9,828,644 or diluted and basic earnings per share of

$.87 for the nine month period then ended. These results compare to

net income of $3,957,465 or diluted and basic earnings per share of

$.35, and $12,597,067 or diluted and basic earnings per share of

$1.20, respectively, for the three and the nine months ended

September 30, 2002. Operating revenues of $74,215,880 were reported

for the third quarter of 2003, a 14.1% increase compared to

$65,033,997 for the third quarter of 2002. Operating revenues for

the nine months ended September 30, 2003 were $219,311,194, a 10.1%

increase compared to $199,188,301 for the nine months ended

September 30, 2002. Of these increases, $11,601,288 and

$29,283,445, respectively, for the three-and nine-month periods

ended September 30, 2003, were the result of revenues from entities

acquired earlier in the year. Robert W. Weaver, President of the

Company, commented, "In light of the current economic climate, I

was generally pleased with our revenue increase for the quarter but

not so with the net income. Our driver recruiting results continue

to improve and we have successfully manned approximately one half

of the unmanned units we had at the close of our second quarter.

These gains in manned units were partially offset by a reduced rate

per mile that came as a result of a portion of our dedicated

business experiencing rate reductions through a bid process and

conversion of "local" dedicated business into long haul dedicated

service. This bid process occurs from time to time as customers

attempt to manage transportation costs in reaction to general

economic pressures. The largest increases in expense as a

percentage of revenue for the quarter were in the areas of

insurance -- Workers Compensation and health insurance. In the area

of workers compensation we expect that some of the increased

expense will be recovered over time in subrogation although we none

the less have the expense to record. While these expenses are

intensely managed, they have increased as the result of unfavorable

claims and rising health care cost in general. We will continue to

emphasize claims management in the areas of Worker's Compensation

and health insurance to mitigate the current negative trend in

insurance losses. Our immediate mission is to continue the

recruiting progress for drivers and strive to maintain our current

rate of revenue growth while restoring freight rates to more

acceptable levels." P.A.M. Transportation Services, Inc. will be

holding a live conference call with certain financial analysts to

discuss the earnings release, the results of operations, and other

matters on Tuesday, October 28, 2003 at 10:00 a.m. CST (Please note

that since the call will begin promptly at 10:00 a.m., you will

need to join at least ten minutes prior to that time.) The public

will be able to listen and participate in the conference

telephonically by dialing (800) 915-4836. Please ask to be joined

to the P.A.M. Transportation Services Third Quarter 2003 Earnings

Release Conference call. An audio replay of the conference call

will be posted on the Company's web site after the meeting

(http://www.pamt.com/investing/audio.html ). In order to listen to

the replay, you will need a PC that is internet enabled and capable

of playing back MP3 audio files. The Company assumes no

responsibility to update any information posted on its Web site.

P.A.M. Transportation Services, Inc., is a leading truckload dry

van carrier transporting general commodities throughout the

continental United States, as well as in the Canadian provinces of

Ontario and Quebec. The Company also provides transportation

services in Mexico through its gateways in Laredo and El Paso,

Texas under agreements with Mexican carriers. Certain information

included in this document contains or may contain "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements may relate to

expected future financial and operating results or events, and are

thus prospective. Such forward-looking statements are subject to

risks, uncertainties and other factors which could cause actual

results to differ materially from future results expressed or

implied by such forward-looking statements. Potential risks and

uncertainties include, but are not limited to, excess capacity in

the trucking industry; surplus inventories; recessionary economic

cycles and downturns in customers' business cycles; increases or

rapid fluctuations in fuel prices, interest rates, fuel taxes,

tolls, license and registration fees; the resale value of the

Company's used equipment and the price of new equipment; increases

in compensation for and difficulty in attracting and retaining

qualified drivers and owner-operators; increases in insurance

premiums and deductible amounts relating to accident, cargo,

workers' compensation, health, and other claims; unanticipated

increases in the number or amount of claims for which the Company

is self insured; inability of the Company to continue to secure

acceptable financing arrangements; seasonal factors such as harsh

weather conditions that increase operating costs; competition from

trucking, rail, and intermodal competitors including reductions in

rates resulting from competitive bidding; the ability to identify

acceptable acquisition candidates, consummate acquisitions, and

integrate acquired operations; a significant reduction in or

termination of the Company's trucking service by a key customer;

and other factors, including risk factors, referred to from time to

time in filings made by the Company with the Securities and

Exchange Commission. The Company undertakes no obligation to update

or clarify forward-looking statements, whether as a result of new

information, future events or otherwise. P.A.M. Transportation

Services, Inc. and Subsidiaries Key Financial and Operating

Statistics (unaudited) Quarter ended Nine months ended September

30, September 30, 2003 2002 2003 2002 Operating revenues

$74,215,880 $65,033,997 $219,311,194 $199,188,301 Operating

expenses: Salaries, wages and benefits 30,161,136 27,678,860

89,367,660 87,666,148 Operating supplies 14,287,278 13,438,346

41,158,312 38,516,822 Rent/purchased transportation 9,276,302

1,910,491 25,867,243 7,584,483 Depreciation/ amortization 6,589,433

6,700,720 19,194,260 17,676,038 Operating taxes and licenses

3,686,289 3,356,039 10,890,090 10,200,197 Insurance and claims

3,088,555 2,558,969 10,219,835 9,504,928 Communications and

utilities 624,225 444,276 1,860,526 1,703,542 Other 1,171,804

1,925,501 3,381,024 3,527,197 Loss on disposition of equipment

14,288 47,949 41,812 95,564 Total operating expenses 68,899,310

58,061,151 201,980,761 176,474,919 Operating income 5,316,570

6,972,846 17,330,433 22,713,382 Other income/(expense): Interest

expense (375,373) (377,070) (1,059,568) (1,718,270) Total other

income/ (expense) (375,373) (377,070) (1,059,568) (1,718,270)

Income before income taxes 4,941,197 6,595,776 16,270,864

20,995,112 Provision for income taxes 1,976,690 2,638,311 6,442,220

8,398,045 Net income $ 2,964,507 $ 3,957,465 $ 9,828,644

$12,597,067 Diluted earnings per share $ 0.26 $ 0.35 $ 0.87 $ 1.20

Average shares o/s - Diluted 11,326,610 11,306,778 11,330,528

10,514,705 Quarter ended Nine months ended September 30, September

30, Truckload Operations 2003 2002 2003 2002 Total miles 59,691,172

56,380,426 175,816,877 172,363,393 Empty miles factor 4.62% 4.34%

4.52% 4.33% Revenue per total mile $1.07 $1.12 $1.08 $1.11 Total

loads 77,946 72,717 232,517 228,764 Revenue per truck per work day

$575 $598 $558 $592 Average company trucks 1,742 1,619 1,703 1,595

Average owner operator trucks 112 136 122 139 Quarter ended Nine

months ended September 30, September 30, Logistics Operations 2003

2002 2003 2002 Total revenue $10,282,490 $ 2,101,990 $28,961,542 $

8,170,868 Operating income $553,606 $(18,440) $1,615,772 $79,496

DATASOURCE: P.A.M. Transportation Services, Inc. CONTACT: Robert W.

Weaver of P.A.M. Transportation Services, Inc., +1-479-361-9111 Web

site: http://www.pamt.com/investing/audio.html

Copyright

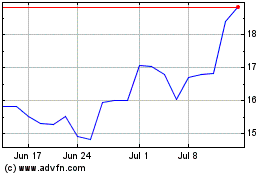

P A M Transport Services (NASDAQ:PTSI)

Historical Stock Chart

From Jun 2024 to Jul 2024

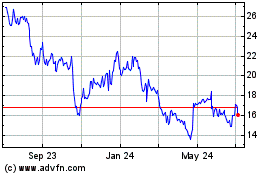

P A M Transport Services (NASDAQ:PTSI)

Historical Stock Chart

From Jul 2023 to Jul 2024