Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

June 09 2022 - 8:35AM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

File No. 333-236574

|

PROSPECTUS SUPPLEMENT

(To Prospectus dated June 1, 2020, as supplemented by the Prospectus

Supplement dated June 4, 2020, the Prospectus Supplement dated August 7, 2020, the Prospectus Supplement dated November 6, 2020, the Prospectus

Supplement dated February 5, 2021, the Prospectus Supplement dated August 11, 2021, the Prospectus Supplement dated November 4, 2021,

the Prospectus Supplement dated February 7, 2022 and the Prospectus Supplement dated May 18, 2022) |

|

June 9, 2022 |

Oxford Lane Capital Corp.

$500,000,000

Common Stock

This prospectus supplement

contains information which amends, supplements and modifies certain information contained in the prospectus dated June 1, 2020 (the “Base

Prospectus”) as supplemented by the prospectus supplement dated June 4, 2020 (the “June 2020 Prospectus Supplement”),

the prospectus supplement dated August 7, 2020 (the “August 2020 Prospectus Supplement”), the prospectus supplement dated

November 6, 2020 (the “November 2020 Prospectus Supplement”), the prospectus supplement dated February 5, 2021 (the “February

2021 Prospectus Supplement”), the prospectus supplement dated August 11, 2021 (the “August 2021 Prospectus Supplement”),

the prospectus supplement dated November 4, 2021 (the “November 2021 Prospectus Supplement”), the prospectus supplement dated

February 7, 2022 (the “February 2022 Prospectus Supplement”) and the prospectus supplement dated May 18, 2022 (the “May

2022 Prospectus Supplement,” and, together with the June 2020 Prospectus Supplement, the August 2020 Prospectus Supplement, the

November 2020 Prospectus Supplement, the February 2021 Prospectus Supplement, the August 2021 Prospectus Supplement, the November 2021

Prospectus Supplement, the February 2022 Prospectus Supplement, this prospectus supplement and the Base Prospectus, the “Prospectus”),

which relate to the sale of shares of common stock of Oxford Lane Capital Corp. in an “at-the-market” offering pursuant to

an equity distribution agreement dated June 4, 2020, with Ladenburg Thalmann & Co. Inc. Oxford Lane Capital Corp.’s (the “Company”)

investment adviser, Oxford Lane Management, LLC (the “Adviser”), has agreed to pay to Ladenburg Thalmann & Co. Inc., if

necessary, a supplemental payment per share that will reflect the difference between the public offering price per share and the net proceeds

per share received by the Company in this offering such that the net proceeds per share received by the Company (before expenses) are

not below the Company’s then current net asset value per share.

You should carefully read the

entire Prospectus before investing in our common stock. You should also review the information set forth under the “Risk Factors”

section beginning on page 22 of the Base Prospectus and under the “Supplementary Risk Factors” sections in certain prospectus

supplements thereto, as well as in our subsequent filings with the Securities and Exchange Commission (the “SEC”) that are

incorporated by reference into the Prospectus, before investing.

The terms “Oxford Lane,”

the “Company,” “we,” “us” and “our” generally refer to Oxford Lane Capital Corp.

PRIOR SALES PURSUANT TO THE “AT THE MARKET”

OFFERING

From June 4, 2020 to June 8,

2022, we sold a total of 64,517,705 shares of common stock pursuant to the “at-the-market” offering. The total amount of capital

raised as a result of these sales of common stock was approximately $440.4 million and net proceeds were approximately $435.2 million,

after deducting the sales agent’s commissions and offering expenses.

MAY 2022 FINANCIAL UPDATE

On June 7, 2022, we announced

the following net asset value (“NAV”) estimate as of May 31, 2022.

| · | Management’s unaudited estimate of the range of the NAV per share of our common stock as of May

31, 2022 is between $5.87 and $5.97. This estimate is not a comprehensive statement

of our financial condition or results for the month ended May 31, 2022. This estimate did not undergo the Company’s typical quarter-end

financial closing procedures and was not approved by the Company’s board of directors. We advise you that our NAV per share for

the quarter ending June 30, 2022 may differ materially from this estimate, which is given only as of May 31, 2022. |

| · | As of May 31, 2022, the Company had approximately

148.3 million shares of common stock issued and outstanding. |

The fair value of the Company’s portfolio

investments may be materially impacted after May 31, 2022 by circumstances and events that are not yet known. To the extent the Company’s

portfolio investments are impacted by the effects of the COVID-19 pandemic, or by other factors, including the conflict between Russia

and Ukraine and related sanctions taken against Russia in response to the conflict, the Company may experience a material impact on its

future net investment income, the fair value of its portfolio investments, its financial condition and the financial condition of its

portfolio investments. Investing in our securities involves a number of significant risks. For a discussion of the additional risks applicable

to an investment in our securities, please refer to the section titled “Risk

Factors” in our prospectus and the note titled “Risks and Uncertainties” in our most recent annual report or semi-annual

report, as applicable.

The preliminary financial

data included in this prospectus supplement has been prepared by, and is the responsibility of, Oxford Lane Capital Corp.'s management.

PricewaterhouseCoopers LLP has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary financial

data. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto.

COMPANY PRICES OFFERING OF 7.125% SERIES 2029 TERM

PREFERRED SHARES

On June 8, 2022, we announced that we had priced

an underwritten public offering of 2,400,000 shares of our newly designated 7.125% Series 2029 Term Preferred Shares (the “Preferred

Stock”) at a public offering price of $25 per share, raising $60.0 million in gross proceeds. We have also granted the underwriters

a 30-day option to purchase up to 360,000 additional shares of Preferred Stock on the same terms and conditions to cover over-allotments,

if any. The closing of the transaction is subject to customary closing conditions and the shares are expected to be delivered on June

16, 2022. We have applied to list the Preferred Stock on the NASDAQ Global Select Market and expect trading to commence thereon

within 30 days after June 16, 2022.

We intend to use the net proceeds from this

offering for acquiring investments in accordance with the our investment objective and strategies and for general working capital purposes.

INCORPORATION BY REFERENCE

We incorporate by reference

into this prospectus supplement our annual report on Form N-CSR for the fiscal year ended March 31, 2022 (filed with the SEC on May 16,

2022). Any statement contained in such annual report on Form N-CSR shall be deemed to be modified or superseded for purposes of this prospectus

supplement to the extent that a statement contained in this prospectus supplement modifies or supersedes such statement in such annual

report on Form N-CSR.

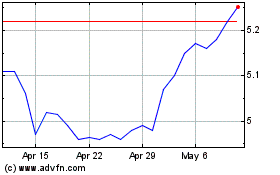

Oxford Lane Capital (NASDAQ:OXLC)

Historical Stock Chart

From Jun 2024 to Jul 2024

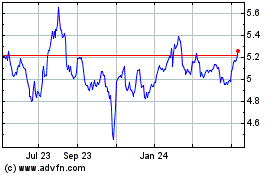

Oxford Lane Capital (NASDAQ:OXLC)

Historical Stock Chart

From Jul 2023 to Jul 2024