Form RW - Registration Withdrawal Request

September 05 2023 - 4:35PM

Edgar (US Regulatory)

Office Properties Income Trust

Two Newton Place, 255 Washington Street, Suite 300

Newton, Massachusetts 02458-1634

September 5, 2023

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Real Estate and Construction

100 F Street, NE

Washington, D.C. 20549

Pam Long

| Re: | Request for Withdrawal of Office Properties Income Trust

Registration Statement on Form S-4

Filed May 19, 2023

File No. 333-272105 |

Dear Ms. Rivera and Ms. Long:

Pursuant to Rule 477 promulgated under the Securities

Act of 1933, as amended (the “Securities Act”), Office Properties Income Trust, a Maryland real estate investment trust

(the “Company”), hereby respectfully requests that the Securities and Exchange Commission (the “Commission”),

consent to the withdrawal, effective as of the date hereof or at the earliest practicable date hereafter, of the Company’s Registration

Statement on Form S-4 (File No. 333-272105), together with all exhibits thereto, initially filed with the Commission on May 19, 2023 and

amended on June 6, 2023, June 20, 2023, July 7, 2023, July 17, 2023, and July 19, 2023 (the “Registration Statement”).

The Registration Statement was initially filed

with respect to the proposed issuance of common shares of beneficial interest, par value $.01 per share, of the Company (the “Company

Common Shares”) in connection with the Agreement and Plan of Merger, dated as of April 11, 2023 (the “Merger Agreement”),

by and between the Company and Diversified Healthcare Trust, a Maryland real estate investment trust (“DHC”). On September

1, 2023, as reported on a Current Report on Form 8-K filed by the Company with the Commission on September 1, 2023, the Company and DHC

terminated the Merger Agreement pursuant to a termination agreement. Consequently, the Company will not proceed with the proposed offering

of Company Common Shares contemplated by the Merger Agreement and the Registration Statement. Because the proposed offering will not occur,

the Company believes that the withdrawal of the Registration Statement is consistent with the public interest and protection of investors

as contemplated by paragraph (a) of Rule 477 under the Securities Act.

U.S. Securities and Exchange Commission

September 5, 2023

Page 2

No shares of the Company Common Stock have

been or will be sold pursuant to the Registration Statement. Accordingly, the Company hereby respectfully requests that the

withdrawal of the Registration Statement be effective as of the date hereof or at the earliest practicable date hereafter and

requests that a written order granting the withdrawal of the Registration Statement and all exhibits and amendments thereto be

issued by the Commission as soon as reasonably practicable. The Company also requests, in accordance with Rule 457(p) under the

Securities Act, that all fees paid to the Commission in connection with the filing of the Registration Statement be credited for

future use to the Company’s account.

Your assistance in this matter is greatly appreciated.

If you have questions or require additional information, please do not hesitate to contact Mark A. Stagliano of Wachtell, Lipton, Rosen

& Katz at (212) 403-1060 or by email at MAStagliano@wlrk.com.

U.S. Securities and Exchange Commission

September 5, 2023

Page 3

| |

Very truly yours, |

| |

|

| |

/s/ Matthew C. Brown |

| |

Matthew C. Brown |

| |

Chief Financial Officer and Treasurer |

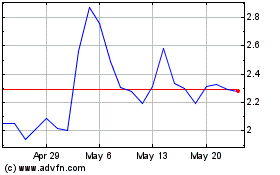

Office Properties Income (NASDAQ:OPI)

Historical Stock Chart

From Jun 2024 to Jul 2024

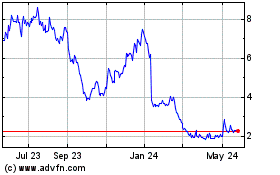

Office Properties Income (NASDAQ:OPI)

Historical Stock Chart

From Jul 2023 to Jul 2024